A partnership agreement should be one of the legal documents for your business at the commencement of the business. This partnership contract from the start of your business venture helps educate all partners about their roles, benefits, responsibilities, and limitations. Technically speaking,

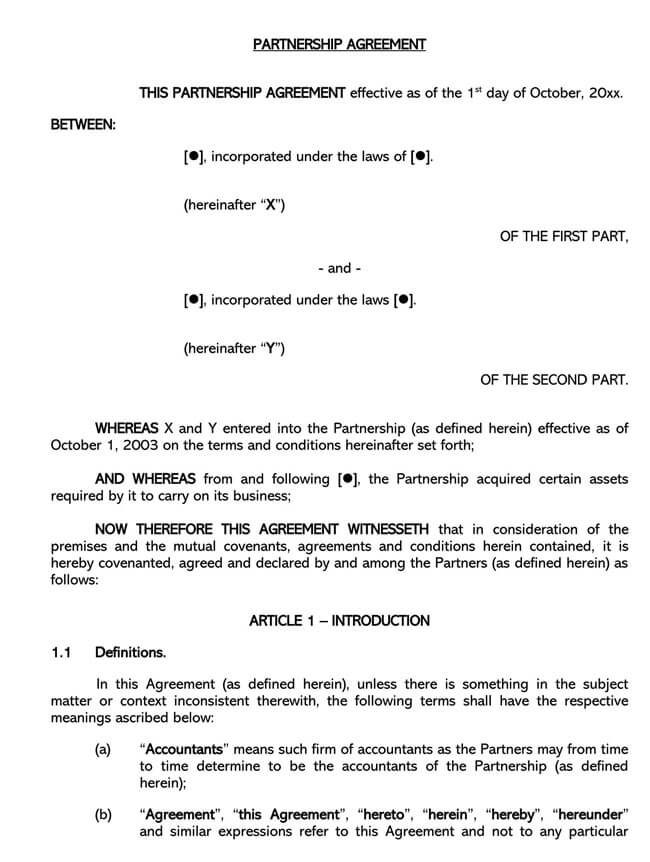

A partnership agreement is a written legal document that binds two parties in a business and dictates how they run the business, describing the relationship and roles of both partners.

There are three main types of partnerships available, namely:

- Limited Liability Partnership

- General Partnership

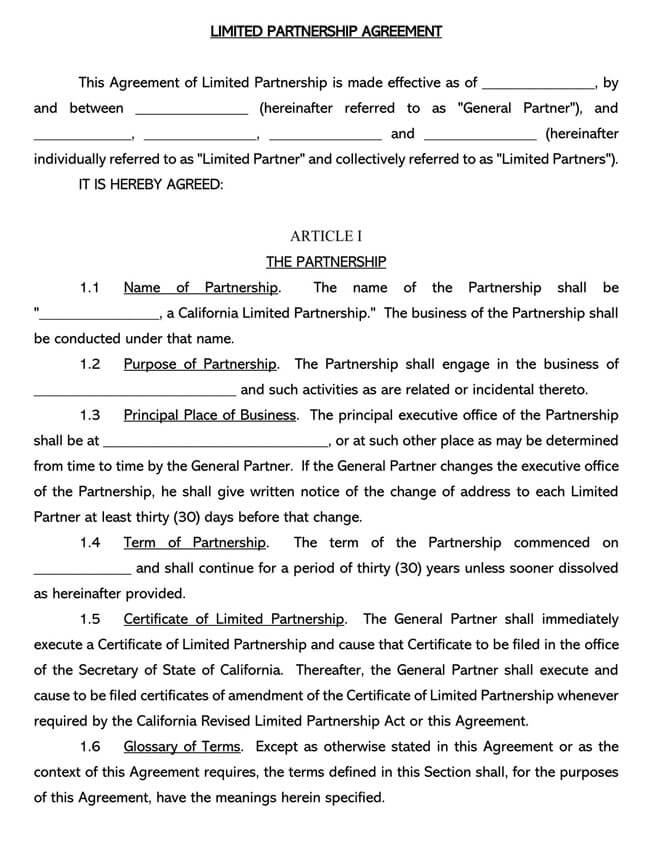

- Limited Partnership

All three differ in their impact on a business management structure, taxation, opportunities for investment, and liability implications. It is sacrosanct to mention the partnership type between you and your partner in the partnership agreement.

