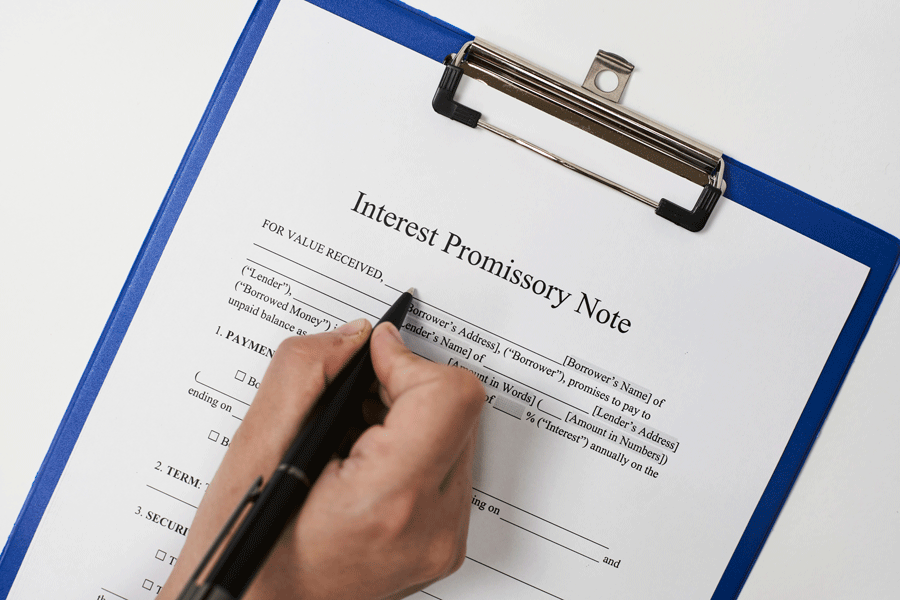

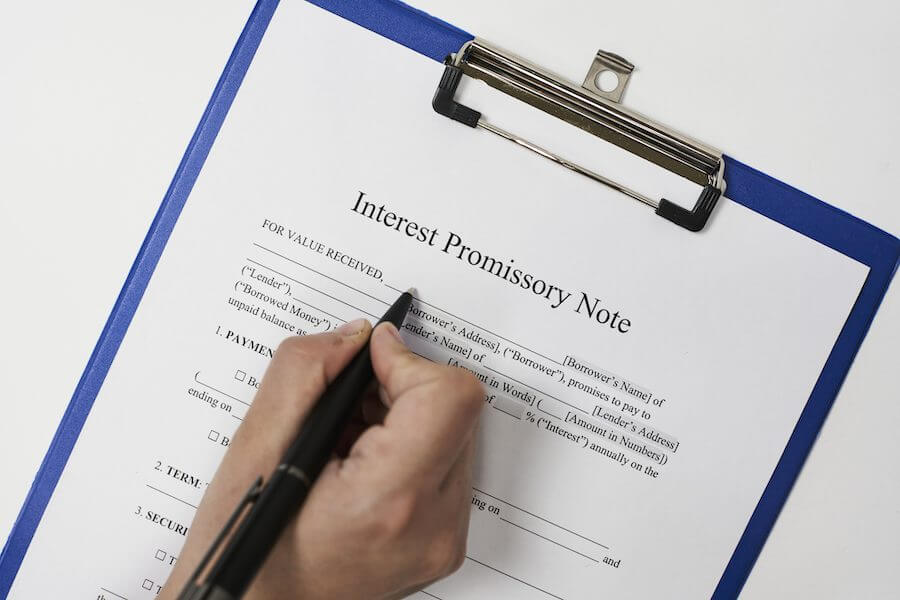

The promissory note is legally documented between two parties and contains information about the amount that was lent, as well as the due maturity date of the payments and the interest rates. It also contains information about the location and time of issuing the promissory note, as well as the signatures involved.

Formally, it is defined as:

A promissory note can typically be described as a written and enforceable agreement that binds a borrower to pay a lender an agreed-upon sum of money immediately or within a specified period.

