Real Estate POA is a legal document that grants an individual (the agent) authority to carry out business that has to do with real estate belonging to another (the principal).

This document lets the property owner entrust matters pertaining to managing, leasing, selling, or refinancing the property to be performed by a different individual on behalf of the owner.

This refers to the freedom to delegate power to a third party to transact businesses that pertain to your real estate. The form comes in when you are either too busy, have no relevant expertise, or are to travel abroad for some time. At such times, you will need someone to come through and take over the management of your estate until you are finally able to do so on your own.

This document goes by other relevant names like:

- Real Estate POA

- Power of Attorney for Real Estate

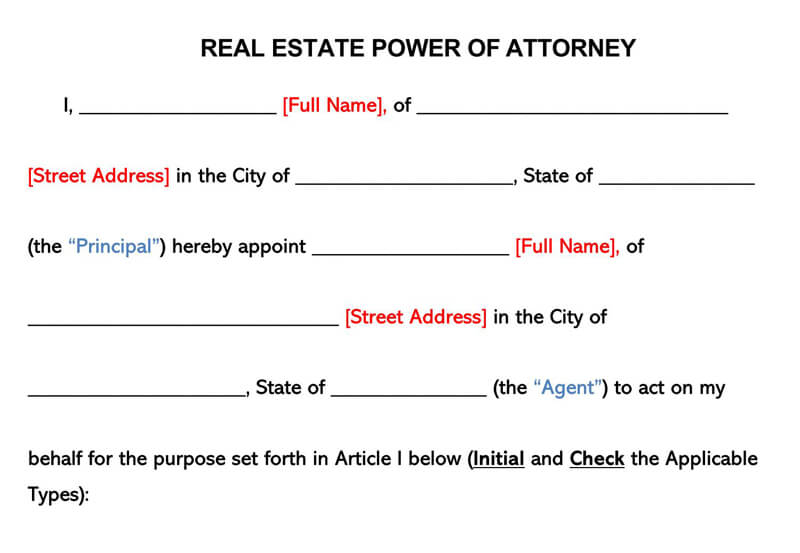

Free Templates

Given below are “standard” and “by state” customizable templates:

Standard template

By state

Types of Real Estate Power of Attorney

According to the extent of rights given to an agent, there are two types of these forms:

Limited real estate POA

As the name goes, this type of POA gives only a specified range of responsibilities to the agent by the principal. It is the most common type of real estate POA form.

It can be used when the real estate owner is temporarily unavailable or has chosen to delegate functions that include managing, renting, selling, or purchasing his property while retaining sovereign ownership and bearing financial benefits.

General real estate power of attorney

This kind of real estate POA grants the attorney-in-fact more power and a wider range of responsibilities than the limited POA. It also allows for the agent to carry out duties for a lengthier duration.

It is to be noted that the attorney-in-fact nominated by the principal will carry out their duties even if the principal is in a vegetative state. Hence, given the name of durable real estate power of attorney

Understanding Real Estate POA

These can be custom-made to suit the unique situation at hand. It can be bespoke to address the management, sale, mortgage, or purchase of a property. It could allow the right of partial or total responsibility of real property by an owner to the agent.

Since the real estate POA is a legal document, it is expected that it should be written, signed, and sealed by a lawyer to be considered binding. In many states, it is expected that this form is empowered when there are witnesses present.

When it comes to doing business that would involve purchasing, selling, leasing, managing, or refinancing fundamental properties, several phases are involved. In most cases, the person purchasing is the one who wants the services of an agent using a real estate POA. Other times, a seller may need a real estate POA to make a quick sale of his real estate.

In situations involving sales and purchases, the real estate process at every step requires signatures of the buyer and seller on the contract documents. However, it is of utmost priority that a lawyer assess such documents.

Executing the power of attorney

To execute, the principal (property owner) must have an attorney review these forms before the agent and the principal sign it.

To avoid errors in the first place, the attorney can be contacted from the start to prepare the real estate POA to ensure that the document meets the demands of the state laws before it is considered for signatories. The principal must be fully aware that the agent will have the authorization to make decisions binding on the owner.

In the signing of the forms, there is usually a written statement of the principal’s date and place of signature. In a situation where the principal is not in the country, this form is likely to be signed at the embassy or consulate. It is noteworthy that military personnel can sign this before a military officer.