These you can use interchangeably:

- Business Partnership Agreement

- Partnership Contract

- General Partnership Agreement

- Articles of Partnership

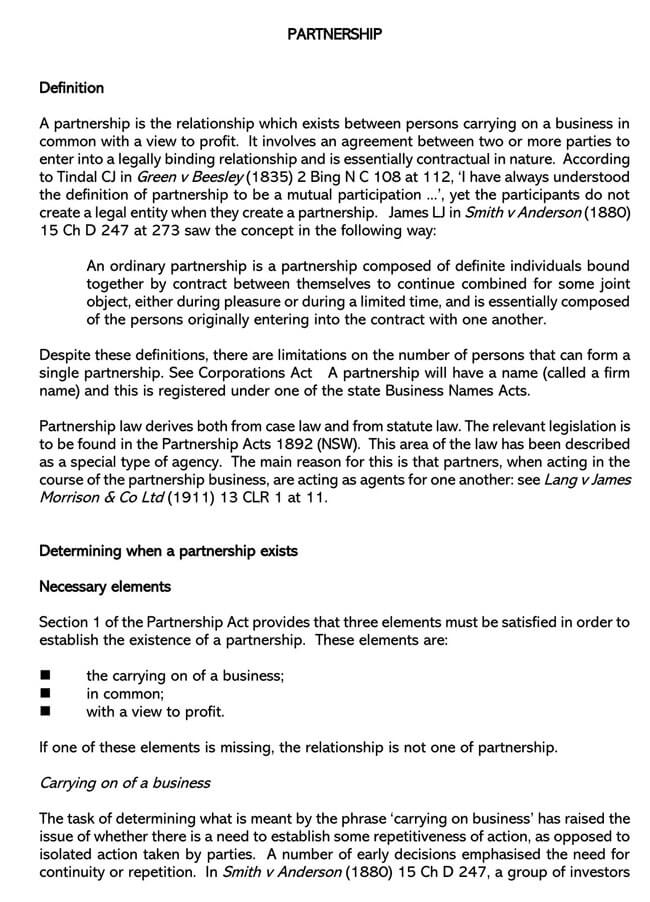

Applicable Laws

There is no general federal law that governs the creation of the agreement; however, it is usually subject to the individual state laws because every state governs business creation.

Who needs a partnership agreement

Every business with more than a sole owner needs a partnership agreement to set ground rules for smooth business running. This binds all the partners in the business and helps in times of decision-making. It is important to have your own agreement because, in the absence of any, your business reverts to the state rules if any of its partners dies or leaves the partnership.

Most states now use the Revised Uniform Partnership Act(1997) or the Uniform Partnership Act (1914).

A partnership does not actually pay any taxes, but the partners pay taxes on their individual shares. However, the business is liable to face tax charges without an agreement. It is also important to show clear-cut differences between partners based on their contribution share to business capital. This is necessary to divide profits accurately.

Overall, it is necessary to outline the partners’ goals, responsibilities, and joint vision. This makes it easy to anticipate business conflicts and prepare handy solutions as they come.

