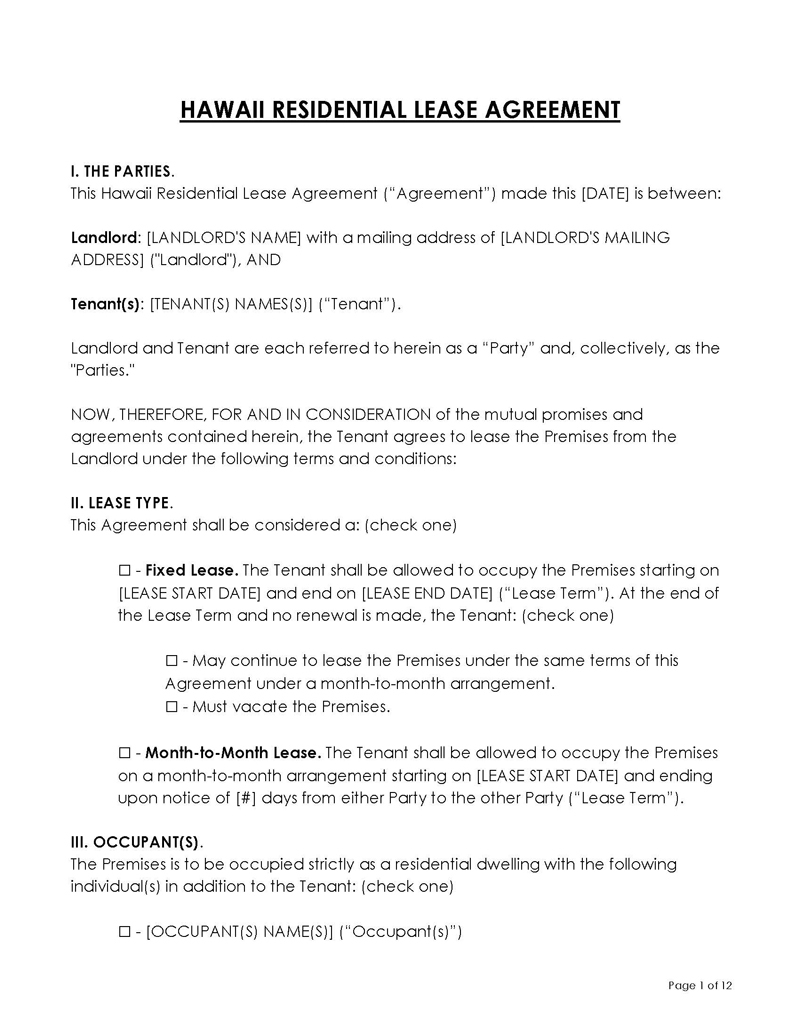

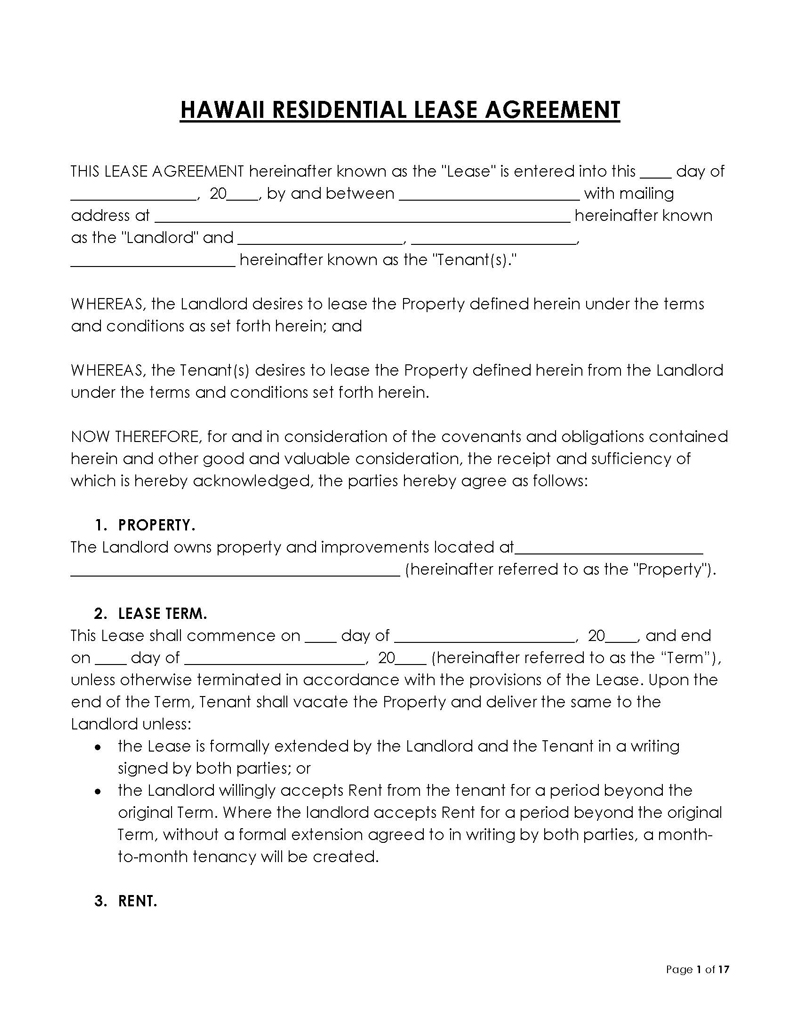

A lease agreement is used in Hawaii for leasing a dwelling and its facilities from the landlord. It is a legal document that governs all aspects of the relationship between the landlord (lessor) and their tenants (lessee), including rent, maintenance, and repair provisions.

The most significant aspect of a lease is that both the property owner and the tenant are required to abide by the terms that are stated in the agreement.

Leasing is a process that entails lots of formalities, especially for the property owner. In accordance with Hawaiian law, the landlord and the tenant must first agree on all of the terms and conditions of the rental agreement. The lessor and lessee negotiate various aspects of a lease, and each party’s terms, obligations, and expectations are explicitly stated in the agreement. The agreement must be signed by all parties for it to be valid and enforceable in court.

The document thus becomes essential for preventing and resolving disputes between the signatories. Lease agreements are used in both residential and commercial leasing. The document can be presented in court as evidence in case of any disputes and violations of the terms and conditions that were agreed upon by both parties.

Templates for You

This article will cover the basics of a lease agreement in Hawaii and the fundamental disclosures to include in such an agreement.

Associated Laws

