A business receipt is a financial document that provides proof of product or service purchased.

In this sense, this receipt is a helpful document that helps keep track of a company’s incoming gains and outgoing expenses. This is especially helpful to be able to monitor financial progress, as well as simplify administrative tasks when tax season comes around.

This article will review exactly what the receipt is and provide insights on how to craft one properly.

What is a Business Receipt?

It is a document that verifies that a financial transaction has taken place. This contrasts with invoices, which only request payment because these receipts are created only after the product or service has been provided and paid for. This is an excellent tool to verify that a purchase was legitimized.

Businesses may provide receipts to their customers and, likewise, they may request one from other businesses. For example, if a business needs to purchase new computers for their office space, the receipt can be used to later write it off as an expense during tax season.

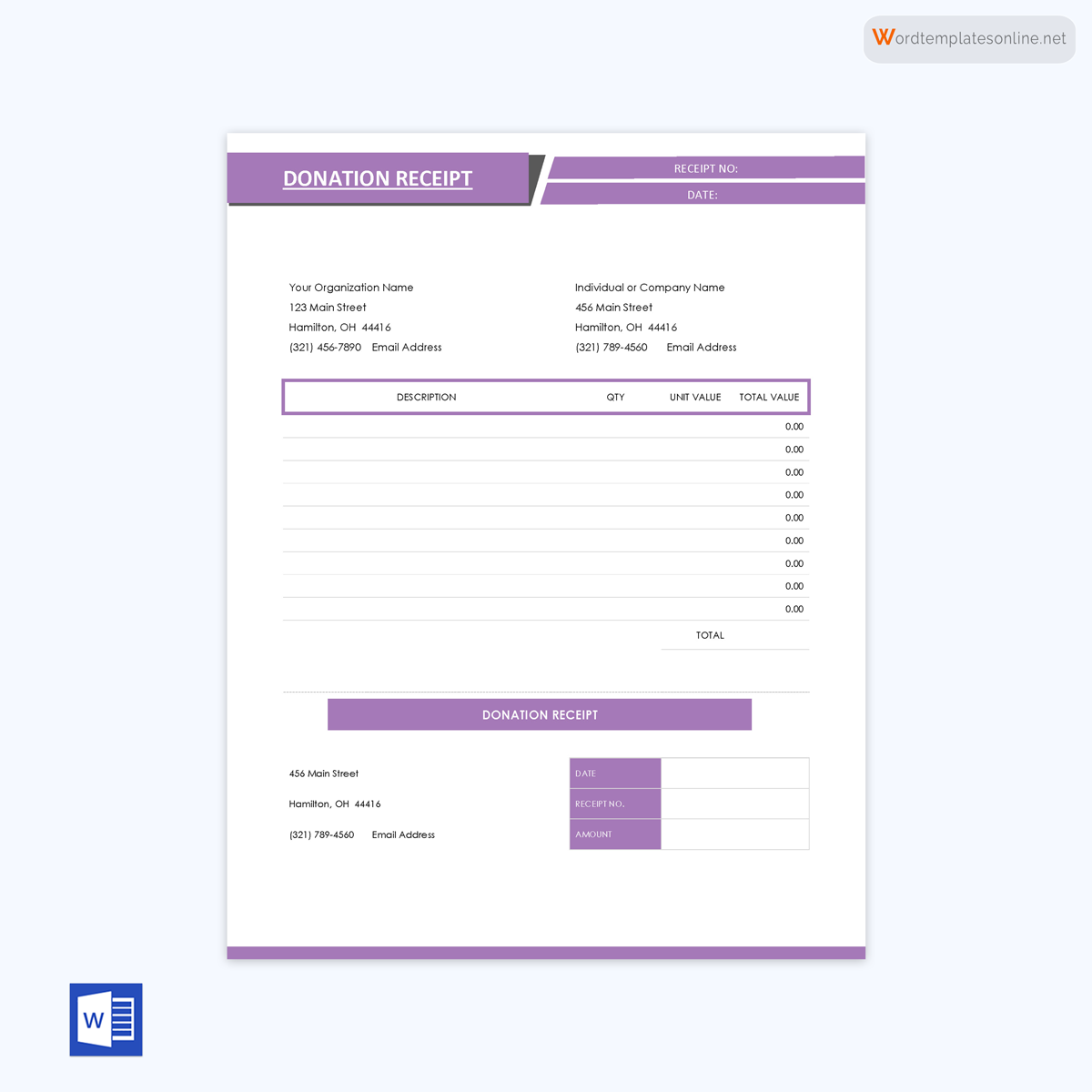

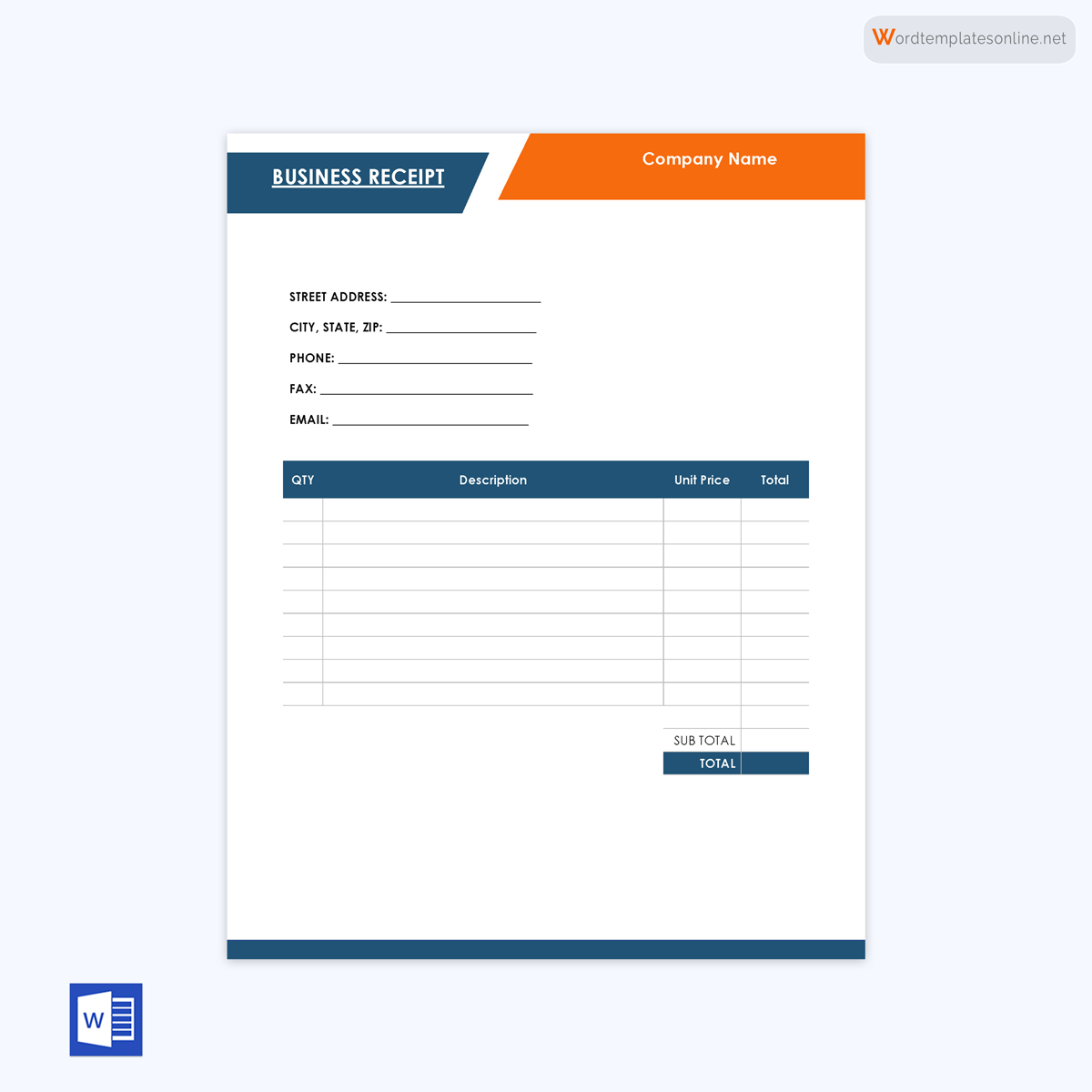

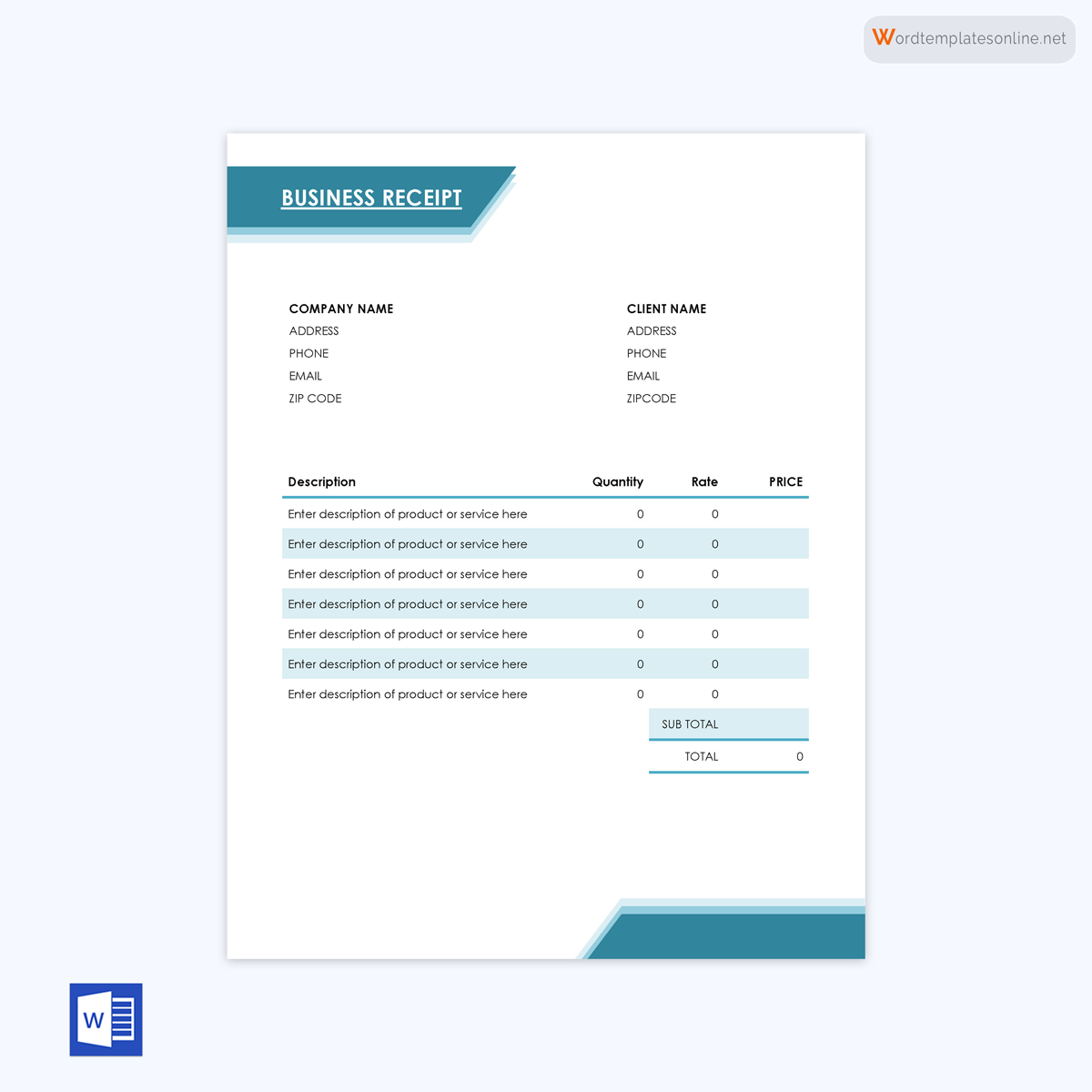

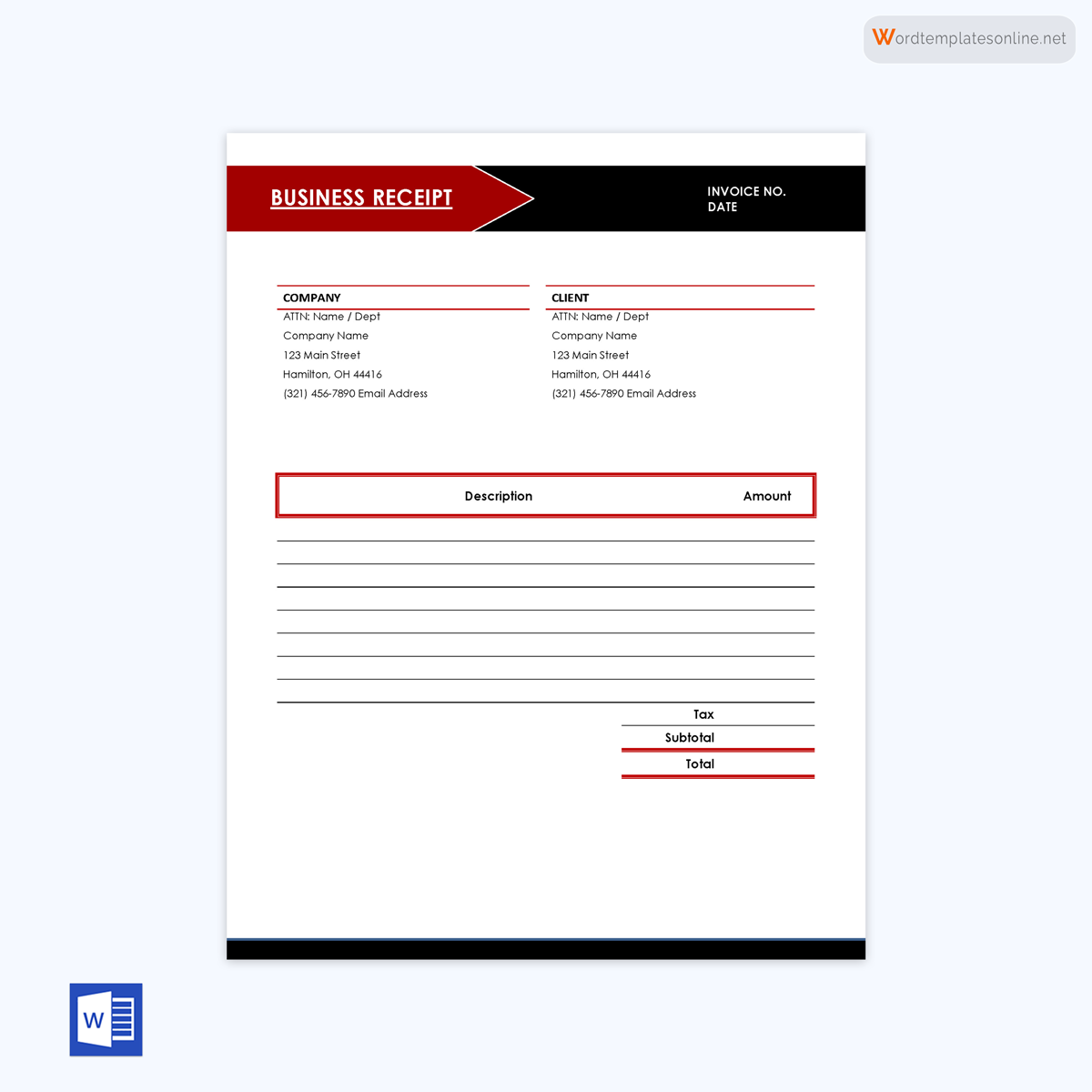

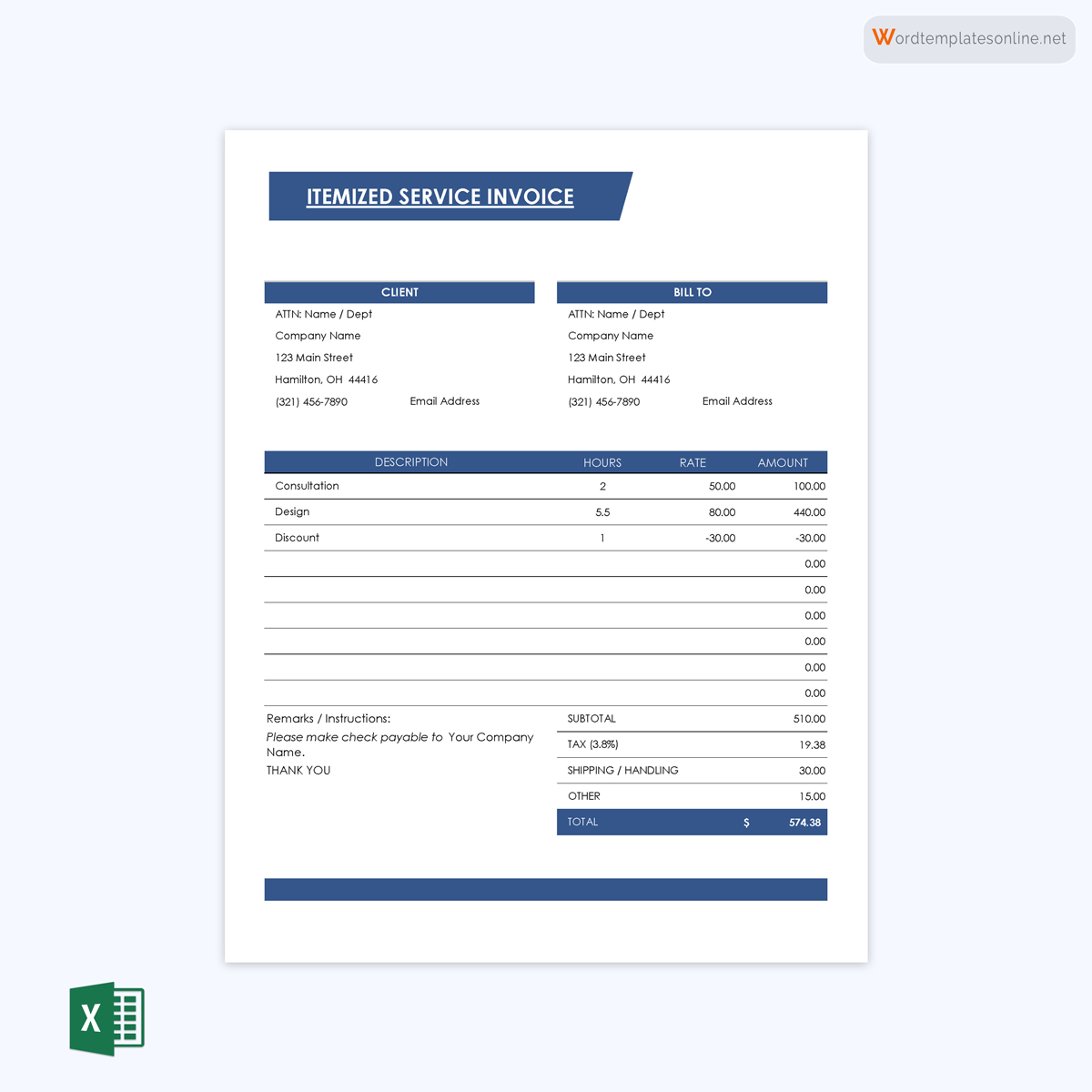

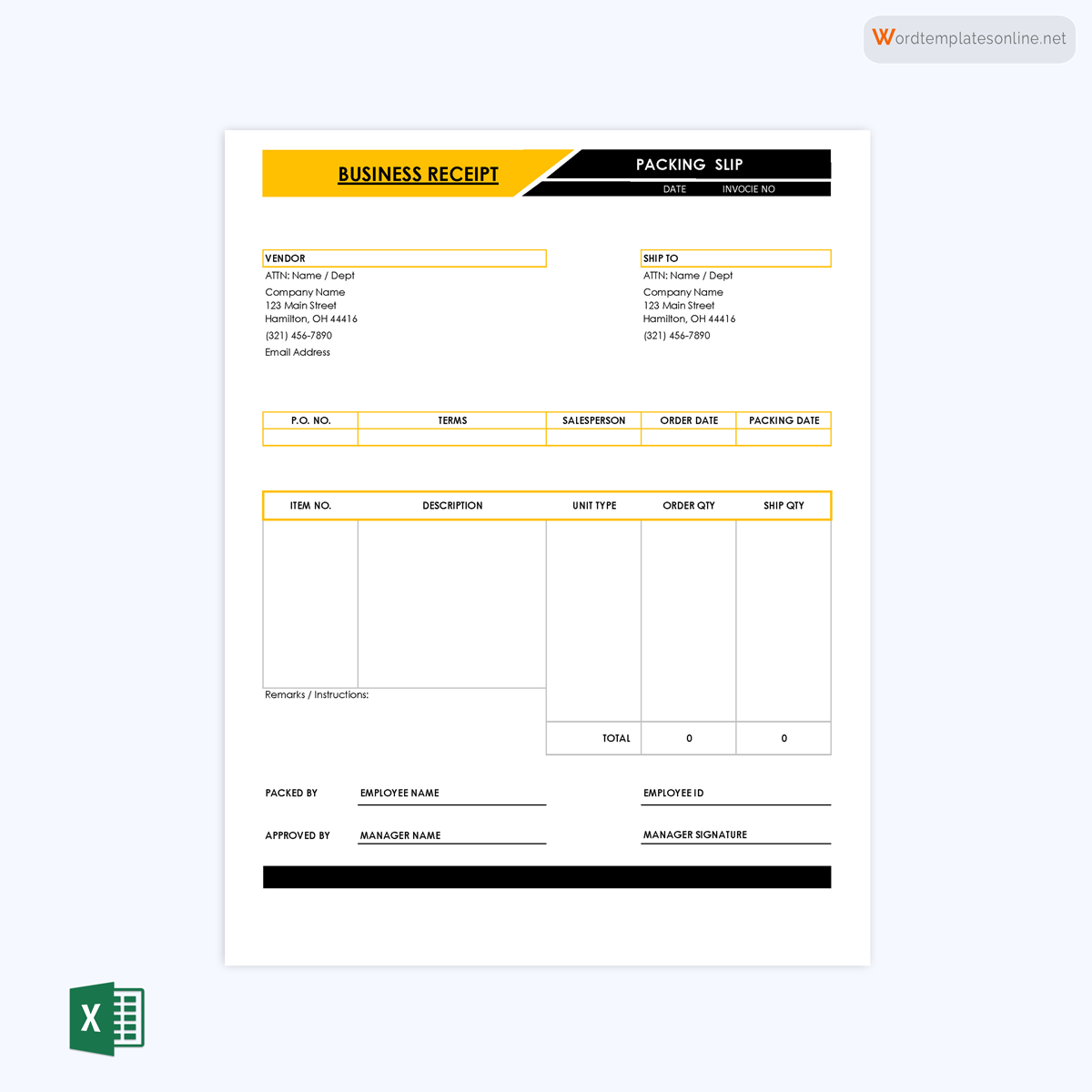

Business Receipt Template

Importance

These documents are essential to support and verify your business deductions. In addition, your tax professional may need to see these receipts and any sales slips, invoices, paid bills, cash register tapes, or 1099 forms. In other words, they form part of basic bookkeeping that all businesses should take part in.

Typically, most receipts are now stored electronically, and most customers are only provided a physical receipt if they cannot receive the digital version. Therefore, a receipt should generally be given to a customer in some form to have a payment record.

