Corporations are usually required to maintain meeting minutes for their shareholders. These minutes can be shared with other interested parties such as investors or shareholders to help them understand the company’s opinion on specific topics, respond to lawsuits and even provide them with information regarding the corporate’s decision-making process. Failing to maintain the required corporate minutes can cause legal complications, such as not being able to present evidence during a lawsuit or putting the company’s corporate liability protection, tax advantages, and other key benefits such as limited liability at risk.

This article discusses corporate meeting minutes, why you should keep meeting minutes, what should be included in the corporate minutes, how to approve the minutes, and how to file the minutes properly.

What are Corporate Minutes?

Corporate minutes, also referred to as meeting minutes, record everything discussed at a meeting among the members.

The minutes provide detailed information on what decisions were made and why they were made, who was present at the meeting, and who was absent in some cases. In addition, the minutes record all official and informal decisions made during the meeting, such as the sale of stock, purchase of property, new pension plans, etc. Corporate minutes should be clear and accurate, and they should reflect the decisions made by the members in a specific time frame.

Alternative names

Corporate minutes can also be referred to as:

- Corporate meeting minutes

- Meeting minutes

- Meeting minutes format

- Board meeting minutes

Who is Required to Keep Corporate Minutes?

To maintain a clear and detailed record, the corporate minutes should be recorded by the corporate secretary or an officer or member of the corporation. The secretary can record the minutes on a printed document or a computer. However, it is recommended to use paper as it is easier to read and provide better security.

Corporate minutes must be recorded for a corporation to retain its legal status, avoid personal liability, and meet the corporate record-keeping requirements. This is particularly important for non-profit and limited liability companies that must keep corporate minutes regularly.

In most states, S-corporations and C-corporations must keep a record of all significant decisions and actions to maintain the company’s liability protection and corporate status. However, some states such as Delaware, North Dakota, Nevada, Kansas, and Oklahoma do not require to maintain corporate minutes regardless of the type of corporation.

