An application letter for a loan is a formal letter written to a financial institution by a borrower requesting a loan, payable in a specified amount of time.

The letter helps lenders get acquainted with the borrowers better to determine if they qualify for the loan based on the information provided or not. Writing it is important because it helps convince lending institutions to lend you a specific amount of money. It is their first impression of you, which is why it should be written with great care. In this article, we will guide you on how to write it, the type of information you should provide, and some pointers that will help you highlight your strengths in the letter.

Brief Overview- What to Include

There are no strict rules for writing an application for a loan. It depends on the borrower to decide what information to include, but the following items are typically included in it:

- Contact information

- Explanation of why money is needed

- Amount of money being requested

- Purpose of the money

- Details about employment history

- Personal references

- Company information

- A list of supporting documents

When to Write?

Two main situations warrant this letter. The first instance is when you are seeking a loan from a conventional bank lender. Conventional bank lenders are financial institutions that do not offer loans but make them available to the general public. Conventional banks usually require applicants to submit this application to prove their creditworthiness.

The second situation that warrants its use is when applying for an SBA-guaranteed loan. An SBA-guaranteed loan involves the federal government; applicants must undergo additional screening before they are approved for funding. Applicants can improve their chances of getting an SBA guarantee by submitting a personalized, formal loan application with supporting documentation.

tip

There are situations when you do not necessarily need to write this letter, such as when you are borrowing from friends and family, from an alternative lender who may only require your bank statements or pay slips, when seeking equipment financing, and lastly when you are requesting a business line of credit.

Free Templates

Pre-writing Considerations

Applying for a loan involves being prepared for anything, so it is important to have the things you need before writing. Do some research on your lender, and write down notes about why they are suitable for you and what you would like them to know about your project. Write those questions that may arise during the process of applying for your loan. Check your credit score and know your rights as a borrower when you apply for a loan.

After you have done all of the above, review everything and ensure that what you’ve written is easy to understand by someone who has not read your notes or audited your finances. When applying for a loan in a major financial institution or applying for an SBA loan, you will almost always be required to write an application letter for a loan. It is important to note that unless it is supported by a sound credit situation or proper financial planning, it may not be enough to help you secure the loan.

Fortunately, there are two things that you can do to increase your loan limit and increase your chances of getting a loan. You can first check your business and personal credit scores from accredited credit reporting bureaus such as TransUnion, Equifax, and Experian and take the necessary steps to improve them.

The second thing that you can do is to prepare your business financial statements, i.e., your profit and loss statement, cash-flow statement, balance statement, etc., for the past six months and attach them to your letter. These documents are essential when applying for a loan as they help the financial institution assess your creditworthiness and increase your chances of securing a loan.

How to Write a Loan Application?

Writing it can seem daunting, but it can be a simple process if you follow the proper format and include all the required information.

The following is a summary of the information you must provide in your letter:

The header is an integral part of the standard business letter format. It should include:

- Your name and contact information: Make sure to include your full name, address, and contact information. This should include a mailing address with a zip code, a business email address, and your cell phone number where you can be reached.

- The date: Include the month, day, and year of the letter. You must ensure that you write the date on which the letter was created.

- The name of the recipient: This will be a bank representative in many cases, but it can also be an SBA representative or another financial institution to whom the borrower is addressing the letter.

Subject line

When writing it, make sure to include a clear subject line that will help the recipient understand the purpose of the letter. Make sure to include whether the loan is for personal or professional use in the subject line.

EXAMPLE

“Loan Request Application Letter.”

Greetings

Address your letter correctly. If you do not know who will be reading it, write “To Whom It May Concern.” If you are trying to get a business loan, address it to the company’s representative issuing the loan. If you are applying for a personal loan, address it to the bank or whoever provides it.

Introduction

It should begin with a brief statement of the goal and amount you are requesting. It should also state your qualifications for the loan and any other pertinent information that can be used for your evaluation as a borrower such as your financial status, your work history, the length of time you have been in business, etc.

Body

The body is the main part of the letter, and it should contain all the information the recipient will need to decide whether to grant the loan or deny the request.

