A checkbook register is a document used to keep track of financial transactions.

Also referred to as a cash disbursement journal or check register, the document is used to record personal, business, or organizational check payments, including check numbers, payee amounts, payee names, and payment dates. It details all financial expenditures made before being posted in a general ledger.

A checkbook register is a vital accounting tool because it helps one avoid bounced checks, missed payments, or insufficient balances. It also helps one identify discrepancies in financial statements and avoid penalties such as late or overdraft fees. With the register, one can determine how much money they have in their checking account at any point in time. At the end of a regular accounting period, the register is usually reconciled with a general ledger account, which is then used to generate financial statements.

Even though most financial transactions are conducted online, you should maintain a detailed checkbook register. This is advisable since your checking balance may be inaccurate. Furthermore, banks may make mistakes, or you may forget to record some transactions. To help keep you on track, you may utilize a checkbook register template to record all your transactions effectively.

This article discusses the importance of using a checkbook register template, who can benefit from it, its components, and the available tools for creating one. Free downloadable templates have also been provided for your convenience.

What is a Checkbook Register Template?

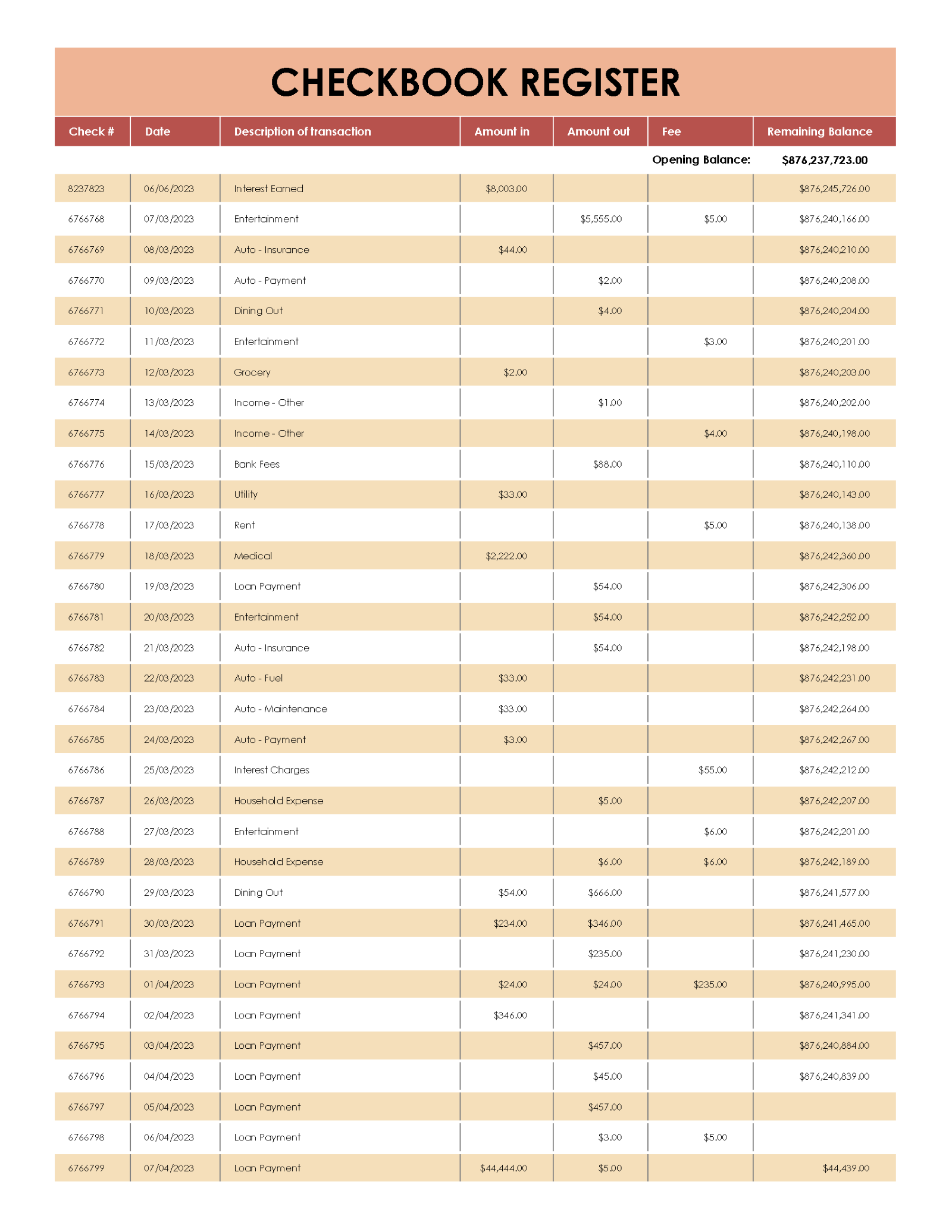

A checkbook register template is a ready-to-use layout you can use to record and track personal, organizational, or business financial transactions.

