A paycheck stub is a document attached to an employee’s paycheck, breaking down an employee’s salary into the different categories whose calculation produced the net income (final pay).

It is given regardless of whether the employee is being paid via physical check, direct deposit (electronically), or payroll card. If the check is to be issued physically, the pay stub should be in tangible form as well. If payment is issued electronically, then it should be digital.

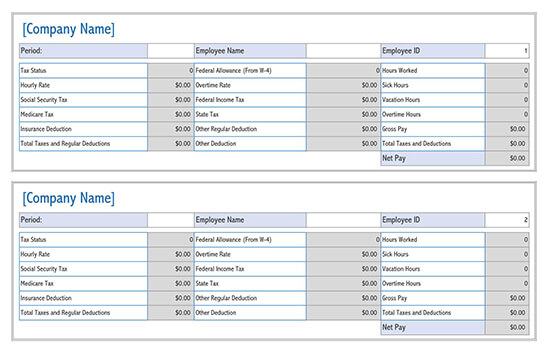

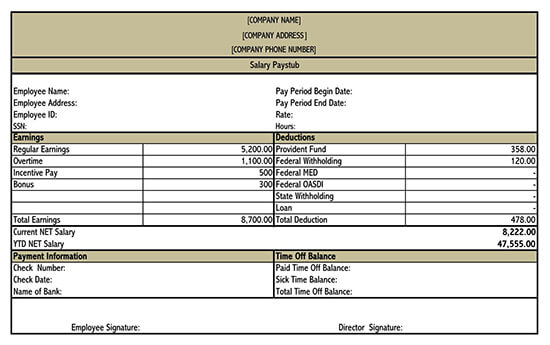

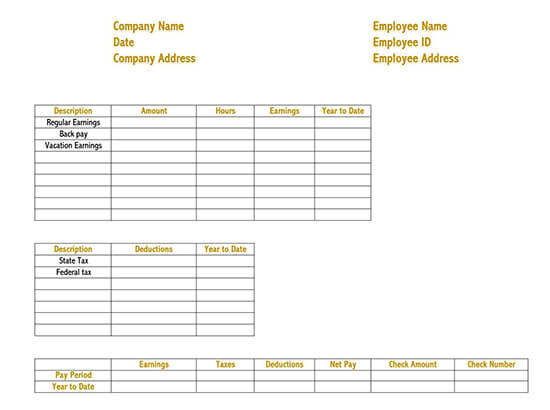

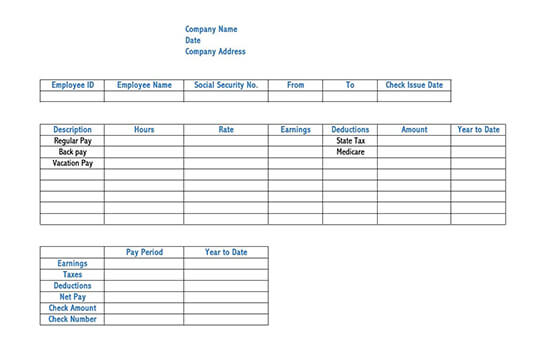

Free Pay Stub Templates

Excel

Word

Understanding Paycheck Stub

Employers and employees will have different preferred payment methods from one workplace to the next. This fact notwithstanding, stubs give the employees key insights into their gross pay and outline what deductions are taken out of their checks each pay period. In addition, it shows the total YTD (year-to-date earnings). The paycheck stub will typically show the wages (rate of pay), deductions, and employee benefits.

Pay stubs can be used in the following scenarios:

- When securing a house or getting a loan: If you want to buy a house, rent an apartment, or plan to apply for a loan, it might help you out. In some cases, you will be asked to provide a copy of your recent pay stubs. Most financiers use them to validate and prove that your income is sufficient to either support the applied loan or buy a property.

- When verifying employment or payment history: It can also provide proof of your employment or past payment history. In some interviews, potential employers may ask for your past payment history as part of the hiring process. Therefore, you will have to print yours and present it to them.

- When ensuring your payment is done properly: It can be used to clear any doubts regarding your payment. It’s therefore recommended that an employee get into the habit of reviewing their pay stubs each time they get paid. This is particularly important when you are starting a new job. Through it, you’ll get to know what deductions apply to you.

Other reasons are:

- Paycheck stubs are used for tax filing purposes

- Employers use it as proof that employees are aware of payment deductions

- When an employed individual wants to secure housing or obtain a loan

Alternative names for it include payslip, pay advice, check stub, or paycheck, depending on the workplace.

Employers can opt to draft a company-specific paycheck or use a template. However, the chosen one should be uniform among the employees to ensure consistency in record keeping.