The state of Hawaii has specific laws that govern the leasing of property. All commercial lease agreements are governed by Chapter 490, Article 2A, while residential leases are governed by Chapter 521. You can also take guidance from the Landlord-Tenant Handbook.

Also, the state has specific guidelines with regard to security deposits for rented properties. Landlords can ask for a security deposit, but it should not exceed a month’s rent. However, the landlord can ask for an extra fee from tenants with pets. In addition, the landlord is required to return the security deposit within 14 days of the expiration or termination of the lease.

Once a tenant takes occupancy, landlords in Hawaii are not permitted to enter the premises without notice. Landlords are obliged to issue a 2 day notice prior to entering the rental unit according to Section 521-53.

What Disclosures are Required for a Lease Agreement in Hawaii?

Certain disclosures are legally required to be provided to tenants, while others may be issued in the interest of maintaining a long-term relationship with the tenant. Disclosures and addenda are required to protect the landlord from liability cases, and without them, it is difficult for tenants to make informed decisions about their tenancy.

The landlord, therefore, has to disclose the following information:

Identification and tax number disclosure

Under § 521-43, any visitors allowed onto the premises must be disclosed by the landlord. In addition, the tenant must be given the landlord’s excise tax number so they can submit an application for a low-income tax credit if they are eligible.

