Leases, or rental agreements, are contracts where a lessee (or tenant) rents property from a lessor (or landlord). The lessor agrees to let the lessee use the property for a particular period in exchange for rental fees paid by the lessee. The document outlines the terms and conditions of tenancy between the lessor and the lessee. Since a Kentucky lease agreement is legally binding, a breach of its provisions can result in legal action.

Therefore, it should ordinarily contain the following information:

- The parties to the contract should be mentioned.This could include the name of the lessee and the lessor or landlord.

- The property being leased—legal description, street address (where applicable) of the property.

- The amount must be paid as rental fees and other payment details, such as the due date and payment method.

- A time period for which the agreement is valid.

- Any provisions for renewal of the agreement.

- Date of the agreement.

- Provision, whether pets are allowed or not.

- Provision of safety, health, and any occupational hazards.

- Signatures of the parties.

- A termination clause, including any fees or penalties for terminating the lease early.

This article will provide information on a lease agreement and how to write it to be used in Kentucky.

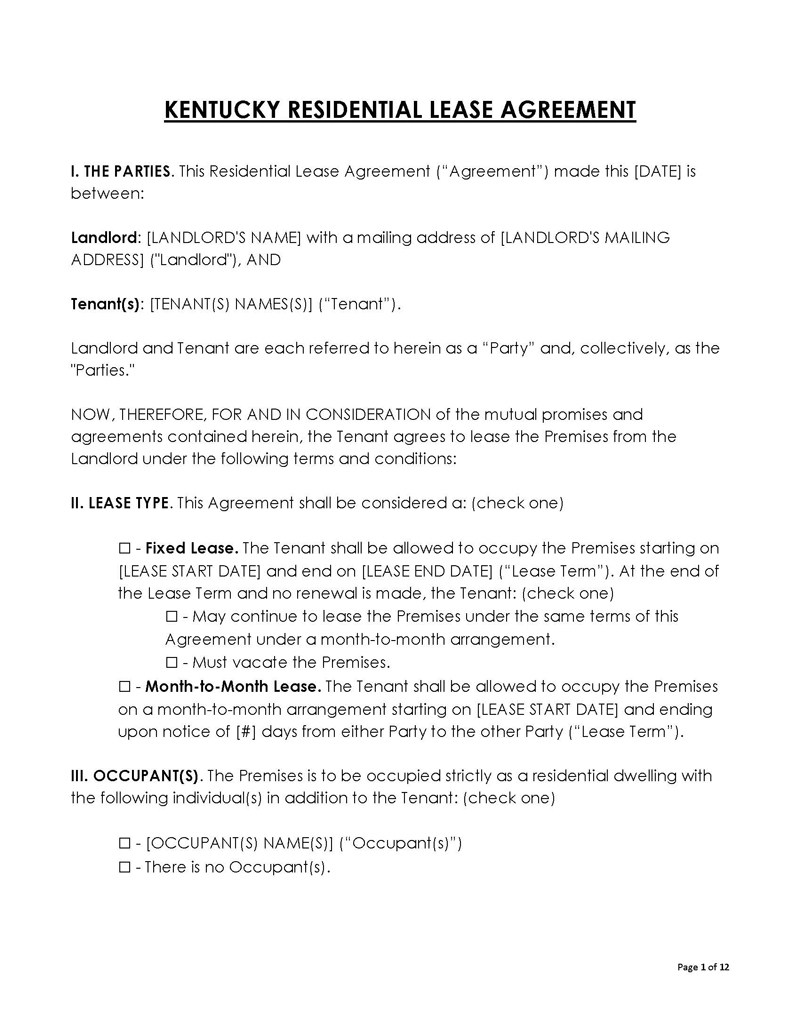

Kentucky Lease Agreement

A lease agreement is where the property owner or lessor offers the tenant or lessee the leased land or building for a specific time without ownership or rights to sell or encumber anything but to use until the contract ends. The agreement is used for both commercial and residential property in Kentucky. Commercial ones are governed by KRS Chapter 355.2A, while residential agreements are governed by KRS Chapter 383.

Lease Agreement Types

There are different types of Kentucky lease agreements for different types of situations. It is essential to specify which type will be used because each type has different clauses to be observed when drafting the document.

