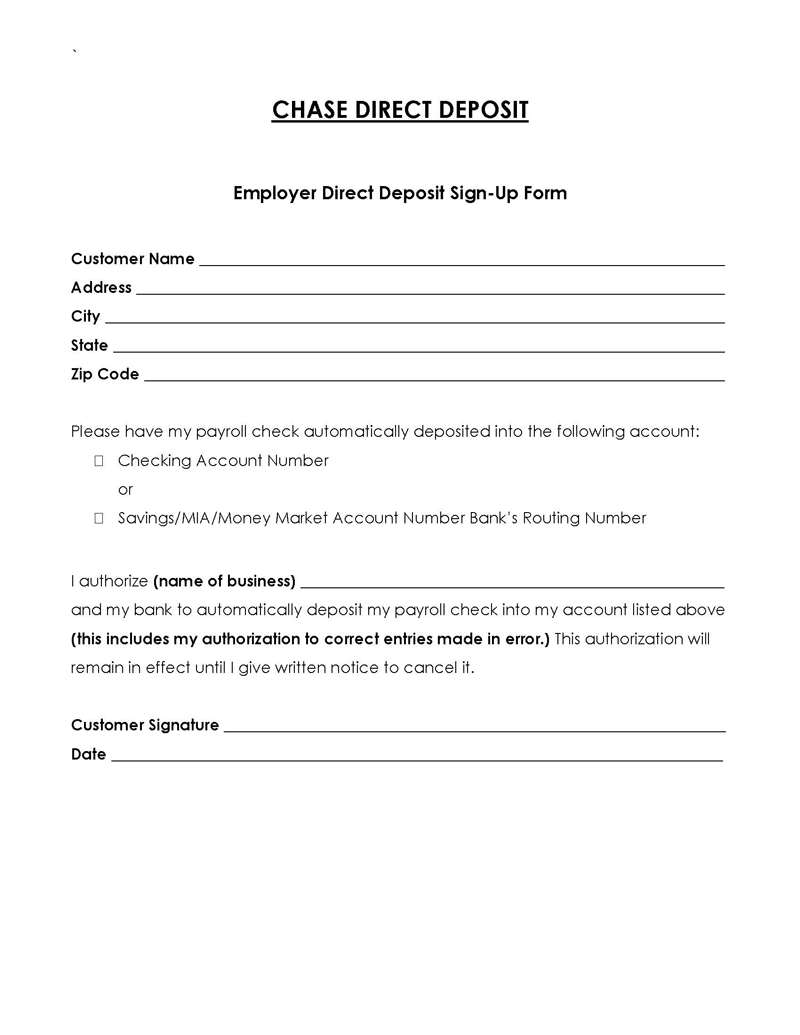

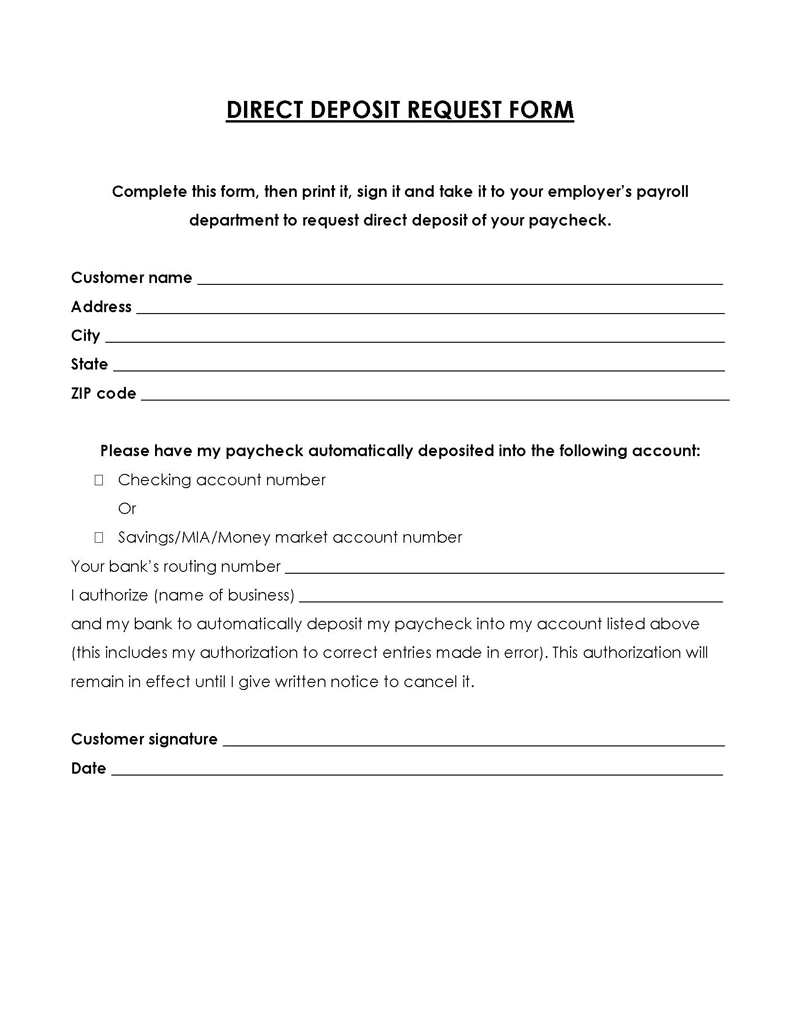

A Chase direct deposit form, also known as a Chase bank direct deposit form or Chase bank direct deposit authorization form, is a standard legal document that an employee completes to allow their employers to directly deposit their salary or any other type of payment directly into their bank account.

