A term sheet is a document that summarizes the terms and conditions of a potential investment opportunity for investors.

After giving a pitch for your organization and identifying potential investors, you will be required to create this document as a company or business startup. This is a non-binding document that only provides a summary of the terms and conditions that will be used in the final binding agreement.

When creating a term sheet, it is best to use a template to ensure that you have all of the necessary information and that you follow the proper format. The terms and conditions presented in a template must be written in bullet points. Given that it is not the final agreement, this sheet should only include a summary of the most important details to aid investors in understanding the potential deal. These terms and conditions, though succinctly stated, must be accurate as they are frequently found in the final agreement document.

The format and style of sheet can also be used as a business proposal for potential stockholders. Once you have identified potential investors, send them this sheet with details about the final deal. A properly written sheet will encourage potential investors to join your company. The terms and conditions of any potential investment request should therefore be carefully and thoughtfully written. The purpose of this article is to assist you as a company or startup business in creating a term sheet that outlines all the terms and conditions of an investment for potential investors.

Free Templates

Requirement of Term Sheet: When and Why!

Whether you are a company or a business startup, you need to identify when and why you need to write a term sheet. You need to prepare a proper term sheet for your potential investors because they use this document to review whether the investment they are about to make is worth their time and finances. Additionally, this document will aid them in determining whether you have comprehended their investment requirements.

With a term sheet, your potential investors will have information regarding the payout and profits they can expect and can also deal with any potential hindrances. Conflicts can be settled during negotiations before becoming partners because they can be anticipated based on the information in the sheet before the final document is created.

Some of the issues that the term sheet will help you and your prospective investors to identify include:

- Investors aiming to maximize their financial gains

- Reduced investment risks by investors

- Investors requesting certain positions in the company based on their capital investment

- Your control of the company

- If, you, as the company, require much equity

- If, you, as the company, are requesting enough capital from the investors for better operations.

You will need a sheet when you have identified a potential investor(s) who is willing to be part of your business and will agree to the terms and conditions of being your business partner. If you are a private company, you can also use this sheet to raise capital from potential investors. You will also require a term sheet, a management presentation, an offering memorandum, a subscription agreement, an NDA, and a teaser.

note

As a private company, you will only prepare a term sheet once you have identified potential investors interested in your company based on the teaser you provided and have signed an NDA.

