Loan amortization involves spreading out a loan’s repayment in equal, fixed, periodic payments. The concept behind loan amortization is to help the borrower save on total accrued interest over the term of the loan. For each monthly payment, a percentage covers the interest charged on the outstanding loan amount, while the remaining portion is dedicated to reducing the loan principal.

Under this repayment schedule, the borrower makes fixed payments throughout the loan term. Initially, a portion of each payment goes toward the interest, while the rest is allocated to reducing the loan principal. With time, the principal payment increases while the interest portion decreases. Towards the end of the loan, most of the monthly payments go towards repaying the principal amount. Additional payments beyond this point are typically applied to lowering the loan principal.

A loan repayment schedule contains two components: principal and interest payments. The principal payment is the percentage of your loan payment that is used to reduce the amount borrowed. As you continue to make principal payments, the loan’s outstanding balance decreases over time, which means you pay less interest with each consecutive payment. The interest payment represents the expense of borrowing money.

Conversely, the interest payment is the amount incurred from borrowing the money. It represents the amount you pay the lender for the privilege of using their money. The interest amount is calculated depending on the interest rate and remaining principal balance. At the beginning of the repayment schedule, the interest payments account for a significant amount of the regular payments but reduce over time as the principal balance decreases as well. This is why, for a fixed-rate loan, the periodic payment stays relatively stable, but the amount allocated to principal and interest changes over time.

The most straightforward approach to calculating payments for an amortized loan is utilizing a schedule template. This article will guide you through the step-by-step process of creating the schedule in MS Excel and provide useful customization tips. For your convenience, we have provided a wide collection of free printable schedule templates readily available for download.

What is a Loan Amortization Schedule Template?