Types of Paycheck Stub

An employer will ordinarily prefer one format over the other. The positive thing is that there are various options when it comes to paper paycheck stubs.

They are as follows:

- Software compatible – A software-compatible one is a digital pay stub that can be utilized with electronic payroll software used by employers to streamline and automate the payment of employees and tax filing.

- Business check – A business check has three portions. The paycheck is printed in the middle, and the employee’s records are printed at the bottom. The employer keeps the top portion for record-keeping. This type of paper meets security specifications and conditions. It mostly benefits financial institutions.

- Standard paper – Alternatively, pay stubs can be created or printed on standard A4 paper. They would still be valid, plus they allow modifications and insertions that might be necessary to be included.

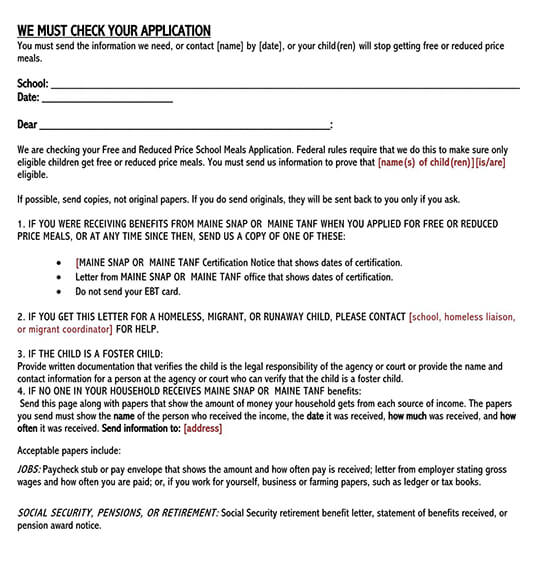

Contents of a Pay Stub

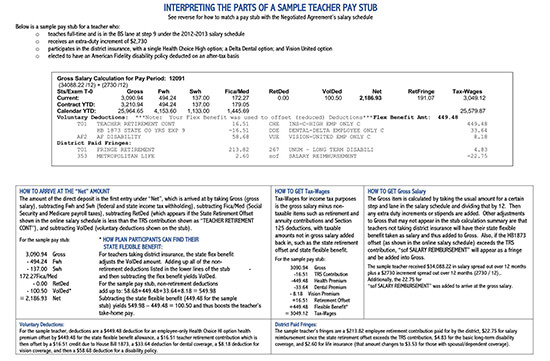

The contents will often vary depending on the type of work/profession. This is because different professions are subjected to different terms of employment and payment. Nevertheless, the contents discussed are fundamental and should appear in every paycheck stub.

