A deposit slip is a paper that must be filled out while depositing money in a bank.It serves as a document in which the record of your transaction is kept. It also helps in transferring your money to the place specified by you.

Banks demand documented proof of every transaction, so a deposit slip serves this purpose appropriately. All the details to be mentioned in that slip should be filled in carefully and accurately.

The amount to be deposited or transferred should be written clearly, and the purpose should also be stated. You may feel overwhelmed while filling this slip for depositing a large amount in the bank but it is relatively simple to fill all the information appropriately in the specified boxes.

Some slips are already attached at the end of your checkbook, or they can be taken from that bank branch where you have your account. However, if you do not want to waste your time or feel embarrassed in front of the bank employees, then you should know how to fill the slip.

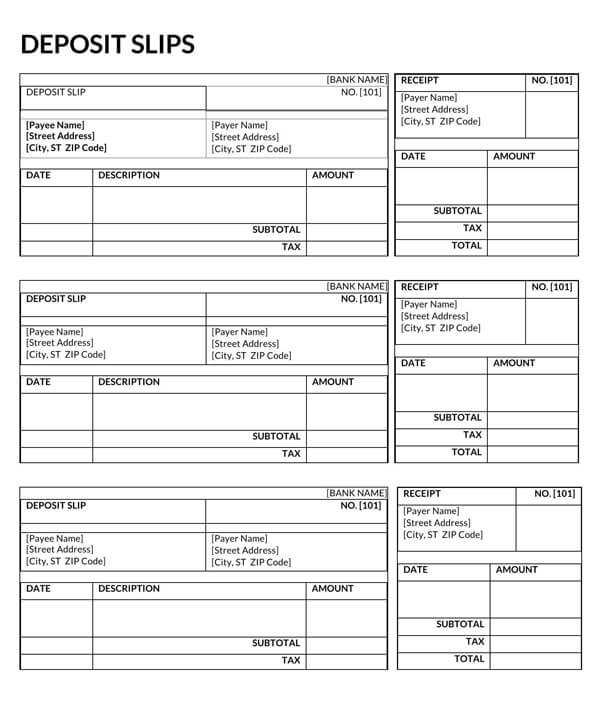

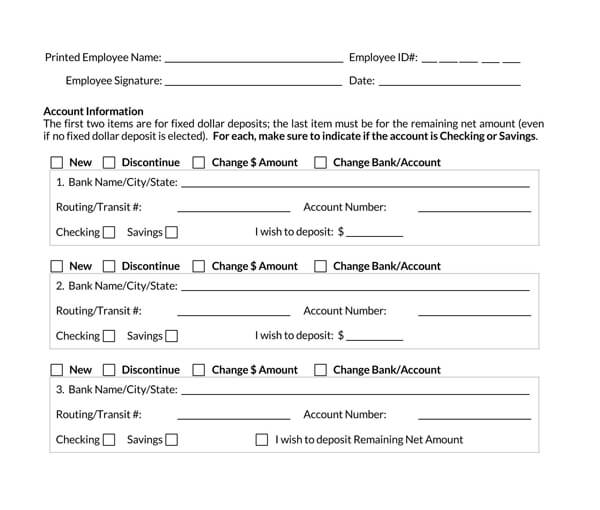

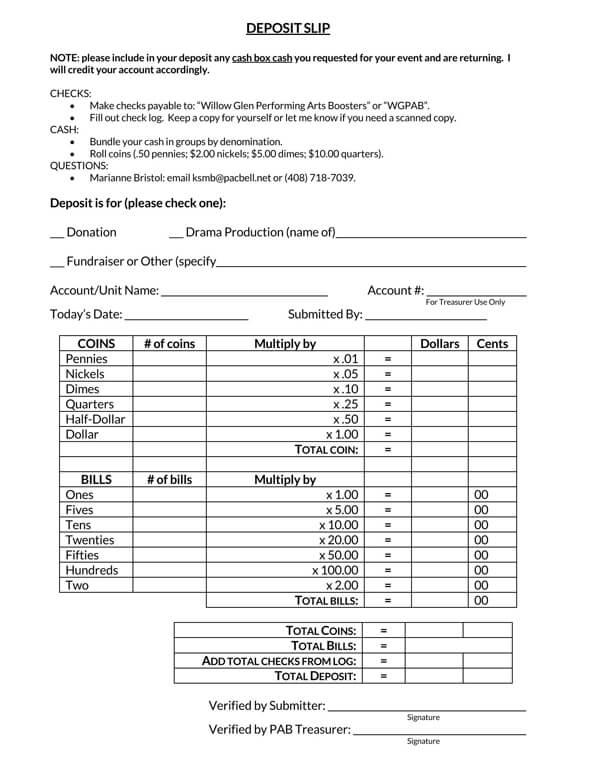

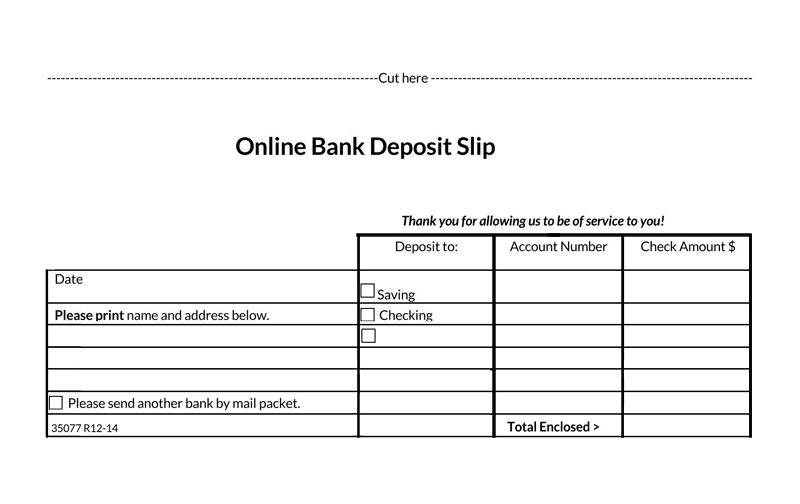

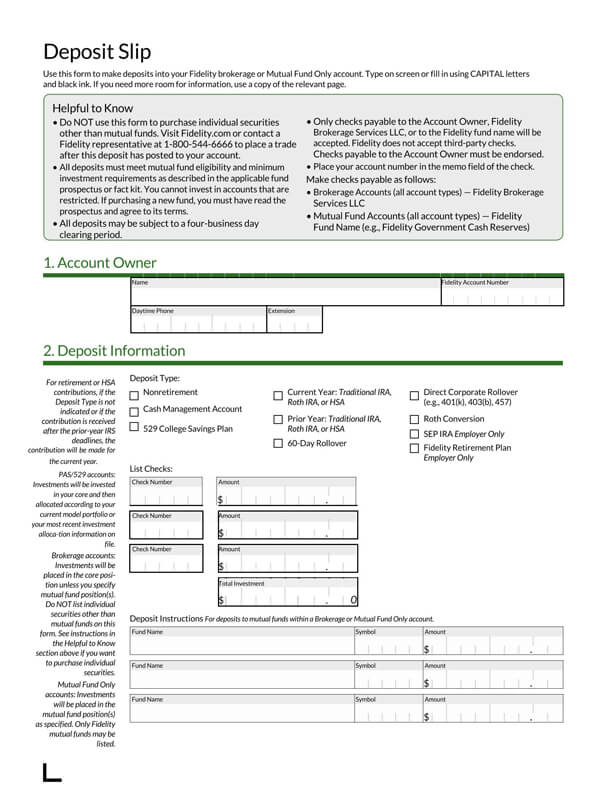

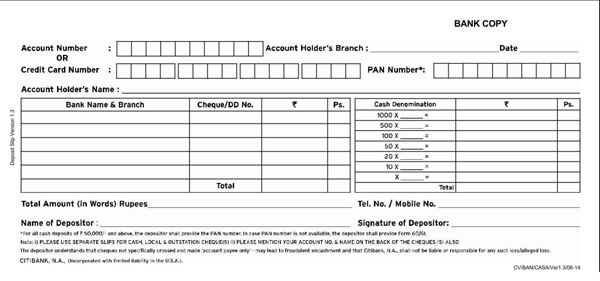

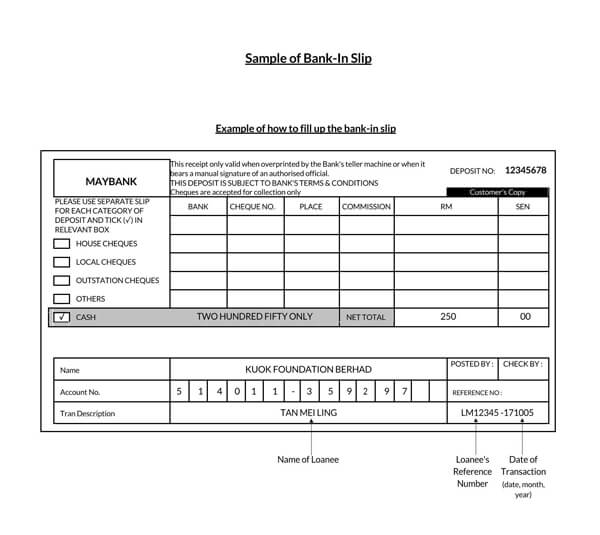

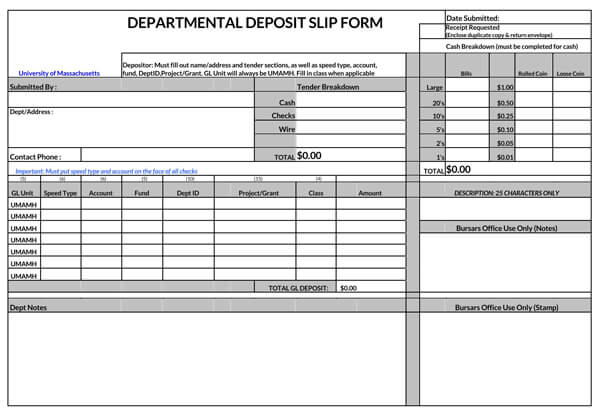

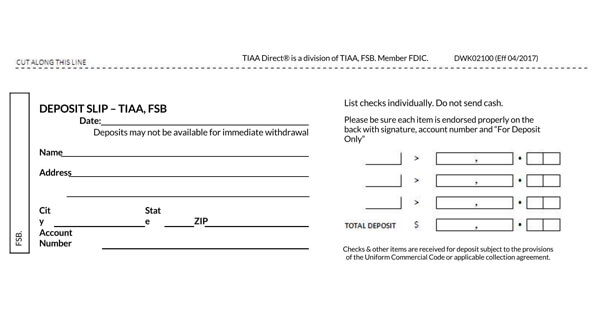

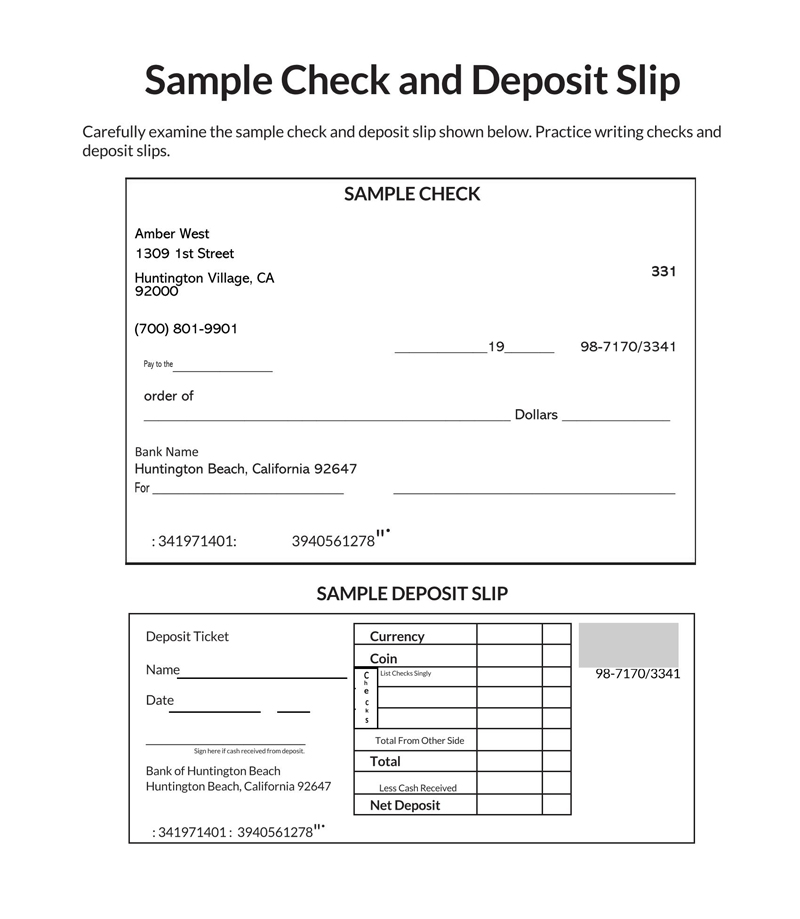

