The fear of running out of money is a major concern among many retirees. The reason for this is that a lot of people do not know how to exploit their Social Security benefits to pay their bills. These people are worried about how much they will use in their individual retirement accounts hence the need for a budget.

A pre-planned budget will show how much you are earning and how much you are spending. It will assist you in making adjustments to fill in the gaps. It will also assist you in preparing a nasty surprise, such as a home or a car, and even an unexpected medical bill. When you have a retirement budget, you avoid the stress of the unknown.

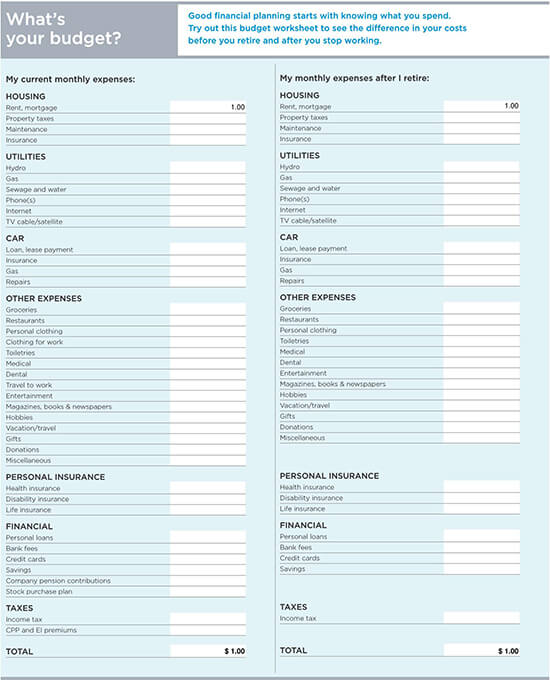

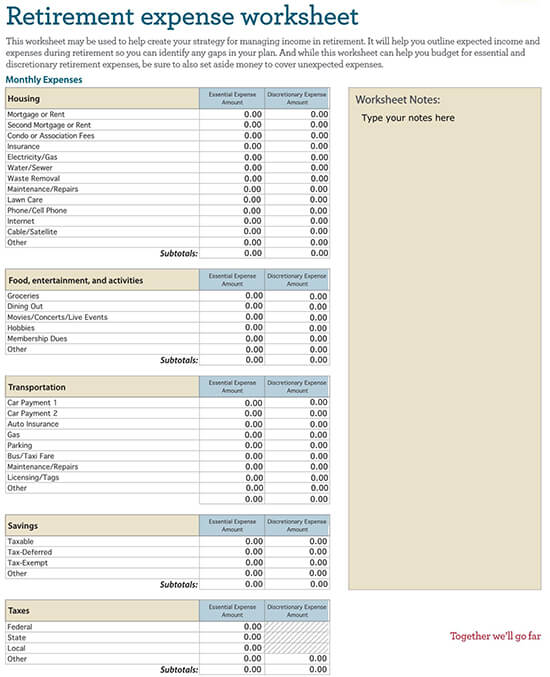

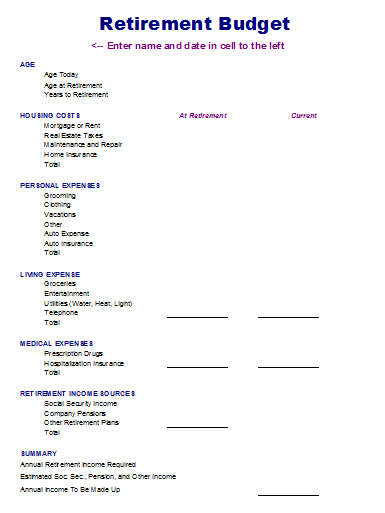

Free Templates & Worksheets

Making a Workable Retirement Budget

Below are steps on how to make a retirement budget:

Gather your financial records

This can be done by hauling out your checkbooks and your credit card statements so that you can access your expense record from the previous year. Most credit companies give a yearly summary of your records, making it even easier. The tax season is the best to do this since you will be using this information to fill out your IRS forms.

