A Virginia lease agreement is a legal document that enables a landowner, also known legally as a lessor or landlord, to collect recurring payments from a tenant or lessor using their property for a predetermined period of time.

The terms of the tenancy have to be signed by the tenant to be effective.

Leasing in Virginia is a business transaction where the landlord provides a service (premises to reside or do business), and the tenant is the consumer. As such, documentation and records are an integral part of the matter. Any agreements between the landlord and their tenants must be signed by both parties.

Each party’s legal rights and responsibilities, from rent, security deposit, and utilities to maintenance, are typically mentioned in this document, which can also be used as a reference document if there are any disputes. The lease agreement is drafted after the landlord conducts a successful screening on the tenant and finds them suitable as their customer.

All lease agreements in Virginia have to comply with the state’s landlord-tenant laws to be valid. The guidelines for legally executing a lease agreement are outlined in the Virginia Residential Landlord and Tenant Act or the Guide to Virginia Landlord-Tenant Law handbook. After being executed, the document protects both parties’ interests throughout the lease term. This article will guide landlords who want to lease their commercial or residential property in Virginia.

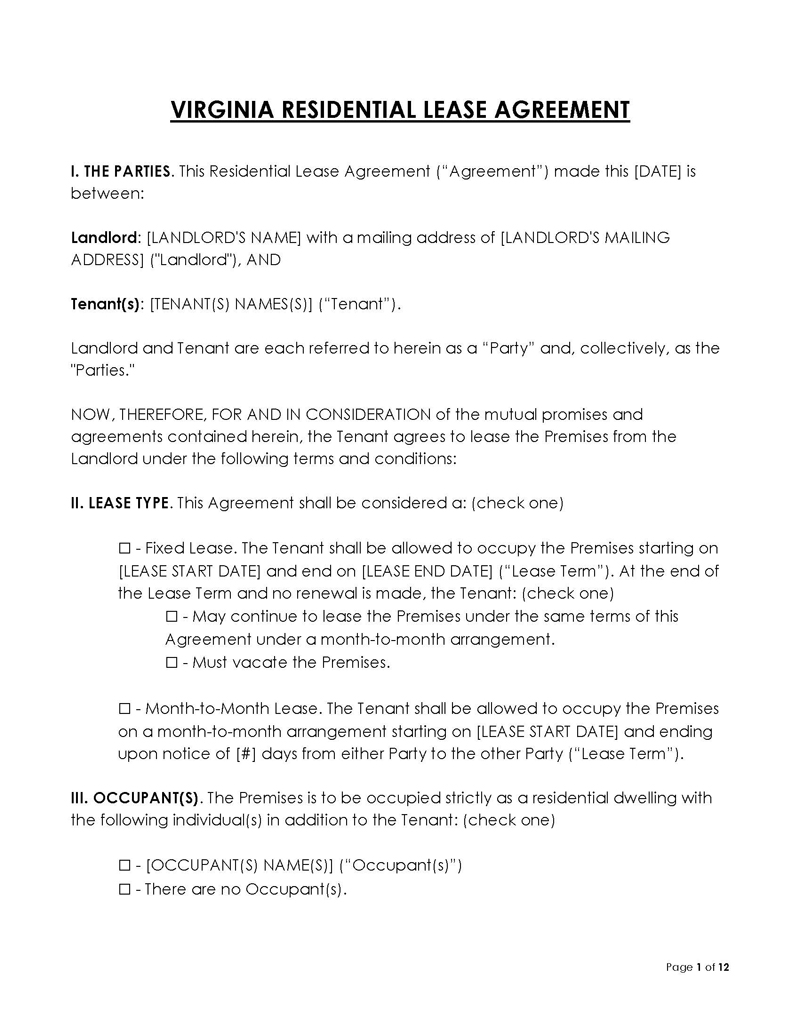

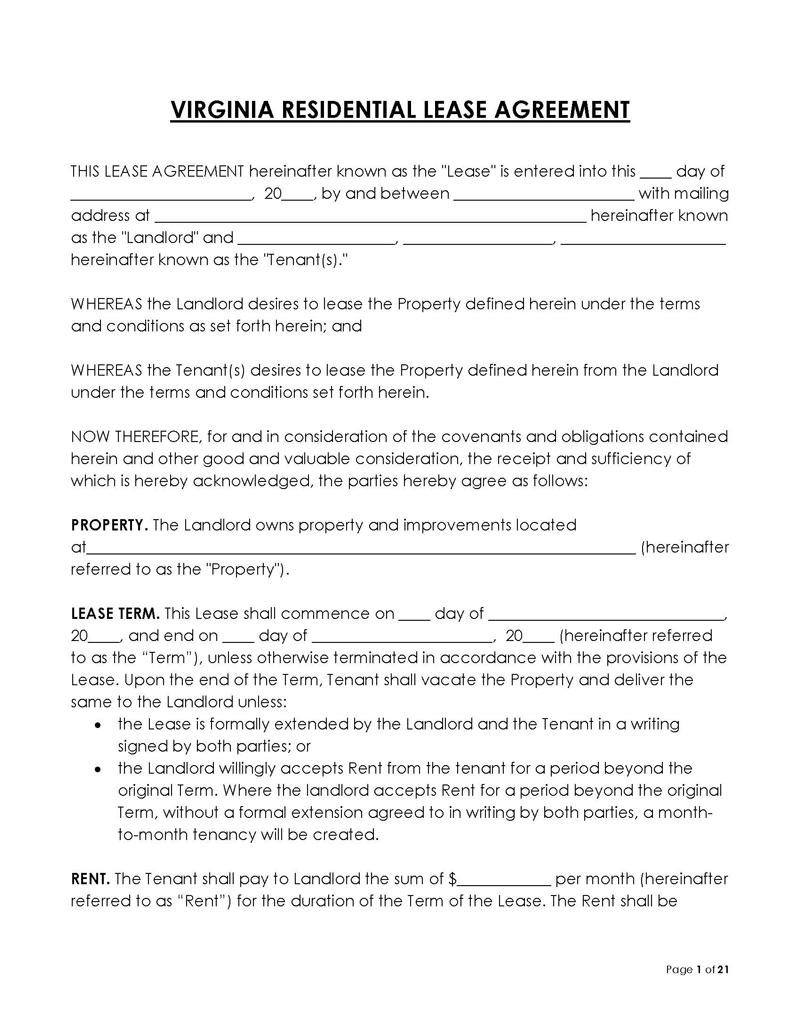

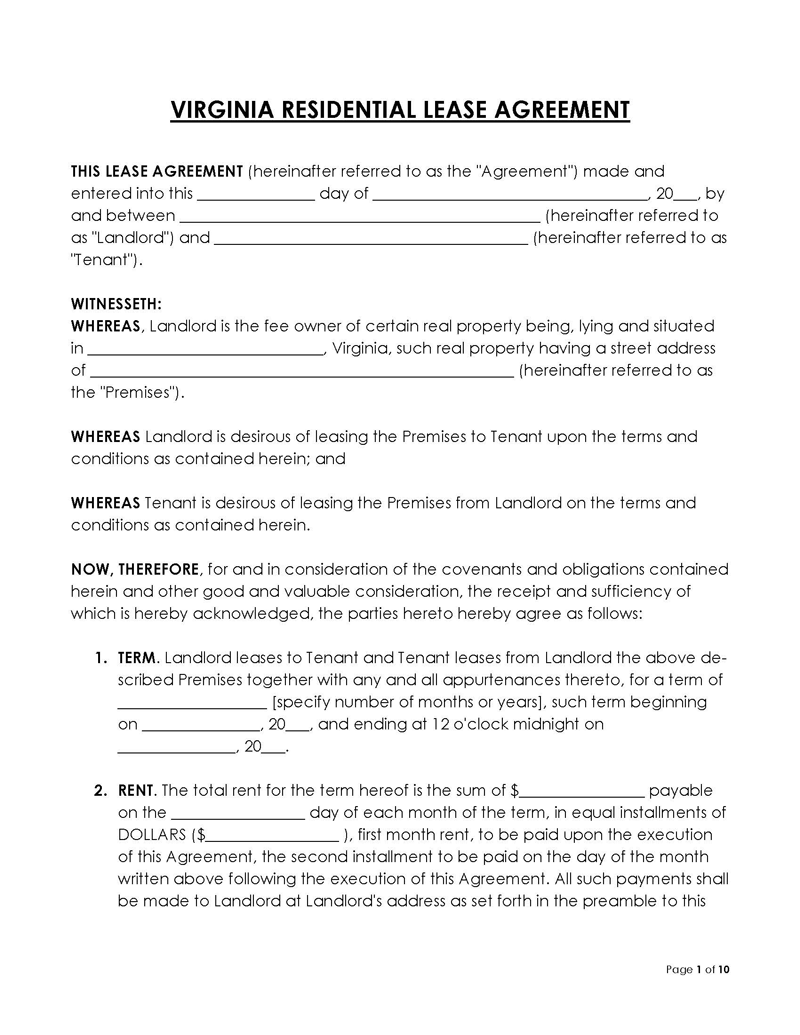

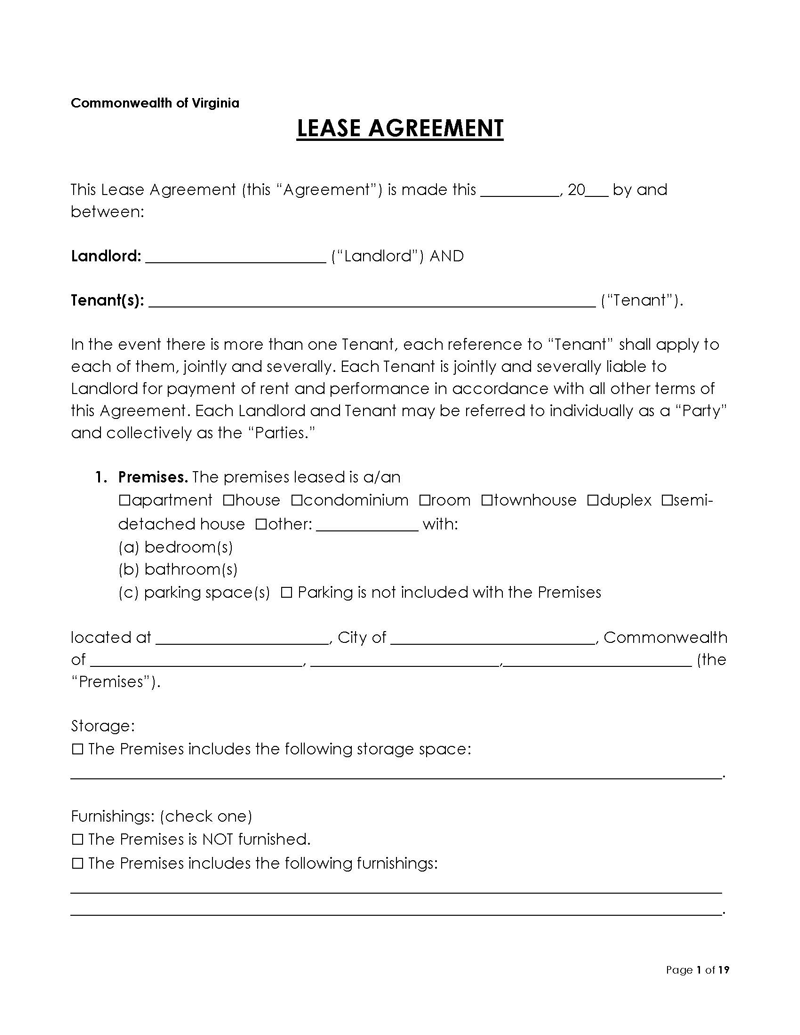

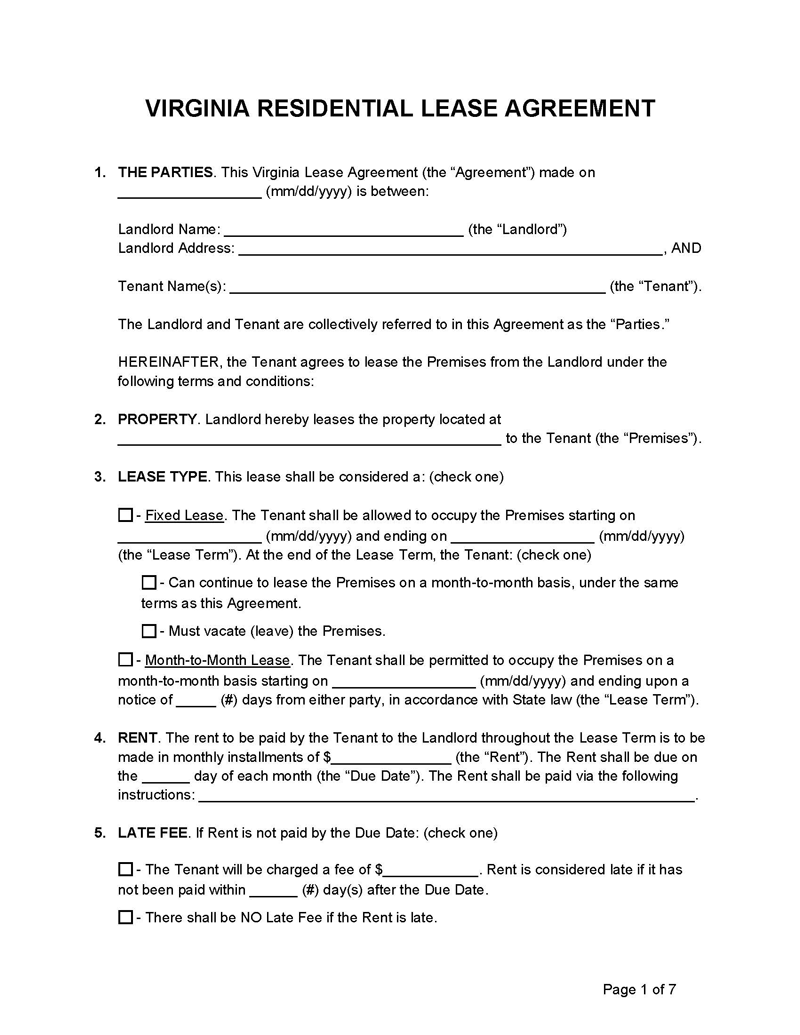

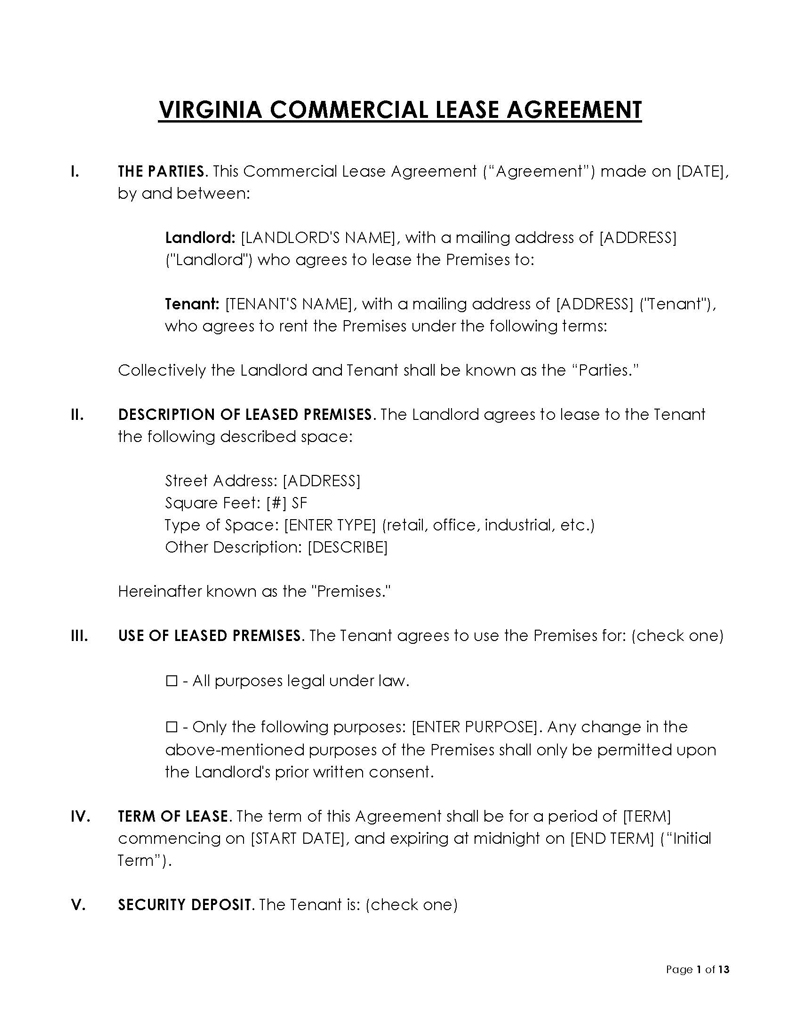

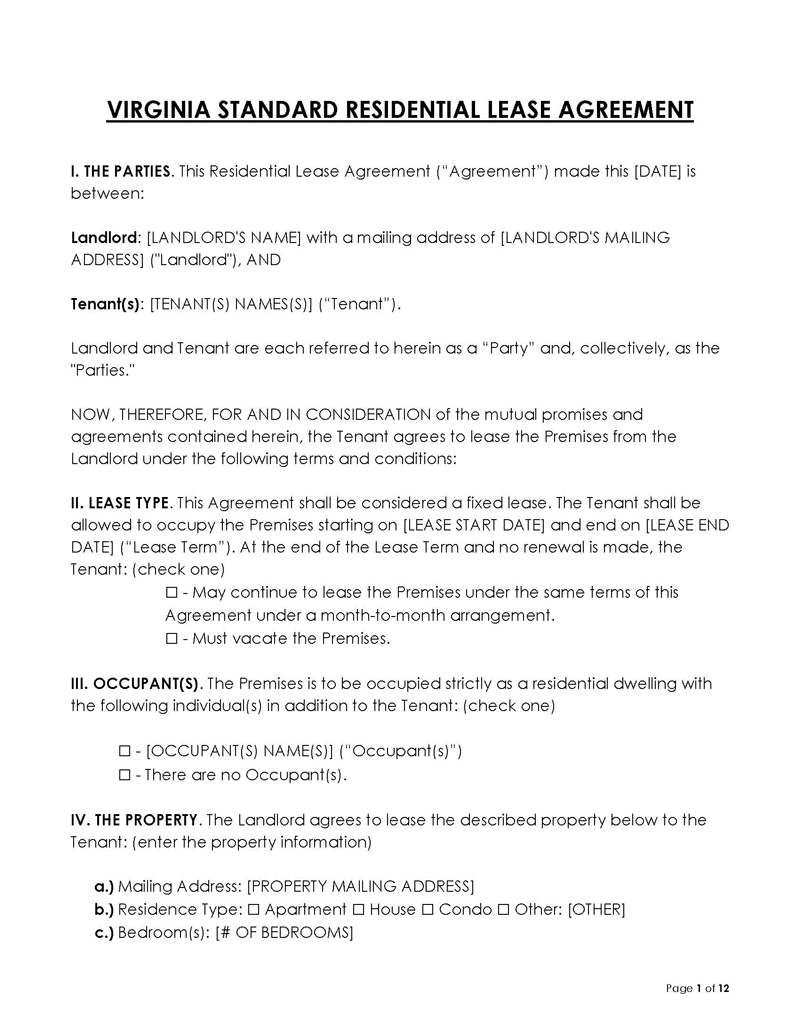

Lease Agreement Templates

Associated Laws

Virginia landlord-tenant laws issue guidelines on how different aspects of the landlord-tenant relationship are to be managed.

Landlords have to make sure they are aware of the policies and laws related to leasing in Virginia, especially in terms of:

Landlord’s access

The legal right of a landlord to enter the leased premises and inspect them while they are in the tenant’s possession is governed by state laws. Landlords have to give a minimum of 24 hours notice. Also, he or she must not enter their property during unreasonable hours. However, a landlord may not need to give a notice for emergency entries.