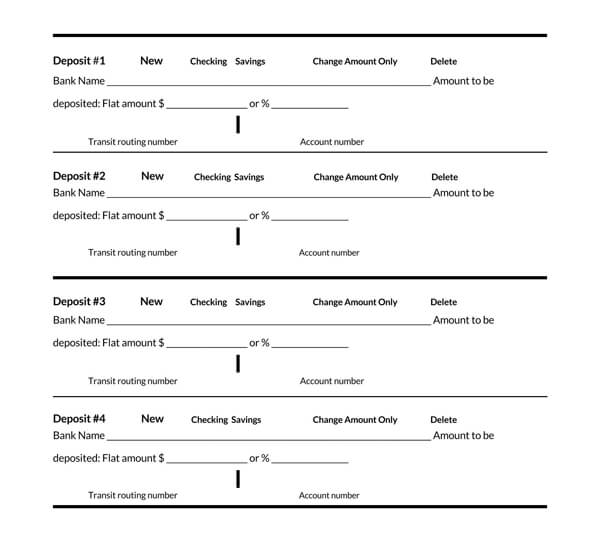

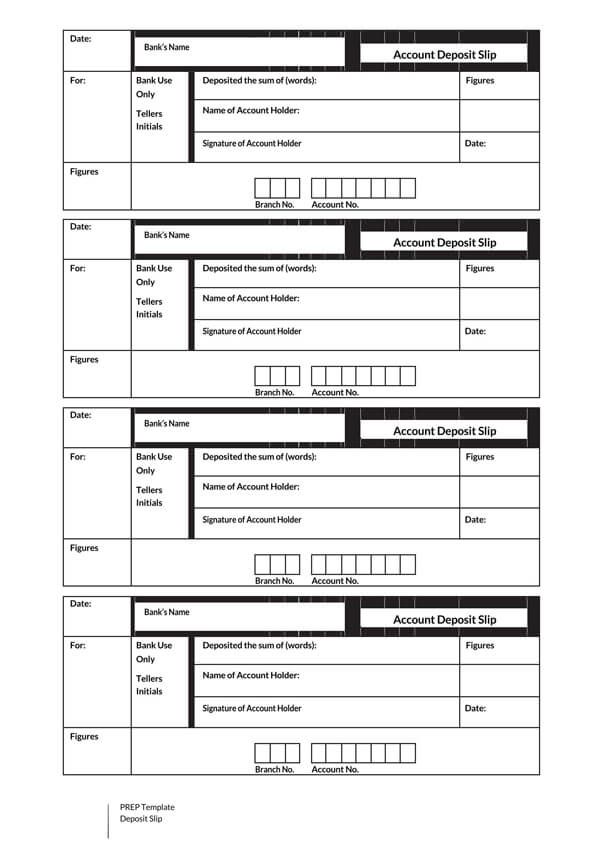

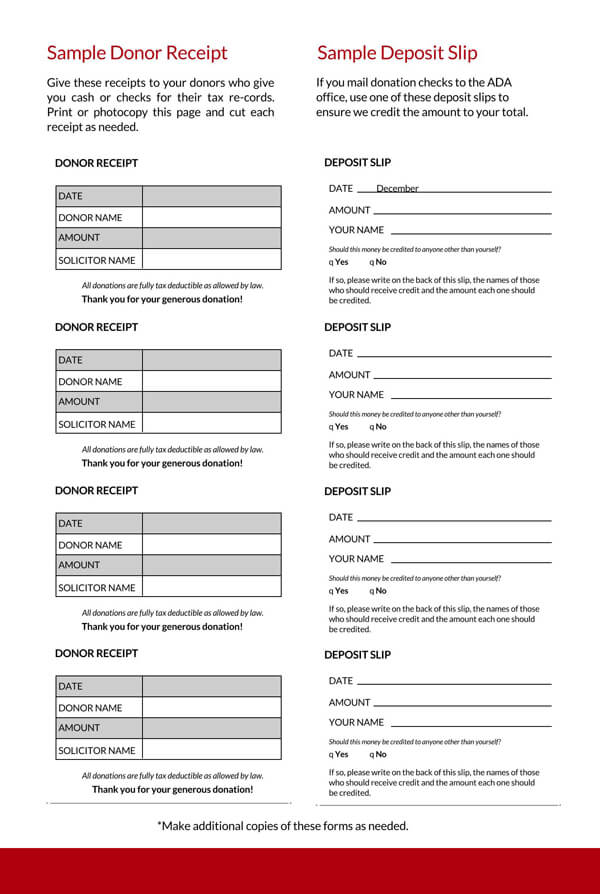

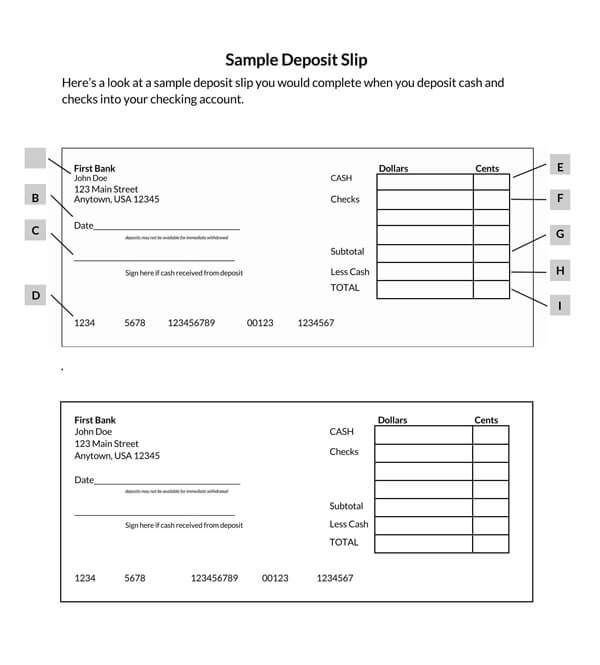

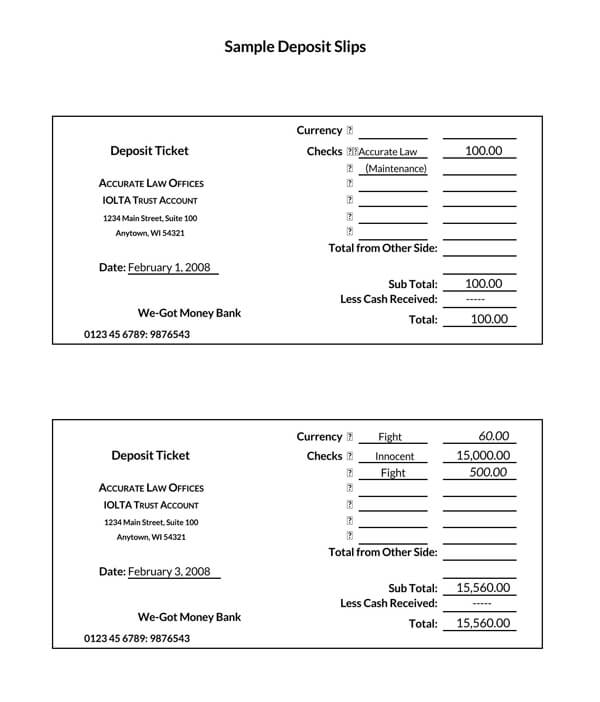

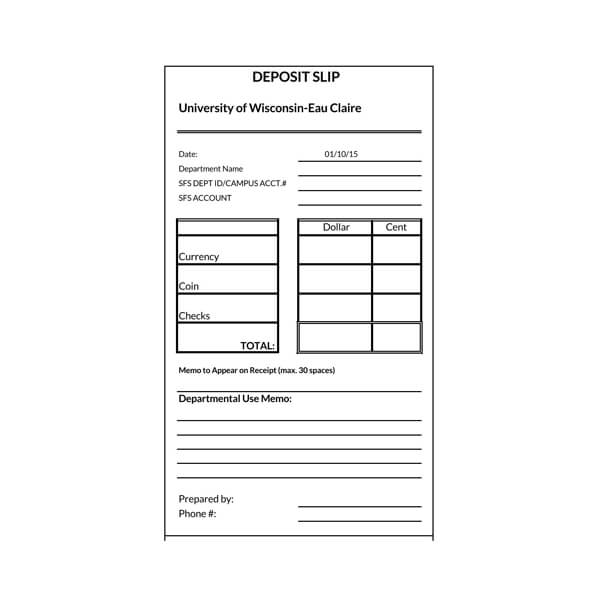

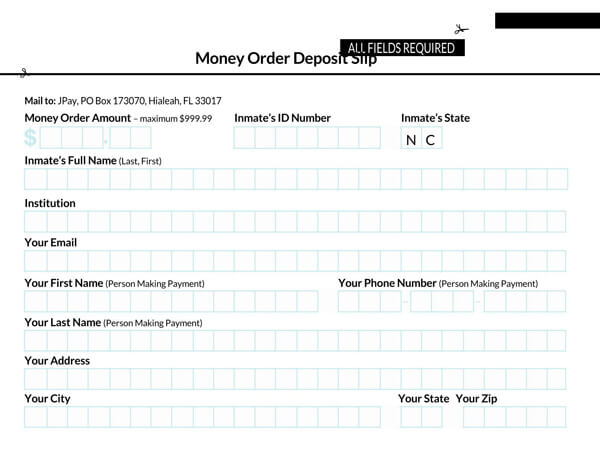

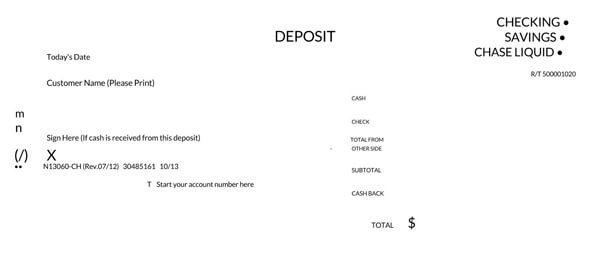

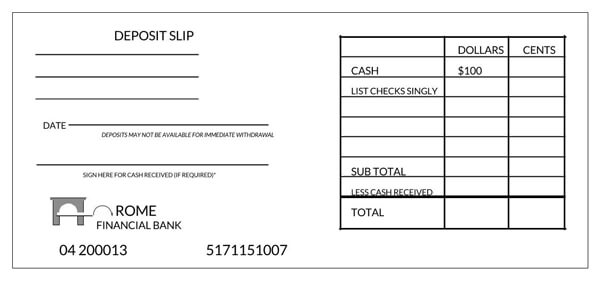

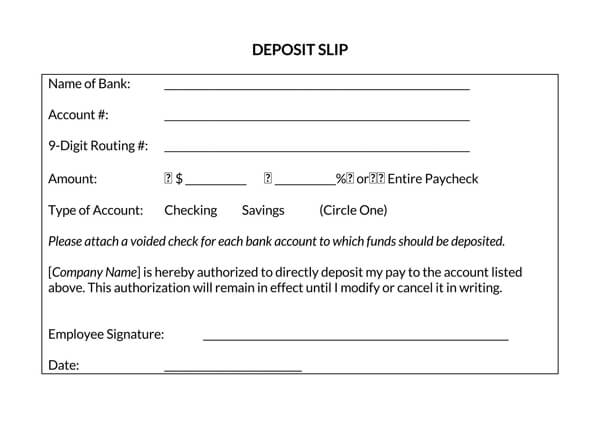

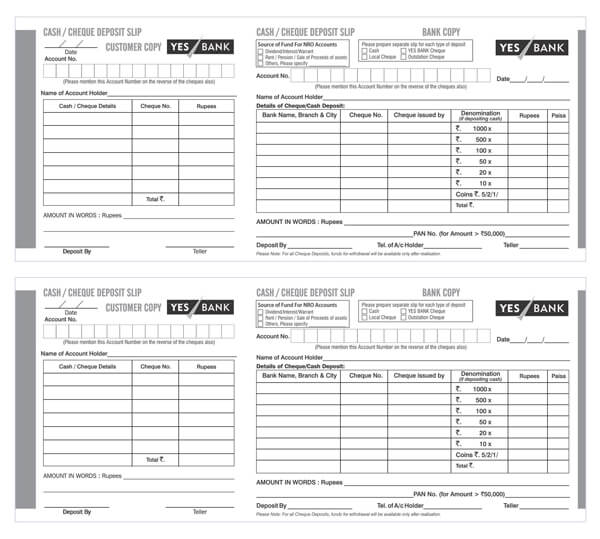

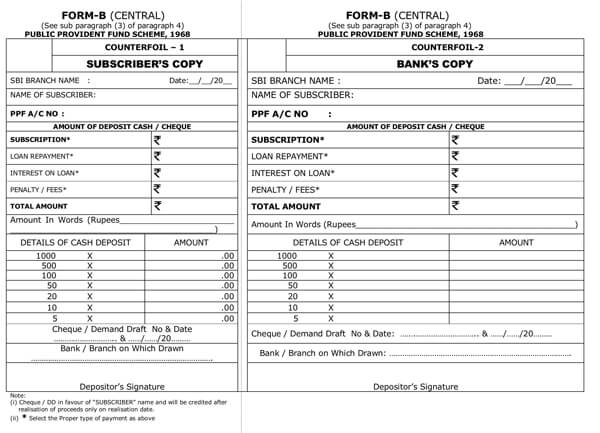

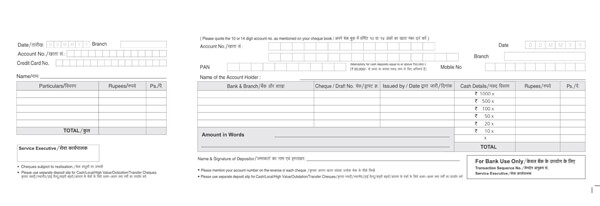

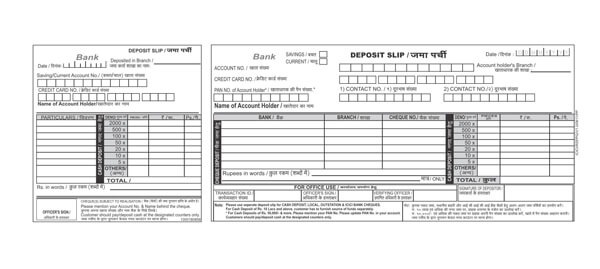

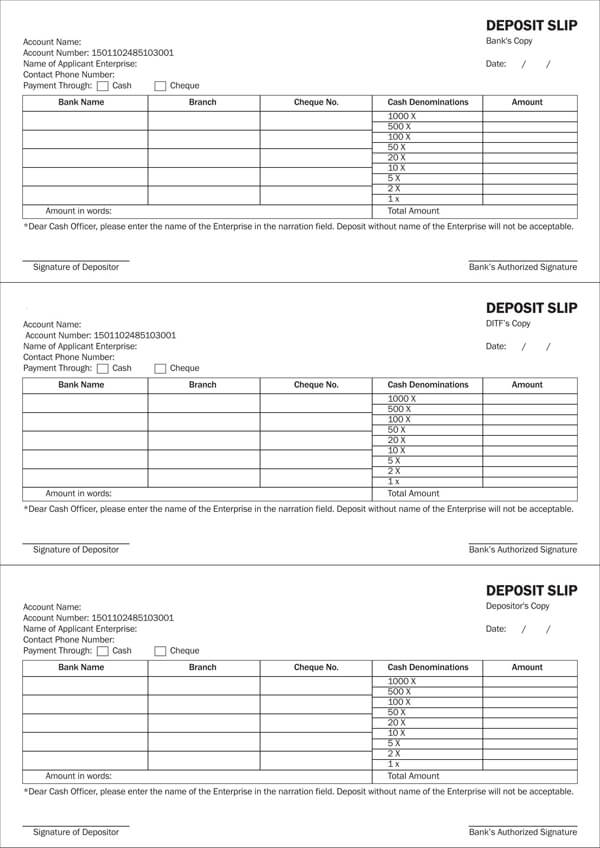

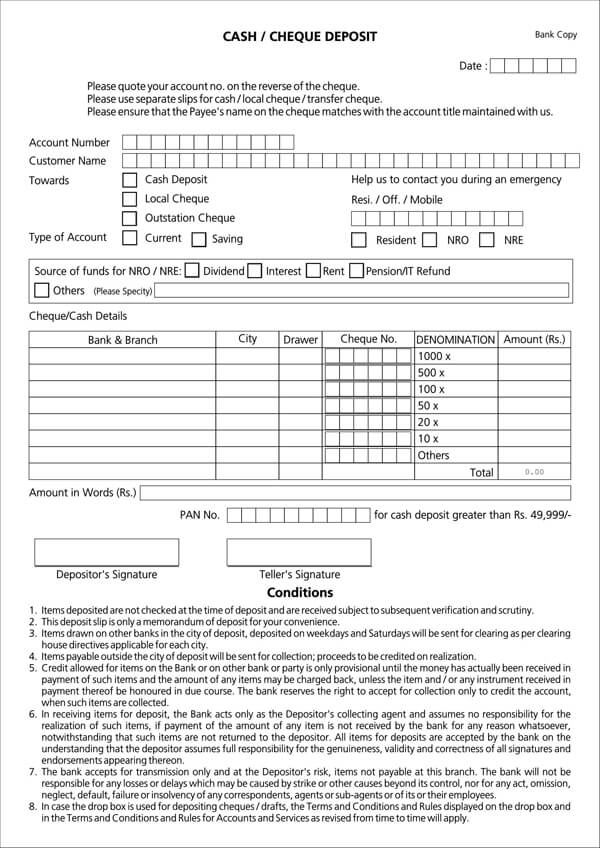

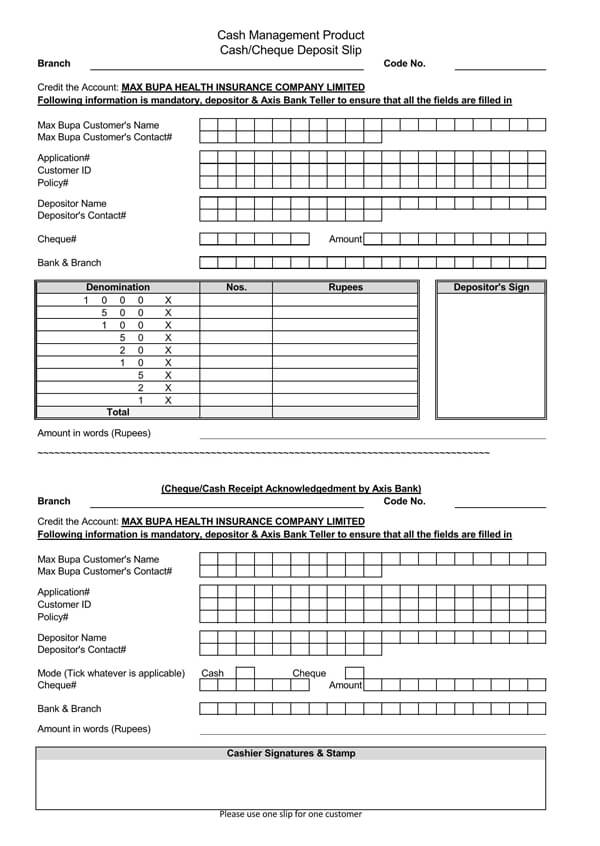

