Financial management is a necessary life skill for people with debts, which can often be inevitable. While accumulating debts is easy, getting out of debt proves to be a challenge for most people. This is because it requires adequate and thorough planning. However, strategies such as debt snowball are quick and easy solutions to avoid accumulating debt. Debt snowball worksheet allows you to rank your debts from the least to the highest to pay off the smallest debts first, followed by the second smallest, and henceforth. This means small debts are fully repaid first and as the debtor continues to pay other subsequent debts until all debts are cleared.

This article guides how a debt worksheet works and provides the definitions of terms used in debt snowball and other educational information.

Debt Snowball

The debt snowball is a financial management strategy that involves ranking all the debts in ascending order (smallest to most significant), and then the debts are cleared one by one (from smallest to largest).

This strategy borrows its name from how a snowball is created – by rolling it out until it grows to a giant snowball – signifying debt clearance. A debt snowball plan does not include mortgage or save on interest payments. However, it ingrains a debt repayment culture and is efficient.

Method to Use a Debt Snowball

How does a debt snowball worksheet work? The process is relatively straightforward to implement. It begins with listing all your debts, mortgage excluded. The debts are then graded based on balance from the smallest to the largest. This means interest rates and other factors shouldn’t be considered.

EXAMPLE

- Personal loan – $500 ($40 minimum payment)

- Credit card loan – $2000 ($100 minimum payment)

- Vehicle loan – $10000 ($500 minimum payment)

Once all the debts have been listed and ranked, the debtors pay off as much money as they can afford to the minor while at the same time making partial minimum payments to the other debts. The smallest debt receives the most money and is cleared first. Once the highest-ranking debt is repaid, cross it off the list, and the process can be repeated for the subsequent debt. Of course, you must try to make minimum payments such as interest in other debts as much as possible to avoid paying more than necessary.

In the above example, if you have $700 cash available to repay the debts per month, the money can be distributed:

The personal loan is cleared in the first month ($540) – debt plus minimum payment – the remaining $200 is distributed to pay the minimum payment of the credit card debt $100, and $100 is snowballed to the vehicle loan. You will have $840 ($740+$100) to repay your credit card loan in the second month. In 3 months, you can clear the debt by paying $840 per month and a $500 minimum payment for the vehicle loan. In the fourth month, you will have $1340 ($840+$500), which you can use to pay your vehicle loan. In approximately eight months, the loan can be cleared.

Debts snowball worksheets work because they instil a debt repayment habit that does not strain your monthly budget by committing to pay all the debts at once. Once debts are cleared one by one, you get motivated to continue with the strategy, and also, the payment towards each subsequent debt gets bigger since smaller debts are being cleared as time goes. It also helps you prioritize your debts instead of making random payments.