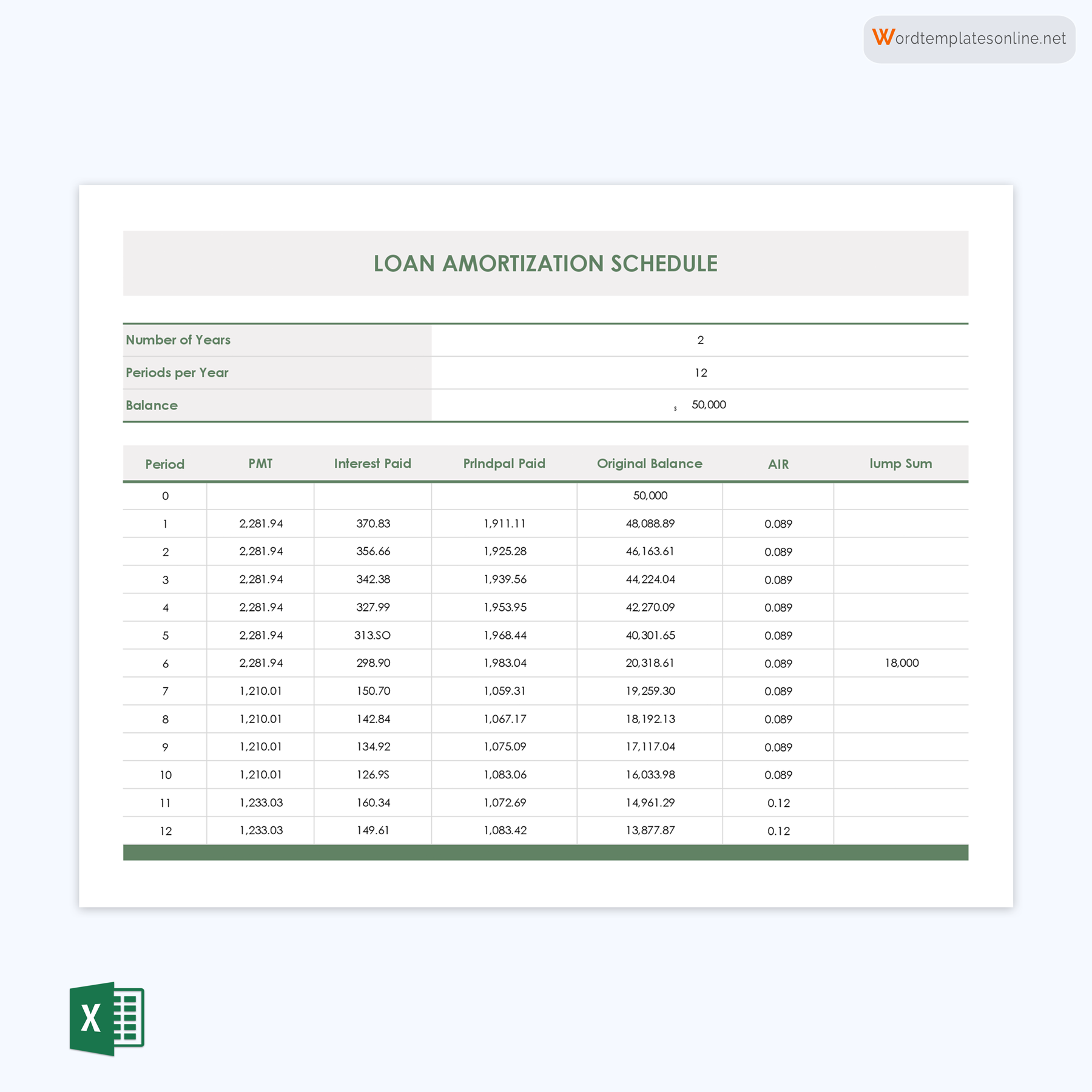

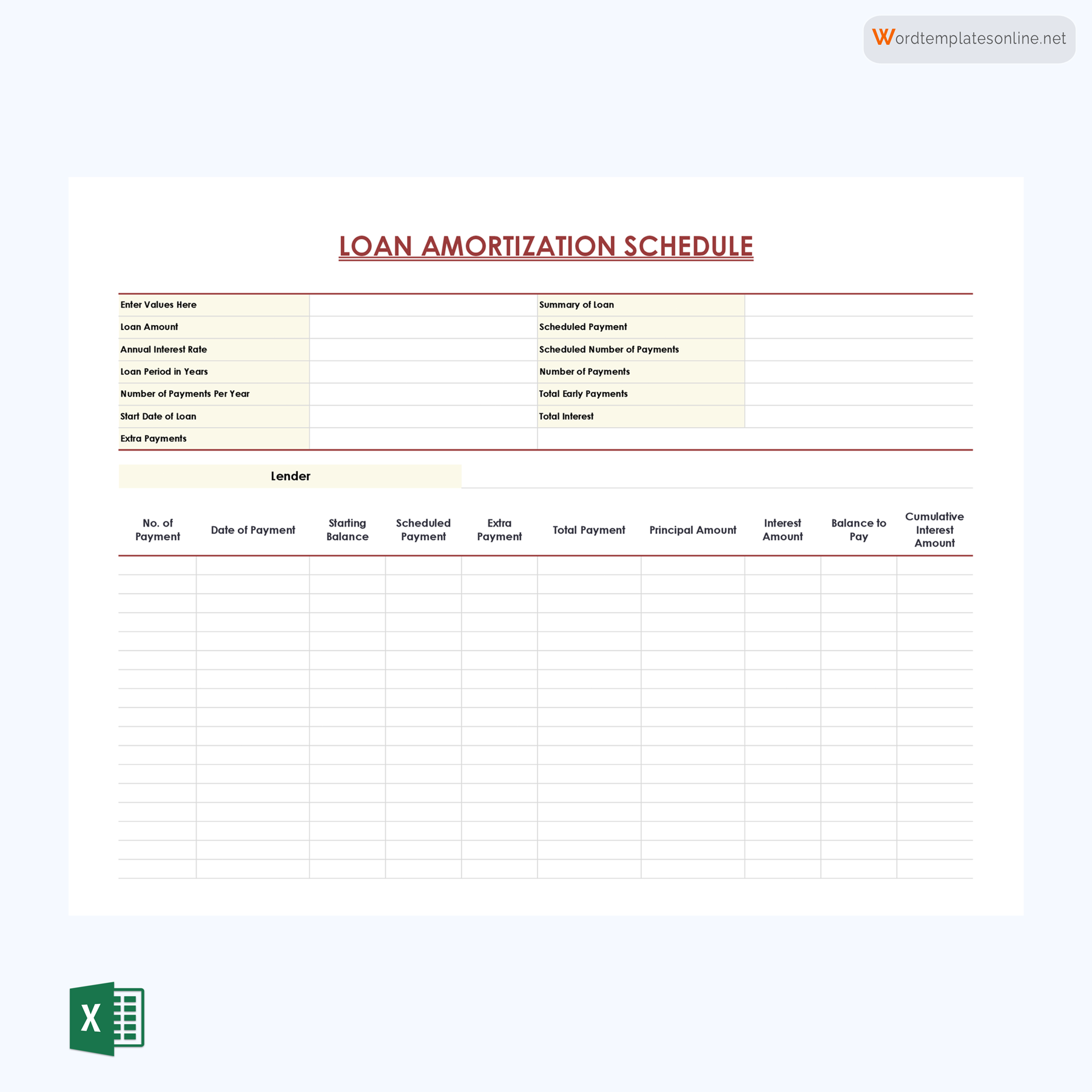

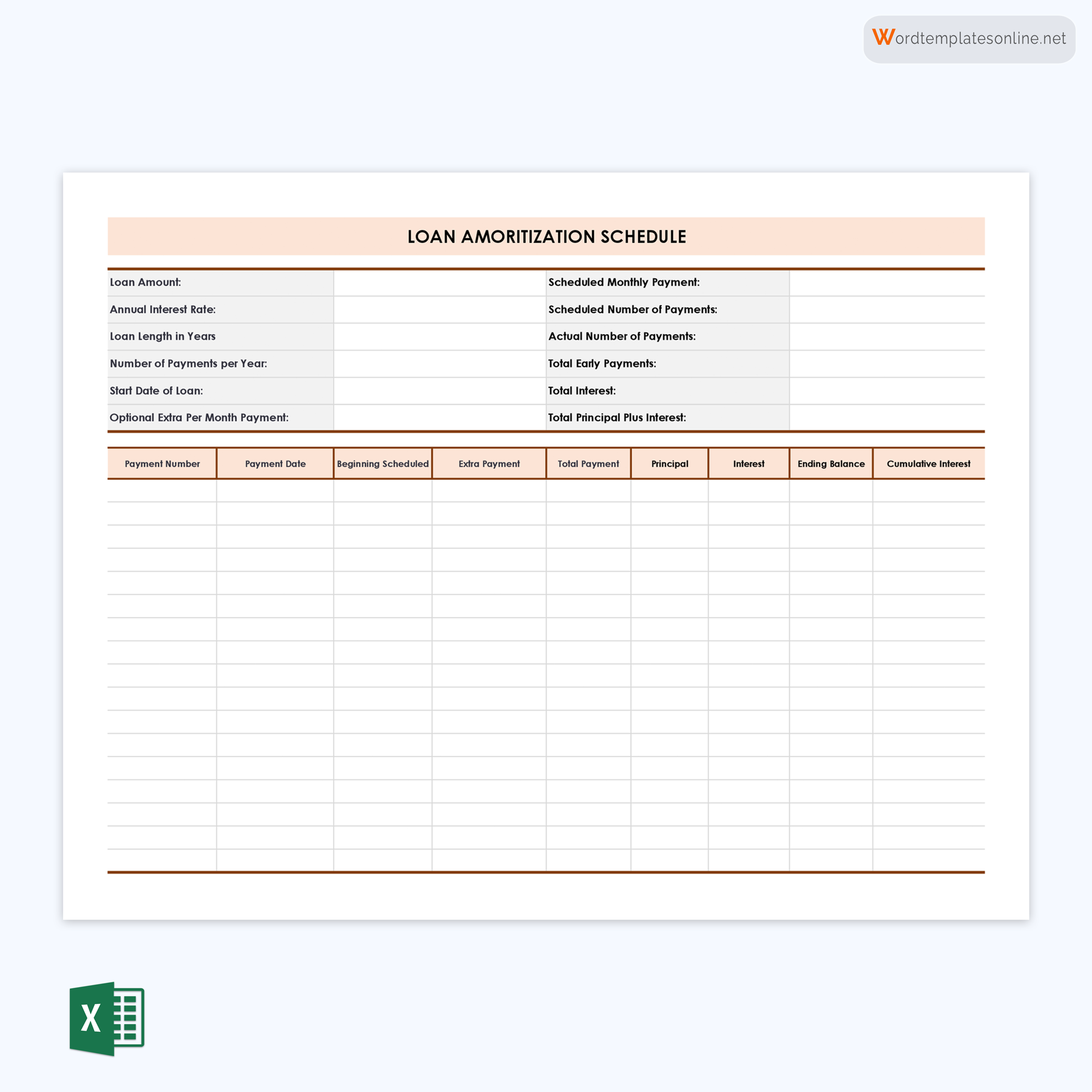