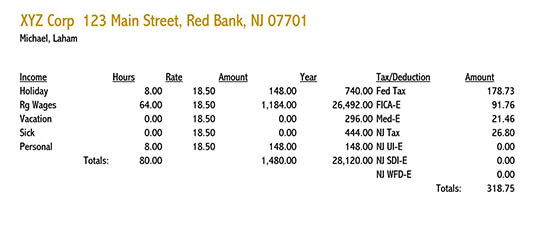

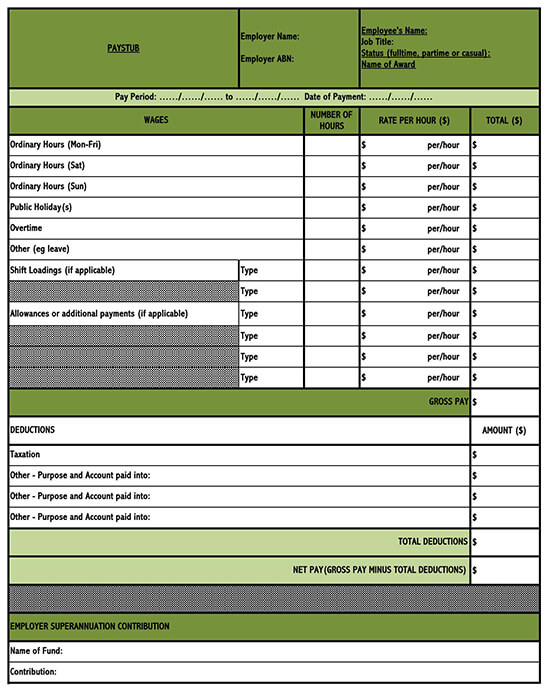

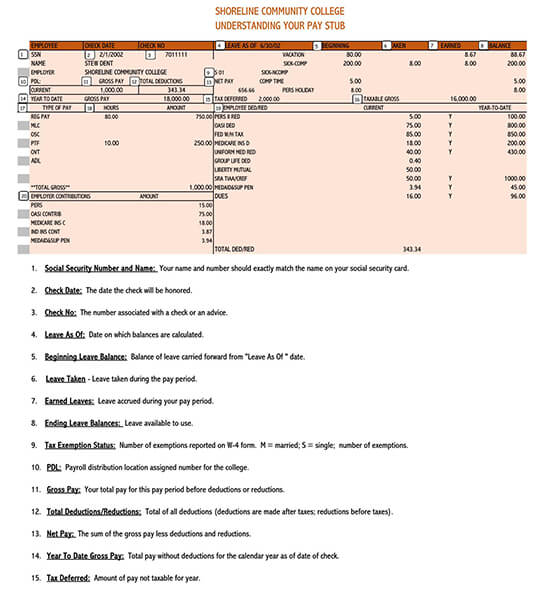

Company information

The first item is the information of the employer. This is inclusive of the employer/company name and mailing address. The information provided should be as specific and detailed as possible. License numbers can also be included. Spellings and typos should be avoided when identifying the employer to avoid misunderstandings during auditing or as the employee is filing taxes.

Employee information

Employee information, such as their official name, mailing address, contact information, and employee identification number, should be provided. This information should be accurate so that if the employee is required to verify their employment status, a stub will suffice.

Payment details

Payment details make up a large portion of the document. Therefore, this section should summarize how much the employee earned for the payment period and, thus far for the specified tax year.

Payment details are given as follows:

- Check number: The check number of the check issued for the given period should be provided. The check number is important should there be a need for reference or cancellation. In addition, it is easier for banks to find payment details if they are given a check number.

- Pay period and date: This is the duration in which the employee has worked for the employer for which they were or are to be compensated a certain amount of money. The period should be specified by indicating the beginning date and the ending date of the pay period. The dates should be clarified by stating the exact date, month, and year.

- Amount and types of income: There should be a section that addresses the types of income (regular or overtime), the number of hours worked, and income rates. These income details are applicable for the pay period indicated. Income information is given as; Gross wages (income) – Gross income is the pre-tax (before federal taxes, state taxes, and other deductions such as Medicare are deducted) income earned by the employee.

EXAMPLE

If an hourly employee worked for 80 hours for an hourly rate of $20 per hour, the gross income is $1600 (20×80).

For an exempt or salaried employee, the gross income is calculated by dividing the annual salary by the number of pay periods in a year.

EXAMPLE

f an employee makes $144000 per year with a pay period of a month, the gross income to be included is $12000 ($144000 divided by 12).

Deductions

Despite the fact that the employee is paid gross income, it does not represent the exact amount that is credited to their accounts. Gross income is subjected to certain deductions that are part of the employee’s legal obligation as an income-earning citizen or for certain government services.

Deductions are inclusive of:

- Income tax deductions – Income tax deductions include taxes withheld (federal, state, and local), Federal Insurance Contributions Act (FICA), that is, Medicare and Social Security, and other critical services.

NOTE

The term withheld refers to the money the employer takes out of the employee’s paycheck on their behalf to cover legally required financial obligations, for example, unemployment insurance.

- Employee benefits deductions – The stub shows the amount of money the employee pays to enjoy employee benefits related to health, vision, life, dental, and disability insurance.

- Voluntary deductions – As an employee, one might have committed to contributing money for a specific purpose; these contributions are regarded as deductions, such as charitable contributions, retirement, or pension plan contributions, e.g., a 401k.

- Involuntary deductions – The pay stub accommodates involuntary financial deductions the employee is obligated to make—for example, wage garnishments such as child support and tax bills.

Net pay/income

The final item a stub outlines is the net pay of the employee. This is the money the employee takes home or sends to their bank account after all the necessary deductions have been made.

NOTE

Pay stubs should indicate the specific payment details for the given pay period and the YTD.