The different types are as follows:

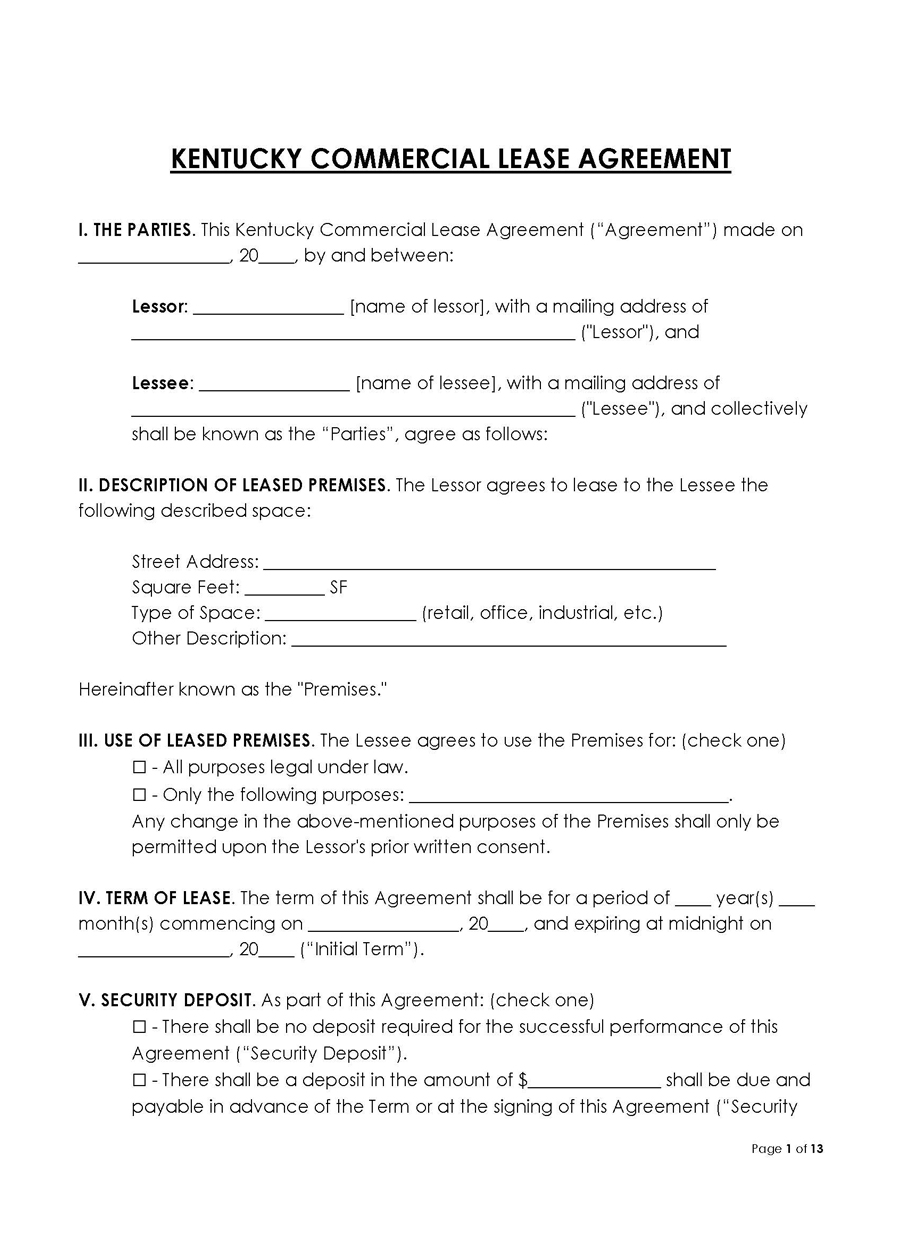

Commercial

A commercial lease agreement is used for business properties such as office buildings and stores. In contrast, a residential one is used by people who want to rent residential homes or apartments to another person.

