In some cases, the property can have multiple parties claiming it, which is known legally as a lien. Liens can be held against different asset types, such as real estate, financial assets, and vehicles. For example, liens can come from contractors, vendors, or mortgage lenders. The lienholders have a claim on the property until the owner fully pays them for the goods delivered or the services rendered. Since a lien is a legal claim against the property, lienholders must formally and legally state through a lien release form that they no longer have a claim to it after being fully paid. The real estate lien release form is thus used to declare that the specified lien holder legally releases their lien on the specified property.

This article is beneficial in understanding what a lien release form is, its different types, and what to include in it.

What is It?

A lien release form of real estate is a legal document that removes a lien from a property after settling payments. It must normally be filed with a government entity that maintains the lien records, such as the county registry of deeds. In addition, the release form has to be signed by the lien holder to be legally enforceable. It is typically one page long, as it does not have to be too detailed.

A real estate lien release form will occasionally be referred to by other names, such as:

- Release of lien

- Lien cancellation

- Lien satisfaction letter

- Lien discharge

Types of Lien Release

The forms will differ depending on the type of lien held against the property. The common types of lien release forms associated with different properties include:

Mechanics Real Estate Lien Release Form

Download: Microsoft Word (.docx)

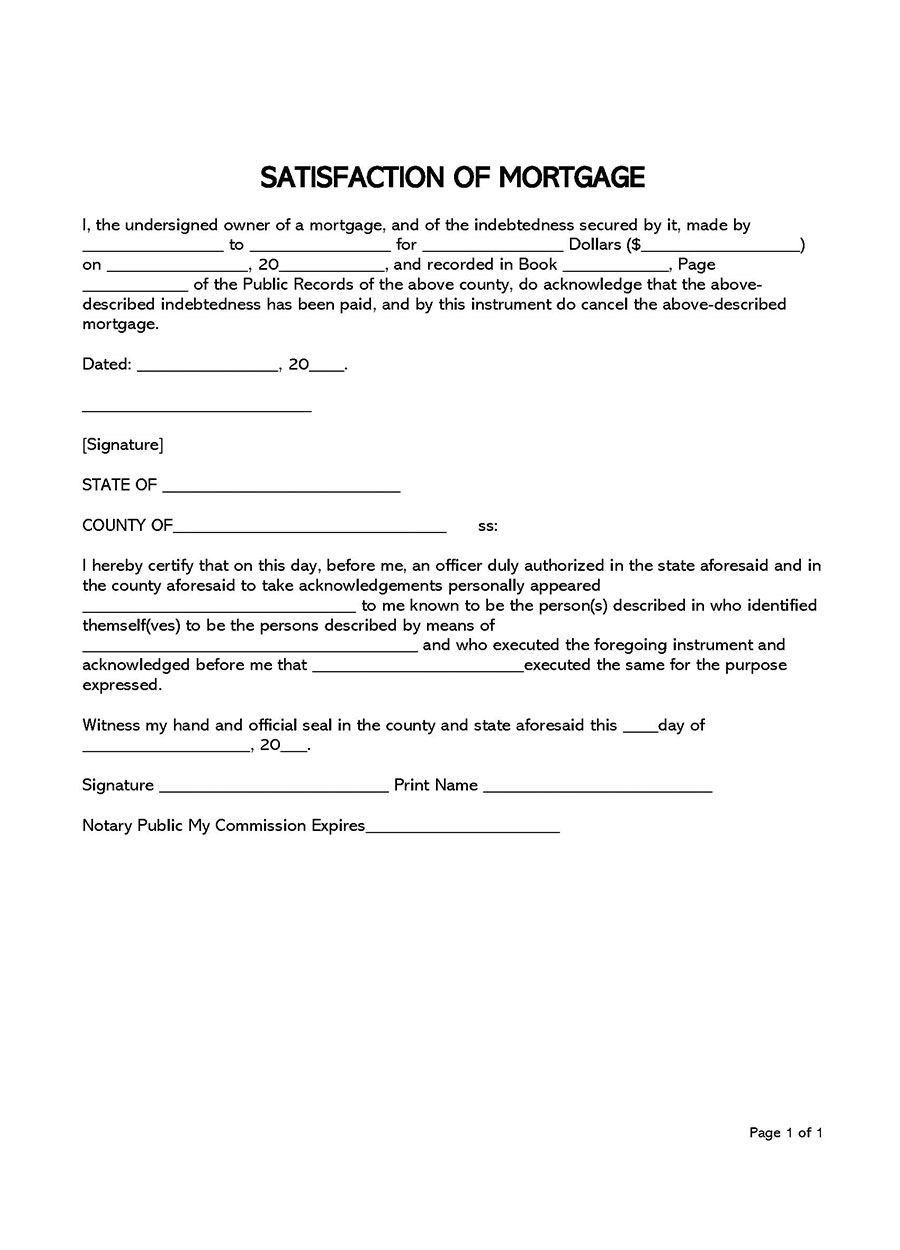

Mortgage Real Estate Lien Release Form

Download: Microsoft Word (.docx)

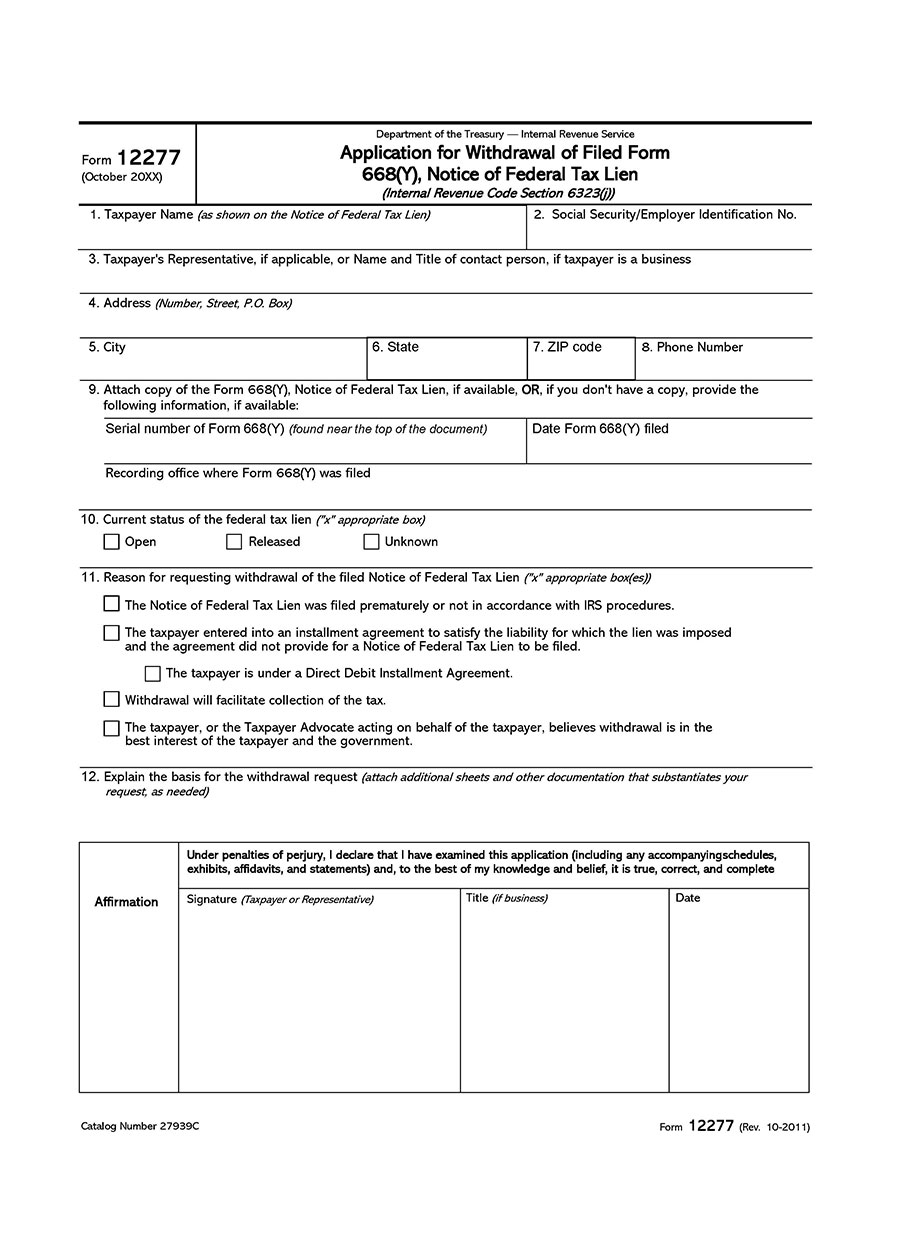

Tax Real Estate Lien Release Form

Download: Microsoft Word (.docx)