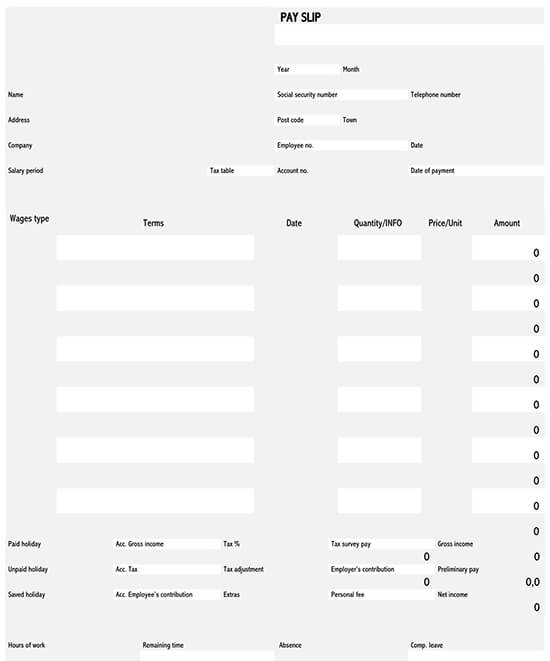

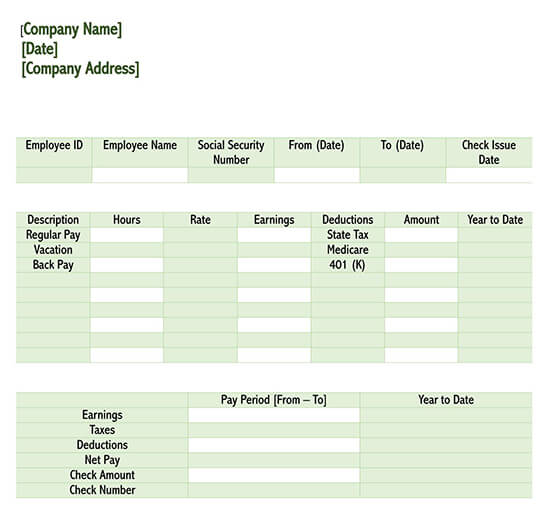

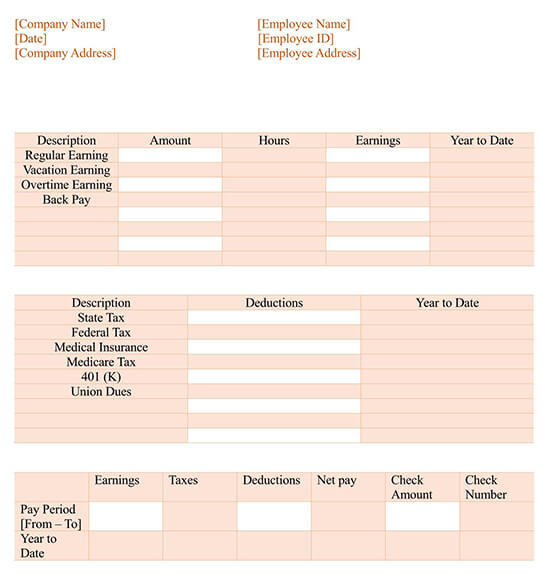

Different Check Stubs

There are a variety of forms or templates one can opt to use. The pay stubs differ in complexity and scope. The selection will depend on the details needed to be recorded and preferences. This article will look into the different types available:

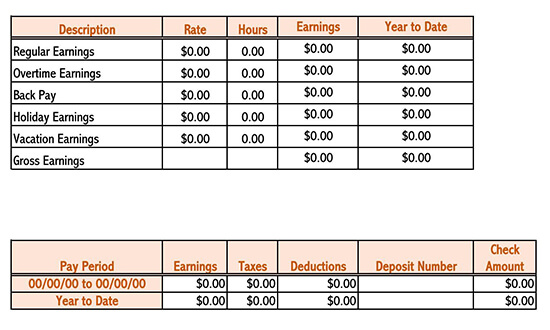

- Basic stub – A basic one comes in a traditional format and includes all the essential categories needed for a standard pay stub. It is simple in design but addresses all the required provisions for a pay period.

- Spreadsheet stub – This one is prepared and designed using a spreadsheet program. It is affordable, easily personalized to include certain design elements, and is preferred for those who intend to print their pay stub

- Document stub – This is a Word document created through word processing software such as Microsoft Word. A simple table is inserted in the document to create spaces for employer and employee information, hours worked, amounts paid, and deductions. Information is filled in, and the stub is printed and attached to the paycheck.

- Irregular hours stub–This one is used for employees whose working hours are recorded manually. The working hours are recorded as the employee arrives. It details the employer and employee information, working hours, pay period dates, net pay, and any applicable deductions.

- Contactor stub–This is used when hiring service providers and consultants on a short-term basis. It can be designed to include hours worked, services provided, invoice details, and client details.

- Electronic stub–This allows users to fill in information digitally. The template is made to be compatible with digital payroll systems. One template can be used over and over. The completed form can either be emailed or printed out.

Often, a pay stub includes the following information:

Conclusion

Pay stubs are becoming increasingly important, not only to employers but to employees alike. It often comes with lots of benefits. First, they provide proof of payment from employers at the end of each period. Also, they help solve any misunderstandings that may occur between the employer and the employee. Lastly, they can be used to process loans, buy properties, or rent an apartment. Due to this, it is recommended that each employer provide their employees with these to improve efficiency in payments.