A closing disclosure form is a standardized document used in the closing stage of mortgage lending or refinance to buy a home.

Closing disclosure form is designed to provide transparency and clarity about the costs associated with the mortgage loan being awarded. The form is a five-page document that comprehensively discloses the loan details, including terms, monthly mortgage payments, interest rates, closing expenses, and other generic and standard financial information.

The form should be issued at least three days before the signing of mortgage documents, unlike the loan estimate, which is issued at the beginning of the loan process. This is done to facilitate reviews and ensure that the information matches the expectations outlined in the estimate. The disclosure form provides a more precise closing or final mortgage breakdown. Lenders should thus ensure its content is as agreed-upon and legally enforceable. Therefore, it is the lender’s responsibility to ensure the borrowers accept and sign the necessary paperwork to complete the mortgage process.

In this article, you will learn what a disclosure form is and how it works when closing a mortgage loan. It also discusses how to structure its different sections with the appropriate information to make the mortgage process more transparent. Additionally, you will have access to new and fillable samples of a disclosure form in PDF format. Use the samples to understand how the form is structured and how to complete it correctly.

Free Form

Given below are closing disclosure forms:

How the Closing Disclosure Form 3-day Rule Works

You should provide the disclosure form to the borrower at least three business days before the scheduled closing date. This waiting period may vary from case to case but should be reasonable. It allows your clients or borrowers to ask questions, seek clarifications, and ensure that they completely understand the terms and costs associated with their mortgage. This rule is implemented to avoid complications on the last day of closing.

During this period, you should rectify any errors or discrepancies the borrower presents. While some errors like typos and misspellings can be rectified within the document, some changes warrant revising the closing disclosure and initiating a new three-day waiting period.

Certain changes that trigger a new three-day waiting period include:

- A significant increase in the APR (annual percentage rate)

- A change in loan product (e.g., converting from a fixed-rate mortgage loan to an adjustable-rate mortgage)

- The addition of a prepayment penalty.

The CFPB (Consumer Financial Protection Bureau) introduced the three-day rule in 2015. It was implemented as a measure to protect borrowers from being pressured into buying homes with mortgage loans. It also ensures they understand the loan terms and verify that they can afford it prior to finalizing the paperwork. Therefore, you can advise borrowers to consult loan officers or attorneys during this period to ensure they understand what they are applying for.

Closing Disclosure Form Sections

The disclosure form for closing a mortgage loan is divided into several sections. Each section prompts you to provide specific information about the terms, costs, and details of a mortgage loan and the associated real estate transaction. Therefore, it is important to carefully review each section of the disclosure form to ensure you understand what type of loan information you must provide.

Below is a comprehensive guide on filling out the form’s different sections:

Page 1

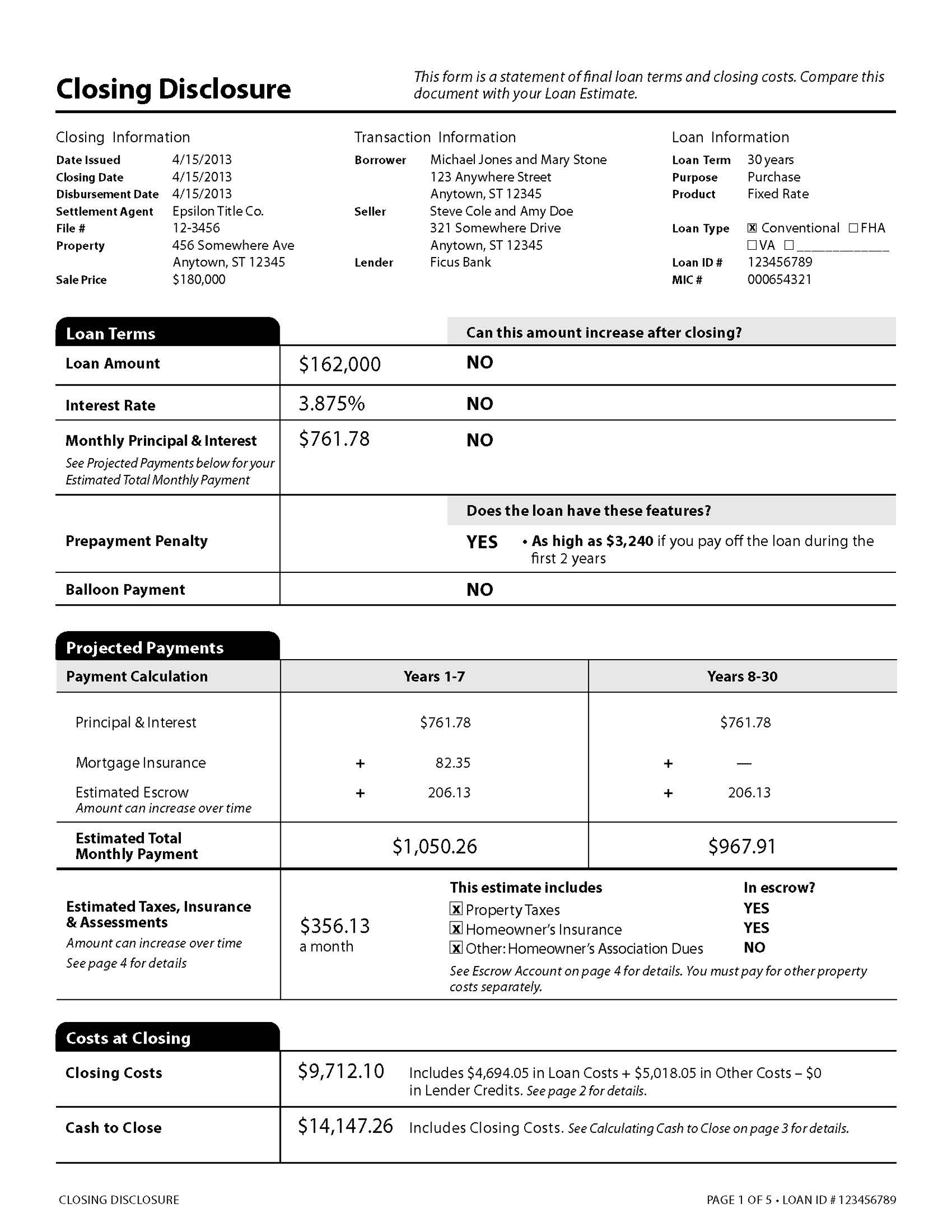

The first page of closing disclosure form serves to summarize the key details of the loan. Use this section to identify the parties involved, loan terms, projected payments, and the cost of closing the loan.

Closing information, transaction information (borrower, seller, and lender information), loan information

This section has three categories of information you should provide – closing, transaction, and loan information. Under the section labeled 1, indicate closing details such as the dates for when the disclosure is issued, projected closing, and disbursement. Also, specify the name of the settlement agent, file reference number, property description, and sale price.

Section 2 provides transaction information by identifying the parties involved – borrower, seller, and lender and their names and addresses. In section 3, input loan information by defining the duration of the loan, specific purpose (purchase or refinance), and the type of loan (conventional, FHA, VA, etc.). Then, indicate the type of loan and its identification or reference number. This part of the disclosure form helps borrowers get a comprehensive overview of the specific transaction being documented and its key features.

Loan terms

Next, input the terms under which the loan is being offered. Start by specifying the loan amount in section 1, the interest rate in section 2, and the monthly installment (principal and interest) in section 3. Also, if applicable, indicate the prepayment terms, such as the prepayment penalty (whether it is a fixed fee or percentage) in section 4. Then, clarify applicable terms; should you decide to receive the amount in a lump sum or balloon payment.

Projected payments

Use this section of closing disclosure form to provide estimated monthly payments, including principal and interest in section 1, mortgage insurance in section 2, and the estimated amount to be deposited with an escrow account in section 3. Also, specify the total estimated monthly payment in section 4. In section 5, document the associated property taxes, homeowners insurance, and any homeowner association (HOA) fees. The projected payments let the borrower decide their financial expectations from the transaction, helping them plan and anticipate these payments should they agree to the mortgage.

Costs at closing

In section 1, you should summarize the costs associated with the closing. This includes loan-related costs (origination charges, discount points, etc.), third-party charges (appraisal, credit report, title services, etc.), and government recording charges. Section 2 shows the amount of money the borrower must bring to the closing table. It includes the down payment, closing costs, prepaid amounts (e.g., taxes, insurance), and any adjustments. The costs of closing section communicates the payments you expect to receive from the borrower before the loan is signed into effect.

