When starting a Limited Liability Company, it’s essential to create an LLC Operating Agreement. This not only explains the workings of your company, but it also works to separate the business owner’s finances from the company and protects them against liability claims.

In simple terms, a limited liability company blends the features of a traditional corporation and a partnership. It gives the business owner better liability protection than just individual ownership, and it is much simpler to manage. Technically,

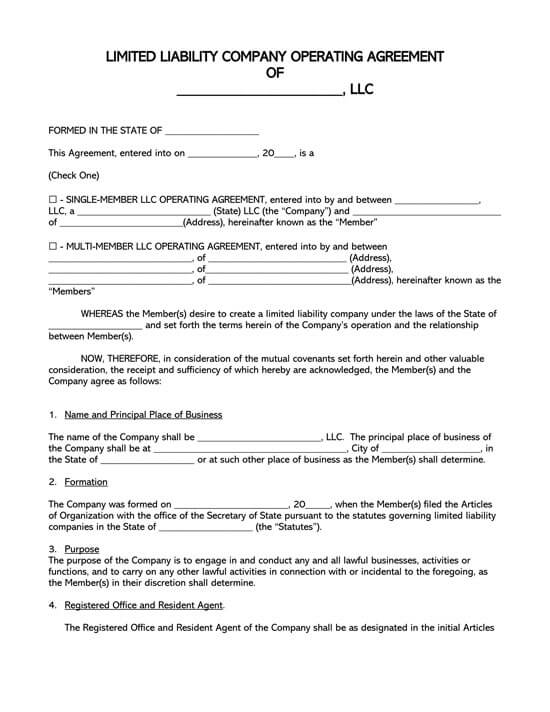

An LLC Operating Agreement is a legally binding document for businesses that outlines how the company will be managed, the structure of the business, its day-to-day operations, members, and their percentage of ownership, and gives instructions regarding what is to be done if the LLC goes out of business.

Details contained in agreement will vary from one situation to the other depending on the following factors:

- Tax considerations,

- Structure of management (which includes information such as how decisions are made, how often meetings are held etc.)

- Member investments

- Number of members

- Sharing of profits

In addition to this, the agreement illuminates the rights and responsibilities of each member/owner of the company and the company’s rules of operation. It is a legally binding document. Additionally, it is the ONLY document that has records of the ownership of an LLC company as ownership is not listed with the State.

note

Such Operating Agreement is not a requirement by many states except; California, Maine, Delaware, Missouri, and New York.

However, IRS and financial institutions will often request for it to prove a member’s ownership interest and when opening bank accounts or filing for a loan or investment, respectively.

Alternative names used when referring to an LLC Operating Agreement include:

- Operating Agreement

- LLC Partnership Agreement

- LLC Agreement

By Type

Benefits of Having LLC Operating Agreement

Even though an LLC Operating Agreement is not a requirement by law in many states, the benefits of having one will at any day outweigh the consequences of not having one. Other than the more straightforward benefit of having the members/owners agree and be legally bound to honouring the agreement on how to run/operate the company, there are other merits of having an operating agreement in your LLC.

Allows to control business

In the absence of an operating agreement, multiple aspects of your LLC will be governed by the state laws, which are regarded as default laws/rules in this case. Customarily, state law provides a standard operating agreement should you opt not to create one. Guidelines stipulated in the state-provided agreement can be unfavourable in different aspects, such as it declares that profits should be shared equally regardless of individual member capital contribution.

Protects the limited liability aspect

Without such an Agreement, LLC owners may be legally subjected to personal liability for the company’s debt and legal obligations. This is because, without an operating agreement, the company could be interpreted to have a sole proprietorship or partnership ownership structure. Therefore, having one protects the company’s members.

Makes business details clearer

Through an LLC Operating Agreement, agreed upon operation guidelines can be referenced in case of any misunderstandings and disputes in the future.

Allows personalised distribution

It provides members of the LLC an opportunity to agree on how to share profits in terms by specifying distributive shares where for example, 65% ownership translates to 65% of the profits and losses or make special allocation such as in a 50/50 ownership yet one member is entitled to 65% of the profits and losses.

The consequences of not having This Agreement go beyond the company itself to the member’s personal space. Below are some of the demerits:

| Individual member | Company |

| Loss of timeWithout the operating agreement, all LLC members must agree and vote on every company decision, big or small, which consequently results in loss of time during the decision-making and implementation process. | Loss of timeThe LLC is governed by state default laws that are subject to changes from time to time, it can slow the decision-making and implementation issues. |

| Loss of moneyWithout such agreement, members are taxed as individual business owners rather than as LLC members | Loss of moneyThe company is taxed as a sole proprietorship or partnership rather than a limited liability company |

| UncertaintyWithout an operating agreement, the liability of members and company is unclear and unlimited in terms of the company’s debts and obligations. | UncertaintyThe liability of members and company is unclear and unlimited in terms of the company’s debts and obligations. Also, in case a member chooses to leave the company, business activities are interrupted, and the company’s efforts to purchase their ownership interest becomes limited. |

Who Would Need an LLC Operating Agreement?