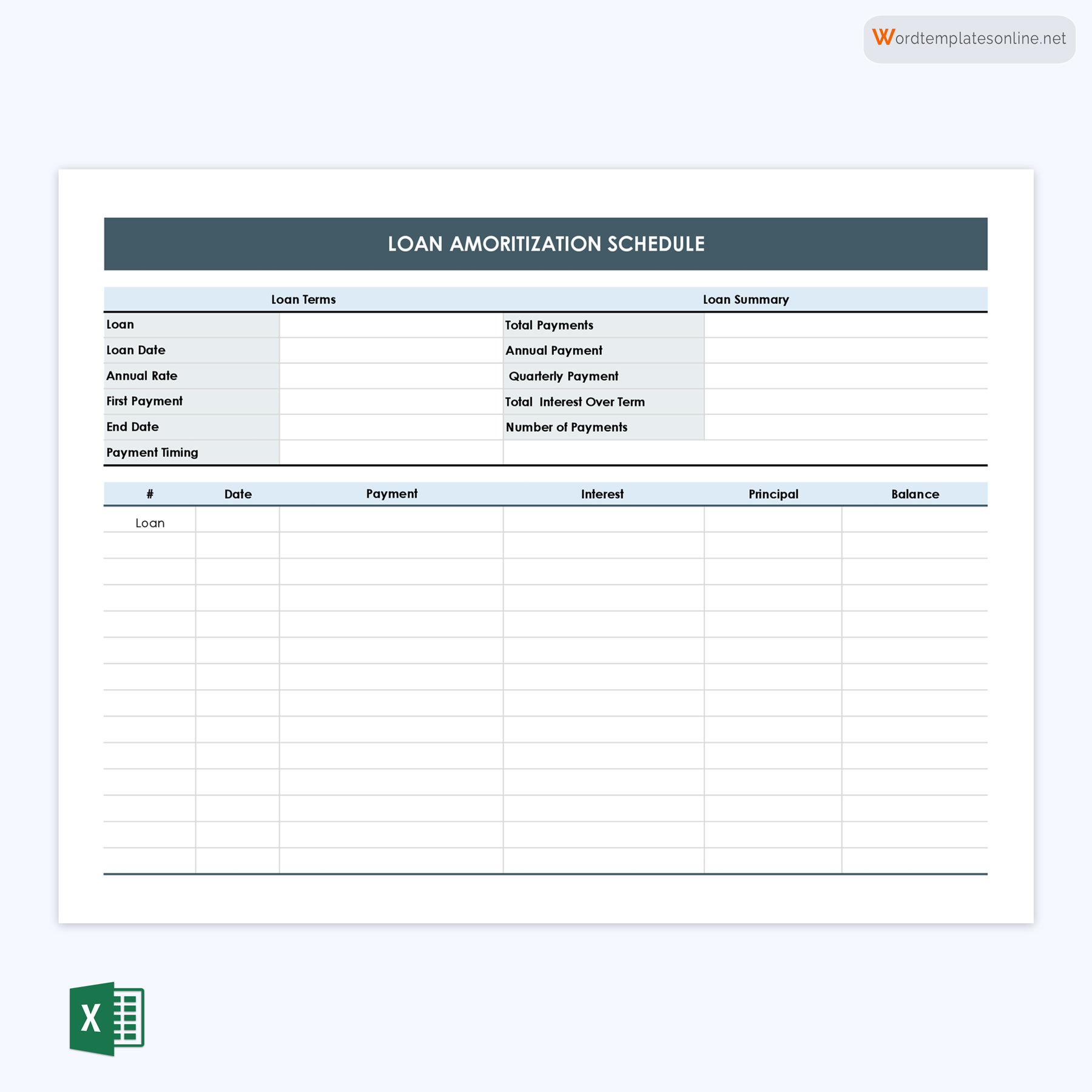

A loan amortization schedule template is a pre-formatted document, usually in Excel format, used to outline the repayment plan for a loan over its term.