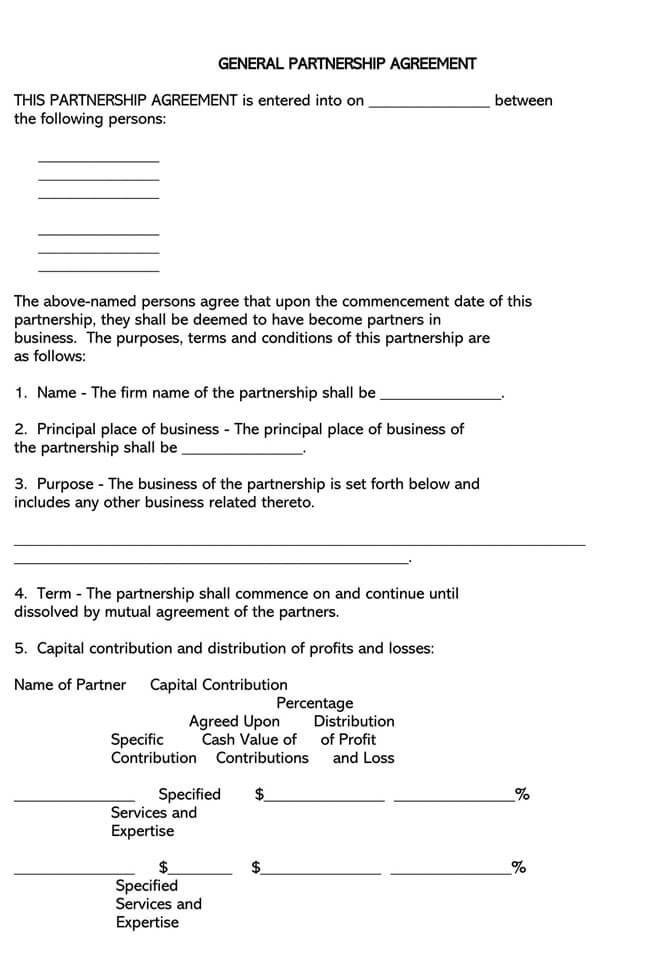

Components of a Partnership Agreement

It should include all important information about the members of the partnership and basic requirements that set a standard for the business venture.

Some examples of components of an agreement include:

Personal information

This is basic and necessary information that entails writing the full name of each partner that co-owns the business.

Business information

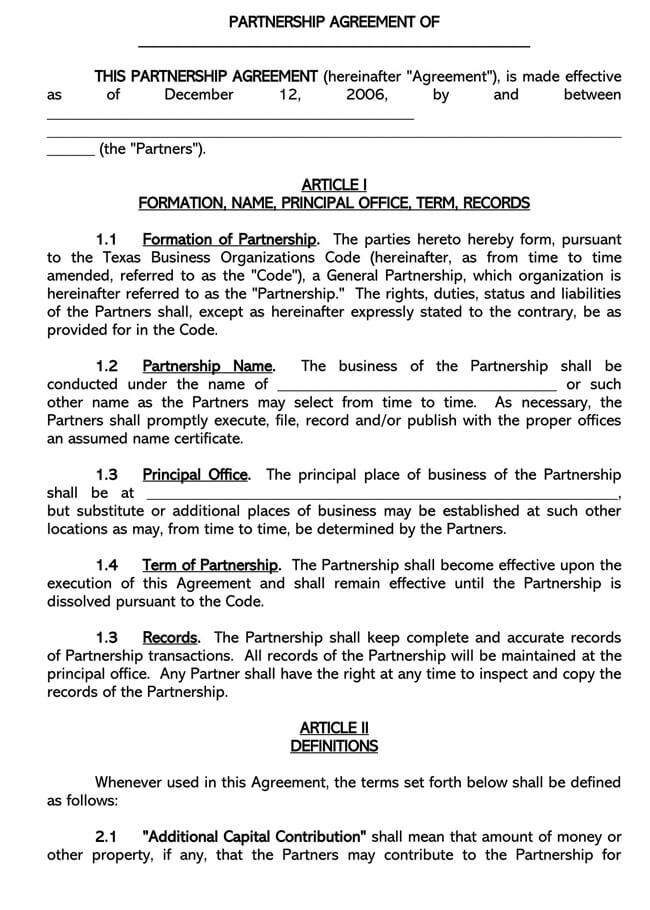

This covers the summary of what business you are venturing into and contains such details as:

- Name of the business: Partners must all agree on the name fitting for the business that they are venturing into and then clearly state it in the agreement.

