A consultant invoice indicates the type of services offered or product delivered, hourly/monthly rates, and project timeline. It is used by both in-house consultants and one-off consultants. An invoice breaks down the services and/or products the client is billed and is thus a vital communication tool between consultants and clients. In addition, by issuing the invoice, consultants can be assured of receiving payments on time. In this article, we have discussed elements and tips for the invoices along with editable templates. But first, let us understand what the invoice really is.

A Consultant Invoice is a financial document used to request payment for consulting services offered to a client.

It also functions as a record of any consultancy services provided by a consultant or consultancy firm within a given timeframe.

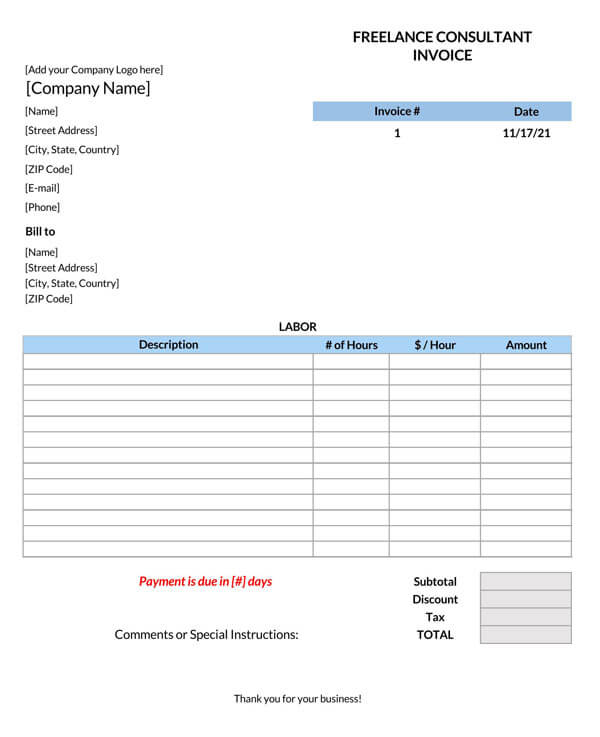

Using an invoice is a good way of showcasing professionalism, especially for freelancers. However, the need for an invoice will depend on the job and contract. Some consultancy jobs require an invoice, while some do not.

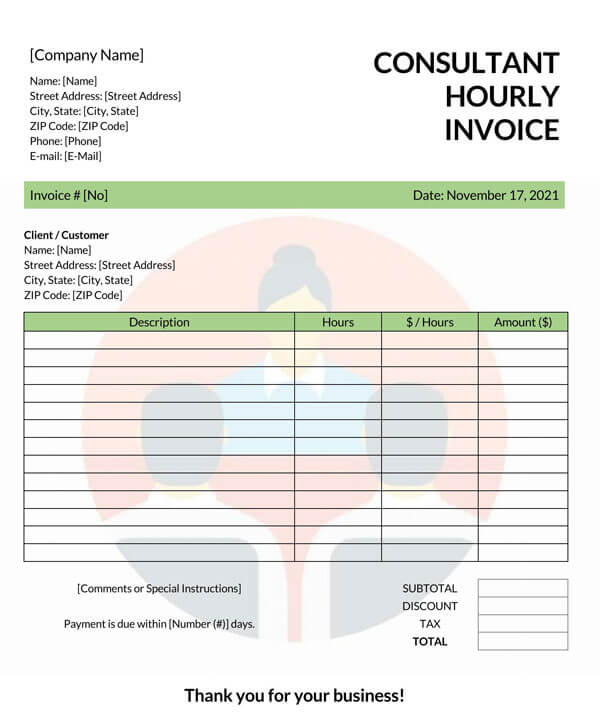

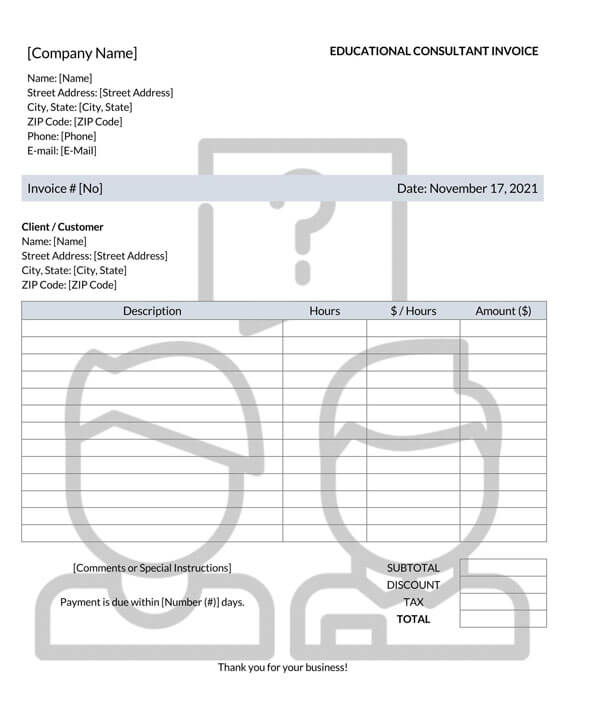

Free Templates

How to Charge a Consultant Fee

Learning how to charge consultancy jobs can be complicated, especially for beginners. Perfecting this craft will more often than not depend on experience.

However, this article has discussed a few steps you can use when billing consultancy clients:

Research about competitor’s rates

Start by researching how other consultants in your field are charging. Determine if the current consultancy fee is flat, hourly and how much they are charging. The last thing any consultant wants is to charge exorbitant fees or too little.

Create a suitable model for the rates/fees

Next, settle on an informed and reasonable charging fee and approach (hourly, monthly, or lump-sum). Ensure to consider varying factors such as project scope, experience, special services, etc.

Bill the client

Once you have decided which billing model to use, create a bill/invoice for the services offered or products delivered. This can be immediately after the completion of the project, after a milestone, or as agreed with the client. Make sure you accurately capture the figures/amount and details such as dates, names, and descriptions. Use the template to ensure all relevant details are provided.

Keep all the records

Lastly, send the invoice to the client and keep a copy for your records. All paid and unpaid invoices must be kept to facilitate accounting and record keeping. Invoices are essential for referencing and tax reporting.

