It’s a good idea to have a lease agreement before renting a property in Indiana. The agreement is a binding contract between the landlord and tenant for a particular time. It’s important to understand that the agreement does not transfer ownership of the rental property from one party to another. Instead, the lease sets out specific terms and conditions for renting the property. Consequently, the lease sets out the landlord and tenant’s rights and obligations. Both parties should read the lease carefully and make sure that they agree to all of its terms.

A lease agreement in Indiana will typically outline the following:

- The names and contact details of parties involved in the agreement (this could be an individual or a group)

- The property that will be rented out (description and address)

- Details regarding pet allowance within the premises

- The term of the lease

- Amount to be paid as rent and payment schedule

- Lead-based paint disclosure

- Any deposits required by either party, including security deposit.

The agreement should be drafted to suit the requirements of landlord-tenant laws within the state specifically; otherwise, it would be unenforceable. Each state has its unique requirements, and as a result, discrepancies should be expected between the agreements in Indiana and other states.

This article discusses the different types of lease agreements in Indiana and the critical clauses that should be included in them.

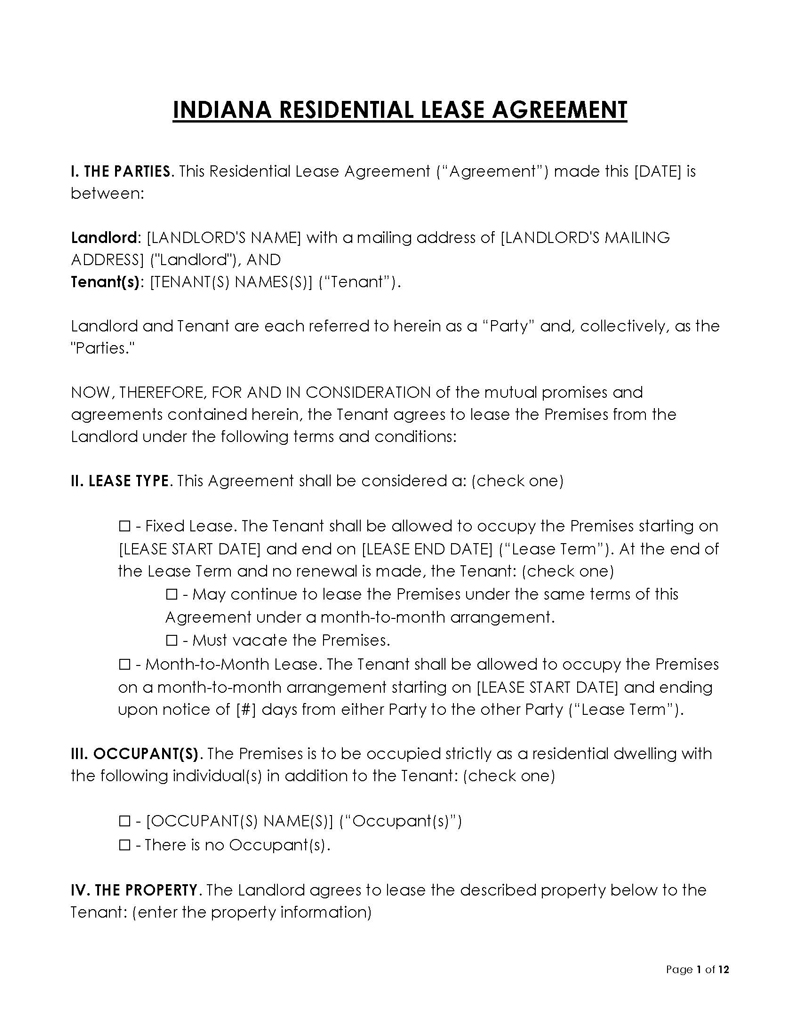

Indiana Lease Agreement

The Indiana lease agreement (ILA) is a legal document that defines the lease terms between a landlord and tenant.

These agreements are used when individuals wish to enter into a contractual relationship. The ILAs typically specify the length of time for which it is valid, the commencement date, rent payment arrangements and payment deadline dates, deposit requirements, late fees, notice requirements for termination of tenancy, etc.

The Indiana Residential Landlord-Tenant Act includes guidelines on making a valid agreement. Title 26, Article 1, Chapter 2.1 dictates the regulations of commercial leasing, while Title 32, Article 31 (Landlord-Tenant Relations) governs residential leasing.

