A budget is a plan showing a person’s or group’s expected earnings and expenses (like the income and expenses of everyone in a family) over a particular period.

You can brace yourself for significant events and safeguard against unexpected expenses or spending by keeping track of your finances.

A budget might be extensive or narrow; by focusing on a few items. But whatever shape it takes, you do not need an accounting degree to create one. Writing your budget might be as straightforward as writing it down in a book. Although some individuals prefer tools such as spreadsheets, what matters is that you stick to the most convenient tool for achieving your goals.

Another common myth about budgeting is that it prevents you from spending money on things you desire. This is not true; if you keep to your budget, you can still spend your money on everything you want. It demonstrates that you control how and where your money is spent.

Free Weekly Budget Templates

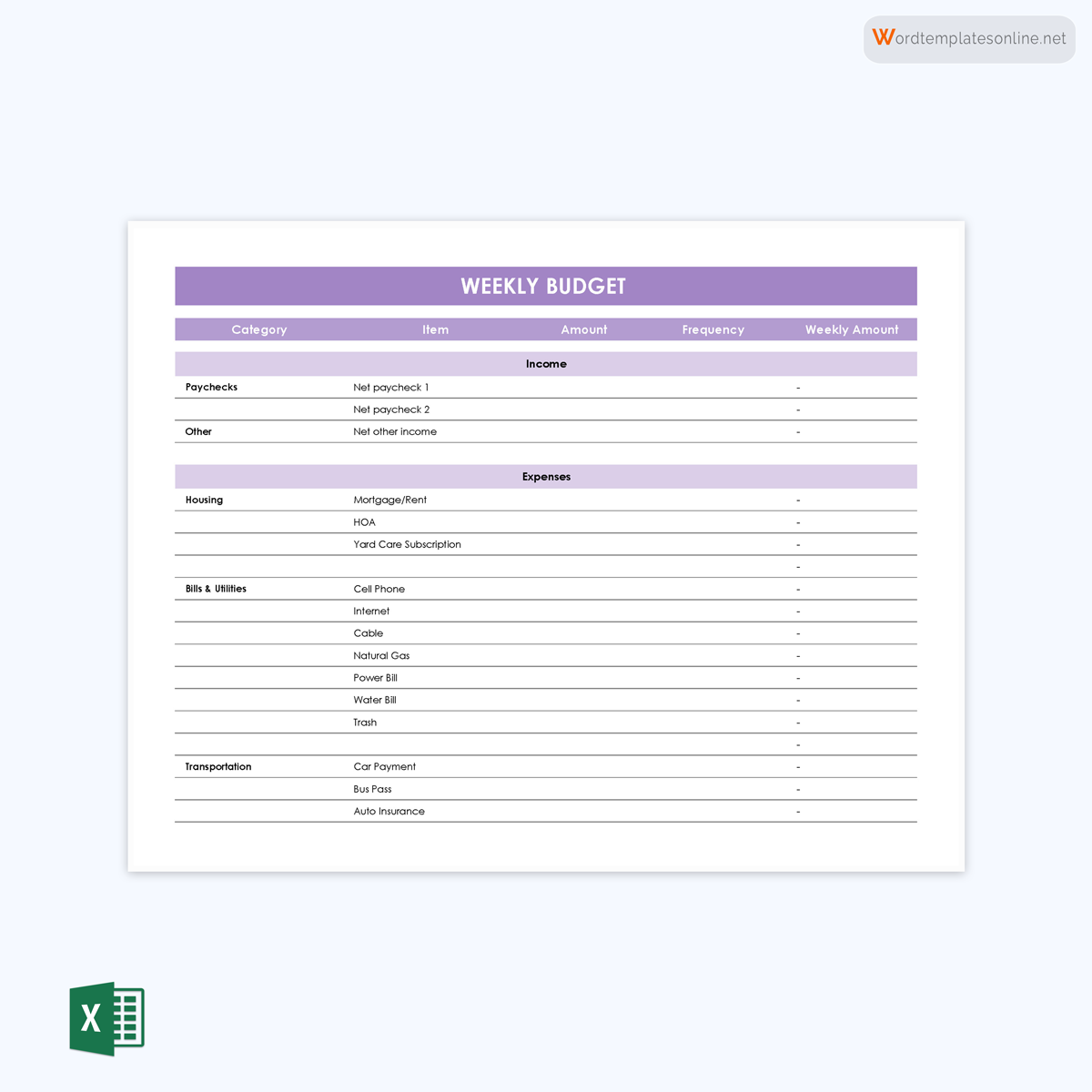

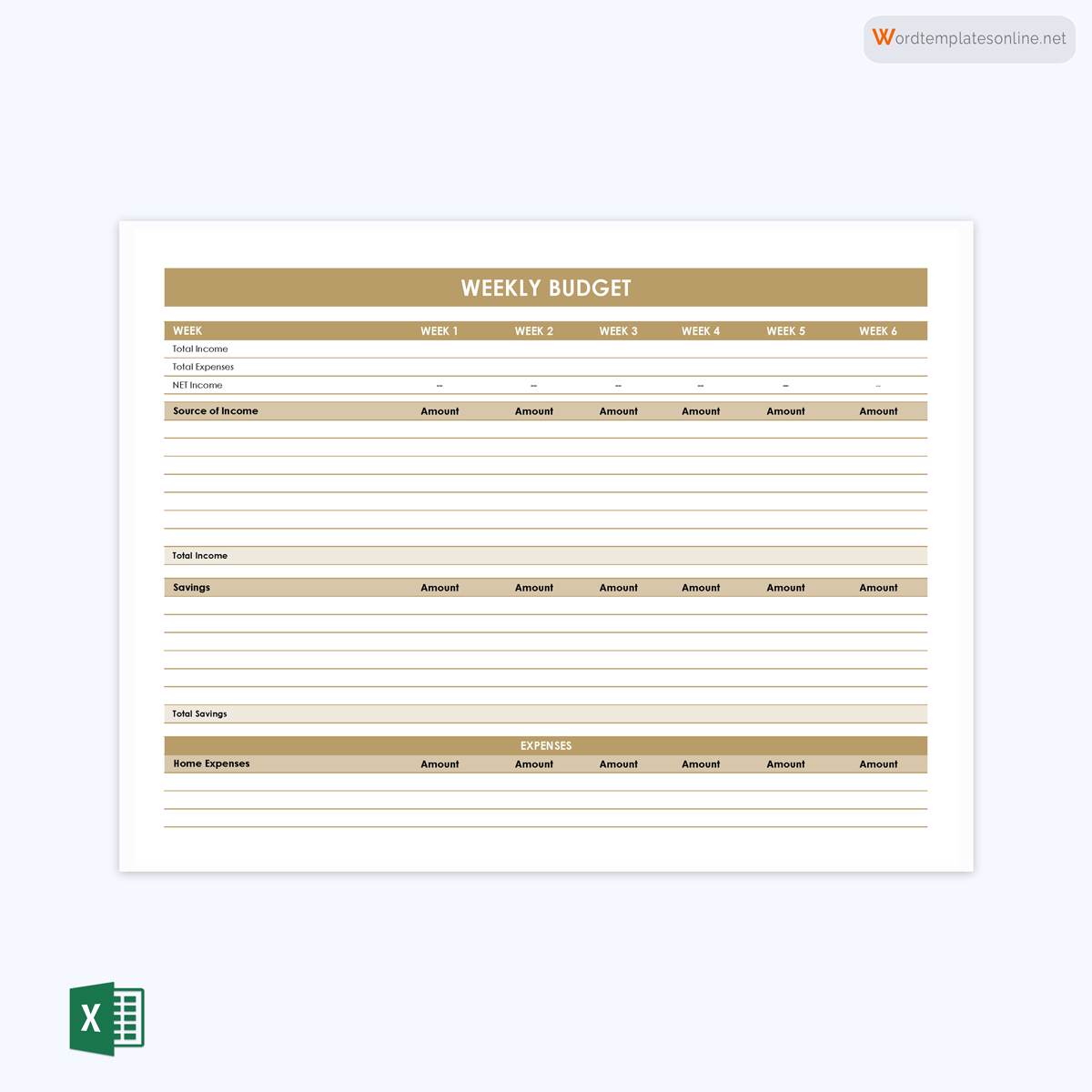

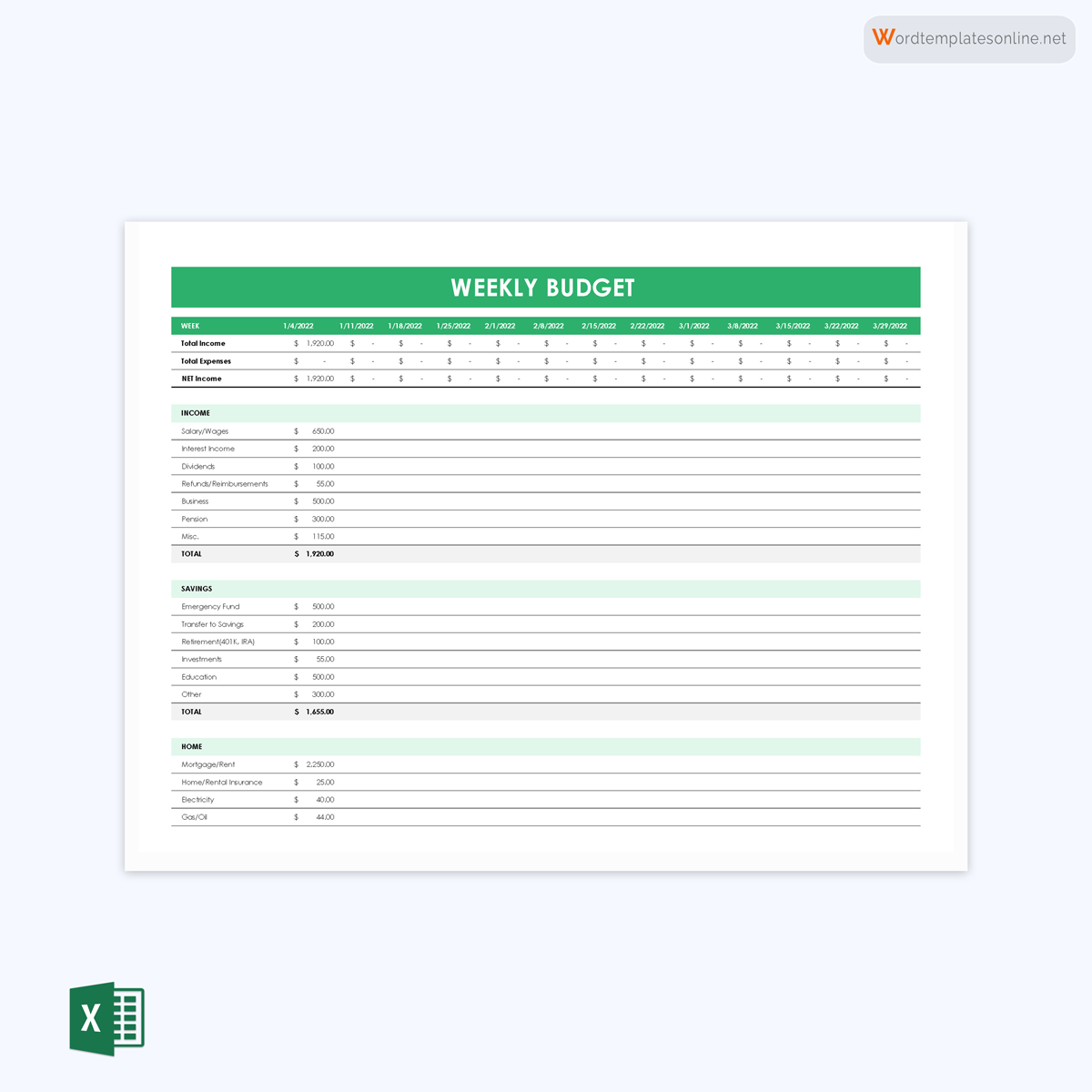

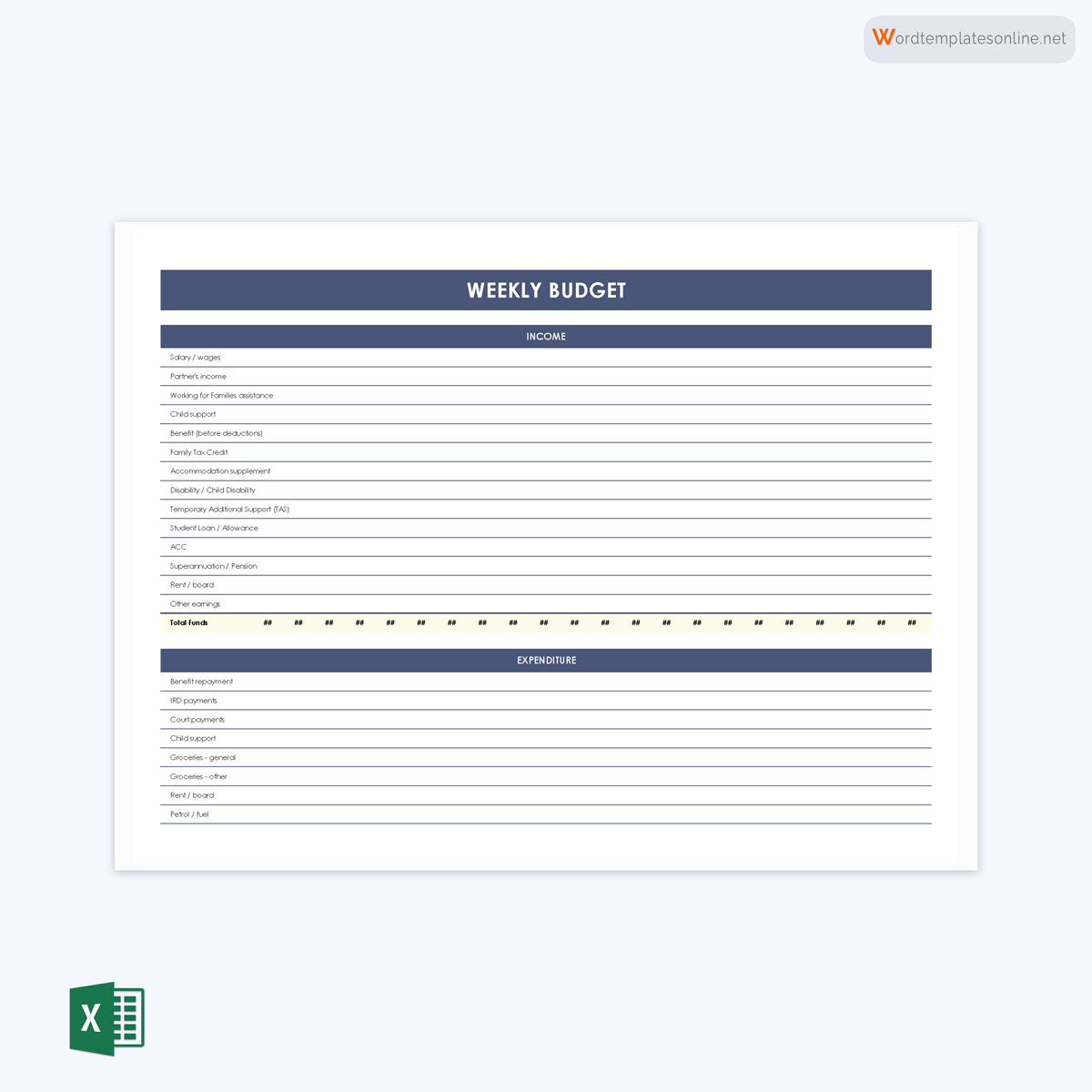

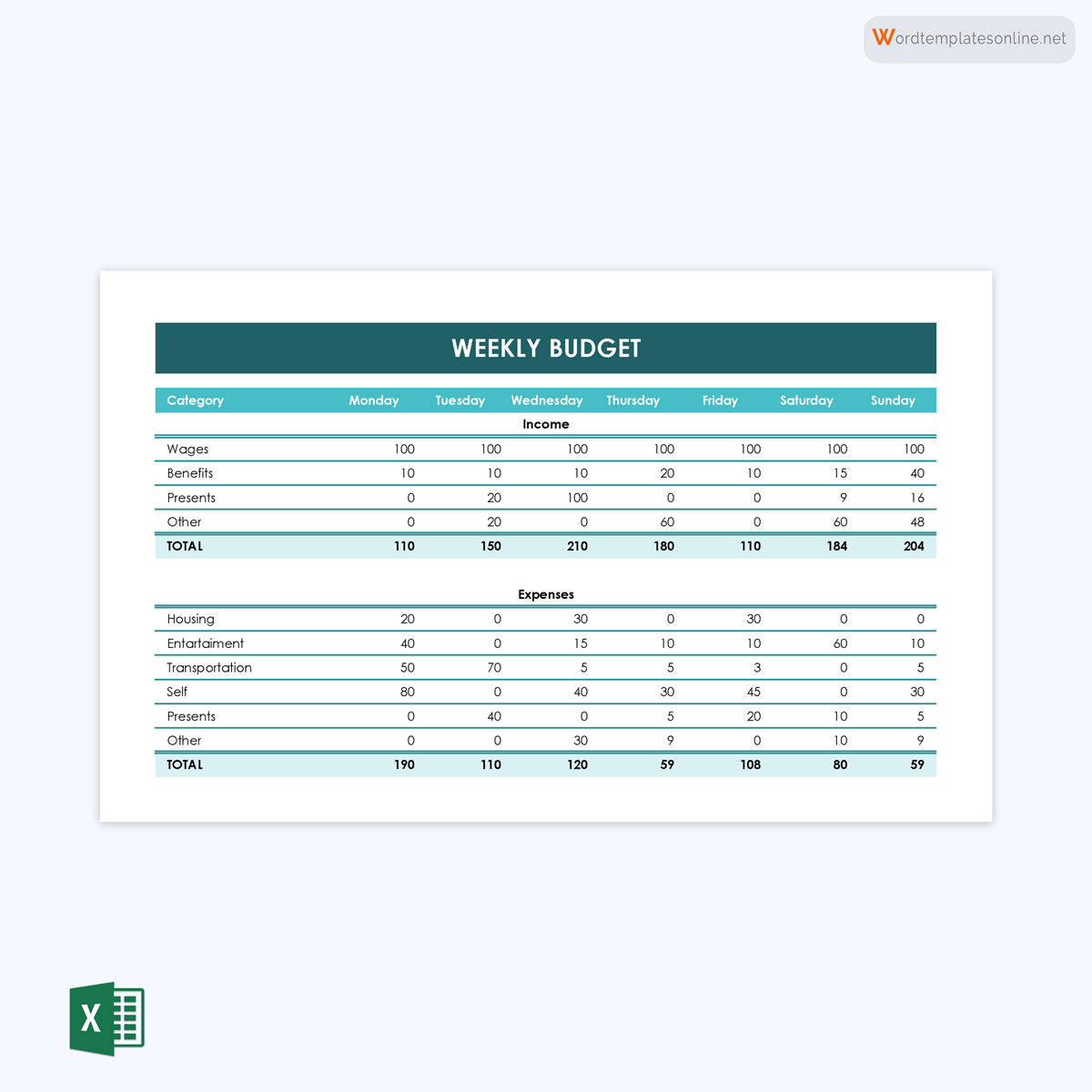

