A lease agreement is a contractual deed that allows you, as a landlord, to rent out your property to a tenant. It contains all the prerequisites for renting your property in Arizona.

In this article, you will find the core components governing property rentals in the state of Arizona. This includes the length of the agreement, start and expiration dates, payment rate and due date, disclosures, and other legal requirements that pertain to Arizona.

What is an Arizona Lease Agreement?

There are certain conditions that you, as a landlord, must fulfill before being able to rent your property in Arizona. A lease agreement is a legal deed that outlines all that is required for renting out your property. Similarly, there are requirements (mandatory and otherwise) that all prospective tenants must fulfill to be able to live on your rental property.

It defines these requirements for both you and the potential tenant and must conform to Arizona state laws and statutes to mark its validity. These requirements include the length of tenancy, payment rate and due date, disclosures, and other set state actions of Arizona.

Lease agreements in Arizona are flexible in terms of landlord objectives. They allow you to dictate certain terms and conditions concerning renting out your property to a tenant. On that account, you must clearly state your conditions prior to completing the authorization process.

The validity of a lease agreement in Arizona stands once both parties complete the signing process, and any contract termination must follow the pre-structured process. With each state having its own rules and regulations governing property management, all lease agreements used in Arizona function solely within the state. Although certain rules are the same in every state, some bits and pieces differ, thus making each document distinctive.

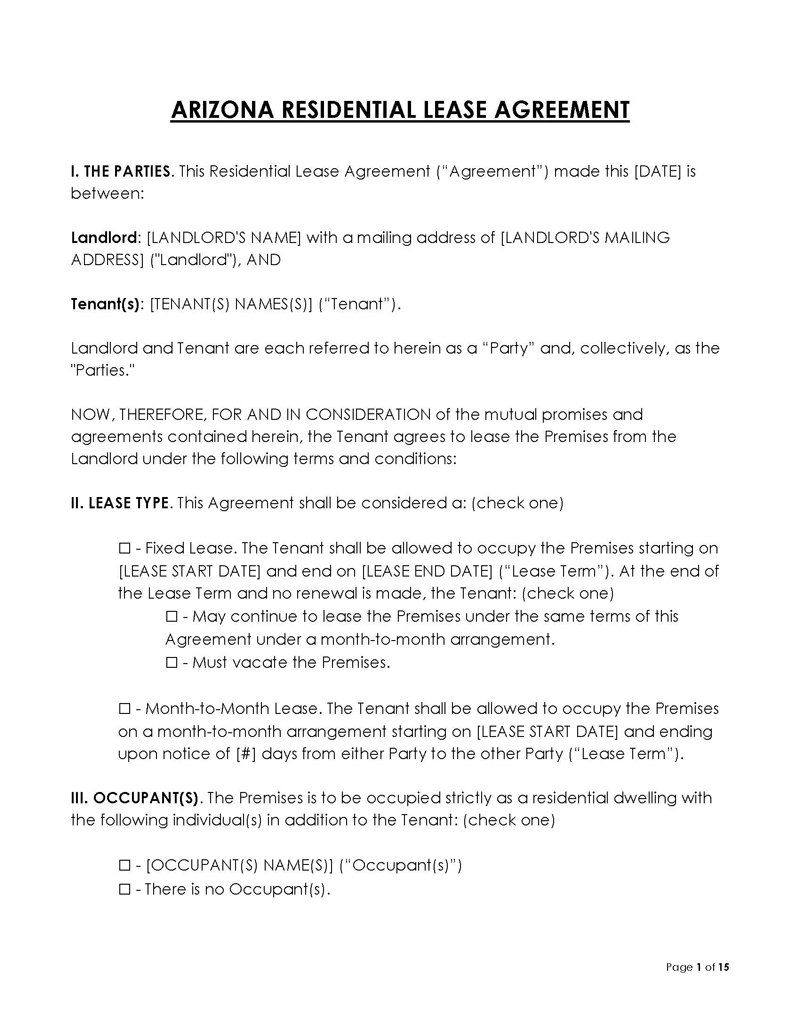

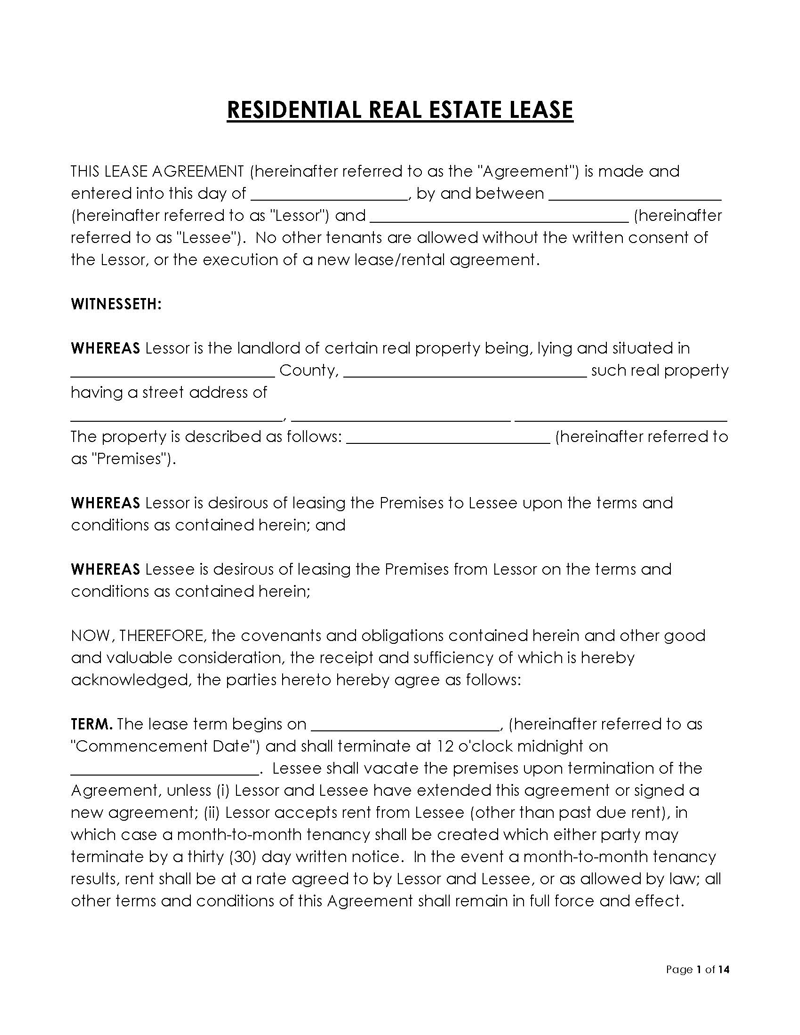

Free Templates

Given below are free templates:

When is the Rent Due?

