A pay stub is a document presented regularly to an employee by an employer detailing the employee’s earnings and wages over a specific period.

Therefore, this document is essential as it helps the employer maintain accurate and complete payroll records for the employees. It can also be referred to as a paycheck stub, salary statement, earning statement, or payroll slip.

Employers fulfill legal obligations and promote transparency by issuing them. They ensure compliance with employment and tax laws by accurately documenting wages, taxes withheld, and other mandatory deductions. They also help employers maintain accurate records and simplify the process of calculating payroll taxes and other statutory contributions.

By providing salary statements to their employees, employers demonstrate transparency and accountability, fostering a sense of trust and reliability within the workforce.

This article will focus on the meaning and significance of a template used to prepare a pay stub. It will also address the components that should be included in this document, along with the tool and tips to consider when creating it.

What is a Pay Stub Template?

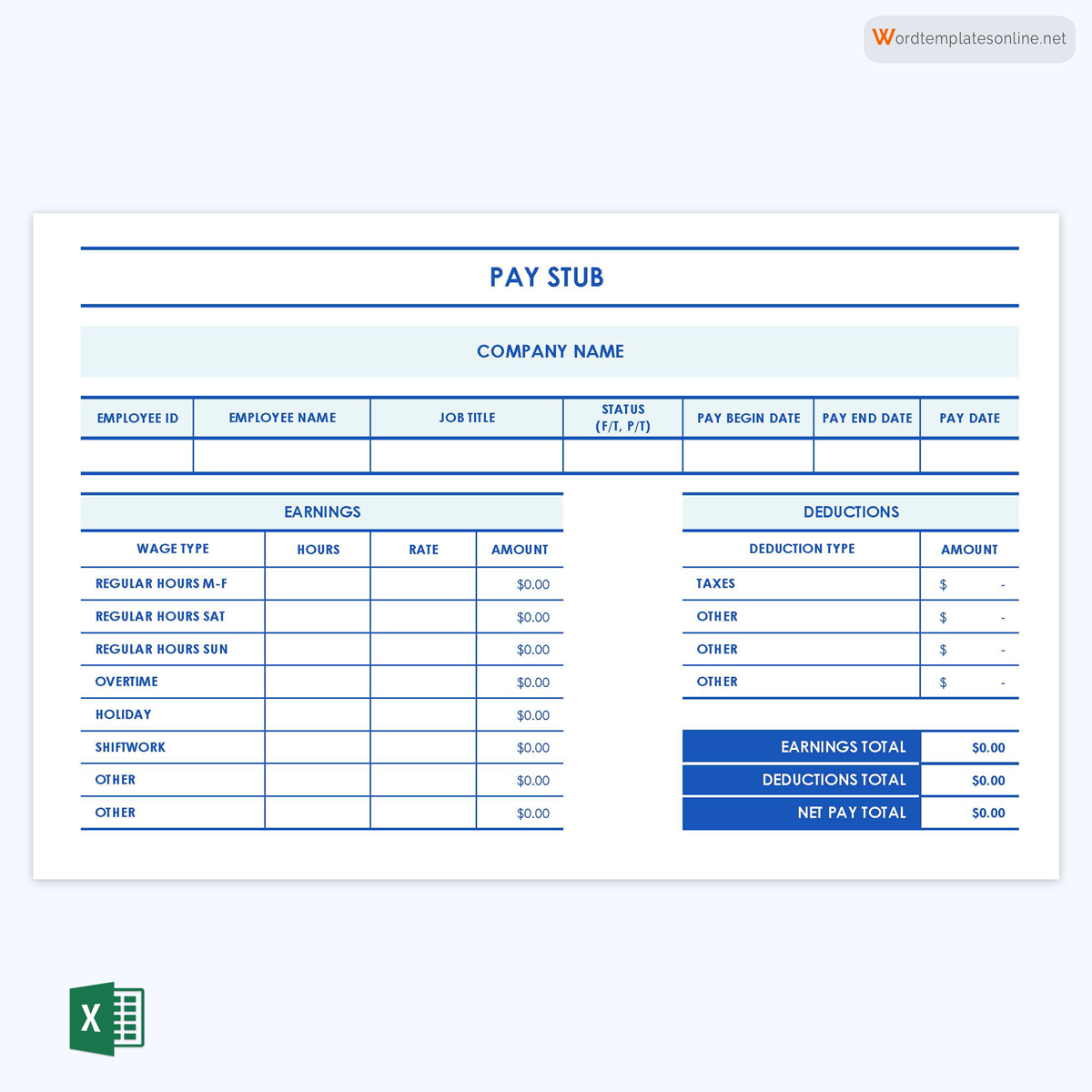

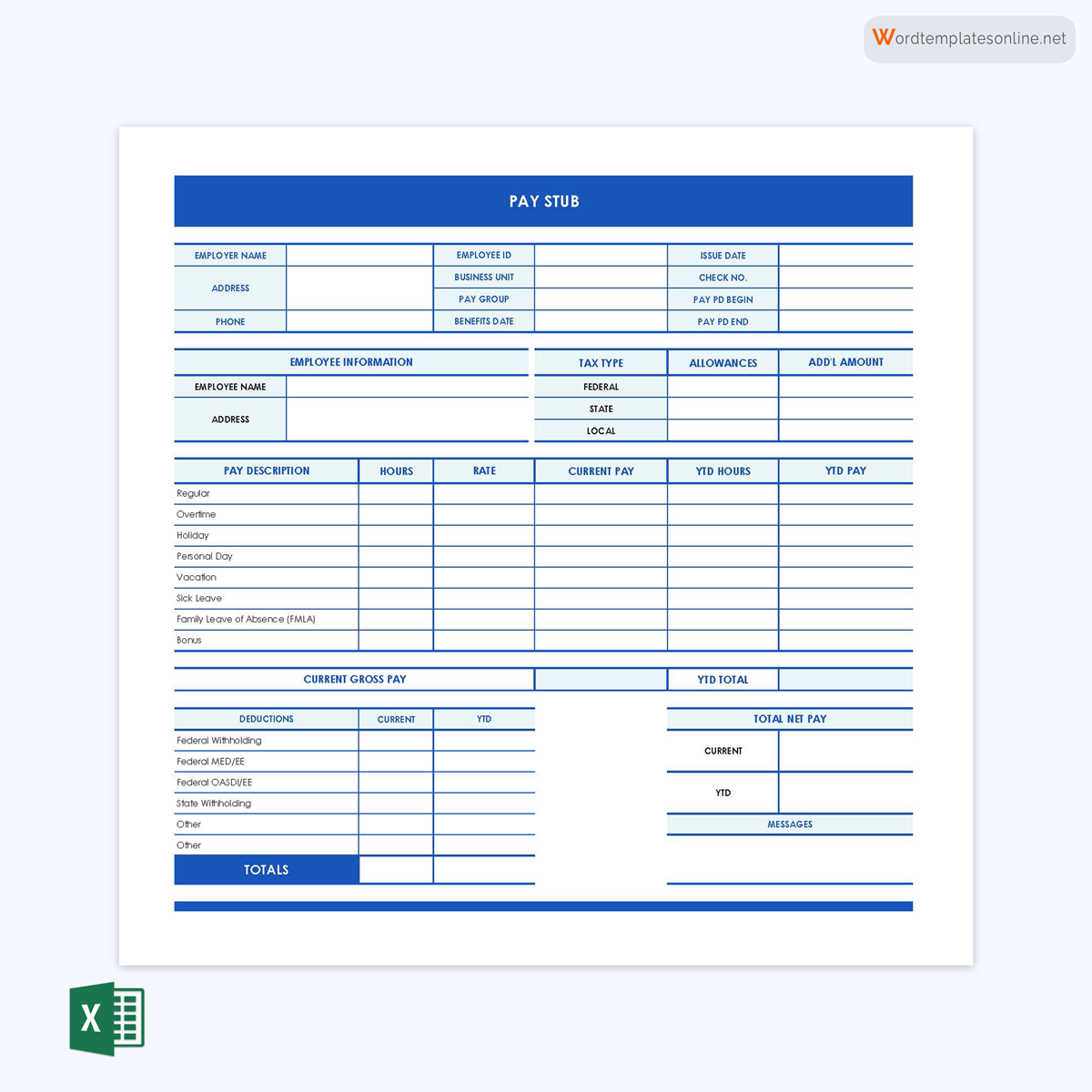

A pay stub template is a pre-formatted document that simplifies the task of generating accurate and professional pay stubs for employees.

The primary purpose of using templates is to standardize the structure and content of these documents, ensuring that all necessary information is included in a clear and organized manner.