Security deposits

State laws regulate the landlord’s right to collect a security deposit from the tenant. Virginia landlord-tenant laws also apply to how much of a deposit is required and when it must be returned. Landlords must return the security deposit 45 days after the lease expires and are not permitted to request amounts greater than two months’ worth of rent.

Warrant of habitability

According to state laws, residential landlords should maintain the habitability of their property. Landlords are to provide HVAC systems, smoke detectors, electrical outlets, and plumbing lines to ensure the rental unit is habitable. Landlords are also responsible for repairing these amenities within “reasonable” timeframes. Tenants can use their legal option to withhold rent until the problem is resolved if this is not done.

Evictions

As per state laws, landlords have to follow the proper eviction process that ensures that the tenant gets due process and is not evicted unlawfully. Landlords are allowed to evict tenants who fail to make rent payments as agreed upon after issuing a 5-day notice. They can also evict tenants who violate lease provisions after providing a 30-day notice. Landlords have the right to evict tenants who engage in illegal activity either immediately or after giving them adequate notice.

Lease terminations

A landlord has a right to terminate a lease agreement when the terms are allowed by state laws. The notice period varies depending on the reason for termination and the type of lease. Month-to-month lease agreements can be terminated with 30 days’ notice in Virginia. Also, fixed-term leases can be terminated prematurely by the tenant for numerous reasons, including the uninhabitable conditions of the rental unit, deployment or active military duty, landlord harassment, any missing compulsory disclosure in the agreement, and domestic violence.

Rent increases and fees

Landlords in Virginia are not regulated in terms of how much or how often they can increase rent. Thus, they can increase rent without prior notice. However, if the landlord is to charge fees, they must be declared in the lease agreement. Also, bounced check fees should not exceed $50.

Settling legal disputes

In legal disputes between landlords and tenants, the state has laws that govern how they can be settled. Disputes of a maximum value of $5000 should file the case in a small claims court. Small claims courts can also handle evictions, even though civil courts will typically handle these cases.

What Disclosures Must Be Made in a Virginia Lease Agreement?

Landlords are required by law to disclose certain information about the rental unit. This information is conveyed through disclosures or addenda.

Below are the disclosures that landlords must provide in their agreements:

Defective drywall

The landlord should disclose any defects that may be found on the dry walls of the rental unit, according to § 55.1-1218. Drywall is a key factor in determining whether or not the property is habitable. Also, this information must be provided to the tenant before they sign a lease agreement. If a defect is discovered, they have the legal right to withhold rent until it is repaired or replaced.

Lead-based paint disclosure

Landlords should disclose if there is any presence of lead paint in the rental unit to abide by laws under Title 42 U.S. Code § 4852(d). This disclosure is mandatory for all buildings built prior to 1978. The landlord and tenant are also required by law to make a safety inspection of the premises before signing a lease agreement to determine the type of paint used and whether it poses a health risk.

Methamphetamines disclosure

Landlords are bound by law to notify the tenant of any information they may have regarding the presence or previous manufacturing of methamphetamines in the rental unit (§ 55.1-708). The landlord risks legal repercussions and exposure-related liability if they fail to do so. The rental unit should have been decontaminated according to the protocols outlined under § 32.1-11.7; otherwise, the unit should not be rented.

Military (air) zone disclosure

If a military base is nearby, the landlord should disclose this information to the tenant in accordance with state laws (§ 55.1-1217). In addition, this information should be declared to alert residents of the noise disturbance and risks associated with living in such close proximity to a military zone.

Mold

Mold is a fungus that may exist on the wall surfaces and other parts of the building. Landlords are required by state law to disclose the presence of mold in their rental units and decontaminate them prior to signing a lease agreement (55.1-215).

Move-in checklist

Five days before the tenant occupies the premises, a move-in checklist should be used to assess the condition of the entire property (55.1-1214). At the time of leasing, the rental unit’s current condition should also be noted so that any damages the tenant causes can be deducted from the security deposit.

Notices

Notices can be sent electronically under § 55.1-1202(A. As a result, a lease agreement must include the email addresses of the landlord and the tenant.