- Type of business: It is essential to have clear information on the document of the exact specifications of the business. This gives the partners an accurate picture for running the business.

- Purpose of business: Every business needs to have goals and objectives to serve a relevant purpose. Hence, there is a need to state the objectives and aims of the business in the agreement.

- Place of business: A business needs an address where partners meet and carry out their functions. It is essential to include this in the business agreement.

- The number of employees: In planning a business, you should also think about the number of people you need to achieve the business aim. This includes enlisting their various qualifications and functions.

Capital contribution

Every partner gets an ownership percentage of the business based on their contribution to the business capital.

This, in turn, influences some major factors in the running of the business, such as:

- Profit and loss distribution: This shows the load of both profit and business loss each partner carries and depends on factors such as the capital contribution and interest share of the partners.

- Fixed percent: For a business to thrive, there must be a clear definition of the percentage of profit that goes to each partner with reference to their capital contribution.

- Equal shares: This understanding is that all partners take an equal brunt of both losses and profits that occur in the business.

- In proportion to capital contribution: Benefits that come with specific capital contributions and other resources that the business requires to grow.

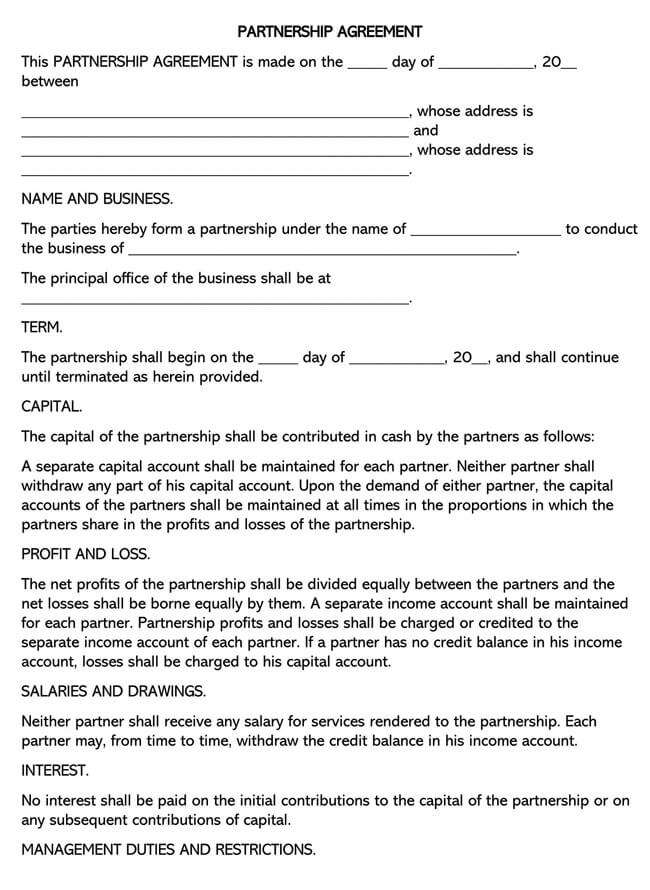

Accounts

A partnership can run several accounts for various business transactions. This helps to maintain clear business records and prevent fraudulent activities.

Some account types in partnership business include:

- Capital account: This will be a separate account from the business account, where all members pay their capital contributions.

- Income account: This is also a separate account for the saving of profits and losses that the members incur from the business.

- Salaries and drawing: These are income accounts for the partners, where they can access their income and withdraw at will.

- Bank accounts: The partners should not share the same personal account as the business account but must keep a separate private account.

Management

For the smooth and efficient running of the business, there has to be a clear and systematic sequence of activities that the partners must adhere to in the business.

These include:

- Books and records: There should be clear instructions on records and maintenance of business books. This should include access to these books and instruction on supervision and inspection of the records.

- Management of duties: There is a clear distribution of roles of each partner, as well as management of the partners.

- New partners: There are basic requirements of entering into the business as a new partner and standards for entry.

