In buying and selling houses, most people would initially consider the mortgage route, which requires a good credit score and an amount of cash for an initial down payment. Although this is the best way to purchase a new house, there are alternative routes that can put you on the part to becoming a homeowner besides that. A rent-to-own, sometimes called a lease-to-own, is one way in which you can begin the homeownership process. The following is a rundown of everything you need to know about this agreement.

It is a contract between a homeowner willing to sell the property and a buyer willing to lease the property.

It is a deal in which you pledge to rent a property for a specified amount of time, with a plan to buy said property before the specified time runs out. There are two parts to this agreement; there’s the standard lease agreement for a property, and also there’s the option to buy the property after some time.

As a reference, it is known by other names:

- Rent-to-Own Contract

- Lease Option Agreement

- Lease-to-Own Agreement

- Lease with the Option to Purchase

- Lease-Purchase Contract

- Option to Purchase Agreement

- Contract-to-Deed Agreement

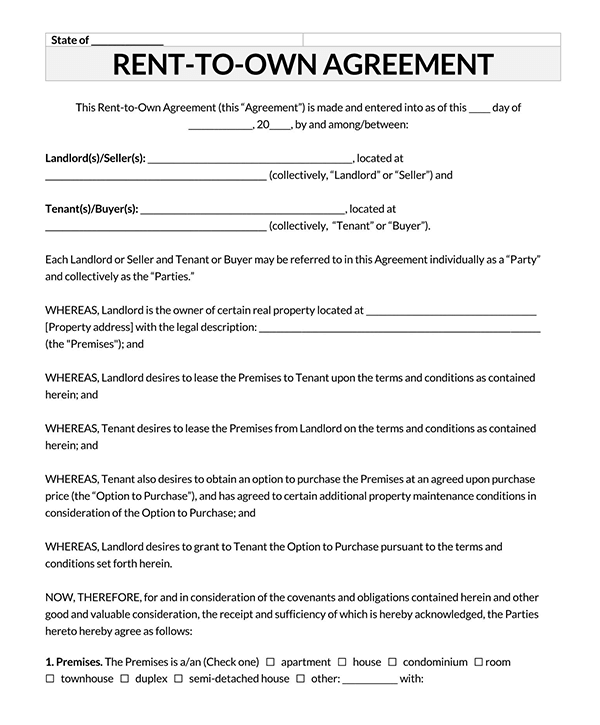

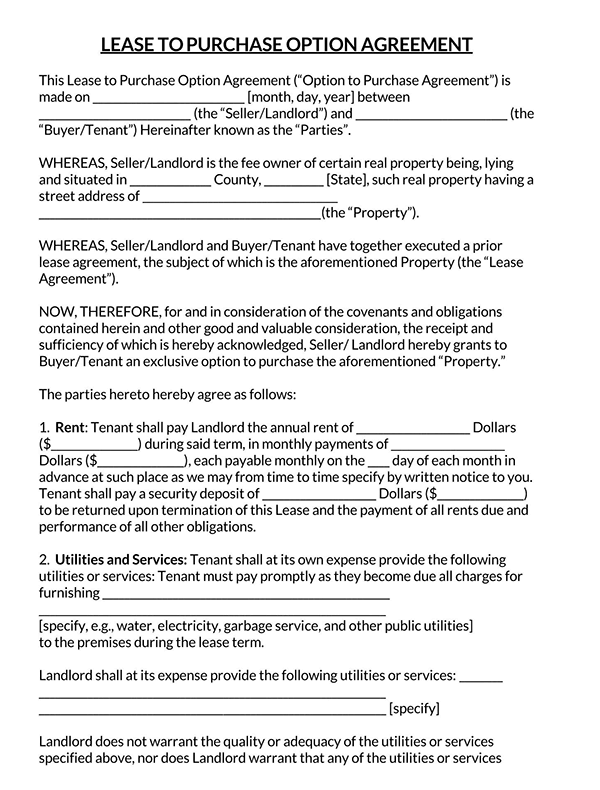

Rent-to-Own Agreement Templates

By states

Who Needs to Use One?