Indiana Lease Agreement Types

The ILA is a legally binding contract between a landlord and a tenant and can be used in different rental transactions. This results in distinct agreements that serve the same purpose but have different stipulations to match each specific situation.

The following are the various lease agreements landlords and tenants utilize in Indiana:

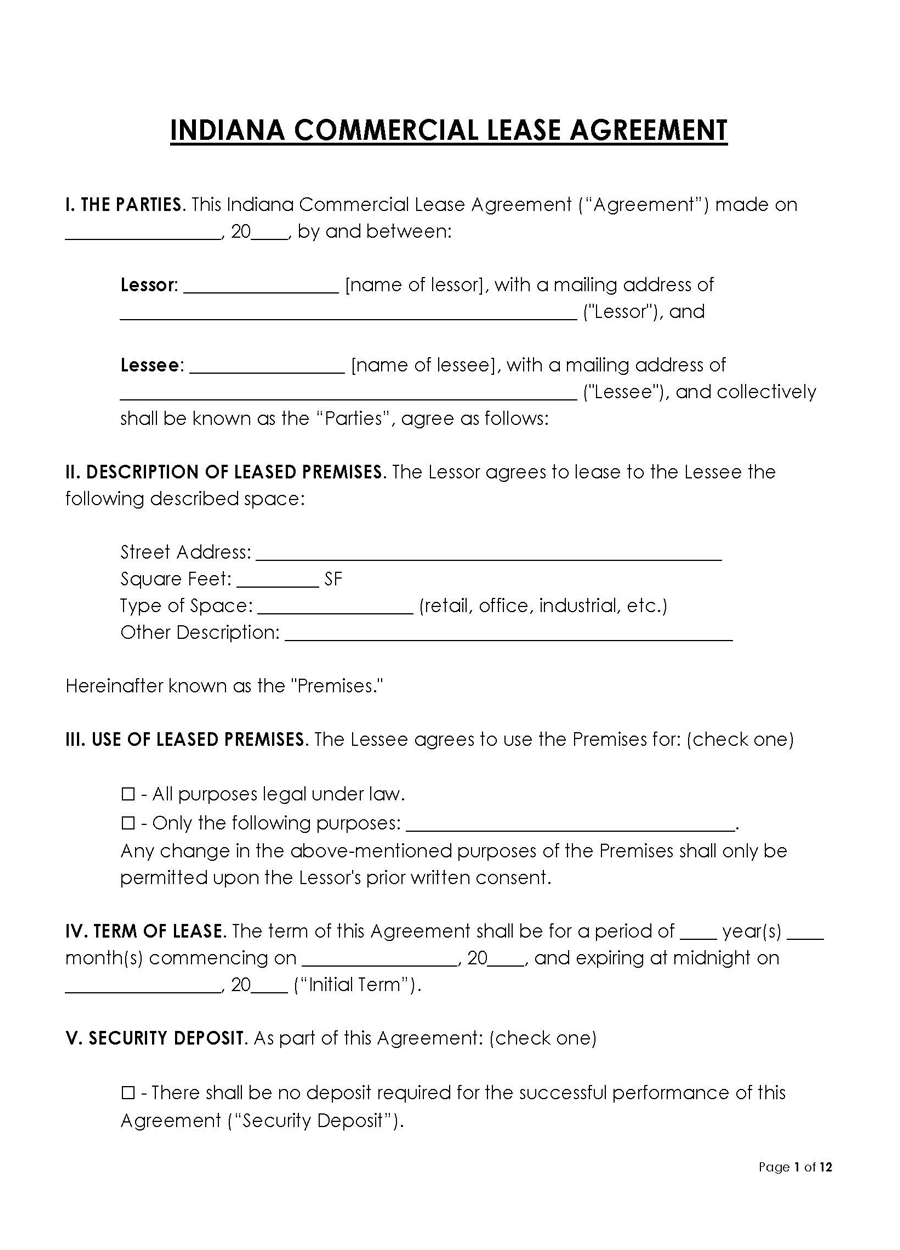

Commercial lease agreement

Commercial leases are used when a property owner rents out an office, retail space, or other commercial units to tenants. These leases typically set out what is included within the lease, its validity, and the rent payment terms. They are more detailed and should thus be reviewed by an attorney before signing.