Voting methods

The partners should agree on voting methods before engaging in the business. This is necessary to have efficiency and accuracy in the running of a business.

Three main methods of voting in business include:

- Proportional to contributions: Each partner’s voting power is a direct reflection of their capital contribution to the business.

- Proportional to profit share: Here, the partners gain voting power in accordance with their share of profit distribution.

- Equal votes: The voting power is equal, and every partner gets a vote.

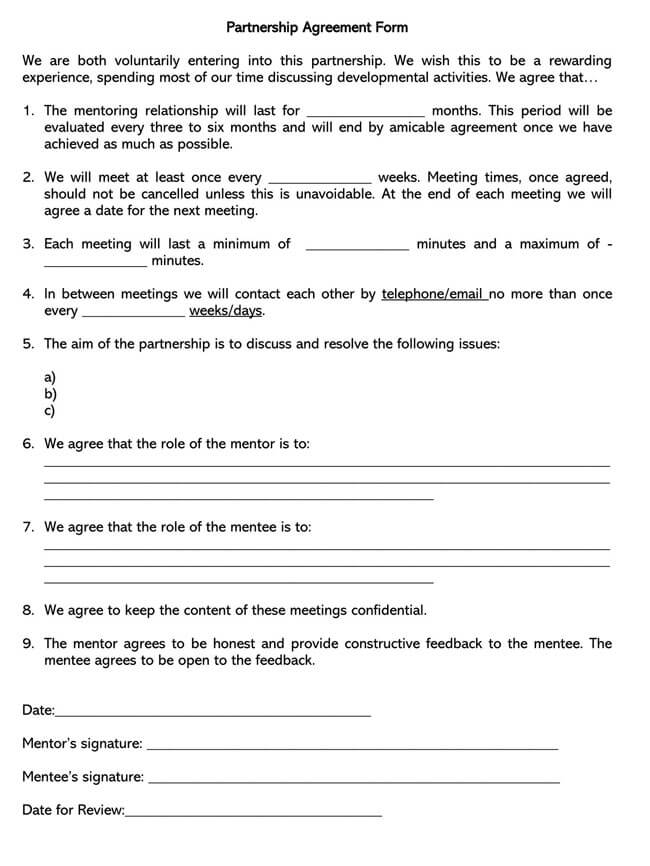

Partner information

This will include all the legal names and addresses of partners that are currently involved in the partnership, as well as steps to take when partners have to leave the partnership.

They include:

- Dissolution: In the agreement, partners must clearly state how to share profits and losses in cases of dissolution. Partners may dissolve their partners due to many factors, including:

- Ending their partnership on a day they agree on at the commencement of the business

- Completion of the business aim and objective

- The bankruptcy of the business or an individual partner

- Withdrawal of a partner from the partnership

- A partner’s death

- Voluntary Withdrawal: The agreement should state rules for voluntary withdrawal. This occurs when a partner decides to leave the partnership out of their own volition and may result from retirement or business, or at times, personal reasons.

- Involuntary Withdrawal: The partner leaves the business without their consent and may be due to ill health, breach of contract agreement, bankruptcy, or disability. The agreement should state what happens to their shares.

- Retirement: There must be a written retirement clause in the agreement for one of the partners to retire without dissolving the entire partnership. However, if there isn’t, the partnership must dissolve to retire one of its partners, and then a new partnership can form.

- Death: In case of the death of one partner, the agreement must state what happens to the partner’s share. For example, the partner’s shares go to their estate, and other partners may then buy it using the business formula.

- Buyout: It must clearly state when a partner can sell their shares, to whom, and the method of valuation and sales of the shares.

- Non-partner requirement: This covers the requirements necessary for a partner to share an interest with a non-partner. The partner must meet all sales requirements, and the non-partner must have information about the business aims, goals, and interest laws.

- Non-compete requirement: Binds on a partner that leaves and helps the business to keep trade secrets. It is a vital part of the agreement and legally binds all partners.