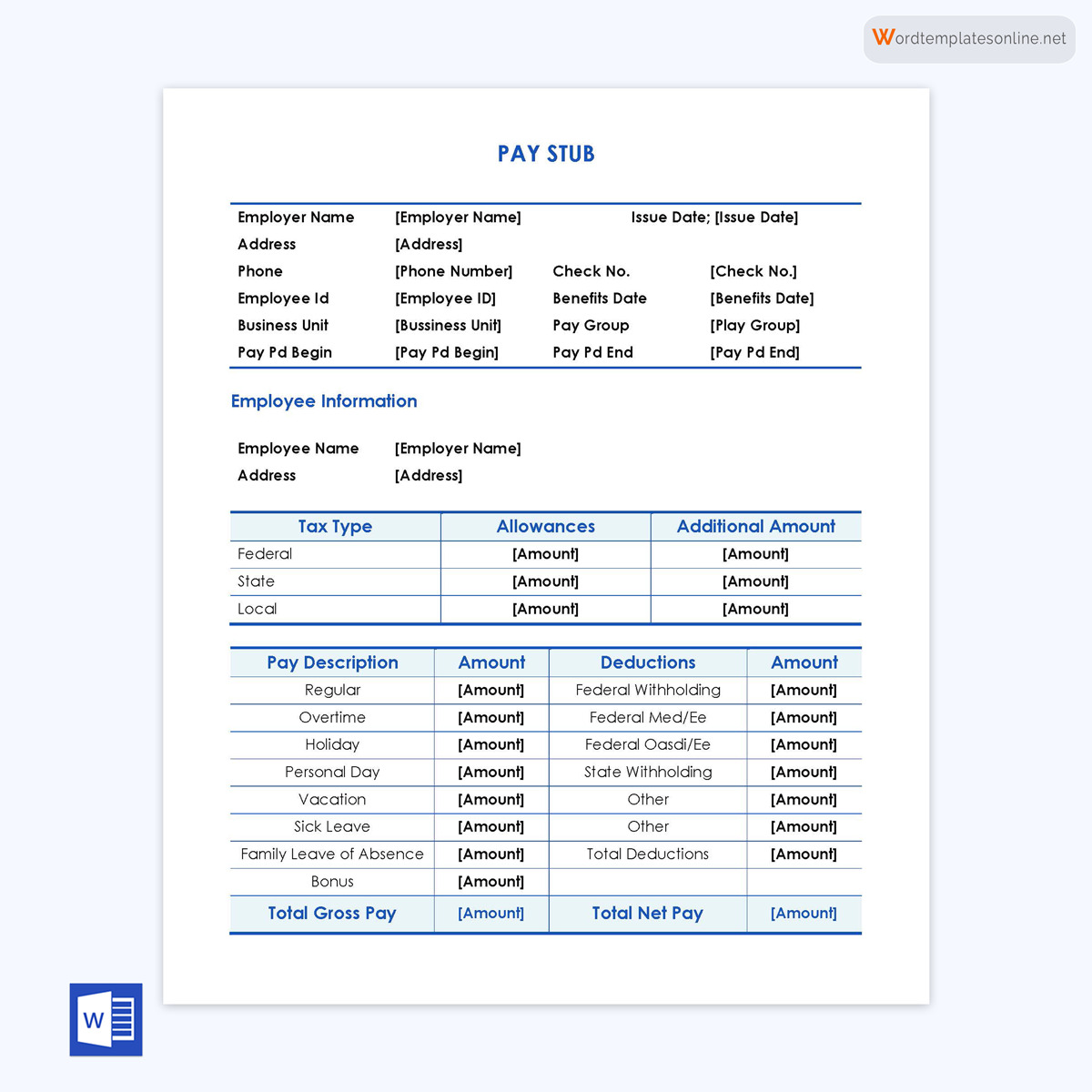

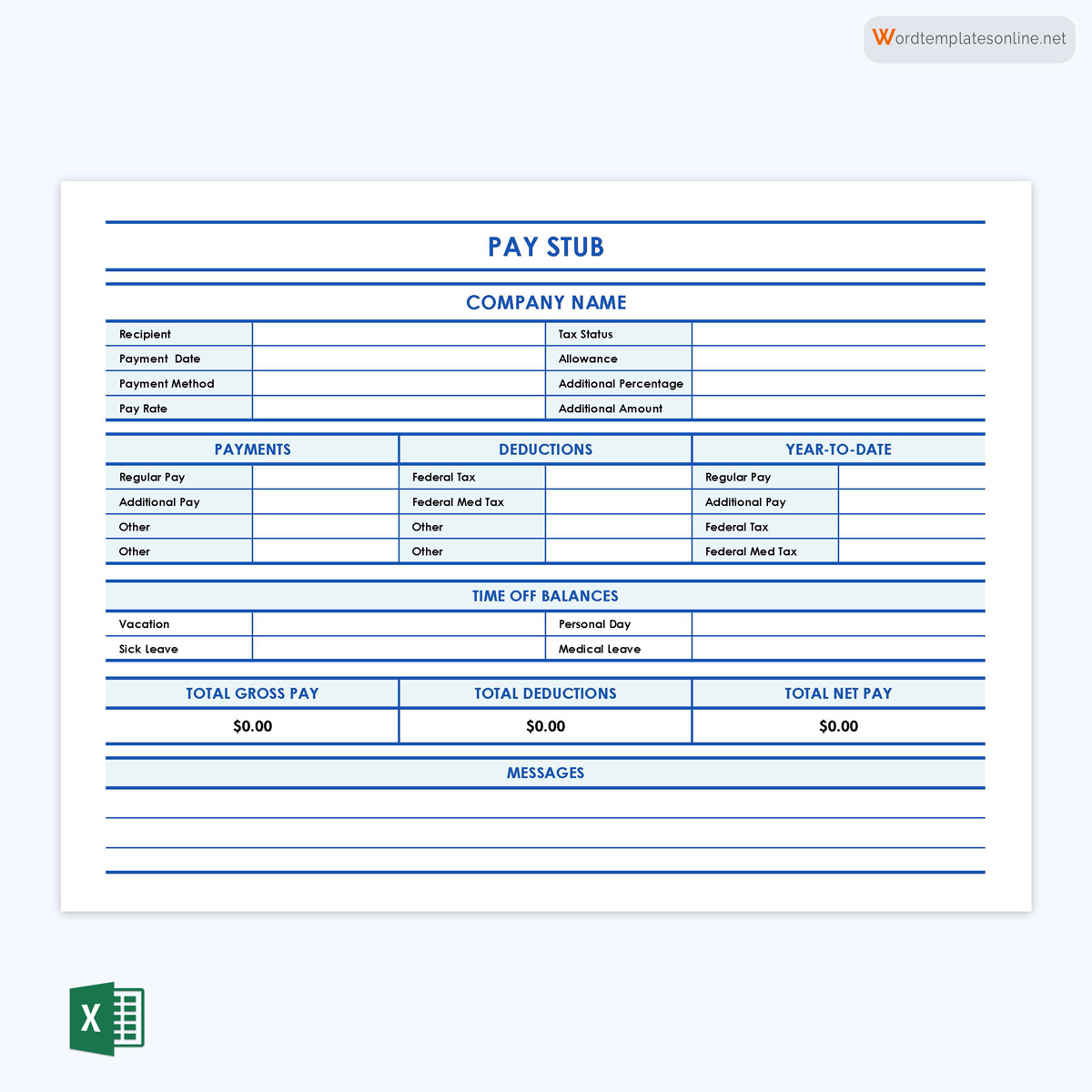

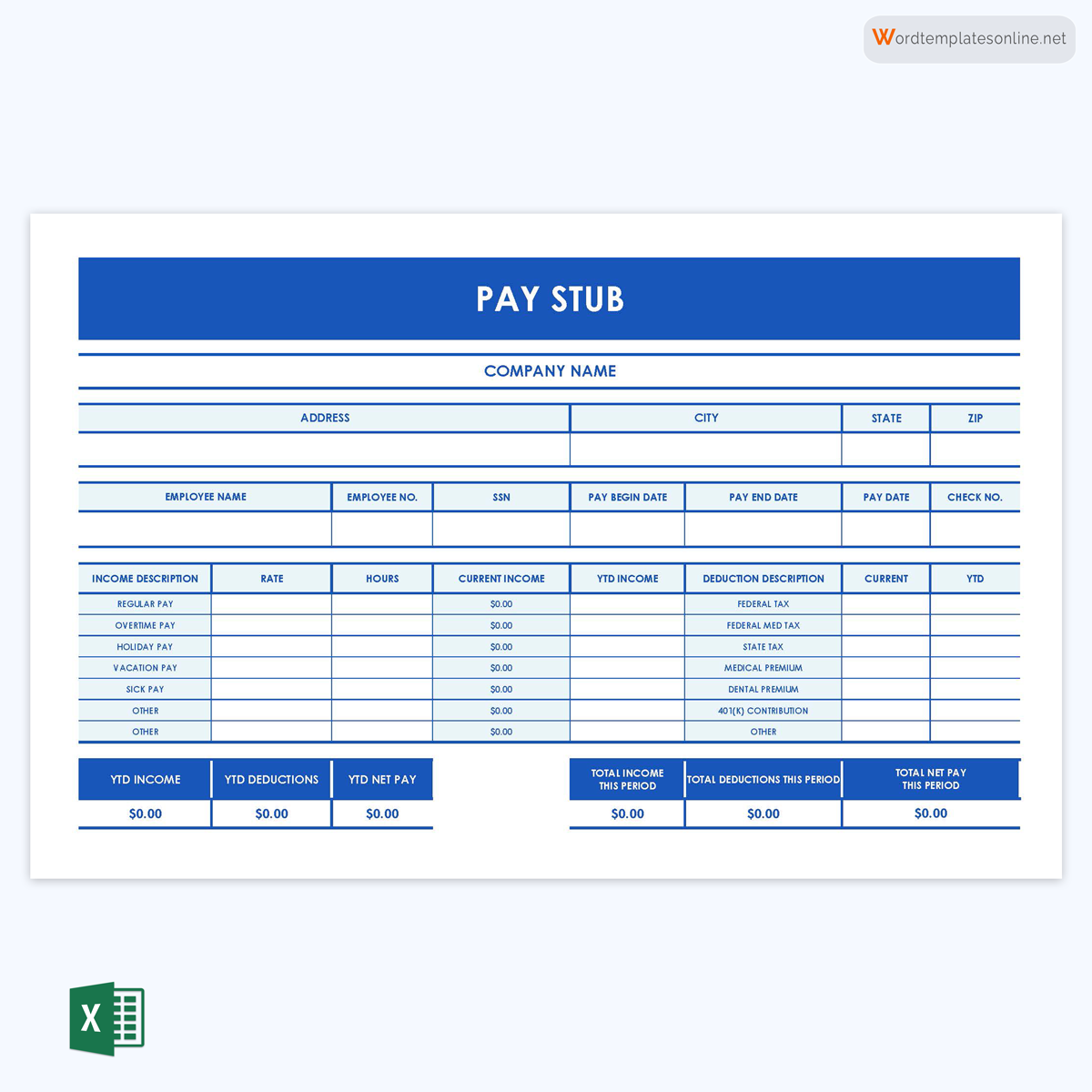

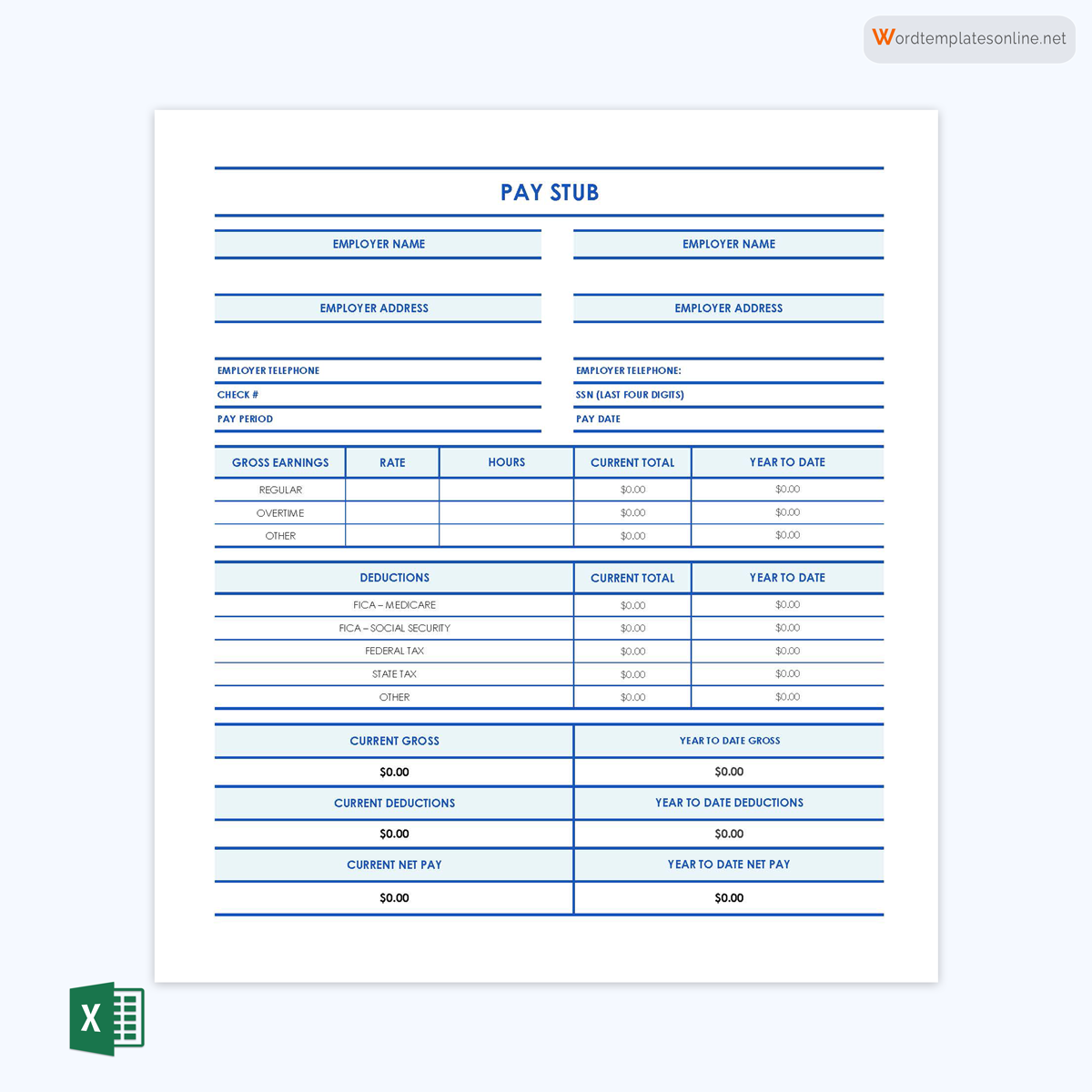

It contains columns where you can add important information such as your name, company name, phone number, and email address. However, it is editable and can be customized to suit your requirements.

Similarly, the employee’s information, such as their name, contact details, payment information, employee identification number, job position, employment date, taxes, deductions, and pay period, must be included.

The template makes it easy for you to effortlessly create a complete, consistent, and accurate document while adhering to all applicable laws and regulations. Note that it can be created using MS Excel or MS Word or downloaded online

Free Templates

Significance of Using a Template for Pay Stubs

The use of templates to create paychecks has become increasingly common for most businesses. Pre-designed documents make creating a paycheck easier, more efficient, and more repeatable.

The following are the benefits of using a template for creating payroll slips:

Accurate and consistent records

The template ensures consistency in the document. This allows you to avoid errors, including incorrect calculations or missing any relevant information when recording vital details, such as the employee’s name, employee ID number, and payment details. That means that you can easily maintain accurate and transparent financial records.