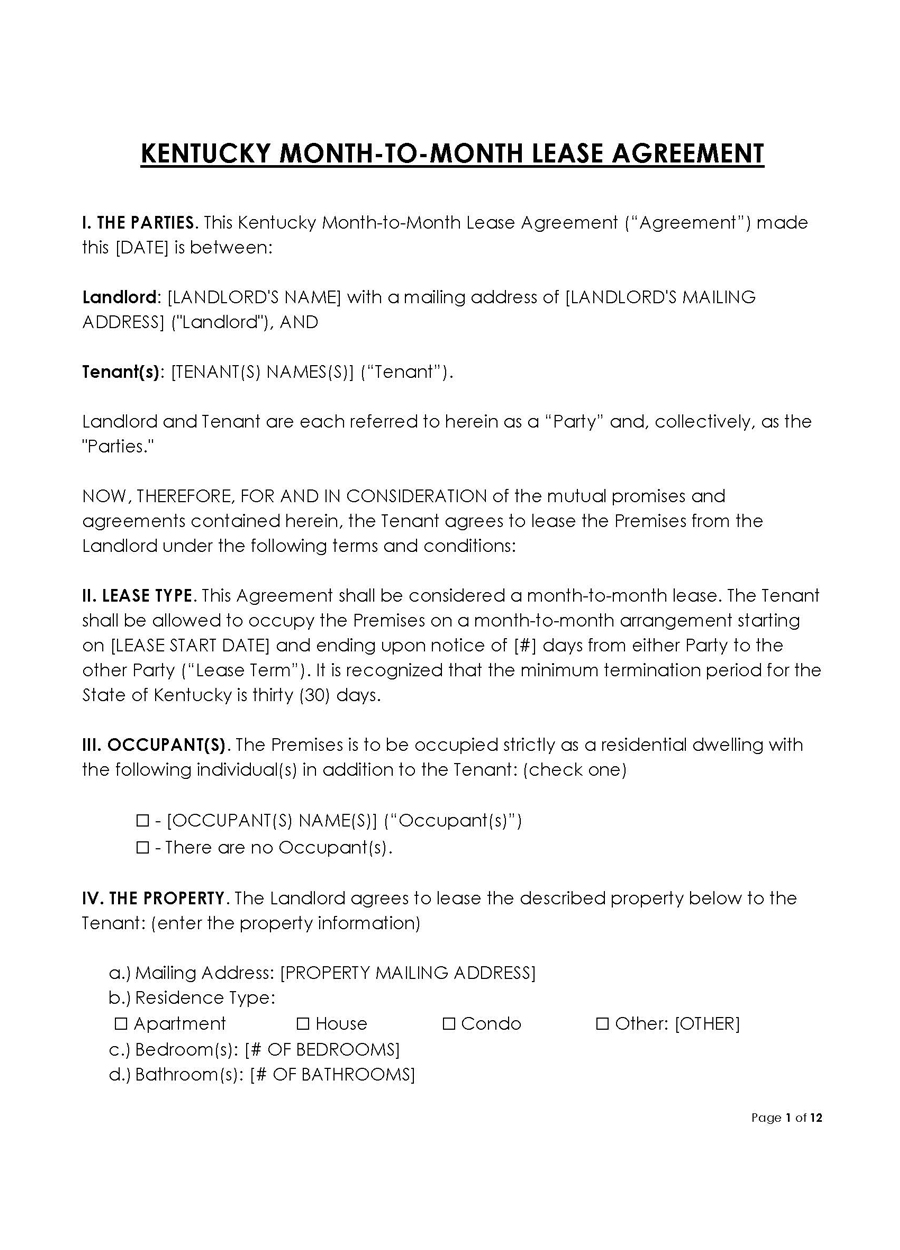

Month-to-month

This is one of the most common types of lease agreements and is used when a lessee wants to rent a property indefinitely. Also called “tenancy-at-will”, it can only be terminated with written notice from either or both contract parties. Notice should be provided to ensure at least 30 days between the date when notice is served and the expected date of contract termination.

