A power of attorney is a legal instrument that grants a third party the power to transact businesses on behalf of yourself.

The person granting the power is called the principal whereas the one receiving the same is the attorney-in-fact. This form enables you to nominate someone to work on your behalf if you ever need someone to make short- or long-term decisions on your behalf.

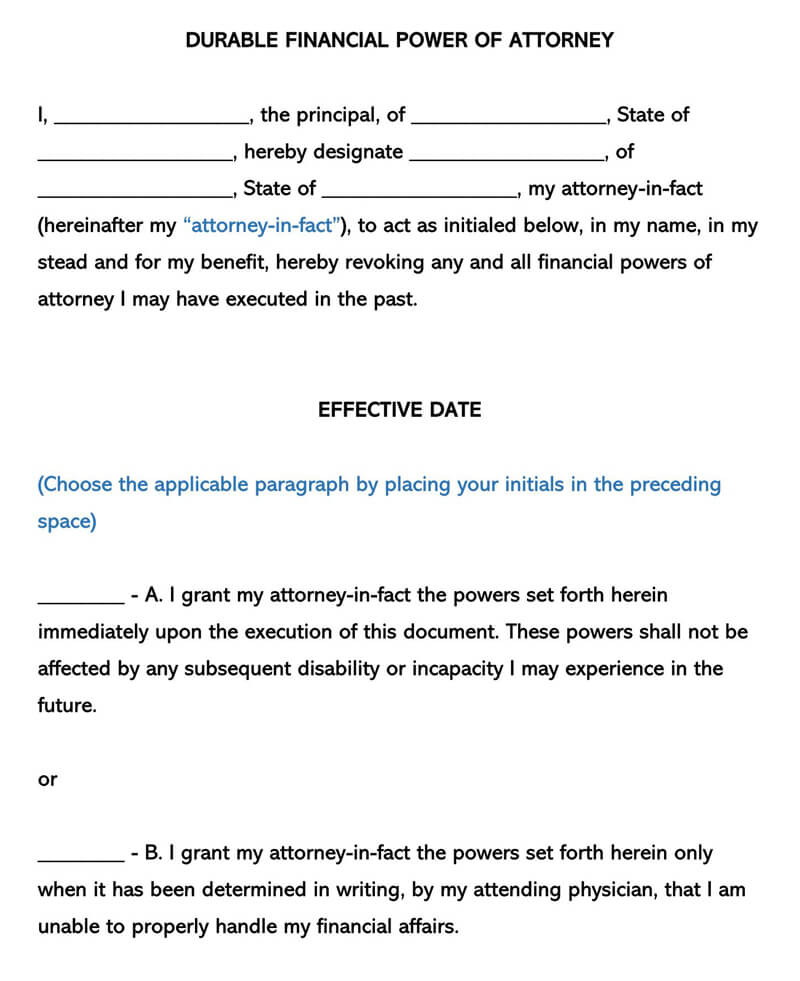

This is the form that is filled out to grant the stated powers from one party to another. The form is issued by the state, is duly filled out, and thereafter notarized. It basically contains the fields that spell out the exact powers to transfer to a third party.

The “Principal” on a POA form is the individual granting authority to another. The individual who is given authority is known as the “Attorney-in-fact” or “Agent.”

POA could be used to enable someone else to make legal decisions on your behalf temporarily or to ensure that decisions about your assets and health care are taken in your best interests if you become “incapable.” If you become incapacitated without appointing power of attorney, a loved one or family member may need to apply to a court for guardianship to assist you with your affairs.

A power of attorney is also known by other similar names:

They are:

- Ordinary Power of Attorney

- Financial Power of Attorney

- POA or P.O.A

- General Power of Attorney

- Durable Power of Attorney

Free Power of Attorney Form

POA Forms (by State)

Types of Power of Attorney Forms

The following mentioned are a few types of a power of attorney:

- Durable (Financial) Power of Attorney– Handles financial aspects of the powers thereof. The form is mainly used when the principal is incapacitated and is hence unable to transact any businesses on his own.

- General (Financial) Power of Attorney– Used for much the same reasons above. It, however, comes in when the principal is still of sound mind but ceases to apply in the event of incapacitation or death.

- IRS Power of Attorney (Form 2848)– Authorizes individuals to represent you before Internal Revenue Service. This individual has to be eligible to practice before the tax collection agency.