Its main purpose is to hold the borrower accountable for repaying the principal amount as well as any interest that may have been accrued.

A promissory note helps the lender (typically an investor or bank) hold the borrower accountable for paying back the loan. In addition, promissory notes are useful for maintaining a document containing all the details and terms of the loan, both for taxation and for the benefit of the lender and the borrower.

Promissory Note Templates

Promissory Note Templates (By States)

Alternative Names for Promissory Notes

A promissory note may be referred to by other terms in a written or legal context.

Here are the other terms by which a promissory note is referenced:

- Commercial paper

- Demand notice

- Notes payable

- Debit note.

When Does a Lender or Borrower Need a Promissory Note?

When lending or borrowing money, both the lender and the borrower will benefit immensely from creating a promissory note that can be used to address payment details, collateral late fees, and interest rates. Depending on the purpose, there are several subcategories of promissory notes that can be used.

These are the most common types are:

- Student loans.

- Car loans. (vehicle or automobile)

- Investment loans (commercial, business, or bank)

- Personal loans between friends, colleagues, and family

- Mortgages, property down payments, or real estate loans

They should generally be used for more straightforward loans that require basic repayment structures. However, more complex loans require a loan agreement.

Types of Promissory Note

There are basically two types of promissory notes, under which several other related promissory documents/notes fall: the secured promissory note and the unsecured promissory note.

These are described as:

Secured Promissory Note

A secured promissory note is used for borrowing money that requires using an asset of value to secure the amount being loaned. The valuable asset used could be a vehicle or a piece of property. If the borrower fails to pay back the principal amount as well as the interest within the time frame suggested by the note, then the lender will have the right to possess the property of the borrower.

Download: Microsoft Word (.docx)

Unsecured Promissory Note

An unsecured promissory note secures none of the borrower’s assets for the lender in the event that the borrower is unable to repay the loan. Consequently, if the borrower is unable to pay the principal amount as well as the interest, the lender cannot possess any of the borrower’s assets. Instead, the lender would have to file small claims by a court or take other legal action to recover the debt.

Download: Microsoft Word (.docx)

Usury Rates and Laws By State

Following are links to each state’s usury rate laws that you can consider looking at before charging the interest rate.