Planned demolition or conversion to condominium

The landlord is required by law to inform the tenant if there are any plans to demolish the building or turn the rental unit into a condominium within six months, according to Section 55.1-1308. This is to prepare the tenants for the inconvenience of being displaced.

Ratio of utilities

Since tenants may sometimes share utility metres, the landlord is obligated to disclose this in the lease agreement (§ 55.1-1212). Furthermore, the disclosure should detail how the utility ratios and applicable service fees are calculated. This is done so that the tenants can estimate future costs.

Manager & owner information

All lease agreements should include the name and address of the landlord, property manager, or agent (as applicable). It must also include the name and address of the person acting on behalf of the landlord (§ 55.1-1216(A)).

Sale of property

If the property is to be sold, the landlord should inform the tenant. This disclosure should also indicate the name, address, and phone number of the buyer, according to § 55.1-1216(B).

Tourism activity zone

This disclosure is needed for rental units located in tourist activity zones. The tenant needs to be notified of any tourist activities that may affect their stay on the premises (§ 55.1-707).

Lease Payment Plan Addendum

During the lease term, unexpected events that can disrupt the tenant’s ability to pay rent can happen. A lease payment plan addendum should be added to the lease agreement to outline the contingency payment plan that should be adopted should the tenant default on a payment due to the following reasons;

- Additional expenses

- Loss of income sources as a result of a health-related state of emergency declared by the Governor of Virginia as defined under 44-146.16.

Types of Lease Agreements Used in Virginia

They include the following:

Commercial lease agreement

This agreement is used to rent property to be used for business purposes. Hotels, office buildings, shops, and other commercial establishments are examples of commercial properties. Commercial lease agreements can be more complex than residential leases.

Standard residential lease agreement

Also called a “fixed lease,” this is a lease with a predetermined start and end date, and the lease term is usually one year. It is the most popular type of residential lease in Virginia. This will include the fundamental or standard components of all valid lease agreements.

Month-to-month lease agreement

A month-to-month lease agreement, also known as a “tenancy at will,” is a contract that automatically renews on a monthly basis for an undefined lease term. However, it can be terminated with 30 days’ notice. According to this, the lease has a 30-day validity period, after which it automatically renews for additional 30-day periods if it is not terminated. This is the least secure and should not be used unless both parties have a trustworthy relationship.

Rent-to-own lease agreement

In a rent-to-own lease, the tenant agrees to pay the landlord recurring rent with the possibility of purchasing the rented property. A specific portion of the payments is used to purchase the property at a predetermined price at a later date.

Roommate lease agreement

A roommate agreement is a tenancy contract made between two or more co-tenants who rent the same home or apartment together. This type of agreement outlines the terms of co-tenancy, roles, and responsibilities of all roommates towards the premises, such as rent payments, utility costs, maintenance, etc.

Sublease agreement

It is used when the tenant wants to lease the property to another person. It is most common in situations where the original tenant leaves for a short duration of the lease period but expects to return at a later date and retain possession of the space. As such, the original lease agreement remains effective throughout the sublease.

Rental Application Form

A rental application form is a formal document that requests information from potential tenants when they submit an application for tenancy with a specific landlord. The form will often request the applicant’s personal identification details, employment status, rental history, references, etc.

When is Rent Due in Virginia?

Rent is normally due on the first of the month, with a five-day grace period. However, lease agreements can be personalized to demand rent on the due date agreed on between the landlord and the tenant. Furthermore, if the rent is paid by the tenant after the fifth day of any given month, the landlord shall be entitled to charge a late charge (55.1-1204(A), (C)(4)(5), and (D)).

Conclusion

Landlords must make every effort to comply with all statutory governing laws in order to avoid violation charges and potential conflicts with their tenants. While leasing property is arguably a straightforward transaction, it can quickly result in conflict, especially if the landlord and tenant do not set appropriate expectations before entering into the agreement.

A well-written lease agreement eliminates future liabilities. As a result, landlords should not rush to draft these without thoroughly researching all applicable laws. Consulting an attorney can be a good way of ensuring that the lease agreements are beneficial to the landlord-tenant relationship.