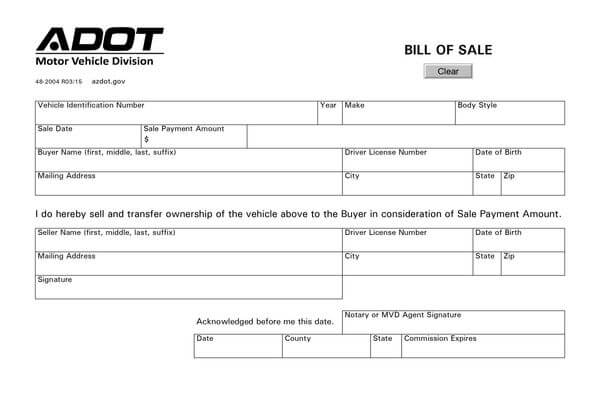

When transferring ownership of a vehicle in Arizona, you will need to have an ADOT Form 48-2004, also known as an Arizona Vehicle Bill of Sale.

The purpose of an Arizona vehicle bill of sale is that it serves as legal documentation of a basic vehicle sale agreement and receipt for both the seller and the buyer.

It’s a required document when registering a vehicle and the seller will need to sign the document in the presence of a Motor Vehicle Department agent or a notary public.

Arizona Vehicle Bill of Sale

Registering a Vehicle in Arizona

Registration of a vehicle for the first time in the state of Arizona cannot be done by mail or online. It must be done in person at a local MVD office.

Vehicles that have been sold as a private sale out of the state of Arizona that need road transport will need a Restricted Use Three-Day Permit (from the ADOT). If purchased out of state at a dealership, you will need a temporary registration plate. This is to allow a buyer the chance to transport the vehicle to its permanent address in Arizona and to register it in line with Arizona’s local requirements.

Vehicles must be registered within 15 days of the date of purchase at the Arizona Department of Transportation (ADOT). Depending on the type of vehicle that you have purchased, registration lasts for 1 to 2 years with the help of the Arizona vehicle bill of sale being completed and filed. For vehicles that have already been registered and just need to be renewed, you can do so online at Service Arizona Webpage to renew.

Where to Register

If you are required to register a vehicle in Arizona in person, you can go to your Local MVD

The documents required when registering a vehicle are:

- Arizona Vehicle Bill of Sale

- The Title and Registration Application (Form 96-0236)

- A completed Sold Notice (Form 46-8502), which needs to be sent in within 10 days from the date of sale

- Proof that the vehicle is insured and that it meets Arizona’s Coverage Requirements:

- $25,000 to cover bodily injury liability for one person

- $50,000 to cover two or more persons

- $15,000 to cover property damage liability;

- An emissions test if you live in Tucson or Phoenix. This must be performed at an Arizona Emissions Testing location

- Proof of identification, such as your driving license. If a third party is registering a vehicle on behalf of the vehicle’s owner, they will need to present a signed Vehicle Power of Attorney (Form 48-1001)

- The correct Registration Fees

Sellers are required to:

- Present a Form 46-8502 (sold notice) on the Arizona Motor Vehicle Department Portal

- Be sure that you have signed the back of the vehicle’s title (must be done in the presence of a notary)

- Remove the vehicle’s license plate – credit for the plate needs to be transferred to the seller’s new vehicle within a 30 day period from the date of sale. If the seller has no other vehicle, the plate must be destroyed.

Public sold notices are issued to deter any criminal activity, which includes ticket avoidance, theft of a vehicle, trying to hide an accident, or vehicle abandonment, which under Arizona law, will be subjected to a penalty of $500.

Once the sale of a vehicle has been completed, the vehicle’s previous registration document becomes invalid and the transfer of the title must be legalized by contacting an authorized provider of vehicle registrations or visiting your local MVD.

Emission Testing Requirements

For vehicles manufactured from 1967 onwards, all residents of the Tucson and greater Phoenix areas, as well as those who use a vehicle to commute regularly into these areas for school or work purposes, will need to pass an emissions test. When your vehicle is due for a new emissions test, you will be notified by MVD. Alternatively, you can call (602)771-3950.

Vehicles that require testing:

- Year 1967 and newer, as well as vehicles older than 5 years.

- Fuel types that need emissions testing include diesel, gas, hybrid vehicles, E85 flexible fuel, and alternative fuelled cars.

- Vehicles that are not diesel and are from 1981 and newer will need to be tested every 2 years.

- Vehicles from 1980 and older will need to be tested every year.

All emissions testing stations work on a first come first serve basis, so there is no need to make an appointment. When registering a vehicle, you cannot have your vehicle tested for more than 90 days before the date of your registration. However, registered vehicles can be tested at any time. For vehicles purchased from a dealership, it is the dealership’s responsibility to have the emissions test done. Anyone can take your vehicle in for emissions testing, as long as they have a valid driver’s license.

Testing fees cannot be refunded once a vehicle has been tested.

Who is Exempt?

There are exemptions for certain types of vehicles. Generally, vehicles that are under 6 years old are exempt, as are motorcycles. Other exemptions include vehicles whose physical registered address is outside of the Tucson and Phoenix area. You can check if you are Out of Area exempt at the ADEQ website. Vehicles that are out of the state of Arizona when their registration is due through the usage of Arizona vehicle bill of sale are exempt.

Final Words

Getting and completing an Arizona Vehicle Bill of Sale is a necessary requirement in the process of purchasing or selling a vehicle in the State of Arizona. This bill of sale form is of great importance in the process of the transaction therefore getting it to be well-crafted and professional is very essential, which you will be able to do with the help of our free of cost, customizable Arizona Vehicle Bill of Sale templates on this website.