| State | Laws |

| Alabama | Ala. Code § 8-8-1 |

| Alaska | Alaska Stat. § 45.45.010 |

| Arizona | Ariz. Rev. Stat. Ann. § 44-1201 |

| Arkansas | Ark. Code Ann. § 4-57-104 |

| California | Cal. Const. Article XV, § 1 |

| Colorado | Colo. Rev. Stat § 5-12-103 and § 5-2-201 |

| Connecticut | Conn. Gen. Stat. § 37-4 |

| Delaware | Del. Code. Ann. tit. 6, § 2301 |

| Florida | Fla. Stat. § 687.03 and § 687.01 |

| Georgia | Ga. Code Ann. § 7-4-2 and § 7-4-18 |

| Hawaii | Haw. Rev. Stat § 478-2, § 478-3, and § 478-4 |

| Idaho | Idaho Code Ann. § 28-22-104 |

| Illinois | 815 Ill. Comp. Stat 205/4 |

| Indiana | Ind. Code § 24-4.6-1-102 and § 24-4.5-3-201 |

| Iowa | Iowa Code § 535.2(3)(a) |

| Kansas | Kan. Stat. Ann. § 16-201 and §16-207 |

| Kentucky | Ky. Rev. Stat. Ann. § 360.010 |

| Louisiana | La. Rev. Stat. Ann. § 9:3500 |

| Maine | Maine Rev. Stat., titl. 9-B, § 432 |

| Maryland | Md. Code Ann., Com. Law § 12-102 – 103 |

| Massachusetts | Mass. Gen. Law Ch. 107, § 3 and Ch. 271, § 49 |

| Michigan | Mich. Comp. Laws § 438.31 |

| Minnesota | Minn. Stat. § 334.01 |

| Mississippi | Miss. Code Ann. § 75-17-1 |

| Missouri | Mo. Rev. Stat. § 408.030 |

| Montana | Mont. Code Ann. § 31-1-107 |

| Nebraska | Neb. Rev. Stat. § 45-101.03 |

| Nevada | Nev. Rev. Stat. § 99.050 |

| New Hampshire | N.H. Rev. Stat. Ann. § 336:1, § 358-A:2 |

| New Jersey | N.J. Stat. Ann. § 31:1-1 |

| New Mexico | N.M. Stat. Ann. § 56-8-3 |

| New York | N.Y. Gen. Oblig. § 5-501 and N.Y. Banking § 14-A |

| North Carolina | N.C. Gen. Stat. § 24-1.1 |

| North Dakota | N.D. Cent. Code § 47-14-09 |

| Ohio | Ohio Rev. Code Ann. § 1343.01 |

| Oklahoma | Okla. Stat. tit. 15, §266 |

| Oregon | Or. Rev. Stat. § 82.010 |

| Pennsylvania | 41 Pa. Cons. Stat. Ann. § 201 |

| Rhode Island | R.I. Gen. Law § 6-26-2 |

| South Carolina | S.C. Code Ann. § 37-3-201 |

| South Dakota | S.D. Codified Laws § 54-3-4 and § 54-3-16(3) |

| Tennessee | Tenn. Code Ann. § 47-14-103 |

| Texas | Tex. Fin. Code Ann. § 302.001(b), §303.002 |

| Utah | Utah Code Ann. § 15-1-1 |

| Vermont | Vt. Stat. Ann. tit. 9, § 41a |

| Virginia | Va. Code Ann. § 6.2-301 and § 6.2-303 |

| Washington | Wash. Rev. Code § 19.52.020 |

| West Virginia | W. Va. Code § 47-6-5 |

| Wisconsin | Wis. Stat. § 138.04 |

| Wyoming | Wyo. Stat. Ann. § 40-14- |

Key Terms and Clauses

The following are the common key terms and clauses used in a promissory note:

Acceleration

If the borrower is unable to pay the amount owed or, by a provision within the promissory note, does not make amends within the allocated period, the lender may demand immediate payment of all outstanding dues from the borrower.

The following are possible situations that may necessitate acceleration:

- If the borrower cannot make payments,

- If the borrower becomes bankrupt,

- Death of the borrower.

- If the borrower sells off the bulk of their assets,

- If the borrower wishes to pay off the loan early.

Attorney’s fees and costs

If the borrower defaults on the loan, resulting in the involvement of attorneys and court proceedings, the borrower must pay all costs incurred. However, if the borrower wins the court case, the lender must then pay all court-related costs.

Waiver of presentments

The waiver of presentment is a short clause implying that the lender does not have to demand payment at the due date and that the borrower is responsible for making certain that the payments are paid when due. Failure of the borrower to pay when due will necessitate that the lender issue a notice of non-payment. If the borrower continues to default on the loan, the lender will have the notice of non-payment presented and notarized in preparation for legal proceedings.

Non-waiver

If the lender fails to exercise their rights under the terms of the promissory note, it does not in any way signify that the lender has waived their rights. This means that if the lender has not contacted the borrower about the upcoming payment due, it does not give the borrower the right to not pay on the due date.

Severability

Severability refers to a clause on the promissory note that states that if any terms or provisions become void or unenforceable, other provisions within the note remain valid.

Integration

Integration means that no other document affects the terms of validity of the promissory note. It can, however, be amended only if both the borrower and lender sign a written agreement.

Conflicting terms

Conflicting terms mean that no other agreement shall be legally superior to or control the promissory note.

Governing law

The governing law refers to which state laws govern the terms in the promissory note.

Joint and several liability

If there is more than one borrower, all co-borrowers share responsibility for the loan according to the terms of the promissory note naming all co-borrowers individually or as a partnership.

Collateral

If the borrower fails to repay the loan, the lender takes ownership of the collateral asset or property according to the written agreement.