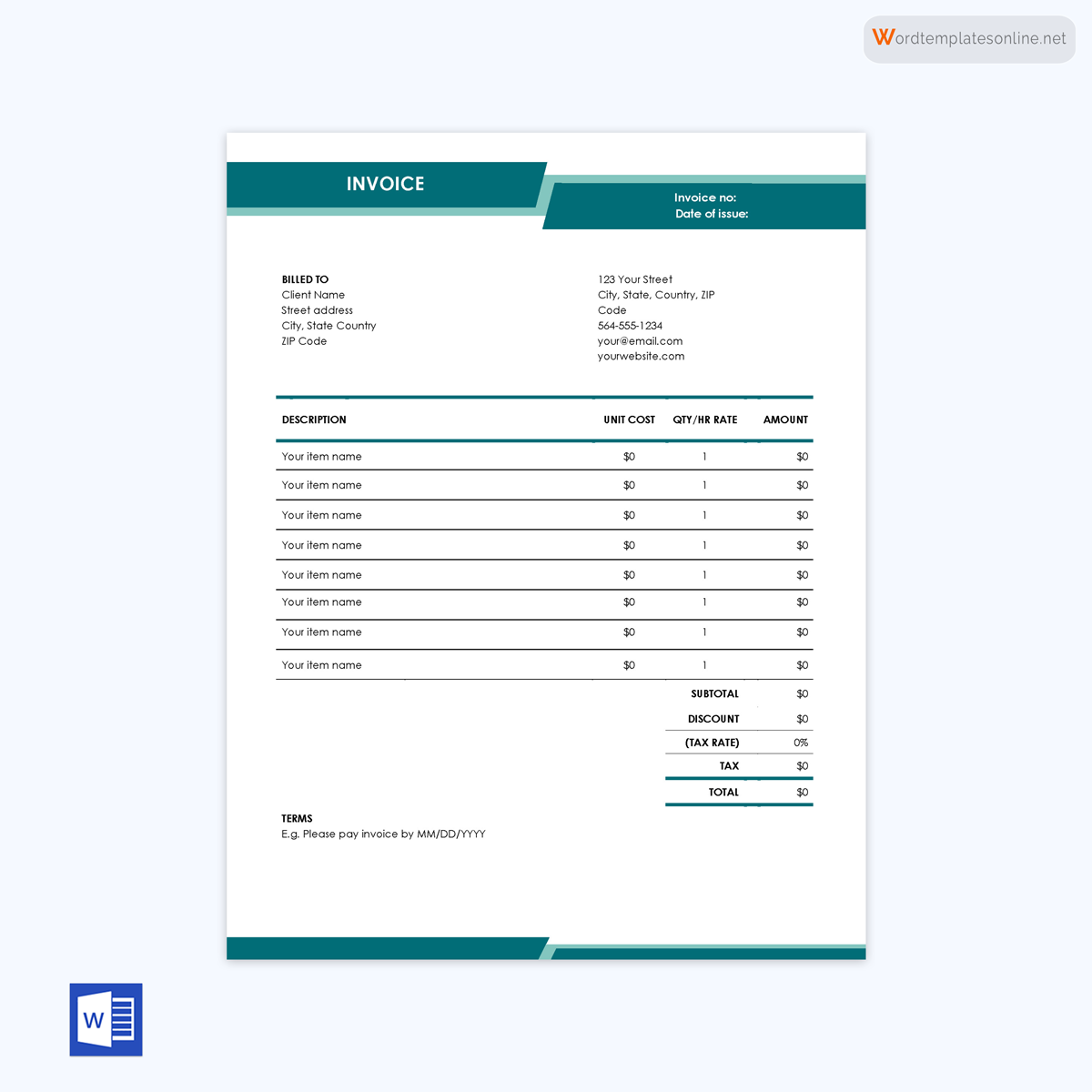

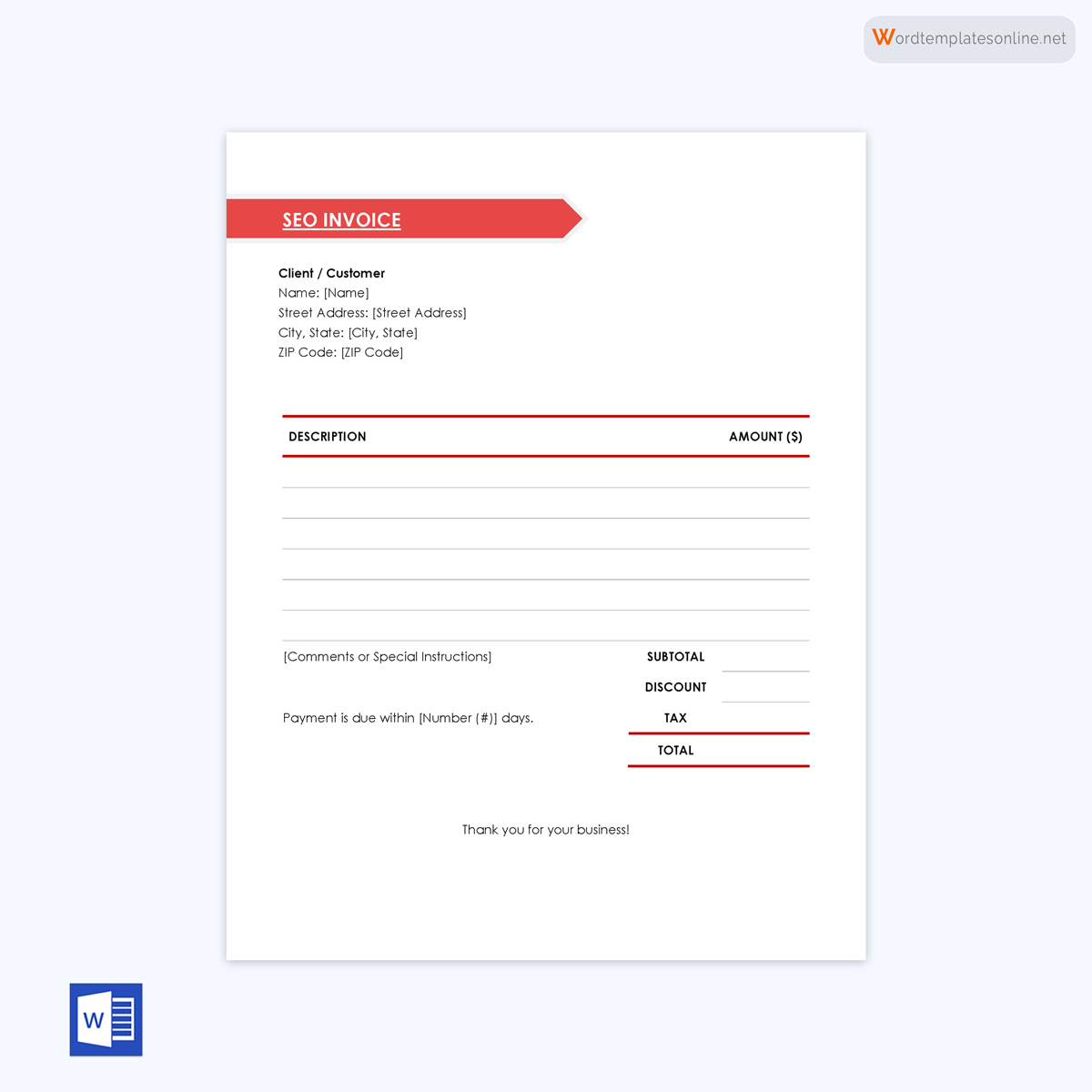

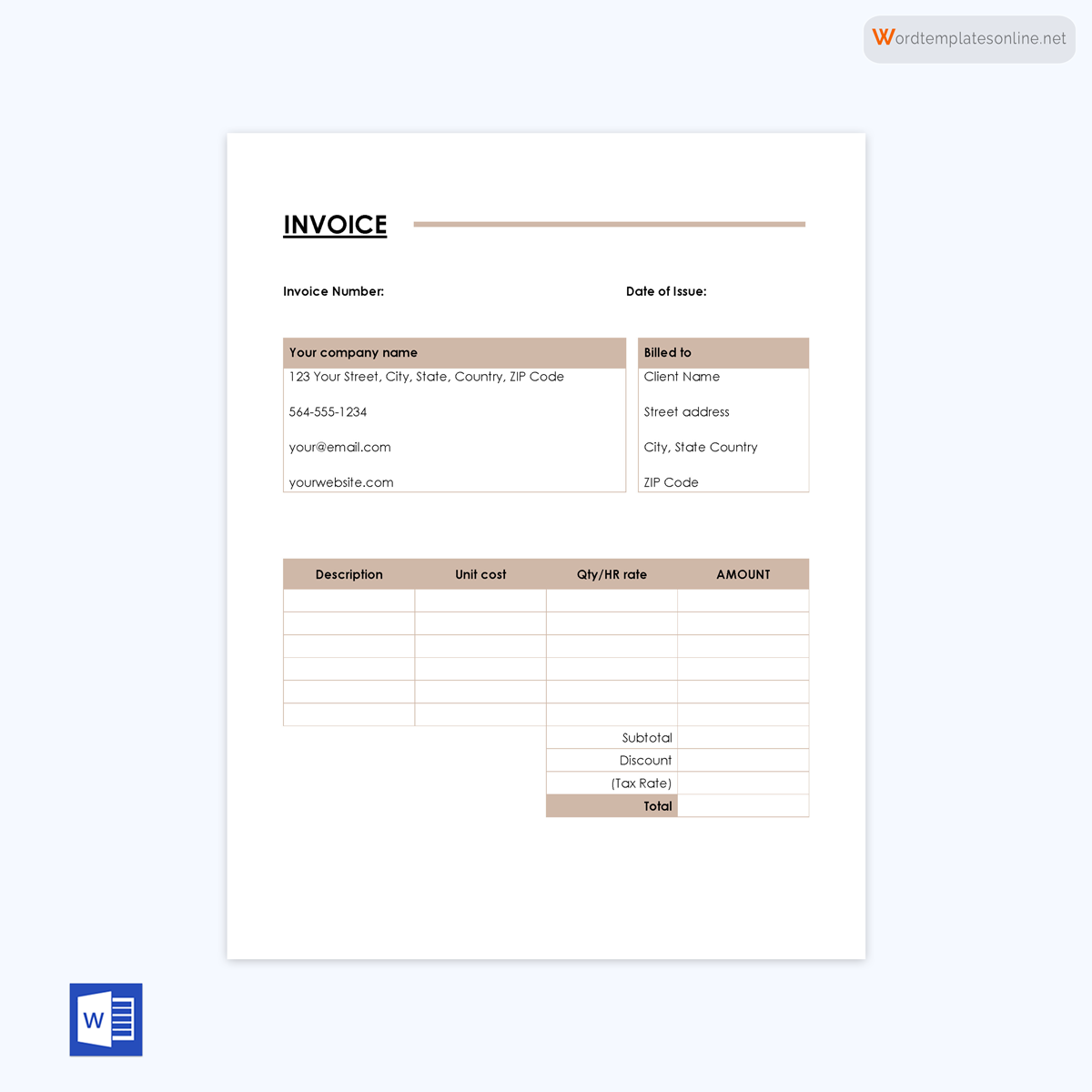

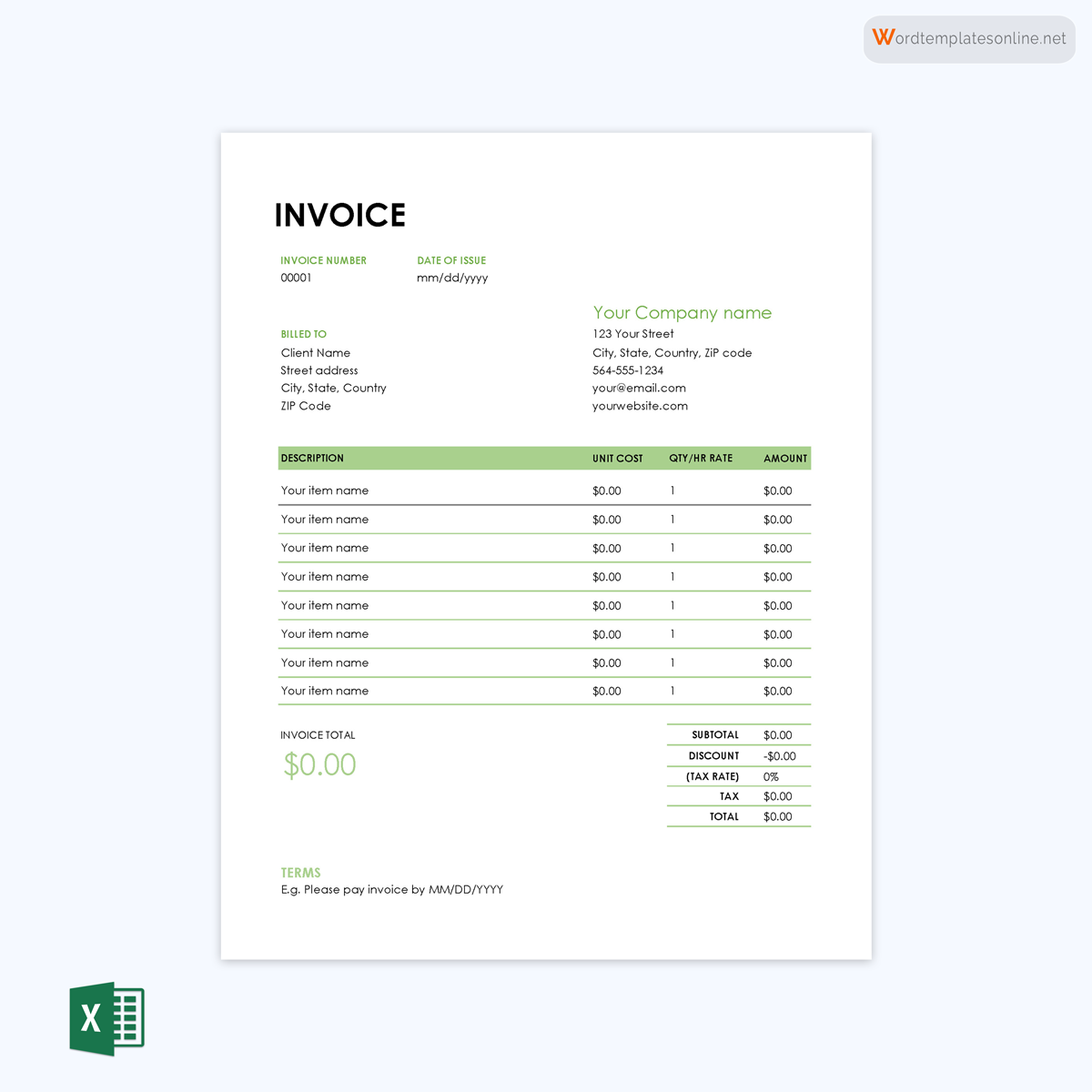

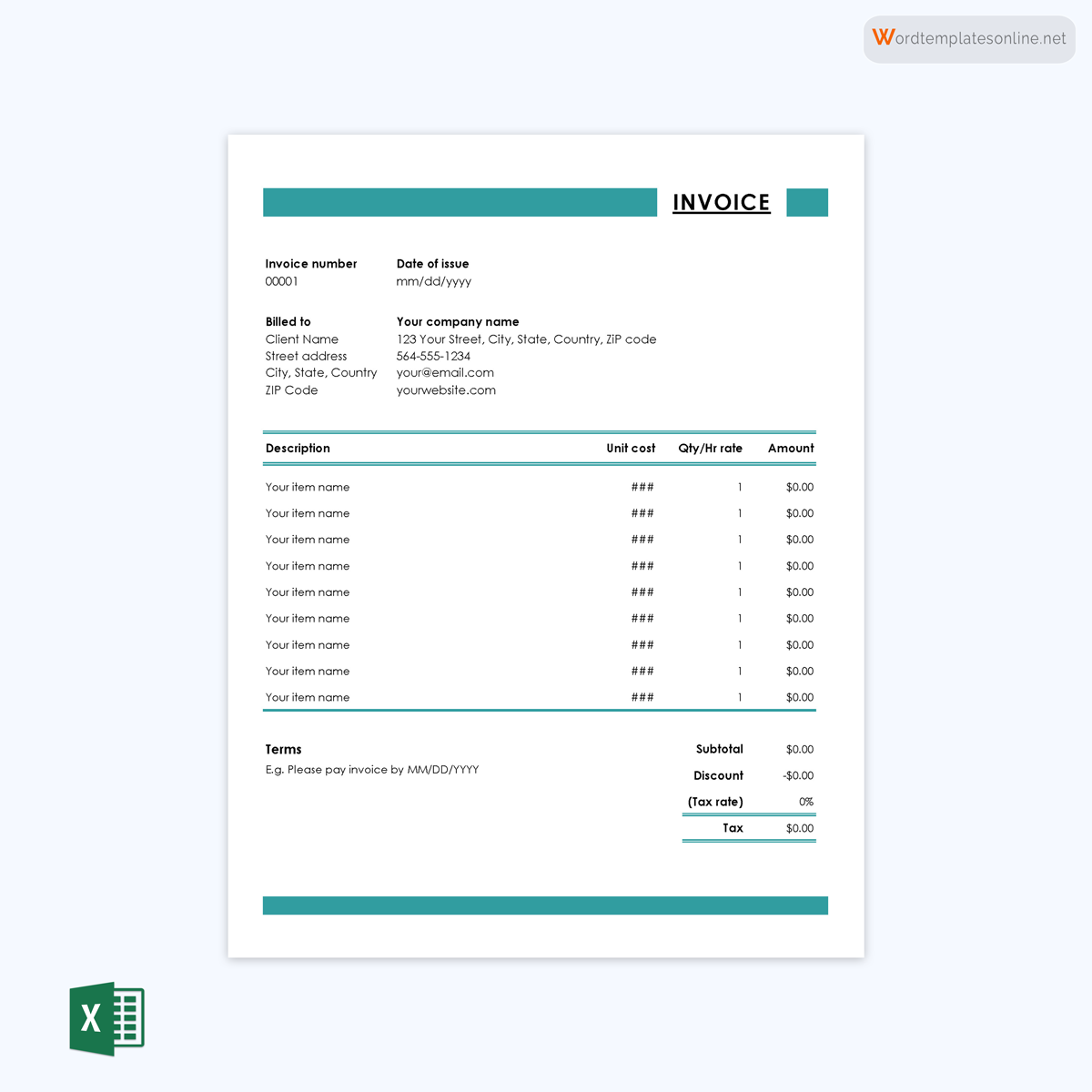

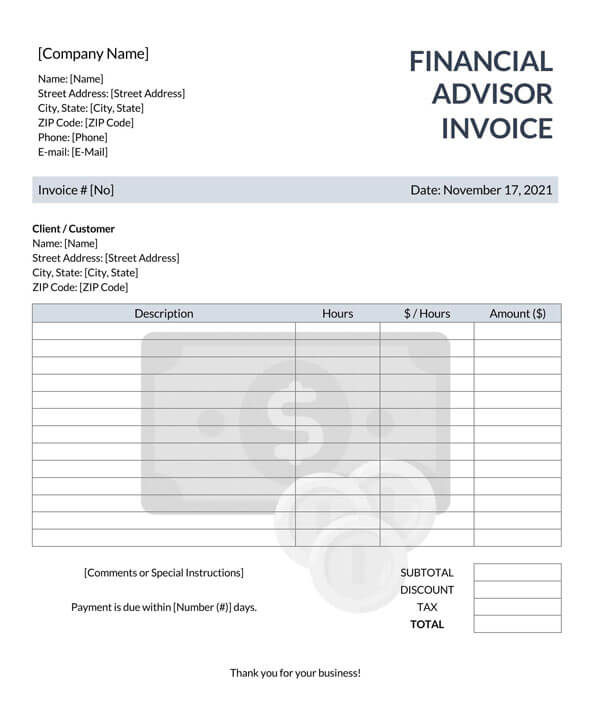

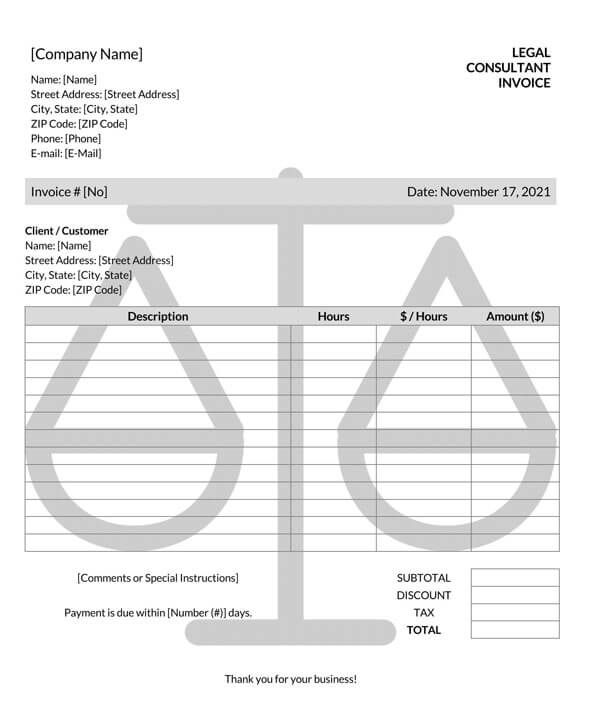

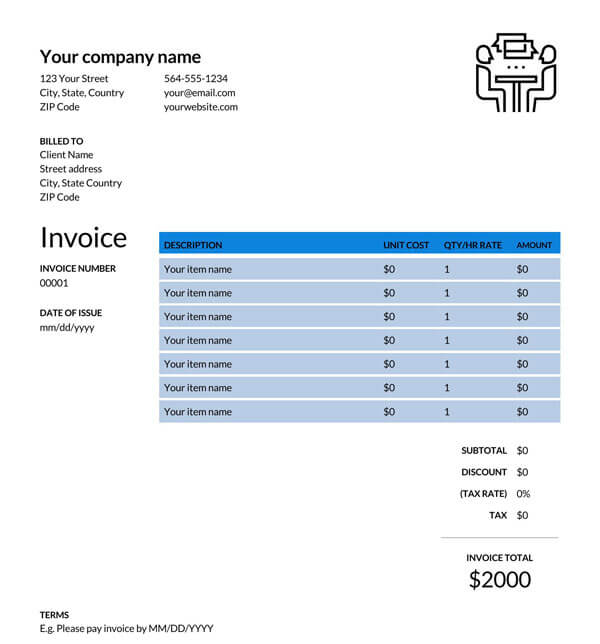

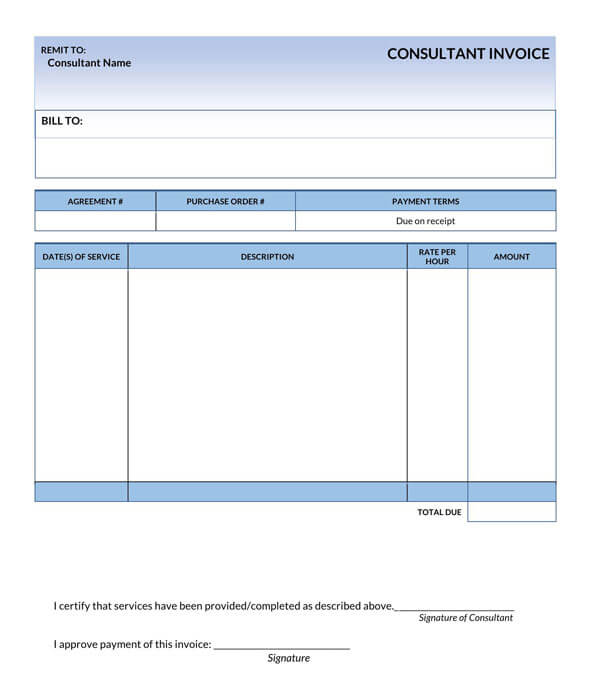

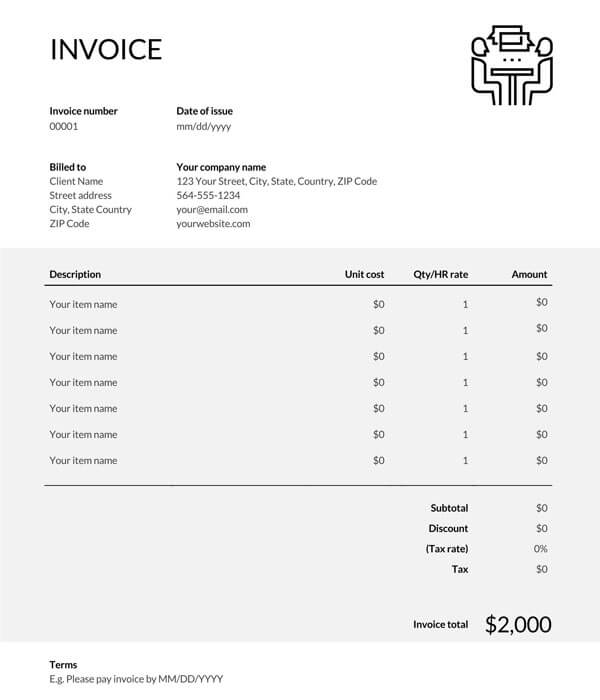

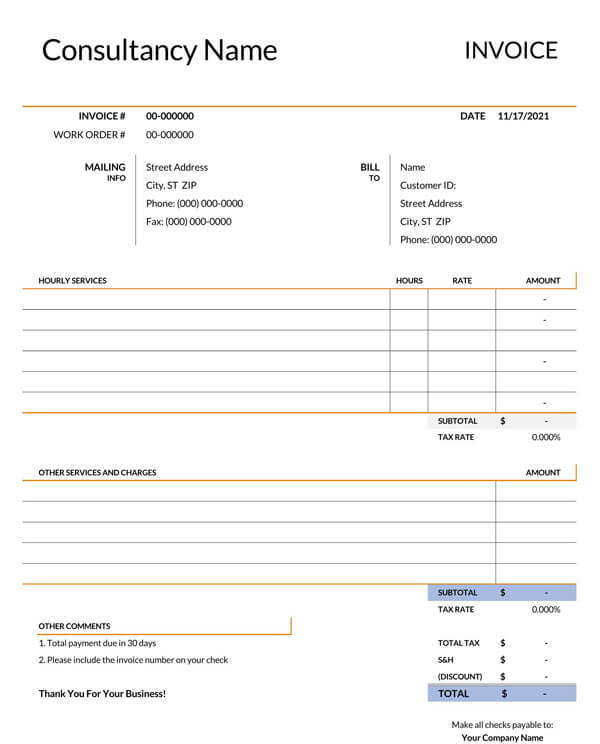