Concerning the rent due dates, there are no specific laws specifying when tenants should pay their rent and an existing grace period in an event whereby a tenant is unable to pay his/her dues.

All tenants must pay their rent at the agreed time by both parties. Failure to do so may result in the evacuation of the tenant. However, a five-day grace period exists only for manufactured homes, as described in § 33-1414.

Arizona Landlord and Tenant Laws

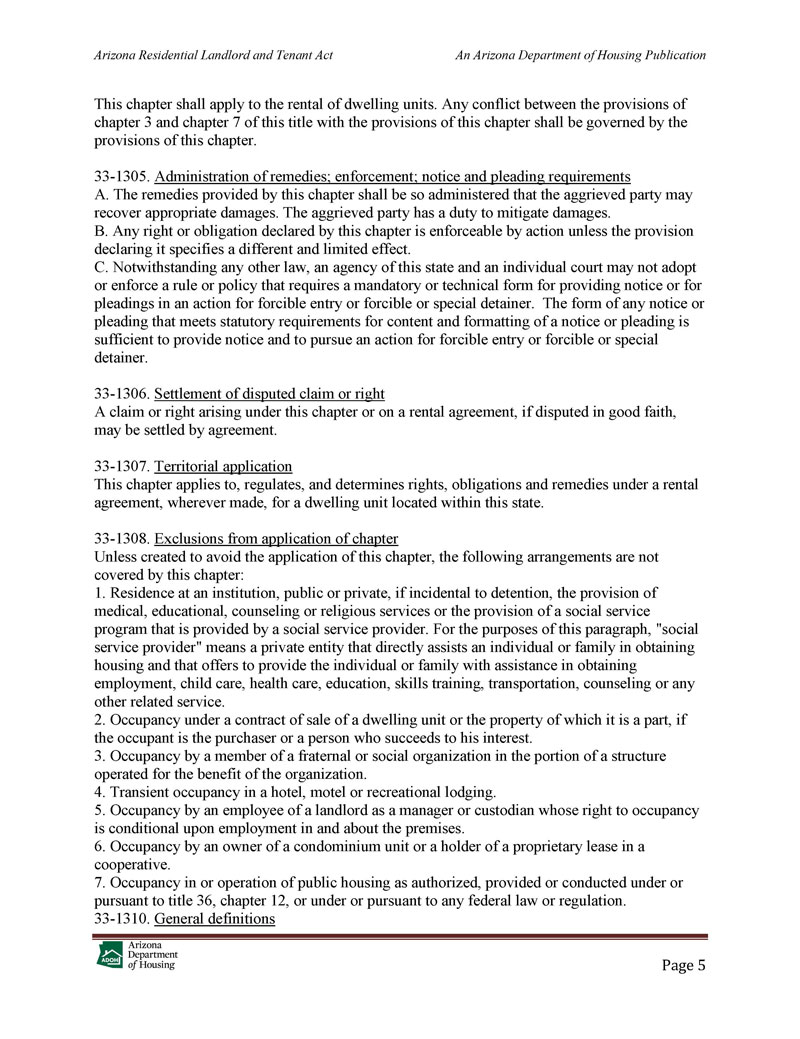

As with all other legal representations, state laws are the building blocks upon which sensitive matters rest. As such, it is important that landlords and tenants familiarize themselves with the laws that govern a lease agreement in Arizona.

You can consult Title 33, Chapter 10 (Residential Landlord and Tenant Act to get a full scope of the laws governing the leasing of a property.

However, here are some landlord and tenant laws that you, as the landlord, should know prior to drafting a lease agreement:

Security deposits

Unlike certain states with a standard security deposit value, Arizona accounts for two laws that govern the payment of security deposits:

- Security deposit maximum: Ariz. Rev. Stat. Ann. §§ 33-1321(A) states that a landlord is not allowed to collect more than a month and a half’s worth of rent as a security deposit.

- Security deposit return: Under the same statute, the landlord must return the security deposit fourteen days after the tenant evacuates the property. This fourteen-day period does not include weekends and recognized holidays. Additionally, the landlord must provide a list outlining subtractions made from the security deposit on account of damaged properties. If both parties reach a disagreement, a 60 days assessment period opens up for them to resolve their problem.

Late fees

Arizona has no statute that delineates the amount a tenant must pay as a late fee. However, Ariz. Rev. Stat. Ann. § 33-1414(8)(c) states that the upper late fee limit for manufactured homes peaks at $5 daily.

In each case, you, as the landlord, must clearly outline the fees.

Landlord’s right to enter

According to Ariz. Rev. Stat. Ann. § 33-1343(D), all landlords must provide a two-day (48 hours) notification (minimum requirement) before gaining entrance to the property for maintenance or free-phone reasons.

Holdover tenants

According to Ariz. Rev. Stat. Ann. §§ 33-1375(C), a landlord can forcefully reclaim possession of their property if a tenant refuses to relinquish control after the end of their tenancy.

In this regard, you may choose to collect two months’ worth of rent or two times the number of damages suffered.