Notice

The notice dictates how the lender should deliver notices to the borrower. Typically, notices are written and delivered in person or by certified mail with receipts and copies.

Co-signer

The co-signer is a person who guarantees that the loan will be paid if the original borrower is unable to pay. Typically, a lender that suspects a borrower to be a risky borrower may require that the borrower obtain another credible individual to co-sign on the promissory note.

Late charges

Late charges are penalties charged if the borrower cannot pay back the amount on the due date.

Right to transfer

The right to transfer refers to the lender’s right to transfer the promissory notes to a different party.

Execution

The “execution” recognizes the borrower as the principal within the promissory note and, as such, is severally liable for all the payments. In the presence of a co-signer, both the borrower and the co-signer are equally responsible for repaying the loan.

Pre-Writing Considerations of a Promissory Note

A promissory note is legally recognized as a binding document. Hence, it must be done right at all times. An advantage to writing one is that, unlike most contracts, they are not usually long and complicated. Rather, they are short and simple.

The borrower and the lender must first agree upon and specify all the amounts and figures owed, as well as the interest and late fees, in order to avoid confusion between both parties. The total interest, as well as monthly payments and the final total payout, are the most important elements to be included in the promissory note. To calculate these elements, the lender and the borrower should agree on the principle or method involved, as well as the duration of the repayment. Also, the annual interest rate should be agreed upon before finalizing it.

It is therefore not essential that the borrower and lender have legal knowledge before filling out a promissory note. However, there is a need for a few basic, essential elements to be kept in mind, such as

Calculate the total interest owed

Calculating the total interest owed by the borrower is the first step to working out the repayment arrangement between the lender and the borrower. The total interest owed is a function of the annual interest and the duration for which the loan is to be paid. Hence, the lender and borrower need to take the repayment time as well as the annual interest into consideration.

To calculate the total interest owed, multiply the principal, which is the borrowed amount, by the annual interest rate. If the borrower and the lender agree on a monthly or quarterly payment schedule, the annual interest is divided by the fraction of the year required to repay the loan.

EXAMPLE 1

if the payment is due in 3 months, since 3 months is a quarter of a year, the annual interest is divided by 4.

EXAMPLE 2

If a lender lends $10,000 to a borrower for 3 months at an annual interest rate of 9%, the first step is to calculate the interest rate over a year, which is 9% of $10,000, or $900. To get the interest for 3 months, the annual interest of $900 is divided by 4, which is $225. The total interest owed by the borrower is then added to the principal, which is 10,000 dollars. At the end of the three months, the borrower will be required to pay $10,225 to the lender.

Calculate the final payment amount

The final payment amount is calculated by adding the principal amount to the total interest owed.

EXAMPLE

If a lender lends $5000 to a borrower over six months at 10% interest, the first step will be to calculate the annual interest, which is 10% of 5,000 dollars. 10% of $5000 is $500. The monthly interest is half of the annual interest, for a total of $250. To calculate the total amount owed, the initial principal of $5000 is added to the $250 interest, giving a total of $5,250.

Calculating the final total payout

The final total payout is the addition of all amounts owed as well as interest and penalty fees. It is essential for the lender and borrower to agree upon how much interest will be paid back on the loan. Furthermore, the lender and the borrower should also determine how much money will be charged when the borrower fails to make a payment before the due date. The final total payout is the total amount the borrower is required to pay to the lender in order to pay off the entire loan.

EXAMPLE

A lender grants a borrower the sum of $50,000 at a monthly interest rate of 5%, with a monthly payment to be paid off in six months. The first step is to calculate the total interest to be paid by the borrower, which is 5% of $50,000. The total interest is $2,500. In the last, the total interest is then added to the principal amount, bringing the total amount to $52,500, all of which should be paid by the borrower by the end of six months.

Calculate the monthly payment

The monthly payment is the amount agreed upon by the lender and the borrower for the borrower to pay to the lender on a designated date every month on an installment basis. The monthly payment is typically an even split of the entire amount owed over the duration of the loan. The total monthly payment must pay off the principal amount as well as the interest.