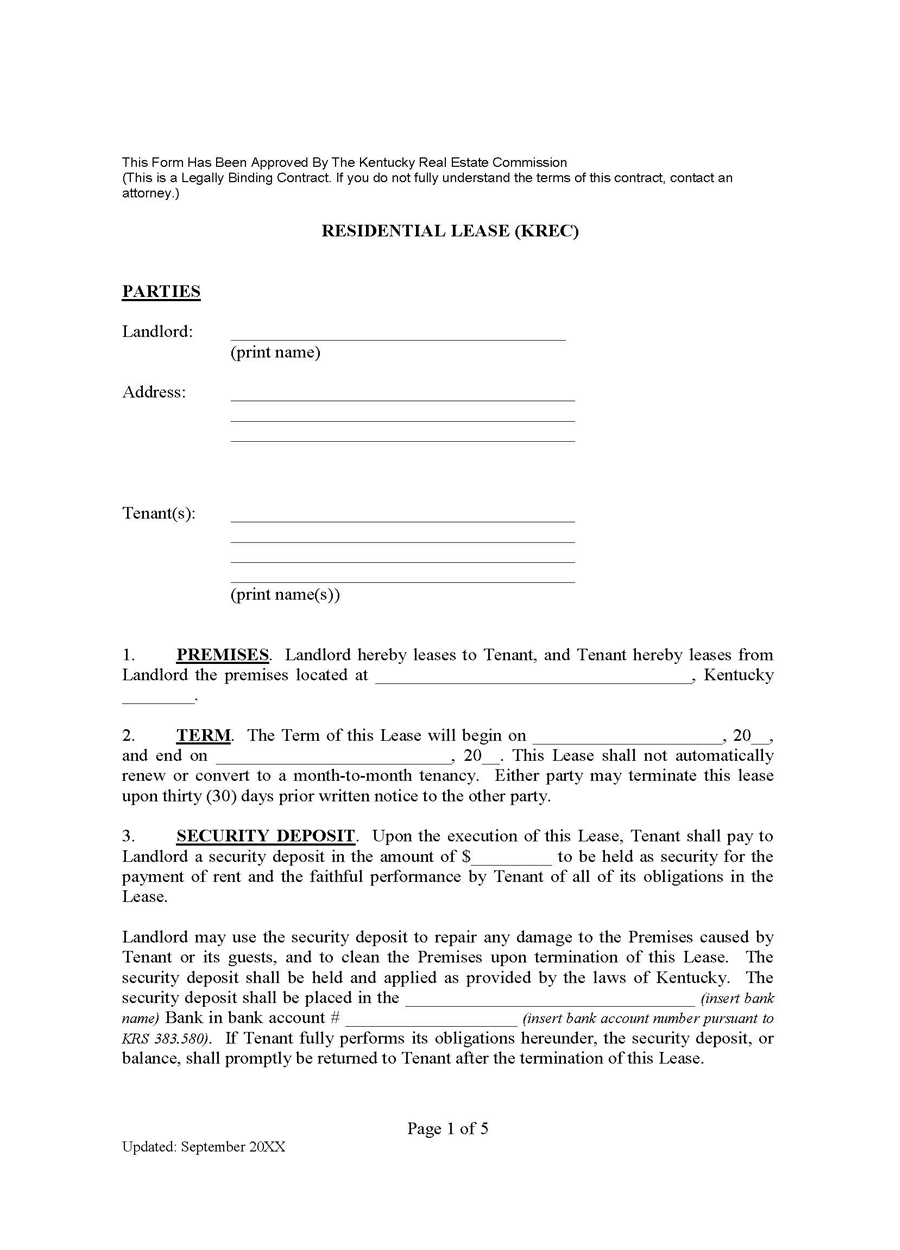

Real estate commission

A real estate commission lease agreement is a type of pre-designed document issued by the state of Kentucky to guide landlords in creating an enforceable contract when renting their property. The tenant should sign this agreement once they agree to move in.