Month-to-month lease agreement

This agreement is where the lease terms are agreed upon between the parties for an indefinite period. As a result, the agreement is automatically renewed every month until either party issues a notice of termination, which should be given 30 days before the termination date. This agreement allows parties to change the terms of their tenancy. This can be used when an individual wants to stay on the property for a short period or is unsure of how long they will stay and thus does not want to commit to a long-term contract.

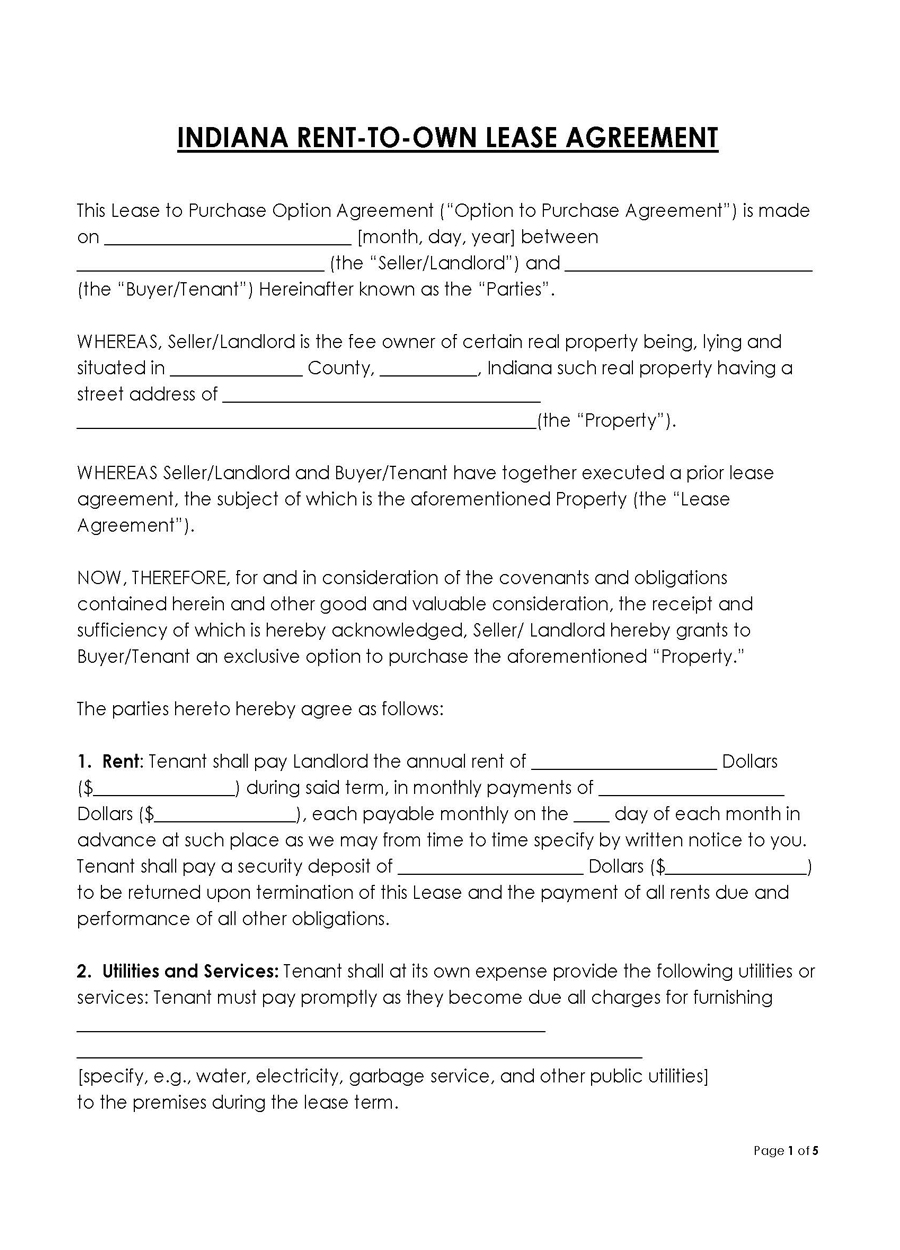

Rent-to-own lease agreement

A rent-to-own lease allows parties to rent the property for a certain time (typically between one and five years). At the end of this time, the tenant has an option to purchase the property at a predetermined price. This is typically an excellent option for young people who may not be able to afford a substantial down payment on the property yet and families that would like to own their home but do not have sufficient income.