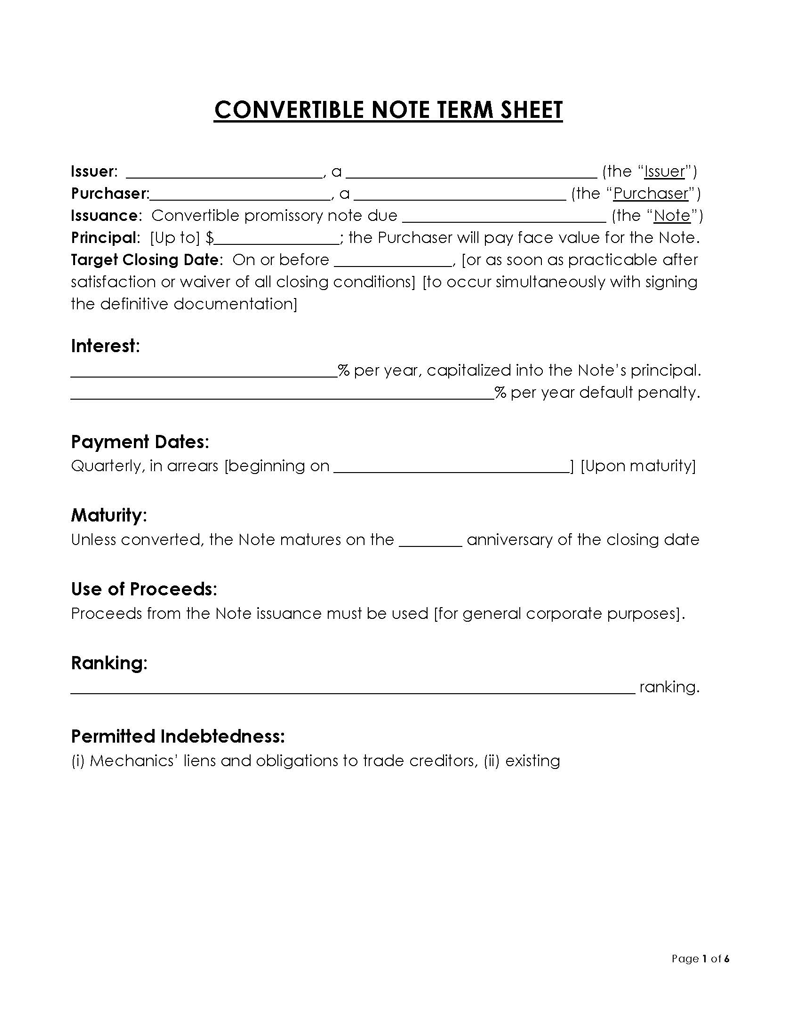

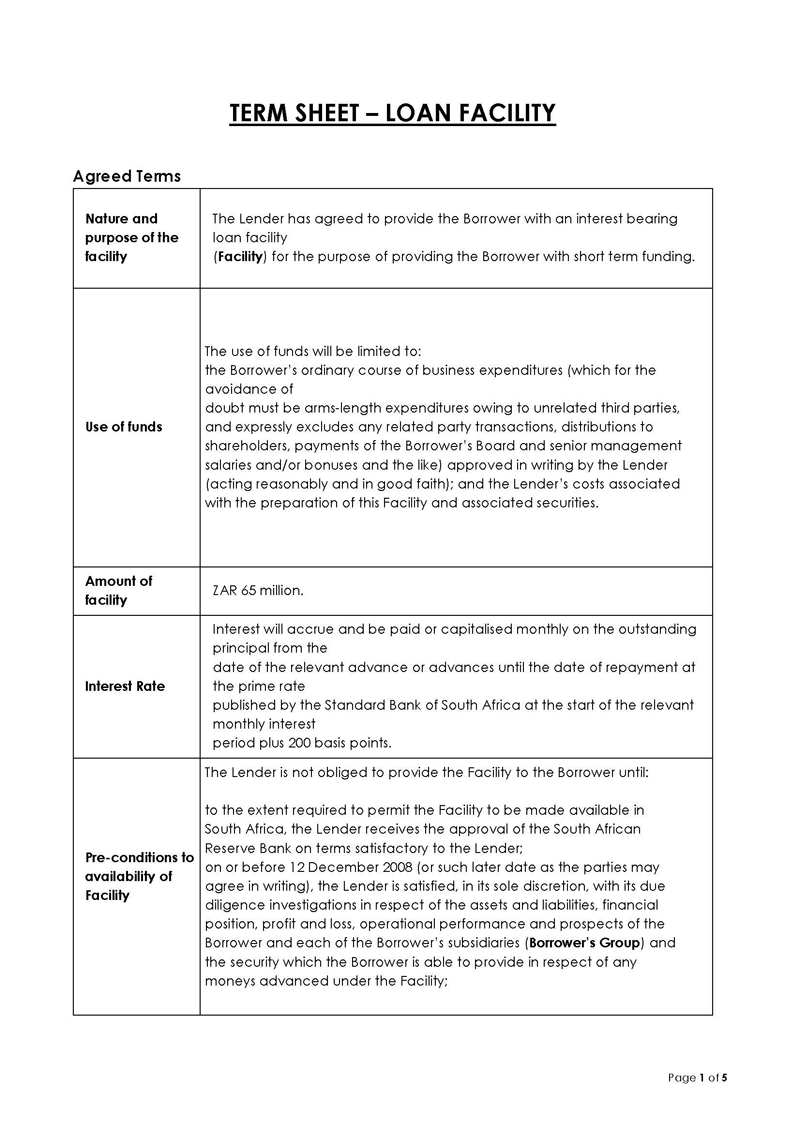

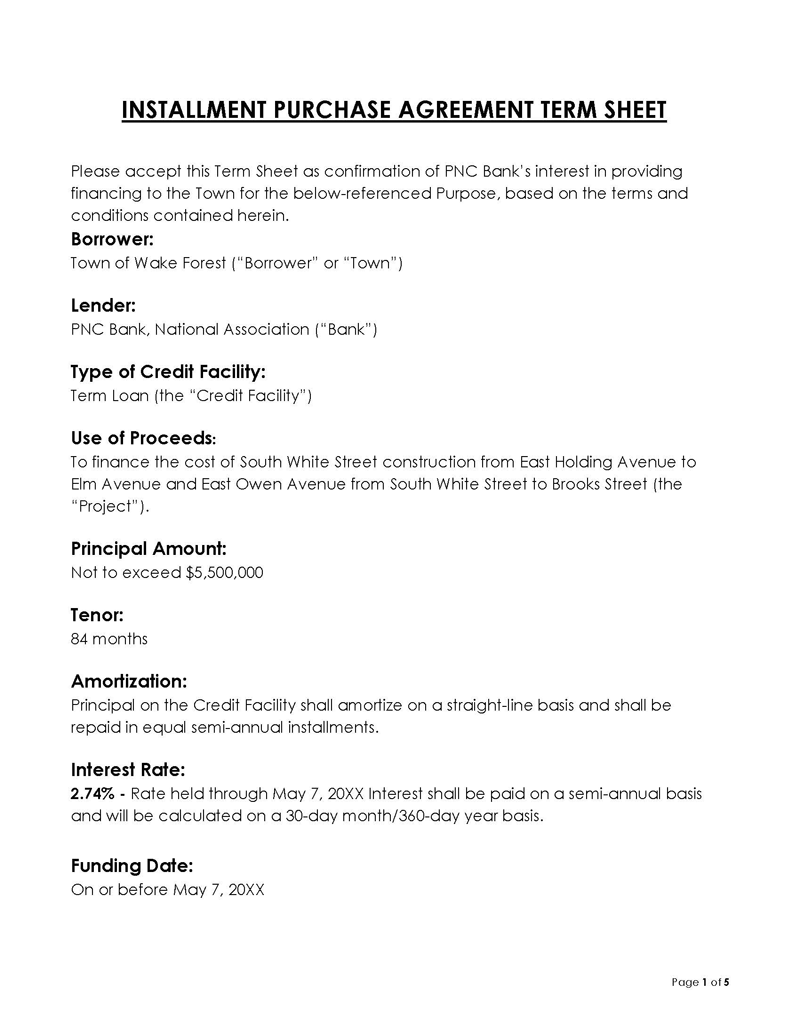

Term Sheet Draft