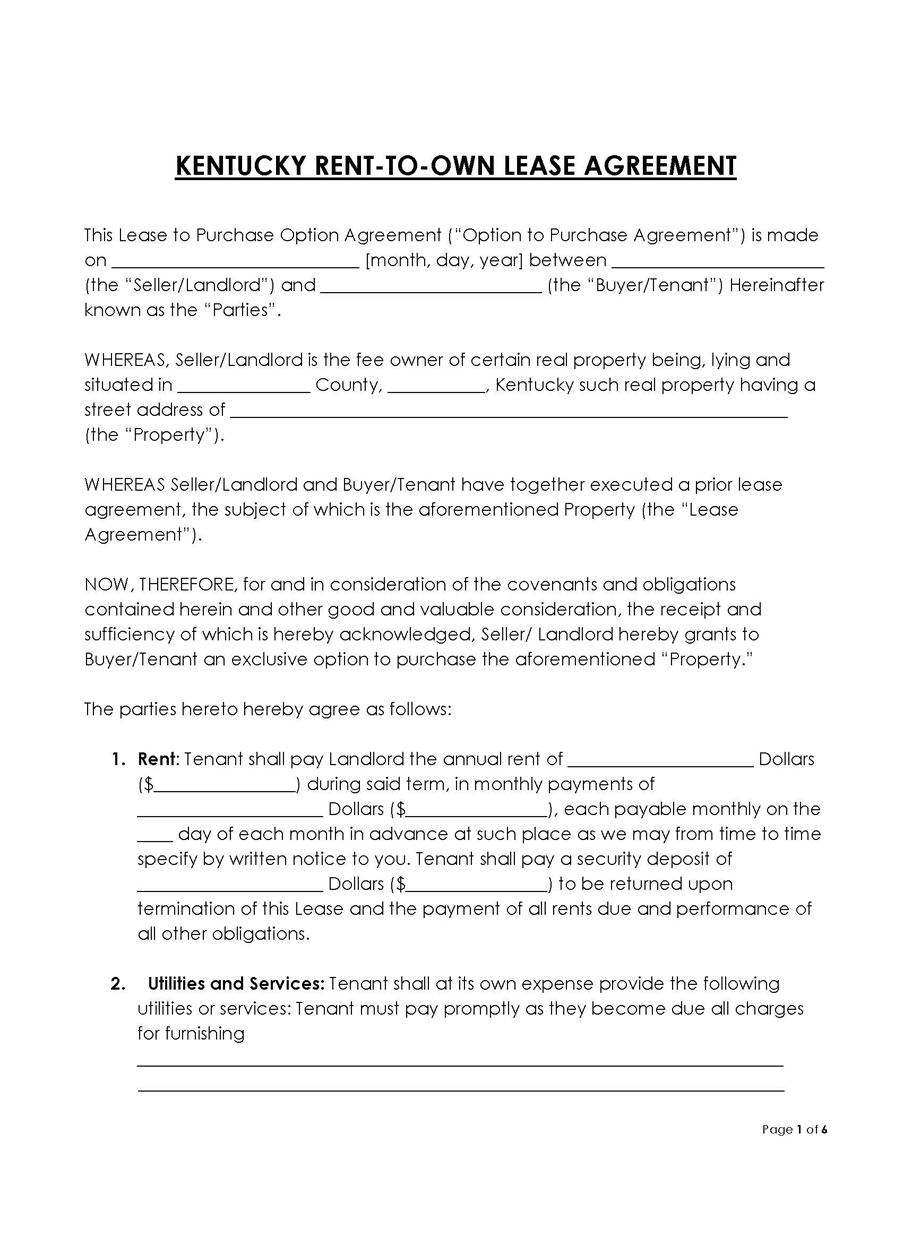

Rent-to-own

This type is where a tenant is given the option to purchase the property after a particular time, typically at the end of the lease agreement. As a result, the parties can agree on a high rental rate that partially contributes to the property’s purchase price. In addition, the lessee pays a certain percentage of the property’s value at the end of the lease to retain ownership. The landlord can benefit from this because they can sell their property at a premium price while the tenant gets to own the property without paying as much as they would if they were to buy it in a lump sum.