Effective financial planning is crucial for maintaining a healthy and stable financial life. One powerful tool that can greatly simplify this process is a template, especially when it comes to weekly budget planning. A template provides a structured framework to outline and track your income, expenses, and savings goals on a weekly basis. By utilizing a template, individuals gain a clearer understanding of their financial situation and can make informed decisions regarding their spending habits.

This pre-designed format allows for easy organization and categorization of expenses, ensuring that every dollar is accounted for. Additionally, a template provides a visual representation of your financial progress, allowing you to identify areas where adjustments may be needed. Whether you are looking to save for a specific goal or simply want to gain control over your finances, using a template can significantly simplify the process and ultimately lead to better financial management and peace of mind.

Why Should I Create a Weekly budget?

Contrary to common opinion, everyone should embrace the habit of budgeting. It makes it possible to track your spending and enables you to use your income as efficiently as possible. Using a weekly budget has many advantages.

Some of the merits include the following:

Controls spending

It prevents you from overspending, which is perhaps the most apparent benefit. You may be able to track your spending without a budget, but you will quickly forget the exact amount you have spent. Using money spent on food, dining out may appear to be a small cost.

Using one will show you that eating at restaurants consumes more money than expected. By using a budget, you can better comprehend the importance of each item in your finances. This will help control your spending.