Regardless, there are several other reasons for which these receipts are essential, such as:

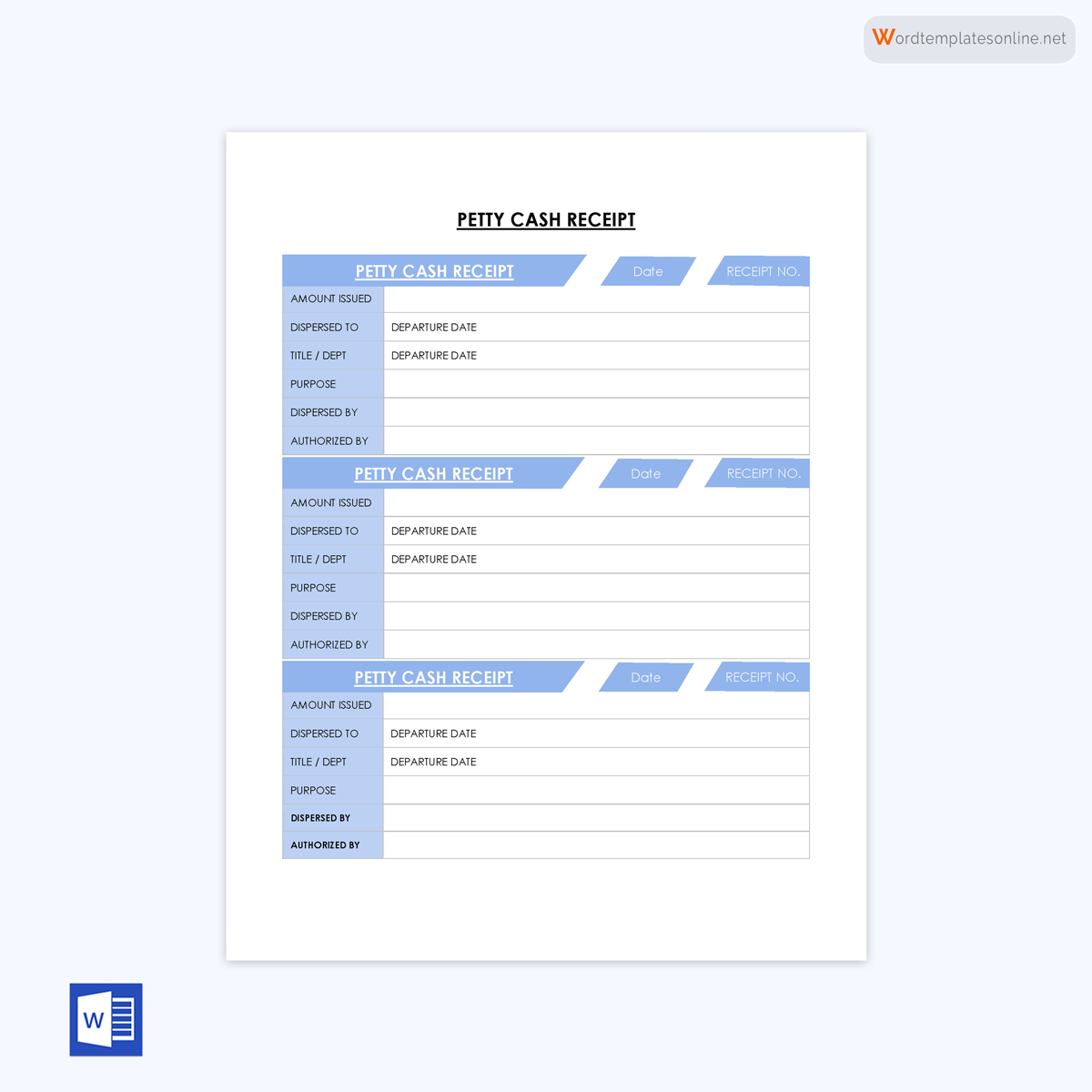

To monitor staff expenses

One of the most critical elements of the receipts is the ability to monitor staff expenses. Generally, a company will have a detailed guide to help employees understand the best way to spend money. In addition, a company may want to track its spending by having them present receipts to the accounting department to help prevent overspending.

Not only does this help keep costs low, but it also makes filing a company’s reports easier during tax season. This is essential to ensure your business is transparent with its expenses. It also helps ensure employees know how to use and report company money properly.

Tax audits

A business’s worst nightmare is having issues in the case of a tax audit. To prevent any issues during an HMRC tax audit, proper recordkeeping through the receipts is an effective way to back up any expense claims.

Setting up an efficient system to track, record, and organize a business’s receipts is also advisable. Tracking these expenses is fundamental to ensuring that a company has proper financial health and can make accurate predictions about future budgets.

Set informed budgets

A company needs to be able to craft and plan adequate budgets for the future. If a company cannot keep track of its spending effectively, it will not be able to set a realistic budget for the next quarter or year.

Therefore, the receipts help a company keep track of overall costs. From day-to-day expenses, such as business lunches, to larger purchases, these receipts make it easy for businesses to plan their incoming and outgoing cash flow. The accounting team can create a clear business budget by tracking this data effectively.

These informed spending plans make it easier for businesses to achieve their goals, avoid surprises, and stay in line with effective practices.

Managing business overheads

Overhead expenses are often overlooked, but these types of expenses should also be tracked through proper receipts. Keeping records of a company’s overhead expenses is essential, both big and small. For example, monthly rent, insurance, and employee salary should be kept on receipt, as well as smaller costs like office equipment and one-time expenses.

By keeping track of these business overheads, you’ll be able to manage your budget more appropriately. It’s recommended to use some cloud-supported spreadsheet to be able to input the outgoing cash flow accurately and quickly.

Which Business Receipts Should be Kept?

A business is likely to have many incoming and outgoing receipts, so it may often be challenging to know how to keep track of everything. Depending on your business, it’s likely that you’ll need the receipts for the following:

Inventory

It is crucial to always keep receipts for the business inventory. This pertains to the materials the company buys and its products, ensuring that the inventory receipts contain information on the buyer and how much of a specific product they bought.

Assets

Any assets essential to the business should also be handled within your recordkeeping. From machinery to regular furniture, all of the receipts for these assets should be kept, especially when you’re able to have your tax attorney handle the depreciation of their value. Of course, this also pertains to receipts anytime you need to service those assets.

Advertising and marketing suspenses

From digital marketing to ads in magazines, any amount of money that is spent on advertising should also be kept track of. These receipts are essential for your overall company budget.

Car and truck expenses

Many companies can deduct taxes if you’re spending money on vehicles, gasoline, or maintenance. There are many different ways you can use these expenses to receive tax deductions, so it’s recommended to keep track of these.