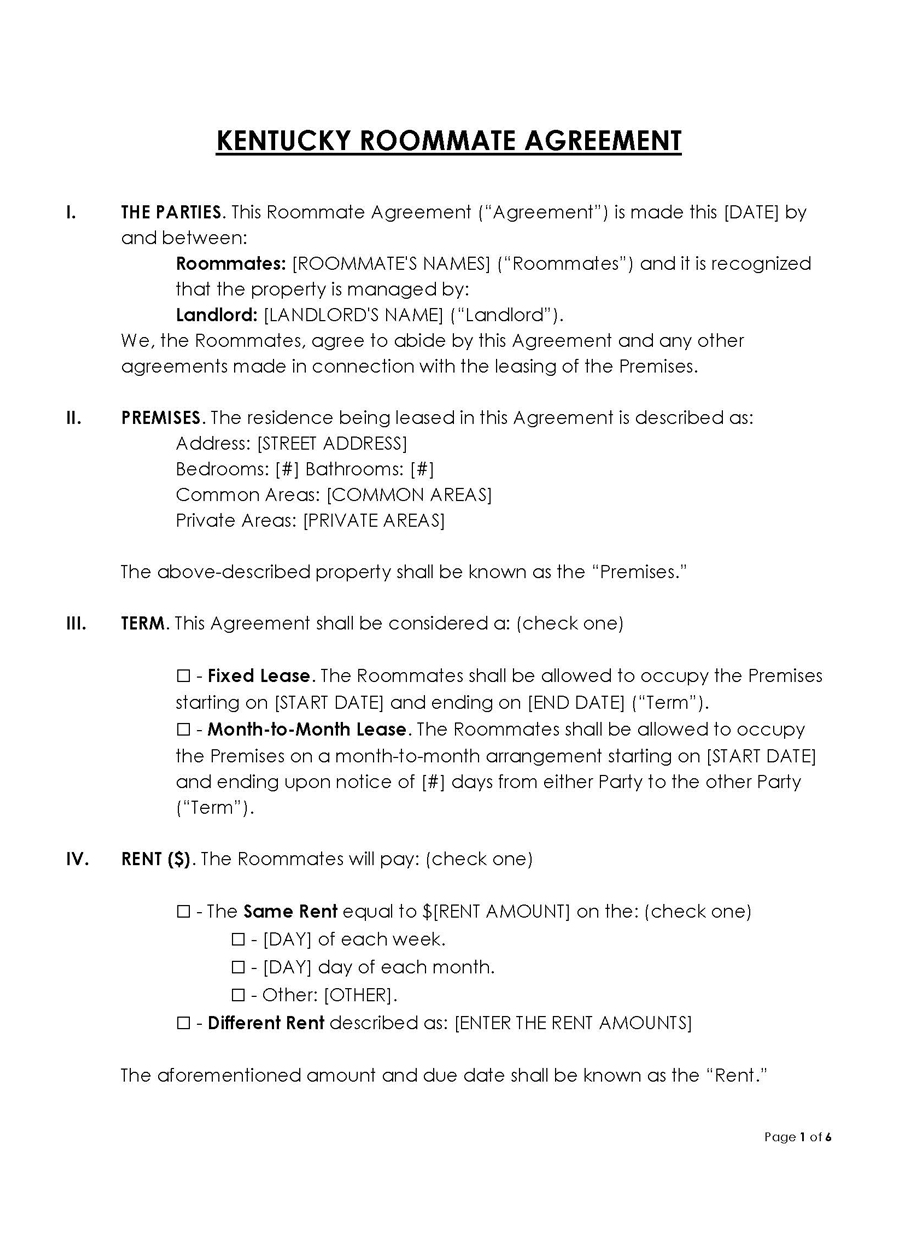

Roommate

This type is a contract between two or more roommates in which they agree to share common property and split the associated costs. The document specifies the expectations and obligations of each roommate and must be signed by all roommates. This agreement is between the roommates, exclusive of the landlord.

