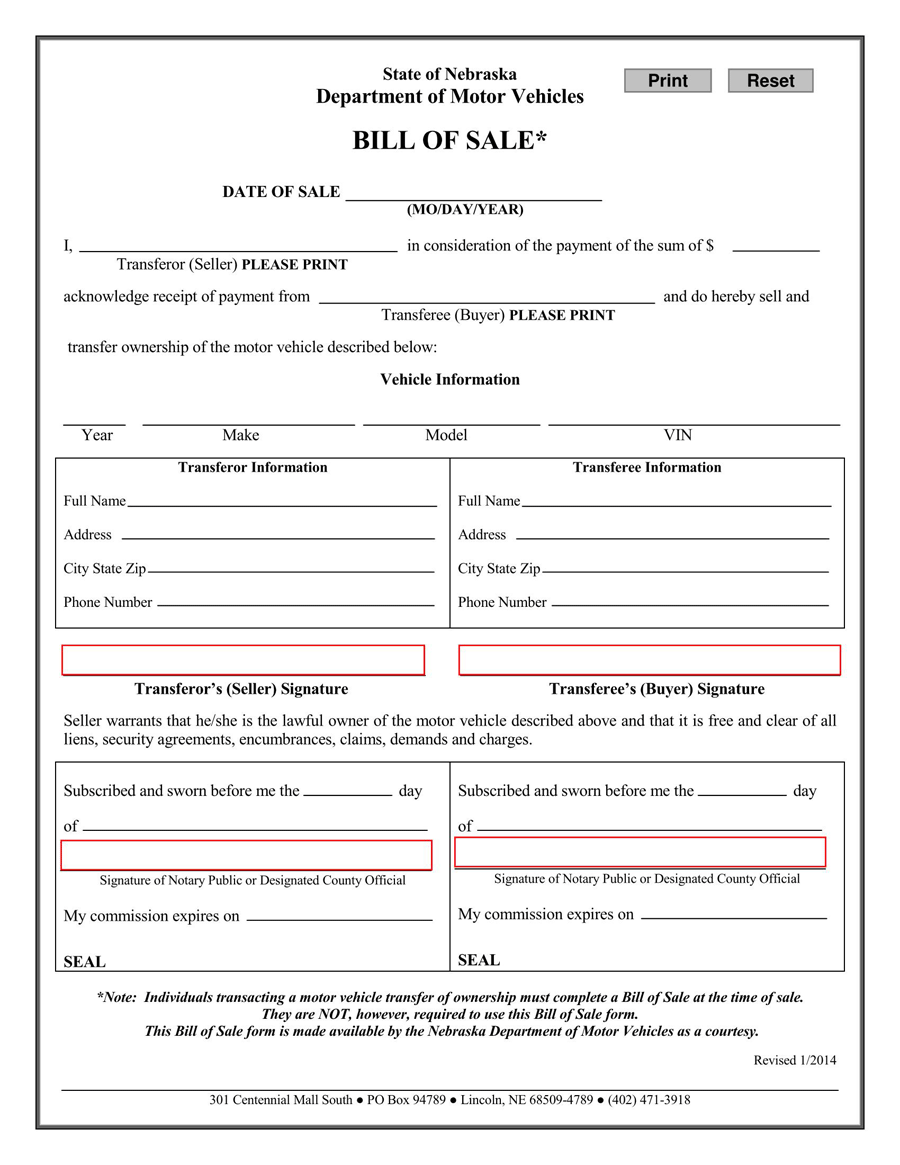

When buying or selling a vehicle in the state of Nebraska, you will need to complete a car Bill of Sale for Nebraska. It is a form of legal documentation that shows proof of the sale. This can protect the seller or the buyer if any discrepancies occur regarding the vehicle. For example, if the vehicle was ticketed after the date of purchase, the seller can prove that the car was no longer owned by them.

It may also be required when the buyer registers the vehicle at the Nebraska DMV. It needs to be signed by both the seller and the buyer and the document needs to be notarized.

Bill of Sale Forms

Other Requirements

Along with this bill of sale, the seller must fill out an Odometer Disclosure Statement (can be acquired from the DMV). This is only required for vehicles that are under 10 years of age or that weigh under 16,000 pounds.

If you are registering a vehicle for a third party, you will need to complete a Motor Vehicle Power of Attorney.