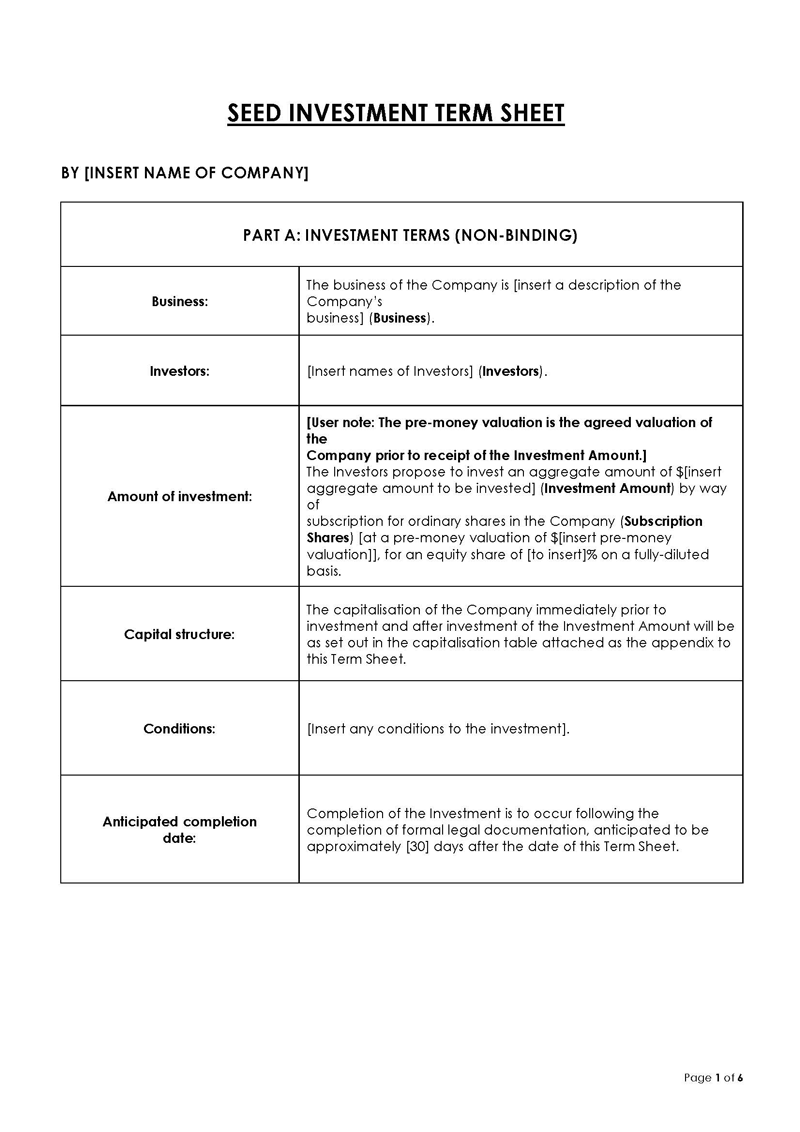

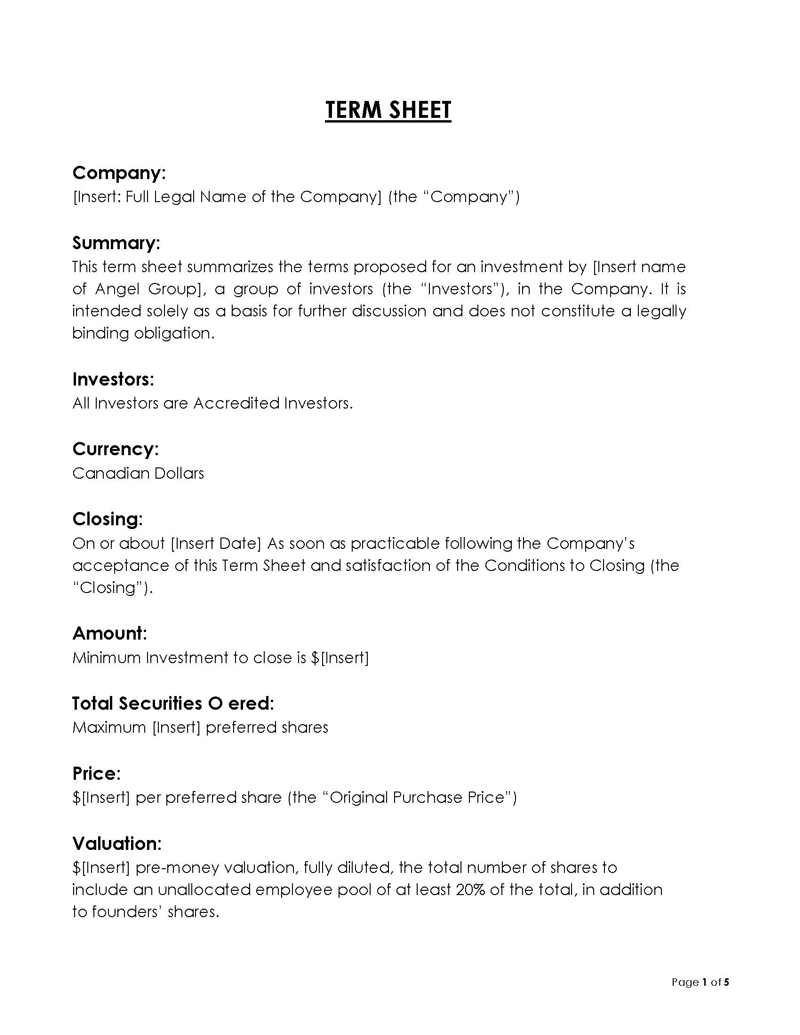

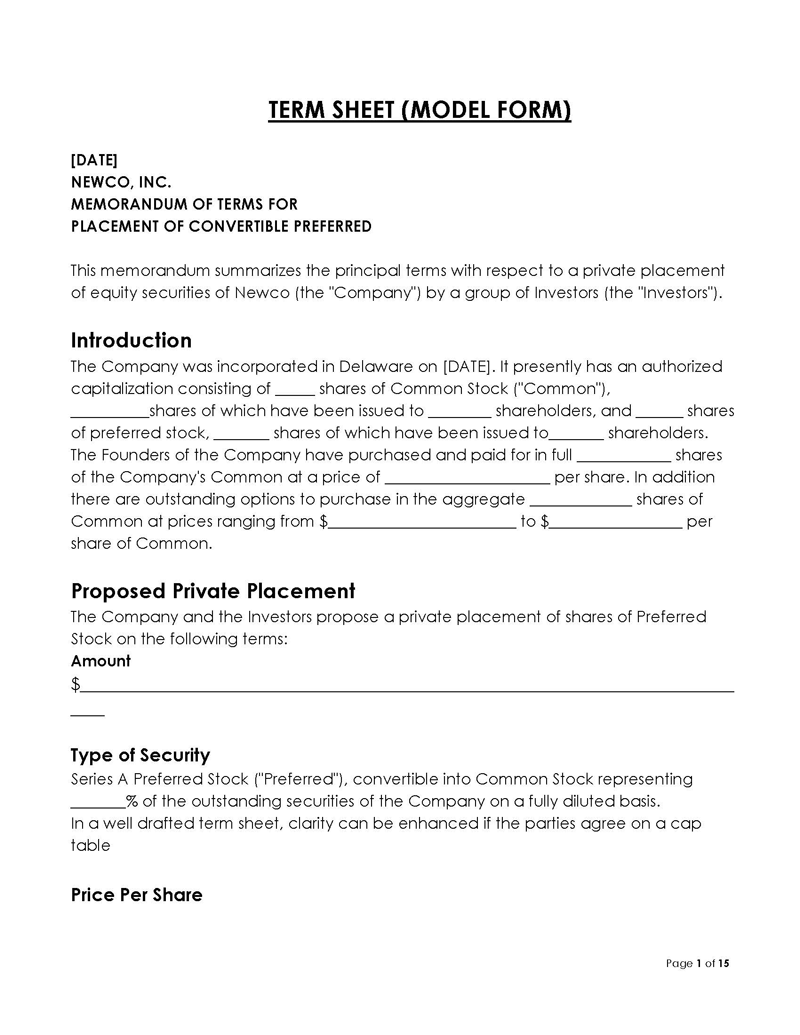