Debt Snowball Worksheet

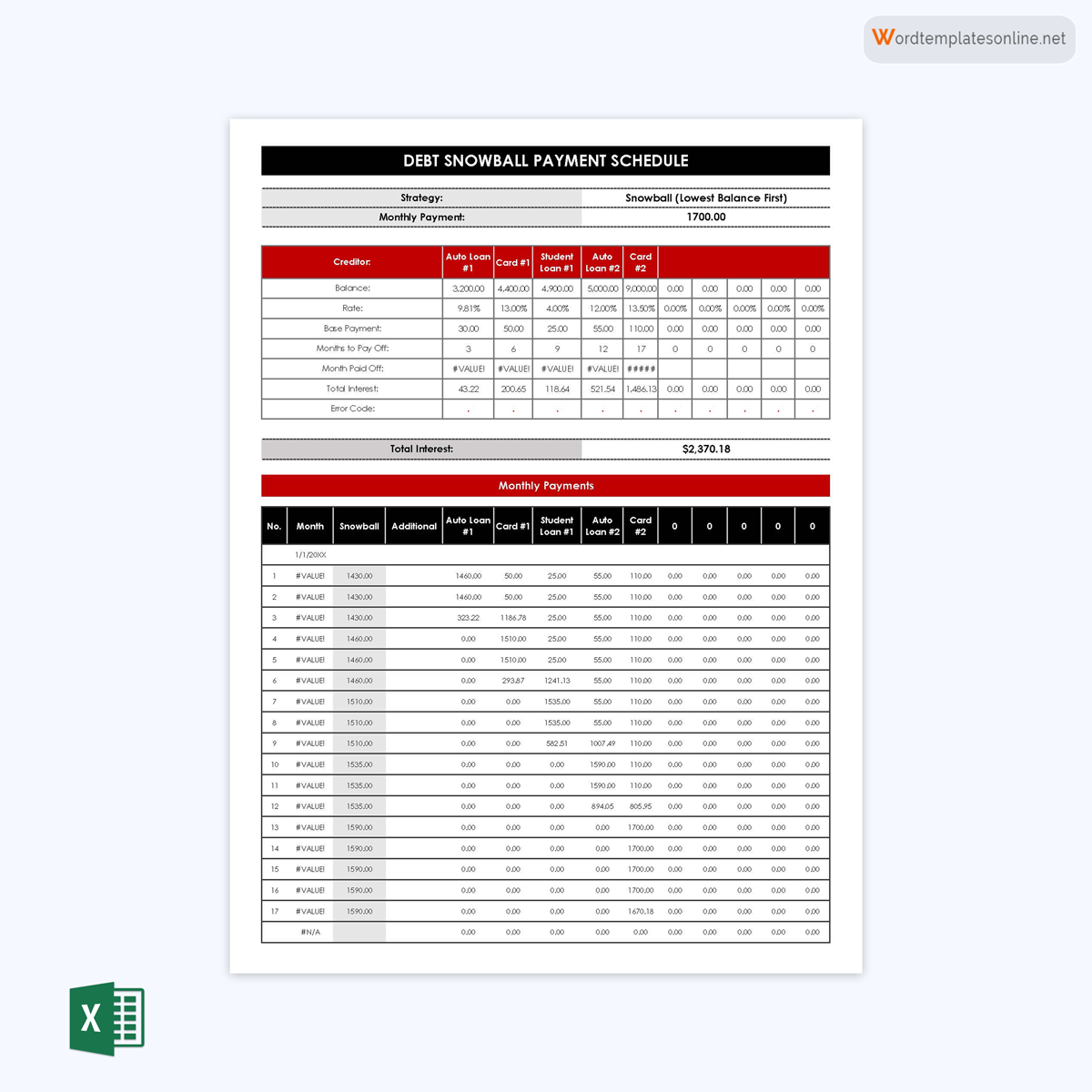

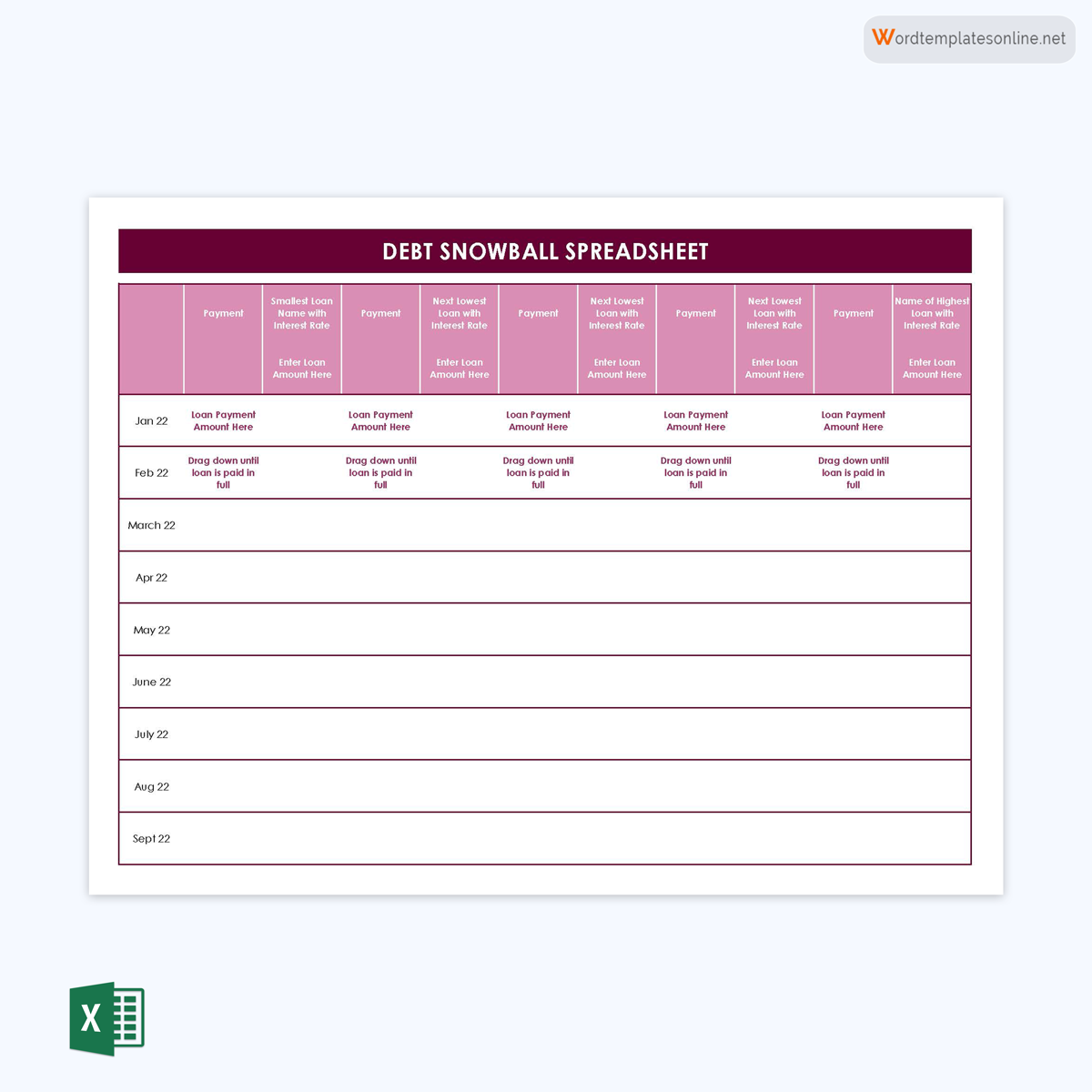

A debt snowball worksheet is a fillable form that users can complete to create a snowball plan to repay their debts.

The worksheets are designed to simplify the process by guiding users where and what information to input. You can download such worksheets from here for free. Using worksheets saves time and requires little effort. The worksheets are also reusable to allow users to use the same worksheets for different debt snowball plans.

Note

Interest rates are a factor you have to overlook when using a debt snowball worksheet. The most considerable debts will often have the highest interest rates. This indicates it takes longer to clear those debts, an aspect that negates the objective of the debt snowball, which is to clear manageable debts as fast as possible. While interest rates can be concerning, you’ll soon have enough money to clear the large debts if you follow the snowball method. The credibility of the debt snowball is centered on efficiency and motivation to clear debts.

Free Templates

Given below are debt snowball worksheet templates:

Pre-Considerations

Before executing your debt snowball plan, you need to plan adequately to make sure you are financially capable and prepared to commit to the plan.

Some of the pre-considerations you ought to take into account include:

Calculate annual percentage rates and balances

Each loan or debt will have its unique characteristics that influence the urgency of repayment. Therefore, it would be best to first understand the annual percentages and balances of all your debts. You can then rank them from smallest to highest based on interest and balance separately. You can then determine whether to carry out a debt snowball or debt avalanche. If you choose to use the debt snowball method, undertake the subsequent steps discussed below.

How much you can afford

A good debt snowball plan should be manageable. Therefore, it would help to determine how much you can set aside for debt repayment in your monthly budget. Any extra cash you can spare should be directed to the smallest balance topping your worksheet. You can try implementing budget cuts, taking extra shifts, or other cost-cutting solutions to generate extra money.