The accuracy of the information is vital, as it helps you avoid unnecessary legal issues. Furthermore, the template ensures the payroll data is updated frequently. This means that auditing and financial reviews can be conducted accurately and easily.

Saves time

By using templates for generating salary statements, employers can streamline the process, reduce manual work, and save time. This is because templates often have designated fields or sections where employers can easily input the necessary information, such as employee details, earnings, and deductions. This eliminates the need to manually create and align each element, significantly reducing the time required for data entry. With a template, you are only required to include the needed information, such as employee details, payments, taxes, and deductions.

Compliance with legal requirements

Templates are designed to ensure compliance with legal requirements such as tax and labor laws regarding salary statements. Employers can be certain that they have complied with all state and federal laws regarding financial documentation by using a template because the salary document contains all necessary information.

Cost-effective

Templates can be cost-effective, especially when compared to outsourcing the creation of salary slips or using specialized software. Many templates are available for free online, reducing the need to invest in expensive tools or services. This makes templates an accessible option for small businesses or organizations with limited budgets.

Note that, through customization, you will be able to add specific information to the document. Also, it will allow you to eliminate any unnecessary fields and customize the template based on your requirements.

Easy modifications and updates

If any changes are required in the salary slip format or content, templates simplify the process of updating and modifying the document. Employers can make necessary adjustments to the template and apply them to all future salary slips, ensuring consistency and saving time on individual updates.

Common Components of a Pay Stub Template

The following are components of a template for a salary statement:

Company information

A column to add company details must be added to your template. This includes the name of the business, its location, the company’s logo, and contact details such as a phone number, fax number, and email address. In addition, ensure to include a space to add the name of the relevant person and the department that is in charge of preparing this document.

This information is crucial, as it allows employees to communicate with you with questions or concerns regarding their payments. It also enables employees to contact the right person if they have any questions about the document.

Employee information

There should also be a column for employee information such as name, address, contact details, a unique employee ID number (if applicable), department and designation, and social security number. This information allows your employees to confirm and verify that the payment received is complete and accurate.

Pay period and pay date

The pay period should list the start and end dates of the pay period in question. You should have a clear section for this information. In addition, your template should also have space for the date the salary will be released.

The pay date is the exact date on which you dispatch the funds to the employee. It is important to include the pay period and pay date in your template to allow you to know the period the employee worked, the amount you owe them, and the exact date to release their payments.

Earning details

Include a section to indicate the details of the earnings. These details give you and the employee an accurate breakdown and analysis of their earnings and deductions. Therefore, outline the employee’s working hours, hourly rate, overtime hours, and overtime rate. Also, indicate the vacation hours and pay, as well as any bonus payments. Indicate the sum of the total earnings before deductions.