- Limited Power of Attorney– Gives a portfolio manager to carry out specific tasks on your behalf and in your account. The form specifies the exact areas that the portfolio manager has a right to come in.

- Medical (Health Care) Power of Attorney– Allows individuals to empower others with decisions that touch on healthcare and treatment strategies.

- Minor Child Power of Attorney– Grants the parents the leeway to delegate to another grown-up the authority to make sound decisions on behalf of his child without necessarily relinquishing the custodial or parental rights.

- Real Estate Power of Attorney– Enables you to authorize another person to buy or sell real estate property on your behalf or carry out any other businesses that revolve around the field of real estate.

- Revocation of Power of Attorney– Cancels a previous appointment which you had made or committed to. It goes ahead to terminate and nix the rights of the agents involved in the process.

- State Tax Filing Power of Attorney- As the designation implies, this form allows a third party to file your taxes but not handle your medical care bills, personal finances, and other pieces of property.

- Vehicle Power of Attorney– Basically grants the owner of an automobile the powers to delegate the responsibilities to handle quite a number of tasks that revolve around the motor vehicle such as obtaining the certificate of title, registration, and sales.

Understanding the Power of Attorney

There are three main things that you should know about a power of attorney. They are:

How to choose a power of attorney

When you are selecting a power of attorney, you should consider your choices carefully. Aside from your preferences, there are also legal requirements for who you select.

Your attorney-in-fact should not be:

- Under the legal age of adulthood in your country.

- Currently bankrupt.

- Own or work in a nursing home where the principal lives or receives treatment.

You can appoint multiple attorneys in fact if you believe that different people can manage different decisions or transactions better. If you prefer, you could appoint a trustee as your attorneys-in-fact, such as an accountant, lawyer, or other specialist.

Where to get the POA form

You can get a power of attorney form from a lawyer, websites, or state government offices like the health services department, online POA form builder, and free country-specific POA forms.

When to have a power of attorney form

There are several scenarios when you should have this form.

They are:

- If you travel outside the country frequently for business, leisure, etc.

- If you are working in a dangerous workplace and have been diagnosed with a severe illness.

- If you have a company or property you would like to keep running, and you could not do so.

- If you have children, that will need to be cared for if you became incapacitated.

- If you want a particular person to oversee your affairs.

- If you have rules for how you run your company, your land, or your life, you want to make sure they are followed.

- When you are getting older and want to appoint a representative for yourself

Powers you can assign

A Power of Attorney contract allows you to specify what your representative, or attorney-in-fact, would be responsible for by granting them specific powers. You can give the following powers to your attorney-in-fact:

- Real estate – You can give your attorney-in-fact the power of buying, selling, renting, or managing residential, commercial, and personal real estate.

- Business – You can give the attorney-in-fact the power to invest, trade, and control all company transactions and decisions, as well as resolve any claims or lawsuits.

- Finance – The attorney-in-fact can exercise power over banking, tax, government, and retirement transactions, as well as a living trust and estate decisions. The financial authority also enables your representative to control personal insurance premiums and continue to donate to charity in your place.

- Family – You can grant the power to buy, sell, or exchange any of your personal property, as well as to purchase gifts, hire staff, and buy, sell, or trade any of your personal property.

- General authority – This empowers your attorney to make any decisions you would make if you were physically present.

Getting a Power of Attorney

Obtaining this form is simple; all you must do is determine which type of form is better for your needs. Below are the steps to take to get a power of attorney:

Understand the needs

Read and view the types of POA to get a better idea of which form to use. The most popular is a Durable Power of Attorney for Financial Matters, which allows someone else to manage any monetary or business-related matter for the principal’s benefit. Furthermore, if you choose someone to manage your medical needs, you can designate a health care representative with the Medical Power of Attorney to make all decisions if you cannot do so by yourself. The Estate Planning Checklists, which are unique to each state, provide a detailed list of documents that a person may wish to complete.

Select the attorney-in-fact

An attorney-in-fact is a person who will make crucial decisions on your behalf. This person does not have to be an attorney, but an attorney will act as your agent. Accountability and confidence are the two most important attributes to look for in your agent. You want to know that your agent will be available during stressful times and faithfully carry out your instructions. If your primary agent becomes ill or is inaccessible when required, you can list more than one agent in your POA form.