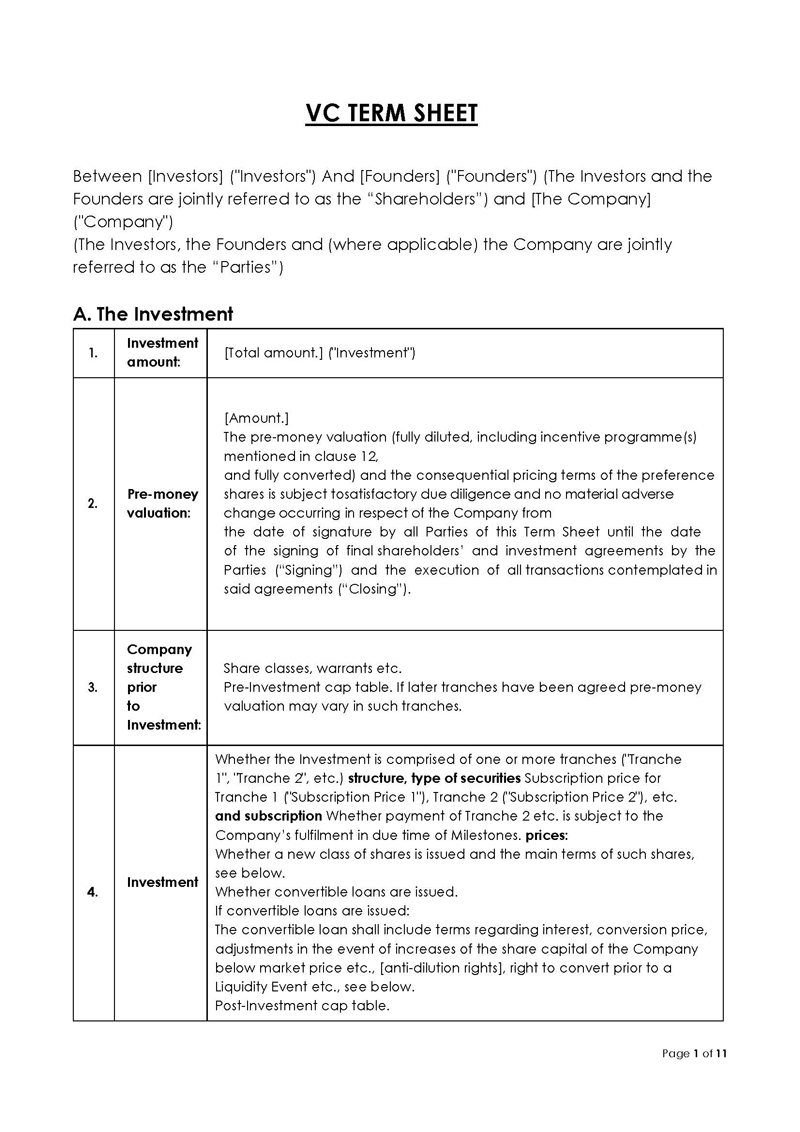

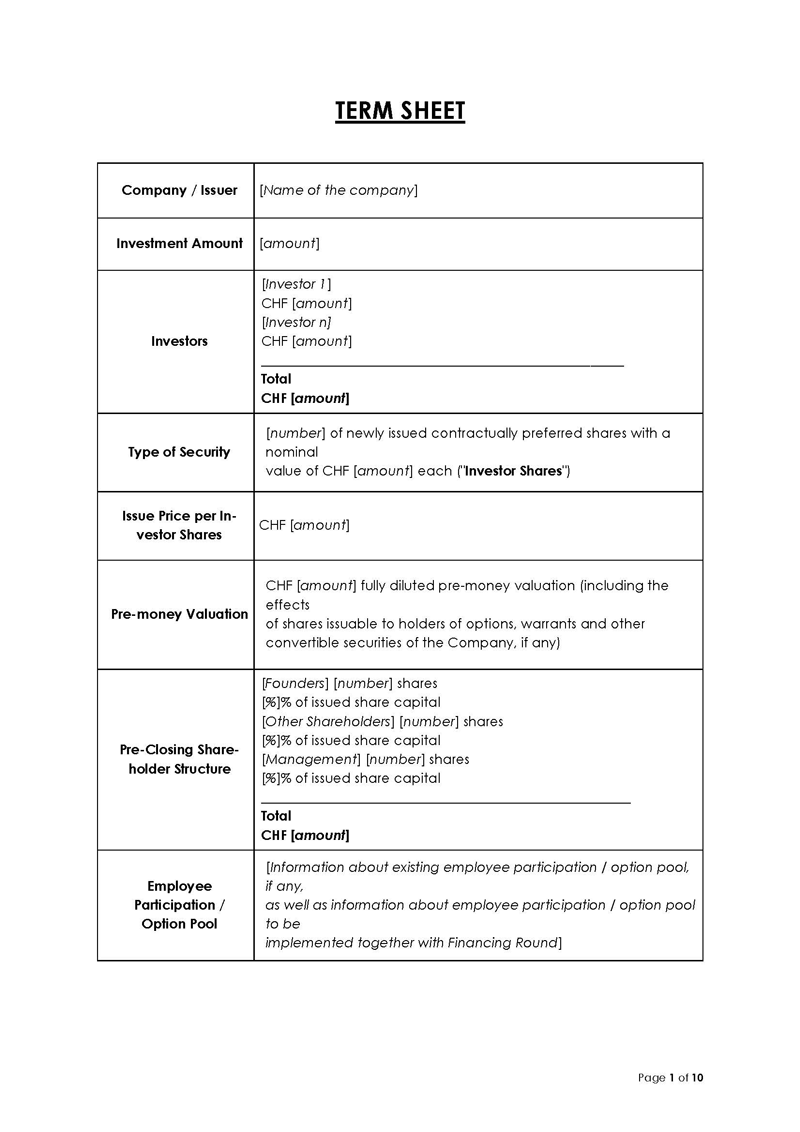

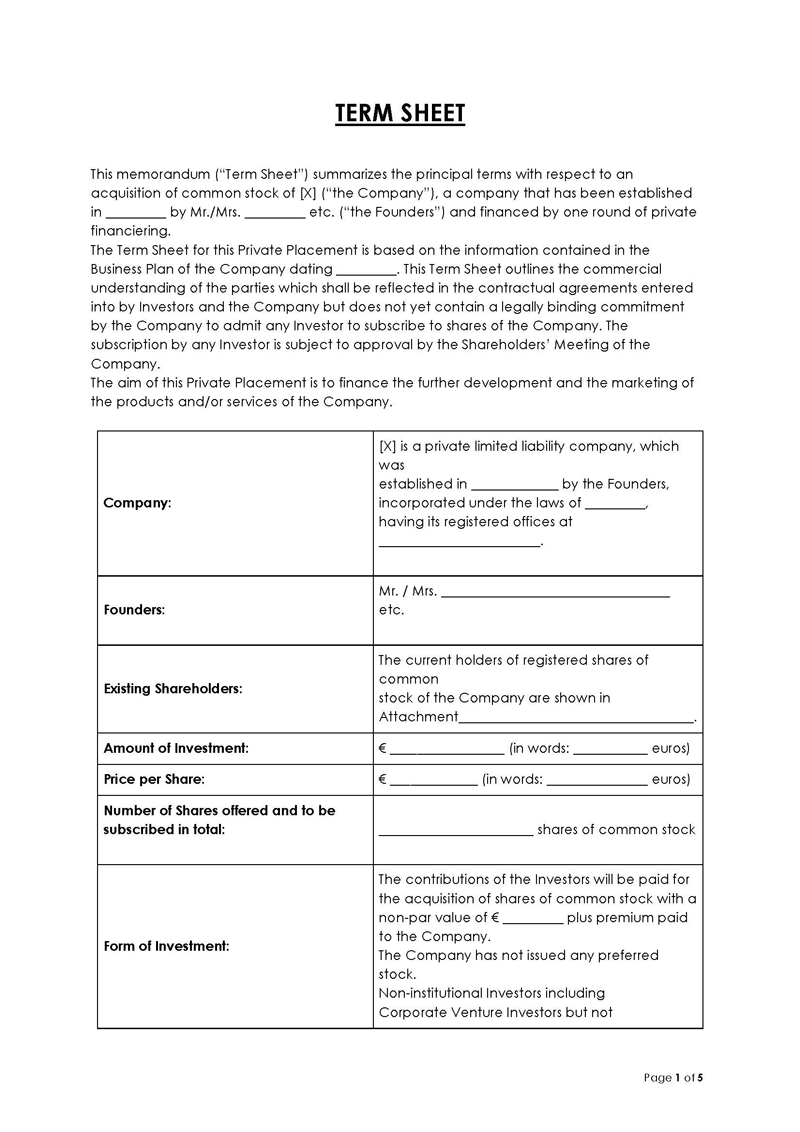

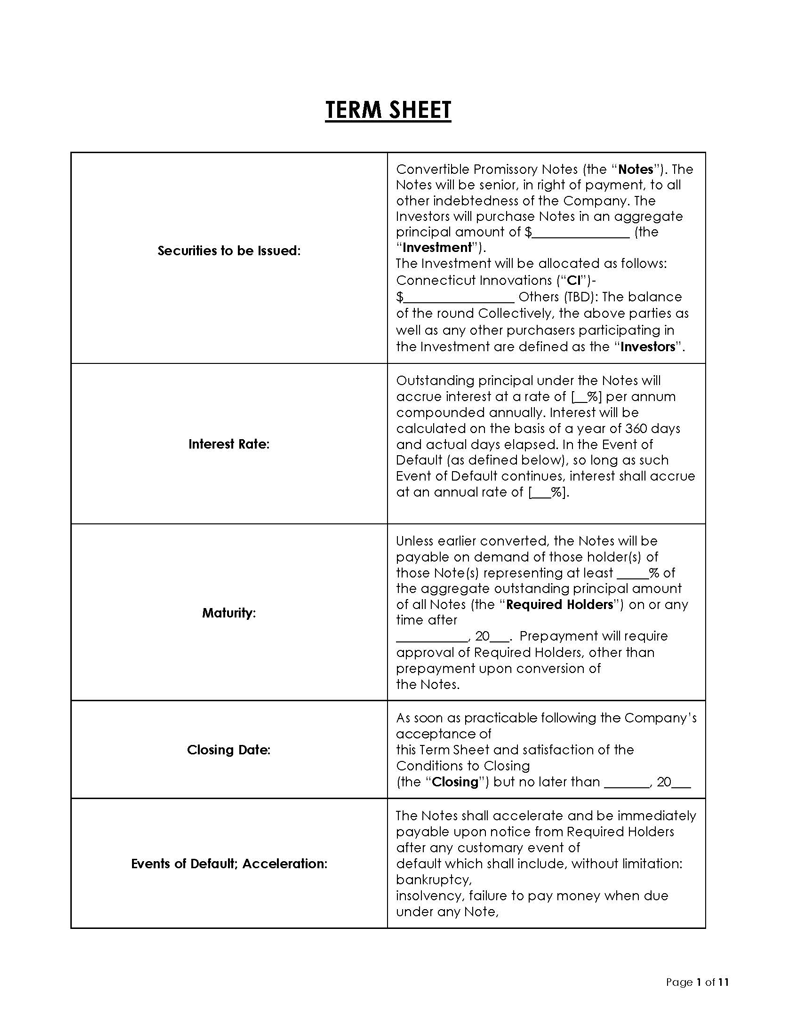