Education expenses

Anything that involves continuing education in your business is an excellent expense to keep track of. You can keep records for classes, seminars, and any course relevant to the business.

Entertainment

Some kind of entertainment can be considered a business-related tax deduction. For example, taking a client out for lunch can be tax deductible if you prove it was directly related to your company. This is why keeping excellent records of business-related stuff is incredibly important.

Networking

Networking on behalf of your business is another expense that should be kept track of. In the same way, educational expenses may be tax deductible, and networking at conferences may also be. It is a good idea to keep detailed records of these events as they are key to business growth.

Professional services/contractors

Any services and contracts that you hire out should involve invoices and receipts. From graphic designers to content writing, businesses should keep hold of their receipts if they want to write them off down the road.

Travel expenses

The IRS clearly outlines travel expenses, so you must keep every receipt and bill incurred during your travels to be able to write it off later. By keeping all the receipts from planes to hotel rooms you should be able to make much, if not all of it, a tax deduction.

How Long to Keep a Receipt?

The IRS recommends keeping your records for a minimum of 3 years, but depending on your business, you may need to keep them for a more extended period. Again, this is because it depends on the gravity of the situation. For example, if the IRS believes you are underpaid by more than 25%, they may request up to 6 years’ worth of records.

While you don’t need to keep all your receipts on paper, they should at least be kept in a digital form for a significant amount of time. For this reason, it’s recommended to keep receipts, invoices, and banking transactions as PDF copies so that you’ll always have easy access to the information.

$75 receipt rule

A good rule of thumb is that you only ever need to keep receipts for items or services that are more than $75. However, lodging expenses should be added to the books, even if they’re below the $75 rule.

Managing a Business Receipt

It cannot be easy to maintain excellent recordkeeping practices. However, there are a couple of elementary techniques you can use to ensure you protect yourself from potential problems.

Two easy solutions are:

Make it a habit

Making a habit of tracking everything allows you to never forget doing so. Avoid procrastination and add your receipts to your collection as soon as you have them. For example, you can make sure to keep all of your physical receipts in the exact location, ordered by date. You can also write notes to help you remember what the receipt was for.

Use leverage technology

Likewise, you can use technology to your advantage. By keeping digital copies of all of your receipts on a cloud service, you’ll never need to worry about losing them. You can also use many apps to track your receipts or even have them automatically captured and uploaded. Depending on your business needs, many different apps are available, such as Shoeboxed, Neat, QuickBooks, and TurboTax.

