A commercial lease agreement is entered into between a landlord and a tenant. Through the agreement, the tenant is allowed to utilize the space/property for a specified amount of money. The tenant will typically pay per square footage ($/SF). The agreement is legally binding.

By definition,

A Commercial Lease Agreement is an agreement made between a landlord and tenant who intends to lease the property for commercial purposes such as office, retail or industrial purposes.

A commercial lease limits the use of the leased property to business-related activities. Unlike most residential leases, it is usually longer, 3 to 5 years. The agreement outlines the fundamental details about the lease, such as rent amount, lease term, tenant, and landlord. Properties that will often require it are retail stores, restaurants, café, office firms, etc.

Prior to the signing of the lease, a landlord will typically have to make use of a commercial rental application to check the background of a tenant. The object of this is to determine the authenticity of the tenant and whether he indeed fits the bill or not.

Introduction to Commercial Lease

Most business entities do lease the property they operate from rather than own them. This stems from the fact that it is often more expensive to purchase those pieces of property altogether. A commercial lease lets the two parties negotiate the terms that govern the use of that said property as well as how to relocate or close shop when they no longer need to use the premises altogether.

Alternative names which can be used to refer to it include;

- Business lease

- Office space agreement

- Commercial property lease

- Industrial lease

- Standard commercial lease

- Commercial real estate lease

Templates (by state)

Types of Commercial Lease

Like residential lease agreements, commercial lease agreements also come in many shades and forms.

Below are some of the most common kinds of these agreements:

Booth (Salon) rental agreement

The booth or salon rental agreement strictly entails the lease of the salons and hair beauty installations. It stipulates the manner in which the facility is rented out and the terms that govern such aspects as closure or abandonment of the same altogether.

Booth (Massage) rental agreement

This one oversees the lease and the use of the massage parlor. This is a room that is used to massage people and relieve them. The agreement spells out how the room is to be issued to a third party. It also pertains to how the facility may be used or disbanded after the use, as well as the rental dues.

Garage (Parking) rental agreement

In case you have a garage that you do not use, you may want to take advantage of the garage parking rental agreement. This one basically demonstrates how a garage is to be converted into a parking lot. It similarly showcases the terms of references that govern the conversion of such facilities for the purposes of parking cars.

Facility event space rental agreement

Other than the garage, you may also wish to devote your facility for other events than parking.

EXAMPLE

You may spare our backyard for a celebration or party event. The ‘facility event space rental agreement’ endeavors to spell out how the facility you have at hand is converted for use for that event.

Office lease agreement

Have some commercial buildings that may serve as office space? The office lease agreement can help with that. It vouches for the conversion of the space for use as an office. Like any other agreement, this one too delineates the space in question as well as the rental costs and other relevant terms.

Net lease

In a net lease, the landlord does not factor in any operating expenses when setting the rental rate. As a result, the tenant has to pay for these expenses on a pro-rata basis. The operating expenses to be paid for included property/estate taxes, property insurance, and common area maintenance. Common area maintenance will include common area utilities and other operating expenses. Depending on which expenses are being billed to the tenant, there are three distinct types of net leases.

- Single Net Lease: The tenant is expected to cater for property taxes alone.

- Double Net Lease: The tenant is expected to cater for the property taxes and property insurance only.

- Triple-Net (NNN) Lease Agreement: In this kind of agreement, the tenant undertakes to pay up all expenses that arise out of the use of the said piece of property. These include insurance, taxes, and costs of maintenance. It is costly and more comprehensive to a tenant but safer for a landlord.

Commercial sublease agreement

Some landlords allow their tenants to lease out their premises to third parties. This requires the use of the sublease agreement. It spells out the extent and the cost implications of such a lease if and when it is allowed to transpire.

Fixed end date lease

With this type of lease, the length of the lease period (term) is pre-determined, and the exact end date of the lease is specified. During this lease term, no changes are to be expected in terms of rent increase. This is unless the landlord included a clause in the agreement and the tenant agreed.

Fixed number of weeks/months/years

In this category of the agreement, the lease term is specified in terms of the number of weeks, months, or years the tenancy is expected to last. During this period, the landlord should not increase rent or implement changes unless the agreement permits.

Periodic lease

With this type of lease, the lease is upheld until either party chooses to terminate the lease. Tenancy in such an agreement can be based on weeks, months, or years. The most common type of periodic lease is month-to-month. In such an agreement, the landlord can effect changes to terms or increase the rent as long as they notify the tenant accordingly.

Automatic renewal lease

With this type of agreement, the lease continues as agreed upon until the tenant or landlord issues a termination notice to end the agreement. After renewal, the same terms provided under the previous agreement will still be upheld.

Full service or gross lease

A full-service lease is one where all operating expenses have been factored in when setting the rental rates. These operating expenses included estate taxes. Due to the ever-changing nature of operating costs, the landlord can opt to withhold from passing down any future increments in operating expenses to the tenant.