The template is typically used for loans with fixed interest rates, monthly payments, and payoff dates, such as mortgage, car, or personal loans. It gives you a detailed breakdown of each payment you should make, indicating how much of each payment goes toward the interest and how much is applied to the principal amount.

This user-friendly resource streamlines the process of calculating loan payments. It is already populated with formulas, eliminating the need to perform complex calculations on your own. The template has fillable fields to input essential loan details such as interest rate, loan amount, and loan term. It will then generate the repayment schedule automatically, with a clear breakdown of each payment. Moreover, using a template also allows you to track your repayment progress accurately. You can observe the remaining balance decrease over time, giving you an understanding of how your loan repayment progresses. It will give you the confidence to focus on your financial goals by simplifying the challenging and time-consuming process of creating the schedule from scratch.

important

An amortization schedule is suitable for tracking long-term payments. These include mortgages, business loans, installment loans, auto loans, consumer loans, long-term rentals, and layaway programs. It keeps you organized and informed throughout the repayment process, allowing you to manage your monthly payments efficiently.

Free Templates

How to Create a Loan Amortization Schedule Template in Excel

Before creating the template, you should have a thorough understanding of three basic functions. First, a PMT function calculates the total amount of a regular payment. This amount remains fixed throughout the entire loan term. Next, a PPMT function obtains the amount dedicated to repaying the principal amount. Over time, this amount increases as you make regular payments. Finally, an IPMT function calculates the amount of each payment that goes towards repaying interest. This amount decreases for each subsequent payment.

To create the template in Excel, follow the step-by-step guide below:

Step 1: Create column A-labels

First, open MS Excel and create a new worksheet. In column A, create proper labels to help keep your information organized. Populate the cells with the following details:

- A1: Loan Amount

- A2: Interest Rate

- A3: Month

- A4: Payments

Step 2: Enter loan information in column B

In column B, enter your loan information. Fill cells B1 to B3 with the relevant information and leave cell B4 blank. Remember to use a percentage value for the interest rate and a currency value for the loan amount. Ensure the value in cell B3 reflects the total number of months for the loan term. For example, input “24” to represent 24 months if the loan term is two years.

Step 3: Calculate payments in cell B4

Next, click on cell B4, enter the following equation into the formula bar, and press Enter.

=ROUND(PMT($B$2/12,$B$3,-$B$1,0),2)

This will calculate the monthly payment amount. The dollar signs in the formula signify absolute references, i.e., the formula will always refer to those specific cells even if copied to other cells in the spreadsheet.

When calculating loan repayment, the interest rate must always be divided by 12. This is because it is an annual rate applied to the principal amount each month.

Step 4: Create column headers inside row seven

After calculating the payment amount, input column headers into row seven. Type the following labels into the corresponding cells:

- A7: Period

- B7: Beginning Balance

- C7: Payment

- D7: Principal

- E7: Interest

- F7: Cumulative Principal

- G7: Cumulative Interest

- H7: Ending Balance

Step 5: Populate the “Period” column

In cell A8, input the month and year for the first payment. Choose an applicable format that displays the month, day, and year, if necessary. Next, click on the cell again, hold the cursor at the center, and drag it downwards to cell A31. When creating your own schedule, ensure the number of rows corresponds to the number of months in your loan term. To ensure the “Last Month” option is active, click the small lightning bolt icon at the bottom right corner of the lowest cell.