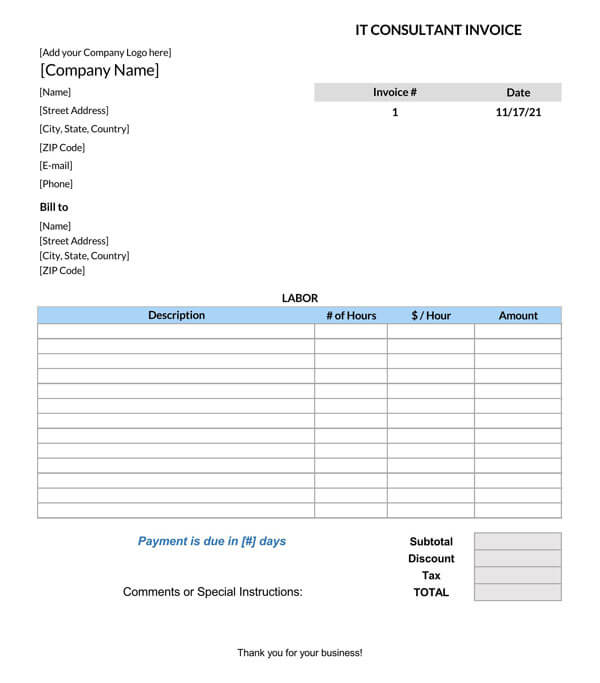

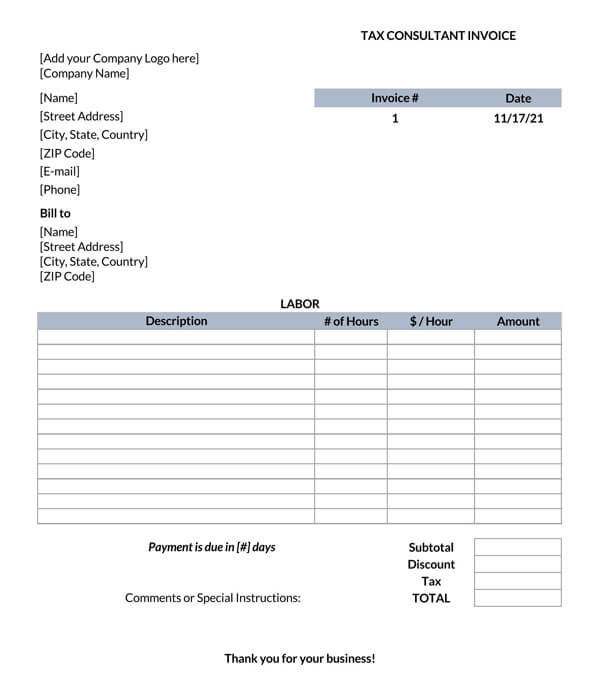

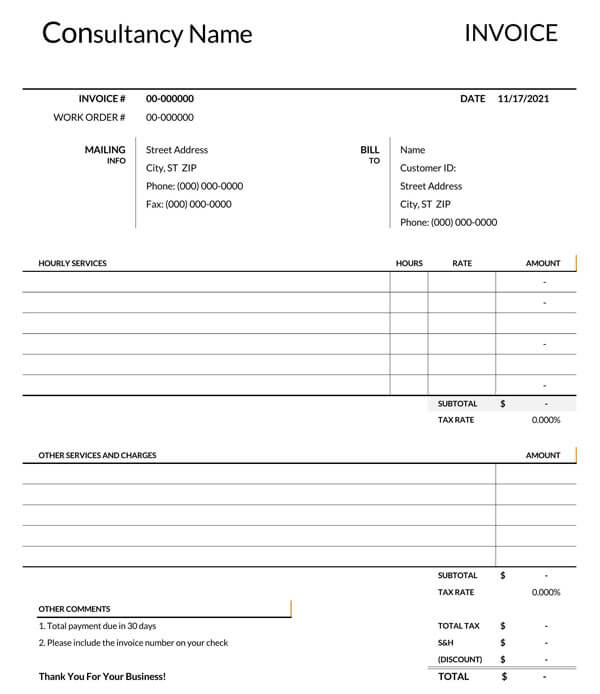

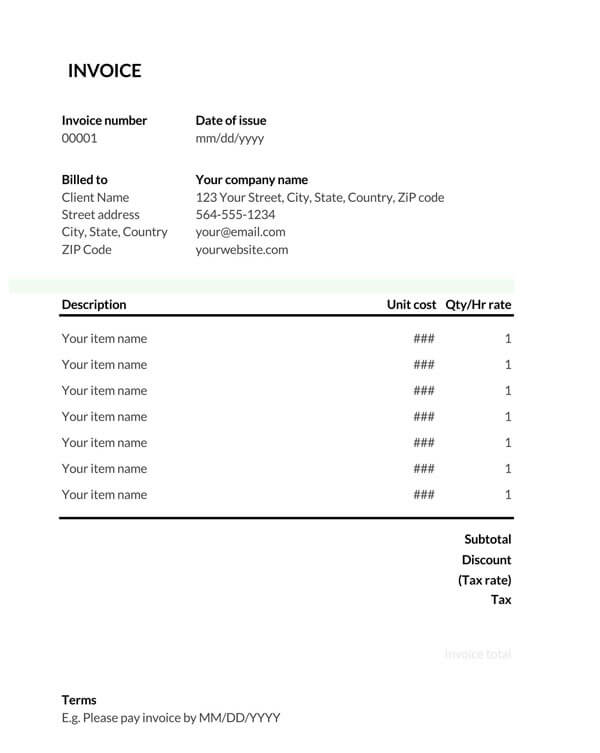

Basic Consultant Invoice Template

A basic type of invoice template allows consultants to bill all types of clients regardless of the type of consultancy at hand. It is generic and will often require the addition or subtraction of items in order to meet the job’s particulars.

Download: Microsoft Word (.docx)