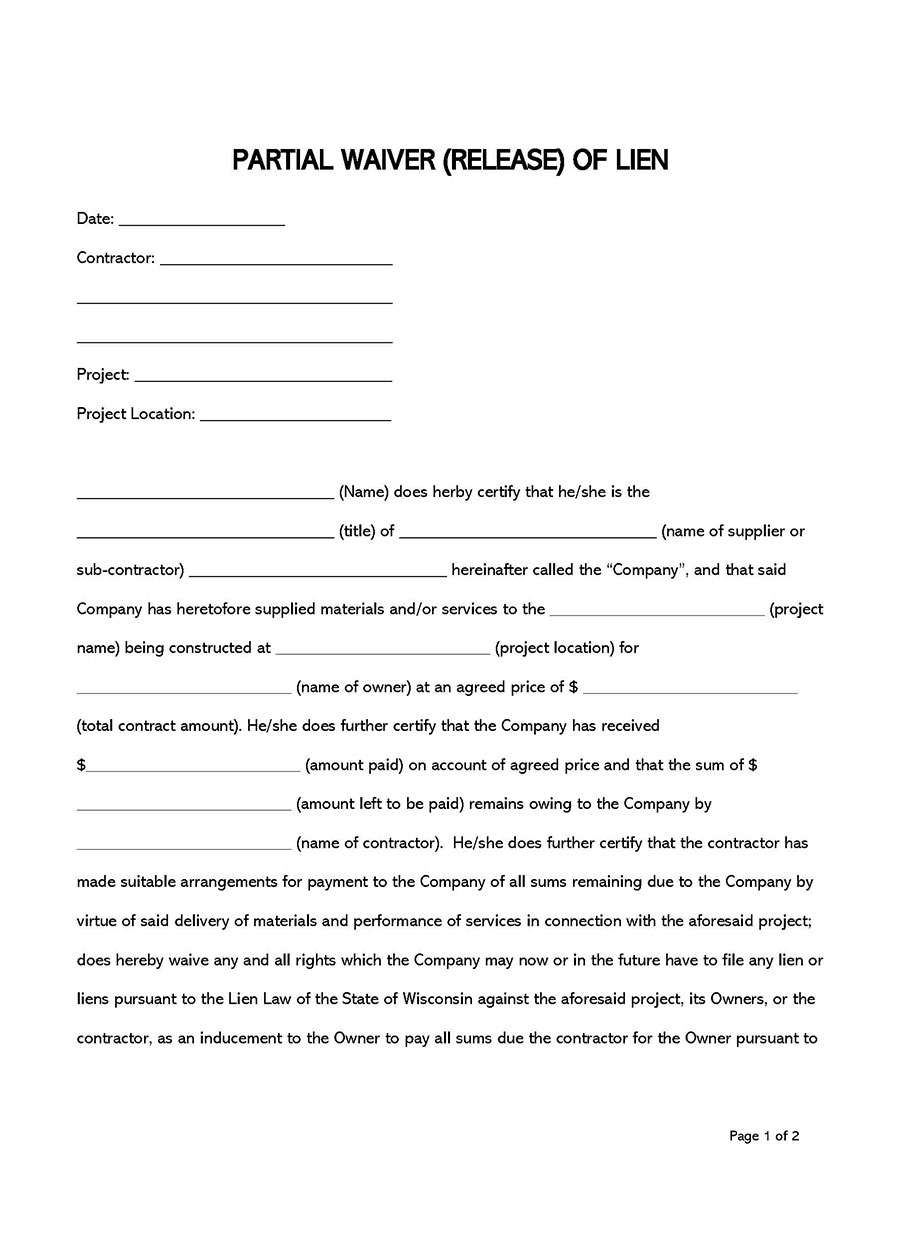

Partial Real Estate Lien Release Form

Download: Microsoft Word (.docx)

Purpose of It

A lien release form is used to officially declare that a property lien has been fully paid. As a result, the lienholder has no legal claim to the property whatsoever. If liens against property have not been settled, lienholders can rightfully seek foreclosure on the property to collect what is owed. The form confirms that all payments are made and creditors cannot foreclose on the property.