NSF checks

Arizona state law does not make provision for any fee attached to rubber checks. Nonetheless, you, as the landlord, may decide to include an anti-rubber check fee (maximum of $25) in the lease document.

You may also go as far as repaying all bank charges attributed to processing rubber checks.

Disclosures Required in a Lease Agreement in Arizona

Arizona state laws demand that you, as a landlord, disclose certain information to all prospective tenants. State laws make these revelations mandatory in order to ensure fairness when it comes to property rentals.

You should be confident in your property and, hence, able to inform tenants about things they should look out for.

In that regard, the disclosures required include the following:

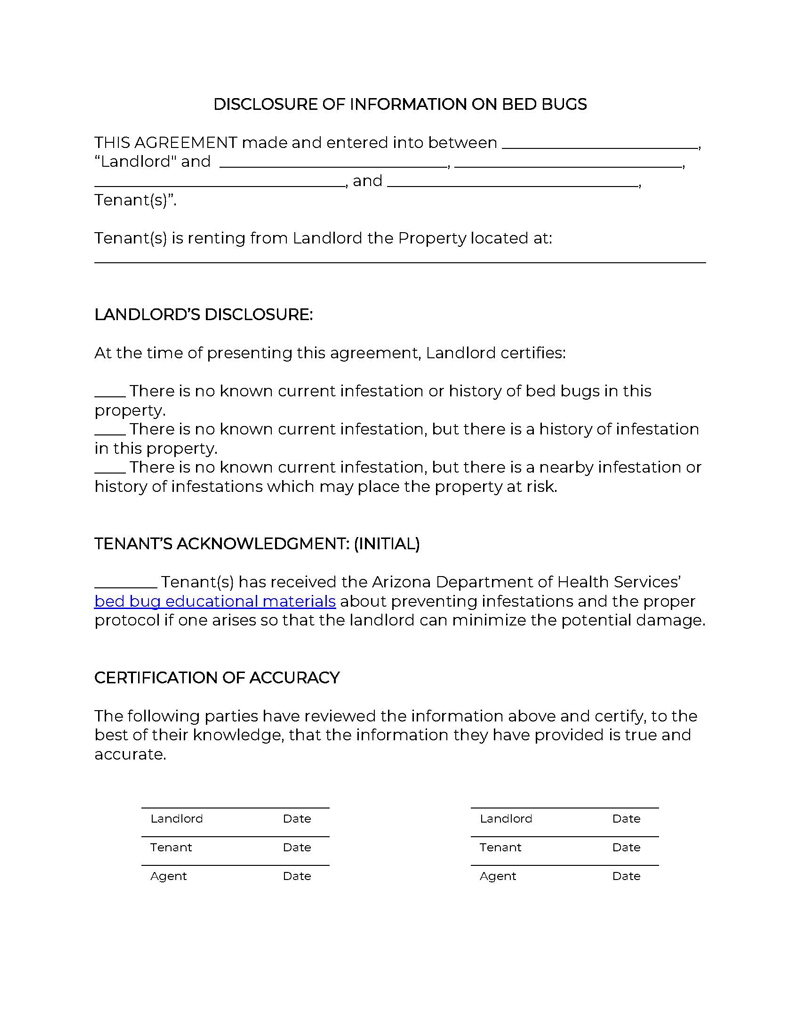

Bed bugs disclosure

All landlords are to inform tenants of a potential bedbug infestation and provide them with information regarding handling a bedbug infestation, as described in Ariz. Rev. Stat. Ann. § 33-1319. The law also forbids landlords from leasing out any property experiencing bedbug infestations.

Non-refundable fees

According to Ariz. Rev. Stat. Ann. § 33-1321, landlords must clearly outline mandatory fees. If there are any non-refundable fees, the landlord must clearly affirm this within the document; otherwise, such fees automatically become refundable.

Landlord-tenant act

Ariz. Rev. Stat. Ann. § 33-1322 requires landlords to issue a copy of the landlord-tenant act prior to finalizing the lease.