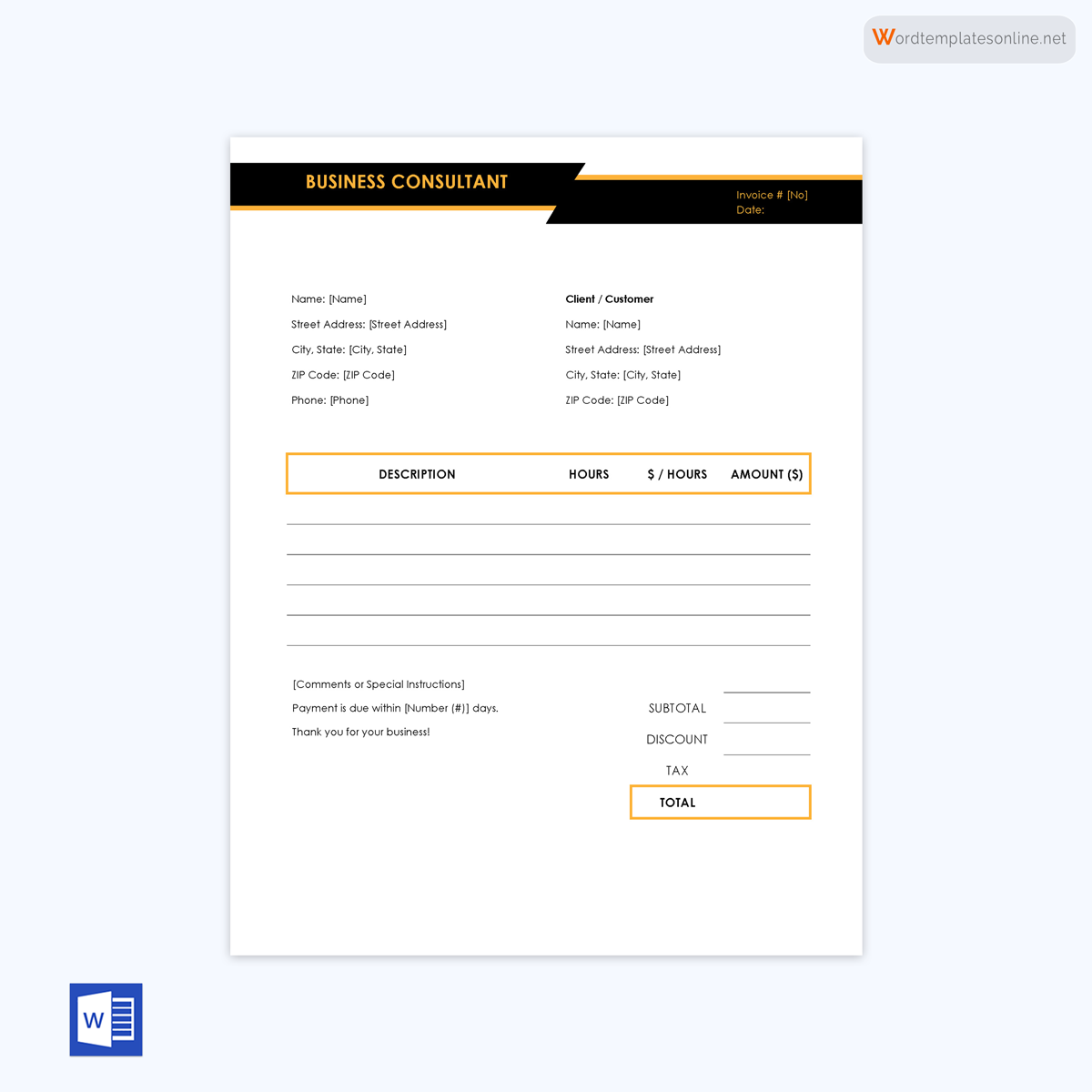

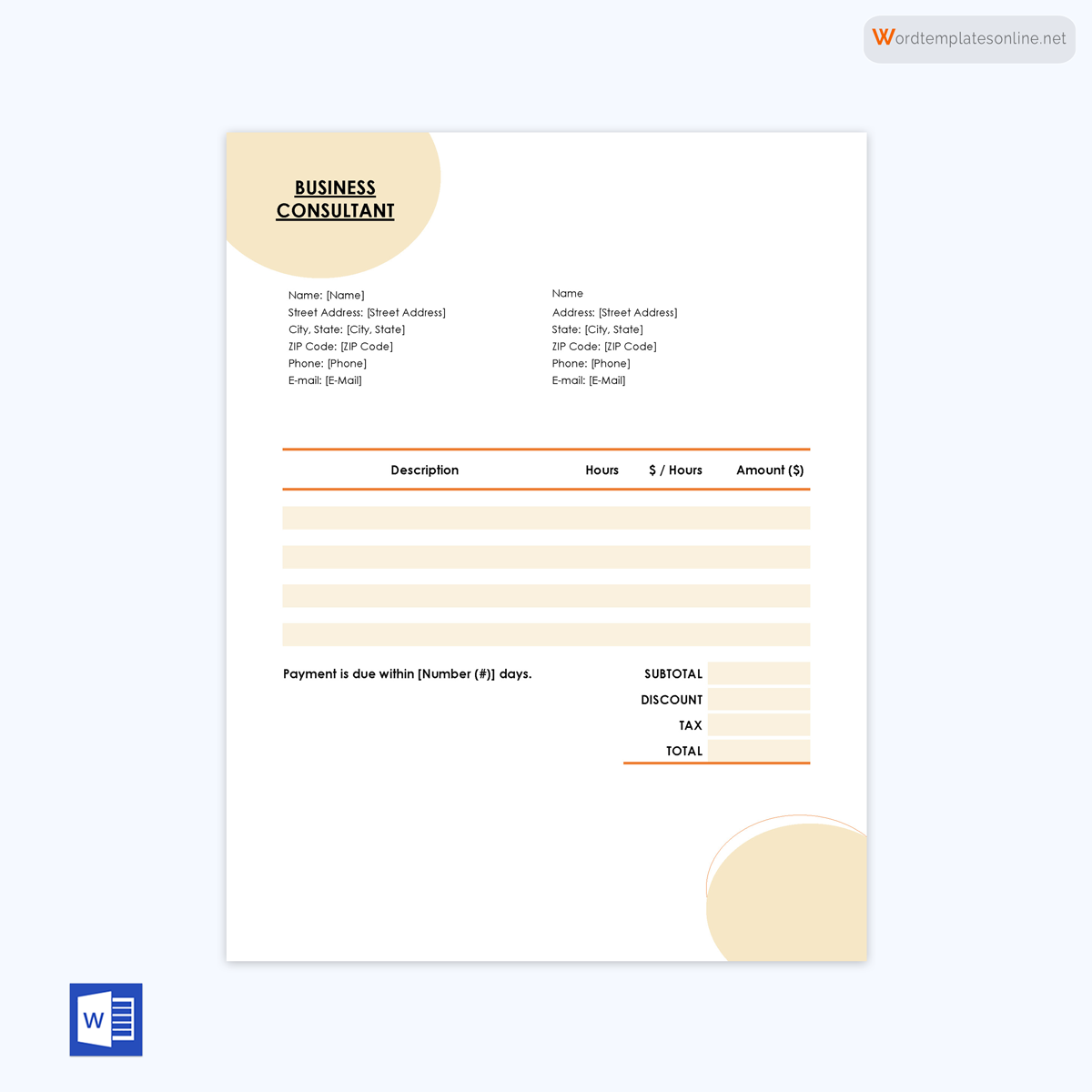

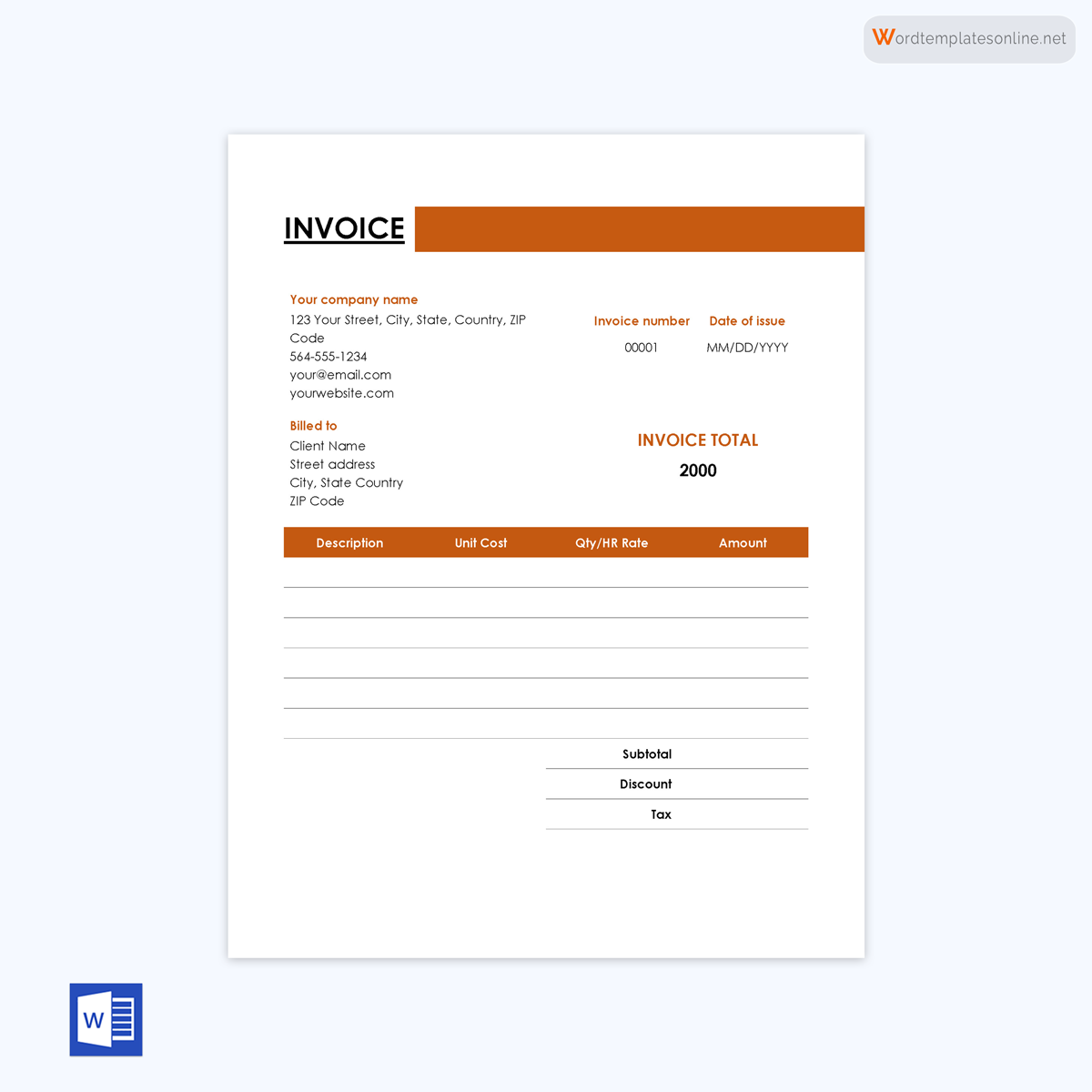

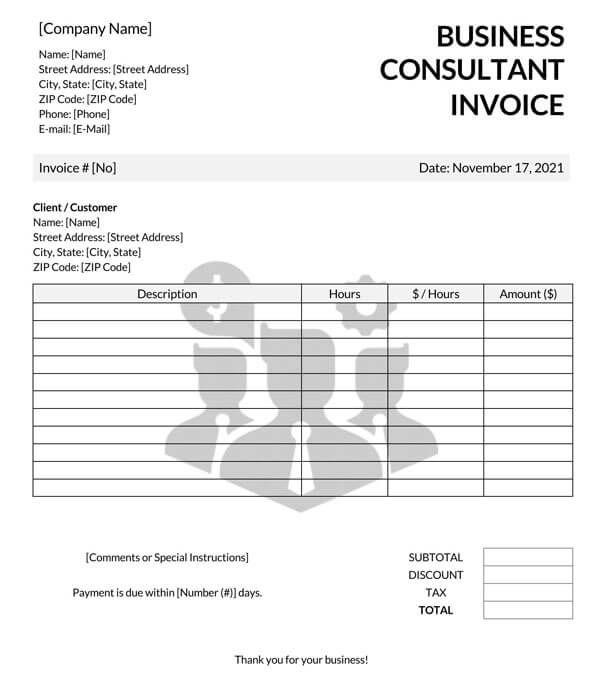

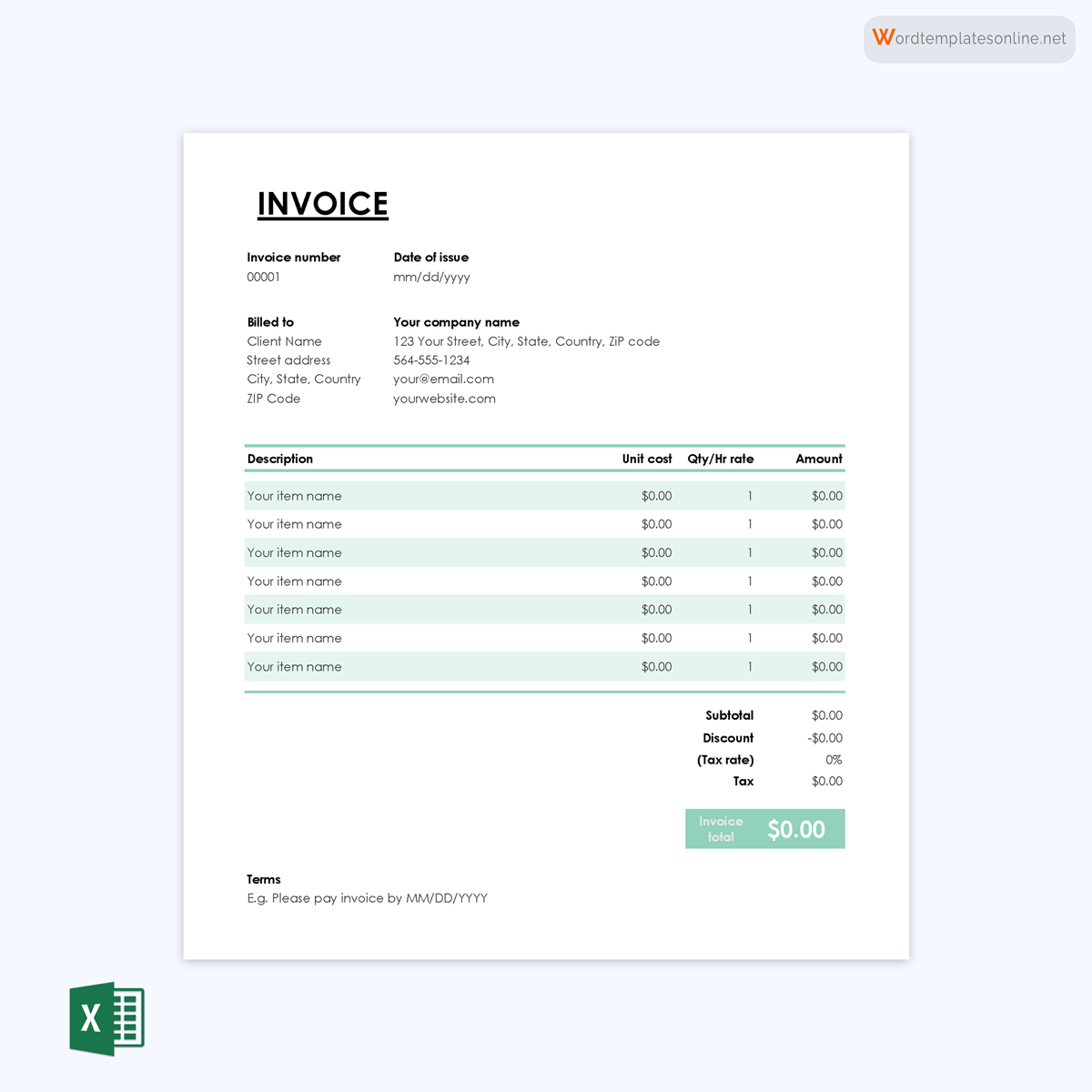

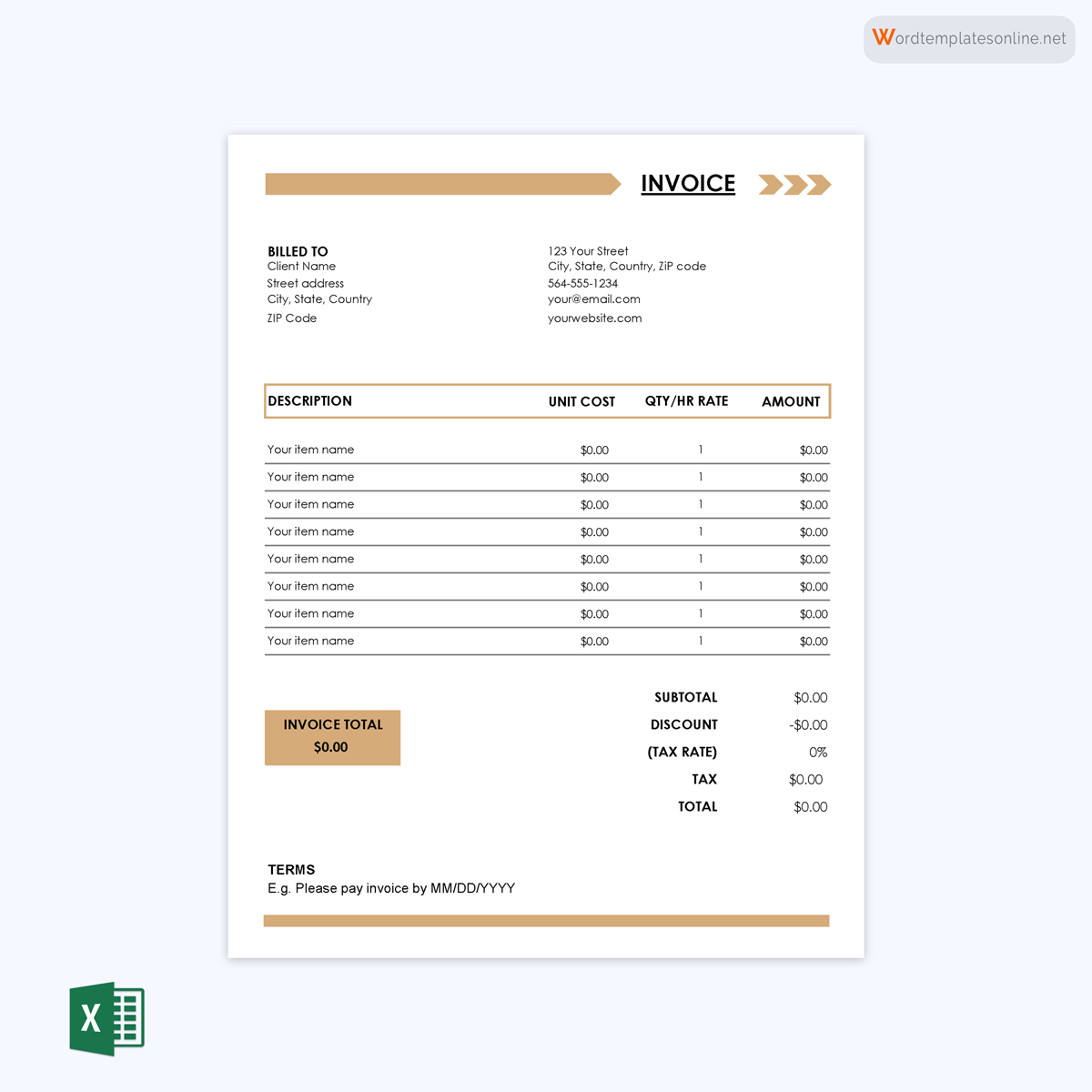

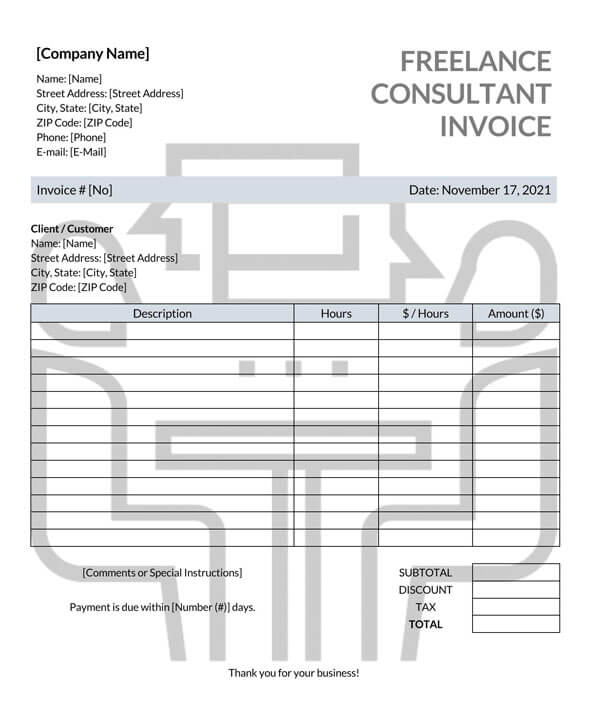

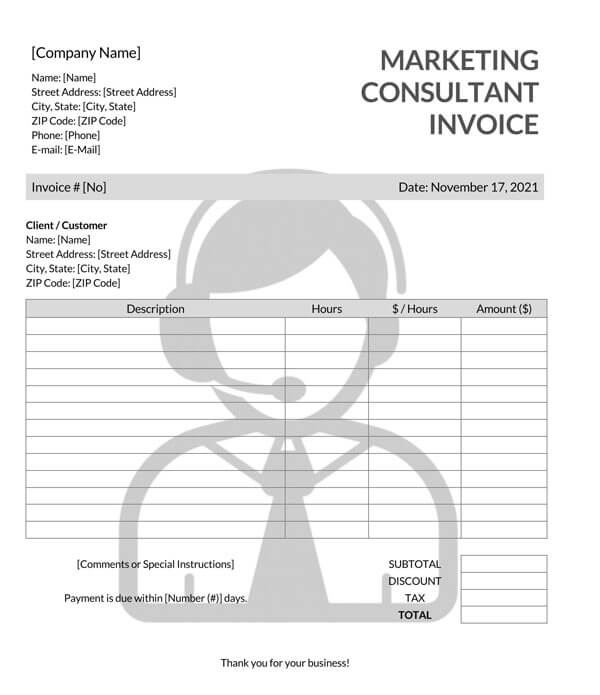

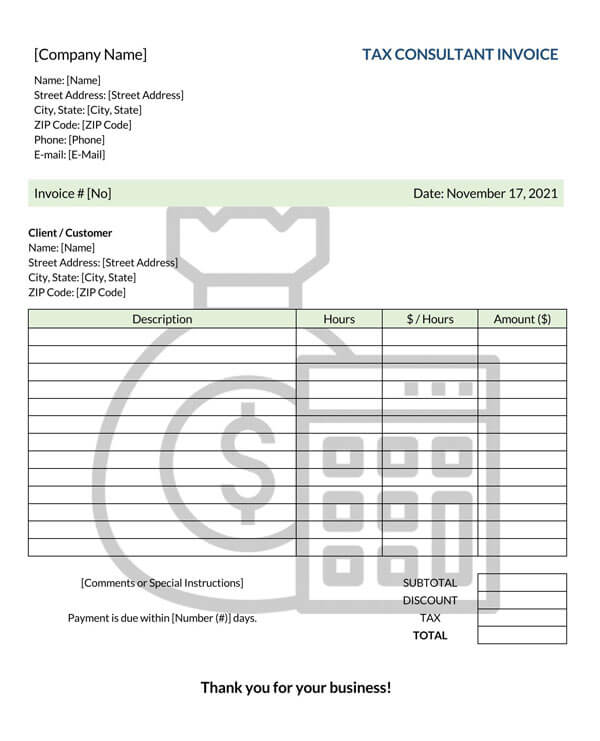

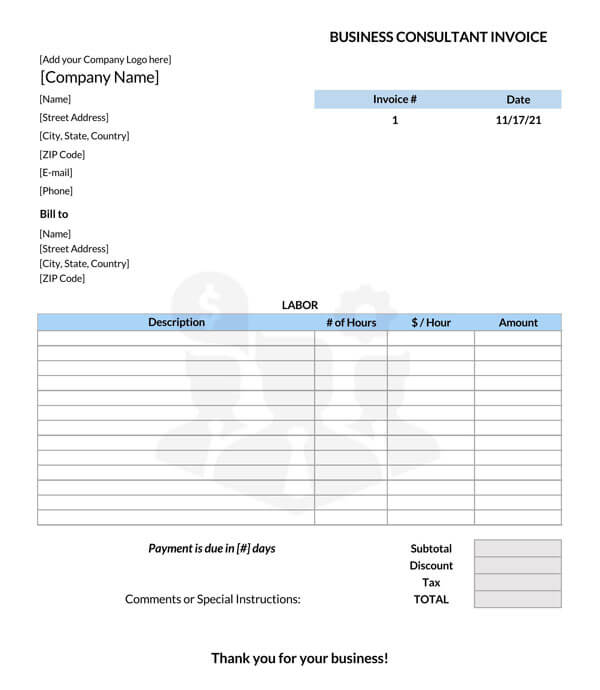

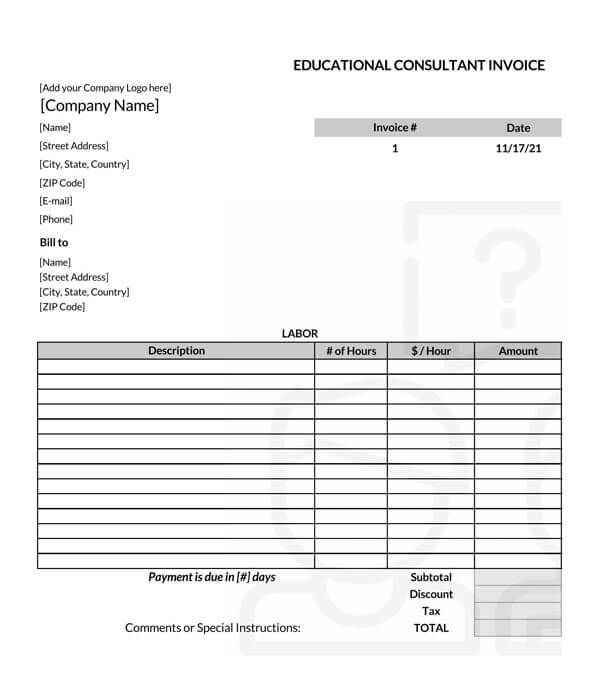