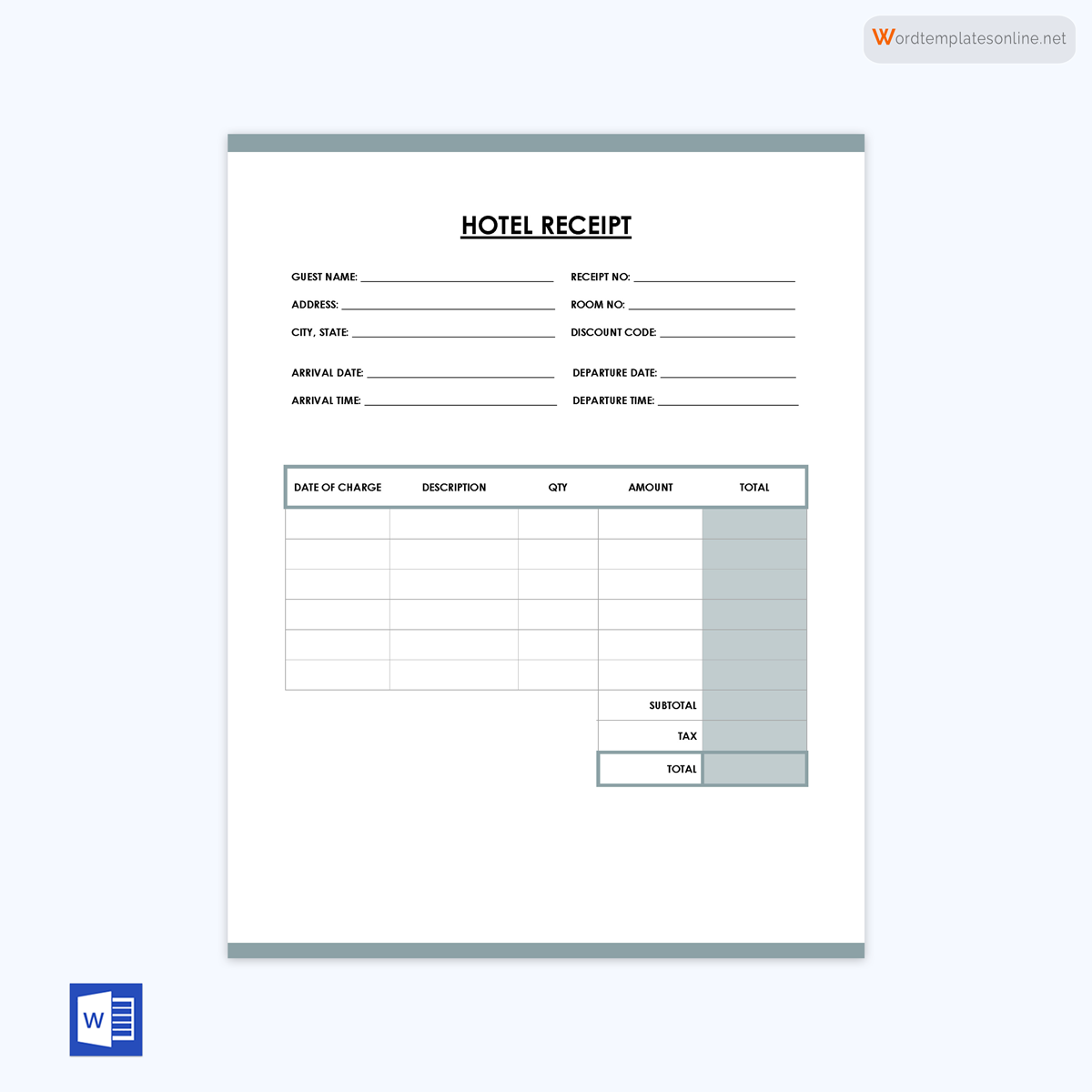

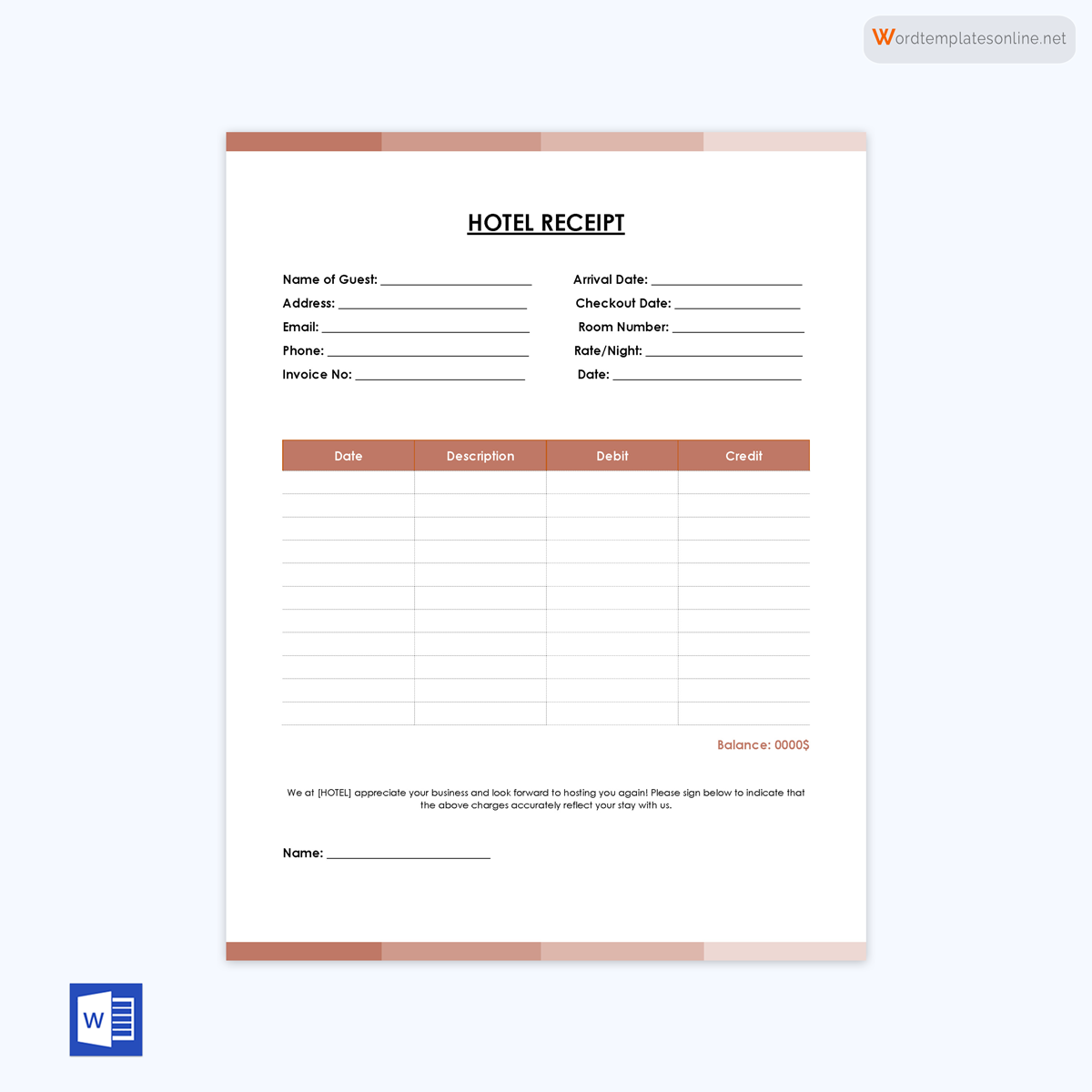

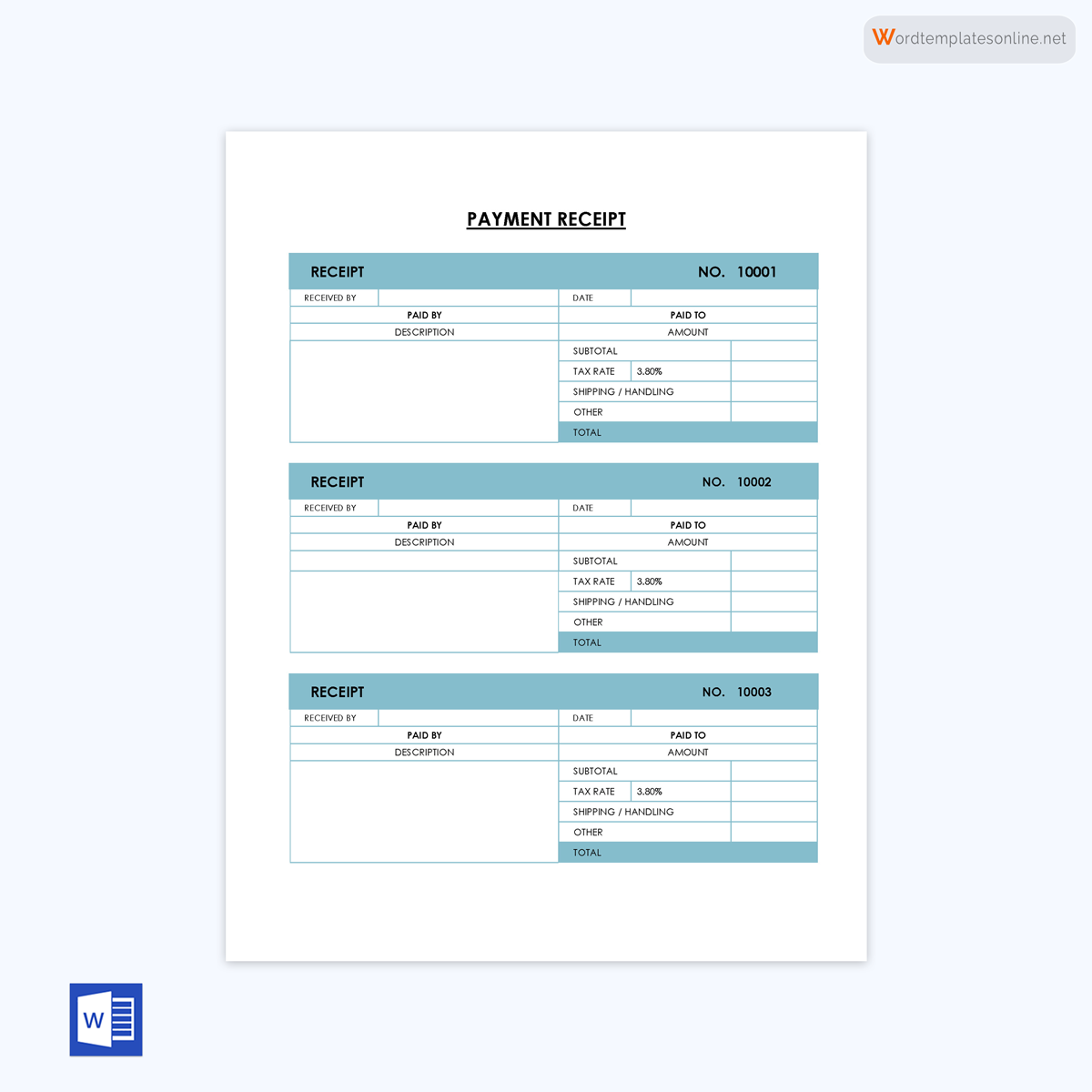

How to Write?

Writing a proper receipt is a crucial skill to maintain appropriate bookkeeping in your business. Whether using automatic software or simply creating a template with Microsoft word, it’s essential to ensure it contains all the appropriate information.

The first information on the receipt should be the business header. This should be used to document where the transaction took place and the two parties involved. Within the header, you’ll want to include the payee information.

Payee’s information

The payee information should include the details that can be used to identify whoever is receiving the information. For example, if you are issuing the receipt, this will include your business information immediately.

- Company name should be stated at the beginning of the receipt. In some cases, it may also include the name of the employee responsible for issuing this specific document.

- The physical address of the company should be placed directly underneath the business name. This is especially helpful for businesses with multiple locations or franchises.

- City, state, zip code are additional identifying pieces of information that helps keep track of the business address.

- It’s essential to include the business’s phone number so that the person who receives the receipt can contact the company if necessary.

- A business may also include its fax number on the receipt if applicable. While not many businesses still use this, more traditional companies may prefer to include this information.

- All receipts should have an email address present on the document. This makes it easier for the receiver to get into contact and have written communication with the business if the case arises.

Date

After the business information is included, the receipt must include the date on which the transaction occurred.

Receipt no

All receipts should have a unique code that signifies the receipt number. This reference number is essential in all excellent bookkeeping and makes it easier to go back and check the receipts in the future.

Transaction details (description of the item, quantity, total)

The transaction details should be included immediately after all of the business identifying information. This helps clearly explain what services or products are being provided. The first column is typically provided to describe the quantity of the item, whereas the middle column is used to describe it. The third and fourth columns will include the unit price and total information. This makes each row easy to understand and explicitly shows the products provided.

Subtotal along with any taxes

After this, the bottom of the receipt should detail the subtotal, which is the total of all of the numbers on the fourth column previously discussed. Afterward, any applicable taxes or discounts will be noted and calculated.

In many cases, a client may submit a partial payment, in which case a section for “Total Amount Due” and “Total Amount Paid” may be added to these calculations. The business receipt will be an excellent way to keep track of continual payments.

Payment method

After all the payment details are included, the payment method should be listed. Depending on the type of business, this could be in cash, credit card, or electronic transfer. Whichever the case, it should be noted.