Keeps you on track

Budgeting is essential to keeping yourself on track to reach your financial goals. It can serve as a tool to create a clear and conscious path to keep achieving your financial goals. Not only will you remain on track with your goals, but you will also be able to see where you stand to achieve them. And the more in touch you are with your goals, the higher your chances of success.

Gives financial contentment

The fact that using a budget brings financial contentment is still another significant advantage. People occasionally become preoccupied with comparing their finances and purchasing power with other people’s own. This causes them to live in a race where they concentrate on other people’s financial capabilities.

However, when you adopt a budget, you can deliberately control your spending and ignore other people’s and societal expectations. As a result, you will be able to achieve financial fulfillment once this becomes a habit.

Helps to track fewer transactions

A weekly budget also allows you to keep track of your transactions because they are divided and scheduled for each week. If you attempt to recall all transactions at the end of the month, you could forget specific details or take more time to recall them. You may overcome this difficulty by creating a weekly budget since it will be simpler to keep track of the fewer weekly transactions.

Keeps from feeling financially overwhelmed

Without a weekly budget, we tend to get overwhelmed by financial obligations later on. The truth remains that we tend to get overwhelmed when we see our finances dwindling. A budget includes allowances and sets aside funds for your weekly needs, so you already have a good idea of what to expect.

Thus, it allows you to always be prepared for expenses that might overwhelm you otherwise.

Helps to avoid or get rid of debt

It helps you plan and structure your spending habits; you can eliminate impulse buying and things that are beyond your financial capacity. If you are already in debt, the best way to get rid of it is through budgeting. Then, you can start setting a reasonable portion of your earnings towards settling such a debt.

More flexible

Budgeting does not cater to just the fixed expenses; it also helps you identify the expenses you did not predict but have spent on. Similarly, you can determine whether you have enough room to indulge in one or two whims without jeopardizing your finances. You will know when you have enough to do things like dining out with your partner or friends, getting someone a random gift, and so on. Budgeting allows you to identify and adjust according to your financial condition at every point.

Keeps organized

You also need a budget because you cannot afford to be disorganized regarding personal finance. Your finances can become messy very quickly without one. This is usually a consequence of seemingly insignificant expenses. These minor costs consume your funds, putting you in a state of panic and stress. When you constantly wonder why your wages are insufficient, use a budget to keep your money in order.

Helps for emergencies

We sometimes face unexpected expenses that need to be sorted out immediately.

EXAMPLE

Facing unexpected hospital bills or repairing something in your home. You do not want to be in this situation without a safety net. Using a budget, you can set aside a percentage of your income for emergencies.

Simplifies saving money

Another apparent reason you should use a budget is to simplify and cultivate the habit of saving money. In most cases, people only save money when they have a particular thing or project they are saving towards. Therefore, when you start utilizing one, you can not only avoid waste but also keep and save extra money. Again, you would not need a project to motivate you to save; it simply becomes a part of you.

Although the numerous advantages of budgeting are apparent, there are also some things to watch for. The first is the temptation to spend more than planned, hoping to balance your finances in the future. Succumbing to this temptation can easily undermine the purpose of the budget, as you might end up repeating the same thing. This should be avoided by setting aside money for your “wants” and not going beyond that once it has been exhausted.

Another thing is that not everyone will have the patience or time to sit down weekly to make the necessary adjustments. If you fall into this category, a way out is to try the bi-weekly or monthly budgeting system.

