Form 944 is an annual tax return form used by employers to report the company’s employment taxes during the year and remit any owed payroll taxes for income tax, social security, and Medicare tax withheld—payroll tax liability.

The total annual tax liability should be $1000 or less. An employee has to pay federal income tax and FICA tax. However, all employers are obligated to withhold these taxes from their employee’s paychecks and forward the withheld tax to the federal government. Small business owners are not exempt.

Any employer who has had at least one employee for some portion of the calendar year (or from January 1 to December 31) and withheld income and FICA tax not exceeding $1000 (translatable to businesses with $4000 or fewer payroll wages) must file Form 944. It was introduced to simplify reporting federal payroll taxes for small businesses and simultaneously minimize paperwork.

It also provides the IRS with information about any additional Medicare tax withheld from high-income employees. This tax is, however, paid by the employee, not the employer.

Form 944 is a simpler alternative to filing Form 941. It contains the same information; however, the two forms differ in that later is meant to be filed quarterly while form 944 is filed once a year (annually). Employers have to request to use this form instead of Form 941, and the IRS has to give you written approval for you to use the form.

Withholding taxes are calculated from employees’ gross income and their portion of FICA taxes. Since federal income tax depends on income amount, qualified dependents, and other personal factors, employers will have to collect W-4 forms from their employees every year to calculate withholding tax.

FICA taxes should be shared between employees and employers (typically equally). The percentages will vary based on the year; for example, for the 2021 tax return, both parties should contribute 7.65% each. 1.45% for Medicare tax and 6.2% for Social Security tax (occasionally referred to as OASDI). Other conditions apply and should be reviewed to ensure compliance. This article will explore how Form 944 works and how to file the form correctly.

Do I Need Form 944?

To avoid penalties due to the IRS, employers need to know if they are required to file Form 944. You (as a company owner) need to file it if you had employees during the year and either:

- Your payroll taxes withheld (employment tax liability) are to be $1000 or less. You need to file it if your payroll taxes are withheld (not just income tax but also FICA, such as Medicare and Social Security), totaling $1000 or less for the fiscal year. Ideally, this means you will have paid wages amounting to $4000 or less. If your payroll tax liability does not exceed $1000, you only have to file one-period Form 944 instead of quarterly Form 941.

- You must’ve received a written permit from the IRS to use the form. You can be eligible to use the form or be required to use the form. Therefore, if you believe you are eligible to use this and have not received any notification from the IRS, contact them and request approval. Note that this request ought to be made within the first few months of the reporting year.

- Your employees must’ve been W-2 employees, not contractors.

If the conditions above were met, you need to file Form 944. If you know you’re eligible but are not reporting employment taxes on Form 941, you must submit this. If you’re a new employer, you can request approval to use it from the IRS.

The request should be made when applying for an EIN (employer identification number) through Form SS-4. The request should state that you believe you’ll meet the eligibility threshold to use the form. When issuing the EIN, the IRS will also send a written notice notifying you if you qualify to use Form 944 or 941.

Not all businesses that qualify to file Form 941 qualify to file Form 944. Note that if you’re required to file the 944 form, you cannot file the other one as its substitute unless you have received approval from the IRS after requesting to do so. However, if you’re eligible only, you can choose to continue using the other one on a quarterly basis.

A business can meet the lower tax liability requirement and still be ineligible to use this form. This is the case if the business employs:

- Household employees such as nannies, maids, etc. ONLY or

- Agricultural employees ONLY

Form 944 Vs. Form 940 and Form 941

Form 940 differs from Form 944 in that it reports an employer’s Futa (Federal Unemployment Act) tax liability, which is an employer-only tax return. However, just like the 944 IRS form, it is filed annually (once every year).

Form 941 differs from the 944 form in that it is filed quarterly. However, they are greatly similar, as they also file income tax and FICA tax withholding. However, since a small business with a total payroll tax liability of less than $1000 would find it inconvenient to file small amounts and sometimes none each quarter with Form 941, they often prefer to use the Form 944 form and file the liability once a year.

Step-by-Step Instructions on Filling Form 944

Form 944 must be accurately completed, like any IRS tax return form. The form can be obtained from the IRS official website. When you must use it, prepare and complete the form according to the instructions below. For the sake of simplicity, the guide has been simplified into a step-by-step format:

Step 1: Gather payroll data and fill in your basic business information

Before filling it out, you need to gather payroll data so that it is available at the time of filing. This requires you to document who the employees were (full name and address), total compensation for the fiscal year, federal income, and FICA tax withholdings. This information can often be sorted out with the help of accounting or payroll software. You also need to identify if you had any employees who were excluded from the W-2 tax information, as their withholdings are not eligible for filing.

To file it, start by entering your employer’s name, Employer Identification Number (EIN), business’s trade name (if available), and address. Also, enter the tax period.