Modified gross lease

With a modified gross lease, the tenant and the landlord negotiate and agree to share the operating expenses. Ordinarily, the tenant will be responsible for paying for rent and common area maintenance while the landlord covers property taxes and insurance. In other cases, at the beginning of the tenancy, the tenant pays for base rent alone, later as time goes by, they can start paying for a portion of the operating expenses.

Percentage lease

In this type of commercial lease, the tenant is responsible for paying the monthly rent of the property and, in addition, a monthly percentage of the gross revenue generated from the business being carried out on the rented space. Percentage lease is common in the retail business.

Standard terms of a Commercial Lease Agreement

These terms vary from state to state as well as with the specific kinds of property in question.

Notwithstanding these inherent differences, below are some of the unifying characteristics of the lease:

- Lessee

- Common Area Maintenance (CAM)

- Fully Serviced Lease

- Gross Lease

- Net Lease

- Double Net Lease

- Triple Net Lease

- Gross Square Foot

- heating, ventilating, and air conditioning

- Turn-key

- Sub-lease

Things to Know

A commercial lease contract/agreement is a significant document for business tenants and commercial landlords to protect them and their interests. To further clarify its use, we shall look into various aspects of commercial leasing.

When is it needed?

This agreement/contract is an important document to both the tenant and the landlord involved in commercial leasing. A person wanting to rent storage or space for business or a landlord willing to rent out space for commercial purposes should ensure that the transaction is guided by the agreement. The agreement outlines and clarifies each party’s obligations and expectations. Each party should declare their concerns during the negotiation of terms so that the agreement will be reflective of their best interests.

It is also important to ensure that consumer laws are observed and landlords do not charge more than allowed when asking for security deposits. It also ensures that tenants’ basic rights such as heating and air conditioning are met. Most states do not dictate the minimum and maximum requirements the landlords must fulfill through state laws. It is imperative to note that the agreement is based on what is acceptable to the tenant and the landlord. Therefore, this could sometimes differ from the specific requirements and procedures provided by the state.

For businesses with a workforce of more than 15 people or open to the public, the agreement is important to ensure that the Americans with Disabilities Act (ADA) is complied with. Effectively, the agreement outlines what is required/expected and, if modifications are necessary, who is responsible for compliance.

Generally, this agreement is a table for negotiating terms and written documentation of either party’s obligations. So, it should be used if one owns an office building or a warehouse and wants to rent the space to another party or if one intends to lease commercial property from a landlord.

Who needs it?

The agreement is used by different industry players whenever they intend to lease property. Renting has been found to be more affordable than purchasing property.

Some of its users include:

- Business Office

- Child Care Facility

- Factory

- Restaurant

- Accounting Firm

- Medical Clinic or Health Care Facility

- Self-Storage Facility

- Hotels or Guesthouses

- Legal Office

- Start-up Company

- Shopping Mall Store

- Trade Businesses

- Warehouse

Landlord’s Responsibilities

As a landlord, before deciding to rent out space/property for commercial or business-related use, there are several things one should take into consideration.

They include:

Property specifications

The landlord should ensure that the property meets the specifications for commercial use or for the specific type of business the tenant wishes to set up in the space. The landlord should be able to give a concise description of the property and how it satisfies commercial usage.

EXAMPLE

If it is an office space, how many offices and conference rooms can fit or how the property meets the codes and bylaws meant for the tenant’s type of business.

Property use

The landlord should determine the type of business the tenant will be running so that they can decide if they permit such type of business on their premises. The tenant should be specific when stating what they will use the building for.

Exclusive use

The landlord must decide if they will award the tenant exclusive use/rights, which means that the tenant will be the only one running a specific type of business within the premises. Competitors in the tenant’s line of business will not be allowed to rent. This is more common in malls or multiple-room buildings.

Lease terms

It is the landlord’s responsibility to outline the terms, which might be valid for weeks, months, yearly, or longer depending on whether the lease is fixed, renewable, or periodic for the tenant to have a clear understanding of what type of lease it is.

Operating costs and utilities

As the landlord, one should decide how they would like tenants to pay for operating costs and utilities. Payment can be either as a percentage of the operating costs or as a fixed rate. The landlord is responsible for distributing these expenses to his or her tenants and deciding on the mode of payment to be used by the tenants- to the landlord or directly.

Also, the landlord should decide how operating expenses of the building and other expenses such as property taxes, collective advertising costs, and utilities should be handled. They can be charged at a fixed rate, or every tenant pays a percentage that could be dependent on the tenant’s store size or footprint.

Taxes

In most cases, tenants are expected to contribute to paying property taxes. The landlord is required to determine the amount to due from the tenant; it can be either a percentage or a fixed rate.