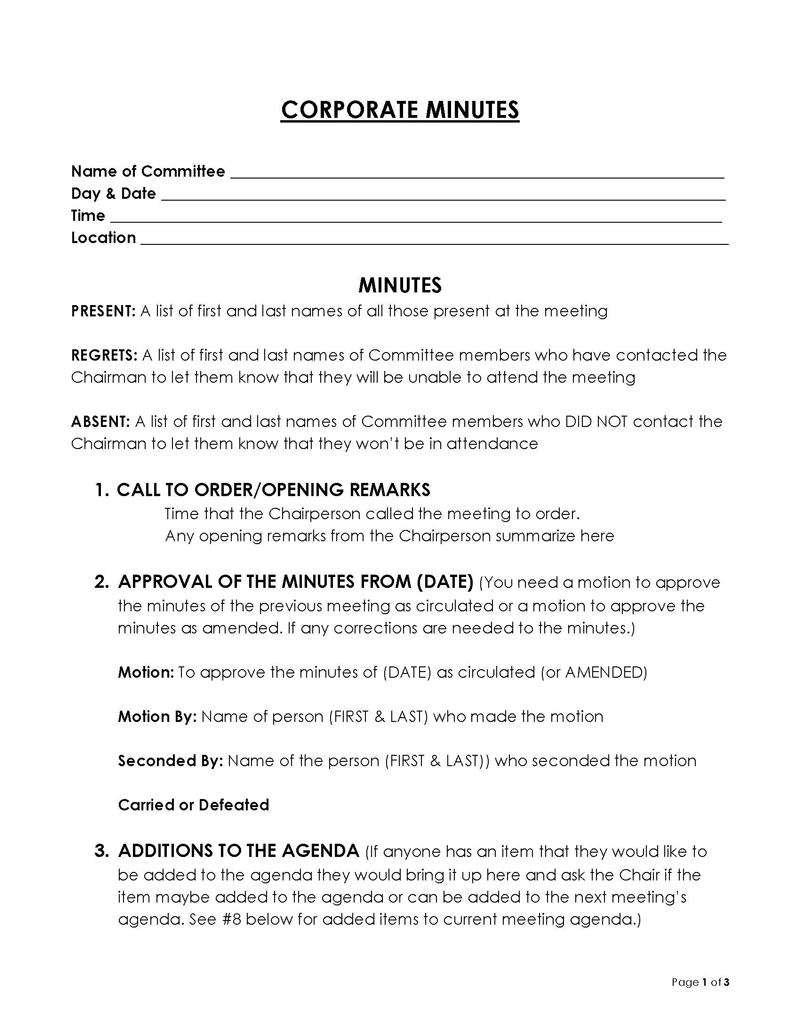

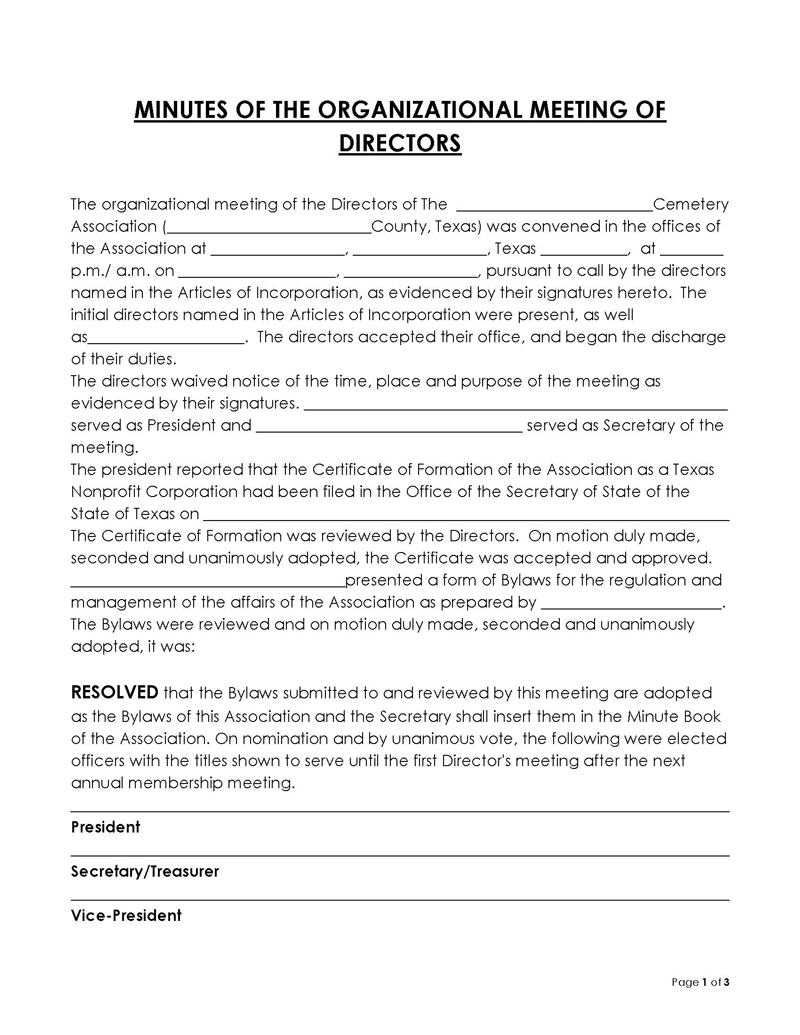

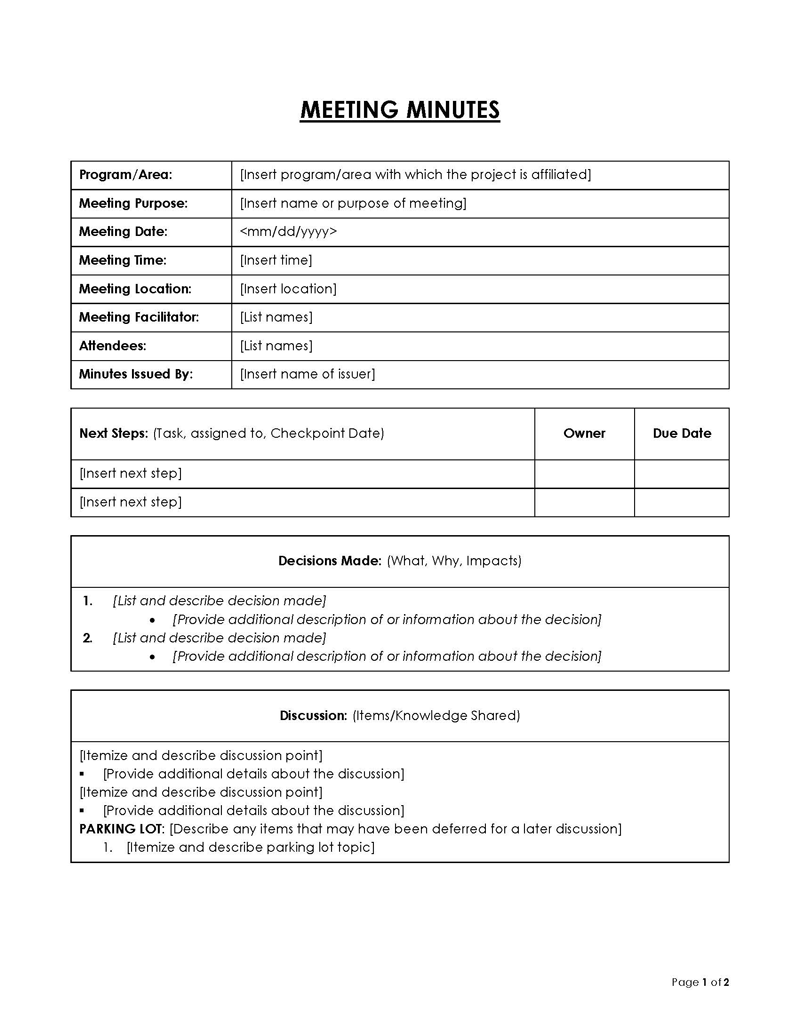

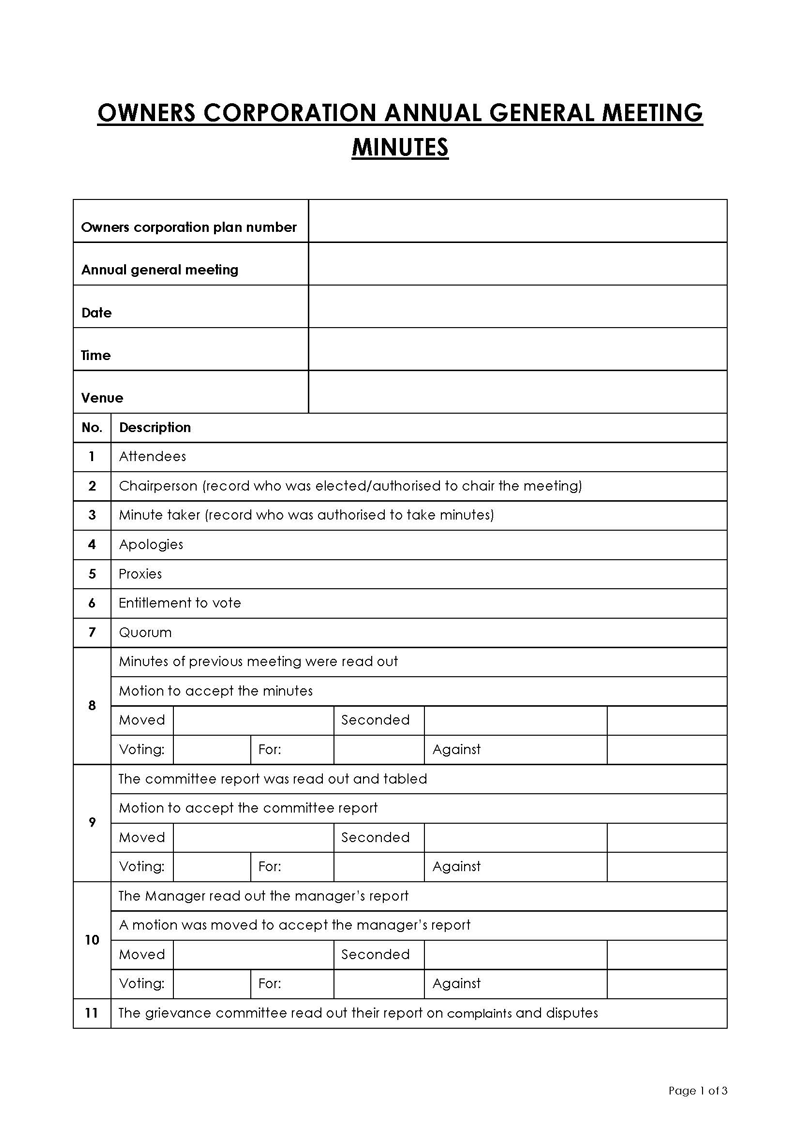

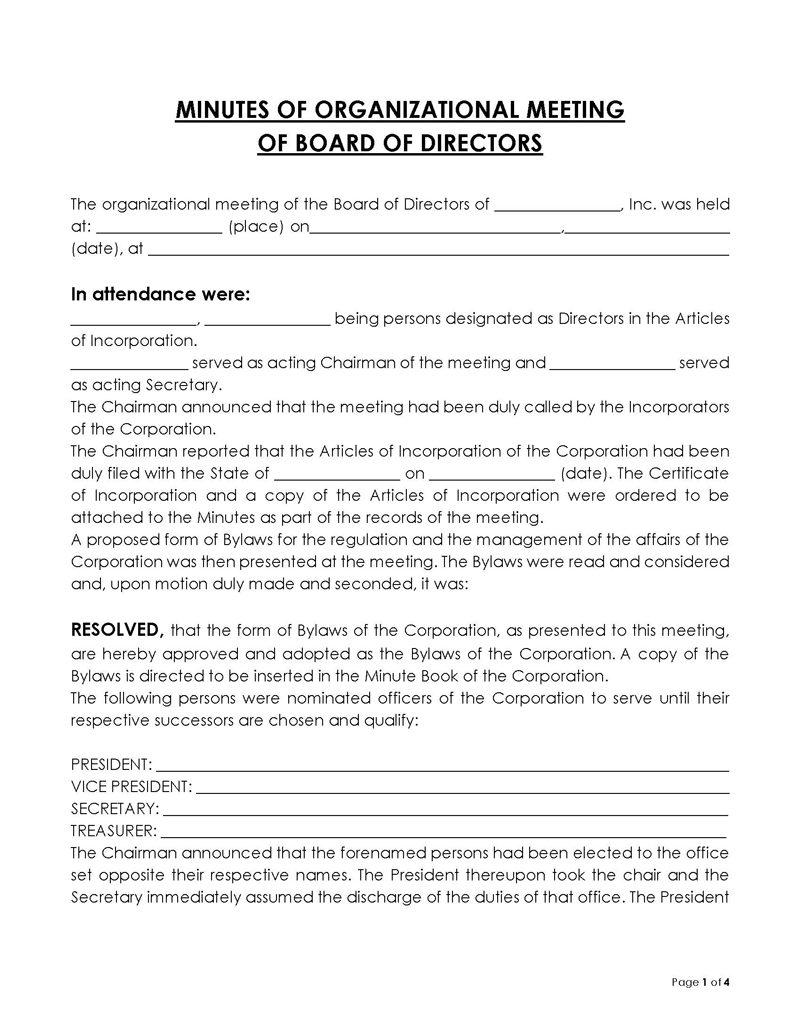

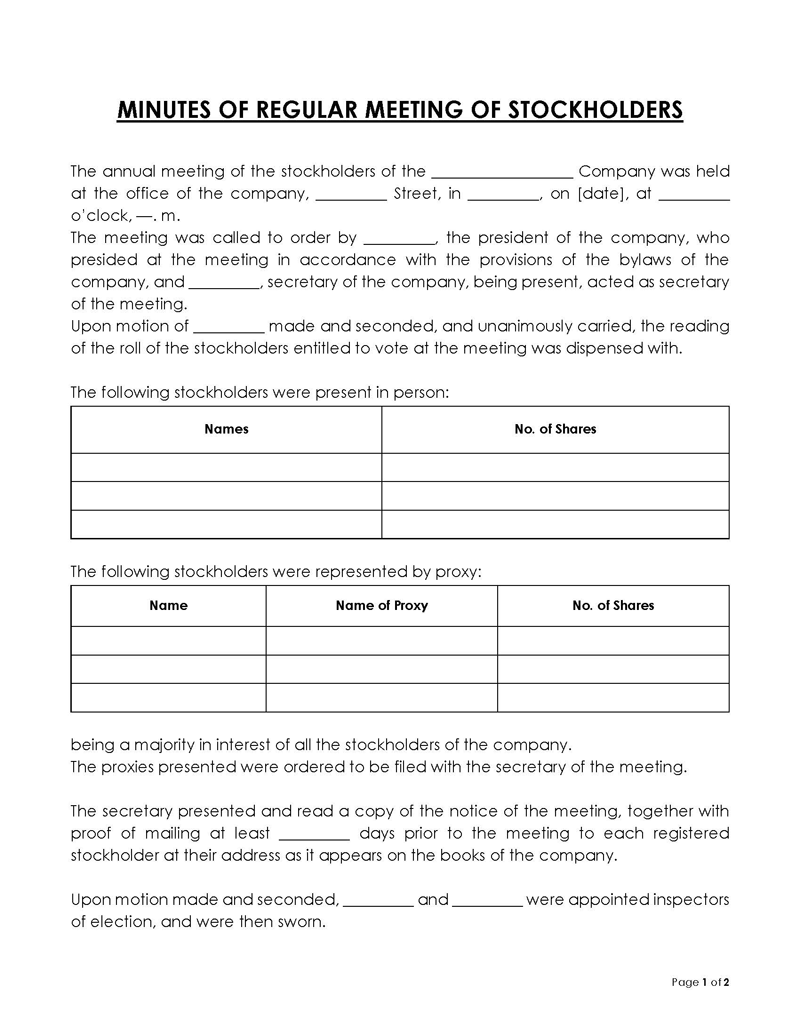

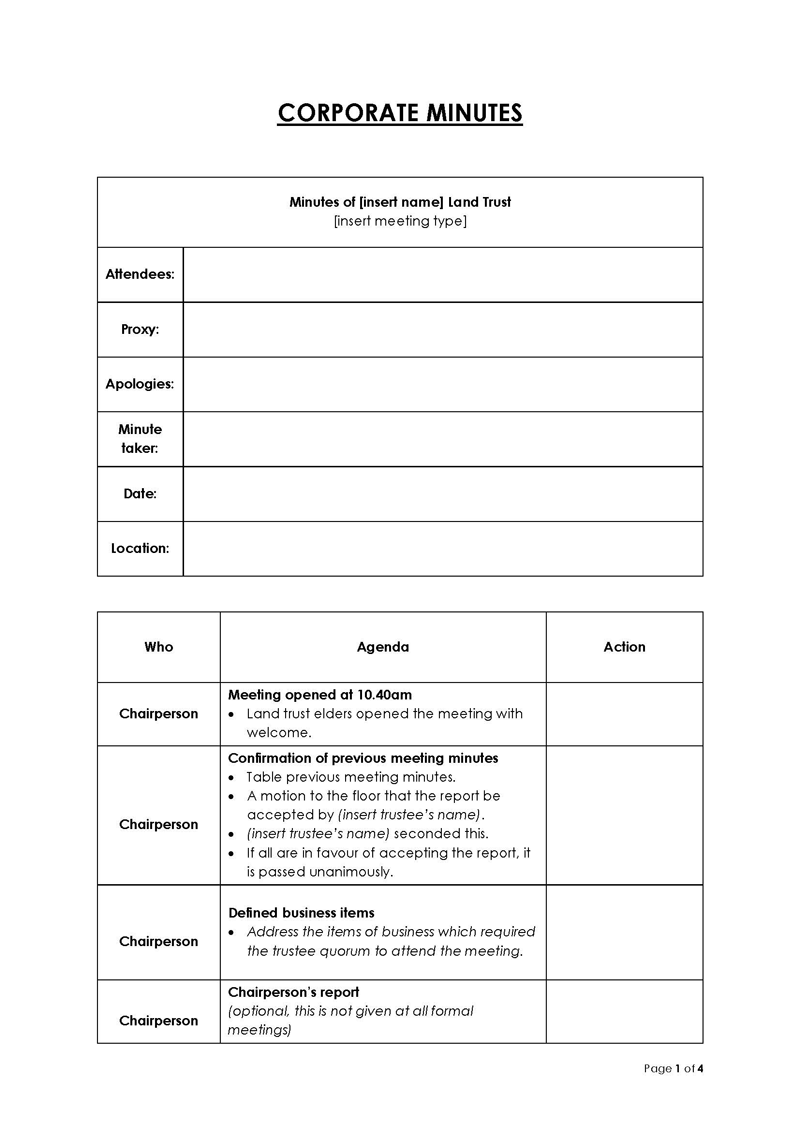

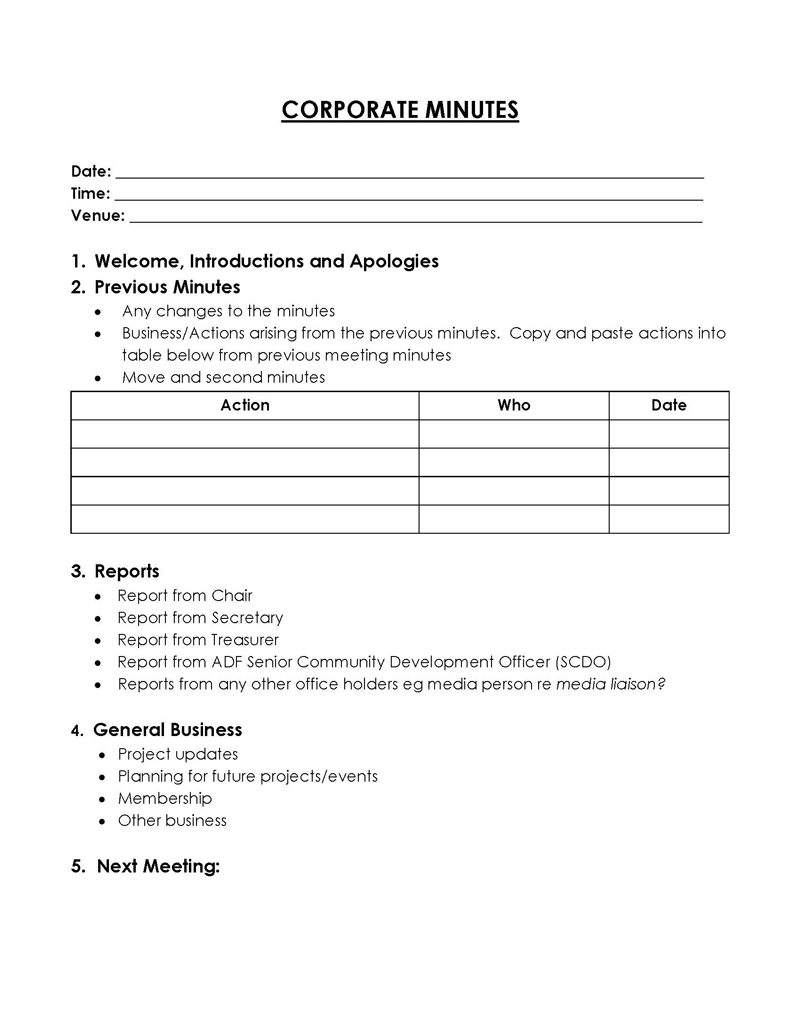

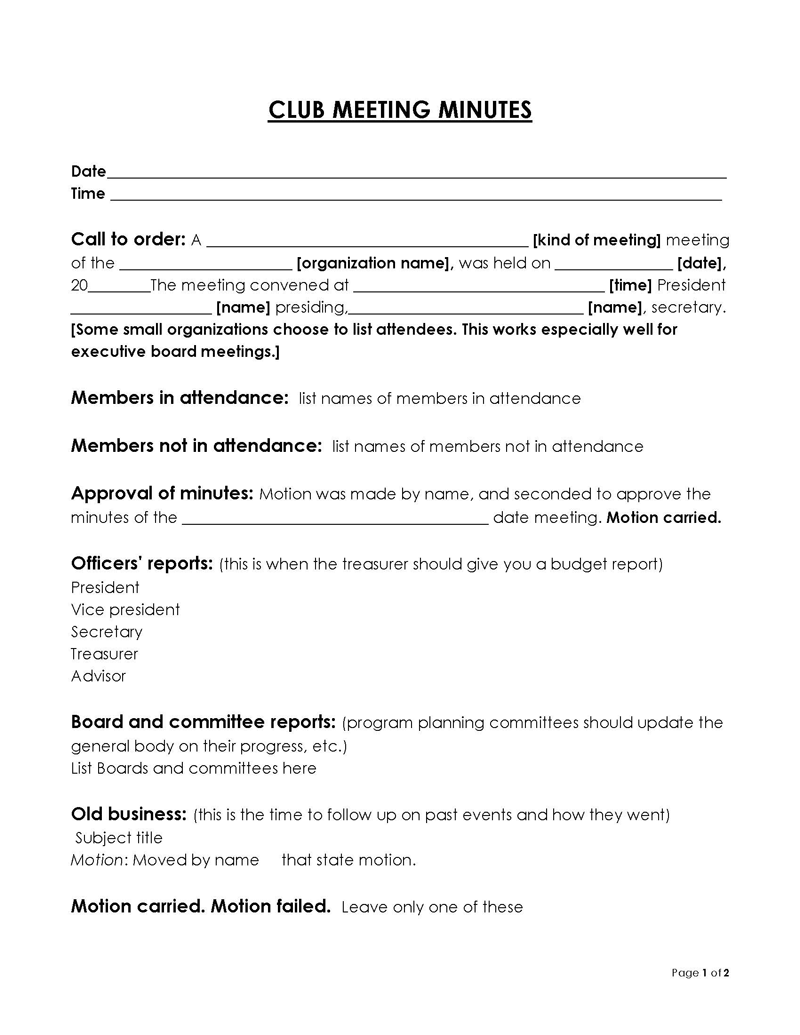

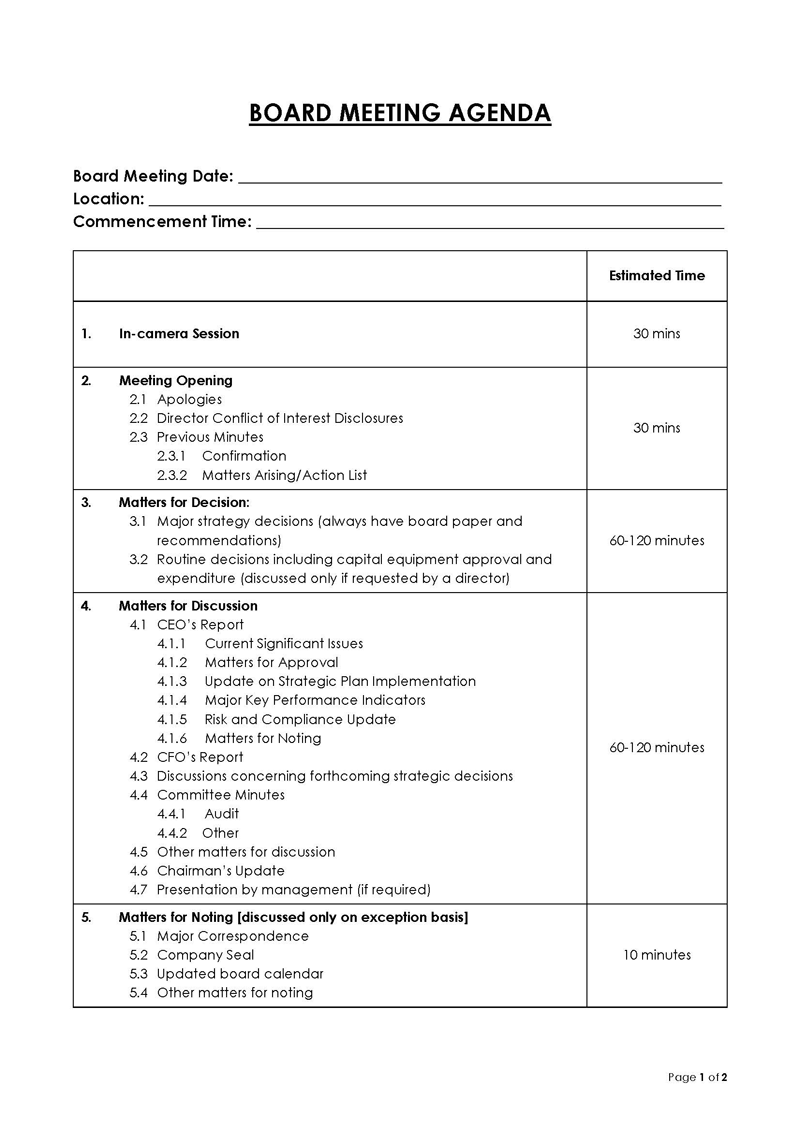

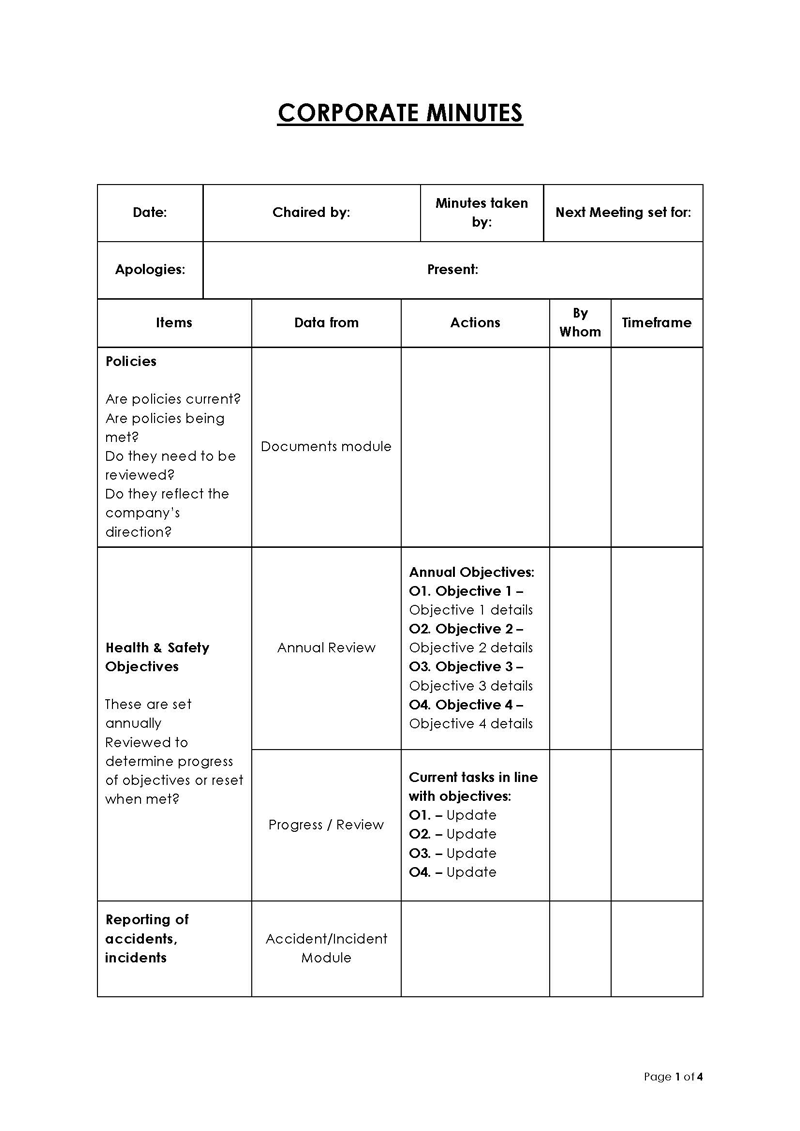

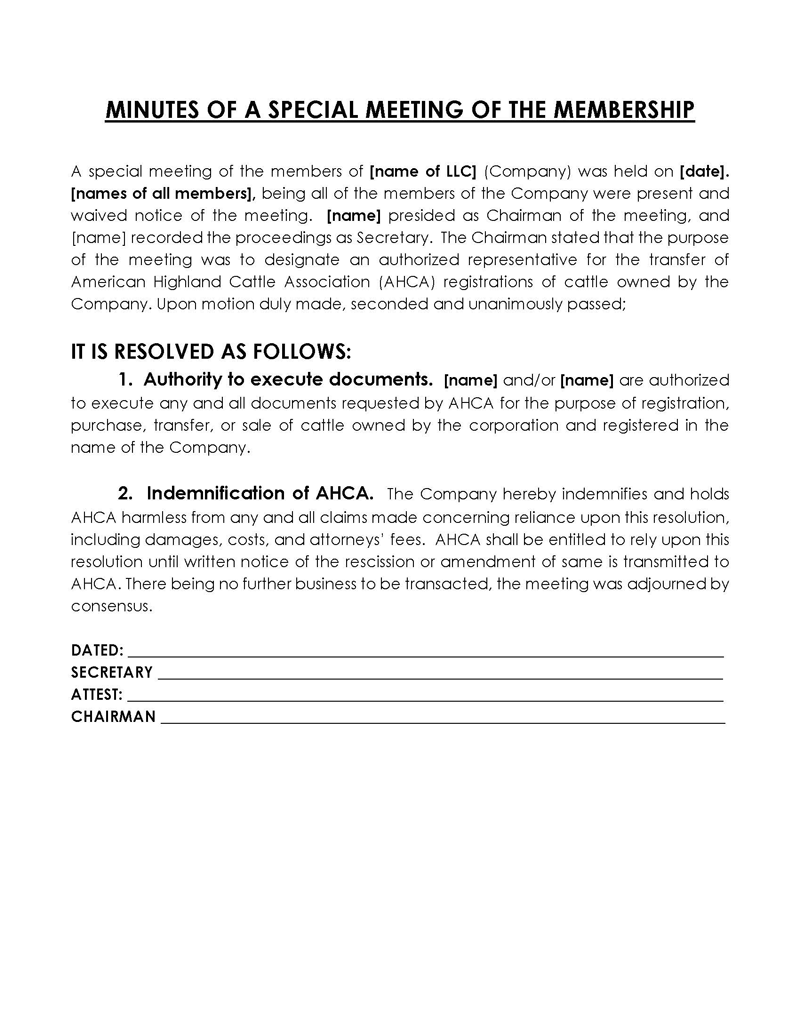

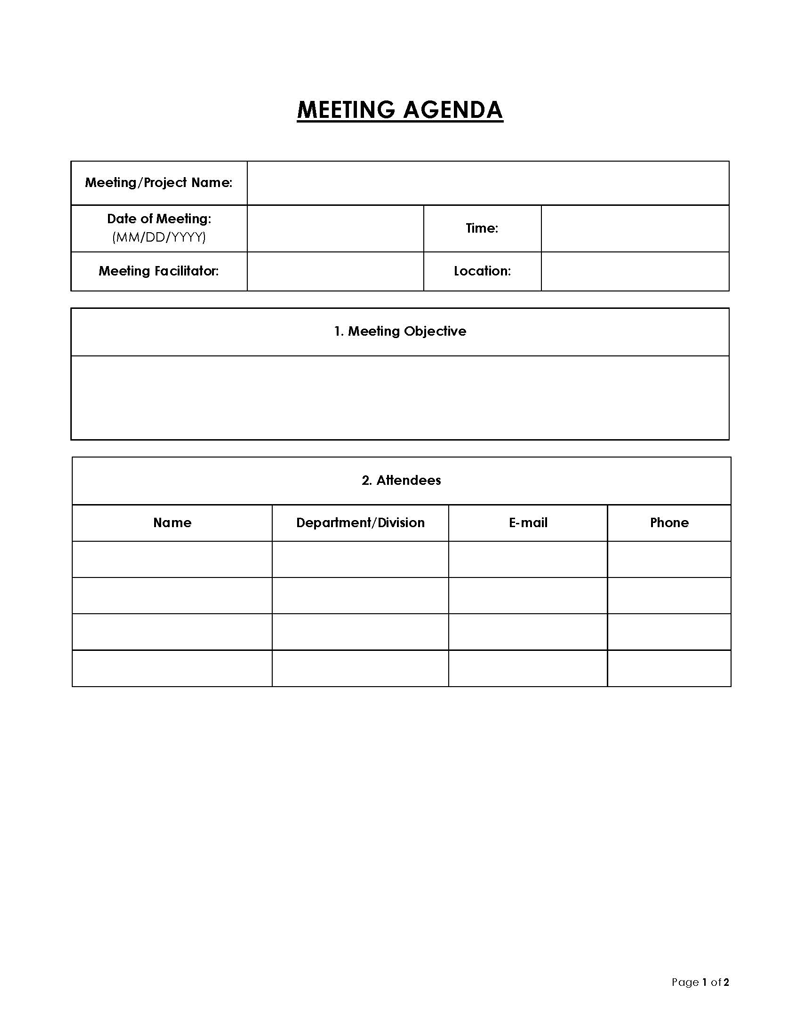

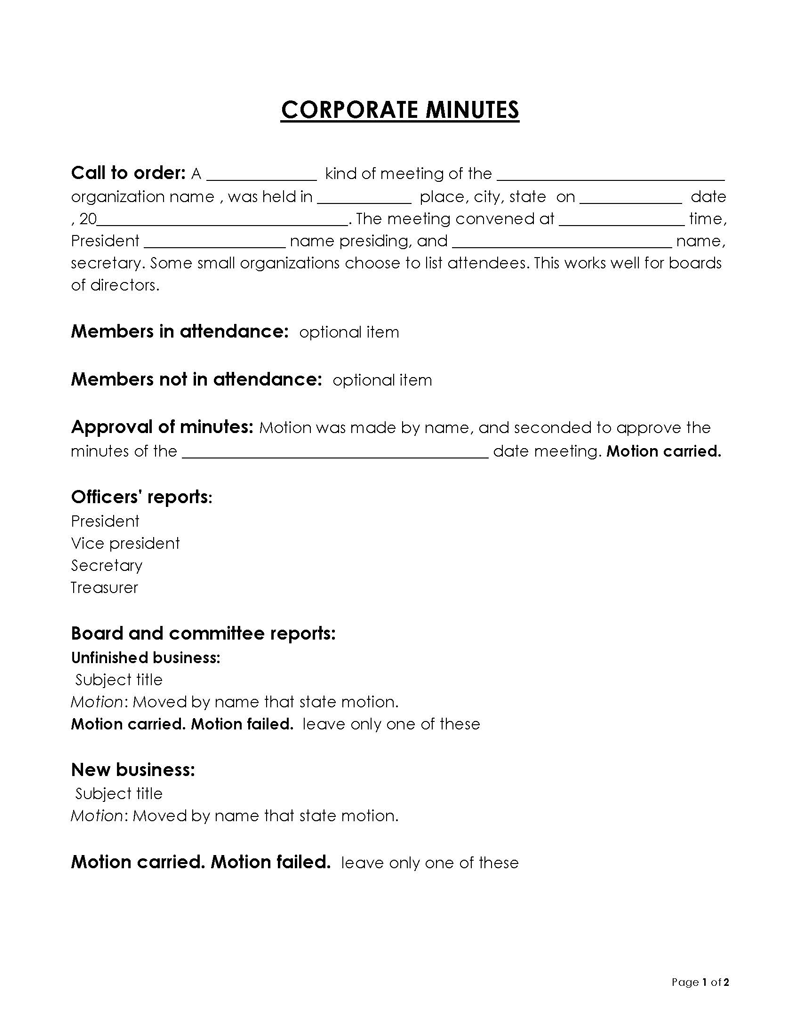

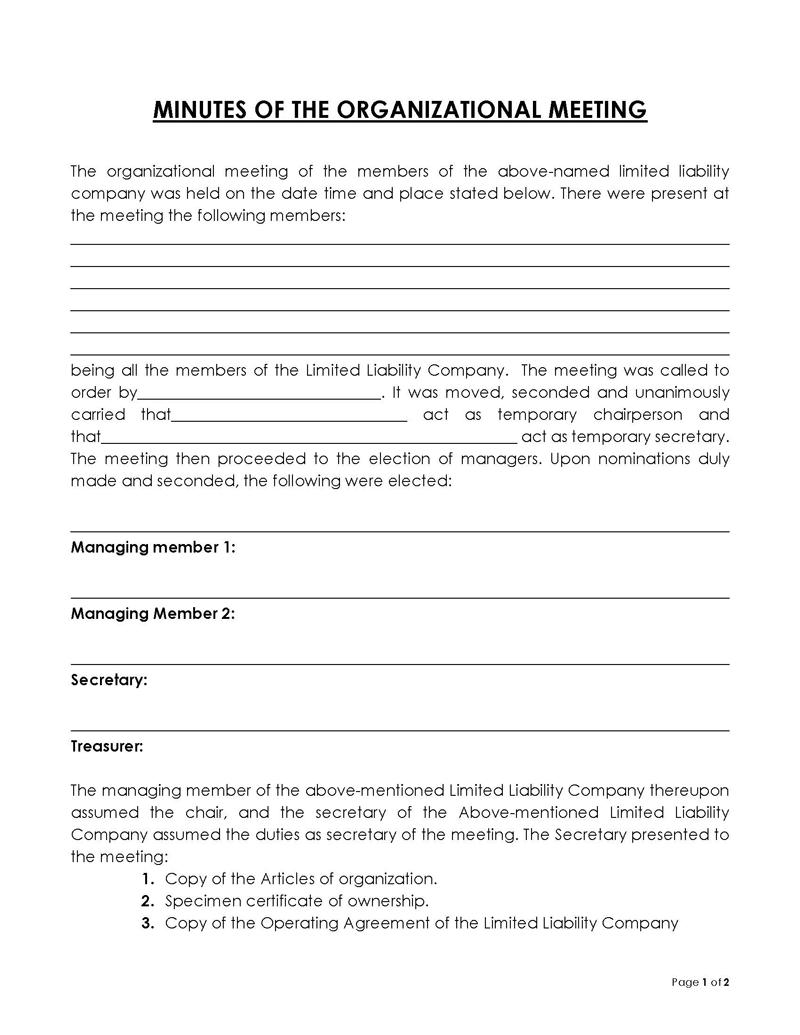

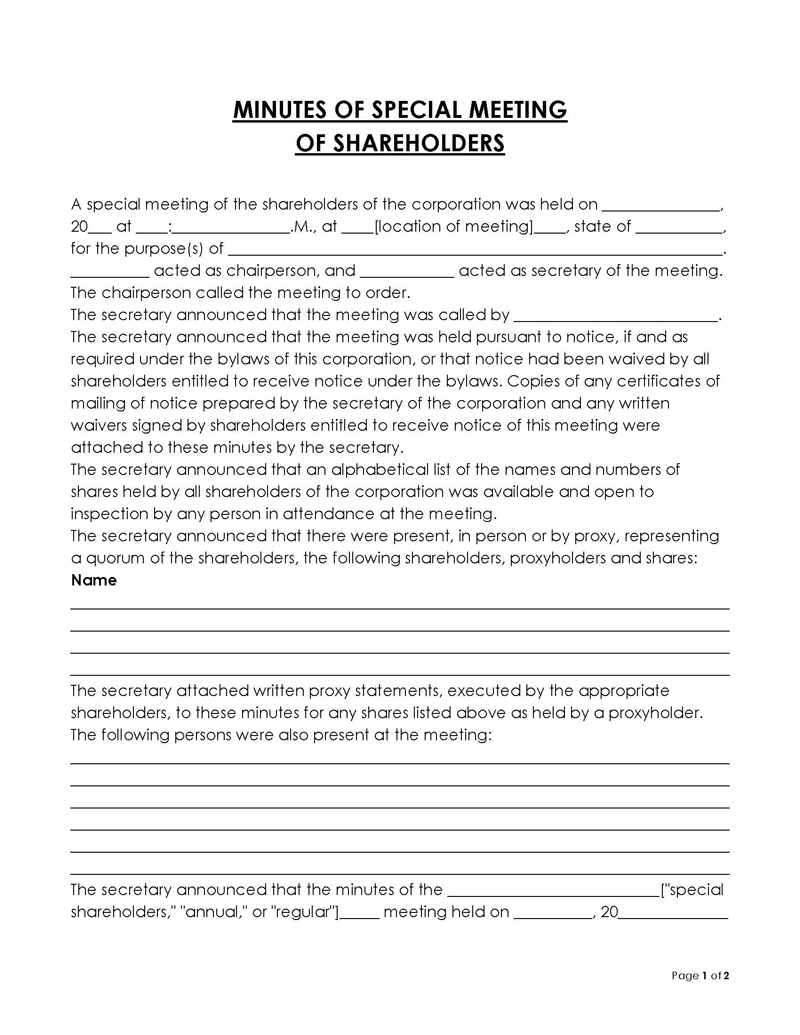

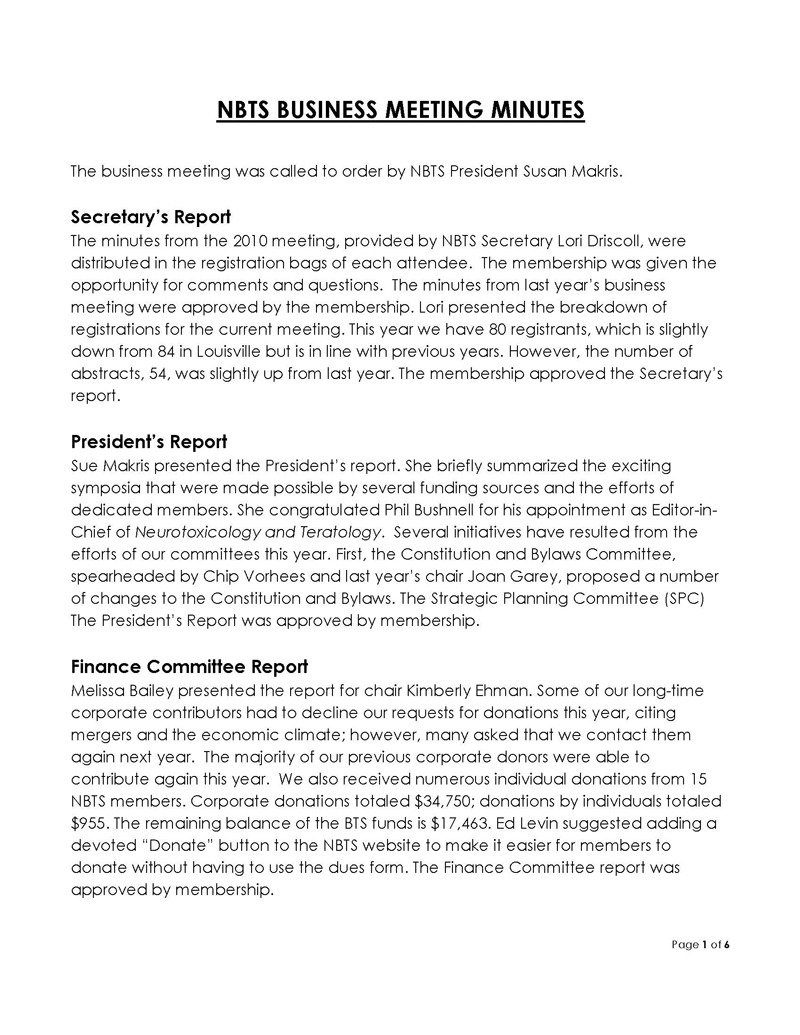

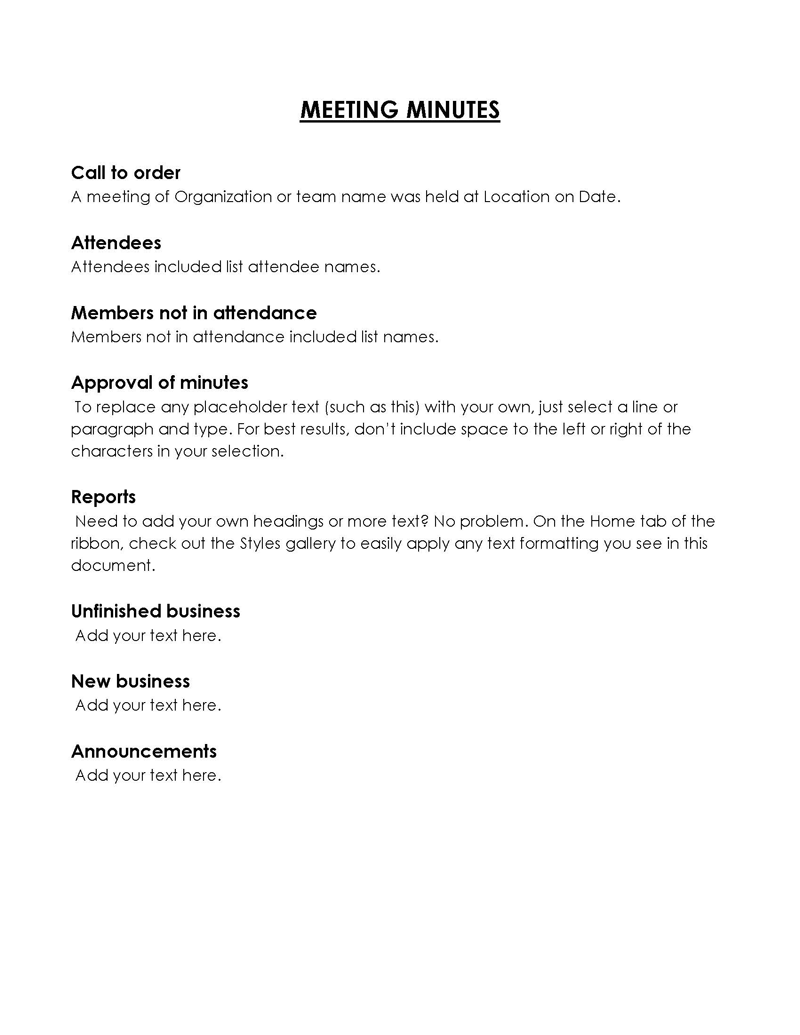

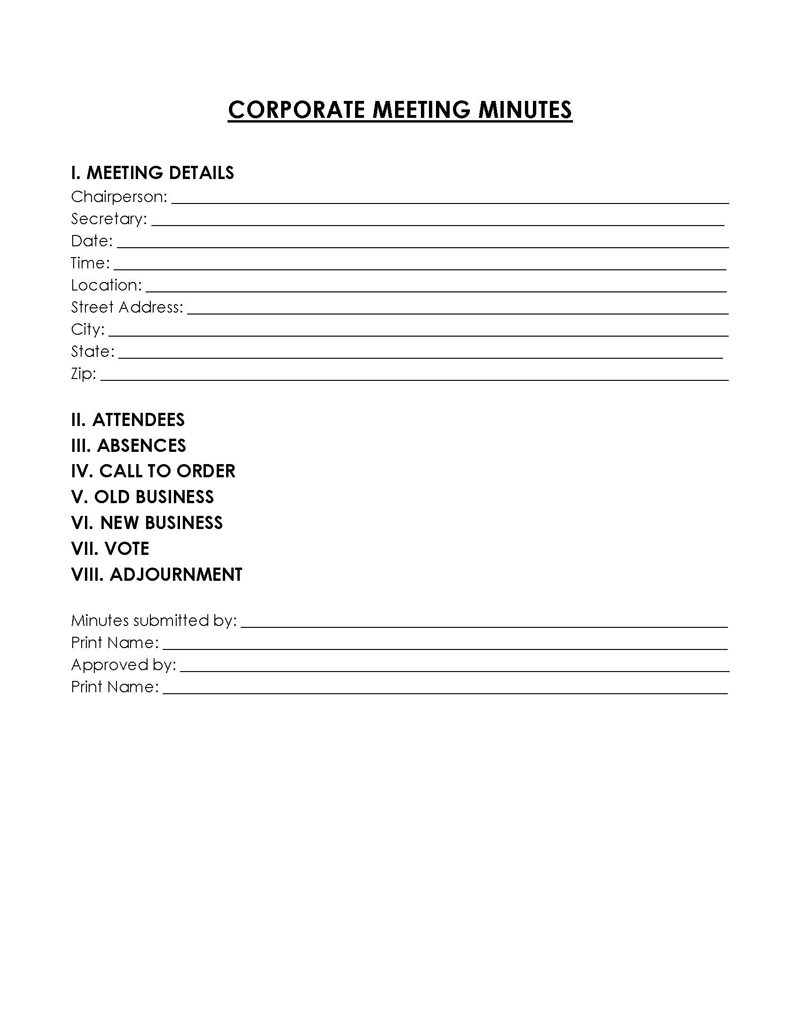

Corporate Minutes Template

Reasons to Keep Corporate Minutes

Several benefits come with keeping corporate minutes and following official meeting procedures. Some of the most important reasons for keeping corporate minutes include:

Acts as a reminder

Corporate minutes are a way to keep track of important events such as meetings, decisions, significant policy changes, etc. The minutes can be used as a reference written down exactly as they are said at the meeting. It can also be used to give legal evidence during lawsuits or investigations. A large corporation may have hundreds of meetings per year, and having exact documentation of those meetings can be helpful in case any decision has to be changed or if another board member does not express their opinion on a matter.

Personal liability protection

It is vital to maintain the corporate minutes for businesses that fall under LLC, Corporation, and other legally recognized forms. Failure to do so may result in the corporation’s failure to collect on debts or other obligations. Keeping corporate minutes is also essential because it helps protect the corporation’s liability.

For example, if the decision was not to close a factory because of financial difficulties and the corporation did not record the minutes of that meeting, they can be held liable for any damages or losses caused by that decision.

Keep the company’s tax standing

Maintaining corporate minutes also helps keep the corporation’s tax standing as well. The corporation can use its minutes to show that it followed its legal obligations to file the corporation’s tax return. In most states, S-corporations and LLC corporations must file a return with the state each year.

The IRS can reclassify a company as a C-corporation if they believe that it was not following its corporate responsibilities. The decision to reclassify a corporation can have substantial tax consequences, and it is recommended to keep corporate minutes to avoid such occurrences. For instance, if there is a change in the stock structure and the number of shareholders drops below the required threshold, a corporation should keep all official meeting minutes where that decision was made or approved.