There are instances when you will need to present your Agreement to someone outside of the business.

People who will need to see the operating agreement include:

- Lenders if you are seeking financing

- Any title companies, if you are making real estate purchases for the business

- Tax and accounting professionals if you seek financial advice

- Lawyers if you are seeking legal advice

- Any potential investor should you find funding

- A court, should you be in a legal battle

Details an Operating LLC Agreement Covers

This Agreement will often try to answer the who, when, what, where, why, and how. It is basically a guide on how the company is being run. Its contents range from who owns the company to the management structure adopted in the company to the sharing of profits.

This information includes:

General information

Following information should be added in your agreement:

- Business purpose

- The names of all members and their signatures

- The interest percentage of each member, as well as any financial contributions they have made towards the company

- The date of annual meetings (if applicable)

Depending on whether you are a Single-Member LLC or a Multi-Member LLC, there will be other areas that you should outline.

It should also include:

- Binding authority- The operating agreement should identify which individuals/members have the authority to sign and enter into agreements on behalf of the company—formerly known as the binding authority.

- Officers and members- Both LLC types should outline any officers or managers that have been appointed to take responsibility for different areas of the business. For an MMLLC, any new members or members who have left should be updated on the agreement, along with their ownership percentage.

The LLC Operating Agreement is flexible and can be as simple or complex as one wants it to be. With an LLC, the business is not taxed.

The members pay a share of the taxes that are based on any personal income. Also, members of an LLC won’t be held liable for the business’s debts or any liabilities.

- Admission of new members- The operating agreement highlights the process of absorbing a new member into the company ownership. Even if you are starting as the sole owner, a time may come in the future where new members wish to come in either as ownership-holding investors; this is why this provision is important. The agreement should outline how the new members can acquire an interest in the company. It will often involve the approval of existing members and the amendment of the existing Operating Agreement. This also addresses cases of increase and decrease of ownership from one member to the other.

Documents to be added

For the company to be considered as an LLC, owners are required to provide additional documents. These include:

- Articles of Organization -These are a set of documents that business owners use to declare their intention to set up an LLC in the state that the business will be registered and operated in.

- Type of LLC – The type of LLC depends on the number of members involved in the company. This is established by selecting the operating agreement that best describes the company’s ownership. This could be either of the two;

- The Single-Member Operating Agreement is used for a business that has one sole owner.

- The Multi-Member Operating Agreement is used for an LLC with more than one member and can be a bit more complicated. It doesn’t need to be submitted to a government office. It is an internal document for your company’s record-keeping.

Statement of intent

A statement of intent is a formal statement that the owner(s) have a serious intention to establish the business once all the formalities have been followed and plan on doing it according to the applicable state laws.

Company formation

The company information includes details such as its name, address information, location of the principal business office, and services description. No two companies should have the same name, so it is important to verify your company’s name through the Secretary of State’s office. The company name must have Limited Liability Company in it or LLC.

This section should also contain the following:

- Operating agreement amendment– A statement that points out how amendments should be handled in writing.

- Dissolution- In the event that the company is dissolved, the agreement should outline how members should tackle dissolution in terms of payments, whether it will be based on ownership or contribution percentage.

Capital contributions

Capital contributions include the amount of money/funding, property, or services raised at the starting up of the business/company. They can be categorised into:

- General capital contributions– These are fundamental contributions required to start the company, such as office spaces, etc.

- Additional Capital contributions- These are additional contributions individuals may provide to ease or fasten operations such as employee transportation or to improve the quality of products or services.

Profit, loss and distribution

This section addresses the distribution of money earned or lost by the LLC between members. This is normally based on each member’s percentage ownership, tax brackets or financial needs of the LLC members. However, as an LLC’s profits are taxed to its members, a huge consideration should be placed on if the distributed funds will be enough to at least cover the taxes due. How often profits are distributed can also be outlined in this section.

Management

Management involves the organisation, coordination, planning, entrepreneurship, budgeting and control of a company’s resources. The operating agreement addresses these aspects in the following ways:

- Duty of Loyalty- This is to declare whether company members are allowed to invest in competing businesses/companies or one must share business opportunities with the company.

- Indemnification- Outlines the protection privileges members enjoy from any legal claims/litigation unless they commit deliberate negligence or misconduct.

- Meetings- The dates when progress meetings are to be held should be stated in the agreement.

- Liability- A statement of the limited liability a member is eligible for if the company or other members were found to be legally at fault should be included. This is applicable unless there was intentional wrongdoing.