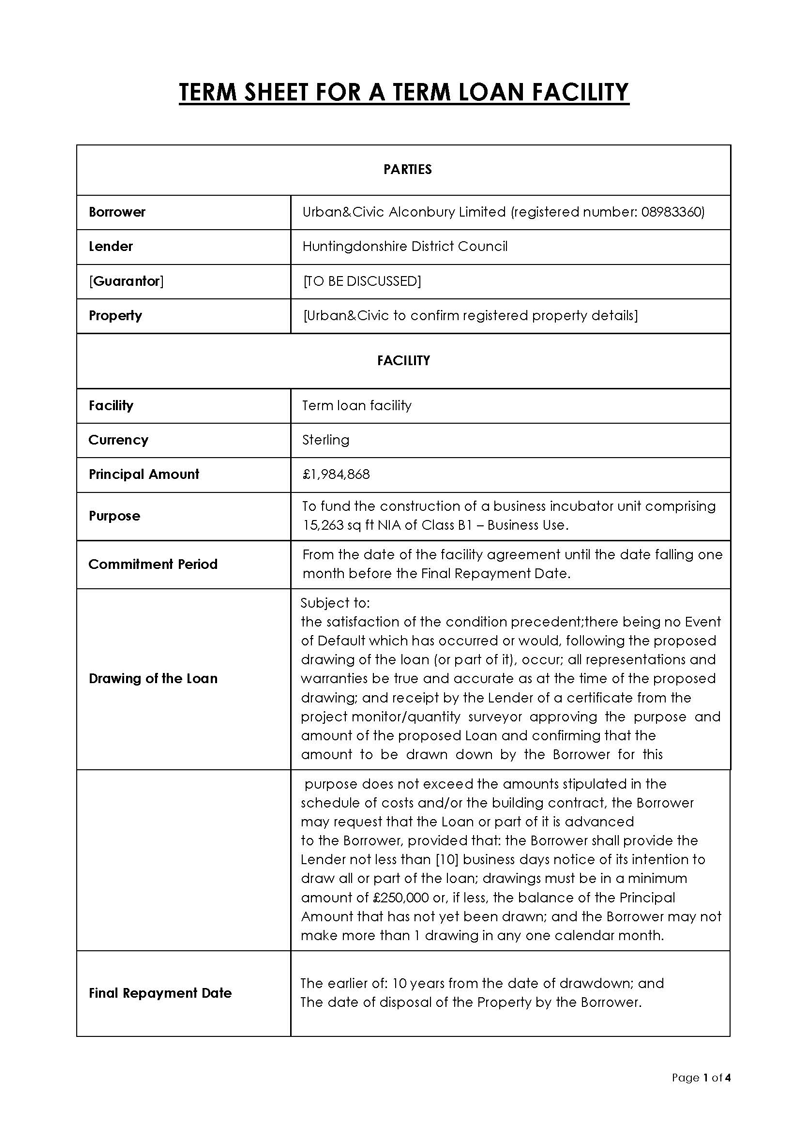

You can use draft as a guide for creating your term sheet. This draft includes all of the necessary information and follows the right format.

Make sure to incorporate all of the elements listed below when making your own:

DRAFT SAMPLE

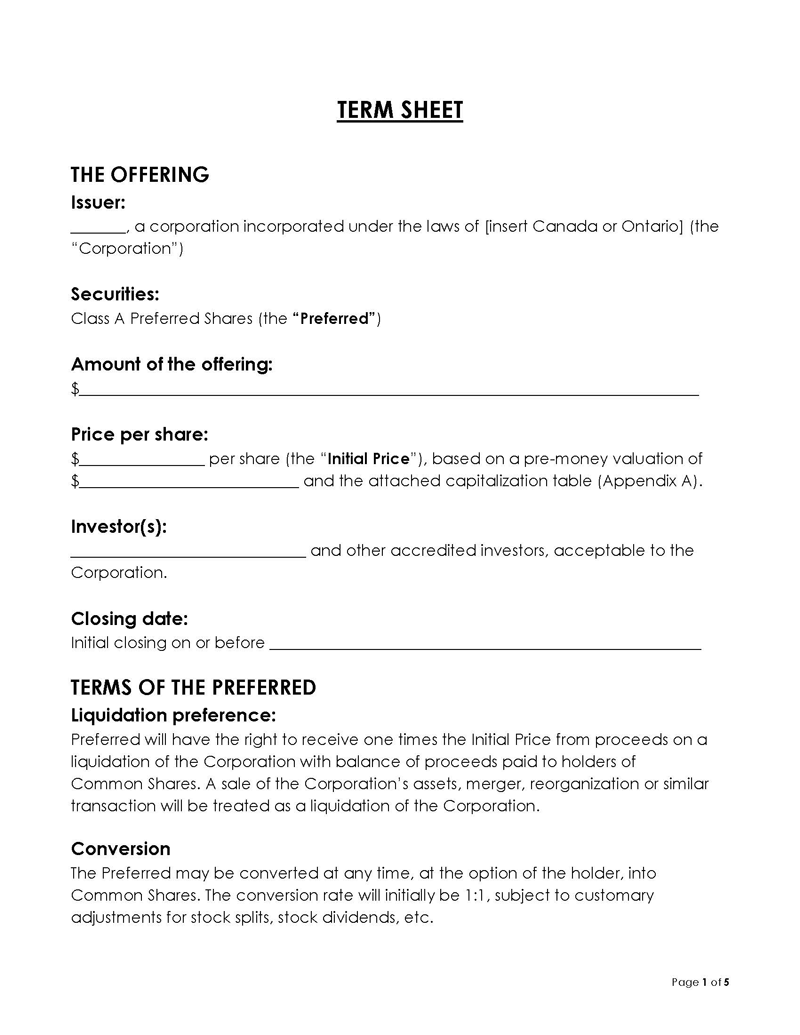

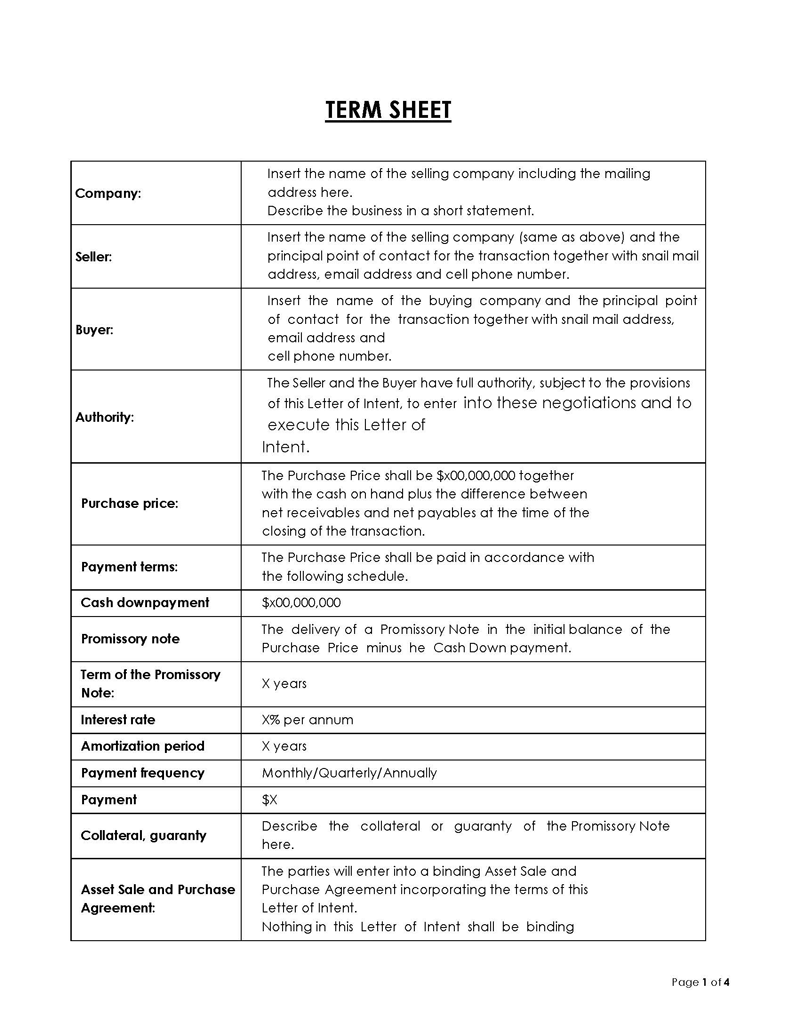

Issuer: [This is the name of your ‘corporation’ as a company or startup business]

Nature of the Offering: [Mention if the investment will be placed through a broker or directly with your company, that is, “brokered” or “non-brokered” investors.] [Mention if it is the Offering of a ‘private placement’ or ‘open market’.]

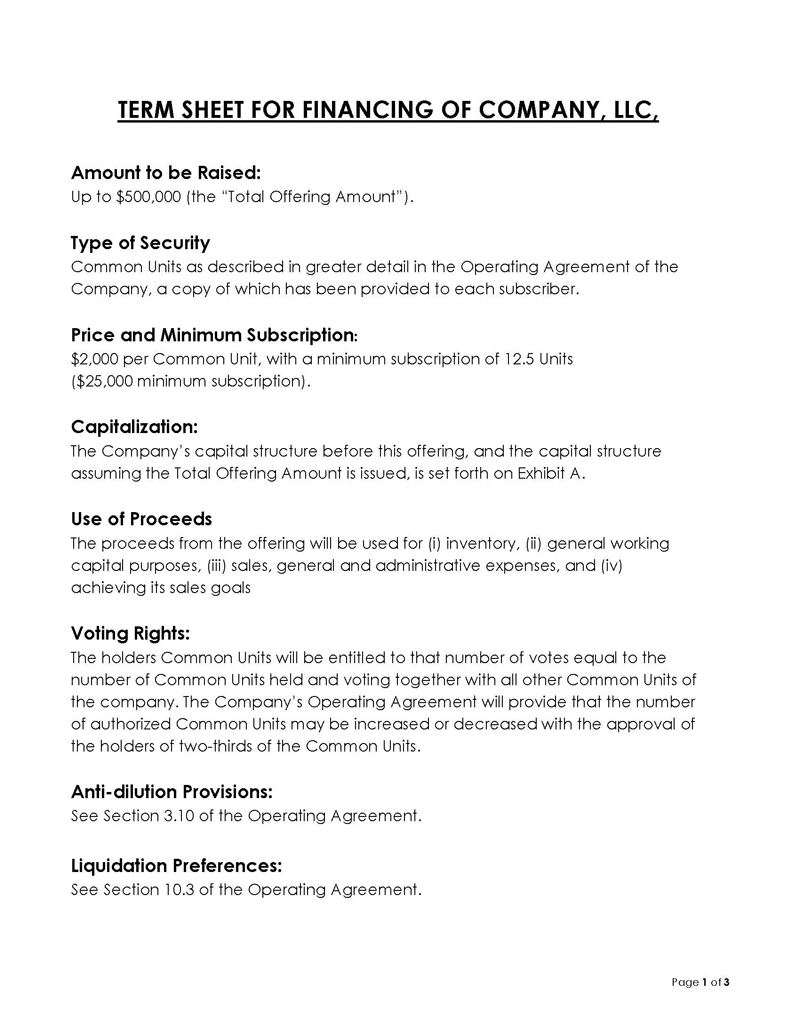

Type of Security: [For example, ‘Common Shares’ which act as proof of the money the investors will place into your company.]

Offering Size: [This is the largest number of shares that can be sold and is usually ‘Up to $50 million]