Some of the information that must be covered in the body includes:

- Basic business information: If you are writing it, the first item to include in the body of the letter is details about your business. This information will help the lender understand who you are and will serve as the foundation for your loan application. Some of the information that you should cover in this section includes your business’s registered name, business type (i.e., partnership, sole proprietorship, LLC, etc.), nature of your business (i.e., what you do), main services and products, your business model, the number of employees that you have, and your annual generated revenue.

- The purpose of the loan: You must explain why you need the loan and the purpose for which it is being requested. This can be to purchase or expand a business, for a personal reason, or to pay some debt.

- Present yourself as being trustworthy: To get a loan, you need to establish trust with the lender. This can be achieved by explaining what you do for a living, providing some identity documents, and demonstrating why you deserve to be trusted.

- Explain how you intend to pay back: Explain briefly how you plan on repaying the loan. This should include a timeline for repayment and be supported by evidence such as a business plan, personal financial statement, or credit report.

- Proof of financial solvency: In some cases, you will be asked to provide evidence that the funds requested are not your only source of income. Documents like bank statements or tax returns can help you prove that you have other sources of funding, which will increase the likelihood that your request will be granted.

Conclusion

In the conclusion, you must thank the lender for considering your request. Briefly mention all the attached financial documents. Remember that each lender has their own set of loan application requirements and may request different information or documentation from borrowers, so make sure to double-check the specific instructions provided by the lender.

Sign off

Once you have finished writing the letter, be sure to sign it at the bottom. You may include phrases such as:

“Respectfully yours” or “Sincerely yours”.

Place your name and contact information directly above the signature line.

SBA Loan Application Letter Template

[Your Name]

[Your Address]

[City, State ZIP Code]

[Your Phone Number]

[Your Email Address]

[Date]

[Loan Officer’s Name]

[Bank Name]

[Bank Address]

[City, State ZIP Code]

Dear [Loan Officer’s Name],

I am writing to apply for a Small Business Administration (SBA) loan to help fund my [business name]. I am excited to have the opportunity to present my business plan to you and explain why I believe my business is a great candidate for an SBA loan.

[Provide an introduction to your business, including its history, products or services offered, and unique selling proposition. Explain why you started the business and what sets it apart from competitors. This should be no more than two paragraphs.]

I am seeking an SBA loan in the amount of [$ amount], which will be used to [briefly explain how the funds will be used]. My business has experienced steady growth in recent years, but we need additional capital to take advantage of new opportunities and expand our reach.

[Provide a detailed explanation of how you plan to use the funds, including any expected return on investment. Be specific about the amount of money you need, how long you will need it for, and how it will be used.]

As part of my loan application, I have included the following documents for your review:

- Business plan

- Financial statements for the past three years

- Tax returns for the past three years

- Cash flow projections

- Articles of incorporation

- Personal financial statements for all owners

A list of collateral that will be used to secure the loan, if applicable

[Provide a comprehensive list of all the documents you have included with your application. Make sure you have included everything the bank has asked for, and any additional documents that may be relevant.]

I am confident in the future success of my business and believe that an SBA loan is the right choice for us. I understand that the loan application process can be lengthy, and I am committed to providing any additional information or documentation that may be required to support my application.

Thank you for considering my loan application. I look forward to hearing from you soon.

Sincerely,

[Your Name]