Boost your sales prices/attract investors

Keeping corporate minutes can also positively impact the company’s value and its stock. Investors, partners, and other interested parties are more likely to invest in a corporation run by an effective board of directors that keeps detailed records of all critical decisions and issues. In addition, investors are more likely to invest in a corporation that maintains high standards and records than one that does not.

Types of Issues to be Included in a Corporate Minutes Template

There are many different types of decisions and issues that are important to include in the corporate minutes template. However, it is vital to have some general guidelines for the corporate, so the secretary will know what needs to be attended to in their record keeping.

The following list gives a general listing of essential issues that should be recorded in the corporate minutes template:

- The election of board members

- Loan or Credit applications

- Asset disposal

- Land acquisition

- Stock purchases, transfers, mergers, and dissolution

- Committee reports and recommendations

- Employee and supervisor compliance with company policies

- Announcement of new technology or equipment to be purchased

- Sales, purchase or rental, and leasing agreements

- Pension plan changes, amendments, and additions

What Information Should a Corporate Minutes Template Address?

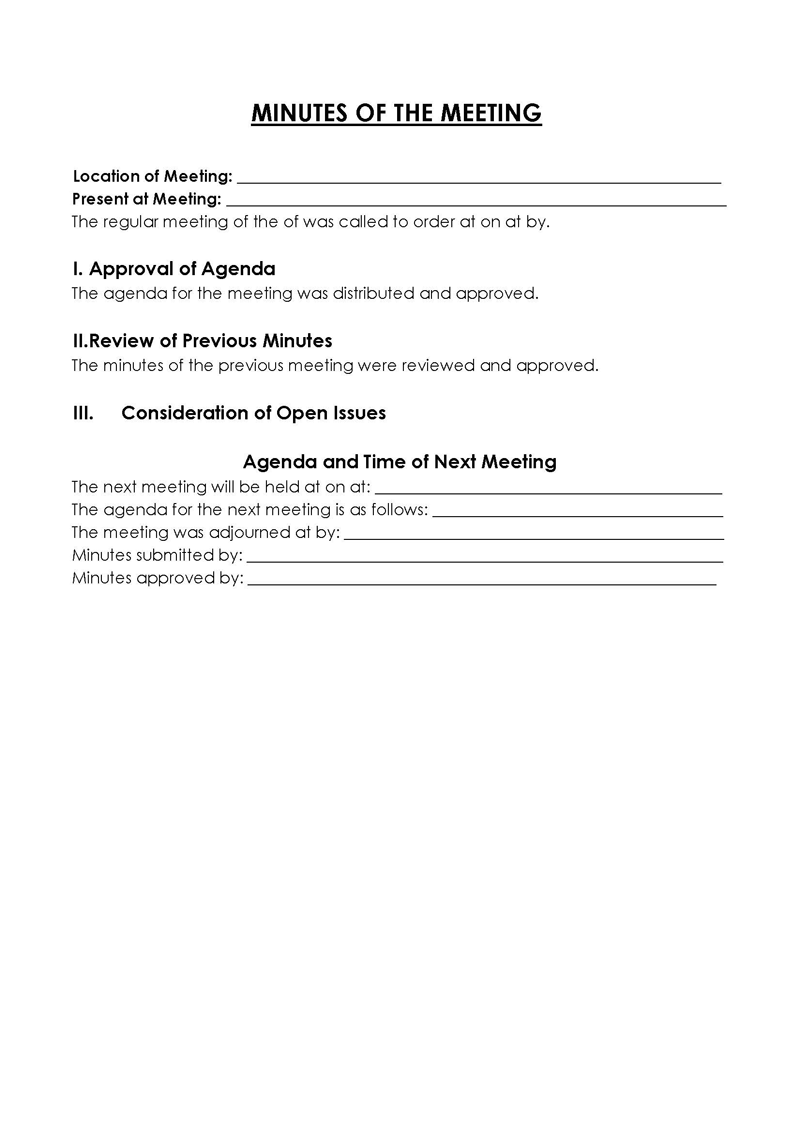

To ensure that the minutes are comprehensive and include all critical information, it is essential to have a template to follow. For example, some of the most important information to include in the corporate minutes template are as follows:

Date

The first item that should be included in all corporate minutes templates is the date. This includes, but is not limited to, the day, month, and year that the minutes were recorded in the corporate records. Minutes must be created and maintained so that they are accurate to reflect the actual date of creation.