Property use and occupancy details

Where other prohibitions such as smoking, dumping garbage, after-hours noise, and limitations in terms of the type of business are applicable, the landlord must communicate them to the tenant. These prohibitions can be in the rented spaces or common areas.

Parking

If parking is available, the landlord should determine whether to make it free for their tenants, to include it in the rent, or charge tenants as an additional fee and then convey it to the tenant.

Improvements

Sometimes tenants will require that certain improvements or modifications be made to the property so as to optimize their business operations. If this is the situation, the landlord should choose to either approve or disapprove. If approved, it should be agreed who should pay for the improvements. If paid for by the landlord, costs of improvements can transfer to the tenant at the end of the lease, however, at a depreciated value.

Demised premise

The landlord should be able to show the tenant the actual space the tenant will be renting. This should include a property map and details about the space, such as size. If the tenant will have access to utilities like cleaning, parking, security, heating, and air conditioning, the landlord is responsible for communicating this.

Real property

The landlord should also declare the entire property under their ownership, for example, a shopping mall with available stalls. They should also indicate shared common areas like parking lots and walkways.

Base rent

The landlord should determine the acceptable price they can charge the tenant(s), known as base rent. Base rent is based on a given duration, like monthly or annually.

Security deposit

A security deposit is a specified amount of money given to the landlord as a sign of good faith and commitment to the lease by the tenant. The landlord should determine the amount to be paid as a deposit and the due date of the same. Security deposit also cushions the landlord from irreparable damages to the property.

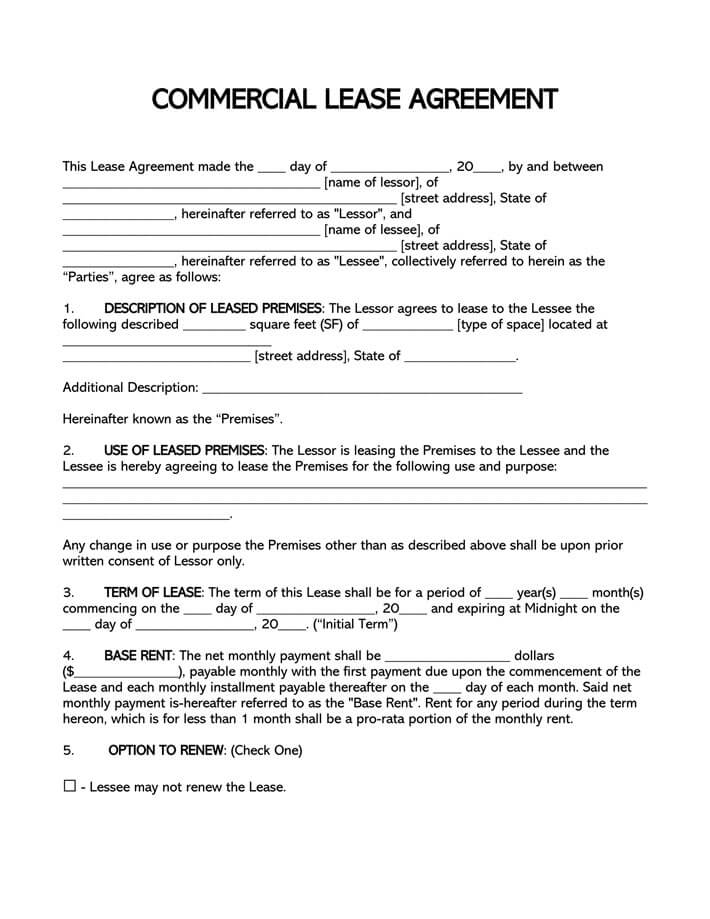

Also, here is a standard commercial lease template that can be customized as per need:

Signing a Commercial Lease

The agreement needs to be signed to be validated. It can be signed in three ways; the three ways are legally acceptable in the United States. Signing with the notary public as a witness is recommended as it offers the signing parties the most protection against future claims that the lease agreement is not authorized.

The three ways of signing include:

In-person signing

A meeting between the parties (tenant and the landlord) is arranged, and the parties sign multiple copies so as each party can obtain an original for their records. It is recommended that at least one or two witnesses are present. The witness should have no relation to either party or bears no particular interest in the lease. Once signed, the document is legally binding.

Electronic signing

In the United States, the Electronic Signatures in Global and National Commerce Act (Public Law 106-229) was effected as of June 20, 2000. The act allows two parties to enter into an agreement online. There are various platforms or websites that provide these services.

Notary public

Signing the lease in the presence of a notary public is highly recommended. This confirms that the parties agreed to the set-out terms and confirms their identity as State ID of each party is required during the signing. If notarized, there is little doubt about the validity of the document and that the individuals who signed the agreement are who they claim to be. For commercial leases with high financial liability, notarizing is vital.