When and Who Releases the Lien?

A lien is released by the lienholder or lienor—any party with a right or claim to the property but not the right of possession. The lienor who initially placed a lien on the property should file the form as soon as they receive the full payment owed to them by the property owner. They must file the release form within the statutory limits of the state in which they have a claim to the property.

Varying states have different statutory deadlines for lienholders to file the form; for example, in Texas, the allowed period is ten days, while there are no limits in California and Florida. Note that an agent authorized by the lienholder through a POA (Power of Attorney) can file the form on behalf of the lienor.

What is Included in Lien Release Form?

It is necessary to properly fill out a lien release form because it is a legal document. The form should indicate the lienor, the property owner, and the payment details. In addition, the following items should appear on the form:

Lienor information

The lien release form must identify the lienholder who filed it. This requires providing specific identification details, such as a name and whether they are an individual or an entity. In addition, the full address of the lienholder must also be provided.

Property owner information

The property owner should also be identified in the lien release form. This includes providing their full names and associated physical addresses. The property owner is the party legally liable for claims against the property. The form should also clarify whether the property has a single owner or multiple owners.

Hirer information

The form should also state the parties directly and indirectly hired by the property owner. In some cases, the lienor and hirer can be the same person, while in others they can be two different parties. Subcontractors, for instance, who are frequently employed by contractors rather than property owners, can be lienors. In this case, the hirer will be the contractor, and the lienholder will be the subcontractor.

However, if the lienor is the contractor, the hirer is the property owner. Thus, the name and address information for the direct hirer should be included in the document.

Lien payment details

The document must then indicate the type of lien held against the property and the amount paid by the property owner as compensation for the lien. This lien amount will vary depending on the type of lien and the work done (if applicable).

Court details

Next, indicate details about the lien, like the date of the lien, the court and county where it was filed, and the page number showing the filed lien. This information is necessary for reference purposes.

Property details

The form should then include a legal description of the property to help identify it. The description should indicate the physical address (county, city, or town), plot number, survey number, and other identification details.

Signing requirements

Lastly, the form must be signed. The lienholder must sign the document and indicate the date of signing. The form can be witnessed and notarized. If this is the case, the witnesses must provide their names and signatures. The document must be authenticated in the relevant jurisdiction by the notary public’s signature and provision of an acknowledgment.

Note

Property owners should strive to ensure their property has no liens. They can do so by using lien waivers for all vendors and contractors, making timely payments on any arrears on taxes, credit card debts, and vendor and contractor balances, and paying any pending parking tickets. Property owners should also avoid lawsuits that could put their property at risk of confiscation.

Lien Release VS Lien Waiver

A lien release form is a legal document used by lienholders to let authorities know that they have received full payment and are no longer claiming the property as originally filed. Conversely, a lien waiver is a document to relinquish an individual’s right to make a claim to or place a lien on a property.

Lien waivers waive the right to file a mechanic’s lien before one has even been filed, which is the primary distinction between the two documents. Lien releases are used to release or cancel the lien when it has been satisfied after the lien has already been filed.

There are four types of lien releases and waivers:

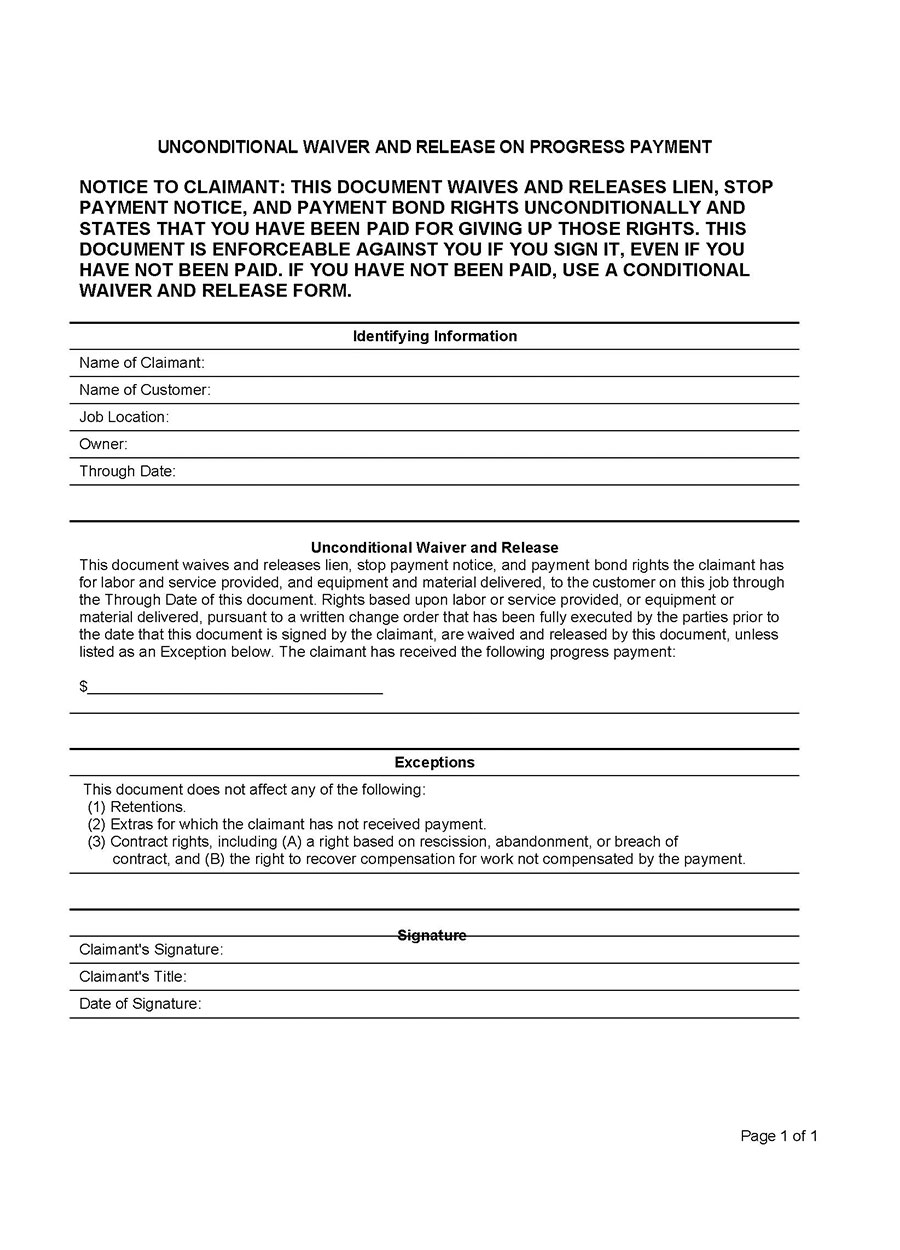

- An “Unconditional Waiver and Release Upon Progress Payment” unconditionally waives and releases all claimant rights up to a given date.

- All claimant rights are released under a “Conditional Waiver and Release Upon Progress Payment” as long as the payments have actually been received and processed by the specified date.

- All claimant rights are forfeited upon receipt of final payment under an “Unconditional Waiver and Release Upon Final Payment.”

- Upon receipt of the final payment, a “Conditional Waiver and Release Upon Final Payment” terminates all claimant rights subject to certain restrictions.

How Can a Lien be Released?

How does a lienholder use a lien release form to release their claim against a property? The use of a release of lien form is a straightforward process.

Below is a guide on using a real estate release form correctly:

Obtain the form

After the property owner makes the final payment, download the form suitable for the situation to avoid any penalties and legal consequences of filing the document late. Verify that the form contains all the necessary sections: claimant details, property owner details, lien payment information, property description, and a signing section.

Fill the form with accurate information

Then, fill out the form with the required information. Finally, ensure that the information provided in the form corresponds to the information in official and legal records. Discrepancies can lead to misunderstandings and render the form legally unenforceable.

Obtain the signatures of all parties involved

Lastly, the lienor should sign the document and indicate the date of signing. Any other involved parties, such as witnesses and a notary public, should also sign the document. The notary public should also provide an official seal to validate the document.

Frequently Asked Questions

Lien release forms should be filed at the same court or office where the lien was initially filed. A real estate lien release form will typically be filed at the county Registry of Deeds.

In most states, lien holders are penalized for not filing the release of lien form within the applicable state’s statutory limits. Therefore, how much a lienor will pay depends on the state’s lien release laws.

.