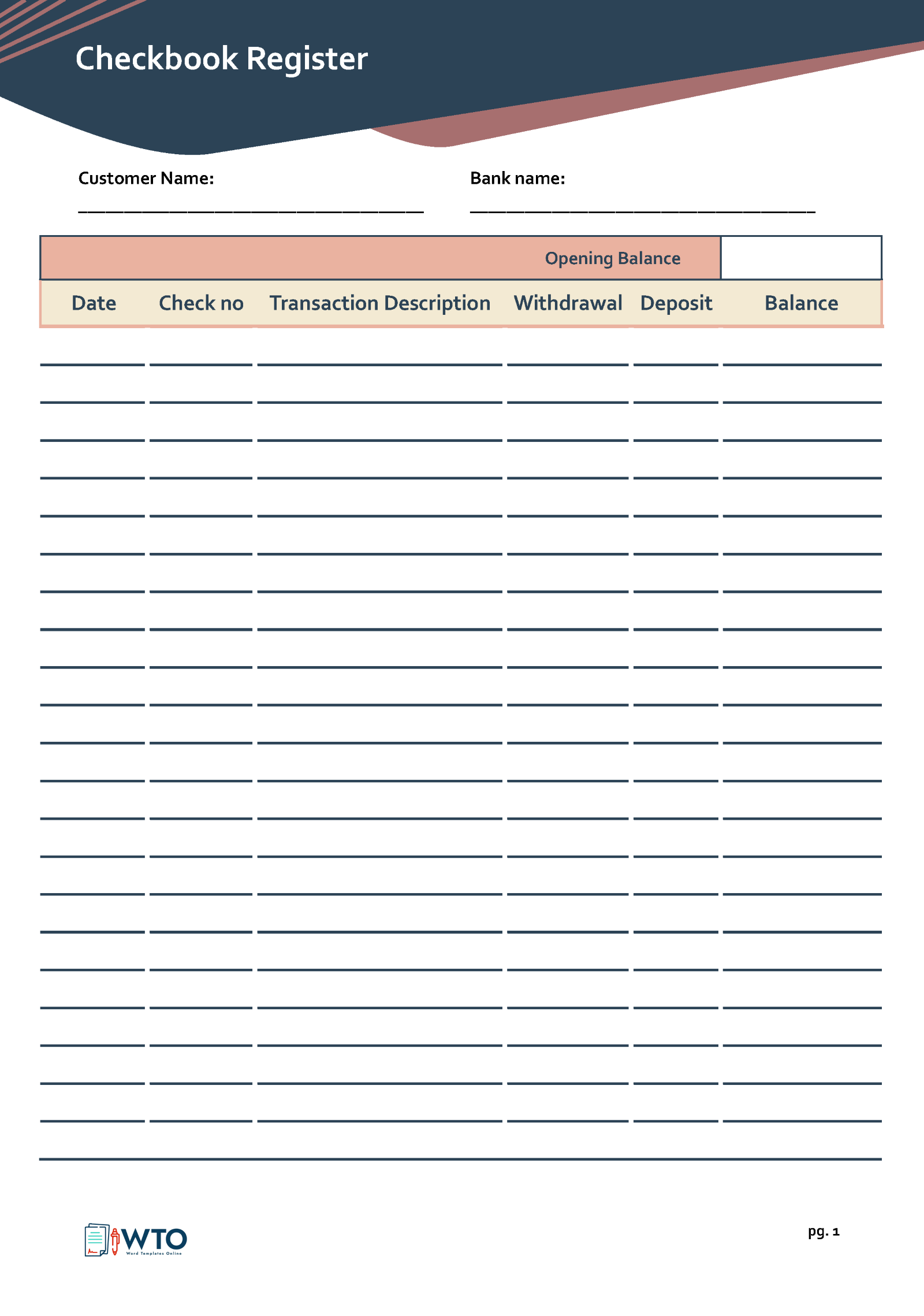

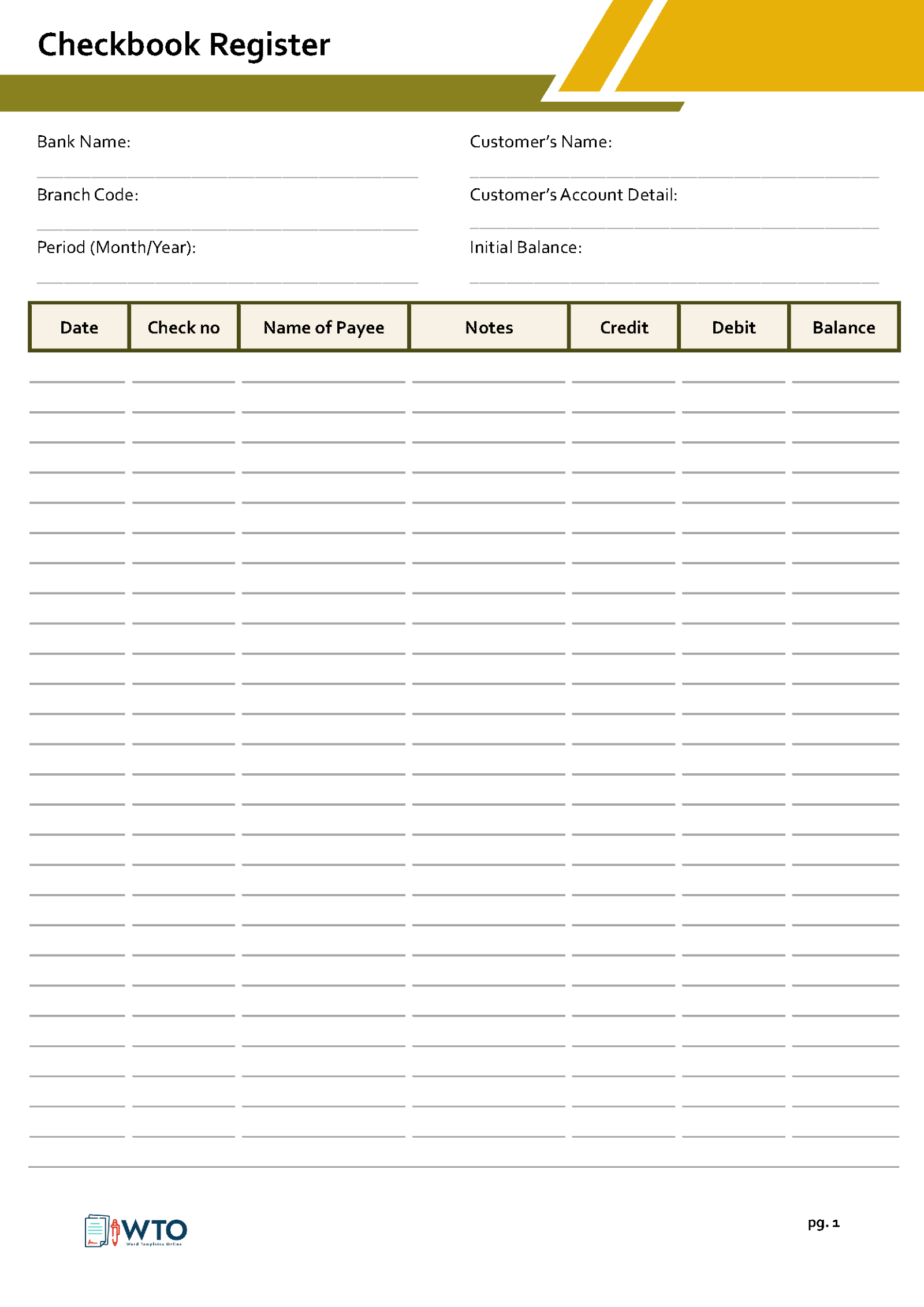

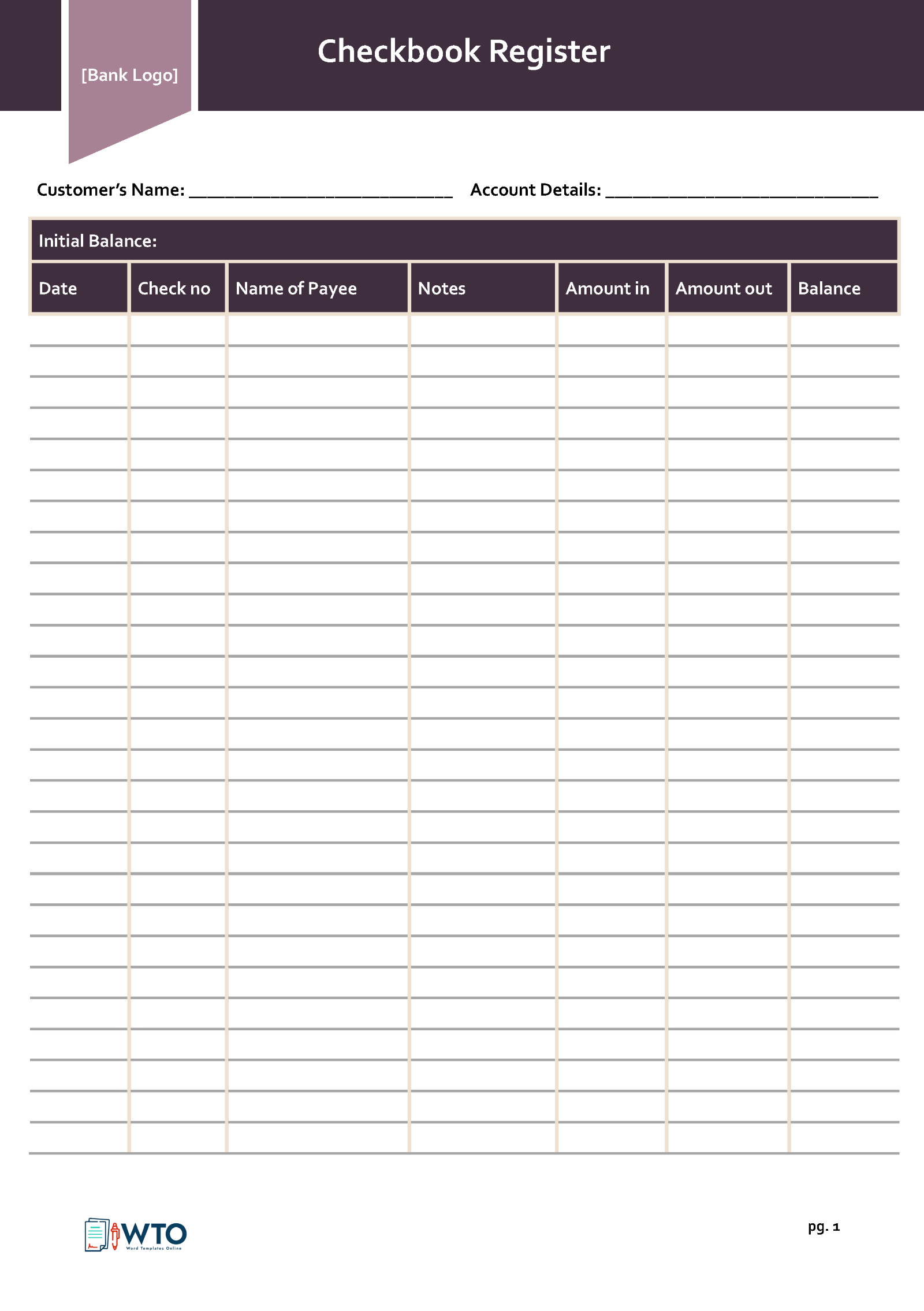

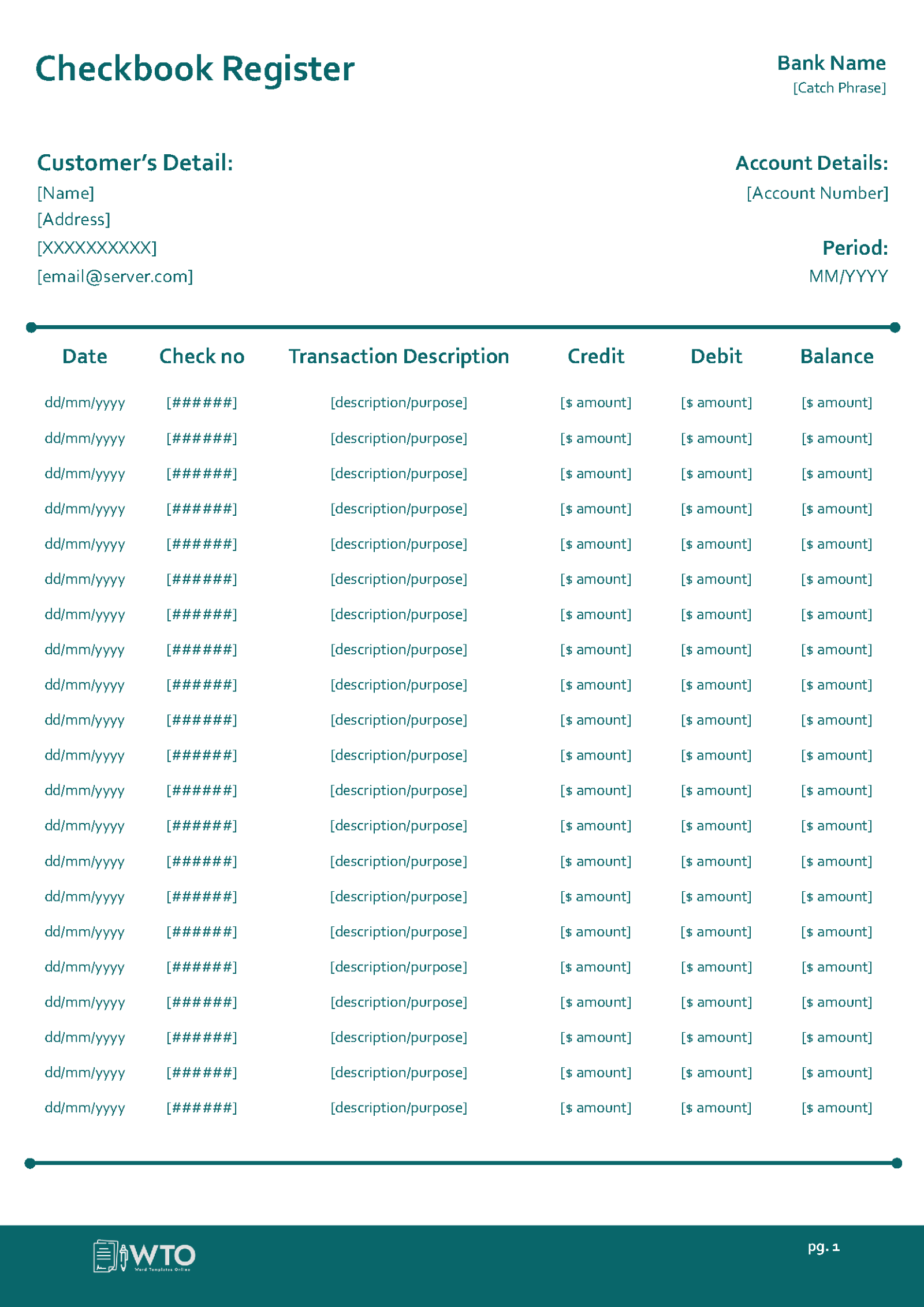

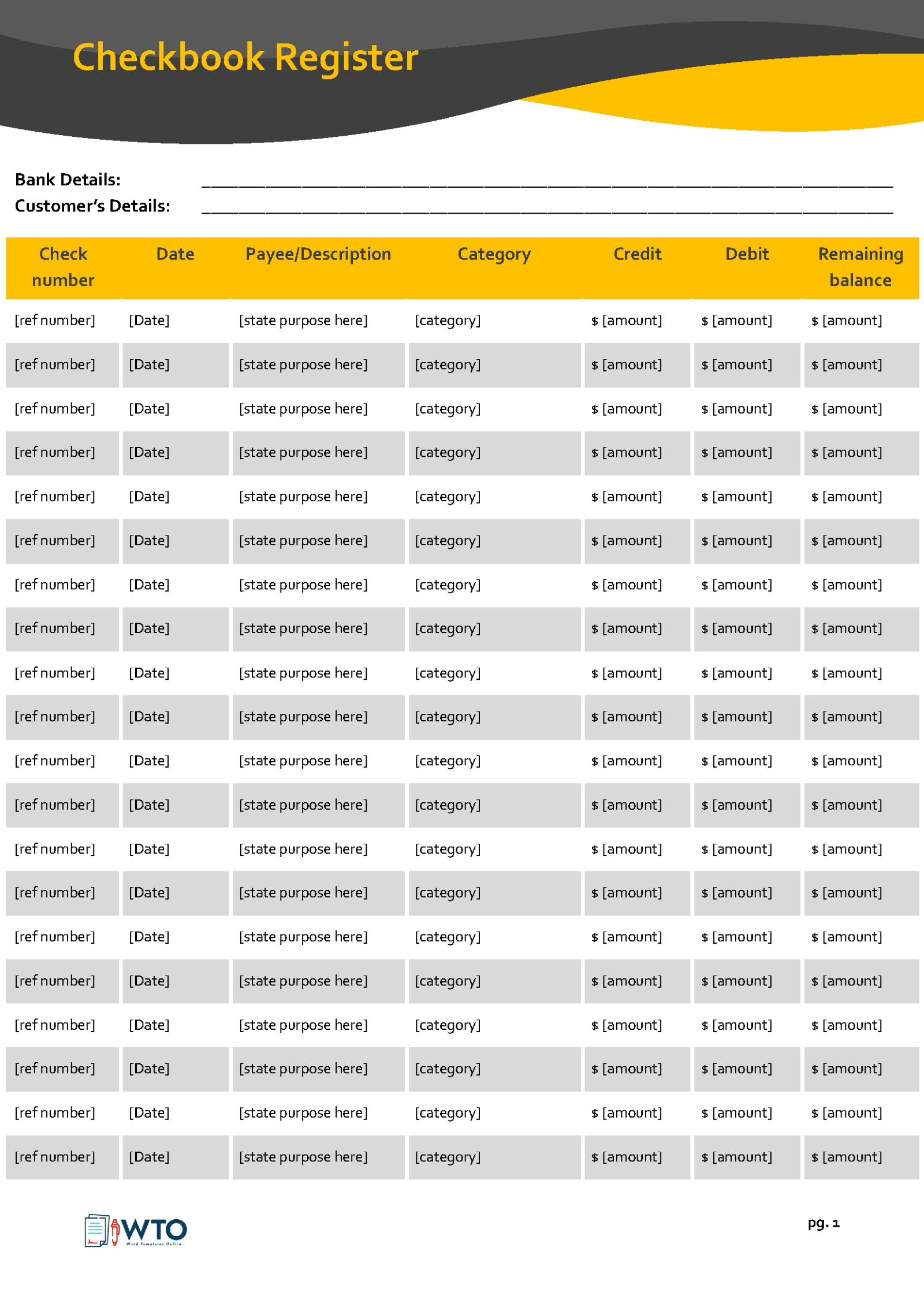

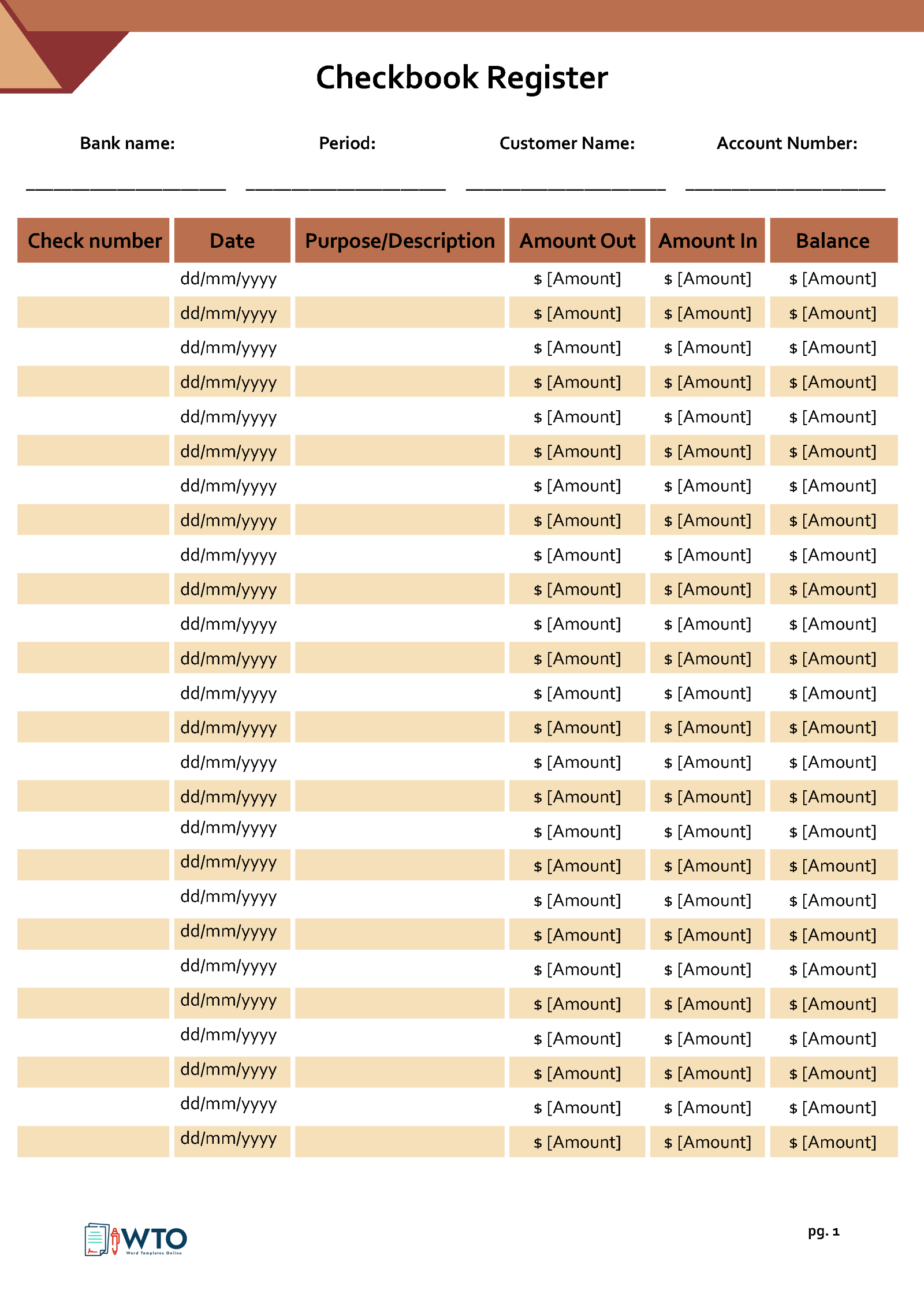

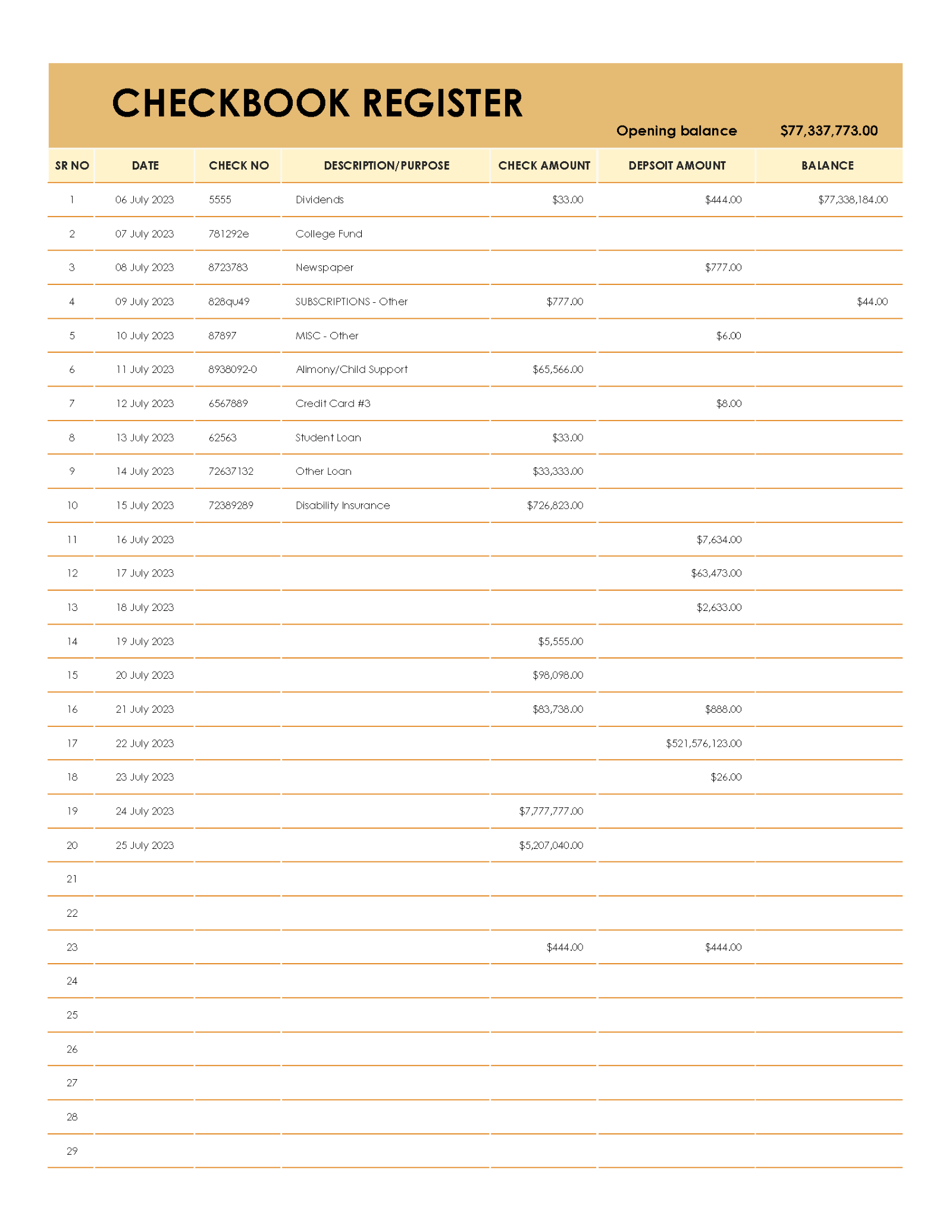

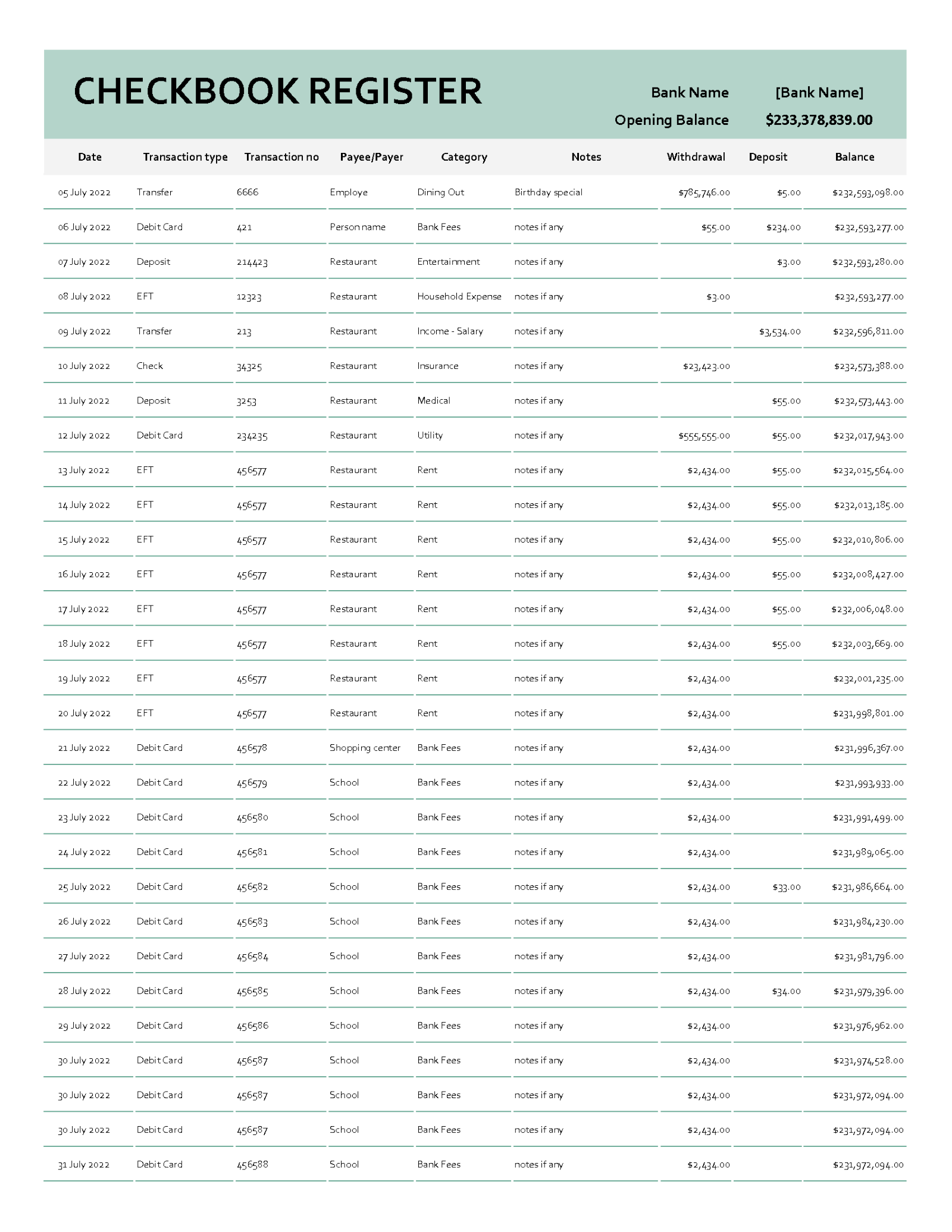

The template has columns that enable you to organize and categorize information associated with various transactions. These include the transaction date, the payee or information, the type of transaction, the check number, the withdrawal or deposit amount, notes, and the account balance.

The template can be in the form of a digital or printable spreadsheet. A digital template can be used in spreadsheet programs such