Roommate lease agreement

These agreements are used when two (or more) individuals rent a property together. As a result, roommates may have different rights and obligations under the agreement depending on how much they are paying for rent and whether or not they share common areas on the property. Note that this agreement is between the roommates, and thus, the landlord is not a signatory. However, often, one roommate will be the signatory to the central ILA.

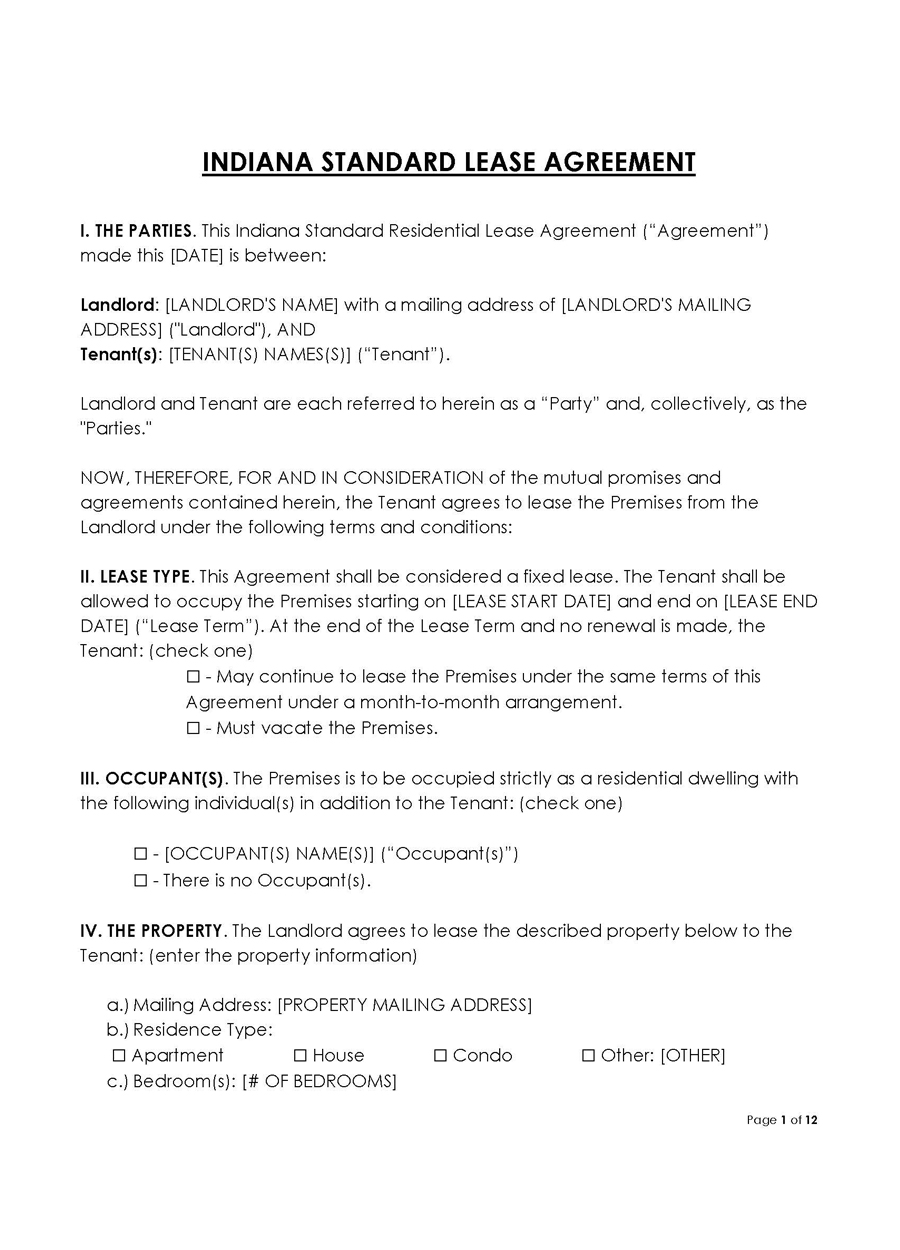

Standard lease agreement

This is the most common type of agreement utilized in Indiana. Typically, it is used for fixed lease terms, often 12 months (1 year), but can be longer or shorter as agreed upon by the parties. It sets up the general parameters of the arrangement between landlord and tenant, including payment terms, deposit requirements, and other vital details. The standard agreement should be used when a landlord or tenant does not want to create a specific agreement for each situation.