The monthly payment amount is calculated by adding the money borrowed to the total interest owed and then dividing the total amount by the number of months.

EXAMPLE

A borrower borrows $300 for 4 months at an annual interest rate of 10%. To calculate the total interest owed, use 10% of the initial borrowed amount, which is $300. The annual interest is $30. However, the timeline for repaying the loan is 4 months, which is 1/3 of a year. The total interest owed is a third of the annual interest, which is $30 / 3, for a total of $10. To calculate the monthly payment, the total amount owed, which is $10 added to $300, is divided by 4 months. $310 ÷ 4 months equals $77.50.

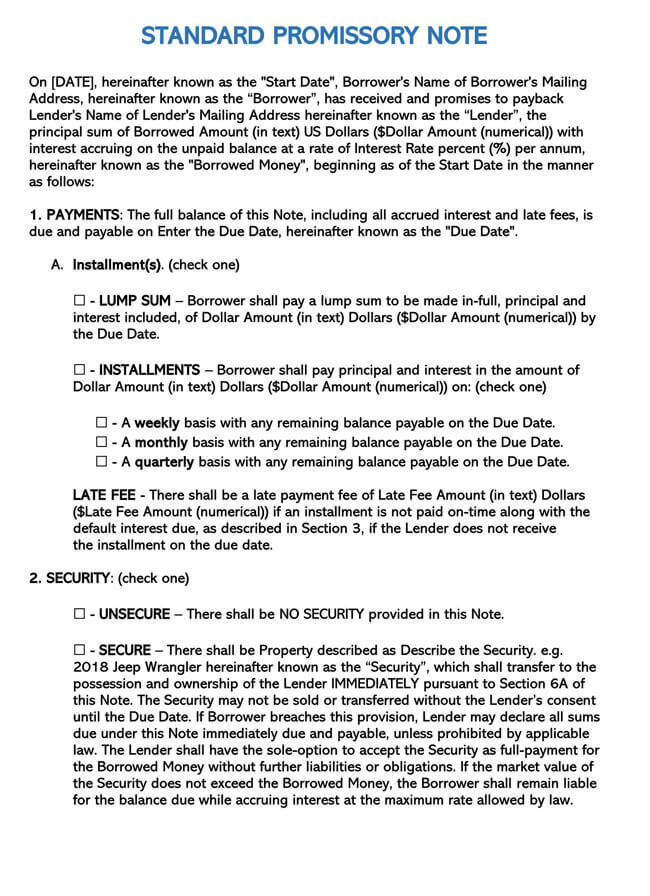

Preparing a Promissory Note

With our detailed and well-researched templates, the lender and borrower only need to fill in the format.

The following is a quick and simple guide to direct the parties involved in this agreement:

Decide the terms of the loan

The lender and the borrower should verbally agree upon and, at a later stage, agree to the terms of the loan in the promissory note.

The terms of the loan upon which the lender and the borrower must agree include the following:

The principal amount

The principal amount refers to the money the lender agrees to lend to the borrower after a mutual agreement, the sum of which must be included in the promissory note.

Interest rate

The interest rate is the agreed-upon fee for borrowing the money. Every state has a maximum amount permitted for the lender to set as their interest rate. Both the lender and borrower should check the interest rate laws in the state to set a favorable and lawful interest rate.

Principal and interest

As far as we have discussed the principal amount and interest rate, it is essential to consider these components while planning the final amount to be repaid. The lender also needs to decide how much interest will be charged, if any, as well as how the interest will be compounded annually or monthly.

The borrower has two choices: pay back the entire loan with a lump sum or pay back the loan in installments. The borrower and the lender should decide by checking the box indicating the agreed-upon frequency of payments and indicating the amount. If the borrower opts for a monthly installment as their payment option, the lender may add a late fee in the event that the borrower is unable to make payments on time.

Late fees

The late fee should be an agreed-upon payment. The borrower is required to pay should the borrower be late in the payment of the loan. This should be decided before the promissory note is prepared and then stated clearly.