One thing to note is that a rent-to-own can be a little more complex than a basic renting process, so there are many things to consider when signing the agreement:

Owner-financing

This is simply a quicker way for sellers to close property sales rather than dealing with the lengthier mortgage process. Again, the buyer is allowed to finance the property purchase through the seller. In this case, the seller doesn’t loan money to the buyer, instead extends credit to the buyer for a while. This process is carried out with a promissory note, in which the buyer promises to carry out the end of the bargain.

Seller

A seller can either be the property or landowner, or anyone looking to sell a property using this method. Below are the advantages and disadvantages of a seller:

- Pros: The seller’s advantages include being guaranteed a longer rental term with a steady income. The seller can avoid risk, as well as the benefit of a non-refundable option fee. The seller can gain if the market falls as the purchase price remains the same. Finally, with some luck, the owner might find tenants who would not damage their property and would rather preserve it.

- Cons: From refusing to buy property, to being unable to sell the home to another buyer, to not being able to receive a lump-sum payment, the landowner may face a few disadvantages during the rent-to-own process.

The landowner could also lose out, in the event of a market hike on property value as the purchase price remains the same.

Buyer

Also known as the tenant, a buyer is an individual willing to enter into this agreement in order to purchase a property. Below are the advantages and disadvantages of a buyer:

- Pros: There are many advantages when buying a property, using the rent-to-own method. The buyer is allowed more time to acquire a loan or to raise their credit. They usually do not require a down payment when purchasing the property, so owning property is easier with this route. The buyers are allowed a trial time to settle into their home and the neighborhood surrounding the property, before making the decision to buy. In the case of a hike in market price, the sales price of the property remains the same, and the buyer is exempted from paying more.

- Cons: With advantages come disadvantages, and buyers would also face a few of them. They can lose their option to buy property if they are ever late when paying rent. Buyers could be disqualified from getting a loan and might be unable to raise their credit score, so getting property could be impossible in the end.

Just as buyers might gain when there’s a hike in the market value of the property, buyers could also lose when there’s a fall in market price since the purchase price stays the same. Just as well, a foreclosure could take place, taking away all chance of the buyer being able to buy property.

Wait, How Exactly Does it Work?

To create an agreement for a rent-to-own method, it is necessary to understand the basics of signing one. The following steps take place when this process begins; negotiating the rental agreement, deciding the option to purchase, checking the tenant’s credit, verifying the tenant’s income, signing the lease, the tenant moves in, activating the clause to purchase property, enter into a purchase agreement, attach the required disclosure, and finally close on the property:

Negotiate the rental arrangement

When an individual is looking for an apartment or a building, there a certain things the individual must consider before making a choice. With a rent-to-own, the individual willing to go into such an agreement will first be a tenant before anything else, and so they must negotiate the terms of the rental arrangements by discussing things like; monthly rent, the term, the security deposit, and the number of utilities and services on the property.

Decide the option to purchase

Once rental arrangements have been made, it is time to discuss the terms of the tenant’s option to purchase the property. This aspect is very crucial to this process, and little mistakes can spell trouble for the party involved. Some of the things to be discussed in this stage include; the purchase price, the expected down payment, the actual terms of option and option payment, and the amount of optional fee to be paid.

Check tenant’s credit

When checking for a tenant’s credit, the property owner wants to know whether the client has been involved in any illegal financial or rental or even criminal activities that could lead to problems between the two parties in the future. Property owners would use background check service providers, whether public or privately owned, to get the information they need. Another alternative is to use U.S. National Directory to perform a nationwide check on the prospective tenant.