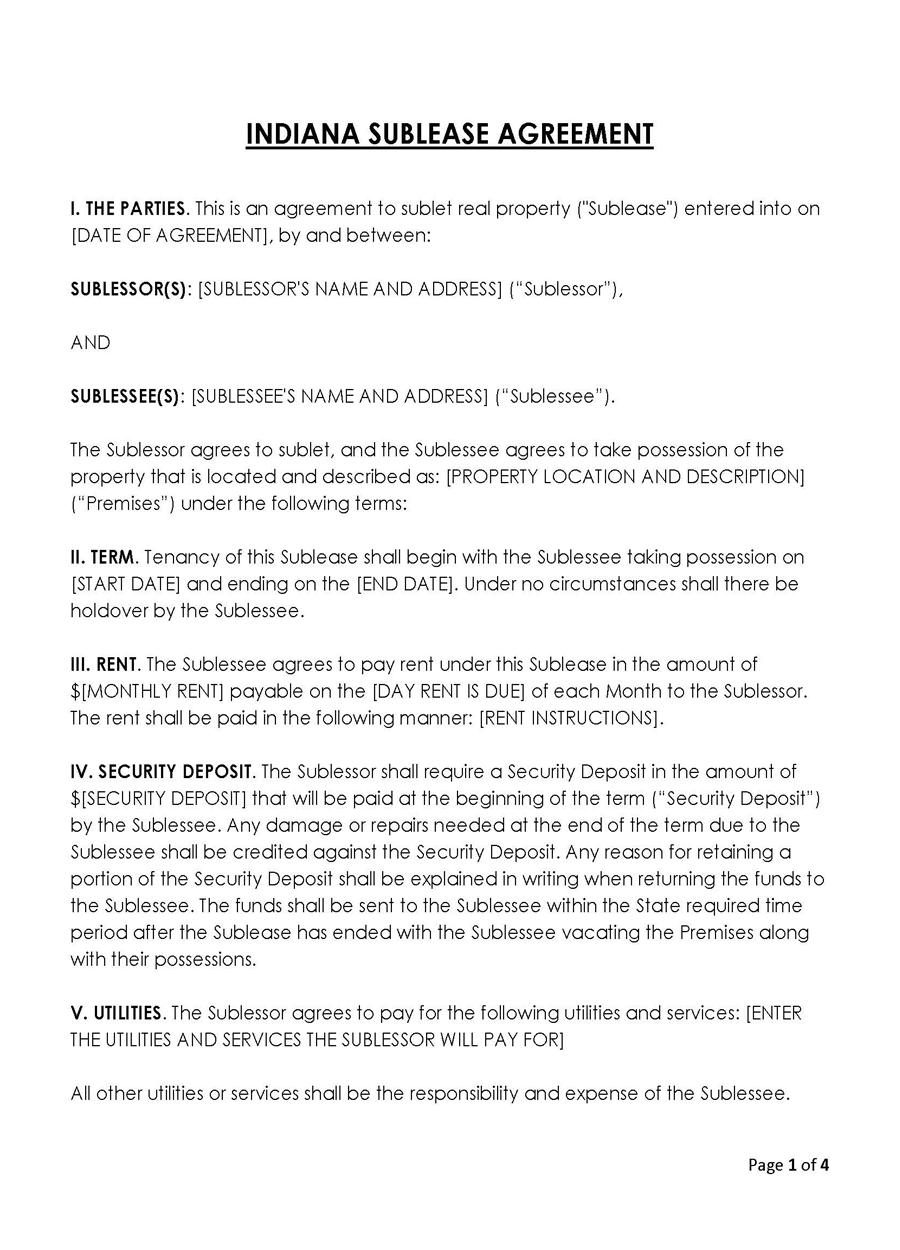

Sublease agreement

These are used when an individual who has already signed the agreement with the original landlord wishes to rent out their unit to a third party. These agreements need to be approved by the landlord in writing. A sublease agreement will often contain the clauses in the original lease because the sub-lessor remains obligated to the initial lease.

Indiana Lease Agreement Disclosures

The agreements occur when there is an offer, acceptance, consideration, and intention to create legal obligations on both sides. It is thus essential that all parties meet the legal requirements and make certain disclosures to comply with federal laws.

The following are general provisions typically included in the agreement in Indiana:

Landlord’s name and address

Any party renting out property in Indiana is obligated to disclose their name and address in the agreement. This information is meant for any future correspondence sent by the lessee/tenant, such as notices. Should these details change in the future, the landlord is obligated to notify the tenant immediately.

