A last will and testament, which is a legally binding document in New York, describes how your assets will be divided and distributed after your passing.

The person who created the document is referred to as a testator. It also provides a legal guardian for any minor children who are left behind. If you want to ensure that your children, spouse, or other heirs are cared for as you intended, then you must have your last will and testament in place in New York.

Wills are essential documents that need to be completed in your lifetime. In New York, this is a legal document that sets out the instructions for how your property will be divided up among any dependents and identifies who is the guardian to look after any minor children. Personal property, real estate, financial accounts, and fiduciary funds are all distributed through last wills.

The last will specify who will receive a piece of property after its owner passes away, along with the beneficiaries who will receive it. Close relatives like spouses, children, parents, and other blood relatives are typical beneficiaries in the state of New York. However, a testator can name anyone they prefer in their last will, including charity organizations. This last will allows testators to designate executors to manage the carrying out of their wishes after passing away.

When writing the last will, it is important to understand how a New York last will works and the applicable state laws to ensure the will is enforceable within the state. For instance, the document must be witnessed by two qualified witnesses and, if desired, notarized. This article will give a basic overview of the last will and testament used in New York and outline the requirements for a valid New York will, as well as its importance.

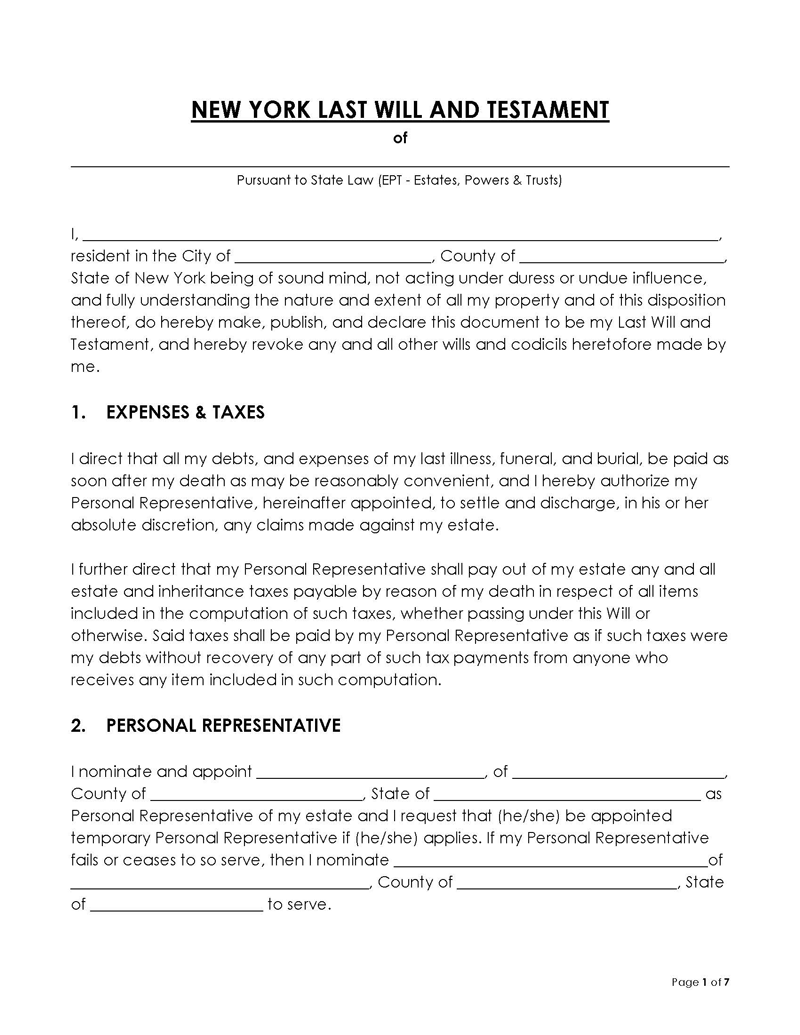

Free Template/Form

Associated Laws

The creation and execution of a last will and testament within the state are governed by New York state law. The statutes that outline the legal requirements of a valid last will are estates, Powers and Trusts. The document must satisfy the definition of a last will and testament outlined in NY Est. Pow. & Trusts L § 1-2.19 (2014). This provision of the law states that a will is a written instrument or oral declaration or codicil made under 3-2.2 or 3-3.3, to be effected after death, whereby an individual disposes of property or issues directives on how it will be disposed of, disposes of their body or any part thereof, exercises a right, appoints a fiduciary, or issues a directive regarding the distribution of their estate, which is revocable during their lifetime.

Basic Rules and Requirements

For a last will to be valid in New York, it must comply with the legal requirements of the State of New York. State laws govern different aspects of the last will, such as the eligibility of the signatories to the will (the testator and witnesses), the eligibility of the executor, and other aspects.