Security

The security is an agreement to provide the lender assurance that the borrower will pay back the loan either in cash or by using the borrower’s assets. The borrower may use items such as vehicles or a second mortgage on the borrower’s home if the borrowed amount is not paid back by the borrower. These items that qualify as security need to be determined and identified. Security is used as a way to guarantee that the lender will either get their money back or something worth the amount lent to the borrower. Security can be used if a credit check is performed, and there are red flags.

Consequences of inability to repay

If the loan is in the form of a secured note, and the borrower is unable or unwilling to pay back the amount owed before the due date, the consequence is that the lender can legally enforce the promissory note, and demand that the full amount owed be paid, or take full possession of the collateral. If the borrower fails to pay the full amount owed and the lender wishes to initiate legal action, the promissory note provides the lender with strong evidence.

If the borrower loses the court proceeding, the borrower will be required to pay any additional reasonable costs associated with the collection of the debt, which includes the legal fees. If the lender enlists a professional collection agency, the lender will be charged a percentage of the outstanding debt or a flat fee. Hence, the lender may choose to negotiate a debt settlement agreement with the borrower, which involves the lender accepting less than the originally owed amount.

Co-signer

In the event that the borrower is not financially capable of borrowing the agreed-upon loan amount, a second individual can be named as a co-signer. A cosigner serves as an additional assurance that the loan will be paid back by another individual if the original borrower fails to pay back the loan. The cosigner will be liable for the full extent of the amount owed by the borrower as well as all penalties and late fees should the borrower fall short.

Co-signers are often used when the loan is an unsecured loan due to the absence of security in assets. A co-signer must be determined and assigned in mutual consensus.

Perform a credit report

It is an excellent practice for a lender to run a credit report on any potential borrower. This is because borrowers may have an outstanding debt that the lender is unaware of. If the outstanding debt owed by the borrower is child support or an IRS debt, such debt will take precedence over a promissory note. It is therefore essential that a lender perform a credit report before making any type of agreement with a borrower.

The lender is required to obtain written legal permission from the borrower to grant them access to the borrower’s credit. It is advisable for the lender to use a reporting agency that does not charge the lender but charges the borrower. Experian is a good choice as it charges the borrower $14.95 and provides the lowest score of the three credit bureaus.

Draft the promissory note

Once the lender and borrower have come to an agreement on the main terms of the promissory note, both parties should come together to authorize the formal agreement. The agreed-upon amount should only be handed in after the note has been signed by all relevant parties.

Here are a few general components to include while preparing the note:

Lender and borrower

The lender and borrower should specify the date by writing the exact day, month, and year in the note. The lender and borrower should also enter their names in the appropriate spaces, followed by both mailing addresses. The mailing address can be the company address or a personal address. The lender must specify the principal amount of the loan, both in numbers and in words.

The annual interest rate percentage should also be specified under the presiding state laws. Although only the borrower’s signature is required for the promissory notes to be valid, it is a good idea for the lender to also include the signature. The lender may also be referred to as the “issuer”, “maker”, “seller”, or “payee”. The borrower may also be referred to as the “buyer” or “payer”.

Set security

The safest type of promissory note a lender can use is a secure one. The secure method is widely adopted by most pawn shops. By selecting a secure option, the lender requires the borrower to use an asset or valuable item as security for the loan. If, for some reason, the borrower is unable to pay back the loan, the lender takes full possession of the asset.

EXAMPLE

Common assets used for security may include real estate, motor vehicles, and any other valuable asset.

If real estate is used as security, the security is provided as a first or second mortgage on the property. Using an asset as security implies that if the borrower fails to pay back the funds, then the lender is legally able to obtain full ownership of the asset used as security in the promissory note.

Default clause

The lender and the borrower should specify terms in the unlikely event that the borrower never repays the loan.

Payment arrangement

The arrangement by which the principal and interest will be paid back to the lender should be clearly stated. The maturity date, which is the date by which the borrower must pay back the lender, should be specified.