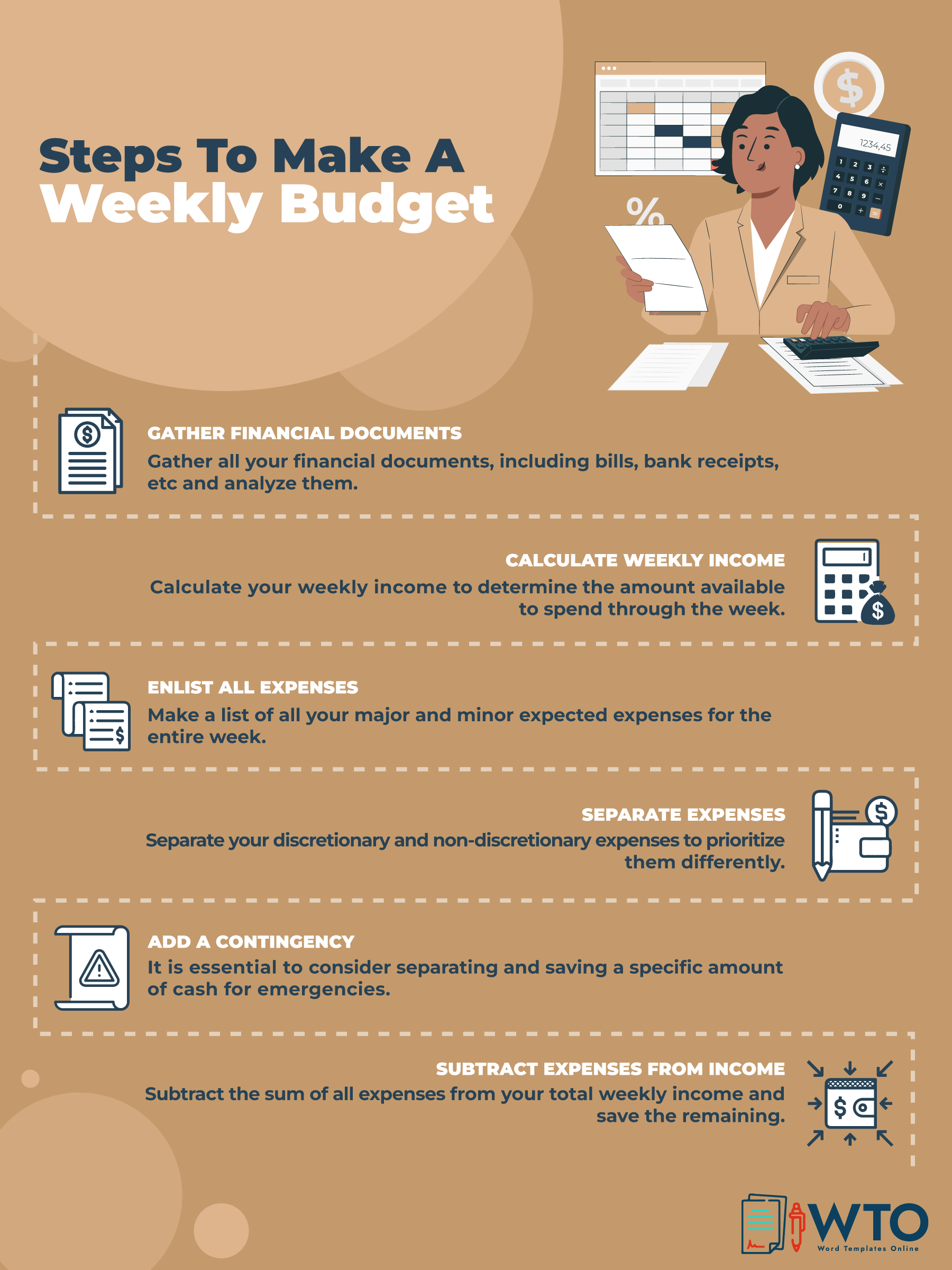

Create a Weekly Budget in 6 Easy Steps

Even though you might not find creating a budget one of your favorite tasks, the benefits attached to it (i.e., taking control of your finances) are enough motivation to do so. Of course, recording your weekly income and expenses is the easiest way to go about it.

Here is how to create one in six simple steps:

note

It is worth saying that not all budgets have the same structure. The structure you use will depend mainly on your spending habits, i.e., the things you want and need. Everything else is just a matter of what your financial goal is.

Gather all of your financial papers

You must gather your financial papers from the last six months, if possible. Financial documents like bank statements, receipts, payment stubs, and monthly bills should all be gathered and kept.

Calculate your weekly income

The next thing to do is to calculate your earnings from all sources. If you do not have a fixed income, you can find a monthly average by adding up your earnings in the last three months and dividing that by three. Since you are creating a weekly budget, split the figure into four equal parts to cover each week of the month. You must only use the earned figure after deducting the tax.

Make separate lists for discretionary and non-discretionary expenses

The next thing to do is to list all your expenses for the past one or two months. Your expenses can be divided into two categories; discretionary and non-discretionary. Discretionary expenses are those expenses incurred by choice and are voluntary.