as Google Sheets or MS Excel, which have formulas that perform automatic calculations. You may also print the template and fill in the necessary information. Some templates also allow you to create electronic registers in various online and offline accounting software, which can be beneficial, especially for businesses.

Free Templates

Benefits of Using the Checkbook Register Template

Using a template for a checkbook register gives you control over your funds and streamlines your financial management. The primary advantage is that it helps you view your bank account balance in real-time.

Other benefits of using the template include:

Organization

A template helps you record financial transactions in an organized and consistent manner. It also provides quick access to all recorded transactions in your checkbook should you need to refer to them. You can therefore view your checking balance and make informed financial decisions.

Accuracy

Using a template for a checkbook register allows you to maintain an accurate record of your transaction history. With a template, completed transactions are recorded as soon as they happen. This gives you a detailed understanding of your financial situation, thus allowing you to make informed financial decisions.

Saves time

With a template, you can save time since you do not have to create a register from scratch. As the template has already been pre-formatted with columns, formulas and labels, you only have to fill in the necessary information. This is beneficial, especially if you have to make multiple records.

Easy to use

Most templates are relatively easy to use, even without extensive computer skills. Others even have instructions that direct you on how to use them. Therefore, you can conveniently record every financial transaction as soon as they occur.

Improved financial management

Using a template for a checkbook register allows you to review all your transactions during a specific period. It provides you with an overview of all your cash inflow and outflow. As a result, you can manage your finances better since you are aware of the amount of money in your checking account.

Improved financial awareness

With a template for a checkbook register, you can determine if more money is leaving your account than coming in and vice versa. This gives you an overview of your finances so you can make adjustments to your spending habits. As such, you can ensure a positive cash flow, thus minimizing overspending.

Tax preparation

By using a template for a checkbook register, you can keep accurate and consistent financial records. You can conveniently provide these records to the IRS when filing tax returns.

Who Can Use a Checkbook Register Template?

A checkbook register template is an essential tool for financial management. It allows one to track where their money is coming from, going to, and how much is left. The following individuals and entities can benefit significantly from its use:

Accountants

Accountants can use a template to record and keep track of financial transactions. In conjunction with a general ledger, accountants can reconcile transactions and ensure all financial records are accurately captured. These records can then be presented to auditors who review companies’ financial records regularly.

Bookkeepers

Bookkeepers can use a checkbook register template to document and keep track of financial transactions. It can aid bookkeepers who need to keep financial records updated by providing a consistent and organized format.

Financial managers

Financial managers can use a checkbook register template to track a company’s cash flow and regular financial transactions. It allows them to maintain records that accurately capture the company’s financial standing.