Flooding

A flooding disclosure is expected for all rental units whose lowest floor is below the 100-year frequency flood elevation. This elevation is determined by the Natural Resources Department, FEMA (Federal Emergency Management Agency’s) Flood Insurance Rate Maps, or Local flood maps approved by FEMA.

Lead-based paint

If the property was built before 1978, the landlord must disclose any possible presence of lead-based paint in the unit and surrounding areas. The landlord should fill out a lead-based paint disclosure form, attach it to the agreement, and issue an EPA (Environmental Protection Agency) pamphlet detailing the dangers of lead-based paint and other records and reports.

In addition, a building-wide evaluation report should be provided for a multi-unit rental property with common areas.

Smoke detector

The agreement can have smoke detector disclosure if opted. The disclosure should indicate that the tenant ascertained there is a functional smoke detector in the rental unit.

Move-in checklist

Landlords are advised but not mandated to provide the tenant with a move-in checklist to record the rental unit’s condition before occupancy. The checklist can be consulted when the tenant is moving out to identify damages to property caused by the tenant and negligence. The checklist can be attached to the agreement or created as a separate document.

Late and returned check fees

The agreement can include a disclosure outlining any applicable fees the landlord will impose for late-payments and bounced checks. There are no stipulated limitations as to how much the landlord can charge, but a reasonable amount, typically not over 10% of the rent, is considered acceptable.

Additionally, the fee must match the expenses incurred by the landlord as a consequence of late payment. The disclosure must also clarify that late fees are applicable only after the stipulated due date in the agreement.

Shared utility arrangements

Shared utilities can be a source of contention. Therefore, landlords can include a clause in the agreement stating how utilities will be shared and how associated costs will be covered. This is reflected in the form of a utility cost disclosure statement.

Bed bug disclosure

If a bed bug infestation has previously occurred on the premises, the landlord should make a bed bug disclosure. The information must include the following details: the date of infestation, how many infested units were present in total and how many were eradicated at that time, who eradicated them and when and how much was paid to get rid of them. The disclosure should also outline the protocol for handling future infestations and obligate the tenant to report any signs of infestation promptly.

Asbestos disclosure

The agreements can contain asbestos disclosures if the property contains asbestos material and all buildings built before 1981. Asbestos-containing materials include insulation, drywall, or floor tiles made with asbestos and other substances known to cause cancer.

The disclosure should encourage the tenant to avoid disturbing asbestos through sanding, modifications, pounding, etc., without the landlord’s consent. The tenant should also be obligated to notify the landlord should any walls and ceilings start to deteriorate.

Mold disclosure

The landlord is expected to disclose any prior mold infestation, measures taken to lessen the infestation, and how much was paid for eradication. In addition, the disclosure should indicate the current mold status on the premises to protect the landlord from future liability in case of mold damage. The disclosure must also outline the tenant’s obligations to prevent mold infestation.

EXAMPLE

The tenant should be informed to avoid excessive water leakage or moisture, leading to a future mold infestation.

Landlord and Tenant Laws

Indiana rental laws mainly focus on ensuring that landlords and tenants act appropriately towards each other. The law ensures that both parties fulfill their obligations and do not take advantage of each other.

EXAMPLE

The tenant needs the property to be habitable, while the landlord needs their rent paid regularly. The law is generally in favor of the landlord; however, the tenant may be protected in some instances.

Examples of stipulations of Indiana landlord-tenant laws:

EXAMPLE

Security deposit

Tenants are entitled to a security deposit refund if the property is in “good order” when moving out. The security deposit ought to be refunded in full. As a result, landlords cannot use the security deposit to cover expenses that are considered normal “wear and tear.”

Right of entry

Landlords are prohibited from entering the premises without prior notice to the tenant. This provision is applicable for the entire duration of the lease.

Indiana Lease Agreement

Key Takeaways

- Indiana lease agreements are legally binding if the terms have been put into writing, agreed on by the parties, and signed by both parties.

- Residential lease duration will typically be no longer than three years. More extended residential lease agreements are expected to satisfy additional requirements to be enforceable.

- Lease agreements in Indiana don’t have to be notarized to be enforceable. However, the lessor and lessee can decide whether or not to notarize the agreement.

- Indiana lease agreements will automatically terminate at the end of the lease term without advanced notice. However, the agreement can be automatically renewed at the end of the tenancy if the parties agree.