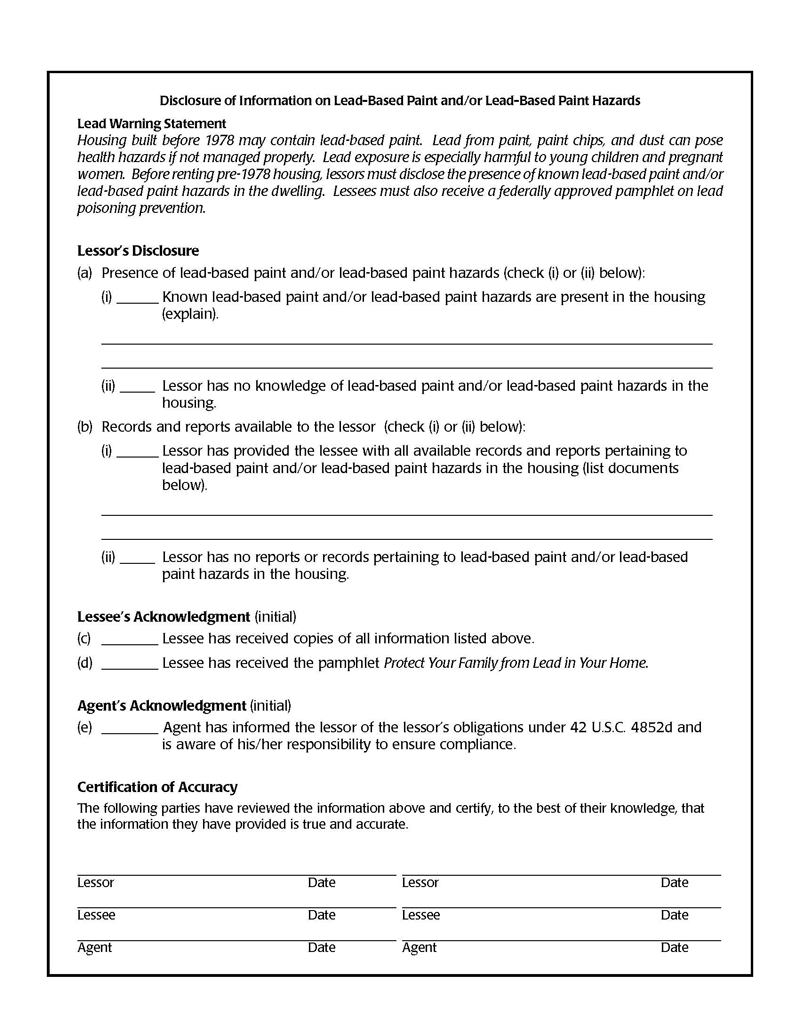

Disclosure of lead-based hazards

Federal law (42 U.S. Code § 4852d) demands all landlords/property controlling agents of homes built before 1978 provide their tenants with information pertaining to the existence of lead-based hazards such as wall paint within the property.

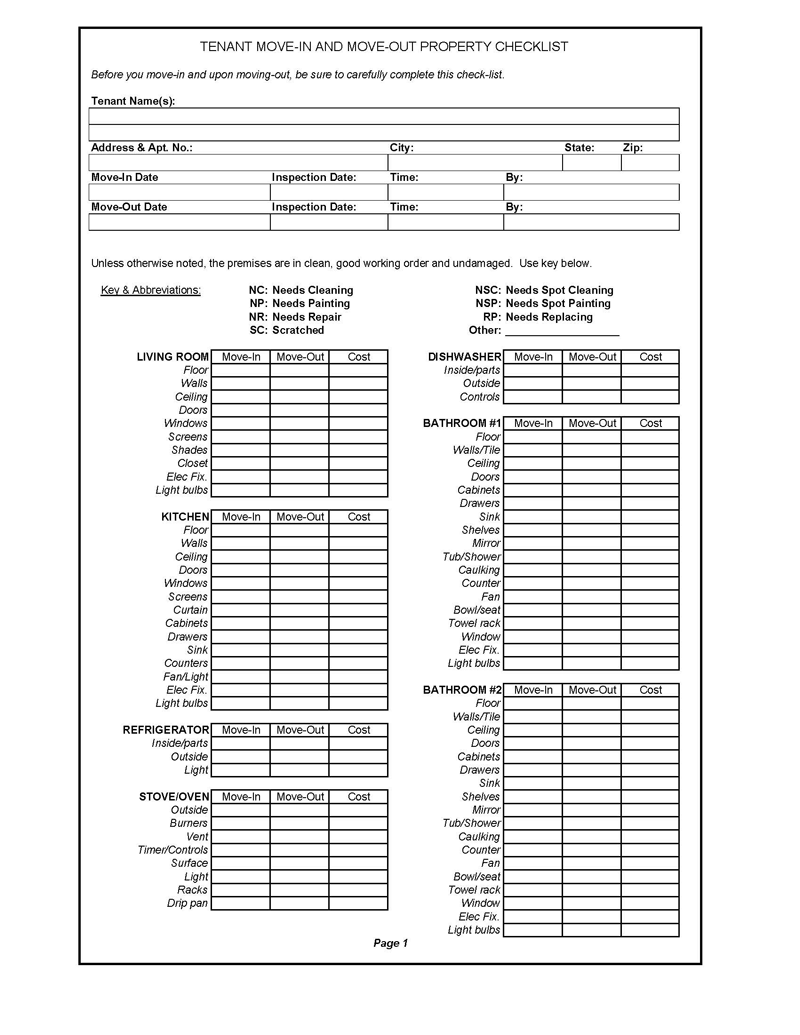

Move-in / move-out condition checklist

After lease authorization, landlords, according to Ariz. Rev. Stat. Ann. § 33-1321(C), must provide the tenant with a move-in checklist.

The checklist takes into account items in the unit prior to the lease, helping you document damages that occurred during the tenancy period. As such, they can legally retain part of the security deposit, one that is equal to the damages incurred.

Notice

According to Ariz. Rev. Stat. Ann. § 33-1322, landlords must make known, the identity and address of the agent(s) tasked with providing tenants with legal notices.

Pool safety notice

Ariz. Rev. Stat. Ann. § 36-1681(E) states that landlords must inform tenants of the existence of a pool within the property.