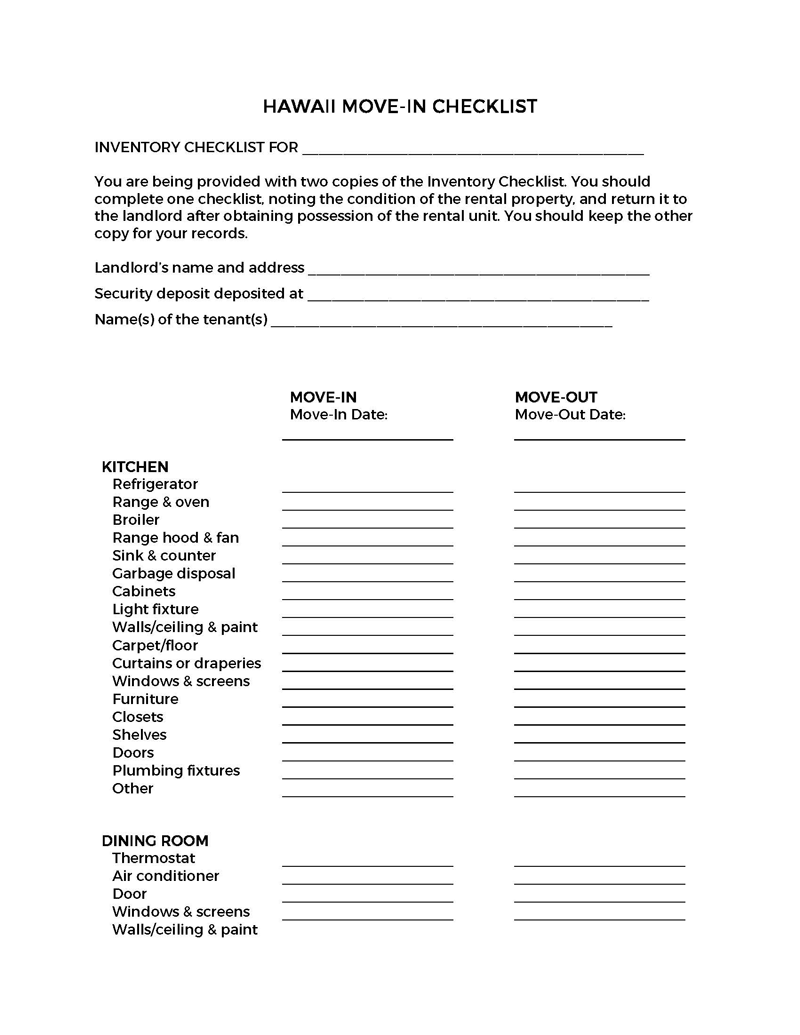

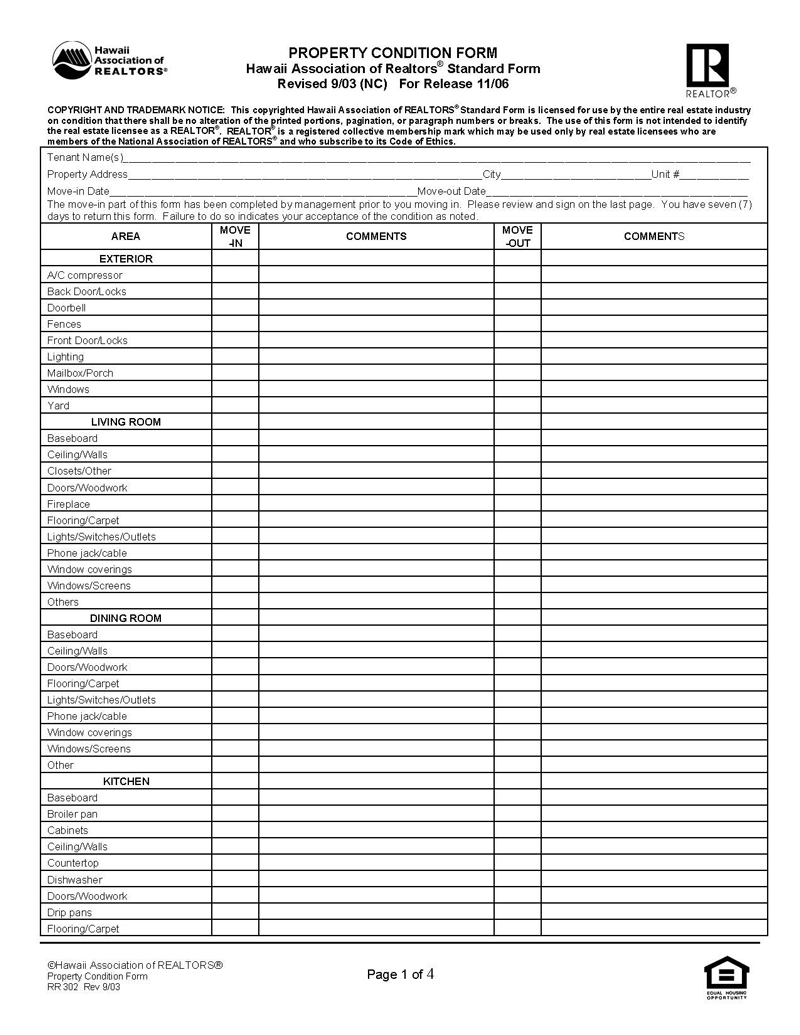

Details of property disclosure and move-in checklist

In accordance with § 521-42(6), landlords are required to supply tenants with details of the state of the dwelling, its accessories, appliances, and grounds.

Any landlord who charges a security deposit is required to provide the tenant with an inventory list prior to occupancy. The list is a description of the state of the property, any damage that has already occurred, and any current furnishings, including appliances. When the tenant vacates, the inventory listed on the checklist should be in the same condition.