Business owners

A template for a checkbook register can help business owners accurately record all of their financial transactions, including cash, card, and bank wire transactions. They can maintain a consistent checking account balance and determine which budget areas require attention.

Administrative assistants

Administrative assistants can use the template to record and keep track of company expenses, petty cash payments, and reimbursements. They can maintain accurate financial records and minimize unnecessary expenditures with a structured format.

Purchasing managers

Purchasing managers can use a template to accurately record company expenses such as rent, inventory purchases, and utilities. This allows them to draft proper budgets and minimize overspending.

Personal finance

A template can be used for personal finance to help individuals effectively comprehend their financial habits. Most people usually find themselves in financial trouble, for example, insufficient funds or bounced checks, simply because they do not monitor their bank account activity. By keeping a record of financial transactions, one can avoid such problems.

Non-profit organizations

Non-profit organizations can use a template to record grants, donations, and expenses. Financial statements outlined in an organized manner can be presented to donors and other stakeholders, thus demonstrating accountability.

Educators

Teachers and other educators can use a template to teach financial literacy to students. Teachers can show students how to use the template, and with regular practice, they can gain important financial skills they can employ in adulthood.

Government agencies

Government agencies, ministries, and other entities can use a checkbook register template to track spending on public projects. It can help justify financial decisions and demonstrate accountability and transparency to the public.

What to Include in a Checkbook Register Template?

A template for a checkbook register has several columns for recording cash inflows and outflows. Even though there are different templates for various situations, they contain similar essential components.

Typically, the template will include the following elements:

Date

This is the most crucial element of the template, where you enter the day, month, and year the transaction is carried out. Accurately capturing the transaction date helps you keep track of every financial transaction and ensure there is no missing entry. By including the date in the register, you can review the frequency of your transactions and make any necessary adjustments.

Check number

A check number is a unique identifier for each leaf in a checkbook. Banks keep track of which check numbers are assigned to which payees. In this column, you must input the check number for incoming and outgoing checks. Keeping track of the check number is critical since it allows you to track the check if it is damaged, lost, or stolen. Including the check number in the template will enable you to keep track of all checks in one spot.

Payee/description of the transaction

This component is critical since it describes the nature of the transactions. You can specify the payee’s name and the purpose of the transaction, for example, personal or business expenses. This will be beneficial when analyzing your previous transactions and bank activities. This column must be filled for both incoming and outgoing checks. The description should be precise, brief, and informative enough for you to understand the scope of the transaction that took place quickly.

Category

In this column, you can specify the category for each transaction. The categories may be broad, like expenses or sales, or detailed, for example, sales from a particular area or expenses associated with a specific business activity. For business purposes, you can establish the categories based on the size of your company and the types of transactions you carry out. For personal purposes, however, these categories can be simple or complex depending on the frequency and nature of transactions involving checks.

Debit

In this column, you can record the dollar amount deducted from your account as a result of the transaction. Examples of debit transactions include purchases, bill and utility payments, or ATM withdrawals. You can also have a separate column on the template to record additional fees such as ATM or check clearing charges. This allows you to track your spending habits and make necessary adjustments. During reconciliation, you can compare the amounts in this column with your bank statements to ensure there are no discrepancies in your records.

Credit

In this column, you can record the dollar amount credited to your bank account for every transaction. Examples of credit transactions include refunds, sales, salary, or other deposits. This helps you keep track of the money being credited to your bank account and ensure your balance is accurate. Like debit, this component can help you during reconciliation with your bank statement to ensure your records are error-free.

Balance

This column reflects the running balance of your bank account after every transaction. Most templates are pre-loaded with formulas to calculate your current bank balance; therefore, you do not have to enter it manually. With this element, you can determine whether you have the required funds for upcoming expenses. This helps you avoid overdrafts and keeps you financially disciplined.

During reconciliation with your bank statements, you can compare the ending balance on your statement and checkbook register, and if they match, you can ensure all transactions are accurately captured.

Tools for Creating Check Book Register Templates

You can use several tools to create checkbook register templates depending on your skill level and preference. Each tool has its own set of advantages and disadvantages.

They include:

Microsoft excel

MS Excel is a spreadsheet processing software that provides a wide range of features you can use to create a template for a checkbook register. You can easily set up columns for the transaction date, check number, category, description, credit, debit, and balance. MS Excel also has formulas that perform automatic calculations and visual tools such as charts and graphs to help you keep track of your finances.

Google sheets

Google Sheets is a cloud-based spreadsheet processing program you can use to create the template. Like MS Excel, it has columns you can easily use to include details for the transaction date, check number, category, description, credit, debit, and balance. It also has formulas that automatically calculate totals, balances, and other financial metrics based on the inputted data. Google Sheets allows multiple users to collaborate on a document simultaneously as long as they have an internet connection. This feature is beneficial if you need to share the register with your accountant or other members of your organization.

Printable templates

Pre-designed checkbook register templates that you can customize to fit your needs are also available online. These printable templates are available in PDF format; therefore, you only need to download one, print it and populate it with data. For online templates, you can input your transactions, categorize them, and generate reports for a more detailed analysis of your financial activities.

Conclusion

A checkbook register is a practical tool for keeping track of the activities in your bank account. It can help you categorize your expenses and determine how and where your money flows, allowing for better financial management. You can budget and plan better by maintaining a consistent and accurate record of your financial transactions.

Making the register from scratch can be tedious. To streamline the process, you may download our free printable templates and customize them to fit your needs. Using a template can also help you identify bank discrepancies, bounced checks, and other errors to keep you on track with your financial goals.