- Life insurance- Indicates where a company may opt to buy life insurance for its members to lower capital gain taxes that would be due when a member’s interest is sold in the event of death.

- Management structure- The LLC Operating Agreement must declare if the company is to be member-managed or manager-managed, and if the latter is chosen, how will compensation be handled.

- Prohibitions- Applicable prohibitions such as transfer of authority to a non-member should be indicated.

- Voting- a statement of how voting will be carried out during the decision-making process should be provided. This is because there are decisions that require a majority vote or unanimous consent from owners/members. Voting can be through per capita vote (each member gets one vote) or by each member’s voting power, which is dependent on percentage ownership.

Compensation

In a manager-managed LLC, other than salary for managerial services, compensation may be necessary in some cases.

- Reimbursement- This section addresses how out-of-pocket expenses incurred by managers or members should be handled.

- Management Fee- It’s essential to include some financial aspects in your Agreement, regardless of whether you are a single-member or multi-member LLC. The purpose of this is to make a clear differentiation between your finances and that of the business. For an SMLLC, you will need to show how much you have put into the business financially, as well as outline how you will be paying yourself a wage. It is essential if you will be seeking investors for your company, as well as when you need to file taxes.

For an MMLLC, you will need to outline how the business will be paying its taxes, how it will handle profits and losses, how much the business owner will be putting towards the company, and how profits will be distributed to any members.

Bookkeeping

In any type of business, bookkeeping is an integral part of its success. This aspect of business operation is also addressed in an LLC Operating Agreement.

- Accounting- The agreement highlights the member’s stand on how accounting should be handled to ensure accurate and detailed records are kept. This is usually the generally accepted accounting principles (GAAP)

- Annual Report – This outlines the member’s expectations of what to be included and when the annual report should be submitted. It helps monitor the company’s financial position.

- Tax purposes documentation– As the LLC can be classified as a disregarded entity or corporation for tax purposes, documentation proving this should be kept. A disregarding entity means the IRS treats a single-member LLC as a sole proprietorship, implying the company will not be addressed as a separate entity from the owner. A corporation means the limited liability company will be taxed as a corporation while its members will pay tax income depending on the profit distributions.

- Auditing- it involves independent review and examination of company records and activities to ensure compliance. When and how auditing is to be done should be evident in the operating agreement.

- Records – This is an assurance that accurate records of the LLC will be kept, and a copy of the records will be available to members on request.

- Tax – A declaration of tax filing processes as a company is outlined in the agreement. LLC businesses are taken as partnerships under state and federal income taxes.

- Tax Matters Partner – The members agree on the person who is supposed to represent the LLC to the IRS in matters regarding taxes.

- Valuation – Shoulda valuation of the LLC be needed, an independent firm may be hired to spearhead the process. How this would be handled to ensure a fair market value is determined should be outlined in the operating agreement.

Transfers of interest

The Operating agreement directs on how the transfer of interest should be handled. Members are granted the ‘right of first refusal’ should a member wish to sell their interest/ownership. The member usually has the right to buy the interest on the same terms offered by a potential third-party buyer.

- Buyout – This highlights if a member can buy another member’s interest should one decide to leave the company for their own reasons.

Death of a member

Operating agreement gives provisions for handling company interests of departed members. In the event of a member’s death, interest can be purchased by other members, certain relatives or give remaining members the right-of-first-refusal before interest is transferred to an heir. Transfer can also be allowed giving the transferee the right to profits and not to inclusion in decision making.

Dissolving the business

For both SMLLC and MMLLC business, you should have a clear outline regarding what should be done should you decide to dissolve or close the business. This will be important if you should be unable to run the business or pass away, and you want other family members to take over. It should also outline how assets should be distributed should the business be dissolved.

How to File an LLC

Setting up an LLC is not as hard as it is usually misconceived. Most people choose to use professional services and pay for the services rather than do it themselves. However, this process can be explained in the following steps:

Choose your State

The first step is determining the preferred state for setting up a company. Different states have diverse regulations in terms of taxes and registrations. The state with the most favourable conditions or convenience should be selected. Companies that serve local demographics will often be set up within their state, whereas others like Internet service providers where location is not a major concern have the freedom to explore.

Below is a list of US states:

Select a name for LLC

The next step is choosing a name for your LLC. The name should be catchy to capture people’s attention. After choosing a name, always ensure that the name is not taken by checking with the Secretary of State’s office or a division of the corporation’s website. It is good to have a few options in mind in case you find out that your preferred name is taken.

Select a registered agent

Most states in the U.S require LLCs to appoint a registered agent. This is an individual that you designate as the recipient of any official documents for the business. If a state requires you to have a registered agent and you don’t appoint one, you may incur a penalty or have the industry prohibited from operating.