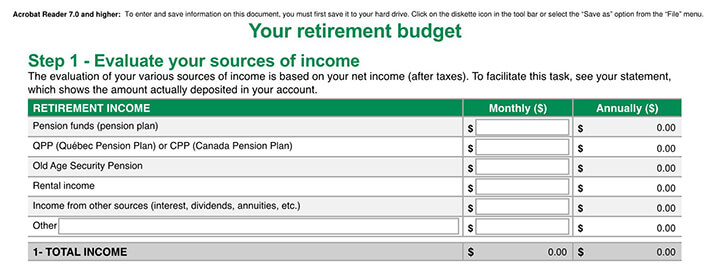

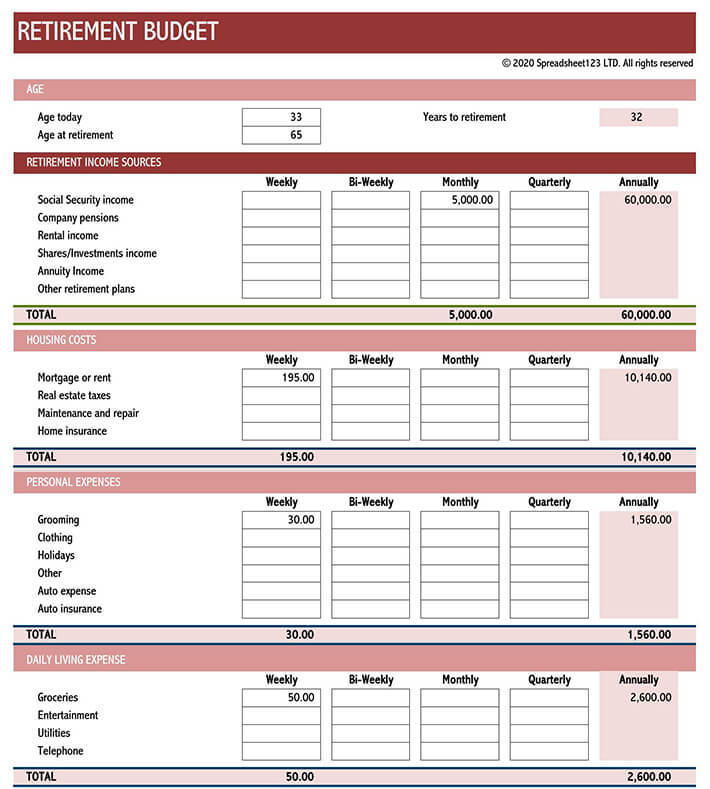

You should have an idea of how much money you will make from the social security benefit. Write down all sources of income you have and the amount you plan to make each month. You should gather information such as bank account statements for the last year, Credit card information for the last year, and the previous tax return.

Make a list of your recurring expenses

These are the expenses that are constant each month. They may include your mortgage, rent, or medical care payment. Identify all your recurring monthly, quarterly, and annual payments.