General

General instructions that the partners must include in the agreement include adherence to governing laws, arbitration, and partner restrictions on transfer.

- Restrictions on transfer: It should state the limitations of a partner to transfer shares or interests to another partner.

- Arbitration: It states steps in resolving disagreements about the partnership.

- Governing laws: It highlights the state laws that apply to partnership disagreements.

note

Ensure to register the business and trade name under the state authorities.

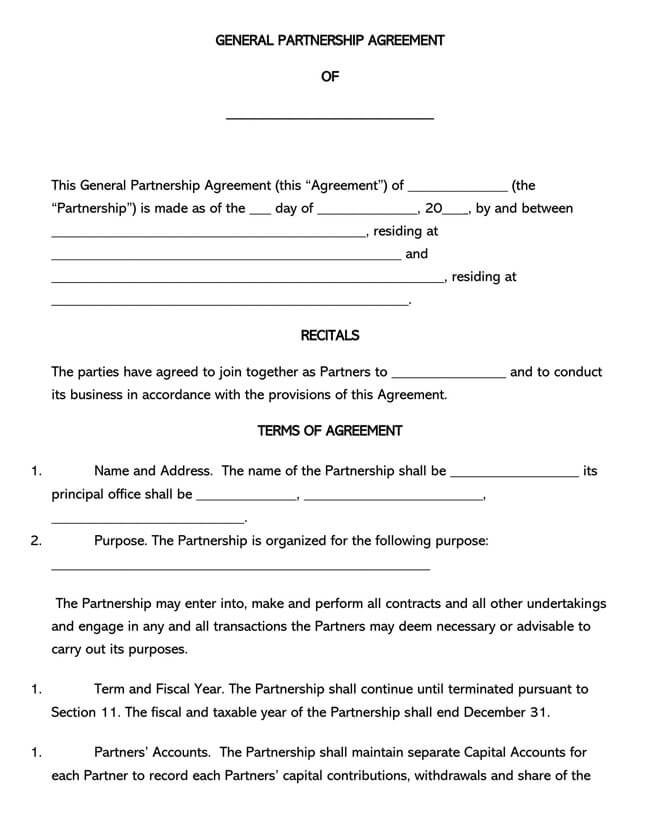

Ownership details

This covers a description of each partner’s percentage ownership of the business, as well as the duration of the partnership and terms of the partnership.

The agreement is a rule book that covers the following:

- Percentage of ownership: The agreement should clearly outline the ownership division of the business. Some partnerships share ownership based on the capital contribution of the partners, while others share partnership equally.

- Length of partnership: The partnership deed should state if the partnership will go on indefinitely or that the partnership has a determined time before dissolution.

- Decision making: It should also highlight the conditions for decision making and whether the partners have equal rights or decision making is a function of capital contribution.

- Resolving disputes: It should state the method of dispute resolution and conflict management.

- Authority/Binding method: It should outline the limits to partner authority over the business in order to make all partners aware of possible outcomes of business decisions and execution by individual partners.

Partnership tax elections

The partners need to choose one among them as representatives and contact tax elections. The representative will serve as a lead for the new task laws of the business.

The agreement outlines these rules and allows the partners to:

- vote out of the new elections if they are eligible to do so, and yearly renew this decision

- allow their representative to answer to them about their dealings with the internal revenue service

- choose to have each partner assessed for tax liability when a tax audit goes to partner level

Benefits of a Partnership Agreement

A partnership venture aims at making more profit at a lower cost than with sole business ownership.

Hence, the legal contract that binds all partners to a certain modus operandi has these benefits:

- Income is only taxed once: The Internal Revenue Service only deducts tasks once because there are general profit and income, in contrast to sole ownership where the state deducts tax from individual income.

- Allows you to anticipate and settle potential business conflicts: A written document serves as a guide for possible conflicts you may face as partners and steps to resolve these conflicts.

When you do not draw up an agreement, you will probably face:

- Unexpected tax liability without an agreement may lead to high losses and bankruptcy.