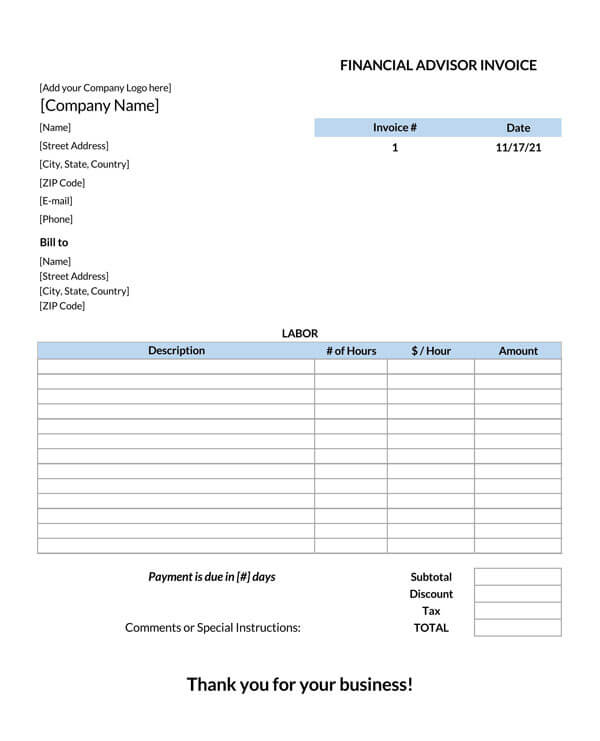

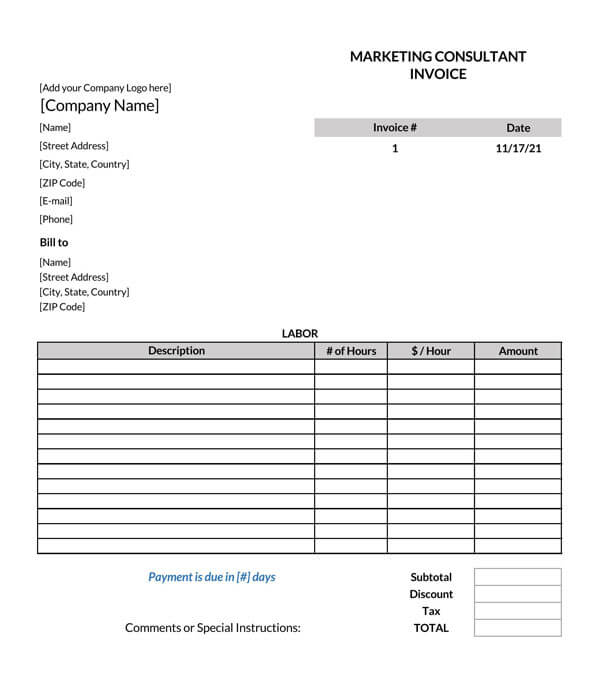

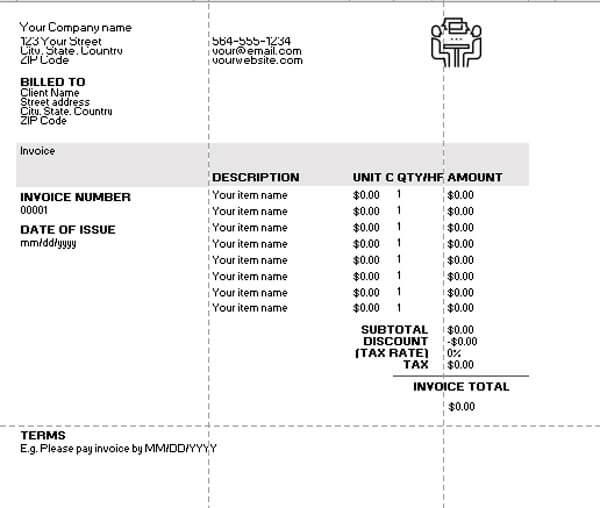

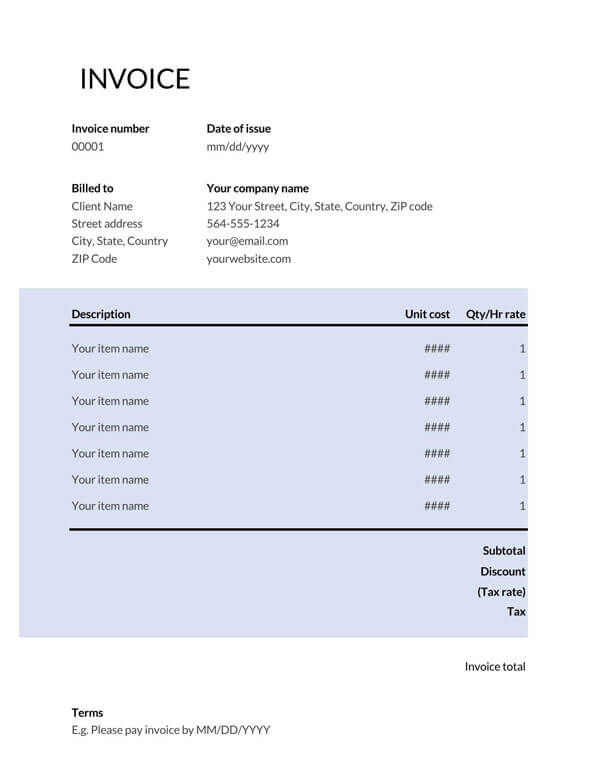

Business Consultant Invoice Template

Businesses use a business invoice template to bill clients for services or products delivered. It is suitable for consultancy firms as it allows customization to align with the business’s or company’s brand.

Download: Microsoft Word (.docx)