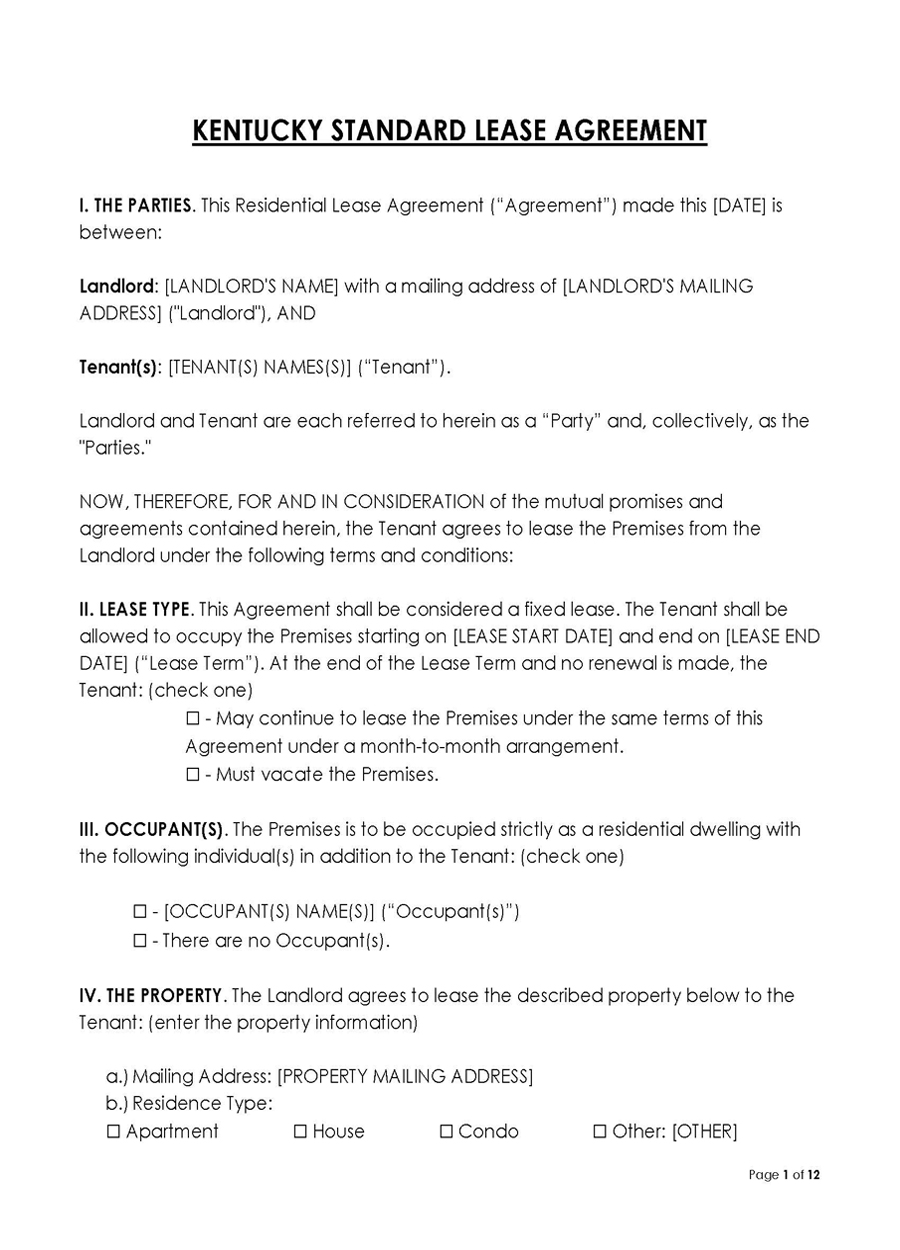

Standard

A standard lease agreement is typically used when renting property for a fixed term. It is signed between the lessor and the lessee. It should state specific fundamental details that pertain to the agreement, such as the rent amount, rental payments, dates of termination, and other legal information. This is Kentucky’s most commonly used agreement for residential and commercial leases. It is governed by KRS Chapter 383 (Uniform Residential Landlord and Tenant Act).

Sublease

A sublease is where the tenant transfers all their rights and obligations to the third party, such as rent payments. This could be useful when the original tenant wishes to extend their stay at the property beyond what was specified in their original contract but doesn’t have enough money for the rent or wants to move out before their agreement ends.

Kentucky Lease Agreement Disclosures

A Kentucky lease agreement should always contain specific clauses to protect both parties from unforeseen occurrences or negligence during the tenancy and ensure that there is no dispute during or after the tenancy.

In addition, the Kentucky lease agreement disclosures are mandated by Kentucky’s Uniform Residential Landlord and Tenant Act (URLTA):

Landlord identification

This disclosure is required for all lease agreements executed in Kentucky. The landlord should be identified in the agreement. The landlord’s name must be stated to file any issues immediately. If they are a company, they should provide their credentials and contact details and mention their business address, as this will be necessary to serve correspondence such as notices. Any changes to these prerequisites should be communicated to the tenant.

Move-in checklist

A move-in checklist must be issued for all units with a security deposit imposed.

EXAMPLE

Suppose a landlord intends to charge a security deposit on their property. In that case, they must provide the prospective tenant with a checklist of the property’s condition before the tenant moves in.

The checklist ought to be completed by the tenant, and they must record any damages to the unit and the existence of accessories such as appliances. This checklist ensures that all of the units are in good condition, and this will act as proof that they were in good condition when the tenant moved in.

The checklist doesn’t have to be attached, but the condition of the unit must be satisfied before the lessee takes occupancy. This system benefits both parties since it provides a record of what the property was like before being rented. If any issues arise during or after the tenancy, they will be easier to resolve.

Security deposit holdings

This disclosure applies to all rental properties with a security deposit attached. The landlord is obligated to disclose where the security deposit is held by declaring details such as the location of the funds, such as a bank, and the associated account number. The amount held in the account must also be stated.

Lead-based paint

The lead-based paint disclosure is imposed on all rental units constructed before 1978. First, the landlord should indicate where lead-based paint is used in their unit. Next, the landlord is obligated to complete and attach a lead-based paint disclosure form.

Then, they should issue the lessee with an EPA (Environmental Protection Agency)-approved pamphlet detailing the risks of the lead-based paint and other records or reports detailing the known hazards of the lead-based paint.

note

Building-wide evaluations are required for multi-unit buildings with common areas.

Marijuana use

In Kentucky, landlords can regulate how tenants intake medical marijuana within their premises. As a result, many landlords choose to include a clause in their lease agreements, even though it is not mandatory, which informs the tenant that they cannot use medical marijuana anywhere within the building, limits usage to non-smoking methods, or designates smoking zones.

Late and returned check fees

Often, landlords will charge a fee for late payments and bounced checks. While there are no restrictions on how much can be charged as late fees, the state advocates for reasonable fees that typically do not exceed 20% of the owed payment and must be reflective of the expenses incurred by the landlord as a consequence of the late payment. Also, the state dictates that late fees should not be imposed unless payment is made five days past the due date.

Bed bug disclosure

Landlords can also disclose the existing bed bug condition of rental units with a history of the same infestation. The lease disclosure can highlight the protocol for handling future infestations and the protection accorded to the tenant.

Asbestos disclosure

The landlord needs to disclose information about the presence of asbestos in a rental unit built before 1981 for the safety of all tenants. In addition, the disclosure should alert the tenant to prevent asbestos from becoming a hazard. Some precautions include no modifications, repairs, sanding, or pounding without the landlord’s say-so.