Stick to your plan

Once everything is set, you can implement the plan. Ensure to abide by the plan. All minimum payments on each loan should be paid every month. Once each debt is cleared, do not abandon the plan. Repeat the process until all debts are cleared, and try not to take any loans as much as possible.

Debt Snowball Vs. Debt Avalanche

The debt snowball method and debt avalanche methods are two effective methods of clearing debts. However, both methods use different approaches. The debt snowball is more psychological as it aims to encourage the debtor to pay off debts by clearing small debts first.

In contrast, debt avalanche is a more rational and mathematical approach. Debt avalanche ranks debts based on interest rates – from highest to lowest and prioritizes repayment based on that order. This way, the debtor avoids accruing interest on the money owed. However, note that large debts do not always imply high-interest rates. It is the other way round. Small loans will usually have high-interest rates to push debtors to pay them off quickly. The debt snowball method and debt avalanche methods are the same in such cases.

Advantages and Disadvantages

The worksheets have their advantages and disadvantages. It would be best if you weigh these pros and cons before using the method to ensure whether it is beneficial for you or not.

Advantages

The pros of using a worksheet include:

- Implementation: The debt snowball method is a straightforward process that is easy to execute even for people with no extensive knowledge in finance. In addition, it does not involve complex calculations involving interest rates as it is based on the amount of money you owe to debtors.

- Motivation: Ensuring you clear small debts entirely and fast boosts your motivation to clear other debts. This would not be the case if you were to pay the most significant balance first, which you might not even be able to clear in one or two payments. The cleared debts can be taken as small wins towards the final objective –debt-free.

Disadvantages

The cons of using worksheets include:

- Time: The debt snowball method is a bit more rigid. This means it may take you longer than anticipated to pay off debts. Some balances may be too large, which would take too long to clear while making fixed payments.

- Interest: Since annual percentage rates of loans are overlooked in a debt snowball method, you may pay way more than expected on debt interests. This is a considerable disadvantage, especially if the debt snowball plan takes too long.

Effective Practices to Stay Out of Debt

It would be unfortunate if anyone endured the debt snowball method only to end up in the same financial dilemma they were in before. Therefore, you should always aim to stay out of debt if you manage to make the worksheet work for you.

Then, you can practice the habits to ensure you stay out of debt.

Avoid overspending with credit cards

Credit cards are notable facilitators of an increase in debt. Therefore, this is one area you should be focusing on. You should avoid spending your credit card money on unnecessary items. Basically, use your credit card to pay for things already in your budget, not random shopping sprees that cost hundreds of dollars.

Align your spending with values

You should align your spending habits and the worksheet with your values. Then, find creative ways to keep you going and motivated. An effective debt snowball plan requires persistence to generate results; you should be prepared for that.

Find accountability

To ensure you follow your plan, you can always find someone to keep you grounded. This can be a close friend or sibling to make you accountable for your financial decisions. You can agree on how they will help you be accountable as you see fit.

Try to live within your means

Always live within your means. Knowing what you are able or unable to afford is an effective way to ensure you stay out of debt. Sometimes it is tempting to buy things we “want,” not things we “need.” Always prioritize your needs. Also, do not take loans to buy unnecessary items to fit within a lifestyle you cannot afford.

Frequently Asked Question

The debt snowball is as efficient as its implementation. Therefore, it cannot be deemed more superior to other debt repayment methods. However, it has been proven to work, primarily due to its psychology. It has been determined that people are more likely to continue clearing their debts once they see they can clear a fraction of their debts, regardless of the amount cleared.

Key Takeaways

- Debt snowball worksheets are fillable forms used in personal finance management to pay off debts. It adopts the debt snowball method, popularized by a personal finance expert known as Dave Ramsey.

- The method ranks debts based on balances – from the most minor and most prominent and focuses on repayment of the debts in the same order.

- While the DSl method has been proven to work for most people, it is criticized for overlooking the APR (annual percentage rates) of a debt which is a huge determinant of how much money an individual pays back on a loan.

- The success of the DS method relies on human psychology. It hopes that the debtor gets motivated to repay their loans once they see they can clear off the small debts first.