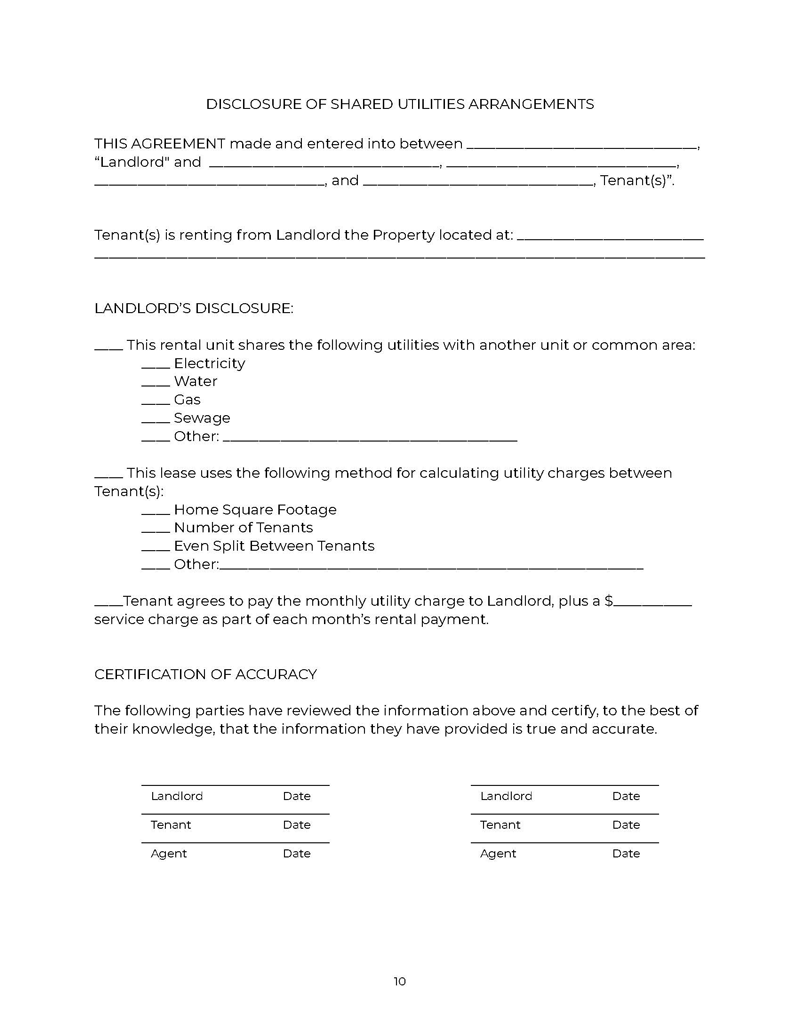

Shared utility charges

According to Ariz. Rev. Stat. Ann § 33-1314.01, landlords must inform tenants about potential shared utilities. Consequently, they must provide details concerning the computation of utility charges.

Landlords are also free to recompense themselves on account of having to calculate and pay utility charges from their pockets.

Pass-through tax notice

Ariz. Rev. Stat. Ann § 33-1314 states that for a landlord to adjust their rent due to changes in the pass-through business tax, they must provide their tenant with a 30-day notification.

You, as the landlord, must, however, outline this in the lease for it to take effect.

Abandoned personal property notice

Five days after a landlord issues a written declaration stating that a tenant has abandoned some of their personal properties on their rental place, Ariz. Rev. Stat. Ann. § 33-1370(E) makes provision for storing the tenant’s personal belongings for 14 days in hopes that the tenant comes to reclaim them.

You, as the landlord, are free to donate or sell the properties if the tenant fails to reclaim them after the 14-day period.

Foreclosure notice

Ariz. Rev. Stat. Ann. § 33-1331 demands that landlords tender a written notice to tenants regarding entering a lease agreement after the commencement of a foreclosure action on the property.

Similarly, if a foreclosure action commences after the completion of the lease agreement, the landlord must write to the tenant within five business days.

Marijuana use policy

According to Ariz. Rev. Stat. § 36-2813, a landlord cannot reject a potential tenant on account of the tenant being a medical marijuana cardholder.

The landlord is free to discuss the terms and conditions of marijuana use within the property prior to lease authorization, but outright rejection is not allowed.

Proprietor information

Ariz. Rev. Stat. § 33-1322(A) states that a landlord must issue a written notice containing the identities and addresses of those with authorized access. This information applies to the landlord, agent(s), and property manager.

Rent increases due to taxes

According to Ariz. Rev. Stat. §33-1314(E), a landlord can legally increase the rental amount to compensate for an increase in the tax rate after an increase in tax percentage by the legislature.

Concerning this, the landlord must indicate in the lease agreement the chances of a potential rent increase, as well as a 30-day notification prior to the increase taking effect.

Most Commonly Used Rental Lease Agreements in Arizona

As with other states, Arizona hosts several lease agreements that apply to different tenancy positions. Overall, these forms contain diverse requirements that serve to protect you as well as your tenant.

Here are seven of the most common forms used in Arizona:

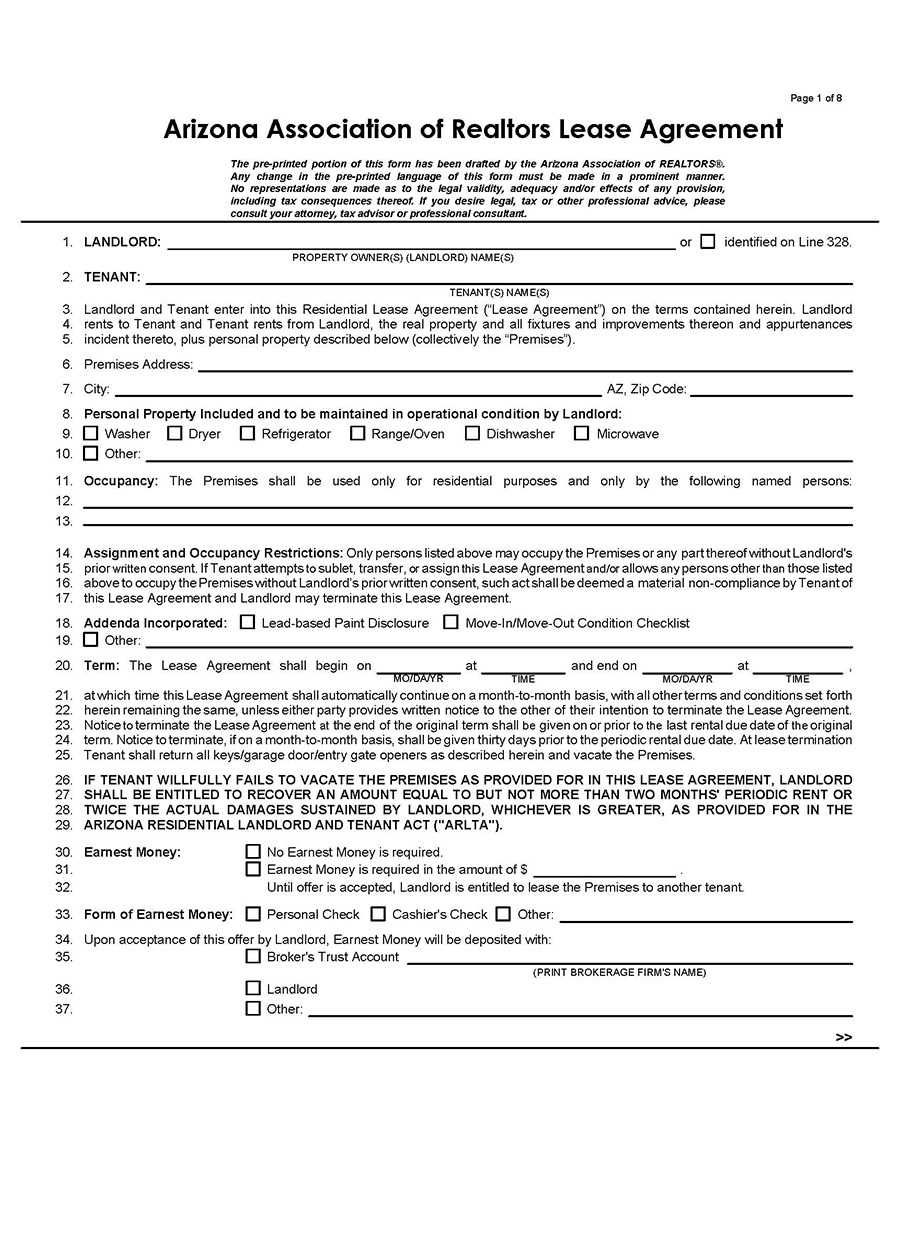

Association of realtors

An association of realtors lease agreement is a version developed solely for properties within Arizona.

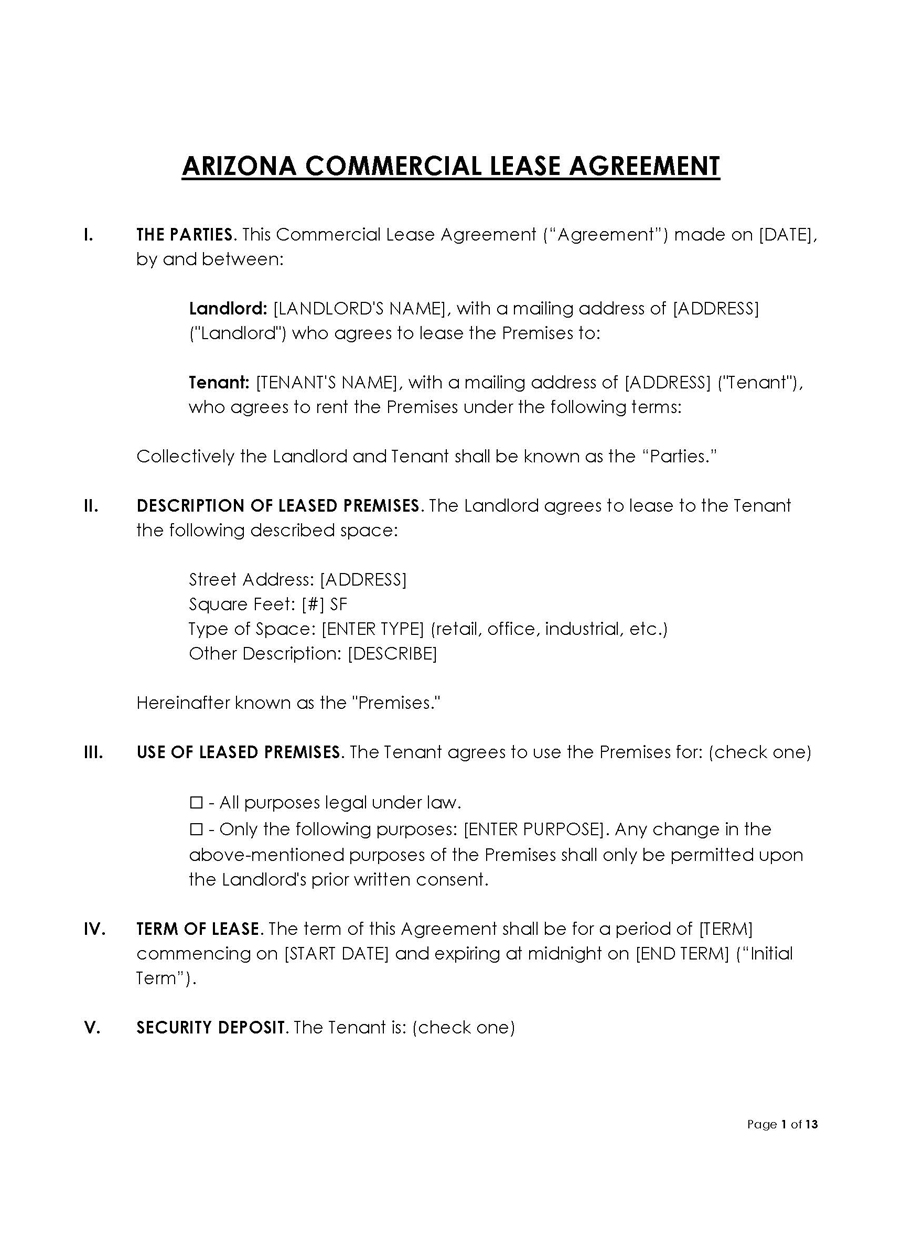

Commercial

A commercial lease agreement is a document that allows you to lease out your property to anyone in need of a business property.

Month-to-month

A month-to-month lease agreement in Arizona is one that grants either you or your tenant the power to annul the contract at any point in time. In this case, the party wishing to annul the rental contract must provide 20 days’ notice before the next rent is due.