Mold disclosure

In Kentucky, a landlord needs to disclose information about the presence of mold in a rental unit for the safety of all tenants. Mold can cause severe health conditions such as respiratory problems, and if it becomes harmful enough, it might even lead to death.

Subleases and assignments

A subleases and assignments disclosure can be added to the lease agreement, stating if a lessee is permitted to sublet or assign the unit or not. In addition, the appropriate subleasing procedure, which typically involves a written notice to the landlord and written consent from the landlord, should be provided.

How do I Write a Kentucky Lease Agreement?

The most important thing to remember is that all exceptions, variations, and requirements must be explicitly written in the document.

The following components ought to be included:

Names of the parties (lessor and lessee)

There must be at least two names appearing in the document. Their full formal names should be provided.

Property address

The property’s address must also be specified in the Kentucky lease agreement. The address must contain the unit number, city, state, and ZIP code. A specific description of the property, such as a house, apartment unit, one bedroom, or any other type of dwelling, can be provided.

Lease term

The description of the lease term and its length, along with the commencement date, should be written in the lease agreement.

EXAMPLE

If a year-long rental term is being used, the document should specify the agreed commencement and expiration dates. It must also refer to whether it is month-to-month, week-to-week, or longer.

Rental amount

The rental amount payable by the tenant should be written. In addition, the monthly rent, due date, and address to send the amount should be stated.

Late fee

The applicable fee for late payments should be specified in figures and numbers, as well as what constitutes “late payment.”

Security deposit

If a security deposit is to be charged to the unit, the exact amount must be stated. This is because the security deposit serves as a safety net for both parties.

Initial payment

The lease agreement must indicate the total amount the tenant is expected to pay before taking the lease. Typically, it includes the security deposit and the first month’s rent.

Occupants

The number of occupants expected to live on the premises should be indicated. They should be identified by their name, whether minors or non-paying occupants.

Utilities

Utilities such as water, electricity, HVAC, etc. are vital considerations in leasing. Therefore, the lease agreement should highlight the existing utilities to which the tenant is entitled. In addition, this section can highlight how the associated costs of utilities will be paid.

Parking

The lease agreement can state the number of parking slots allotted to the tenant, the lot number, and whether they are reserved.

Furnishings

The lease agreement must declare the furnishings that can be brought into the unit by the tenant. Therefore, if some furnishings are prohibited, the tenant should be aware.

Notices

The names and mailing addresses of the parties who are meant to receive any correspondence or notices, should this be required, must be indicated.

Eviction

An eviction procedure should be specified in the document if a tenant has breached the lease agreement terms. In addition, it must be clearly stated how the tenant will be evicted and what it takes.

Additional terms

This section should outline any other lease terms not addressed in the clauses mentioned otherwise.

Signature and date

Lastly, it ought to be signed by the lessor and the lessee and must indicate the date of signing.

Landlord-Tenant Laws

The terms between a landlord and tenant cover any foreseeable events. Such events may include repairs, maintenance, or alteration of the premises by either party required for the property to be made habitable.

The landlord-tenant laws dictate different aspects of leasing, as indicated below:

Security deposit

Landlords are restricted from asking for a specific percentage or amount of a security deposit by the state of Kentucky. However, Statute 383.580 obligates landlords to refund the security deposit 60 (sixty) days after the lease termination date. However, they can retain the security deposit if the tenant fails to provide a forwarding address within that period.

Right of entry

Under KRS § 383.615, landlords must issue at least two days’ notice before entering the rented unit. However, during emergencies, the landlord can enter the rental unit without prior notice, according to KRS § 383.615.

Utilities

The landlords are expected to provide an adequate number of toilets, cooking, and plumbing facilities, including heat, air conditioning, and hot water. However, they are obligated by law to provide running water, adequate hot water, and heat between October 1 and May 1, according to KRS § 383.595.

Kentucky Lease Agreement

Frequently Asked Questions

A residential lease can be written for an agreed-upon period, but typically it runs from year to year.

Yes, a lease is a legally binding contract. However, it must be signed by both parties. Once signed, each party is obligated to follow its provisions.

Not necessarily. Whether a lease agreement needs to be notarized depends on whether it is for commercial or residential property. For example, signing the agreement does not require notarization for apartment units, houses, or other residential rentals. However, if it is for commercial property, such as a retail space in a shopping mall, then it is advisable to have it notarized.

Yes. Once signed, a lease agreement can be renewed at the end of the lease term if the lessor and lessee agree. It will carry the same terms and conditions as the initial one.