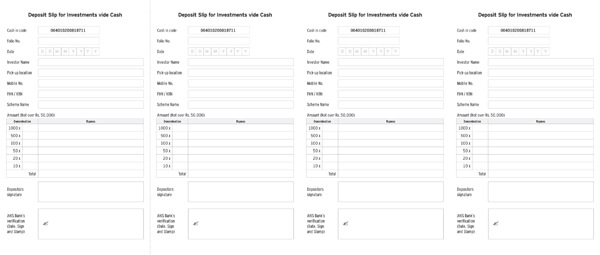

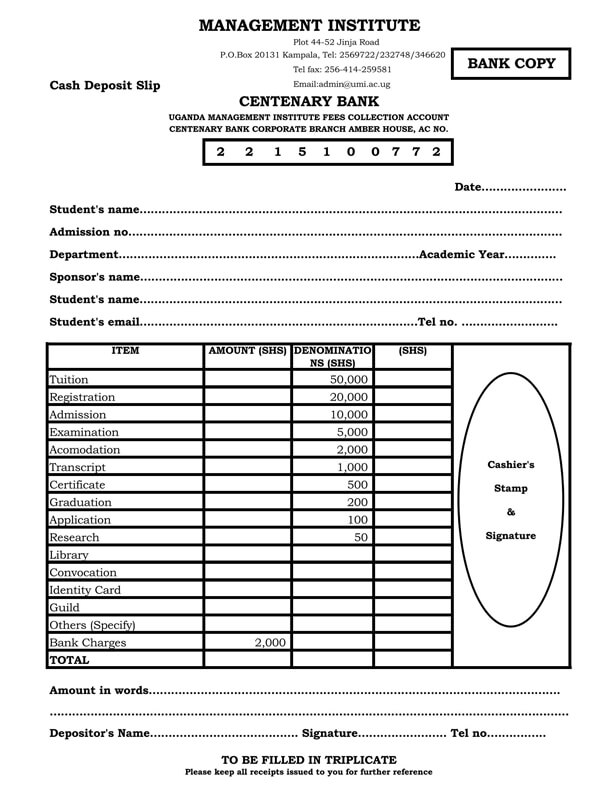

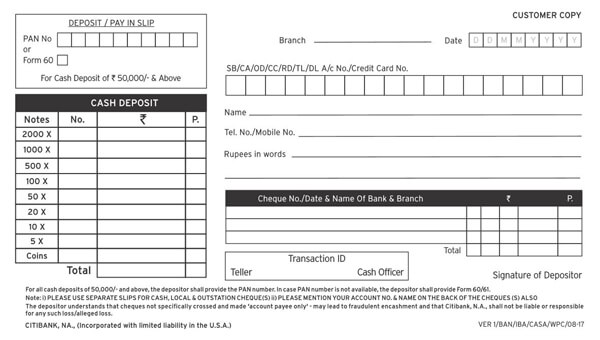

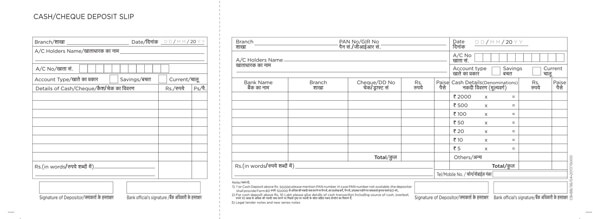

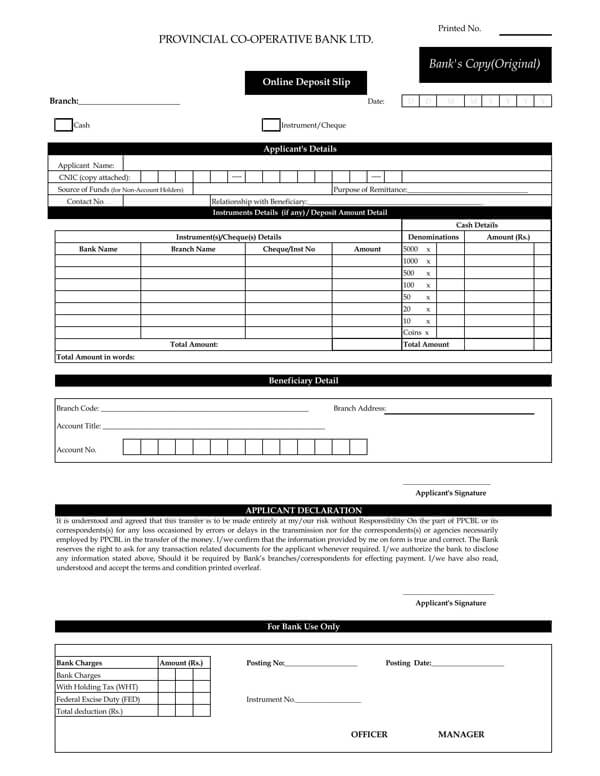

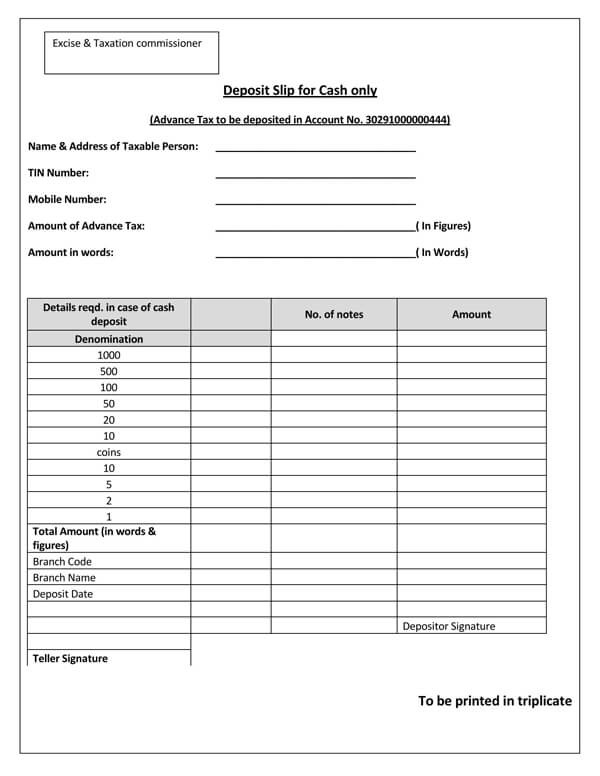

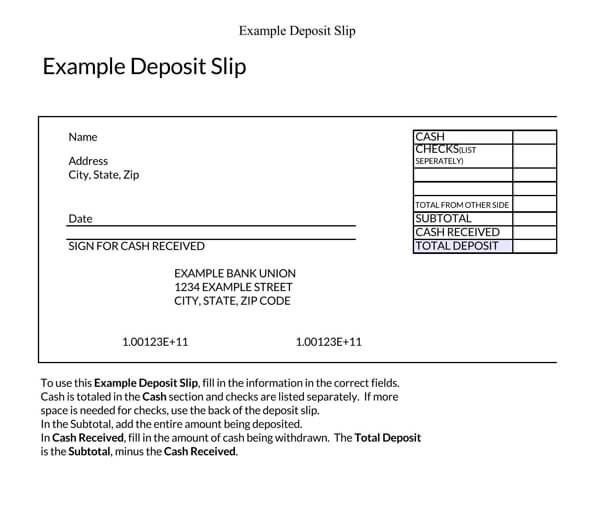

Deposit Slip Samples

Following are a few deposit slip samples to get you an idea of what it looks like. You can also download these and can use them after customization:

Pre Considerations

There are some essential things that you should keep with yourself and the information you should remember while going to the bank to deposit your money.

These things have been mentioned below:

Account information