Direct deposit benefits employees by making the payment process more efficient because it eliminates the need to mail checks and saves time and effort. Additionally, it is safe because only the company whose name appears on the form is authorized to write a check payable to a specific employee and deposit that check’s proceeds into that employee’s account.

If you want to create or use a direct deposit form, this article will guide you through the whole process, including how to complete the form, where to submit it after completing it, and when to expect your deposit to be credited to your bank account.

Download Direct Deposit Form

How to Complete the Form

These important forms can mean the difference between receiving payment on time and having your paycheck delayed or not deposited. As such, it is important that you provide all information accurately and completely in the form to avoid any unnecessary inconveniences.

Below are steps that you should follow to help you complete the form:

Step 1: Download and print the form

The first step is to download and print the form. You can download the direct deposit form from the official Chase bank site. We have also provided a PDF version of this form that you can download, print, and complete. Please note that you cannot create your own templates for this form, as the bank will not accept them.

Step 2: Fill in your personal information

Providing your personal information is the second step. You should include your name, address, email, and phone number on the form, as this information is necessary for the bank to process your request effectively. Make sure the information is accurate because if there is a discrepancy between it and the information on your bank account, the bank may reject your request.

Step 3: Provide the employer’s information

The form requires that you provide information on your employer. This information is crucial because it is used to instantly confirm your identity and validate your connection to the company you work for. This information includes your employer’s name, address, phone number, tax identification number, and bank account number.

Step 4: Specify the type of account

The next step while filling chase bank direct deposit form is to specify the type of account into which the funds should be deposited. This can range from a personal checking account to your business account, an investment account, or a retirement plan. You must also specify the type of account, as this determines how and when the payment will be deposited into your bank account.

Make sure to include all necessary information, such as your account number, account type, and various deposit percentages if you want various amounts to be deposited into various accounts.

Step 5: Enter the bank branch’s routing number

The Federal Reserve Bank assigns every bank branch a routing number to identify individual banks, branches, or even specific accounts. A routing number is a nine-digit number used for transferring or processing electronic and wire transfers. The routing number is required on the form for directly depositing funds because it is used to electronically deposit your paycheck into your account.

The routing number for your bank can be found in any correspondence you receive from the bank or at the bottom of your checkbook. You can also contact your local branch for the routing number and have it sent to you in the subsequent correspondence they send you.

Step 6: Complete the “I authorize…” statement

The final step is completing the “I authorize…” statement on your direct deposit form. The “I authorize…” the statement serves as your signature. It includes a statement that you have read, understand, and agree to the terms and conditions under which the payroll company’s representative will verify your information and process your request.

This is one of the most crucial parts of the form, as it contains your declaration that you authorize the company to make a direct deposit into your chosen bank account. When completing the “I authorize…” statement, it is important to mention the name of the party you are authorizing to complete the request, i.e., the name of your employer or company.

Step 7: Add signatures and date

It is critical to sign and date the deposit form once it has been completed. Your signature is critical, as it prevents any form of dispute between the company and you. Your date of signature is also crucial because it serves as official proof of the precise date on which you signed the form.

Where Should I Submit the Form?

Submitting the form to the right place helps expedite the processing of your request. The processing of and depositing of your paycheck into your bank account are facilitated as a result.

Once you have completed the form and verified that the information you provided is accurate, you should submit the form to your company, employer, or the payroll team or department at your place of employment. Before submitting, make sure to contact them for information on any additional documents that you are required to submit.

When Will the Bank Receive the Form?

When your employer receives the direct credit form, he or she will forward the information to the bank. The banks then process these details and update the accounts with this information. It is important to understand that it may take up to two payment cycles before the credited amounts appear in your account. After the first deposit is successful, subsequent deposits will take one to three business days to be credited to your account.

You can download Chase Bank’s mobile application on your phone and activate the debit and credit notifications to be notified each time there are any changes to your bank account amounts. Every time there is a credit in your account, the mobile application will notify you and send you a push message. This makes it easier for you to manage your money, particularly if you have several bank accounts.

Conclusion

Direct deposit is a simple and convenient way to receive your monthly paycheck. This means that you do not have to worry about going to the bank each payday, making transactions, and standing in a queue to receive your salary. Direct deposit helps you save time, reduces the need to spend money on check-cashing services, and helps improve your cash flow. To ensure that your direct deposit request is processed quickly and the salary is deposited into your account quickly and efficiently, make sure to accurately complete the form. It is essential to submit your completed form, with your signature and date, to the appropriate person in your office.