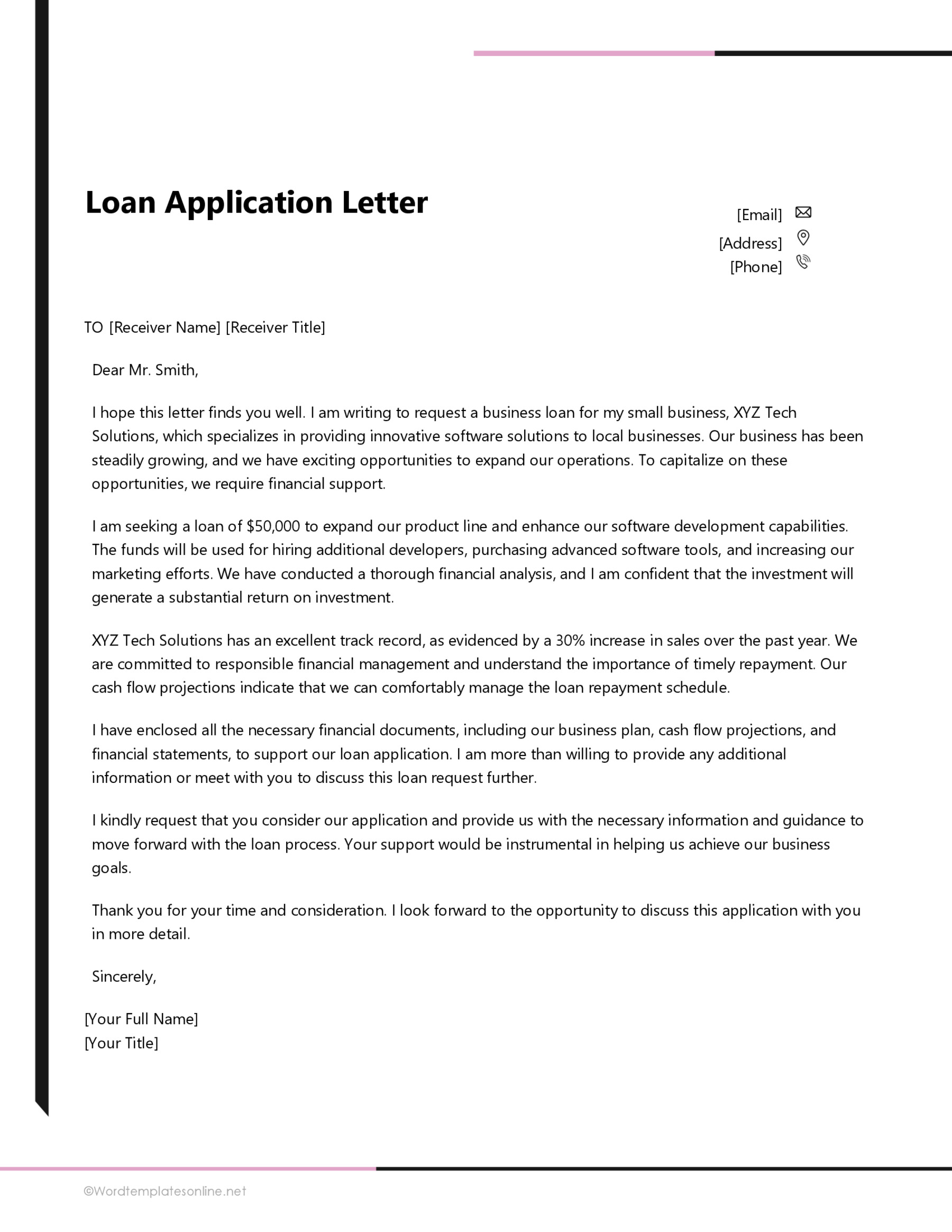

Loan Application Letter Sample

Make your small business loan application more polished with our simple sample letters. They’re crafted to help you convey your needs professionally and improve the impact of your request.

Sample letter 1

Dear Sir/Madam,

I am writing to apply for a Small Business Administration loan to support my growing business, GreenTech Innovations. Established in 2018, we specialize in eco-friendly technology solutions. Our recent market analysis indicates significant growth potential in sustainable energy products.

To capitalize on this opportunity, we require additional funding for research and development, marketing, and expanding our team. An SBA loan would enable us to invest in these critical areas, fostering innovation and job creation. Our business plan, attached to this application, outlines our strategy for a sustainable and profitable future.

GreenTech Innovations has a strong financial track record, with consistent revenue growth over the past three years. We have maintained a healthy cash flow and have a solid plan for loan repayment, as detailed in our financial projections. Our commitment to financial responsibility and strategic growth makes us an ideal candidate for an SBA loan.

Thank you for considering our application. We are committed to contributing positively to the economy and the environment. Your support would be instrumental in helping us achieve our goals.