Step 6: Fill in cells B8 to H8

The next step is to populate cells B8 to H8. Start by inputting your loan’s beginning balance in cell B8. Click on cell C8, type the formula =$B$4, and press Enter. To calculate the amount of loan interest at the beginning of the period, type the following formula into cell E8:

=ROUND($B8*($B$2/12),2)

Enter the formula below in cell D8 to calculate the difference between the amount of loan interest in cell E8 and the total payment in cell C8:

=$C8-$E8

In cell H8, enter the formula below to calculate the difference between the principal portion of the loan repayment and the beginning balance for the designated period:

=$B8-$D8

Step 7: Fill in cells B9 to H9

Continue populating the template by inputting entries in cells B9 to H9. In cell B9, type =$H8 and press enter. Next, copy the contents of cells C8, D8, and E8 and paste them into cells C9, D9, and E9, respectively. Copy the contents of cell H8 and paste them into cell H9.

Input the following formula in cell F9 to calculate the complete principal you have paid:

=$D9+$F8

In cell G9, enter the following cumulative interest formula:

=$E9+$G8

Step 8: Populate the rest of the template using the crosshairs

Finally, highlight cells B9 to H9 and place your cursor over the bottom right corner of the highlighted section to turn it into a crosshair icon. Drag the highlighted section to row 31 to fill every cell automatically. This will create the amortization schedule, which you may use to track and manage your loan payments.

note

One convenient and efficient approach to computing payments for an amortized loan is by utilizing an online loan amortization calculator. Amortization calculators are readily available on numerous financial websites, allowing you to input crucial details such as loan amount, loan term, interest rate, and payment frequency. They are relatively easy to use and generate detailed schedules containing interest and principal components at the click of a button. Online calculators help you make informed financial decisions, such as whether to refinance, extend the loan term, or make larger payments.

Best Practices for Customizing Your Loan Amortization Schedule Template

By customizing the template accordingly, you can tailor it to your unique needs and ensure it is suited to your specific repayment schedule. You can readily anticipate future payments, budget accordingly, and ensure you have the necessary funds available.

Discussed below are some best practices to consider when customizing your template:

Adjust the payment frequency

Depending on your financial capabilities and preferences, you may adjust the payment frequency when customizing the template. You might want to gauge how payments differ on a monthly, bi-weekly, annual, or quarterly basis. If you are capable, you may choose a more frequent schedule, such as bi-weekly or monthly payments. If not, you may opt for a less frequent schedule, such as yearly or quarterly payments. This flexibility allows you to explore different repayment frequencies that best align with your cash flow and financial capability.

Account for extra payments

If you plan to make additional payments beyond what is required, you can include extra fields to capture payments you make toward the principal. This will help you assess how extra payments accelerate repayment and reduce interest costs. Additionally, this feature can encourage you to restructure your loan repayment, potentially quickening the repayment process and reducing the overall interest.

Handle variable interest rates

Some financial institutions give loans with variable interest rates. If so, ensure your template allows for a flexible repayment plan. You may input formulas that adjust the payment amounts automatically as the interest rates fluctuate. Adding these formulas ensures that your amortization schedule remains up-to-date and accurate.

Personalize formatting and design

You may improve the visual outlook of the template by adding colors, styles, and borders that best suit your preferences. This is especially important if you intend to share the schedule with a third party, such as your bank or lender. A visually appealing schedule template is easier to read, enhancing the overall loan management experience.

Incorporate payment reminders

When customizing the template, you may include a feature to set up regular payment reminders. These can be through email notifications or alerts. Reminders ensure you do not miss a payment and help you maintain a positive credit history.

Conclusion

Using a template for a loan amortization schedule gives you a powerful advantage in personal financial management. It empowers you to navigate the complexities of loan repayment with clarity, precision, and informed decision-making. It is also easy to customize, giving you a dynamic visual representation of your loan repayment schedule – from the distribution of interest and principal in each payment to the prospect of accelerated repayment through extra contributions.

A schedule template or online-based calculator also saves you time and effort since you do not have to carry out complex calculations by yourself. This allows you to devote more time to repaying the loan. Whether you are a first-time borrower or a seasoned financial expert, take advantage of our free printable schedule templates to secure a brighter, debt-free future. Simply download one that best suits your needs and fill in the necessary details to unlock your financial freedom.