Verify the tenant’s income

This is a basic screening process carried out by property owners to ensure that tenants can afford to fulfill rental agreements for the rental term. The owner is legally allowed to request the tenant’s bank statement, gotten directly from the bank for at least a duration of 2-3 months. The owner can also request the tenant’s most recent employment verification letter, a pay stub (also known as a payslip or paycheck), and a copy of the tenant’s tax return forms.

Sign the lease

If a tenant decides to purchase the property, they’re doing so at a price. The tenant will be required to pay some amount of money called the option fee. This can either be paid upfront or can come as a portion of the monthly rent. It is usually non-refundable and can be attached as a credit to the initial purchase price.

When signing the agreement, the tenant must fulfill his part of the agreement, and each party must agree on the stated amount. The property owner is required to create a completed lease with a purchase option, which both parties are reading to sign.

Tenant moves in

This is a step towards the end of this process. Once the tenant moves in, it is agreed that the deal is in motion, and each party is subject to the terms of the agreement.

Activate the clause to purchase

By this time, all purchase options must have been made, and both parties must have been informed appropriately. In addition, the option fee should have been made ready by the tenant.

Enter into a purchase agreement

A purchase agreement must be established and executed by the property owner and tenant. This agreement will define all the terms associated with renting and finally buying the property. The party should check the financial contingency of the tenants and their ability to purchase the property.

There must also be a period where the tenant can inspect the property for faults and defects, as well as to survey the property to prove the owners’ claims. Once the decision has been made, there would be a negotiation to determine who is responsible for repairs and property improvement.

Attach required disclosure

For each state, there are specific disclosure forms for purchase. In addition, for a seamless transaction, the property owner must inform the tenant of defects or repairs that the property requires to prevent any complaints in the future.

Close on property

Most of what is required in this phase are the funds the tenant and prospective buyer need to pay for closing the transaction. After the transfer has been made, the deed is then taken to the county recorder’s office. A transfer fee is required at this stage, and it is usually split between buyer and seller and can be paid entirely by either party.

Writing a Rent-to-Own Agreement

When drafting it, the following details must be included:

- Basic information: This includes information about the seller and the buyer, the property, rent term, rent payments, etc.

- Seller: The seller is the party who owns the property, known as the landowner. Information like his name and address must be provided.

- Buyer: The tenant or party leasing the property. Information about the buyer like his name and address must be provided as well.

- Rent payments: The amount of rent payment decided by both parties, and any extra fees for late-payments must be stated.

- Property: Everything about the property including the address and the legal descriptions must be stated.

- Rent term: The agreed dates of the start of rent term and end of rent term must be clearly detailed as well.

- Security deposit: The amount agreed upon as a security deposit must be included along with the terms of repayment if any.

- Option to purchase: This is a type of grant, or exclusive rights given to a tenant to allow them to purchase a property after a specified period of time.

- Option consideration: This is the amount the landowner requests from the tenant, to pay for the option to purchase grant.

- Purchase price: This is the actual price of the property. This price is set by the landowner and will not change once the agreement has been signed.

- Earnest money deposit: This money is paid along with the option’s consideration by the tenant to prove to the landowner, a willingness to purchase the property.

- Lease details: The lease details comprise information about the lease, such as the following:

- Use of property: The question of the manner in which the property will be used must be presented.

- Condition of property: The current condition of the property must be clearly and completely stated, and the tenant must be aware.

- Holdover tenancy: The penalties that would take place, should tenants stay longer than the agreed lease term on the property.

- Utilities, maintenance, and repairs: It should be clearly stated what utilities are included in the rent per month, as well as the repairs and maintenance services to be carried out on the property, and which party intends to carry it out.

- Alteration: Whether or not the tenant is allowed to carry out any alterations, renovations, or improvements to the property.

- Smoking allowances: It must be clearly stated whether tenants can smoke on the property or within the property.

- Pet allowances: Should also be stated clearly, whether or not any pets are allowed on the property.

- Rules and regulations: Property rules and regulations must be properly stated and accepted by the tenant.