Usually, real estate POA has a date of termination. From this point, it loses its power, and all the terms of agreement stated are no longer binding on any of the parties previously involved.

Practical issues

The real estate POA is often misunderstood by many, and indeed, it can be a bit complicated to grasp without proper knowledge. One common issue is that the agent, also referred to as the attorney-in-fact, may be mistaken for a lawyer, an actual “attorney at law,” who has a different role.

Sometimes, the attorney-in-fact is wrongly referred to as the Power of Attorney (POA). Whereas it is just the document signed to grant legal rights to someone to act on another’s behalf.

In many instances, there have been quite a lot of real estate POA forms that do not comply with state laws or carry sufficient details necessary to meet the parties’ requirements. It is advised that if ever a POA is needed for any real estate transaction, then preparations should be made to ensure that it is prepared on time and reviewed.

Real Estate POA Usage

You will find this form handy many times. The following are the main times in which the document is by all means essential:

- Incapacitation: If you are incapacitated for whatever reason such that you are unable to go about your normal duties, this form will definitely come to your rescue. It lets you appoint another person to handle your real estate management without necessarily requiring that you get there on your own.

- Busy Lifestyles: The case above also applies when you are too busy to go about your businesses normally. It basically gives you the freedom to choose someone to act in your capacity until such a time that you are not as busy as you have been. This way, you do not forfeit your normal duties and the returns you would accrue from your investments.

- Legal Compliance: Some jurisdictions require that the handling of real estate property be performed by persons who are competent and widely knowledgeable in the field. Chances could be that you simply lack these skills and competence. That is why it makes sense for you to choose someone who has the necessary knowledge and expertise to handle the issues for you.

- Terminal Illness: When people are terminally ill, they lack the capacity to reason and make sound decisions. This obviously impacts the manner in which they might handle and manage their estates. To be sure that the management will go on without any interferences in the process, you want to make do with a form of power that allows you to delegate that very responsibility.

- Temporal Separation: It could be that you are simply unable to handle these issues on your own by reason of being temporarily separated. If and when this happens, you will surely have to bring in another person to take over the management of your real estate and the associated tasks. The form will give you the power to do just that.

- Vastness of Portfolio: Some real estate portfolios are ordinarily too vast to manage single-handedly. You have to options for your consideration in case you own such a vast estate. These are, the appointment of a management firm, and the delegation of the authority to manage those estates to a third party. The latter is definitely the more viable alternative.

- Sales agreement: The sales agreement for real estate agrees that themproperty would be sold under specific terms and conditions. It explains the responsibilities of the parties involved and has signatories of the buyer and seller.

The sales agreement includes information such as the purchase price, deposits, title requirements, obligations for inspection, closing cost, etc.

An attorney should review a document with this much importance before the signing by the parties involved (the buyer and seller) in case of necessary modifications and ensure that they comply with state laws.

The signing of the sales agreement may be done via a real estate POA. - Title closing documents: To discuss any issues with no sufficient clarity, such as repairs, maintenance, title defects, or inspection obligation, the buyer and seller come with their respective attorneys to close the real estate.

After a consensus is reached by the parties involved, the mortgage papers, notices for regulation, sheets for settlement, and any other required documents are then signed by the buyer and seller in the presence of the real estate POA.

How to Get Real Estate POA

Given below are the steps to to real estate POA:

Choosing the agent

For a principal, the decision for who to manage his properties should be given careful thought. The principal needs to be sure that whoever he chooses should be someone capable of representing his best interest and very trustworthy, especially when that person is given control to a large extent.

In a situation where the principal has a written will, it is recommended that a significant beneficiary be chosen as the agent to reduce the liability of other estate affiliates peradventure he mismanages the property.

Select the real estate powers

Real estate POA forms may be used for either multiple or single transactions.

It is also suitable for delegating real estate property management to an individual or entity. The powers may comprise purchase or sale of property, lease agreements, tenancy and evacuation of tenants, etc.

For example, a principal can choose to employ the services of a company that specializes in managing real estate to lease the property out and be in charge of maintenance as it deems necessary.

Setting the terms form

The terms on these forms can be set according to the principal’s desires as regards the duration and scope of authority to be given to the agent. This is where the principal decides on a limited or durable real estate POA.

This may be issued to the agent when the principal is no longer able to perform cognitive functions or has become incapacitated due to prolonged ailments or the likes.