If you have memorized your account number, then it is good. Still, you should not take a risk and keep your checkbook with you while depositing your money in the bank so that the account number can be mentioned accurately on the slip.

Money gets transferred to the correct account to avoid trouble afterward. You should recheck the account number before giving the slip to the bank accountant. You can deposit your money to keep it as savings in your bank account, so you should remember the correct account number.

Identification document

There can be any unseen problem, so you should prepare yourself in advance. It is always better to carry your CNIC or any other document with your picture while going to the bank for deposit money.

If you are visiting the bank after a long time, the money depositing system of the bank might get updated, and now they may require your identity card from you. If CNIC is not available, you should have those documents which your bank accepts, and you can have this information by viewing the bank’s policy available on their online website.

p.s

Any document on which your picture is present such as a driving license, passport, or university card if you are a student, can be taken along with you while going to the bank.

Take cash and ready checks

Check and count your money more than two times to ensure whether you have kept all the money you want to deposit in a bank or not. On the other hand, if you do not have the cash amount and want to deposit the check in the bank, you should ensure that the check is properly filled and your signature is also present.

You can write “For Deposit Only” on the back of your check. It will ensure that no one can get the cash amount by going to the bank if the check is misplaced. It will keep your money safe!

Bank hours

Different banks can have different bank timings, and the days of working may also vary, i.e., some banks have the holiday of 2 days, Saturday and Sunday, and in some banks, there is only one holiday, that is of Sunday. So you should know whether you will visit the bank during their working days and hours or not. It will save you time.