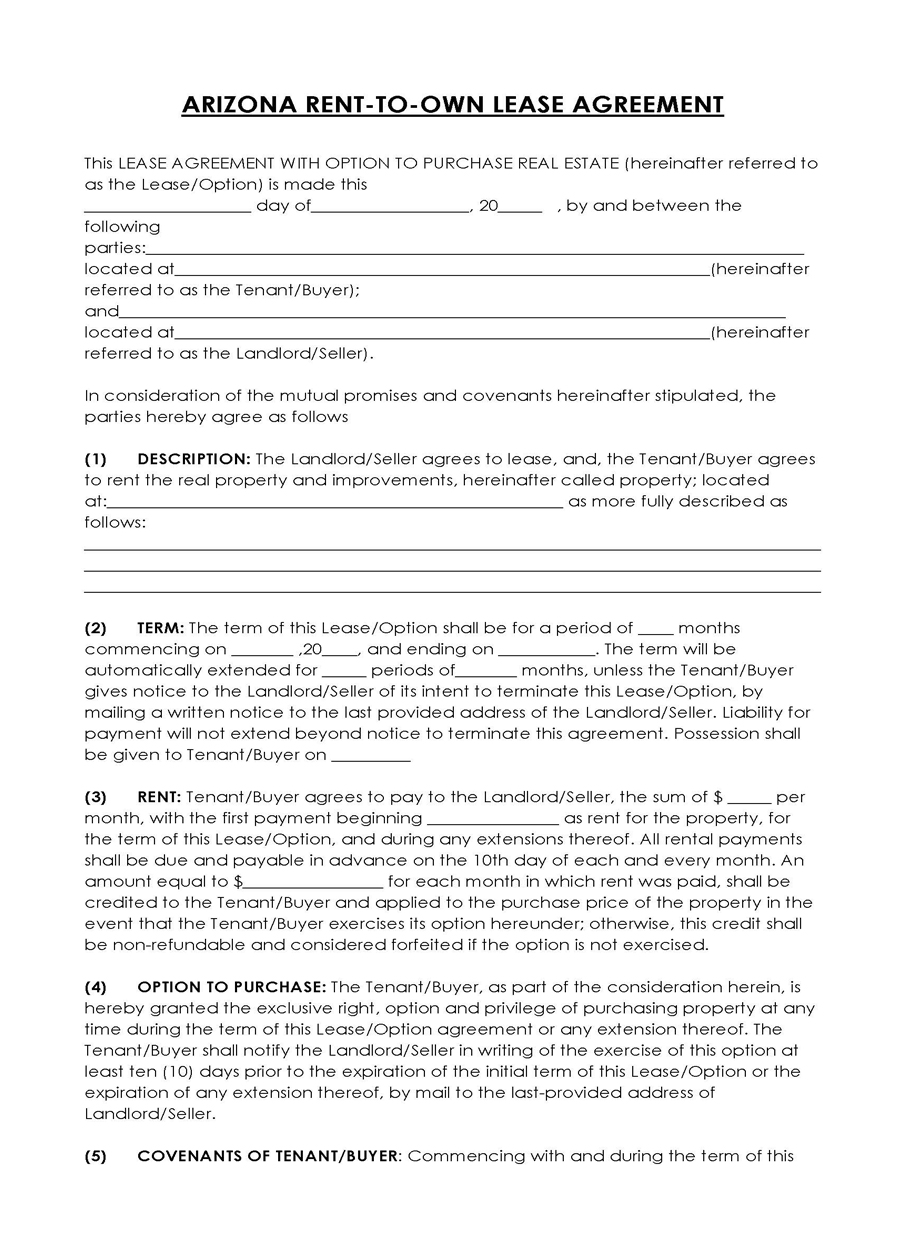

Rent-to-own

A rent-to-own lease agreement in Arizona is a contract that gives a tenant renting a property the option of buying that property prior to the expiration of their contract.

Roommate

A roommate lease agreement is a document that outlines the responsibilities and rights of tenants sharing a property. This includes rent and utility payments, as well as other predetermined fees.