EXAMPLE

Money spent on eating at a fancy restaurant, going to the movies, or going to a live concert.

Non-discretionary expenses, on the other hand, cannot be avoided. They are necessary bills and part of your daily life.

EXAMPLE

Rent and mortgage payments.

This division is necessary to make healthier decisions, as you can identify what and where you can trim your spending to stay within your financial capacity.

Add a contingency

You need to set some money aside for difficult days. An incident like a sudden car breakdown cannot be anticipated. Indeed, your budget is not complete without making room for contingencies. However, what you set aside does not have to be huge. A little every week will go a long way in making you more capable of dealing with contingencies.

Subtract the sum of your expenses from your weekly income

Next, sum up all your expenses and subtract the total from your weekly income. You may have an excess, which can be used to meet other goals. You can also decide to save it. However, if the subtraction gives a negative number, it signals that your finances are not in order and should be adjusted accordingly.

Evaluate and make the necessary adjustments

The final thing is to evaluate the status of your finances. If you have a negative balance or constantly exhaust your income, you should start looking for ways to eliminate some of your expenses. An excellent way to do this is to examine your discretionary expenses for items that can be adjusted.

tip

Elizabeth Warren and her daughter, Amelia Warren, recommended a guideline for allocating funds in a book. This rule is called the 50/30/20. It recommends that you allocate 50% of your earnings to things you need and 30% to those you want, and the remaining 20% should be put towards fulfilling your financial goals. This rule is merely a guideline. You can tweak these percentages to meet your needs.

Expert Tips for Weekly Budget

Even though creating a budget is simple, there are some measures you should put in place to ensure you have a well-rounded one. Also, if you are familiar with it, these tips will sharpen your skills.

Here are some expert tips to keep in mind:

Think of the future

Do not just start utilizing a budget because you know it is appropriate; think about the future and the final goal. Determine and document your financial objectives and purpose. Savings should never be regarded as a convenience-based action. Instead, savings should be treated as crucial as non-discretionary expenses, such as rent or mortgage payments.

Set achievable goals

Do not be too hasty or overly passionate to over stress your money. Instead, divide your long-term goals into small ones you can complete in a few weeks.

Schedule a day and time to create your budget

Errors should be avoided by all means. As a result, pick a specific and convenient day and time to create your budget. Then, determine and plan when you would like to review it. Finally, make all required modifications for the discounts you have gotten and update them.

Contact companies for bill reduction

This can be handy when attempting to prevent a negative balance. Get in touch with the businesses where you use their services to inquire if there is a plan that might lower the costs. Remember to remain kind to their representatives and let them know if you have been a client for a while.

In addition, obtaining firsthand knowledge about promotional offerings that may drastically lower your costs may be possible.

Use a template to save time

Since budgeting is continuous, it might be exhausting to go through the same steps every week. However, one way is by using a template. As a result, you only spend time entering fields that are unique and applicable to you. On this website, you can find free-to-download templates to simplify the process.

Schedule monthly check-ins

It is impossible to exaggerate how crucial it is to re-evaluate and check in. This is to make sure your progress toward your objectives is maintained. Additionally, you will be able to recall why you must adhere to your budget. The check-in will be more effective when you are likely to go on a spending spree (like a Friday night). To maintain your motivation, you must know your objectives and current situation.

Organize and update frequently

Your budget should always be set up correctly and constantly updated per your current circumstances to ensure you get the most out of it. Your objectives, expenditures, and savings must be adjusted according to your most recent financial circumstances.

For instance

If your income increases, you should revise your budget to reflect your new goals and savings.

Key Points

Budgeting keeps you in charge of your finances. Hopefully, at this stage, you have seen the numerous benefits attached to it and started working towards putting one in place.

Here are some key points discussed in this article:

- Using a budget is the easiest way to gain control over your financial life. It shows you what and how you spend your money.

- Budgeting might take some time when you are just starting, but it will become more straightforward as you get used to it.

- You can save yourself a lot of time and stress by making use of our free downloadable budget templates.

- The money to cater to your non-discretionary expenses needs to be assigned first. Then, split the remaining funds to satisfy your wants and financial goals when that is sorted out.

- Budgeting is not meant for people planning a massive project or those struggling financially. However, it is a healthy habit that everyone should always adopt.