Deductions and contributions

Deductions are expenses subtracted from an employee’s gross salary. These may include Federal Income Tax, State Income Tax, if applicable, Social Security contributions, the amount withheld for Medicare contributions, any deductions for health insurance premiums, deductions for retirement savings plans, such as 401(k) or pension contributions, and any additional deductions, such as union dues or employee loan repayments.

Net pay

Your template should have a section that indicates the net salary of your employee. Net pay is the amount after deductions, contributions, and taxes have been deducted from gross earnings.

The year-to-date totals

A year-to-date total is an important detail that should be included in the template. This section should include the following information:

- YTD Earnings: The total earnings the employee has received since the beginning of the year.

- YTD Deductions: The total deductions taken from the employee’s earnings since the beginning of the year.

Suitable Tools for Creating an Editable Template

There are several tools that you can use to create the perfect template for a statement of earnings. These tools include Google Sheets, MS Excel, Google Docs, and MS Word:

Google Sheets or Excel

Google Sheets and Excel are among the most preferred programs used to create templates. Both tools are effective and efficient when creating these documents, as they have similar structures, features, and capabilities. However, some differences will influence which tool you select.

Below are two tables with the pros and cons of each tool mentioned above:

| Google Sheets | |

| Pros | Cons |

| Free to use | Requires internet |

| User-friendly | Limited features |

| Built-in templates | |

| Cloud-based | |

| Allows collaboration | |

| MS Excel | |

| Pros | Cons |

| Offline access | Expensive |

| Data visualization | Complex |

| Superior features | Compatibility issues |

| Vast selection of templates | |

Google docs or MS word

Google Docs and Microsoft Word are effective and efficient tools you can use to create a template for salary slips. Both tools share similarities but also have unique features that set them apart. These similarities and differences play a significant role in the tool you choose.

Two tables with the advantages and disadvantages of each are shown below:

| Google Docs | |

| Pros | Cons |

| User-friendly | Storage issues |

| Free to use | Limited features |

| Collaborative | Can only be accessed when the internet is available. |

| Microsoft Word | |

| Pros | Cons |

| Integration with Excel | Costly |

| Advanced formatting options | Limited collaboration options |

| Better features | Steep learning curve |

The Google Sheets feature is best for creating this document. It has built-in templates that you can customize when creating your own document.

Having an editable template to create salary slips for your employees is important for your business. Note that you can access and download them for free from our website. They can be customized to meet your requirements and allow you to create salary slips effortlessly.

Simplify Your Payroll Process with a Pay Stub Generator and Calculator

The pay stub generator and calculator are online tools that streamline the process of creating a perfect financial document. More technical information about these two online tools is provided below:

Pay stub generator

A pay stub generator is a tool or piece of software that automates the process of creating complete salary slips for employees. This tool requires you to add your employee’s information, such as their name and salary details. It streamlines the payroll process and ensures accuracy in the contents of the financial document. In addition, no technical expertise is needed when using such programs.

Pay stub calculator

A pay stub calculator is a tool that focuses specifically on calculating the various components of a statement of earnings, such as gross pay, deductions, and net pay. It is often used as a standalone calculator or an embedded feature within larger payroll software or systems.

It performs the necessary calculations based on the provided inputs and generates a summary of the earnings, deductions, and net pay for a given pay period. It can accurately quantify an employee’s gross pay, deductions, and net pay. Therefore, this tool is essential to you and your employees when it comes to payment calculation.