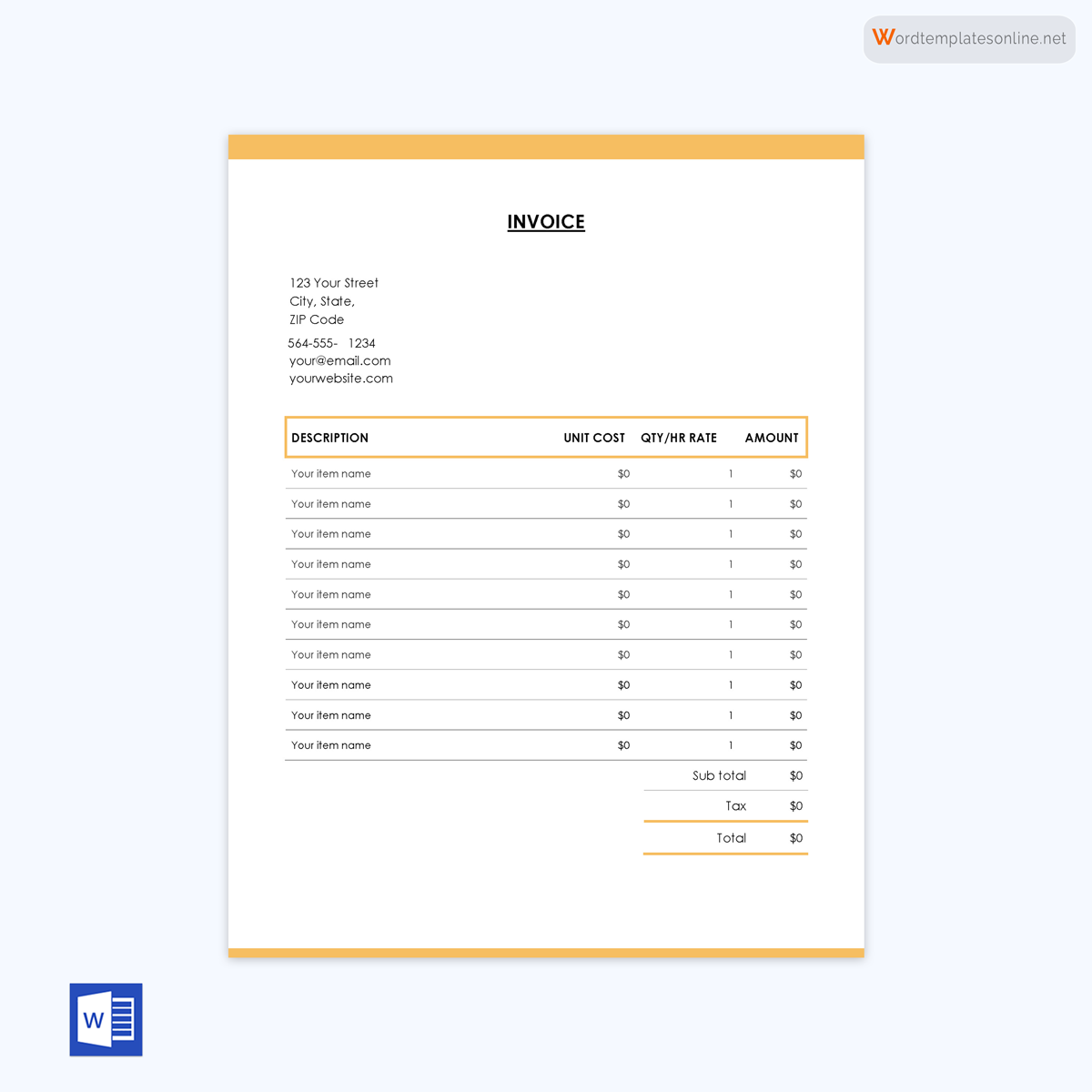

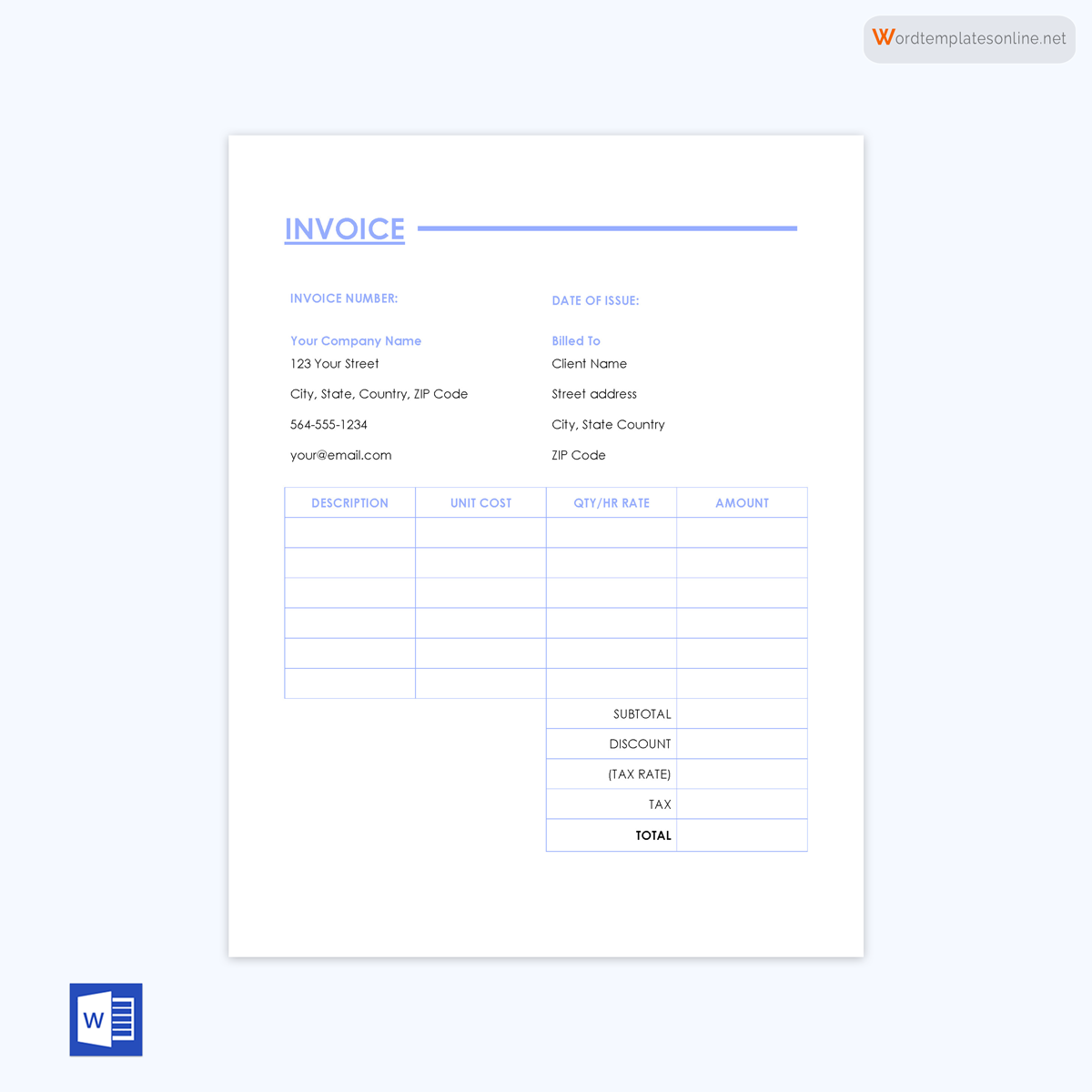

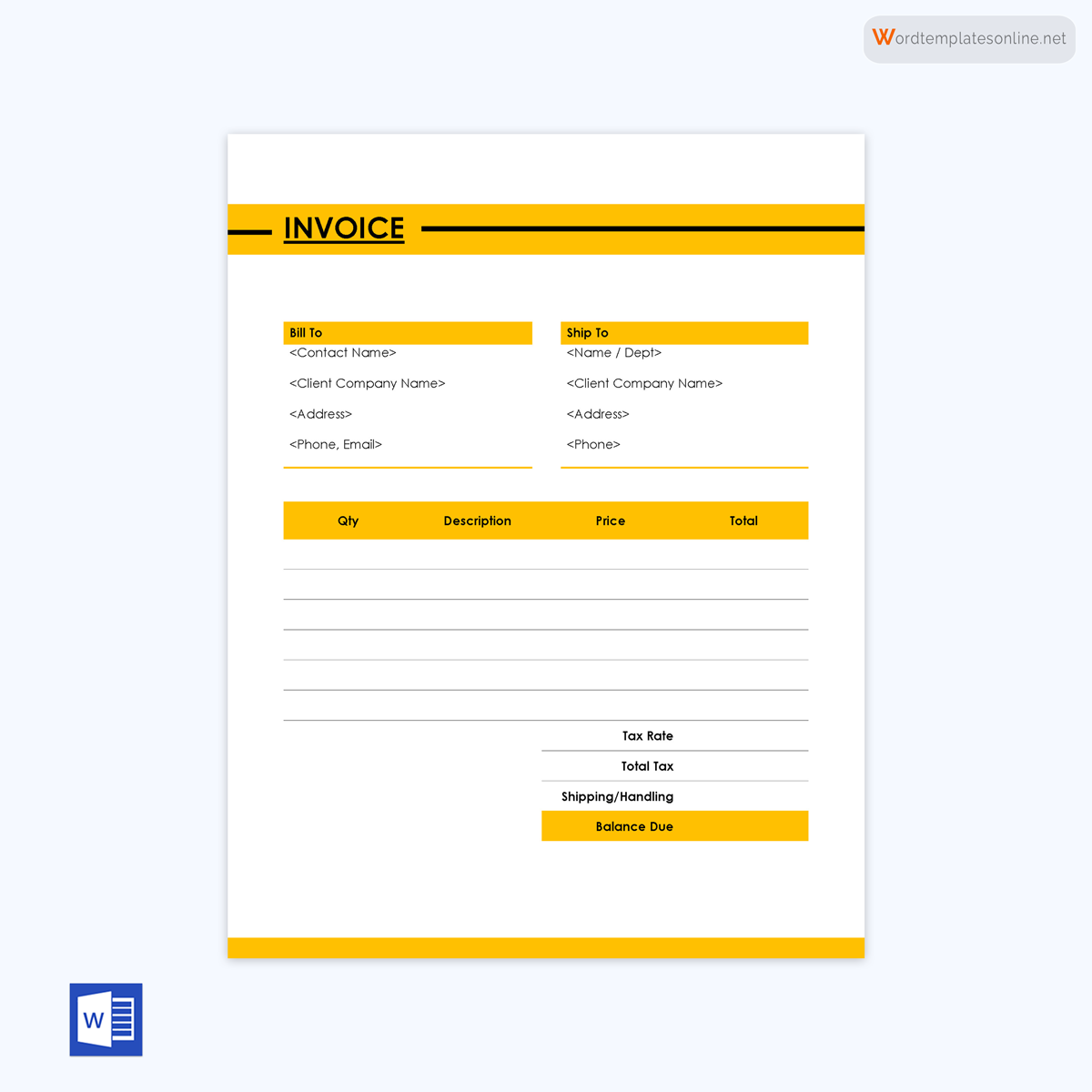

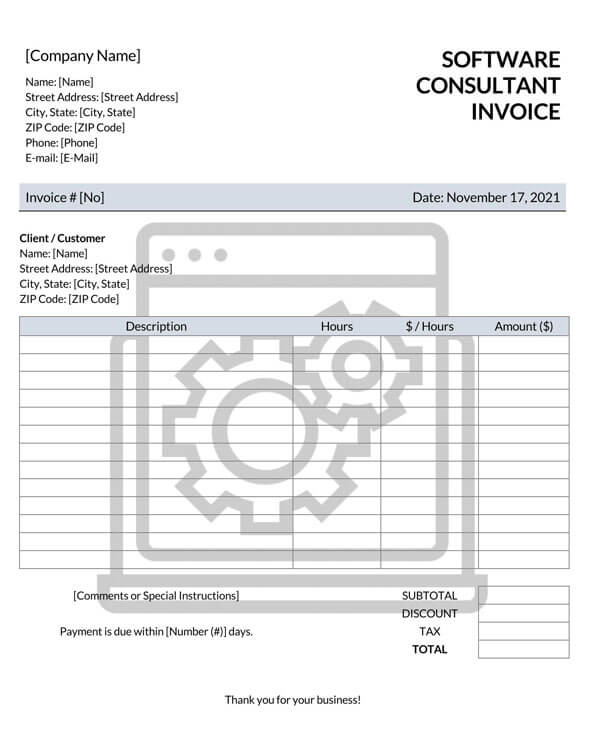

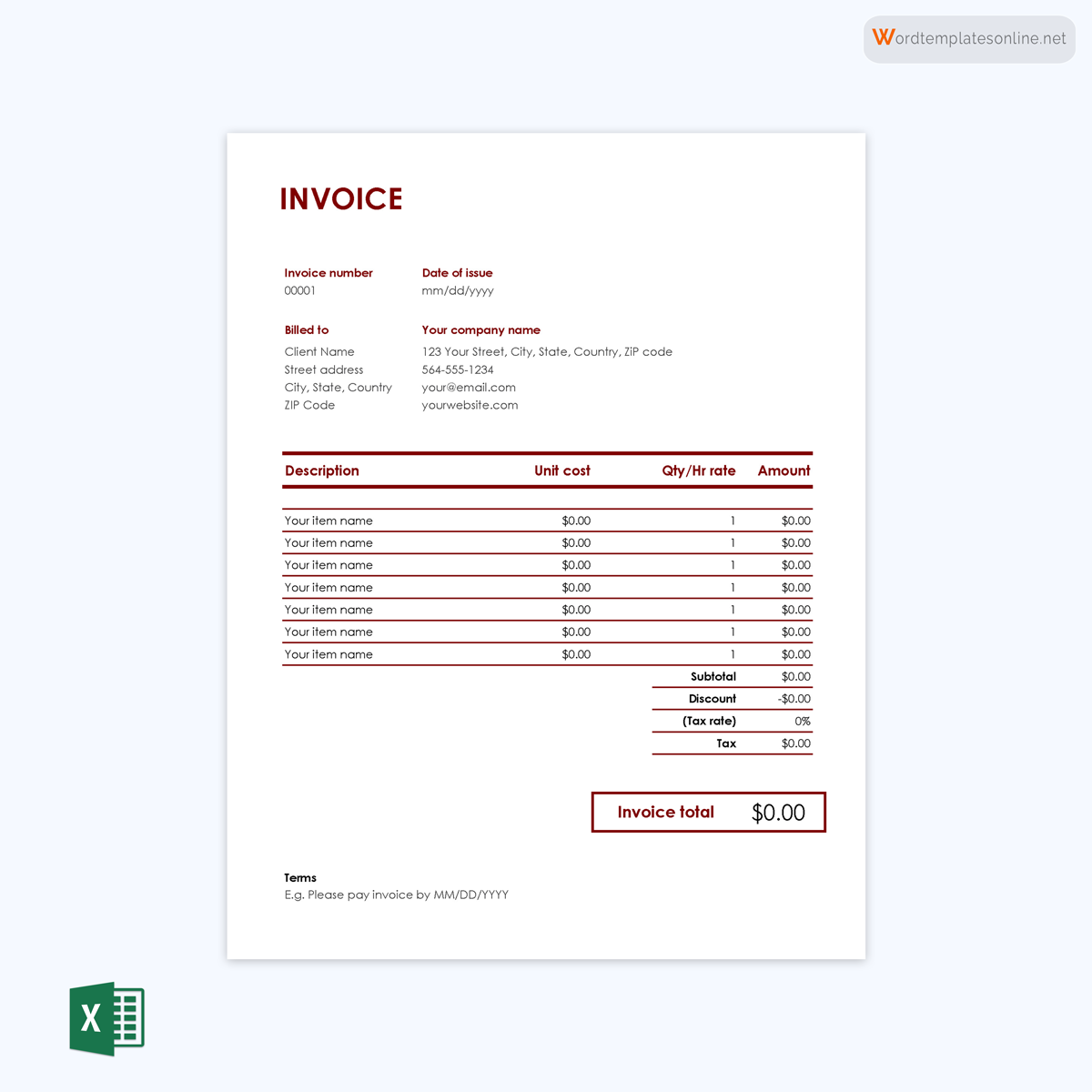

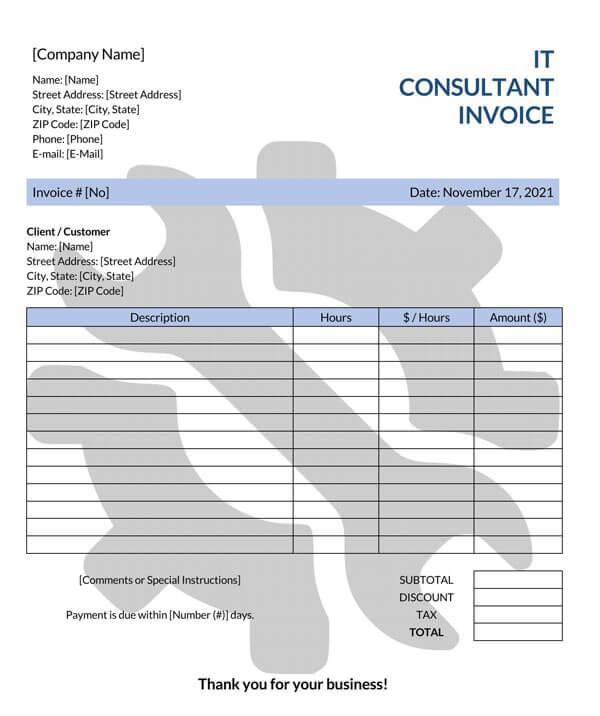

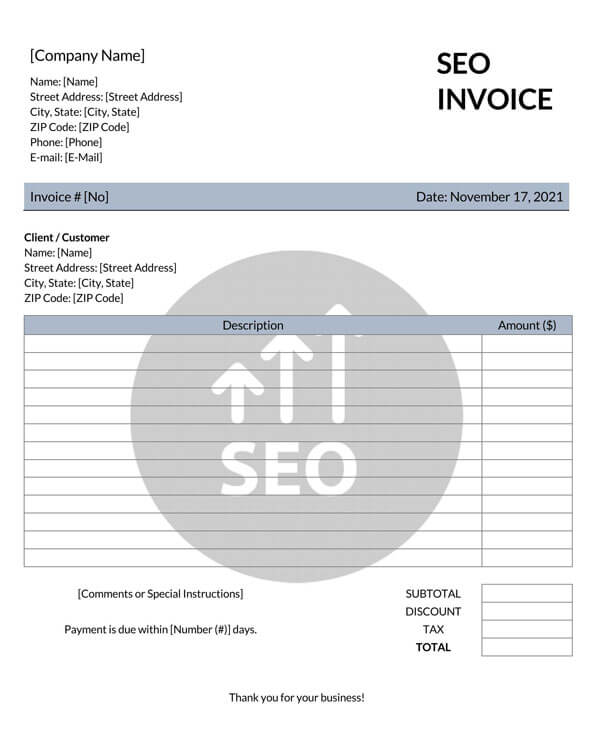

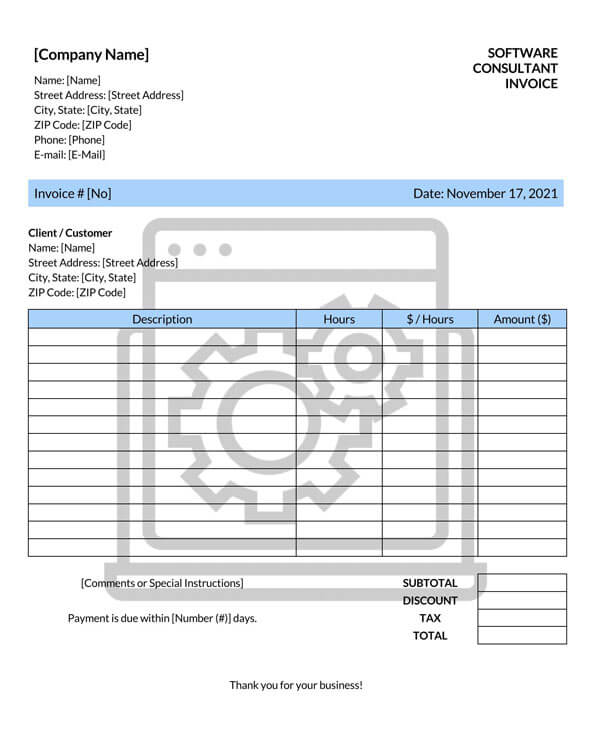

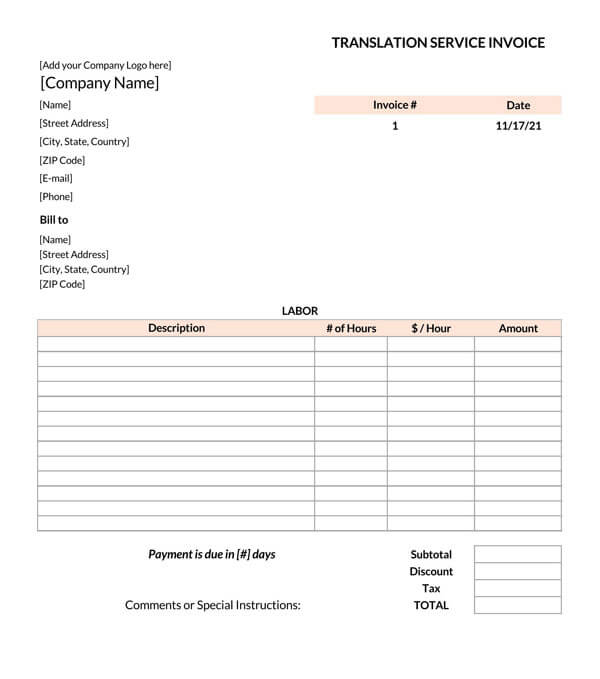

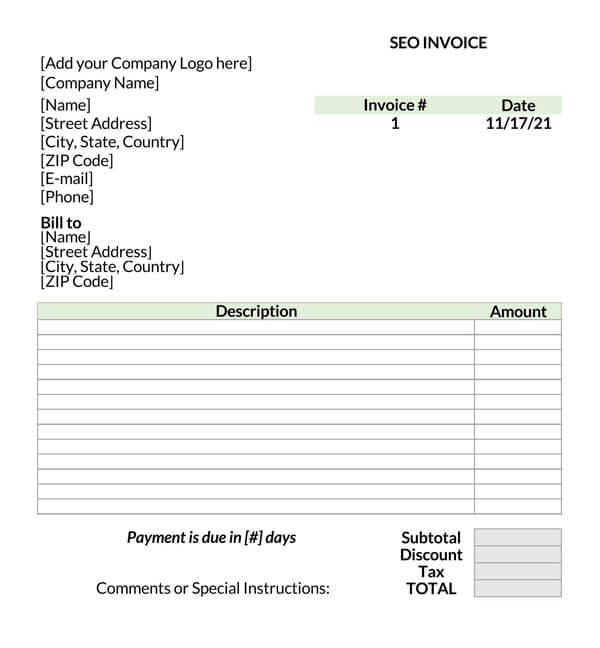

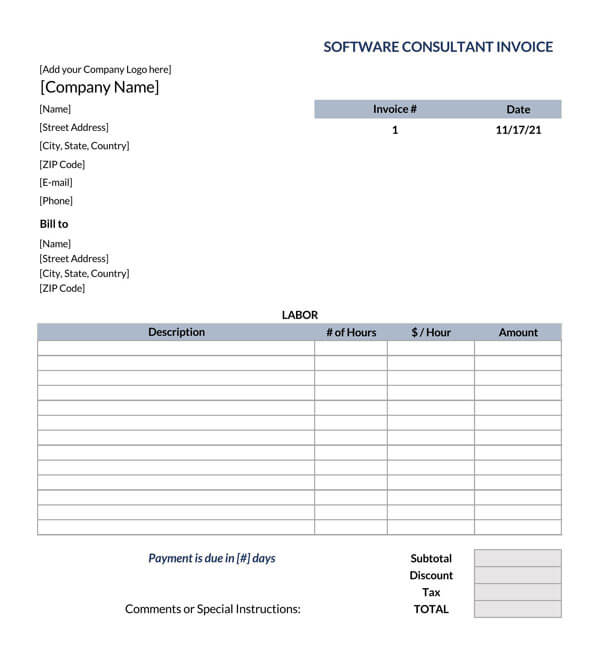

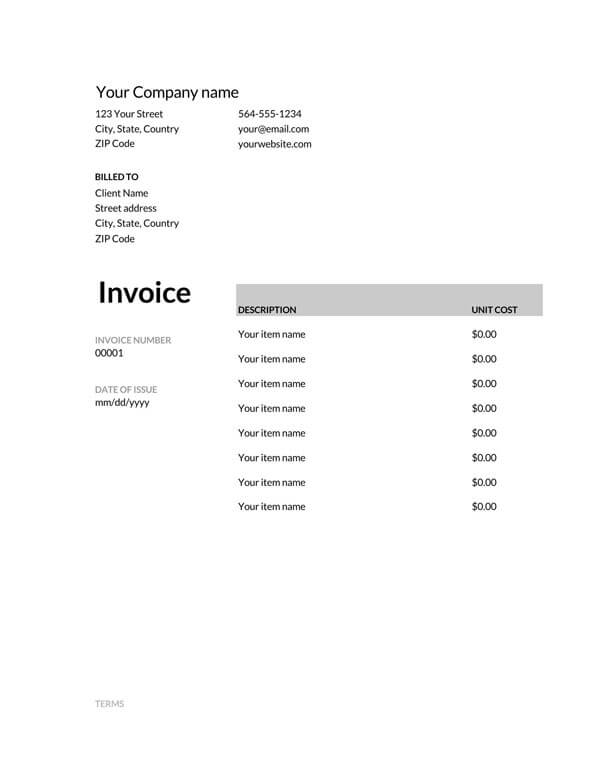

Software Consultant Invoice Template

A software type of invoice template is meant for consultants in the technology field such as software engineers, application developers, software analysts, etc. It covers details specific to this field and is therefore easy to fill out the costs and materials used in the project.