- Subleasing: Whether or not the tenant is allowed to sublease or sublet the property.

- Renter’s insurance: The tenant should know if there’s a need to take on a renter’s insurance.

- Damage to the property: Consequences for damaging property should be listed.

- Surrender of the property: Penalties for breach of the agreement should be known by both parties.

- Defaults: The next thing to do is to check whether the tenant defaults with payment.

- Details about the purchase: This includes the following information:

- The property included in the sale: Both parties must discuss the availability of furniture, lands, or decorations that will come with the purchase of the property.

- Exclusivity of option: The tenant must ensure that the purchase option is available only to them. This is an important factor to be discussed between both parties, to avoid future problems.

- Inspection: Once an inspection has been carried out and faults have been identified, parties will discuss who will be responsible for repairs before the final purchase.

- Closing: The specified date for closing of the agreement should be clearly stated.

- Closing costs: Both parties must decide who will be responsible for the cost of closing.

- Title insurance: A title insurance is necessary at this point, and parties must discuss who will be responsible for acquiring one to avoid title problems once the property has been purchased.

- Financing: If the tenant agrees to purchase property, whether or not the tenant will be allowed to take a loan out to pay for the purchase, should be clearly stated.

- Real estate taxes: Parties must discuss the amounts of real estate taxes, and choose the party who will pay them.

- Existing mortgages: Mortgages on the property must be revealed by the landowner, and both parties should conclude whether or not the tenant should take responsibility for them.

- No equitable ownership: The property owner should clearly state if the payment of rent allows the tenant legal or any other forms of interest in and to the property.

- Legal information: Includes information like; disclosures, notices, severability, binding effect, governing law, amendments, disputes, and entire agreements.

- Disclosures: Disclosures include both federal and state facts that are made known to the tenant.

- Notices: These are pointers, rules, and updates regarding agreements that are sent to not parties regularly.

- Severability: Severability allows the agreement to remain valid, even when one of the provisions of the agreement is invalid.

- Binding effect: The binding effect, just as the name implies binds both parties and their offspring to the terms of the agreement once it has been set in motion.

- Governing law: This is the law of the state on which property lies, and by which agreement is made.

- Amendments: This suggests how changes can be made to the agreement and its terms.

- Disputes: This specifies the solution method that would be used if any disputes arise between parties.

- Entire agreements: This certifies that the agreement signed is the original and complete agreement that displaces all other agreements.

Consequence of Not Having It

Without a written and signed agreement, property owners, buyers, or tenants who intend to transition into buyers, have very few options left in deciding to purchase the property.

An agreement ensures that both buying and selling party fulfills their promises. Both parties might have to deal with consequences like:

Lost money

A property owner might be forced to pay all maintenance and repair costs on the property, and would not be able to cash in on higher purchase prices when there is a rise in the value of the property on market. In contrast, tenants might not get the option to purchase after paying the rent premium, in addition, all the money spent on repairs and improvements to the home would be lost.

Mental anguish

Property owners would constantly worry about whether tenants will damage the home since they have no interest in the property. Tenants would constantly worry about their inability to purchase a home.

Time lost

A property owner must waste time marketing property for sale. Yet, at the same time, tenants spend an enormous amount of time looking for a home.

Frequently Asked Questions

Yes, it is. It is often necessary to ask a lawyer to review the terms before signing the agreement.

This depends on the attorney or firm in question. Otherwise, you can create your own agreement using the above information and to your liking.

The option fee includes most times, both the consideration/earnest fee and the options money. The earnest fee is paid to show interest in purchasing property for a duration of time. It is paid upfront to the seller. The options money is a certain percentage out of the property purchase price paid at one of the monthly rent to show that the buyer intends to buy the property after a stipulated period. Usually, options money- paid as extra rent monthly-goes into an escrow account where it compiles and can then be deducted from the purchase price as the down payment for the property.

The buyer loses option fees and rights to purchase the home at the end of the agreed term.