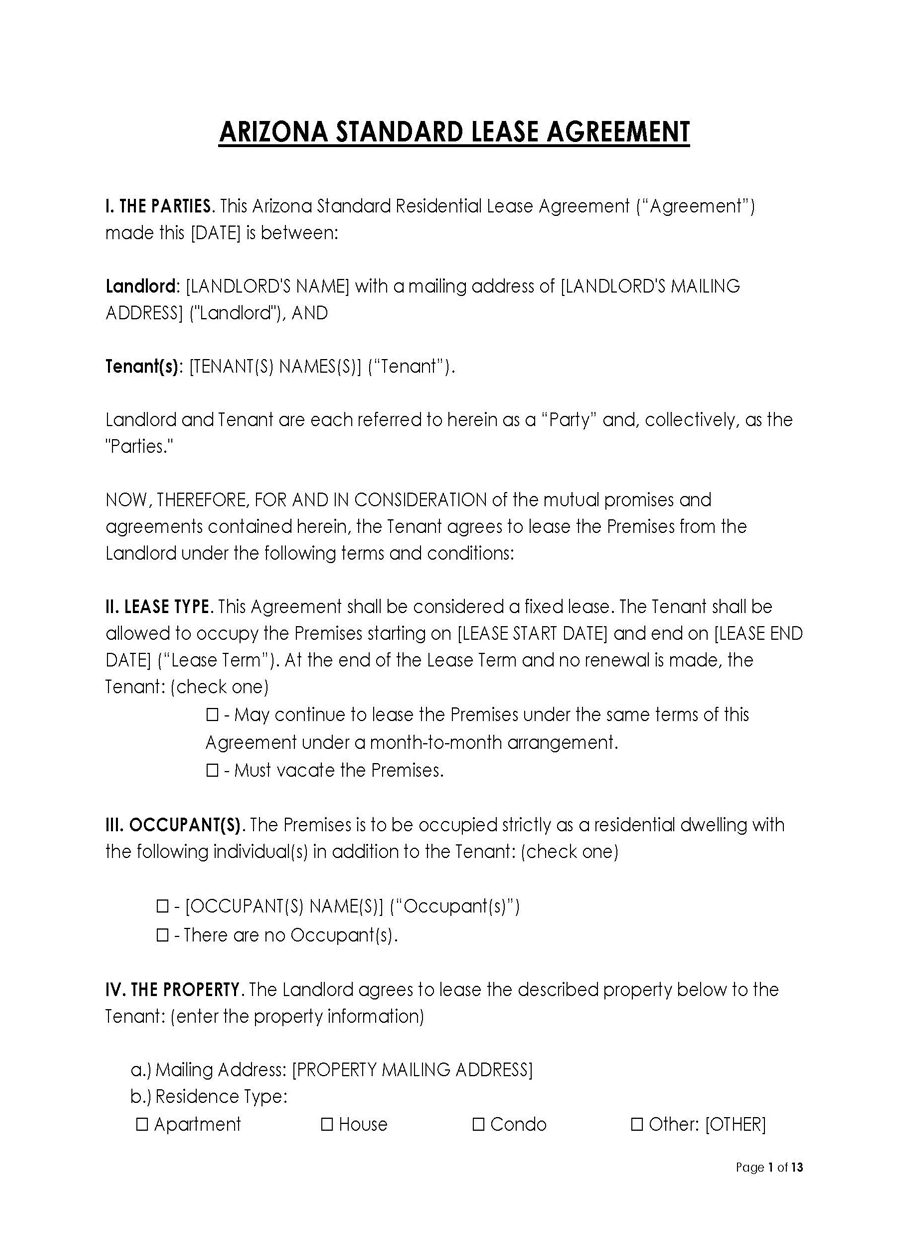

Standard

A standard lease agreement in Arizona is a fixed-term contract involving you and your tenant for the sole purpose of residency.

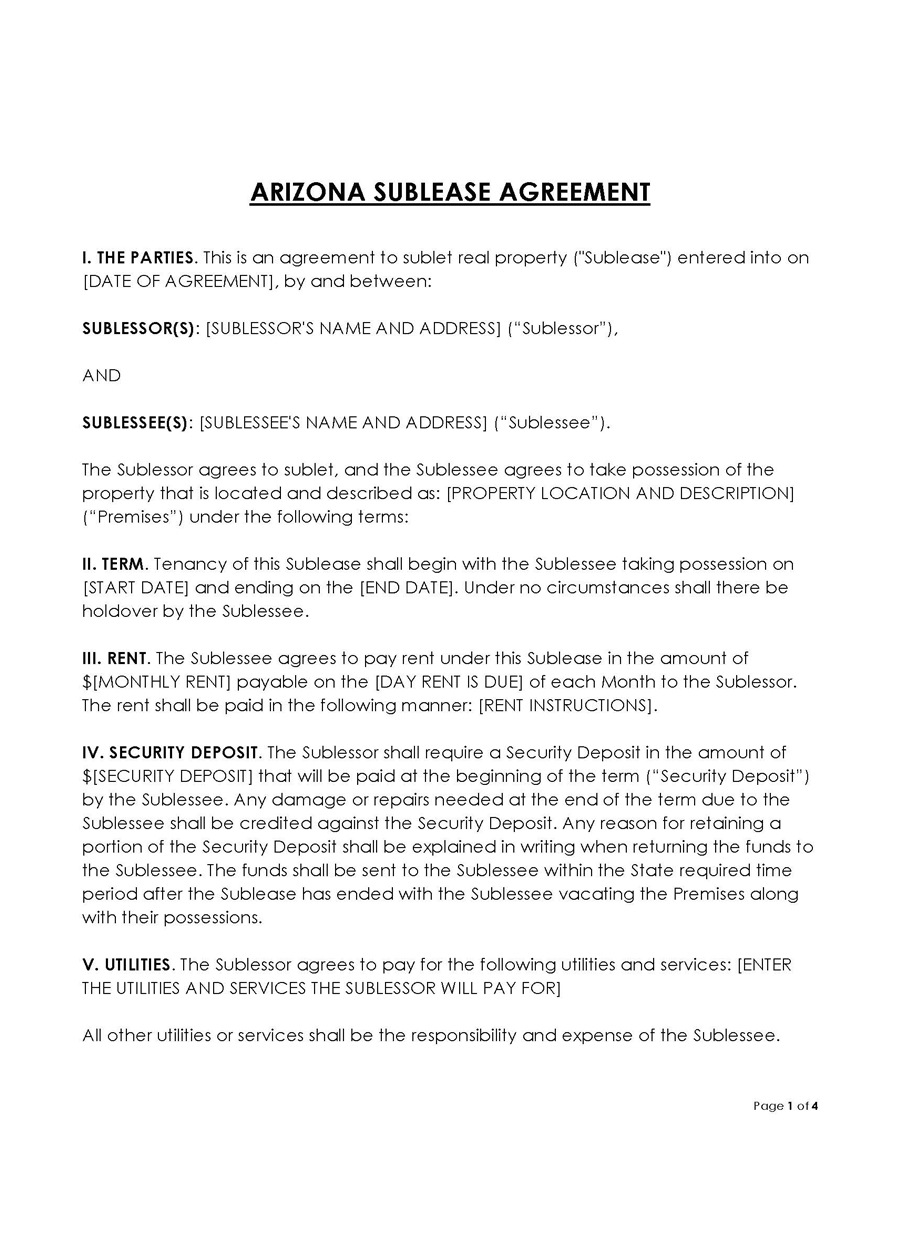

Sublease

A sublease is a legal contract that allows your tenant, in this case, the sublessor, to rent their leased unit to another tenant (subtenant). Your tenant is unable to rent their unit to a subtenant without notifying you, and even still, you must affirm their request before they can proceed with any action.

Final Thoughts

As a landlord, you must understand the rules governing the leasing of properties in Arizona. Although it depends largely on your situation, the information a lease agreement provides helps you achieve your goals and objectives. It also ensures that the interests of your tenants are a top priority.

Furthermore, the contract offers you flexibility in selecting a tenant based on the information you get through the rental application form. Arizona state laws are set to guarantee that the partnership that exists between you and your tenant(s) remains free and fair. Furthermore, the laws provide that any defaulting party accounts for their mistakes and faces the appropriate punishment.