Create the document

After you have settled on the form you will need, it’s time to sit down and fill out the paperwork. Most forms are issued by the state and can be easily filled out in PDF format. The agent should be present when filling out the form, and all personal details for both the principal and the agent should be entered.

There is no unified way of obtaining this power. The requirements vary greatly from state to state. You hence have to familiarize yourself with the laws that govern the acquisition of this form in your state.

The following are the steps to create the document:

- Obtain the forms- Generally, though, you will have to download the form from the website of the relevant state. Alternatively, you will have to pay a visit to the local state office and request the same from the office.

- Choose an agent- An agent is the one who transacts business on your behalf. This is a person who is not only known to you but is also trustworthy. You have the leeway to choose whomever you deem qualified as there are no restrictions here.

- Fill the forms- Go ahead to fill the forms. Many states require that you fill three or four copies. These are to be retained by you, your attorney, the state, and one witness. After you are done with filling, you have to append your signature to make it official. You may choose to hire an attorney to review it and determine whether it meets the legal thresholds.

- Notarize the form- As the last step, you have to notarize the form. This basically entails taking the form to a notary public to be certified as being genuine. It is only after this that the form becomes recognized by the state.

- Sign the form- The form should be signed in the presence of witnesses, a Notary Public, or both. Check your state’s signing laws; the document will be valid only after being properly witnessed. Some hospitals need originals for Medical Powers of Attorney, so it is recommended that originals be given to the agent.

- Store the form- After the form is signed, it is up to the principal and the Agent to properly store it for when it is required. Since these forms are not filed with any government

Now that you know what a power of attorney form is and how to write and use it, there are other forms related to it that you should know. They are:

- A living will/health care directive– A living will, also known as a health care directive, outlines your specific medical needs and determines what decisions you want to be taken if you become sick or are hospitalized.

- Last will and testament- When you die, your savings, debts, properties, and belongings will be divided according to the terms of your last will and testament.

- Codicil– A Codicil is a document that allows you to make minor changes to your current last will and testament.

- End of life plan- An End-of-Life Plan is a document that helps you to plan your funeral service and express other final desires that other estate planning documents do not address.

- Revocation of power of attorney– You can terminate a previously established form using a Revocation of Power of Attorney form.

Changing the Power of Attorney

The following steps are required in order to either change or remove the power of attorney:

- Draft a revoking statement- Express the intent to revoke the ‘power of attorney.’ This should be in writing and has to be drafted on a standard revocation online form. In the statement, include your own name, date, expression of sound mind, and a desire to revoke the POA you had earlier issued.

- Prepare a witness certificate- Prepare a witness certificate if you wish to revoke a ‘durable power of attorney.’ The purpose of this witness certificate is to prove that you are mentally competent to nix this power.

- Sign the revocation letter- You now have to sign this revocation letter. Other than you, some two witnesses must also sign the same. These witnesses are persons who are familiar with but not related to you. They should also be ineligible to inherit your estate upon your demise.

- Name the new agent- At this stage, you have to reveal and name your new agent.

- Make copies of the revocation letter- Lastly, produce several copies of this revocation letter. Furnish your former agent with a copy of the same too! Needless to say, you have to furnish every other party with his own copy also.

Frequently Asked Questions

Yes. A power of attorney must be signed in front of a licensed notary public to be legally binding.

Complete a formal, written revocation to revoke your existing power of attorney. It would be best if you mentioned that you are removing your existing POAin your revocation. You should also sign and notarize your cancellation.

If you have completed the revocation, you can destroy or apply a copy of all versions of your existing power of attorney. You can confirm that no one can use your revoked power of attorney while cancelling it.

Regardless of when the document becomes effective, all powers granted by a POA terminate upon the principal’s death. The only exception is a non-durable power of attorney, which ends if/when the principal is incompetent. The agent loses all right to work in the principal’s capacity, both medically and financially, until the principal dies.

Final Thoughts

A POA is a legal document that grants the agent/ attorney-in-fact the authority to act on behalf of the principal. The agent may have extensive or limited legal authority to make legal decisions about the principal’s land, finances, or medical care. In the case of a principal’s illness or injury, or when the principal cannot sign required legal papers for financial transactions, POA is often used. It can be revoked for several reasons, including the principal’s death, the principal’s dismissal, a court’s invalidation, the principal’s divorce from their partner, who also happens to be the agent, or the agent’s inability to carry out the outlined duties.