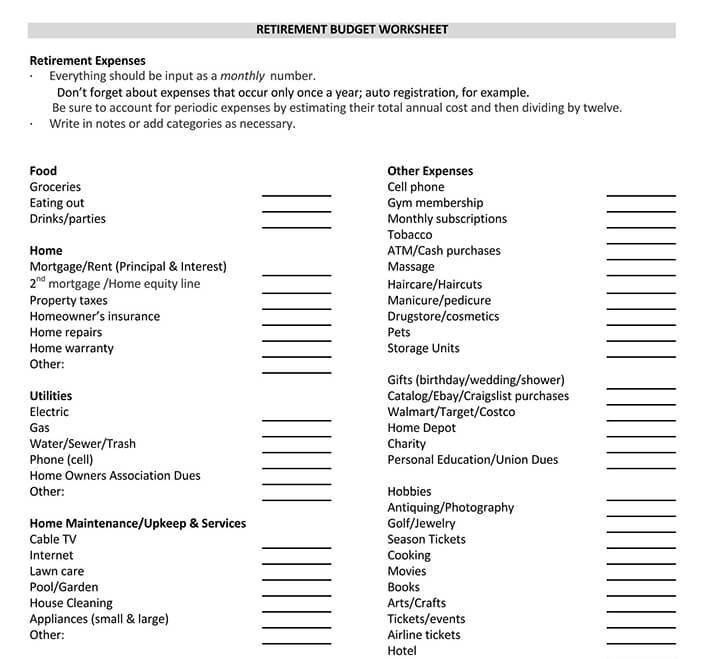

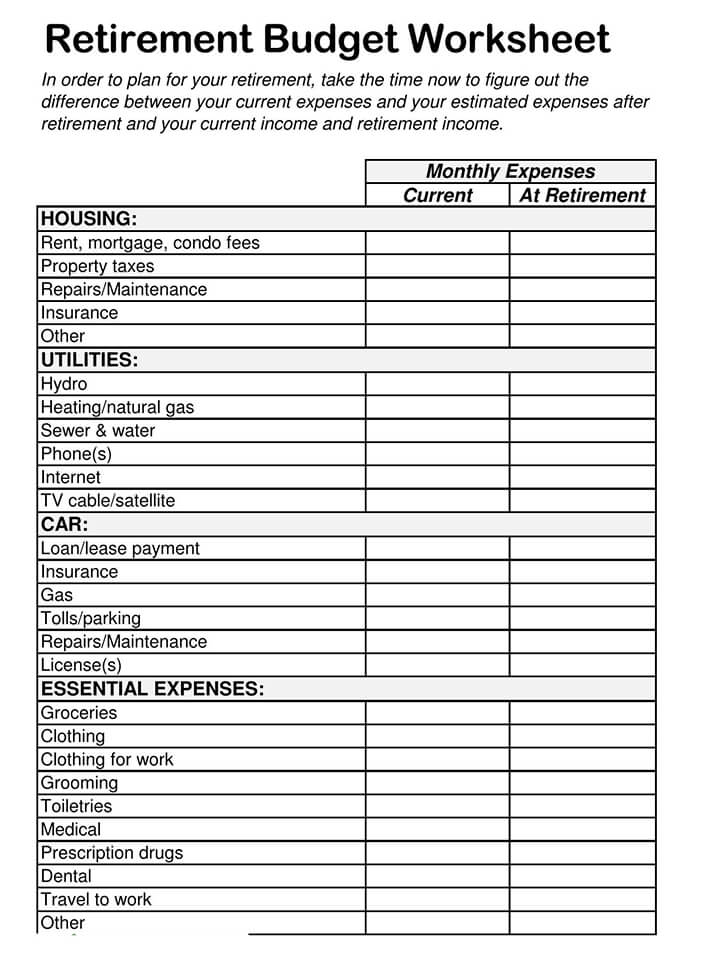

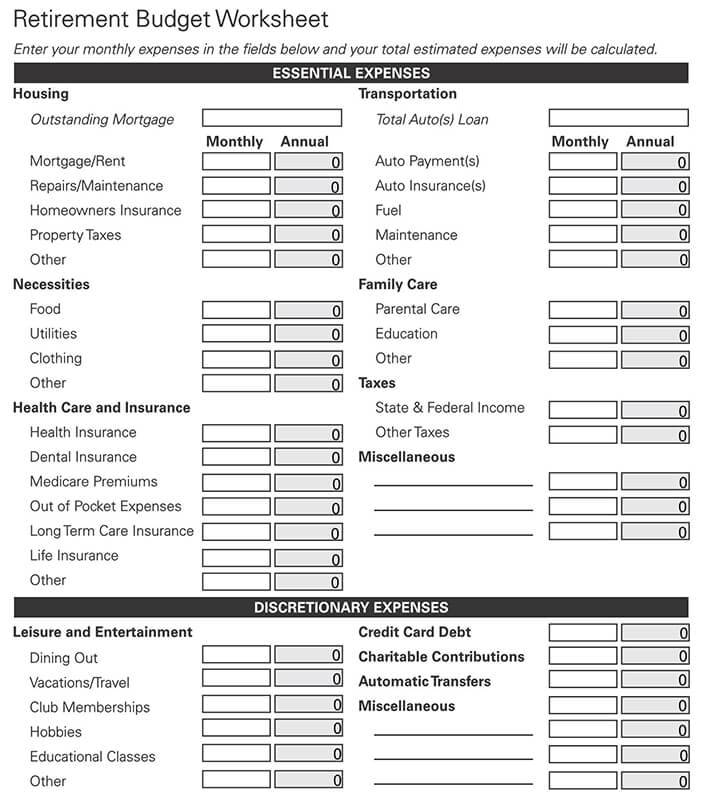

You can divide your recurring expenses as follows:

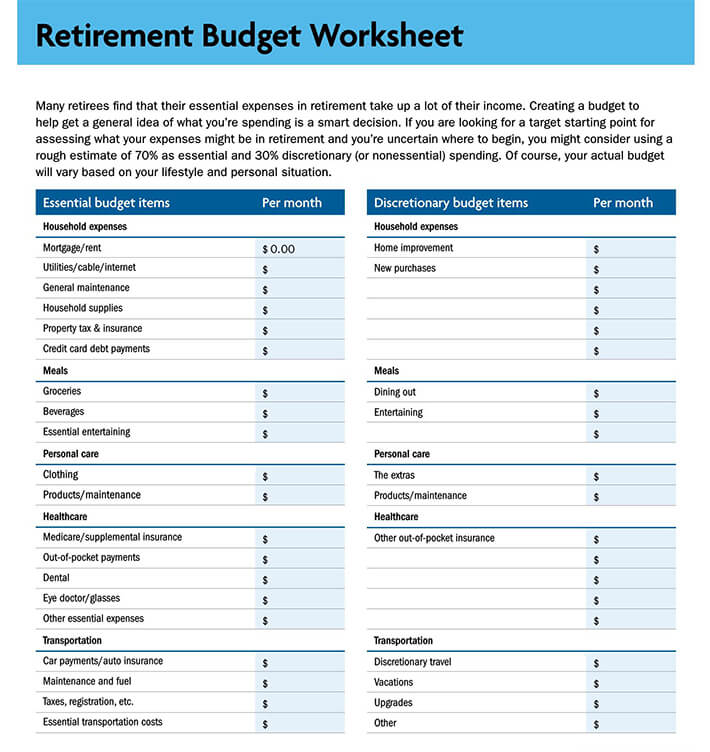

- Essential spending: This includes housing, food, clothing, medical expenses, and other basic utilities.

- Non-essential monthly expenses: These bills include cable TV, mobile phone plans, gym memberships, and other subscriptions.

- Required non-monthly expenses: These are the insurance premiums, bills for property taxes, and home warranties, which may come once a year.

Factor in the non-recurring expenses

This is applicable when you are planning a vacation or buying something with a one-time full payment. This unique expense requires advanced planning. You should add these one-time expenses to this section. For example, if you plan to spend your free time involved in expensive hobbies, then account for this in your budget.

Make adjustments

After listing down your total income and expenses, the next step is to make the necessary adjustments to meet your budgeting goals. For instance, if you travel more, you can decide to downsize and live in a small house to minimize housing costs and fund your travel.

Tips for Successful Budget Planning

Save wisely

Most of the savings that you have come from your working years. You can still boost your finances while in retirement by keeping the money in a high-interest savings account, and this will run you for your entire aging years.

Manage essential expenses

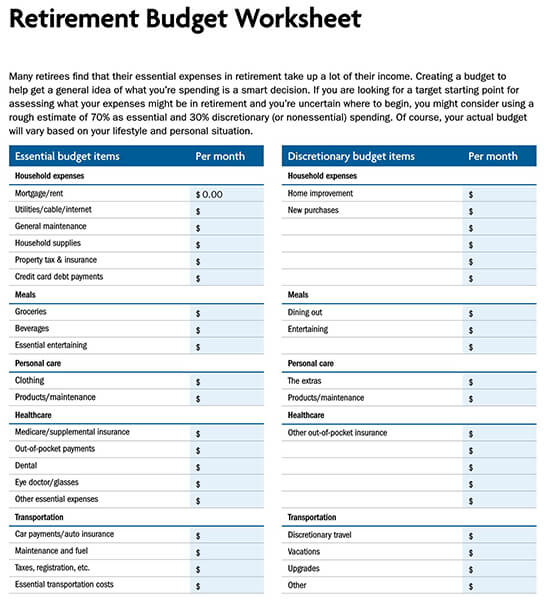

A good budget should first cover the essential expenses, which are life’s most crucial priorities. Some of the top priorities are:

- Healthcare: If your employer has been paying for your health coverage insurance, then you are obliged to pick up that task after retirement. You will have to explore the best healthcare coverage.

- Housing: You might be lucky to have your house paid for, but you should account for other maintenance activities. The best way is to budget at least 1% of your home value and set aside the amount for maintenance.

- Transportation: After retirement, you can still have occasional movements to the malls or for medical checkups where you would like your stuff to be transported to your destination. You should also set aside a certain figure for this activity.

- Food: Food is a basic need for each human regardless of age. You should budget for your food on a monthly basis and weekly for delicate items such as groceries.

Discretionary spending

This is spending according to your own discretion. You should set aside a certain amount for this spending on activities such as traveling, gifting, and others.

- Traveling: Your budget for this will depend on how often and what types of trips you are planning, whether they are long vacations or just visiting friends.

- Gifting: When planning for this, you already have an idea of what you intend to buy for your friends and family.