- The agreement helps in the distribution of profits accordingly. However, in the absence of this, there may be partial distribution, and this is of no benefit to the partners.

- Without your own business partnership laws, the state’s partnership laws bind on your business.

Related Documents

From the inception of the business partnership to the daily running of the business, there are additional documents that may be necessary aside from the agreement.

These include:

- Notice of Withdrawal from Partnership: This is a notice that a partner tenders to other members of a partnership, notifying them of the partner’s intention to exit the business partnership.

- Assignment of Partnership Interest: This is a document that permits the transfer of one partner’s interest to another partner within the business.

- Partnership Amending Agreement: This allows for a modification in the initial agreement, and the partners can use this to unanimously alter the terms of the agreement.

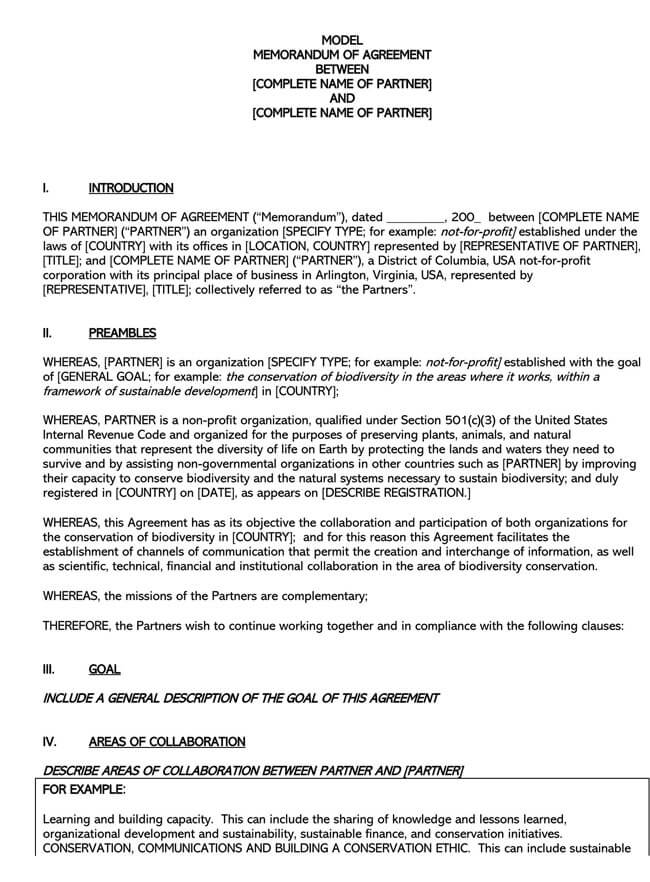

- Joint Venture Agreement: This document outlines in detail the terms of agreement of two parties that unite to achieve a specific goal at a given time.

- LLC Operating Agreement: This document represents an agreement that highlights the responsibilities, benefits, and rights of its members. It also clearly states the guidelines and rules that govern all members of a limited liability company.

- Business Plan: This is a highly detailed document that encompasses a company’s rule book. This includes the company’s plans, values, aims, goals, financial vision, mission, and employee management plan.

Frequently Asked Questions

If a partner wants to leave a business partnership, the partner must first offer to sell their interest to one of the other partners in the business before offering these shares to an outsider. And so, a partner can choose to willingly transfer interest with another partner in the firm.

Yes, a partnership can own assets, which it can acquire from the partners in the business or directly. In the latter, there is a legal transfer of said assets to the partnership formally.

A tax matters partner is that partner that the members of the partnership elect to represent before the internal revenue system. This representative reports back to the team and assumes this role for a year. According to the law, it is only a general partner that can assume and function in this role.

Final Thoughts

A business partnership agreement is necessary to forestall all future misgivings about the business. It gives clear and explicit roles about the functions and responsibilities of partners and serves as a guide in the business running. You should have a partnership deed when you have business partners and involve a trusted legal practitioner to help you with drawing up the document and Partnership Agreement execution.