Payer’s information

After all of the payment details are written, the person purchasing the product or service should also have their information noted. This is helpful for companies to keep track of who is frequently giving them business.

- The purchaser’s name should be included. Again, this could be the client’s name, or it could be the name of another company in the case of business-to-business transactions.

- Likewise, the physical address of the person or entity should be included to make future correspondence more efficient. This is also helpful in case any items need to be shipped.

- After the street address is noted, a city, state, and zip code line should be included.

- The payer’s telephone number should be added to the respective line, making it easier to get in touch with them should the provider need to contact them in the future.

- Finally, the purchaser’s email address should be added.

Payee’s signature

Once the above information is included, the payee should sign the document to verify its authenticity. This helps ensure that the receipt is valid and confirmed by both parties.

Tracking a Business Receipt

As a business grows, it is essential to ensure that the recordkeeping process is efficient, smooth, and all-inclusive. To avoid needing to track down pieces of paper or lose precious time doing administrative tasks, there are several methods a business can apply to grow more efficiently:

Store receipts online

The first step a business should take is to store all of its receipts digitally, preferably on a cloud service. Since a business may need to store up to 6 years of documents, keeping electronic versions is a much more viable option. Most of the time, digital versions of records are more adequate for tax reporting.

Many businesses may also provide digital receipts rather than physical ones, allowing companies to store any necessary documents quickly and easily.

Arrange them chronologically

As your business grows, it becomes essential to stay organized. For this reason, chronological receipts are the most efficient way to keep track of income and expenses. Not only does it make it easier to go back and track monthly expenses, but it also allows for easier reporting when tax season comes around.

Group receipts into categories

A business may also find it helpful to keep receipts organized in categories and chronological order. This is especially helpful for larger companies that may need to manage budgets and expenses separately.

For example, a business may want to organize their entertainment or education expenses and tag them separately, as they are all tax-deductible. Likewise, the receipts for overhead costs may be organized together. This allows a business to quickly look at separate budgets and better understand different aspects of their business.

Make a backup for your business receipts

One of the worst possible scenarios for a business would be losing all its necessary receipts. Whether digital or physical, both cases may be disastrous. For this reason, a cloud service is an excellent way to make sure that all the receipts are correctly stored and that they may be accessed from anywhere in the world.

Frequently Asked Question

In most cases, you do not need to keep a paper receipt. For example, while you should keep at least six years’ worth of records, they can be in digital form, so a paper copy is not usually necessary.