Common Commercial Lease Clauses

Clauses are important in an agreement to address additional concerns by the landlord or tenant.

They cut across different types of lease agreements.

Default

A commercial lease agreement should include guidelines on how defaulting payments should be handled. Default clauses should be included regardless of the type of lease. A default will often occur when the tenant can no longer pay for rent. When either party fails to uphold/observe their contractual obligations, it is recommended that monetary penalties should be fined to the party at fault.

Exclusive rights

In situations where a landlord has multiple spaces to rent out and one tenant requests “exclusive rights” to their type of business, a clause should be inserted in the agreement.

Option to purchase

Some landlords offer tenants an option to purchase the leased property, either at predetermined terms or at a price to be negotiated in the future. If this is the case, this should be indicated through a clause in the agreement.

Option to terminate

Lease termination should be at a price. The price should be so large that it is only sensible to pay under extreme circumstances. This price should be equal to the property’s financial value.

- Landlord Example – The price should be an amount such that the sale of the property would be sensible if the landlord is being offered such a high offer that it would be worth paying the tenant the set amount to leave the premises.

- Tenant Example – The set price should be such that if the tenant were to move to another location or go out of business, it would be sensible to pay the termination penalty rather than incurring the rent for the full-term lease.

HVAC

Heating, Ventilation, and Air Conditioning come at a cost; this can be at the expense of the tenant or the landlord. A clause detailing how these expenses should be handled, that is, who is responsible for installing and maintaining the HVAC system, should be included in the agreement.

Right of first refusal

The right of first refusal is prevalent with single-tenant property leases. It grants the tenant the opportunity to purchase the property rather than renting. Purchasing could be more beneficial in some scenarios as the tenant would only be responsible for mortgage payment if they purchased with a loan, therefore, exempting them from rental responsibilities and any fears of future rent increments.

Renewal periods and options to renew

Some tenants often prefer to extend the lease after a predetermined date, with predetermined terms, rental and rates. Renewal periods and options to renew are commonly seen with large companies which would like to implement long-term plans. If this is an option, it should be declared through a clause in the agreement.

EXAMPLE

A company that has leased property for a period of 20 years with 5-years and 10-years options to renew. This clause allows the tenant to continuously renew the lease at past rates, which are ordinarily lower than the current market prices.

Sublet/assignment

Subletting can be an option for tenants, especially in urban areas. Where tenants are allowed to sublet, this provision should appear in the agreement. Customarily, the landlord sets out the terms through which subletting is permitted, which would normally involve evaluating the sublessee’s suitability for the property.

The agreement must be witnessed by a third party and/ or notarized to protect the landlord and tenant.

Required Clauses

There are two critical clauses that the agreement should include. That is, the Americans with Disability Act clause and a Hazard Waste clause.

Americans with disability act

The ADA (Americans with Disability Act) (42 U.S. Code § 12183) is also known as the ‘ADA.’ It stipulates that commercial tenants that have a minimum of fifteen employees or offer “public accommodation” such as restaurants, retail stores, etc., should observe all the handicap (persons with disabilities) access rules and obligations. The ‘ADA’ is, however, applicable to buildings that were built before or have not been renovated since 1992. ADA compliance is the responsibility of owners, operators, lessors, and lessees of commercial properties in the US. Where the property is not in compliance with the ADA, any modifications/renovations or construction is the responsibility of the lessor/landlord.

Hazard waste

Hazard waste (42 U.S. Code § 6901) dictates that a tenant should sign in writing that they will observe all and any federal, State, or local laws guiding the handling/disposal of hazardous waste, toxic substances, and harmful environmental conditions on or under the premises.

Terminating a Commercial Lease

Termination of a commercial lease can be inevitable due to unforeseen circumstances. One of the most common reasons for commercial lease termination is the tenant’s inability to pay for monthly rent. In a situation where the business owner/tenant determines that the business is no longer profitable or making enough to cover rent expenses. To protect any assets (business and personal) from being seized, they may opt to make a deal with the landlord to terminate the lease. The landlord must give consent and sign off on termination under such circumstances. Therefore, the tenant should approach the landlord with a mutually beneficial deal.

In situations where the landlord wishes to terminate the lease, its complexity and cost of “buying out” the lease will depend on how successful the tenant’s business is. Most tenants will be open to such an agreement as at the end of the lease; they would be forced to vacate anyway.

Frequently Asked Questions

An oral lease agreement is difficult to enforce as it is a matter of, he-say she-say. If a dispute arose due to a lack of commitment to the lease from one party, the court would have to listen and decide which version of the argument is true, which can be hard to determine. A written agreement ensures there is written proof of what was agreed on, and the guilty party can easily be determined.

Governing law is the applicable state, federal or local laws that govern the leasing of property in an area. They are applicable where the property is located and not where the landlord or tenant is located.