Download: Microsoft Word (.docx)

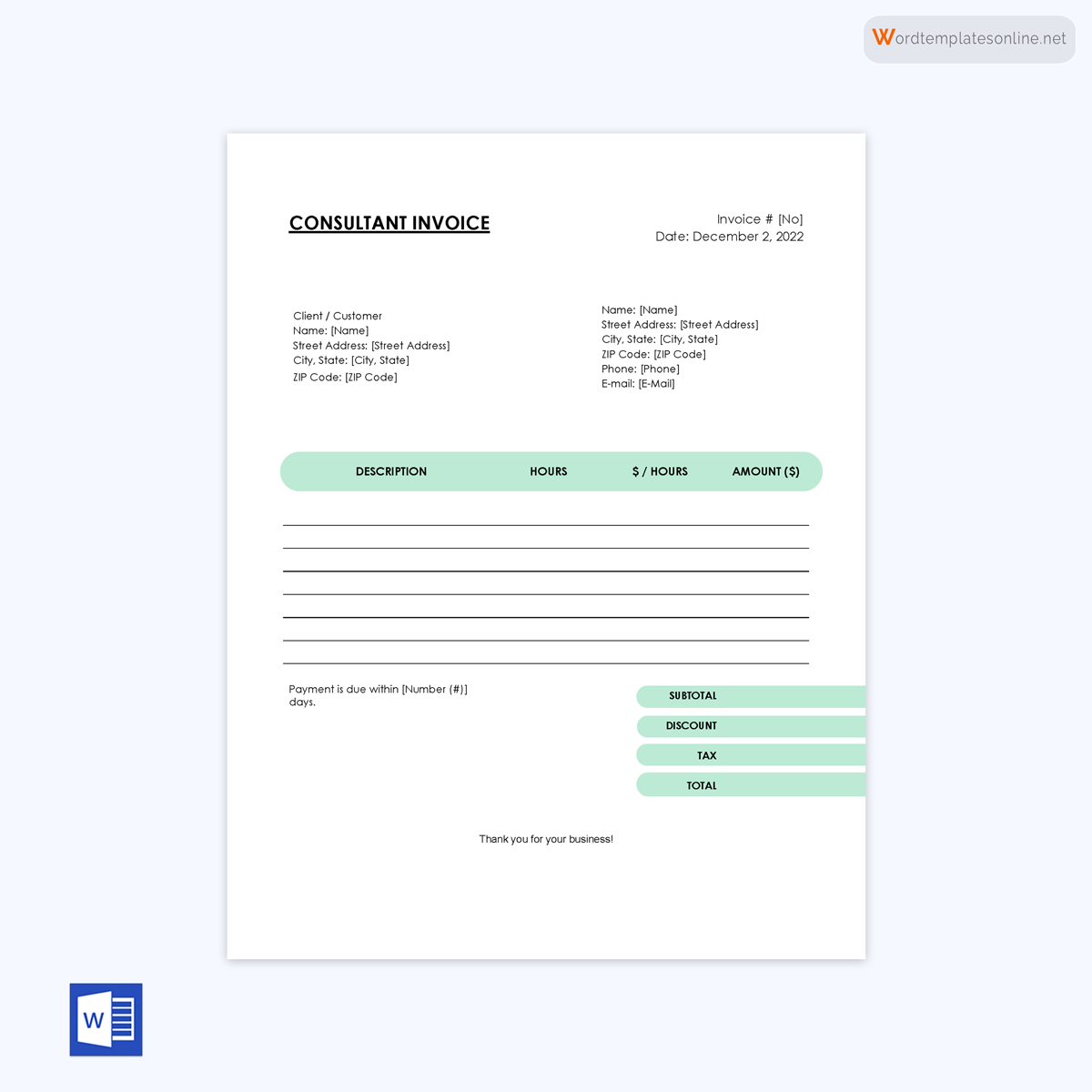

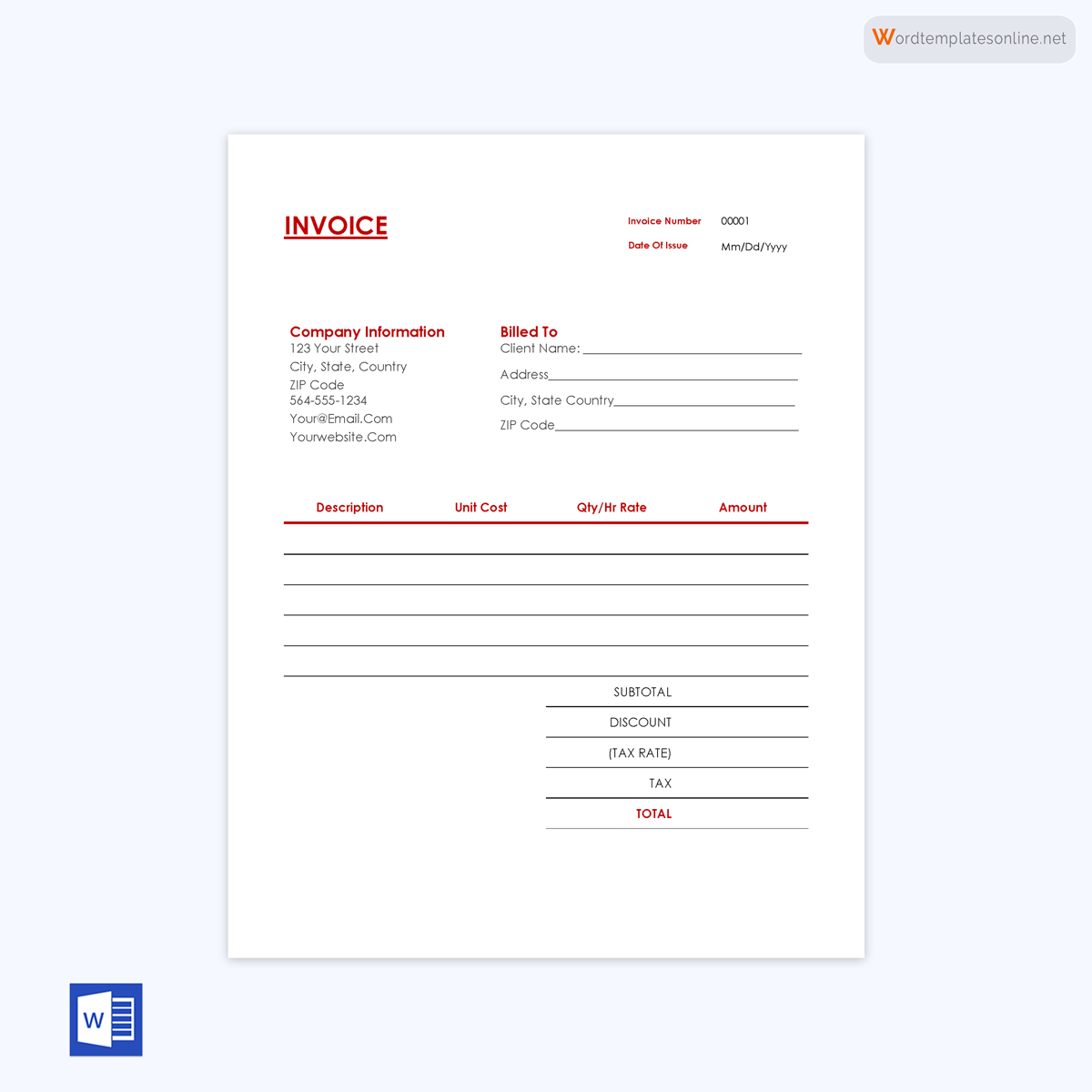

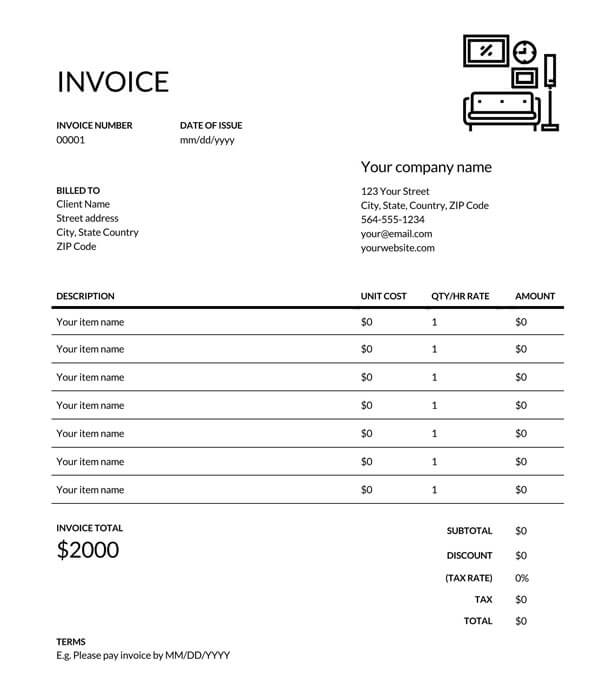

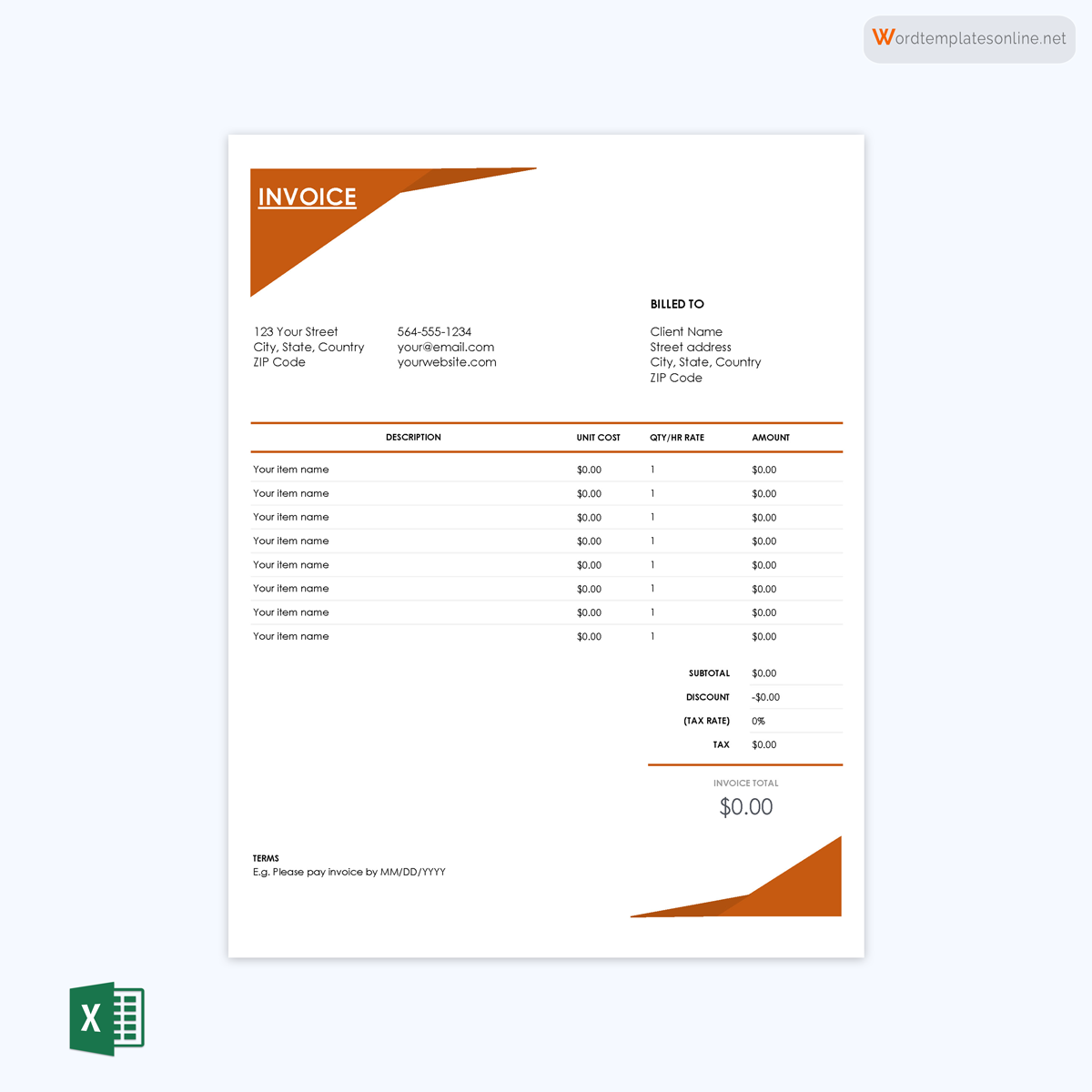

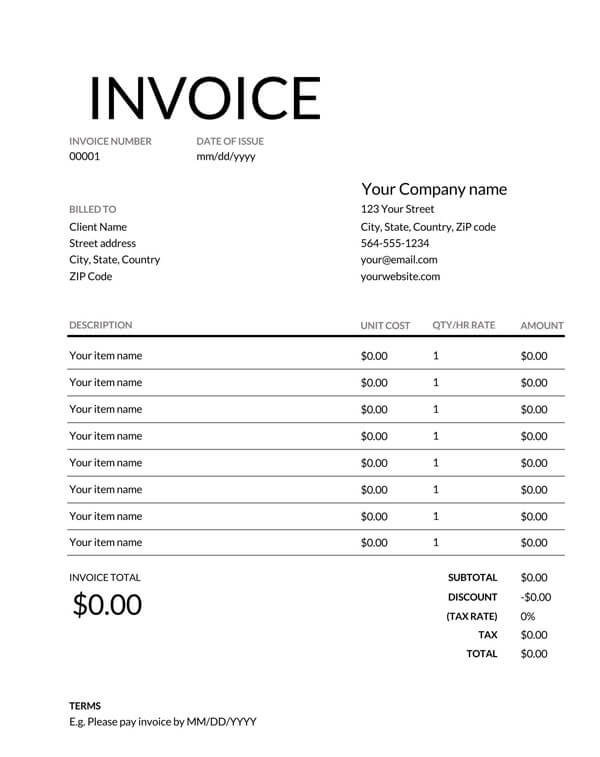

Interior Design Consultant Invoice Template

An interior design invoice template is used by interior designers to bill clients for decorated spaces. It outlines the different categories of interior decorating materials to make it easier for interior decorates to have an easy time completing them.