Consider state laws

While writing the real estate POA, the state laws must be taken into consideration. It must be ensured that all the rules provided by the state to check the preparation are duly followed.

This is necessary because even though some states may allow a durable provision to be featured in their forms, others may set the highest time frame for a real estate POA shorter.

Complete and sign

After all, required by the state law has been put in place and the execution terms are now set, the principal and the agent must sign the real estate POA forms. Signing requirements also differ from one state to another.

To ensure that the form is accepted across different states, it should be signed in the presence of a notary public.

How to Fill Real Estate POA Form

When a principal chooses to use real estate POA, certain things should be included.

- Property Identity: There must be a detailed legal description of the property involved, liable for purchase or sale. It should not just contain the address of the property alone.

- The individuals or parties involved in the attorney’s real estate power include the attorney-in-fact, the principal, and any substitute agents.

- it should clearly state the situations that the power applies to, such as leasing, managing, or closing the property. The authority should be more specific than generic.

- In a situation where the seller is the principal, the attorney-in-fact should have the legal right to sign the documents that pertain to selling the property, such as the deed or settlement sheet.

- When the buyer is the principal, the attorney-in-fact should have the legal right to sign buyer-related documents on behalf of the principal. These documents may include the deed of trust, settlement statements, or mortgage agreements.

In line with the laws of different states, there are essential requirements involved in authorizing it. They include:

- principal, who is the owner of the real estate, usually in his right mind

- agent, the attorney-in-fact, chosen by the owner and given the legal right to act on his behalf

- real estate power of attorney forms

- real estate power of attorney documents

- notary public

- witnesses (2), this may not always be included

When everything on the list above is checked and present, the real estate POA form is ready to be filled and enacted.

State Laws

The table below shows the state laws guiding real estate transactions for different states in the United States:

| State | Laws | State | Laws |

| Alabama | § 26-1A-204 | Alaska | AS 13.26.645 |

| Arizona | No statute | Arkansas | § 18-12-501 |

| California | § 4123(b) | Colorado | § 15-14-727 |

| Connecticut | Sec. 1-44 | Delaware | § 49A-301 |

| Florida | § 689.111 | Georgia | § 10-6B-43 |

| Hawaii | Uniform POA Act, § 30 | Idaho | § 15-12-204 |

| Illinois | 755 ILCS 45/3-4(a) | Indiana | § 30-5-5-2 |

| Iowa | § 633B.204 | Kansas | § 58-654 |

| Kentucky | KRS 382.370 | Louisiana | No Statute |

| Maine | 18-A §5-901 to 18-A | Maryland | § 4–107 |

| Massachusetts | No statutes | Michigan | § 700.5502 |

| Minnesota | § 523.24 | Mississippi | Section 204 |

| Missouri | § 442.360 | Montana | § 72-31-339 |

| Nebraska | § 30-4027 | Nevada | NRS 162A.480 |

| New Hampshire | § 506:7 | New Jersey | § 46:2B-11 |

| New Mexico | § 46B-1-204 | New York | § 5-1501B |

| North Carolina | § 32C-3-303 | North Dakota | Chapter 30.1-30 |

| Ohio | § 1337.04 | Oklahoma | § 58-1072.1 |

| Oregon | § 127.045 | Pennsylvania | § 5603(i) |

| Rhode Island | § 18-16-3 | South Carolina | § 62-5-708 |

| South Dakota | § 59-3-12 & § 44-8-2 | Tennessee | § 34-6-109(3) |

| Texas | § 752.102 | Utah | No Statute |

| Vermont | 27 V.S.A. § 305 | Virginia | § 64.2-1625 |

| Washington D.C. | § 11.94.050 | West Virginia | § 39B-2-104 |

| Wisconsin | § 244.44 | Wyoming | No Statute |

Key Takeaways

- Real Estate POA forms are legal documents that authorize someone (the agent) to act on another’s behalf (the principal/owner)

- The agent should be someone that the principal considers very trustworthy

- These forms could take one of two forms: limited (most common for real estates) or durable, depending on the extent and duration of authority given to the agent

- The role of an agent (attorney-in-fact) is different from an attorney or lawyer (the legal practitioner)

- Before signing these forms, the principal must make sure an attorney reviews the documents and terms to maintain compliance with state laws

- Signing requirements differ from state to state