Set terms and conditions of repayment

The borrower is advised to repay the borrowed money on or before the agreed-upon time and in accordance with the set terms of the promissory note. Failure to do this may attract additional fees, which will be added to the overall due balance. Once the borrower has fully repaid the entire amount to the lender, as well as any interest or fees, the lender is required to create a loan release form which is then issued to the borrower, relieving the borrower of any liability.

Repayment terms

The payment arrangements must include specific details on how the loan amount is to be fully paid. Both the lender and borrower can make an agreement for the borrower to pay back the loan in incremental sums or as a lump sum.

Installments with final balloon payment

Like the installment payment, the installment with the final balloon payment also has a specific due date; however, interest payments are only made at regular intervals, and the principal amount is due on the maturity date.

EXAMPLE

If a borrower takes a $10,000 loan with a monthly interest of $500 under the installments with a final balloon payment plan, the borrower pays $500 monthly applied only towards the interest, and on the due date, the borrower is required to pay the full $10,000 principal.

Due on a specific date (“Lump Sum”)

The lump-sum payment plan also has a specific due date; however, the due payment is the entire amount owed. The entire amount owed includes the principal as well as the interest, all paid at once.

EXAMPLE

If the borrower takes a $30,000 loan with a $1,000 monthly interest, the lump sum payment after six months would be the entire $30,000 and the accumulated $1,000 for six months, which is a one-time payment of $36,000.

Due on demand (“payable on demand”)

A payable-on-demand loan has no specific due date. The borrower is required to pay the entire amount owed whenever the lender demands their money back.

EXAMPLE

If a lender lends a friend or family member $100,000 for business, the entire amount owed is due for repayment at any time the lender requires or whenever it is financially feasible.

Late payment

In the event that the borrower is unable or unwilling to pay the agreed-upon amount by the end of the established period, the lender is advised to issue a demand letter. A demand letter is a form that communicates to the borrower the terms stated in the promissory note, referencing the penalty for late payment as well as the new total amount owed after the addition of the late payment fees. The demand letter should also contain a deadline by which the borrower is required to repay the full amount as well as the penalty fee before the borrower is regarded as being in default.

Non-payment conditions

If, after the lender has issued a demand letter, the borrower is still unable to pay the full amount, the borrower is said to be in default. The lender may seek to recover their funds through a small claims court. However, small claims are typically limited to amounts below $10,000. However, these laws vary from state to state. In the event that there was security placed on the note, the lender can take possession of the asset property and all valuables used as security in the promissory note. If the value of the loan exceeds $10,000, legal action will probably be necessary.

Frequently Asked Questions

Either the lender or borrower may be an individual or an entity. An individual refers to a single person, while an entity is a company, partnership, corporation, or organization. If either the lender or the borrower is an entity, a representative of the entity is required to sign on the entity’s behalf.

There can be more than one lender; however, if there is more than one lender, the additional lenders’ names must be listed on the promissory note.

A promissory note can be used as a substitute for money and can be transferred between individuals and entities. If the state requirements have not been violated, it can be exchanged and transferred between different parties, effectively serving as a substitute for money.

Each state has regulations, so it is best to consult the relevant local laws to include acceptable language in the original draft. The note may be made “payable to order” or “payable to the bearer.”

A promissory note can be used to render assistance between family members without the loan amount being charged the full tax amount. Since the IRS allows family members a $14,000 limit to gift their family members annually without attracting any tax, family members that have exceeded the limit may use one in accordance with the presiding state laws on interest to give their family members money without paying a high tax on the gift amount.

The borrower has two options: paying a lump sum or paying in installments.

If the borrower chooses the installments option, the borrower will be required to repay the lender in a set number of installments over a set period of time, as specified in the promissory note.

The interest rate depends on the presiding state law. Hence, the lender and borrower must confirm the local or state law for the maximum allowable interest rate.

The lender and borrower may agree to specify any or all of the methods of communication: fax, email, or in person, or they may choose to specify their own preferred method of communication.