An auto insurance verification letter is a letter that is used as evidence of a third party such as DMV office and many more to show that the driver has the insurance. The third-party, which is the requesting party, must deliver the form to the insurance provider so as to get the specific information about the insurance policy concerning the driver, such as the policy number, accident coverage details, and the expiration date of the insurance. As soon as the insurance company agent retrieves the requested information against the submitted form, it will be sent back to the requesting party.

The information needed so as to fill this request form or request letter includes the client’s name, client’s address, name of the insurance company and insurance company phone number agent’s name, and the insurance company fax number. Below is the basic content contained in this insurance verification letter.

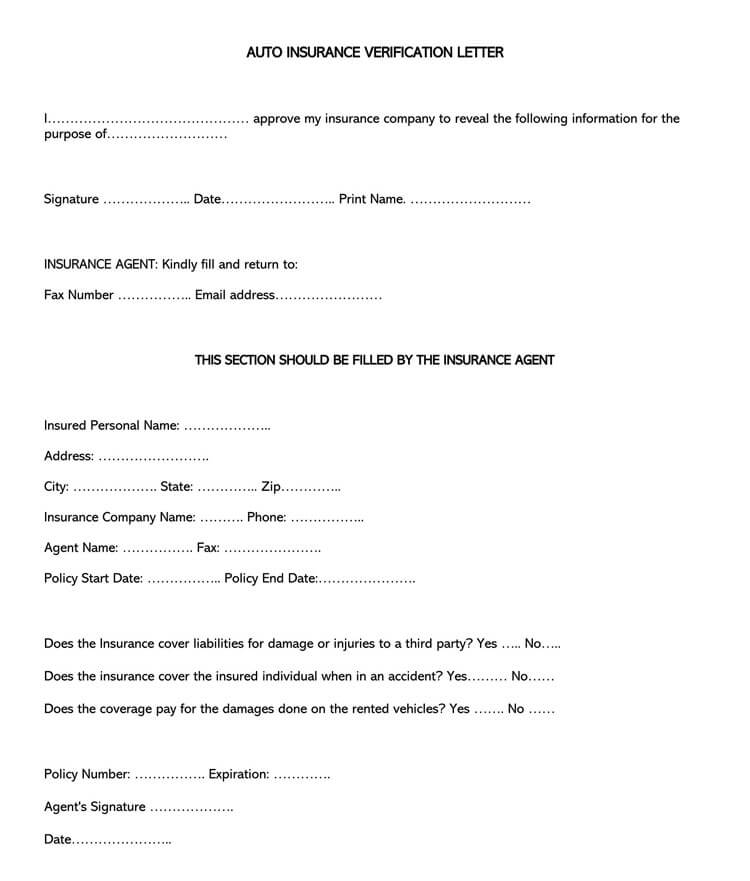

Sample Auto Insurance Verification Letter Template

AUTO INSURANCE VERIFICATION LETTER.

I……………………………………… approve my insurance company to reveal the following information for the purpose of………………………

Signature ……………….. Date……………………..

Print Name. ………………………

INSURANCE AGENT: Kindly fill and return to:

Fax Number …………….. Email address……………………

THIS SECTION SHOULD BE FILLED BY THE INSURANCE AGENT.

Insured Personal Name: ………………..

Address: …………………….

City: ………………. State: ………….. Zip…………..

Insurance Company Name: ………. Phone: ……………..

Agent Name: ……………. Fax: ………………….

Policy Start Date: …………….. Policy End Date:………………….

Does the Insurance cover liabilities for damage or injuries to a third party? Yes ….. No…..

Does the insurance cover the insured individual when in an accident? Yes……… No……

Does the coverage pay for the damages done on the rented vehicles? Yes ……. No ……

Policy Number: ……………. Expiration: ………….

Agent’s Signature ……………….

Date…………………..

Template in Word Format

- MS Word

How to Fill this Template

The following guide will help you to fill the provided form.

Client’s Section: The first step is for the client to fill this form by indicating the first and last name. After this, the client provides the name of the third party and explains the intentions of this letter.

Third-Party Entry Field: Secondly, the next two fields in this form are set for the third party to enter their email address or fax number. The blank spaces have to be filled by the client’s insurance company. The agent enters the following details:

- Client’s Name.

- Client’s address, including the city, zip, or state.

- The insurance company’s phone number.

- The name of the insurance company.

- Name of the Agent.

- Fax number of the insurance company.

In the next section, the agent is obliged to specify the following details before delivering the form to the insurance company.

- Whether there is a liability for injuries or damage to the third party. The agent selects either yes or no.

- Does the insurance coverage pay for damages done on rental vehicles?

- Does this coverage pay the insured person in an accident?

- Describe the policy.

- Specify the expiration date.

- Agent’s printed name.

- Agent’s signature.

FAQs

There is nothing to change you because of your car insurance. Actually, it can even help you. For instance, MTIVS can assist in verifying insurance for a driver, if he/she has forgotten to carry the recent insurance card while driving.

Currently, MTIVS does not have an entry to any commercial or self-insured vehicles. Under this insurance policy, a commercial policy is coverage given to the insured without considering the vehicles that are covered under a commercial garage and are rated using the rating rule.

MTIVS gives a way to track independently or differentiate motor vehicles that are self-insured if a self-insurer decides to give vehicle specific information regarding their fleet. You can also decide to continue relying on your proof of insurance card that indicates the fleet designation.

MTIVS does not verify an out of state insurance policy. Instead, it only gets information from the automobile liability insurance companies that are insuring companies registered with Montana. On the contrary, law enforcement will receive information about out-of-state insurance through criminal justice networks that are available depending on the procedures.

There are a number of causes for this scenario:

• Occasions, where MTIVS is not accessible due to the system being down, are rare. The office in charge will exercise discretion according to the personal circumstances, whether a citation has been issued.

• You need to verify that the vehicle identification number indicated on your policy matches what is listed on the title of the vehicle to avoid discrepancies.

• The display of an insurance card from the operator may not match with the response received from the MTIVS and the insurance card provided by the operator. If this is the case, the law imposition officer will issue a notice to appear to the operator for the violation of the law of the state.

For such a case, the third-party will give you a binder, which is a temporary card good for a limited time. This will indicate the status that is listed in MTIVS. The new information will be available through MTIVS in several days, depending on how fast your insurance company updates its system.

MTIVS will definitely verify that insurance as long as the car is listed on your insurance policy. You need to know that MTIVS is a vehicle-based information system, and it will only verify a vehicle if it is associated with a particular auto liability policy.

As long as your vehicle is registered with MTIVS, you will be required to pay minimum liability insurance.

MTIVS laws will require all drivers to carry a small amount of liability insurance. You should know that lacking an insurance cover can lead to severe penalties that you cannot afford.

For a first time offense, MTIVS will require you to carry proof of Montana insurance with you and give it if a law enforcement officer requests for it. It is an offense to drive without insurance, and the penalty for non-insurance is a range of 250 to 500 Dollars or around 10 days in jail for the first offense.

For the second time offense, you will be required to pay a minimum fine of 350 Dollars or 10-day imprisonment. Your driving license will also be revoked for 3 months. Five points will also be deducted from your driving record.

If this offense is repeated for the third time, a fine of 500 Dollars is imposed or imprisonment for not less than 6 months or both.

If you are involved in an accident, and you are an uninsured driver, then you will be charged a lot of money. Drivers who have insured their vehicles legally are the ones to pay the costs of the uninsured drivers and the policies that they ought to be carrying.

Disclaimer: The information may have been updated since we have published it. Please check with your state website for recent policy changes and fine updates.