Page 2 (closing cost specifics including loan costs and other costs)

Page 2 of closing disclosure form is meant to provide a detailed breakdown of the closing costs, including the loan costs (origination charges, discount points, etc.), other costs (appraisal, credit report, title services, etc.), and the total closing costs. It is separated into two parts – loan costs and other costs.

Fill this page as follows:

Loan costs

In this section, enlist all the costs associated directly with the loan. Disclose any origination costs, services the borrower requested, and those they did not but were needed to complete the mortgage process. Also, specify the costs paid by the borrower, seller, and any other party. In section 4 indicate the total amount of loan costs paid by the borrower.

Other costs

Then, break down any additional costs that will be incurred but are not directly related to the loan. Such costs include expenses for appraisal, prepaid such as homeowner’s insurance, title searches, inspections, etc. Itemize each cost under its respective category. Then, in section 5, indicate the total additional costs the borrower paid. Finally, state the total closing cost in section 6.

Page 3 (cash required to close and a summary of the transaction)

On page 3 of closing disclosure form, calculate and compare key loan terms and costs between the initial loan estimate and the final closing. Also, this page summarizes the loan terms and costs paid by the borrower and the seller comprehensively. It helps you inform the borrower of any changes that may have occurred during the loan process.

Calculating cash to close

Use section 1 to summarize the amount of money the borrower requires to bring to the closing table. It includes the down payment, closing costs, prepaid amounts (e.g., taxes, insurance), and any adjustments. Section 2 indicates the final cash needed to close the transaction successfully.

Summaries of transaction

Next, summarize all the loan terms and costs incurred by the borrower and the seller for the entire transaction. This part is separated into sections: 1 for the borrower and 2 for the seller. For each party, document the costs due and owed at closing. Then, indicate the final figure and specify where it is owed or due to the respective party.

Page 4 (additional information about the loan)

Next, document any additional information related to the loan that you want to convey to the borrower but have not discussed in the previous pages. On this page, you can discuss several provisions of the loan. You can provide details about whether the loan can be transferred, late payment terms, and negative amortization stipulations.

Details about any escrow accounts established to facilitate the process can be outlined on this page. Information provided on this page is meant to disclose any unique features or conditions of the loan, other than those already discussed in other sections, that the borrower ought to know. You disclose this information to ensure the borrower fully understands how the mortgage will be implemented.

Page 5

The last page offers further insights into how the loan serves the borrower, any associated disclosures, and contact information they can use after the transaction.

Loan calculations

Section 1 indicates all the total payments you will have received by the end of the mortgage term. These include principal, interest, mortgage insurance, and other loan costs. In section 2, indicate the amount you will receive from the borrower and the amount you will finance. Also, specify the APR (annual percentage rate) in section 4 and TIP (total interest percentage) in section 5.

Disclosure information

Then, indicate any additional legal or regulatory disclosures relevant to the loan and transaction. These disclosures may discuss appraisal requirements, liability for foreclosure, refinance, contract details, and tax deductions.

Contact information

In the final part of the disclosure form, provide the contact details of the parties involved in the transaction. Such details include company name, address, license ID, contact person, contact ID, contact ST license ID, email, and phone number. In section 1, provide your details. In section 2, provide the mortgage broker’s information. In sections 3 and 4, indicate the real estate broker’s details.

Then, in section 5, provide the settlement agent’s details. This information is needed for future communication should the borrower have inquiries or require clarification or assistance. Lastly, have the borrower and their co-applicant sign the disclosure form at the bottom and indicate the date of signing.

Final Words

A disclosure form delineates loan terms, closing costs, and other essential financial components to help you break down the financial implications of the mortgage and your expectations of the borrower to repay the loan. Its standardized format simplifies the once-complicated mortgage disclosure process.

The information you input in the disclosure form should convey your knowledge of the mortgage loan to aid your clients in making informed decisions. As a regulatory evolution and consumer protection intervention, this form promotes more equitable and transparent real estate transactions. Its mandated three-day review period offers you ample time to rectify issues, clarify concerns, and implement any suggestions highlighted by the borrowers. This is after reviewing and comparing the closing disclosure against the loan estimate. This promotes accuracy and alignment with both parties’ expectations.