Stick to your income plan

For your income to be effective, you need to back it up with an investing strategy that will ensure growth opportunities for your assets. This will assist in keeping your income at par with inflation. Fidelity insists on limiting your withdrawals from the savings account to 5% within your first year of retirement and then adjusting this number higher for increased inflation in the coming years.

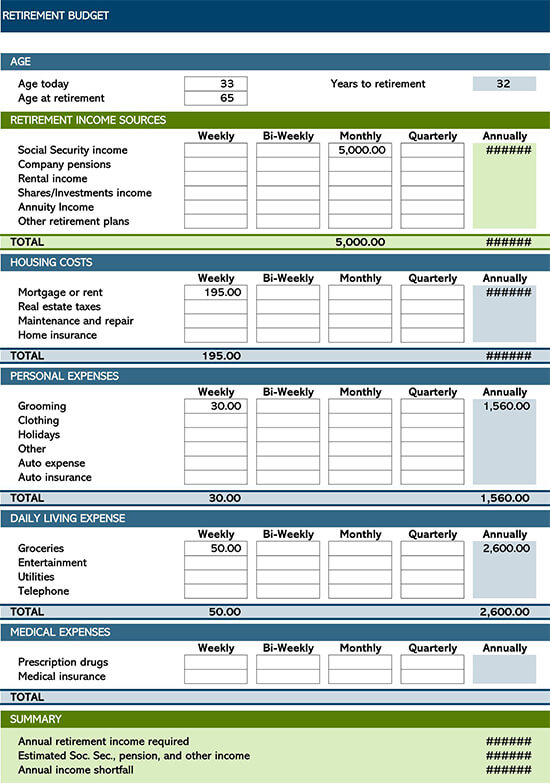

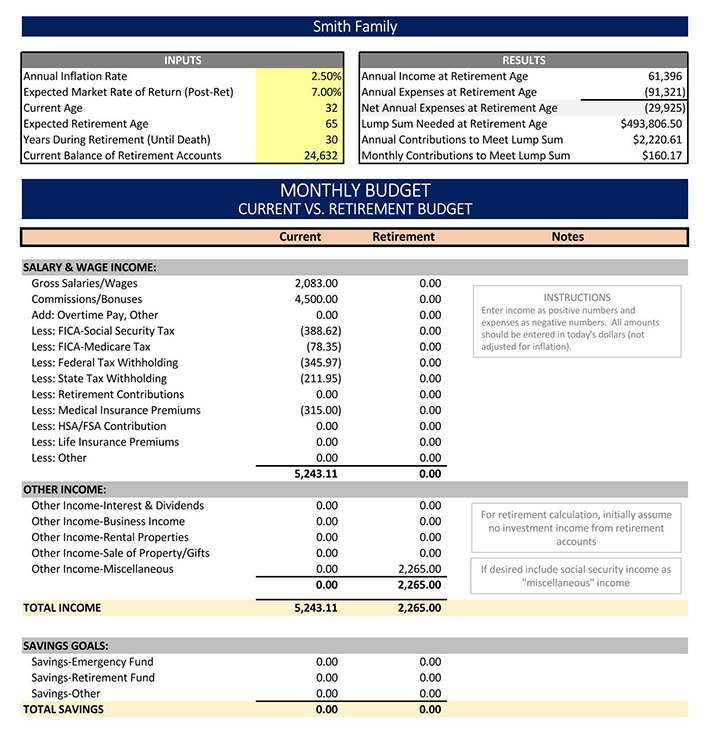

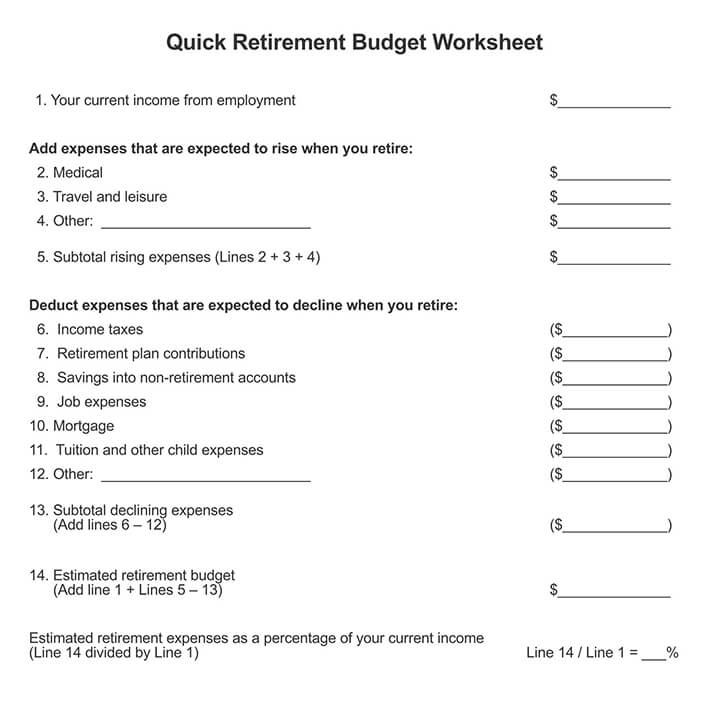

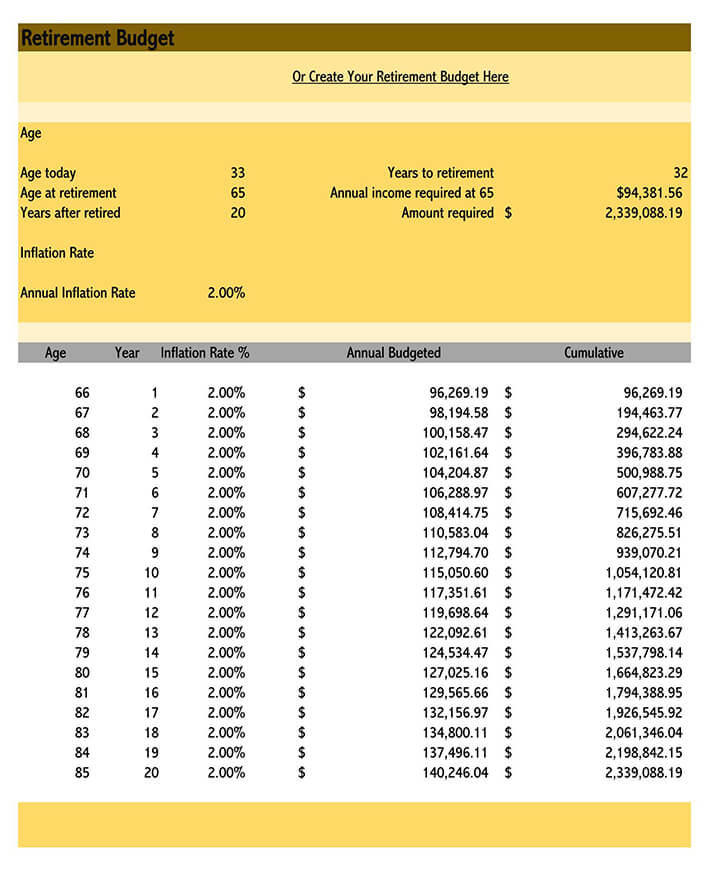

A budget worksheet is divided into a number of sub-sections so as to record the types of earnings and spending. The templates are designed by professionals and are easy to use. You enter the age of retirement, and then the sheets calculate the years you have to plan for automatically. The templates save you time in drawing worksheets that could be tiring and difficult.

Worksheet Examples [PDF]

tip

Based on research, a retirement budget is very important since it relieves the panic you might develop by using your income in an unplanned way. Always calculate the debt-to-income ratio and trim your expenses.

You can also consider a part-time job; hence, you won’t dwell much on your retirement money. It will make it easier for you to account for any penny that you spend, and hence, you can predict how long you will spend that amount of money.

Frequently Asked Questions

The first step is to determine all your assets and debts and hope that your assets are greater than your debts. Ensure you do not take on any debt and work with what you have. Downsize your house since your kids have grown up; hence, there is no need for three or four bedrooms. You can also take advantage of the senior citizen discount.

Mississippi is one of the most affordable states with the lowest cost of living for people aged 65 years and above. With your low income, you will access affordable housing and health care. The city is also quiet, which gives you a perfect environment as you age.

• Lancaster, Pennsylvania

• Fort Myers, Florida

• Sarasota, Florida

• Austin, Texas.

• Pittsburgh, Pennsylvania.

• Grans Rapids, Michigan

• Nashville, Tennessee

• San Antonio, Texas

• Dallas-Fort Worth, Texas

• Lakeland, Florida.

Conclusion

In conclusion, you should consider a budget so that it would be easier for you to account for what you earn and what you spend. This will prevent you from panicking upon using a huge amount of money for different items, and you will be able to plan for your future.