Creating a Bill of Sale for Nebraska

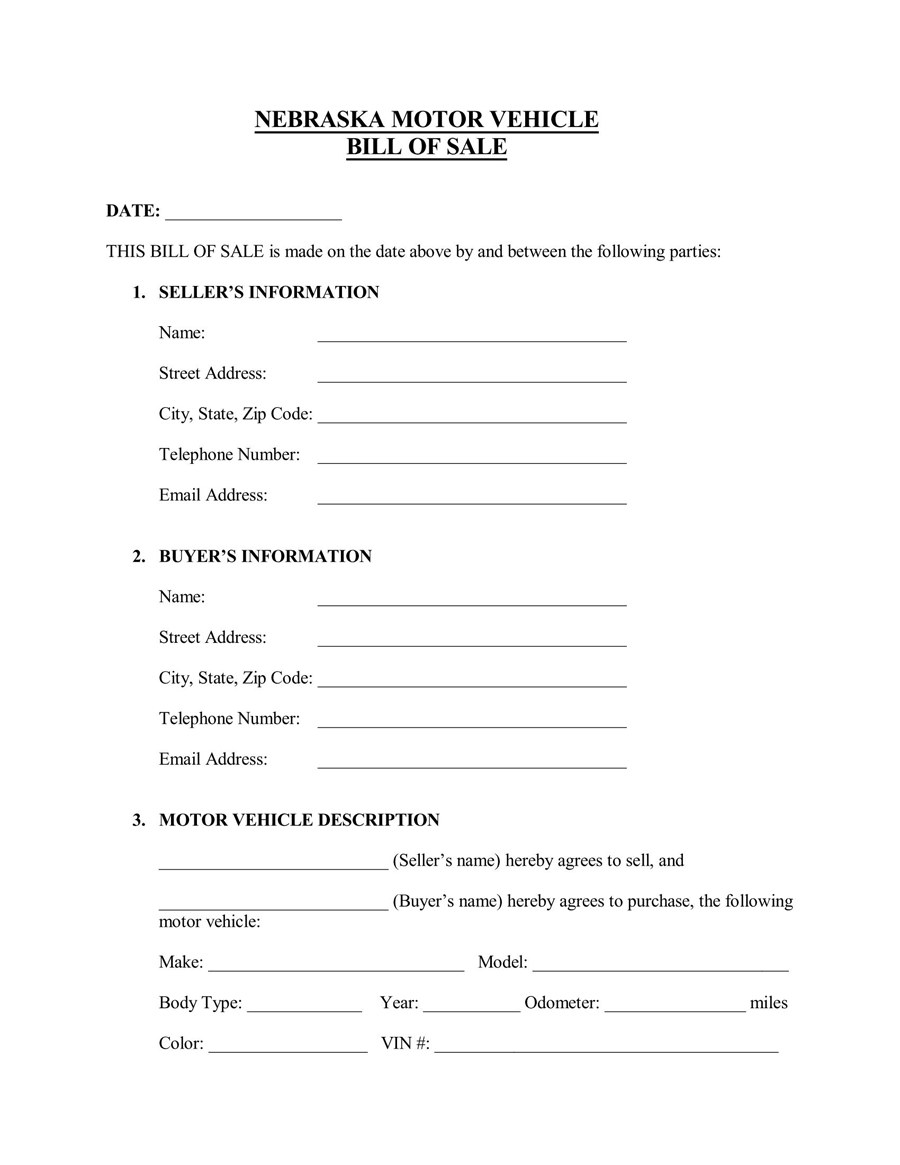

You can either download the Bill of Sale form provided on the DMV website or create your own. If you choose to create your own bill of sale, you need to include these key elements:

- Date that the document was created

- Legal names and full contact details of both the seller and the buyer

- Details about the vehicle, which should include the make, model, body type, year, odometer reading, color, and VIN.

- Price that the vehicle was sold for and method of payment

- Standard terms of purchase, for example, the buyer is purchasing the vehicle as it is.

- Signatures of both the seller and the buyer

It should be written in plain English without the use of any legal jargon. The original bill of sale must be given to the buyer for registration purposes and a copy should be made for the seller’s records.

Registering a Vehicle in Nebraska

If you are a new vehicle owner, you will have 30 days from the date of purchase to register your vehicle. Your registration must be renewed every year. By law, in order to operate a vehicle on the highways and roads of Nebraska, the vehicle must be registered, unless it falls under an exemption.

Where to register?

Vehicle registration is done via Nebraska’s Department of Motor Vehicles. This can be done in person or by mail at your local county treasurer’s office. Registration renewals can be done in person, by mail, or Online.

Documents required for registration in Nebraska

When registering your vehicle for the first time, you will need to provide the following documents and information:

- A current and valid Nebraska driver’s license

- A completed and signed Bill of Sale for Nebraska

- A completed Odometer Disclosure Statement

- The vehicle’s Certificate of Title. If this document has been lost, you will need to request a replacement using an Application for Duplicate Certificate of Title. This will need to be submitted to your local county treasurer’s office

- A completed Application for Certificate of Title (Form RV-707)

- Proof showing that you have paid sales tax

- Funds to cover the appropriate Registration Fees

- Proof of vehicle insurance from a licensed Nebraska insurance provider. Insurance must provide the required minimums of:

- $25,000 to cover death or bodily injury (per person)

- $25,000 to cover damage to property

- $50,000 to cover death or bodily injury (total)

- If you are registering the vehicle for a third party, you will need to complete a Vehicle Power of Attorney

Emissions Testing in Nebraska

Currently, Nebraska does not require emissions testing. However, vehicles registered in the state of Nebraska are required to have a vehicle inspection done, which includes an odometer and VIN check. There are some exemptions, which can be found on Nebraska’s Emissions website. If you require emissions tests to be done for your vehicle, you can book one in for a registered emissions testing center in your county.