Download: Microsoft Word (.docx)

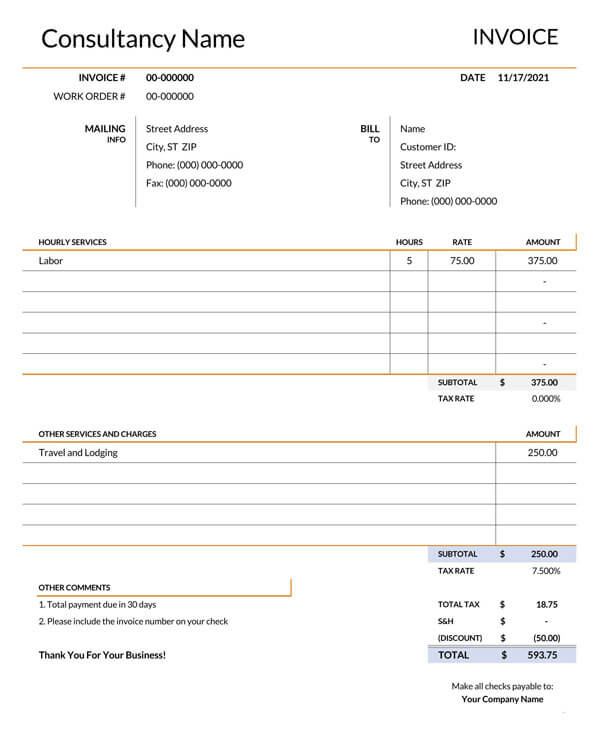

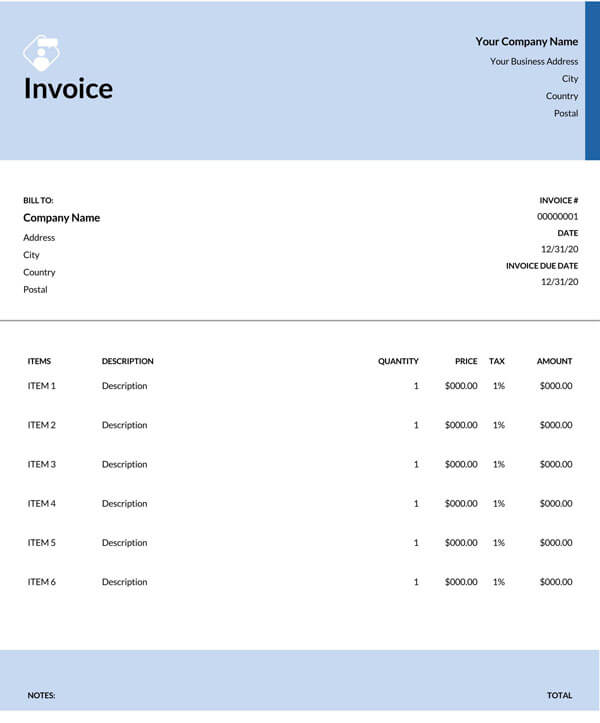

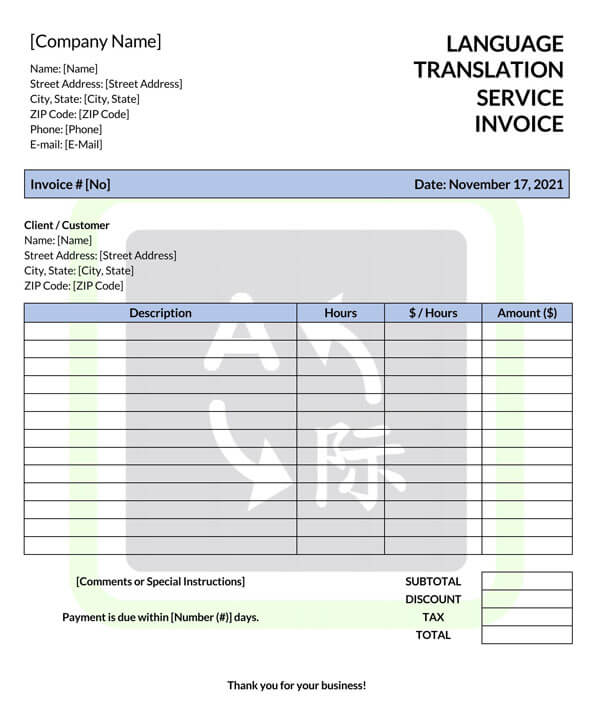

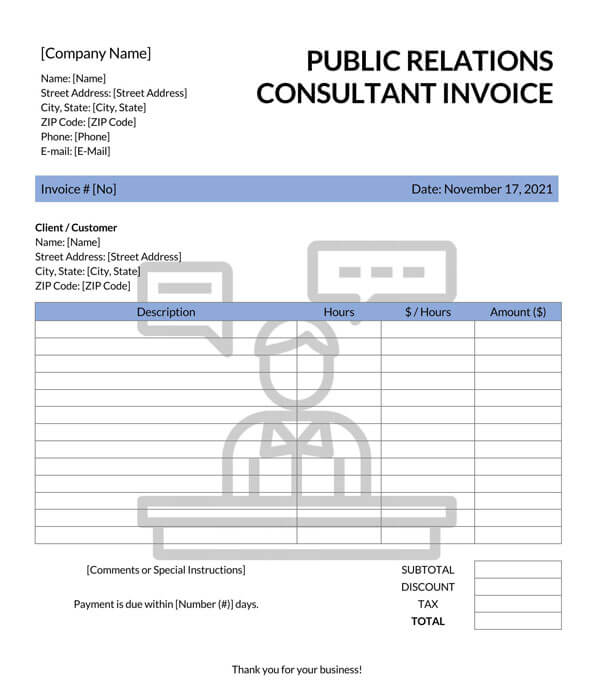

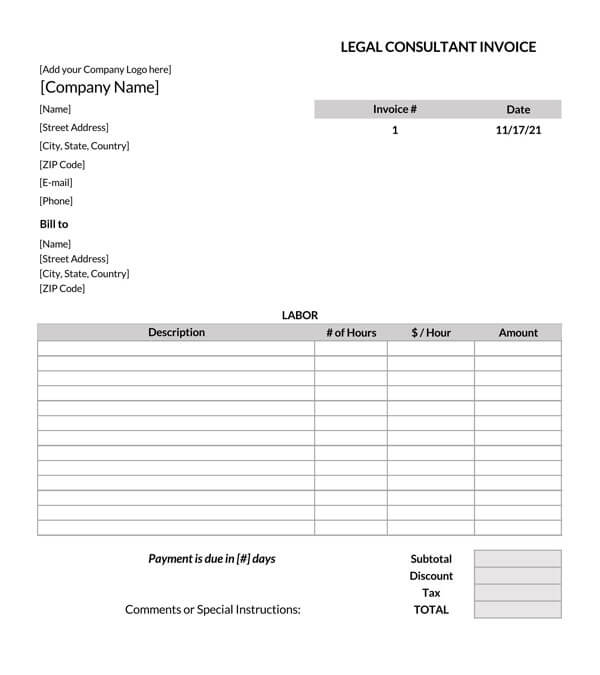

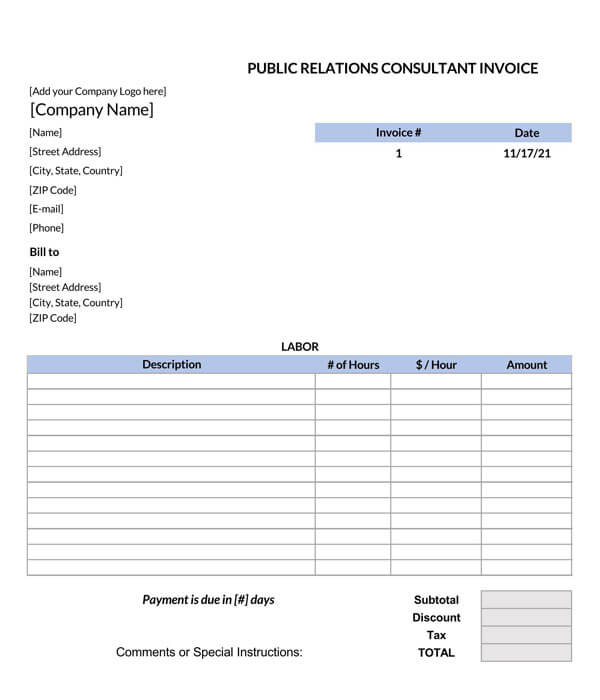

Communications Consultant invoice template

A communications type of invoice template is used by communications consultants. This type of template outlines the different billing items that are applicable when offering services to clients as a communications expert.

Download: Microsoft Word (.docx)

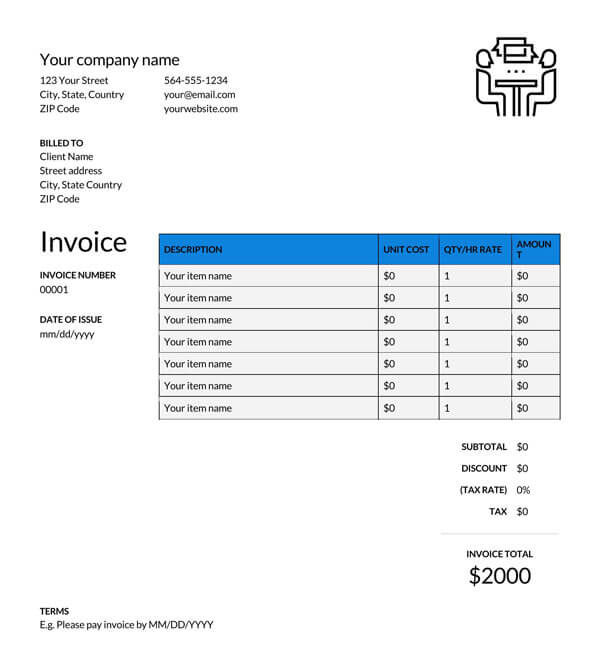

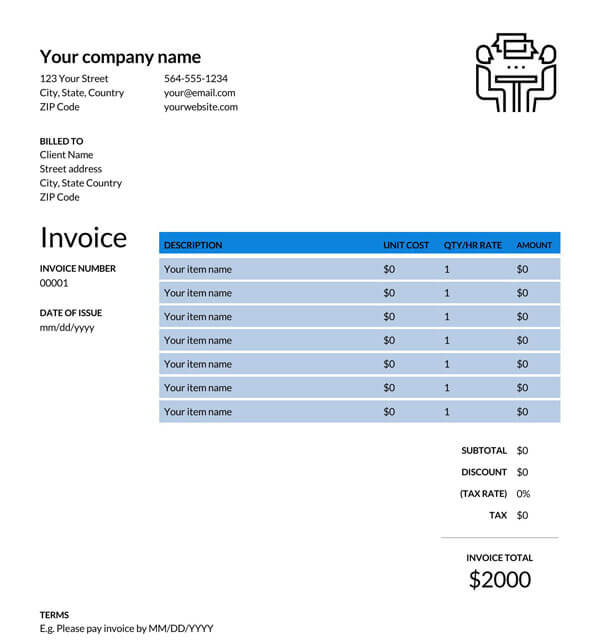

What to Include in a Consultant Invoice Template

An invoice should give enough details to the client such that they do not question the quoted amount being requested. To ensure your template effectively serves as a financial and documentation tool, there are some essential items you should look out for in the template.

These essential items include:

Add business details

The consultant details such as business name, telephone number, logo, website URL, and other branding details should be supplied to identify the consultant issuing the invoice. Use of a standard header is recommended so that it can be reused with future invoices.

note

Indicate who it should be directed to by inserting “Attention to:” if your client is a large company to avoid being dismissed or lost within the business. This consequently prevents payment delays.

Add client’s contact details

The client’s identification information must appear on the invoice. Indicate their name and contact details.

Include invoice date and the due date

An invoice must be dated. The date of issuing and the due date of payments should be clearly supplied in the template. Dates are essential for keeping track of paid and unpaid payments.

Number your invoices

The invoice number should also be indicated for reference and record-keeping purposes. The invoice must be unique for every invoice you send. This is important for distinguishing invoices for different jobs.

Add descriptions of line item/product/service

A list of all the consultancy services you offered to the client should be given. A comprehensive description should accompany each service. Mention the type of service or product, amount, and other descriptive details in the template.

Mention the number of hours worked

The billable hours associated with the job must also be stated. Most consultancy services are billed based on hourly rates hence the need to communicate how long it took to complete the project. Specify how the hours were utilized by breaking down the timeframe into different activities or milestones and then give the total billable hours.

State current price/resale rates

Indicate the current prices or hourly rates applicable to the job at hand. Multiply this pay rate with the number of billable hours or products to determine the total amount receivable. Indicate the total amount the client is expected to pay.

Include discount details, if any

Discounts are common in consultancy, especially for large projects, first-time clients, or recurrent clients. Indicate the applicable discount and clarify why you are awarding the specific client the discount.

Free Downloads

Applicable VAT/GST or Sales Tax rates

Applicable tax charges should be declared before the total amount due is indicated. Since there could be more than one tax charge, list them in one section and then provide the discounted amount payable by the client.

State your payment terms and conditions

It is best to indicate your payment terms and conditions in an invoice so as to avoid misunderstandings. It should be clear if payments are to be made in a lump sum or a payment plan can be adopted. The due date of payments should be specified, and a list of the consultant’s preferred payment methods should be stated.

EXAMPLE

Checks, credit cards, bank transfers, cash, online payments, mobile payments, or any other.

Include details of privacy policy and rights reserved

Any applicable privacy policies and rights reserved in regards to the transaction must be declared in the invoice. An invoice may contain sensitive information that needs protection, and if this is the case, it is important to state the guidelines surrounding the issuance and utilization of the invoice.

State the total amount due

The subtotal amount due must be indicated at the bottom of the invoice in the appropriate monetary units. Ensure the figure is accurate to the one calculated after taxes. It should be written in bold and with a large and conspicuous font.

Include a thank-you note

A thank you note can be added to the invoice to show gratitude for being given a chance to work for the client as a polite gesture. Politeness goes a long way in any professional field.

Invoicing Tips for Consultants

There are different ways a consultant can make their invoice serve them better.

This article will look at these tips to improve the quality of any consultant invoice:

Add a timesheet

Attach a timesheet that shows how the billable hours were tracked throughout the project. A timesheet is an effective way of showing the amount of work input utilized towards completing the job.

Include an expense report

Add an expense report that details any miscellaneous expenses incurred during the job. Expenses of miscellaneous expenses are travel expenses, unprecedented expenses, etc. Ensure to attach receipts with the report.

Be clear

Be clear when stating how much is expected and when the payment is due. Definitive communication of information illustrates a high level of professionalism.

Accept a variety of payment methods

Offer the client options of payment methods. This flexibility allows them to use the most convenient method for their business. It also accommodates a wide variety of businesses.

Personalize your invoices

Always personalize the template to match your company, specific job, and client. Adding a thank you note at the end is a good way of making the invoice personal.

Track your hours automatically

When doing consultancy, track your working hours automatically to reduce the workload of manual tracking. Use the different software available to track the time. Alternatively, cloud-based accounting software can track billable hours and simplify the transfer of information onto the invoice.

Send invoice right after completion of the project

Send the invoice as soon as the job is completed. This ensures timely payments are made when the project details are still fresh in the consultant’s and client’s minds. Therefore, no crucial information is missed in the invoice.

Request deposits

Before starting the project, ask for an upfront deposit of about 25-50%, especially for long-term projects. A deposit provides cash flow for the project and guarantees partial payment is made before any time and resources are input into the project.

Be polite

Always remain polite and respectful when writing the invoice and requesting payment, even when the client delays payment.

Manage invoices with ease

Create an efficient invoicing system that allows you to manage consultancy invoices easily. Use invoice generators or accounting software to speed up the process. Use Google Sheets to manage recurring invoices. Also, opt for using a PC or desktop to manage the invoices instead of physical invoices.

Change the currency format

When using the templates, ensure to adjust the currency format to suit the particular job. This is vital for freelancers or online consultants who work for clients in different parts of the world. Then, in MS Excel, simply go to the currency and select the appropriate currency.

Free Templates

Invoice templates word

Invoice templates excel

Frequently Asked Questions

Ordinarily, consultant invoices are sent after completing the job. You must also make certain that you have all the details and documents required in the invoice. Invoices can be sent at the consultant’s convenience, but factors such as late payments and payment delays must be considered.

After sending an invoice, you should expect to receive payments from the clients. First, check all the payment methods listed on the invoice to see if the client has paid. If not, reach out to check if they received the invoice and discuss how to move forward.

Yes. Freelance consultants are recommended to issue invoices to the clients as it shows professionalism and can boost your chances of getting recurrent jobs from the client. Also, invoices are good for creating your brand image.

Consider all the relevant details pertaining to the consultancy project in question. Fundamental details that ought to appear in a standard invoice are consultant and client details, invoice number, services or products offered, billable hours, breakdown of costs, the amount owed, due date, payment methods, and terms.

Once the job has been completed, research applicable consultation fee rates, get a consultant invoice template that suits the job description, customize it to match your company, input relevant details, send it to the client, and keep a copy of the invoice.