Sincerely,

Jordan Smith

Owner, GreenTech Innovations

Sample letter 2

Dear Business Loan Officer,

I am reaching out to request a business loan for my company, Bella’s Boutique, a unique clothing and accessories store located in downtown Springfield. Since our opening in 2019, we have become a beloved part of the local community, known for our exclusive designs and personalized customer service.

This loan is sought to enhance our inventory, upgrade our in-store technology, and expand our online presence. These improvements are essential for keeping pace with the evolving retail landscape and meeting the growing demands of our customers. Our detailed business plan is attached for your review.

Financially, Bella’s Boutique has demonstrated resilience and growth, even amid challenging economic times. Our sales figures have shown a steady increase, and we have a clear plan for managing the loan and ensuring its repayment. We believe these factors make us a strong candidate for a loan.

Your consideration of our loan application is greatly appreciated. This funding will not only help Bella’s Boutique thrive but will also support the local economy by providing more employment opportunities and enhanced retail experiences.

Thank you for your time and consideration.

Warm regards,

Isabella Martinez

Founder, Bella’s Boutique

Analysis

The effectiveness of these sample letters as a guide for someone seeking to write a loan application lies in several key aspects. Firstly, they demonstrate the importance of a clear and concise introduction, where the purpose of the letter is immediately stated, ensuring the reader understands the intent from the outset. This is crucial in any formal business communication. Both samples skillfully describe the nature and background of the respective businesses, providing just enough detail to give the reader a sense of the company’s identity and market position without overwhelming them with unnecessary information. This balance is vital in maintaining the reader’s interest and establishing the context of the request.

Moreover, the letters excel in explicitly stating the purpose of the loan, which is a critical component of any loan application. They outline how the funds will be utilized to grow and improve the business, demonstrating not only a clear vision but also a strategic approach to business development. This helps in building a sense of trust and reliability with the lender. Furthermore, the inclusion of financial health indicators, such as past revenue growth, cash flow management, and a repayment plan, adds to this trust by showing financial responsibility and foresight.

The writers also incorporate attachments like business plans and financial projections, which provide additional depth and substantiation to their claims. This shows thorough preparation and professionalism, which are highly regarded in the business world. Finally, the tone of the letters is appropriately formal yet approachable, and they conclude with a note of gratitude, reflecting good business etiquette. This combination of clarity, conciseness, relevance, and professionalism makes these letters exemplary guides for anyone looking to draft an effective and persuasive business loan application.

Tips for Writing

Following are some tips for writing this letter:

Be specific

Be sure to include specific details in it to keep the reader’s attention. Ensure that you include information about the purpose of the loan, how much money you need, and the reason why you are a good candidate for a loan.

Be concise

Brevity is essential when writing this letter. Stick to the essential points and avoid extraneous details. This will help to ensure that your letter is easy to read and that the reader is not distracted by irrelevant information.

Address the appropriate person

Ensure that you address your letter to the most relevant party for your particular situation.

EXAMPLE

Consider contacting the bank to find out to whom it should be addressed. This is how you can be sure that it will get to the right person.

Use a proper format and layout

As with all letters, you should use clear, concise paragraphs and avoid unnecessary jargon. Make sure to use the appropriate format for formal letter writing and use a professional, polished layout.

Include business financial statements

The financial statements for your company must be attached to your letter if you are a business owner. In this way, the reader will better understand your overall financial situation and help demonstrate that you are a good candidate for a loan.

tip

The following are some of the purposes for which you may request a small business administration loan: to start a new business, to buy new equipment or inventory for your company, to upgrade or expand an existing business, to cover unanticipated expenditures, to pay off high-interest debt, to fund marketing campaigns, to move your office to a new location, to buy insurance for your business, to purchase stock, to buy out shareholders, and for any other lawful reason authorized by the lender.

Key Takeaways

Here are the key takeaways from this article:

- When writing an application for a loan, be sure to provide specific details about the purpose of the loan, how much money you need, and why you are a good candidate for a loan.

- Use the standard business letter format and use clear, concise paragraphs.

- Brevity is vital when writing such a document, so mention only the essential points and avoid extraneous details.

- Address your letter to the most relevant party for your situation, and be sure to include your company’s financial statements.