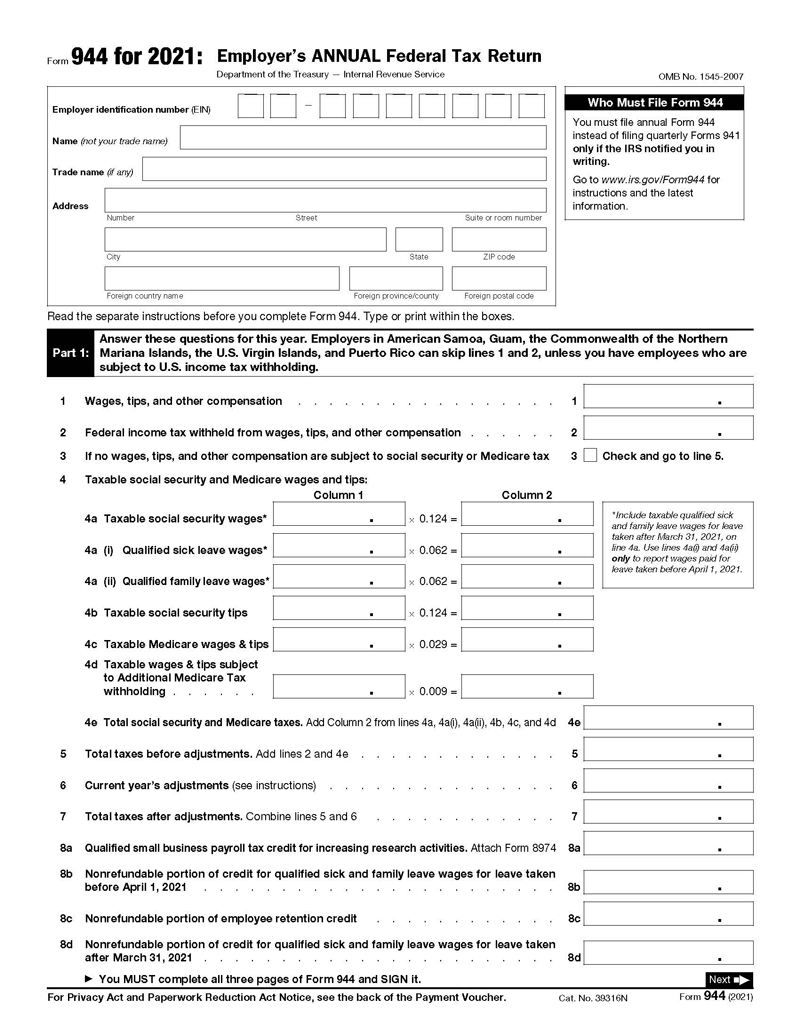

Step 2: Complete part 1 of the 944 form

Then proceed to complete Part 1 of the form. This section can be completed as follows:

- In line 1, declare the amount of wages, tips, and other compensation offered to the employees.

- In line 2, indicate the amount of federal income withheld for that calendar year.

- If there were no wages, tips, or other compensations subject to FICA tax, you should check the box in line 3 and proceed to line 5.

- Line 4 is used to calculate taxable Social Security and Medicare wages. This section has two columns: the first column records the wages and tips, while the second column records the total tax to be withheld for each declared wage. You should include the amount of wages and/or tips in the first column, multiply it by the given tax rate (multiplier), and record the product in column 2.

EXAMPLE

If the taxable social security wage amount is $3000, enter the amount, multiply it by 0.124, and record the answer ($372) in column 2.

note

Line 4a records the taxable social security wages with line 4a (i), and line 4a (ii) records the qualified family and sick leave wages, respectively. Line 4b is the table of social security tips. 4c records the taxable Medicare wages and tips, while 4d records the taxable wages and tips subject to Additional Medicare Tax withholding. This is applicable to employees who earn more than $ 200,000 for single filers and $250,000 for joint filers (in 2021). The 0.9 tax rate is incurred on top of the applicable 1.45%. This additional tax is also declared, but it is paid by the employee. Line 4e records the total amount in column 2—the total social security and Medicare taxes.

- Record the total taxes before adjustments in line 5 by adding the figures in lines 2 and 4e.

- Line 6 records the adjustments for the respective year. Adjustments can include sick pay adjustments, adjustments due to rounding off, adjustments for items like long-term life insurance premiums, etc.

- Line 7 will then report the total taxes after adjustments, which is an addition of lines 5 and 6.

- Small businesses performing or participating in research activities can claim payroll tax credits if they are eligible. If they qualify, complete Form 8974 and attach it to this form. Line 8a will record the business’s payroll tax credit. Line 8b records the non-refundable portion of the tax credit for any qualified family and sick leave wages for leave taken prior to April 1, 2021. Line 8c records the non-refundable portion of the employee retention credit. Enter the non-refundable portion of the tax credit for sick and family leave taken after March 31, 2021. In line 8e, record the non-refundable portion of COBRA premium assistance credit, and line 8f records the number of individuals or employees provided with COBRA premium assistance. Enter the total non-refundable credit, which is the sum of lines 8a through 8e, in line 8g.