Some banks also provide drive-through services, but if you are going to submit the slip for the first time, you should choose to go to the bank lobby yourself to get immediate help if required while filling out the slip.

Here are our free downloadable templates for you:

How to Fill Out a Deposit Slip

There are different ways to fill a deposit slip based on the purpose of filling the slip and the bank in which you have your account. The details required by one bank on the slip may vary from that of other banks.

But it is easy to fill this slip, and you can get guidance from bank staff if you face any problems. You should take a final look at your slip before giving it to the bank accountant.

Some of the important information required to fill a deposit slip has been given below:

Personal information

The section of personal information includes your name and account number. You should make sure that you write the accurate spellings of your name, and you should confirm the account number from your checkbook while writing it on the slip.

If the slips are available with your checkbook, your personal information is already mentioned. On the other hand, if you want to transfer the money to another account, you will have to write another person’s name and account number.

Additional information

Along with personal information, some other information is also required, including different things. While filling out the slip, mention the date you deposited the money. Some bank slips may require writing down the branch name in which the money should be deposited.

Total cash amount

If you want to deposit a cash amount in your bank account or to the account of any other person, then you should write the total number of the amount to be deposited or transferred to another account. The digits of your amount should be written in separate boxes available in this section.

note

You can leave this line empty if you do not want to deposit the amount in cash.

Individual check details

If you have more than one check which is to be deposited, the details of each check should be mentioned separately in the specified lines. For this purpose, the amount of every check should be filled separately on the slip. There is a space for entering the check number on the slip, which means a proper place for every check is available for your personal use and the bank’s use.

If there is not sufficient space available, you can use the backside of the slip to enlist the details of other checks. Finally, in the end, you should mention the number of check details present on the front side of the slip and the number of check details present on the backside of the slip so that any information might not get misplaced in any case.

Sub-total

This section includes the total cash amount and the amount mentioned on the check. If you have deposited a single check, then the total amount and its subtotal will be the same. If more than one number of checks are to be deposited, you will add up the individual check amounts and then write the sub-total.

p.s

If you have already received any cash, you should subtract that amount from the subtotal.

Cash withdrawal amount

You need to fill this section if you want to have some cash from the total deposited amount. It can be helpful for you if you have deposited a check and want to have the cash amount at that particular time.

Total deposit

The remaining amount after subtracting the cash amount received by you comes under the total deposited amount in the total deposit.

Signing the deposit slip

Your signature is very crucial while filling out a deposit slip. It will make the bank verify that there is no scam, and you verify the slip.

Tips to Keep in Mind

Here are some more points that should be kept in mind while filling out a deposit slip to avoid any misunderstanding:

Write with a pen

To fill a t slip you should use an ink pen or a ballpoint. The use of a pencil should be avoided; it does not leave a good impression. Moreover, the information mentioned by you will be kept safe, and no one would be able to make any changes to it. The numbers will be visible to the bank accountant.

p.s

If you have made any mistake while filling out the deposit slip, you should not worry about it. You can take a new slip and fill it out appropriately.

Legible writing

All the information listed on the slip is crucial and should be visible to the accountant. You should fill the slip in simple, neat, and clean handwriting. Neat handwriting will help in avoiding any sort of mistake during transactions. The date of submitting the slip should also be mentioned to have an appropriate record.

Deposit details

There are separate boxes for writing the amount you want to deposit in the bank. The total amount of cash to be deposited should also be carefully written at the specified place. If there are more than one check, then there is appropriate space available on the slip to write the details of all checks appropriately.

p.s

You can also use the backside of the deposit slip if the front side is not sufficient to list all the details.

Enter deposit amounts in dollars and cents

You should prefer to write the amount to be deposited in dollars and cents. There are separate boxes for writing each digit on the slip. The cents which constitute the decimal part are written on the extreme right side, and after that, the amount in dollars is written on the left side. Make sure that you place the commas and decimal points in the right place.

Using the backside

The backside of the slip can also be brought under your use if required in any case. If the amount of information is more than the accommodating capacity of the front side, then some part of the data can be filled on the backside of the slip. Extra boxes are also available on the backside of the slip for such use.

Take receipt

After completing all the processes of depositing your money in your bank account, you should take a receipt from the depositor. Make sure that the name of the bank should be written on the receipt. In this way, you can keep a record of all the transactions. Moreover, any sort of error can be avoided by accurately knowing the exact amount you have in your bank account.

Use notations

It is essential to keep a record of all the transactions by yourself and the bank receipts. By using this strategy, you can have an idea about your spending and savings simultaneously. You can also download your bank’s application from the online store to check the available funds in your account at any time.

You may also prefer to write the financial savings in your diary or any notepad from where you can easily see them.

Funds availability

Every bank has its funds availability policy. The deposited amount can be withdrawn or used after a specified period of time, which may vary from bank to bank. For this purpose, you should ask the accountant when you can use the deposited amount while depositing the cash amount in your bank account. You should also keep in mind that your check can also not get cashed immediately on the spot; this process also requires some time.

Frequently Asked Questions

It is signed when you want to get some cash out of the deposited amount from your bank account. It is not required to sign the deposit slip when you are just depositing your funds and do not require any cash amount back, and signing the slip is also not required while depositing money through the ATM.

Usually, the routing number is written at the bottom of your slip. Your account number will also be mentioned if you are using the printed slip. There is a specific routing number on the slip while depositing your funds. You should make sure that the same routing number is written on the slip when you transfer the amount to another account or if you want to withdraw it for your own requirements.

If you are depositing money online, then a deposit slip is not required. However, you need to ensure that the routing number, account number, and the amount to be deposited are mentioned accurately. Different banks have set varying limits for making deposits through mobile, so you should know what that limit is for your bank. It will help you to avoid any trouble on the spot.

It depends on the bank’s policy whether they have such settings in their ATM machines by which a check can be deposited or not. So you should have prior information whether your bank’s ATM accepts checks or not.

The cash can be deposited through an ATM, but this policy varies for all the banks as some banks’ ATMs accept deposited cash and other ATMs do not. So you should get this information from your bank before trying to do it yourself!