In the state of Massachusetts, when you buy, sell, or register a vehicle, you need to have a signed Massachusetts bill of sale. This is a legal document that helps show proof in regards to a change in the vehicle’s ownership.

Buyers will need this bill of sale when registering a vehicle as required by the Commonwealth of Massachusetts. Both the buyer and the seller must sign the Massachusetts bill of sale.

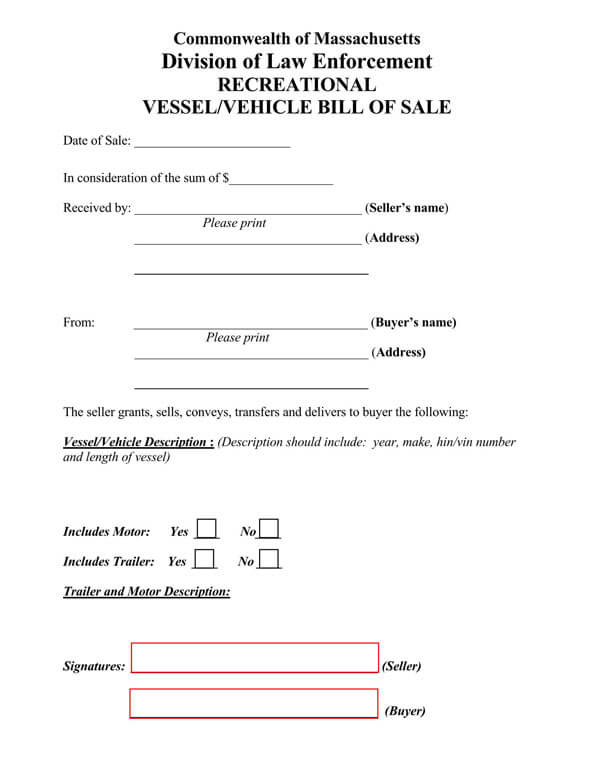

Free Template

Other Requirements

For vehicles that are under 16,000 pounds in weight or that are under 10 years of age, you will also need to provide a federal Odometer Disclosure Statement, which must be attached to the Massachusetts bill of sale. Massachusetts RMV does not offer its own version of this form. Normally, there is a space on the vehicle’s title to record the odometer reading.

If you are registering or titling a vehicle on behalf of the owner, you will need to complete a Vehicle Power of Attorney (Form M-2848)

What is Required to be on a Massachusetts Bill of Sale?

You can download a Massachusetts Bill of Sale from the Registry of Motor Vehicles or create your own.

If creating your own Massachusetts bill of sale, you must include the following information:

- Date of the creation of the document

- Seller’s and buyer’s contact details, which should include their full legal names, full addresses, contact numbers, and e-mail addresses

- Details about the vehicle being sold, which should include the VIN, make, model, year, color, body type, and odometer reading

- The price that the vehicle was sold for and how it was paid for

- Miscellaneous details, such as an “as-is” statement

- Signatures of both the seller and the buyer. This must be witnessed by a notary public

Registering a Vehicle in Massachusetts

Once you have purchased a vehicle, you will need to have it registered and titled in your name at a branch of the RMV before it can be driven on public roads. You must first complete an Application for Registration & Title. You will then need to take out an insurance policy and have the insurance provider stamp the application.

Also, be sure you have obtained the previous Certificate of Title from the seller and a Massachusetts Bill of Sale.

Where to register a vehicle

If you are registering your vehicle for the first time, you will need to do so in person. This can be done by making an appointment with your nearest Registry of Motor Vehicle center, or one of their Registration Drop Off sites. You will have 10 days from the date that you acquired the vehicle to register it. Registration renewal is required every 1 to 2 years, which is dependent on the license plate type that you have.

To renew a vehicle registration, you can use the MyRMV Online Portal or renew by mail at:

Massachusetts Registry of Motor Vehicles

Attention: Mail-In Registration Department

PO Box 55891

Boston, MA

02205-5891

Documentation Required When Registering a Vehicle

You will need to have the following required documentation when registering and titling your vehicle:

- A current and valid Massachusetts Driver’s Licence

- A Massachusetts Bill of Sale

- If unable to record the odometer reading on the vehicle’s title, you will need a federal form Odometer Disclosure Statement

- A completed Certificate of Title. If the title is not available, you can request a duplicate title from the RMV

- A completed Registration and Title Application (Form TTLREG100)

- Funds to cover the appropriate Registration Fees

- Proof of Insurance from a recognized Massachusetts vehicle insurance provider. The policy must have the following Minimum Requirements:

- $20,000 to cover bodily injury (per individual)

- $40,000 to cover bodily injury (per accident)

- $8,000 to cover personal injury protection (per individual and per accident)

- $20,000 to cover bodily injury that has been caused by an uninsured vehicle (per individual)

- $40,000 to cover bodily injury that has been caused by an uninsured vehicle (per accident)

- $5,000 to cover any damage to property belonging to someone else.

- If you are registering the vehicle on behalf of the owner, you will need to complete a Motor Vehicle Power of Attorney (Form M-2848)

Sales Tax

When registering a vehicle, new owners are required to pay 6.25% sales tax on the vehicle’s full purchase amount. If the vehicle was purchased outside of Massachusetts, proof of paid taxes from the state it is registered in must be provided.