Location

The location where the board meeting was held. This should include but is not limited to a physical address, country, and specific room number where the meeting was held. In addition, the corporate minutes template must be created and maintained by the board of directors at its designated meeting venue, thereby eliminating any possibility of confusion or potential mistakes.

Meeting participants

The secretary should record all the participants involved in the meeting. In addition, the names of all corporate board members should be included in the corporate minutes template so each member will fully understand their responsibilities, postures, and obligations.

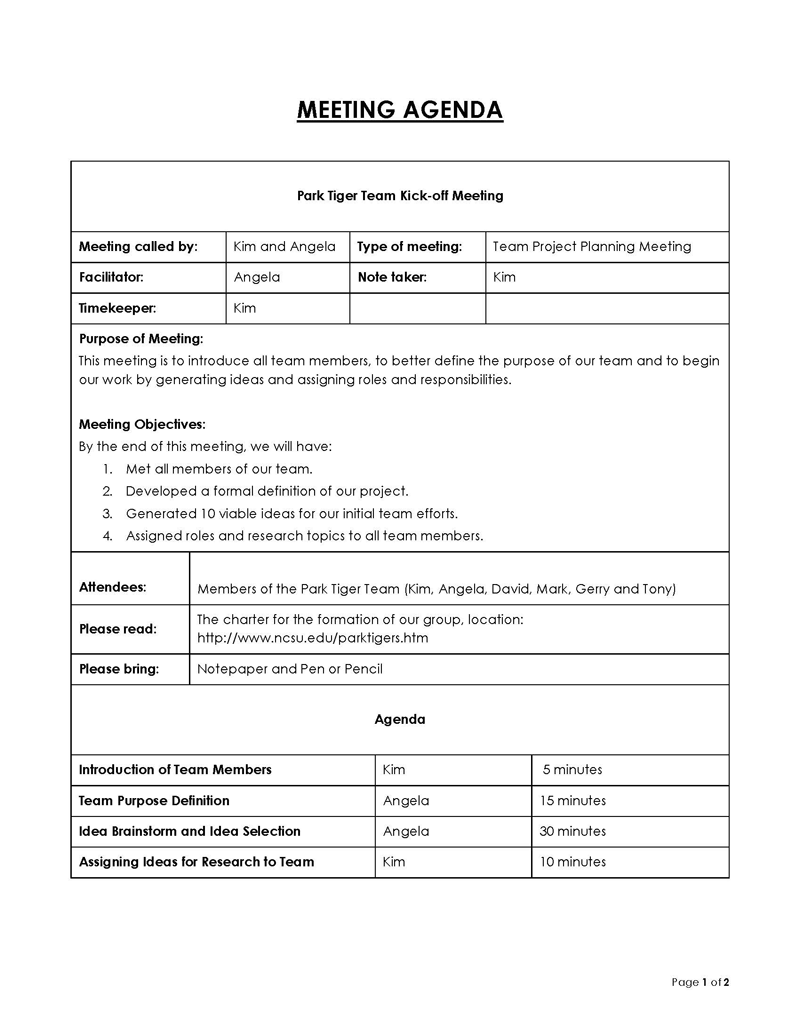

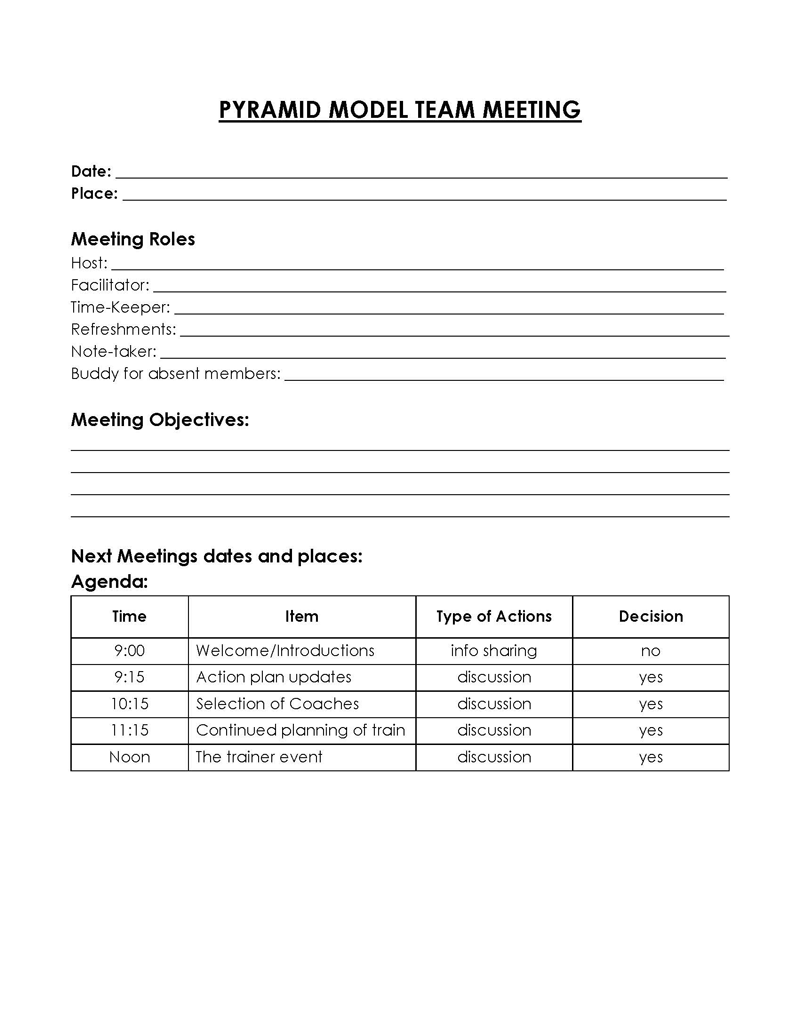

Agenda

An agenda is a complete list of all items discussed at a meeting. The schedule should include the main topics and any other relevant issues, such as ad hoc items added during the meeting.

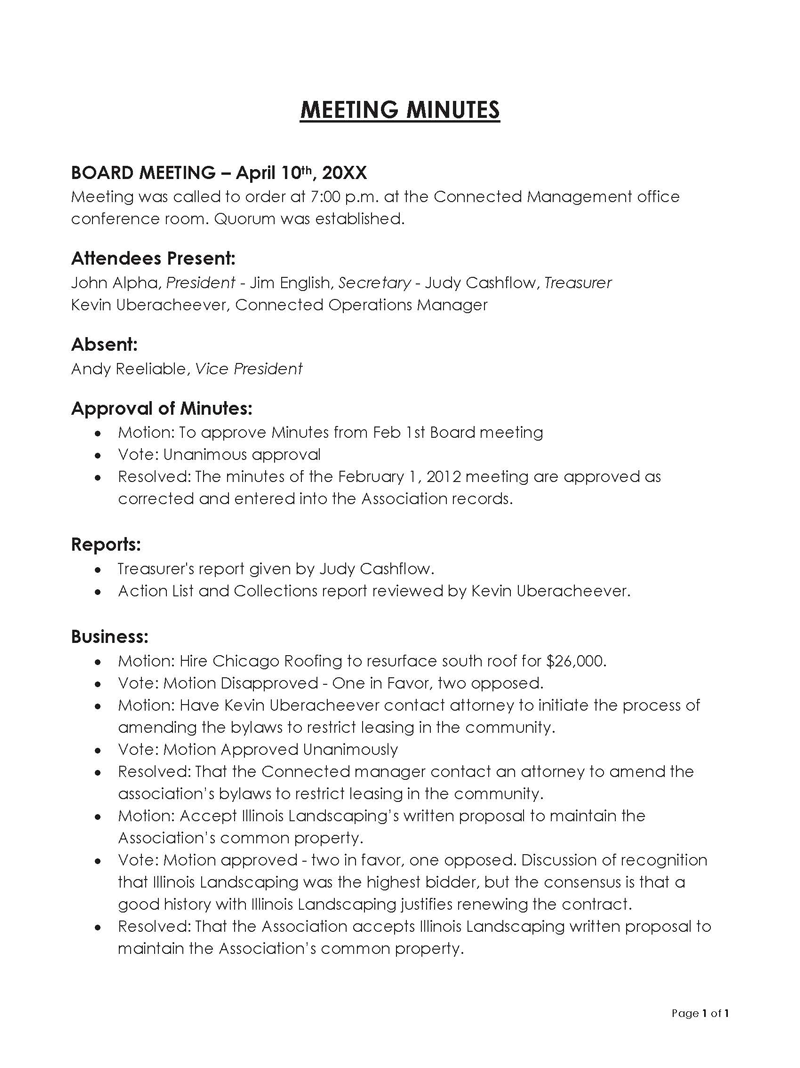

Major decisions

Any decisions that are to be made and have a significant impact on the company should be included in a corporate minutes template. These matters include but are not limited to mergers and acquisitions, new product launches, hiring/firing decisions, and other significant changes to the company’s overall operation.