Basic considerations of a valid last will in New York are as follows:

Testator’s eligibility

Age and mental capacity are factors taken into account when determining whether a testator is eligible. The testator must be at least 18 years old and mentally capable of comprehending the contents of the last will. This implies that the testator must be mentally healthy and able to make informed decisions.

Executor’s eligibility

According to New York state law, an executor must be a responsible adult who is at least 18 years old. The law strictly prohibits naming non-residents as executors unless a co-executor who is a New York resident is also named. The law also objects to naming executors who have prior felonies, substance abuse issues, or who cannot read or understand English.

Witnesses and notarization

In New York, two witnesses must sign the forms. Both witnesses should sign the document within 30 days. The testator should also sign the will. The witnesses are required to supply their addresses next to their signatures (Section 3-2.1). Another person can sign the will on your behalf, as long as they do it in your presence and under your directive. The third party should provide their name and address on the will, though failure to do so does not invalidate the will. The third party does not count as a witness. Beneficiaries can be witnesses, but they risk losing any portion of the estate to which they are entitled under the will.

A last will and testament can be self-proved (notarized) even though it is not a requirement. A self-proven last will cannot be challenged after the testator’s death and eliminates the need for witnesses to appear in court to validate the will. Notarization simplifies the probate process.

Handwritten and Oral Wills

A last will and testament in New York should be in writing. However, state laws permit handwritten (holographic) and oral (nuncupative) wills under certain conditions, which include:

- A testator ought to be a serving member of the armed forces during war or armed conflict. It becomes invalid a year after discharge.

- The testator must be serving or accompanying an armed force during armed conflict or war. It becomes void after a year out of service.

- The testator should be a mariner at sea. Such a will becomes void three years after discharge (§ 3-2.2)

Handwritten and oral wills should be witnessed similarly to a regular, typed last will. These two types of wills can be valid without a witness if made by a mariner, a member of the armed forces, or an individual accompanying the armed forces on active duty.

It can be used in court and can be written without the help of an attorney. You can use online platforms since lawyers can often be expensive. However, if you have a sizable and complex estate and need a comprehensive last will, hiring an attorney may be worth the money.

Exceptions to the Distribution of Property

State laws limit the assets you can distribute through a last will and testament. The state dictates that only property under your name can be input into the will. Assets under joint tenancy should be inherited by the surviving account holder. Also, life insurance benefits should go to the beneficiary named under the insurance policy.

Furthermore, a surviving spouse is entitled to a portion of the estate through the right of election, which equates to one-third of the estate if it is worth more than $150 000 or $50,000 for estates worth more, whichever is greater. Other provisions state that, depending on who is left behind, property like a car worth no more than $25,000 should go to the surviving spouse or children. State regulations also list additional exempt property.

The Consequences of Not Having a Will

In the absence of a will, the law of intestacy governs how property is distributed among beneficiaries. New York intestacy laws determine inheritance based on bloodline. A spouse, parents, children, and other designated legal heirs receive inheritances in accordance with their line of kinship.

For instance, if you leave behind only your spouse and have no children, your spouse will be the sole beneficiary of your estate. If children survive you, they inherit the estate fully. If a spouse and children were left behind, the spouse receives the first $50,000 and half of the remaining estate. If your parents survive you as the next of kin, the property goes to them fully. This order is followed until all blood relatives are exhausted. Note that if there are no blood relatives, the state of New York will receive the estate.

How to Appropriately Revoke or Change a Will in New York

To formally revoke your will, you must possess the mental capacity to comprehend that you are revoking it. You can do this by making a new will or submitting a written testamentary stating your intention to revoke the current one. Alternatively, you can burn, tear, cut, cancel, and obliterate the will. A testator can revoke the will or appoint another person to do so in their presence and in front of two witnesses. A codicil can be added to a last will and testament in New York, but it is recommended that you write a new will instead. If a codicil is used, it needs to be witnessed and follow all legal requirements for a last will.

Benefits of Making a Will in New York

Your assets will be distributed according to your wishes if you create a last will and testament in New York. Because the court only needs to determine whether the will is valid rather than deciding which beneficiary should receive each asset, people who make a will avoid time-consuming and expensive probate court procedures for their heirs after their passing.

The best thing about this is that it provides an opportunity for you to assign a guardian to care for your loved ones who are left behind. This will also ensure that all of your wishes, desires, and intentions are carried out without distortion. You can list all types of assets under your ownership in your last will, from personal items to real property to bank accounts, etc. In New York, the last will also permits the appointment of an executor to see that the decedent’s wishes are carried out.

It also gives the testator the freedom to name anyone they want as beneficiaries of their estate, from family and friends to charitable organizations. Also, through a last will, a pet trust for the care of any pets left behind can be established.

Final Thoughts

If you do not leave behind an estate plan, your estate will be subject to dispute. It is crucial to include a will in your estate planning because it will make sure that your possessions and other assets are distributed following your wishes and remain in the hands of people you trust. The most important thing about a will is that it protects your heirs from the stress and anxiety of lengthy and expensive court procedures to claim their share of the estate.