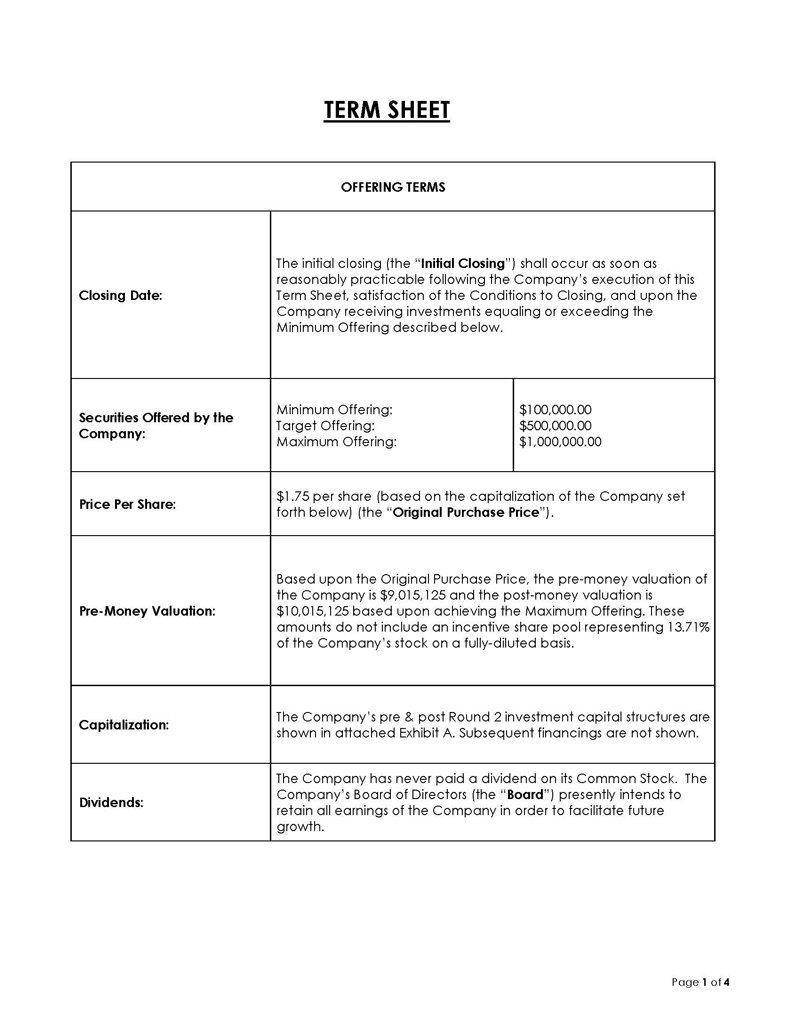

Issue Price: [This is the price of the offered shares once they become public: $[10.00] per Share.]

Commission: [Variable pay remuneration, which is always set at 6.0%]

Capitalization: [The investment amount required from the interested investors, which is approximately $60,000,000 and set forth as “Exhibit [A]”]

Dividends: [A policy governing how to distribute profits and any retained earnings is described here.]

Rights to Preferential Liquidation: [Any liquidation preferences that determine the payout order in the event of a corporate liquidation should be described.]

Liquidation Event Defined: [You must also specify the legal prerequisites that will characterize a liquidation event.]

Conversion Rights: [Only include these conversion rights in your sheet if applicable.] These are the options that investors have when converting their shares to common shares for their benefit.

Anti-Dilution Provision: [These provisions prohibit the issuance of shares at prices lower than the Issue Price to safeguard shareholders’ investments from potential loss of value.]

Voting Rights: [Ensure that you describe the voting rights regarding your position in the company and that of the investors.]

Use of Proceeds: [There is a need for directions regarding the use of proceeds from the Offering, which can be for general corporate or working capital purposes.]

Closing Conditions: [These are clauses that should be included to direct the conditions that will facilitate the closing of the Offering.]

Agent: [Generic Capital Corp.]

Closing Date: [Include the closing date]

Important Clauses to Cover in a Term Sheet

You should keep in mind some essential clauses, as they must be included in your template. These clauses play an essential role in informing your potential investors about the terms and conditions of their investment.

Among these are:

Valuation and ownership percentages

The term sheet template must contain information about valuation and ownership percentages. This includes deciding what percentage of ownership you will have in your company and what shares you will allow investors to purchase when investing. You must choose investors who will benefit your expanding business.

The equity percentage that investors will receive based on their investment will be determined by a clause in the company’s valuation. Your clause needs to establish if it will be based on the pre-money or post-money valuation. Pre-money valuation is the company’s value before the investment is made, while post-money valuation is the company’s value after the investment is made.

Option pool

The option pool is a clause that details how many shares or how much company equity you will reserve for potential investors or employees in the future. This clause must be included in your template to protect you from experiencing dilution without the participation of your investors.

Setting aside a group of shares or equity in your term sheet is also a great way to motivate your employees to work hard by offering them the opportunity to own shares. In most cases, you can leave about 10 to 15% of your shares in the option pool. You can reduce the option pool shares for companies with a strong management structure.

Liquidation preference clause

In your term sheet template, you must include the liquidation preference clause. The clause is meant to establish the order in which entities and parties that own the company will receive payment when and if a liquidation (a sale or even bankruptcy) of the company happens.

This clause ensures your prospective investors, or VCs (venture capitalists), that they will get their investments back before other shareholders. There are different types of liquidation preferences you can include in the clause.

EXAMPLE

A preference of “1x” means that after liquidation, the VCs will be first to get their investment before the rest of the shareholders can divide what is left among themselves. You can also include the “2x” or, less often, “3x” liquidation preference, which will guarantee the investors to double or triple their investment before further division occurs.

Dividends

You must include a dividend policy or clause that spells out what will happen whether or not dividends accrue in your contract. In most cases, if the dividends accrue from the start of the investment, the money realized should be included in the shares that investors will receive in the event of a sale. You also need to establish the rights of the party that will be responsible for the dividend payout.

Anti-dilution clause

To assure the VCs that their equity value will be safeguarded in the event that additional funding is required at prices lower than those in the previous round, the anti-dilution clause is also required in your sheet template. Make sure to mention the ratchet-based and weighted average anti-dilution as part of the two anti-dilution protection sections.

The ratchet-based anti-dilution protection tends to give more control to prospective investors than the weighted average anti-dilution protection. It allows them to get more stocks for the same initial investment in case a dilution occurs.

Controlling rights

The final important clause that must be included in your template is the controlling rights clause. This establishes the allocation of board seats and ownership interests among the voting classes. The main focus is to include the controlling rights to determine whether the investors or the founder shareholders will hold the majority of these seats.

It is not only about the majority seats but also determining the decision-makers in your company. Therefore, be careful to distribute the voting rights fairly so that you can maintain control, but not too much control to deter potential investors.

What is a Startup Term Sheet?

There are different types of term sheets, with the main one being the startup term sheet. A startup sheet is a document that you, as a company, will need to prepare before you present the legal financing documents to potential investors.

The startup sheet contains the terms and conditions of the proposed investment that cover the following:

- Valuation

- Option pool

- Liquidation preference

- Participation rights

- Dividends

- Anti-dilution protection

- Controlling rights

When these terms appear in the term sheet, they all have the same meaning.

EXAMPLE

The term “participation rights” refers to the privileges that some stakeholders have that allow them to receive dividends before others.

Final Thoughts

When you are a company or startup seeking investment, a term sheet is an essential part of your business documents. With a term sheet, you will be able to present the terms and conditions of the investment to your prospective investor(s). Keep in mind that this is not a final agreement but a summary of details that will appear in the final document. Use the term sheet draft or template to create a proper sheet with all the necessary information and crucial clauses.