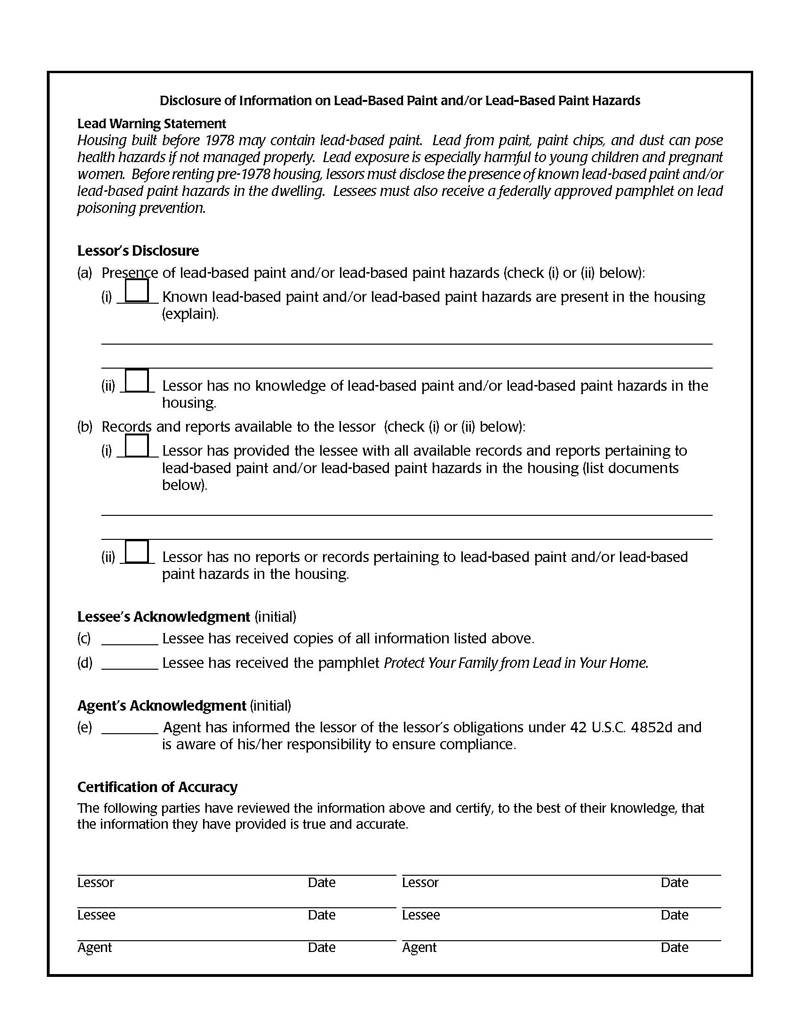

Lead-based paint disclosure

According to the Federal Lead-Based Paint Disclosure Law, landlords of all residential properties constructed prior to 1978 are required to share a lead-based paint disclosure form with all new tenants. This information is also applicable for rental units in condominiums, cooperatives, and apartments that contain two or more dwelling units.

The disclosure should entail a completed lead-based paint disclosure form with all known information regarding lead-based paints on the property, an EPA (Environmental Protection Agency) approved pamphlet outlining the hazards of lead-based paint, and any reports and records of such dangers within the premises. In addition, all multi-unit buildings ought to have a lead-based paint report based on building-wide evaluations.

Optional Disclosures and Addenda

There are several optional sources of disclosures and addenda that a landlord can give the tenant to strengthen their relationship. They include the following:

Medical marijuana use

The agreement should clarify whether the use of medical marijuana is allowed on the premises or not. The Hawaiian laws do not allow landlords to impose restrictions regarding medical marijuana use, but they can limit its use if it is used for smoking.

Late and returned check fees

Landlords can charge additional fees for late and returned checks. The law does not impose a maximum or minimum limit on such fees. However, the amount should be reasonable and justifiable, taking into consideration the expenses incurred as a result of the late payment.

Often, 10% of the rent amount is considered reasonable. The amount of such fees should be mentioned in the agreement. Furthermore, late fees should only be charged after the due date specified in the agreement.

Shared utility arrangements

In some cases, tenants could be sharing utility meters. As a result, each tenant is expected to contribute toward utility bills. The agreement should specify how these utilities are shared and how each tenant’s contribution will be calculated.

Bed bug disclosure

The landlord is required to inform the tenants of prior or current bedbug infestations within their unit and whether they have been successfully eradicated. The agreement should also state any policies or procedures the landlord may have regarding bed bugs. This disclosure should also state the tenant’s responsibility to report signs of bed bugs on the premises.

Asbestos disclosure

According to Hawaii law, asbestos should be disclosed by landlords renting out properties built before 1981. Asbestos-containing materials can be found in building materials, plumbing, and insulation. Additionally, landlords must inform tenants of the building’s asbestos-containing material’s history, safety precautions, and removal procedures should they become aware of them during the tenancy.

Mold disclosure

These agreements should include the landlord’s policies and protocol on mold detection, remediation, and prevention. Mold can pose health risks to inhabitants. The purpose of this disclosure is to protect the landlord from any potential liability resulting from mold damage.

Frequently Asked Questions

The minimum tenancy duration is one (1) month, and the maximum period is one (1) year for a standard residential lease. If agreed to by both parties in writing, the maximum term may be extended for an additional year.

Both an oral and written agreement are considered legally binding contracts. This is as long as they agree to the terms mentioned in the agreement.

No, these agreements do not require notarization. They are binding upon signing. Also, the agreement ought to be executed according to Hawaii’s landlord-tenant laws.

Yes, a lease is automatically renewed if the landlord gives his or her consent in writing. Upon renewal, the lease is considered a month-to-month lease agreement.