- Enter the total taxes after adjustments and non-refundable credits in line 9. This is equivalent to the subtraction of line 8g from line 7.

- Next, report any deposits you’ve made throughout the year in lines 10a through 10j. This is used to calculate the total tax liability.

- Then compare lines 9 and 10j and record the difference in line 11. This figure represents your tax liability for that year.

- If line 10j is greater than line 9, record this figure in line 12. It represents overpayment. You can select to apply it to the next tax return or request a refund.

Step 3: Fill in part 2 of the form

Next, complete part 2. Part 2 of the form records your deposit schedule and tax liability for the respective year. Two options are presented in line 13 of Part 2. Option one is if line 9 is less than $2500 and if it is $2500 or greater. If less than $2500, check box one and proceed to part 3 of the form. If $2500 or more, check box 2. Option 2 has 12 boxes (13a to 13l) representing 12 months where you are supposed to record the tax liability for each month. Then record the total liability for the year in box 13m.

Step 4: Fill in part 3

Part 3 records information about your business. You are required to declare if your business stopped paying wages or closed, then answer the questions if applicable. If this section does not apply to your business, proceed to Section 4.

Step 5: Fill in part 4

In Part 4, the IRS requests that you nominate a third-party designee whom they can speak to about your business. You can accept or deny this request by checking either of the two boxes (yes or no). A designee can be an employee, tax preparer, or any other person. If you agree, indicate their name, phone number, and a 5-digit PIN they should use to talk with the IRS.

Step 6: Complete filling out part 5 of the form

Finally, complete the form by completing Part 5. This section contains an acknowledgment statement or oath that legally binds you to the claims made in the form. Sign the document, print your name, the signing date, and a daytime phone number. If a preparer has completed the form, have them complete the “Paid Preparer Use Only” section. They’ll provide their name, signature, firm’s name (or your business’s name if they’re self-employed), address, PTIN (preparer’s tax identification number), EIN (of the firm or your business, as applicable), and phone number.

Filing Form 944: Everything You Need to Know

Other than filling it out correctly, you have to take into account certain things like deadlines and the submission method.

Consider the following whenever you want to report federal income tax and FICA tax withholdings:

Where to find the form

You can obtain the form online or at any IRS office. Form 944 is issued on the IRS official website:https://www.irs.gov/pub/irs-pdf/f944.pdf. Depending on whether you want to complete it manually or electronically, you can download, complete, and print it in order to submit it.

When to submit it

It is an annual filing form, and its deadline is January 31 of the subsequent year. For the year 2022, the deadline is January 31, 2023. If you’ve made deposits on schedule and paid the taxes due in full, you may be accorded an extension that typically lasts up to February 10 but may vary from year to year.

Payment deadlines are different from filing deadlines. Payment deadlines typically depend on the tax liability amount, as follows:

- If the employment taxes are less than $2500, they can be paid as you file the form.

- If the tax liability is $2500 or more but less than $2500 for a quarter, the payment can be deposited by the last day of the quarter’s final month.

- If the fourth quarter’s payroll tax liability is less than $2500, you can deposit the payment as you file the 944 form.

- If the tax liability is greater than $2500 for a quarter, it must be paid on schedule, whether it is monthly or semi-weekly.

How to file it

Form 944 can be filed manually or electronically, with the IRS preferring electronic submissions. The IRS advises small business owners to file the form with the EFTPS (electronic federal tax payment system). With electronic filing, you can pay any money owed electronically. There are no application fees other than your bank charges for the transaction.

With electronic filing, you can use a tax preparer, tax preparation software, or any other authorized tax professional. Electronic filing is preferred as it is accurate, fast, and more secure. The IRS provides a list of all authorized e-file providers and approved software. If you’re using a third party to file, consider making payments through EFW (electronic funds withdrawal).

Alternatively, you can mail the form to the IRS. The IRS will provide the forwarding address and filing instructions, which will vary depending on whether you’re filing the form with or without a payment. If a payment is being made, complete Form 944-V, which is included at the end of Form 944 as a payment voucher. Also, include a check or money order and mail the documents to the appropriate address.

Remember to file Form 944; you need approval from the IRS. This approval should be requested between January 1 and March 15 of the fiscal year through a written request or by calling 800-829-4933 anywhere between January 1 and April 1 of the fiscal year.

Fillable Form 944

You can find more information on it by visiting the IRS website or our website. The form is provided in the PDF format below for your convenience. However, always check the official IRS website for the latest version in case of any changes in the form.

Key Takeaways

- Always observe applicable deadlines, whether you’re requesting approval to use Form 944, making deposits, or filing the form.

- You cannot file it without written approval from the IRS.

- It is meant to simplify reporting payroll taxes for small businesses by allowing them to file returns once a year rather than quarterly through Form 941.

- The IRS recommends that payroll tax deposits be made through the EFTPS (electronic federal tax payment system) system.

- You should always it as a small business owner regardless of whether you have taxes to report. Should the business close, always file a final return with the form.