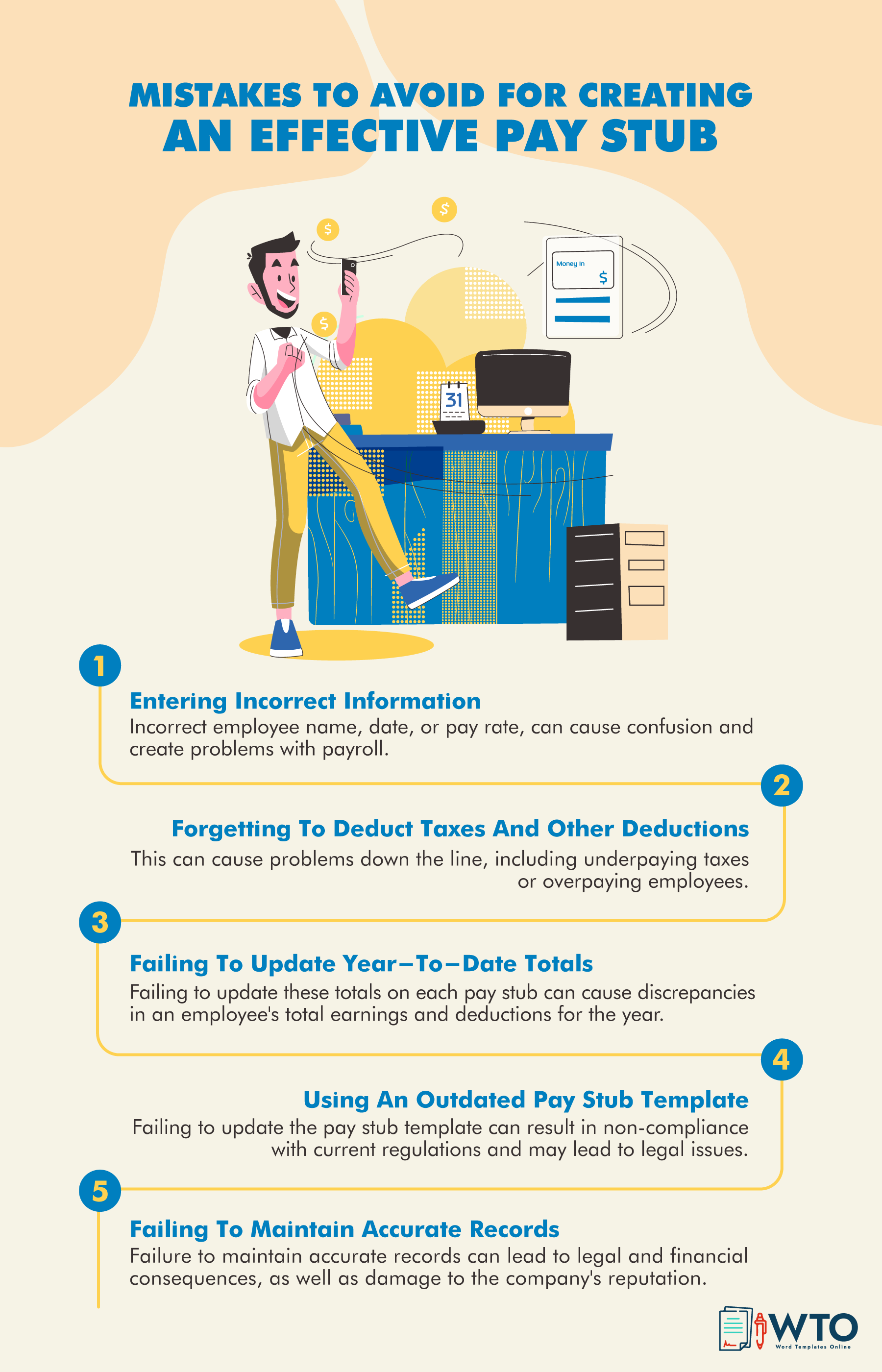

Tips for Creating a Pay Stub Template

Creating a template for a check stub can be hectic and tedious. However, there are tips that you can consider to make your work easier, and they include the following:

Research legal requirements

Familiarize yourself with the legal requirements for salary statements in your jurisdiction. Different regions may have specific information or formatting guidelines that must be included in financial documents. Ensure your template meets these requirements to maintain compliance.

Keep it simple

The essence of this document is to help you display the gross earnings, deductions, and net pay of an employee. Therefore, the template should be easy to navigate and use. In addition, ensure you use a language that is clear, simple, and easy to understand.

Use consistent formatting

Use the same font, font size, and formatting for all the sections of the document to create a cohesive and polished look. Also, proper formatting enables you to clearly and concisely present all information.

Consider visual hierarchy

Arrange the information on the pay slip in a logical and visually pleasing manner. Use formatting techniques like bolding, underlining, or different font sizes to highlight important details, such as the employee name, total earnings, and net pay.

Test the template before using it

Testing the template ensures that all calculations are accurate and complete. Additionally, it allows you to find any formatting and design errors. Testing allows you to gauge the functionality and usability of the template. This can help to avoid errors and discrepancies in the future.

Conclusion

Pay stub templates serve as invaluable tools for streamlining the creation of salary slips, saving time, and ensuring accuracy in the payroll process. This article has provided insightful guidelines on creating effective templates, highlighting the importance of research, consistency, and compliance with legal requirements.

Additionally, the article has emphasized the components that should be included in a salary slip, ranging from employee and employer information to earnings, deductions, net pay, and year-to-date totals.

By following these guidelines and leveraging the appropriate tools, employers can create professional and informative templates that effectively communicate employee compensation, contributing to streamlined payroll operations and employee satisfaction. Therefore, it is essential to use these templates in order to manage your employees’ payrolls efficiently.