Action items

It is essential to include all action items assigned to a committee member or an individual in the minutes. For example, to decide whether or not they want to buy a new plot of land, certain members need to meet with real estate agents and apply for loans from banks to find out how much the plot would cost. To make a final decision, the board of directors needs to know who made inquiries and what information they were given.

Vote results

The vote results should be recorded when the board has to vote on a particular matter. This will ensure that all corporate board members are on the same page and have similar viewpoints regarding particular issues or decisions facing the company.

Adjournment

The date, time, and location of the next meeting should be included so that each member is fully aware of their responsibilities at the next corporate meeting. This helps ensure that each member has full knowledge of when and where they will need to arrive for the next scheduled board meeting.

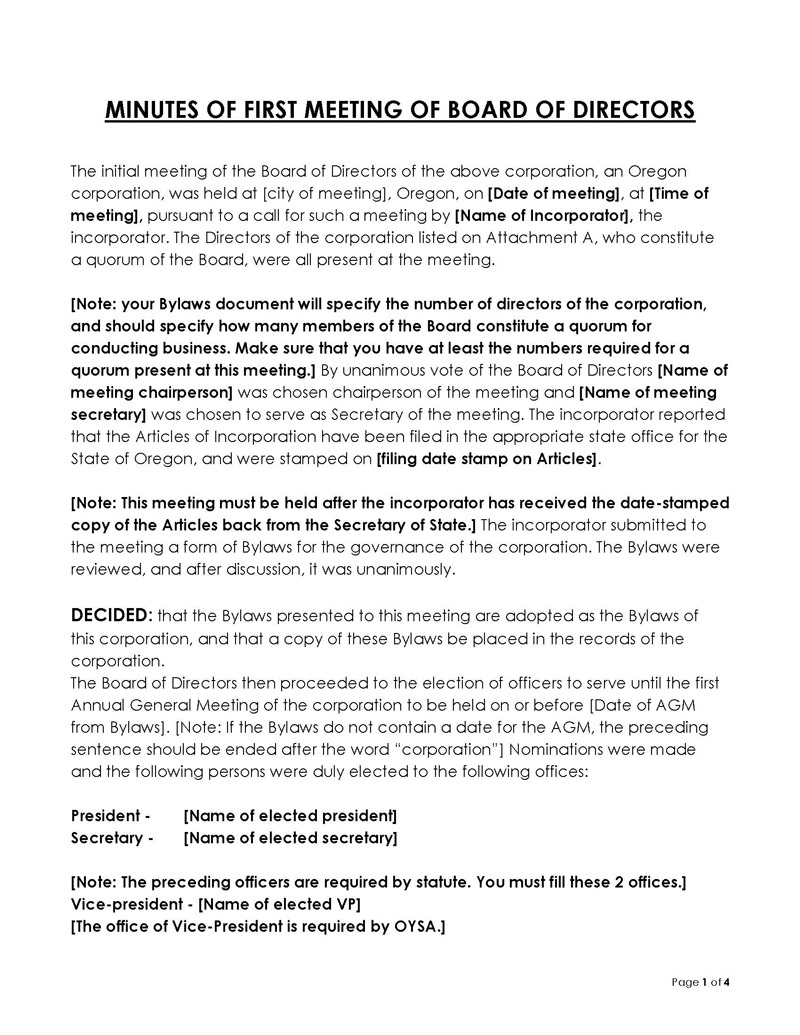

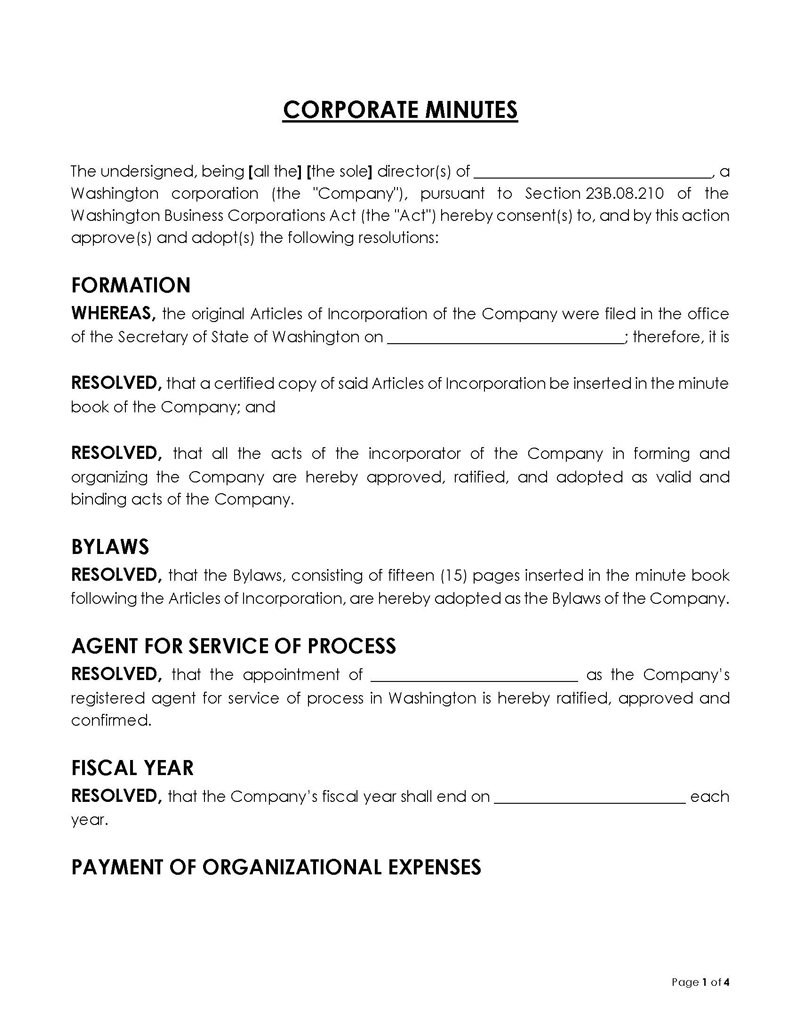

Resolutions

Next, the corporate minutes template should contain any decisions made by the board regarding new policies and procedures. This includes approving the new organizational structure, approving management plans, and reviewing personnel issues.

Meeting minutes should also document the transactions or resolutions made during the meeting. Some of the resolutions that should be recorded in the minutes include:

- New officers’ announcements

- Issuance of new stock

- Purchase or sale of shares

- Financial transactions, e.g., issuing stock, loans, credit applications, new bank accounts, etc.

- Issuance or redemption of bonds

- Purchase of land or equipment

- Pension plan elections or amendments

- Increasing employee salary

- Hiring new employees

Approve Corporate Minutes

All members of a corporate board should agree before approving the minutes of a meeting. This will ensure that each member understands the potential risks associated with specific issues or decisions made at a meeting. Due to the numerous legal and ethical considerations involved in approving corporate minutes, it is important for each member to fully understand their obligations and responsibilities before signing off on official minutes. It is also critical for the secretary to keep detailed records of all action items assigned to a committee member or an individual during the meeting.

When properly approved by all board members, minutes are considered fully official and legally enforceable as evidence against the corporation in a court of law. Therefore, it is essential that all corporate minutes be written in compliance with civil law and business practices.

File the Minutes

Once the minutes have been reviewed, approved by all the board members, and signed by the corporate secretary, the corporate minutes should be kept in file. This can be done by storing the minutes in a physical location, such as filing cabinets or file drawers. It is preferable, however, to store them digitally. This provides a more efficient and easier way of retrieving and reviewing important information, documents, and resources.

Two main methods of storing digital minutes include:

Filing with internal corporate records

This is the most common method of storing corporate minutes and other internal documents. You can create a file folder on your computer and store the digital document there. It is crucial to ensure that all board members have access to these resources so that they can refer to them as an accurate and authentic record of past actions, decisions, and transactions.

Filing with the state (if applicable)

If your corporation is incorporated in a state that requires corporate minutes to be filed, you must follow the state’s requirements. Although several states have specific requirements for keeping records, make sure to check with the corporation’s state-specific requirements.

note

Once the meeting minutes have been reviewed, approved, and signed by the relevant parties, they should be stored with other necessary documents such as its bylaws, incorporation documents, and corporate resolutions. If any member wishes to review the minutes for their purposes, they should request the board secretary to provide them with a copy. Corporations are encouraged to keep their minutes for seven years in the event of an audit. Corporations looking to sell their shares, have a merger or acquisition or begin an aggressive expansion campaign should also consider keeping corporate minutes for a longer duration.

Don’ts

Here are some general rules and advice that should be considered when composing and editing the board minutes:

- The minutes should not be too detailed or voluminous. You want to include all relevant information in the minutes to make it easy for members to understand, follow, and read. These include decisions and resolutions that are important for the company, progress of specific projects, attendance report of officers during meetings, etc. Also, be careful about publishing sensitive information as this may reveal the personal details of individual members. However, the goal is to make the minutes compelling, informative, and as short as possible.

- Do not record or video record the meeting. This is against most state and federal laws. In addition, recording meetings can hinder members from effectively expressing their points of view and may cause conflict between individuals.

- Any privileged information shared within the board room should not be shared with third parties. This is to maintain the trust, integrity, and confidentiality between other board members.

Conclusion

A well-written, approved, and signed corporate minutes will shorten the time needed for board members to review and take action on the most critical information. Furthermore, the minutes provide an excellent source of reference materials for all other company business actions, procedures, and projects.

However, drafting minutes is not an easy task. It takes a lot of time to compose meeting minutes, and it even needs more time to approve and review the content. If you are looking for a way to solve this problem, we recommend you download and use pre-made templates given here. These templates will save you precious time and effort and help you draft effective corporate minutes faster.