File your LLC

After you have settled on a name for your business, you are required to file the Articles of Organization for your LLC. The filing process will often vary from state to state. Some states have made it possible to carry out this process online; however, a printed file is expected to be handed or mailed to the Secretary of State’s Office.

As this process is formal and legal, the information provided must be relevant to the LLC. In an effort to ascertain that the state has adequate information, the requirements for filing the Articles of Organization for an LLC include:

- Money to cater for the filing fee, which is usually around $80-$150.

- Name and address of the registered agent

- The principal place/office of business and mailing address.

- The correspondence name as well as their email address. Important should the state need to communicate something important such as the Notice of Annual Report.

- The names and addresses of all members/owners and authorised representatives. Authorised members imply members given the authority to act on behalf of the company.

Write the LLC Operating agreement

The final step of this process is drafting the Agreement. This document is normally not submitted to any government office(s). Due to its sensitive nature, it is kept personally or as an internal record. All the members must provide their names and signatures. Individual capital and interest contributions are also outlined in the agreement. A date should be included for referencing. Eventually, every member is handed their copy to keep.

Laws by State

As mentioned earlier, having an LLC Operating Agreement is a critical way to protect yourself legally. If the business where to get pulled into a legal battle, for example, and you didn’t have an agreement, the courts could go after personal assets.

The laws associated with this Agreement in different states are as follows:

| State and law | State and law |

| Alabama – § 10A-5A-1.08 | Montana – § 35-8-109 |

| Alaska – AS 10.50.095 | Nebraska – § 21-110 |

| Arizona – § 29-3105 | Nevada – NRS 86.286 |

| Arkansas – § 4-32-405 | New Hampshire – § 304.C:41 |

| California – Corp Code 17701.10 | New Jersey – § 42-2C-11 |

| Colorado – § 7-80-108 | New Mexico – § 53-19-19 |

| Connecticut – § 34-243d | New York – § 417 |

| Delaware – § 18-101 – § 18-1109 | North Carolina – § 57D-2-30 |

| Florida – § 605.0105 | North Dakota – § 10-31.1-13 |

| Georgia – Title 14, Chapter 11 | Ohio – § 1705.081 |

| Hawaii – § 428-103 | Oklahoma – § 18.2012.2 |

| Idaho – § 30-25-105 | Oregon – § 63.057 |

| Illinois – 805 ILCS 180/ | Pennsylvania – § 8916 |

| Indiana – IC 23-18-4-4 | Rhode Island – § 7-16-22 |

| Iowa – § 489.110 | South Carolina – § 33-44-103 |

| Kansas – § 76-7672 | South Dakota – § 47-34A-103 |

| Kentucky – § 275-180 | Tennessee – § 48-206-101 |

| Louisiana – RS 12:1319 | Texas – § 101.052 |

| Maine – § 31-1521 | Utah – § 48-3a-112 |

| Maryland – § 4A-402 | Vermont – 11 V.S.A. § 4003 |

| Massachusetts – Chapter 156C | Virginia – § 13.1-1023 |

| Michigan – § 450.4308 | Washington – RCW 25.15.018 |

| Minnesota – § 322C.0110 | West Virginia – § 31B-1-103 |

| Mississippi – § 79-29-123 | Wisconsin – Chapter 183 |

| Missouri – § 347.081 | Wyoming – § 17-29-110 |

The LLC Operating Agreement is accompanied by other documents to validate an LLC. These documents include;

- Partnership agreement- This document is used to outline the terms and responsibilities of the general partnership between the LLC members.

- Shareholder agreement- To some extent, it resembles an LLC Operating Agreement. However, its primary purpose is to define management details, dispute(s) resolution procedures, and share value in the corporation.

- Business plan- This is a summary of the company’s values, operations, future goals, market and sales plan, financial projections, and organisation details.

Frequently Asked Questions

Some states do require a business to have an operating agreement. Whether your state requires it or not, it is beneficial to have one in place as a means of protecting yourself against liability.

The role of a registered agent is to take care of documents, correspondence, and communication on behalf of the business. They will need to have a registered address in the state that the LLC operates in. Some states allow the names of LLC members to be kept secret from the public and just use the name of the registered agent.

Final Words

An LLC Operating Agreement outlines the members of a company, responsibilities, and other relevant information about the partnership. Through an LLC, owners are exempted from the company’s debt and legal obligations. Having an operating agreement protects the owner(s) and the company from default state laws that would otherwise be applicable in its absence. Such Agreement includes information such as management structure, list of members, bookkeeping procedures, compensation, dissolution, and other major issues surrounding an LLC partnership. An operating is not a legal requirement even though some states demand one must be drafted if an LLC is to be set up. Hopefully, the information provided in this article has shed enough light and contributed to your insight about an LLC Operating Agreement.