Like any other occupation, financial advisors must also write a resume when applying for a job. You’re in the right place if you’re unsure how to write it or haven’t done it in a very long time. This article will guide you through the entire process of writing and formatting a resume for the financial advisor position.

What Is a Financial Advisor Resume?

A financial advisor resume highlights the skills and competencies of financial advisors. A well-written financial advisor resume can add value to your career by enabling employers to notice essential features of your professional life. Therefore, we can say a resume is a career investment since it helps you get your dream job.

If you’re currently hunting for a new job, you probably know all employers are asking their applicants for a resume. Reviewing resumes is the first step of every hiring process, which is why candidates need to create a resume that will be noticeable and different from the rest. A well-written resume is the only way to secure an interview, which is necessary for getting the job.

Also, you never know when you’ll get a new job opportunity as a financial advisor. These offers tend to be sudden and unexpected, often requiring people to hand in their resumes as soon as possible. That’s why it is always vital to have an updated resume version ready in case you need it.

This article will cover everything you need to know about formatting financial advisor resumes. From providing insightful writing guidelines to equipping you with helpful templates, here you’ll find it all.

What Does a Financial Advisor Do?

Many people believe the only job of financial advisors is to find the best investment opportunities where their clients will invest their money. Although that’s one of the financial advisors’ responsibilities, they have many other things on their plate.

For example, financial advisors must fully understand the different types of financial accounts their clients should enroll in, besides managing their existing accounts.

Furthermore, they must examine the bigger picture of their client’s assets, earnings, and debts to devise a realistic plan if clients want to reach a specific financial goal and do everything to guide them towards achieving it.

Additionally, financial advisors educate their clients on available financial and investment products, work with them on a one-to-one basis, and help them understand the pros and cons of their financial situation.

Financial advisors have an ongoing relationship with their clients. Their job is to check in with their clients regularly and ensure the clients are investing correctly. They also introduce changes to financial plans when necessary.

When it comes to people working as financial advisors, most of them are employed in the financial investment sector. Nevertheless, some advisors work in accounting, business management, tax preparation, different agencies, brokerages, and credit intermediation.

How to Write a Financial Advisor Resume

Follow this step-by-step guide to create the perfect resume for the financial advisor position:

Step 1: Choose the best resume format

The first step to writing a high-quality financial advisor resume is to select a resume format that best fits your level of experience. In most cases, people use reverse chronological order when formatting their resumes because it allows them to draw attention to recent work experiences, which are more important than the older ones.

Another popular format is the hybrid resume format. People who recently changed their career path or are entering a specific job market for the first time typically use it. Functional resumes are generally for people who work in highly specialized or technical fields, as that format allows candidates to highlight the progress of their skills throughout their work history.

Reverse chronological order is the best resume format for financial advisors.

Step 2: Add a resume header

A resume header is a perfect way to start any resume, not just a financial advisor one. A resume header is where applicants insert their names and contact details, making it significantly easier for recruiters to find the necessary information.

The header is always at the top of the page. Some essential pieces of information you should insert in it are:

- Your full name;

- The position you’re applying for;

- Location (the city is enough);

- A professional-looking email address;

- A LinkedIn profile.

Step 3: Write the resume summary

Another helpful feature to include is the resume summary. A resume summary is typically the first section recruiters look at when reviewing resumes. Summaries play an essential role in helping recruiters paint a picture of the candidate, which is why it’s vital to come up with an engaging and captivating resume summary.

In the resume summary, experienced financial advisors start by introducing themselves and their professional careers. Then, they dive deeper into the highest points of their professional life and go through the significant events that marked their careers so far. However, people switching professions can also use these summaries to say something about what motivated them to change their occupations.

A resume summary’s purpose is to narrate every financial advisor’s unique story and help them showcase their motivation for the position.

Step 4: Include your employment history

Your previous work experience makes up a big part of your resume. Since working as a financial advisor requires plenty of hands-on experience, presenting your potential employers with a detailed employment history is one of the best ways to showcase your field-related skills and capabilities.

When crafting your employment history, consider implementing these tips:

- Use bulleted lists and mention employments that add to your potential position;

- Start with action verbs in the past and keep all entries consistent (decide whether you’ll end with a period and keep every entry one or two lines long;

- Use reverse chronological order when listing your previous work experiences;

- Mention the job position, company, and working period for every entry;

- Describe your previous job responsibilities and duties;

- Incorporate numbers and other relevant data to show your expertise;

- List the primary outcomes you achieved during every employment;

- Mention other notable accomplishments, such as awards or recognitions.

Step 5: Add a resume skills section

A resume skills section allows financial advisors to stay competitive since it enables them to demonstrate their capabilities. Besides that, the resume skills section works perfectly if your recruiter uses ATS to screen potential candidates. That way, you can mention all skills from the job ad which hiring managers refer to when choosing the best match for the company.

Working as a financial advisor requires a perfect balance of soft and hard skills. On the one hand, financial advisors need to understand and analyze the financial market, current trends, and available financial products and services. On the other hand, they also must possess meticulous organizational and communication skills.

Therefore, some of the hard skills that you should add to a financial advisor resume skills section are:

- 401(k) retirement savings plans

- Bonds

- Commercial banking

- Customer service

- Estate planning

- Financial reporting

- Income protection

- Investment banking

- Marketing strategy

- Pension funds

- Proficient in MS Office (Word, Excel, PowerPoint)

- SAS

- Strategic planning

- Trading

- Asset allocation

- Business development

- Corporate finance

- Data analysis

- Financial accounting

- Financial risk

- Inheritance tax planning

- Investment strategies

- Mortgage lending

- Personal financial planning

- Project management

- Sales management

- Superannuation

- Webex

- Assurance

- Asset management

- Change management

- Credit analysis

- Economics

- Financial markets

- Fixed annuities

- Interim management

- Leadership

- Mutual funds

- Portfolio management

- Public speaking

- Salesforce

- Team leadership

- Wealth accumulation

- Coaching

- Credit risk

- Equities

- Financial modeling

- IRAs

- Investment advisory

- Management consulting

- Negotiation

- Private banking

- SAP Crystal Reports

- Self-Managed Superannuation Funds (SMSF)

- Teamwork

- Wealth management

Even if you’re an entry-level financial advisor without much experience in the field, you can still show your capabilities by presenting your skills related to advising, consulting, and financial plan creation.

Pro tip: Understanding the balance of soft and hard skills will make you a perfect match for the position of a financial advisor. While you certainly need to understand financial markets and analyze different financial products and services, you mustn’t underestimate the importance of soft skills.

So when it comes to soft skills, consider mentioning these:

- Committed

- Confident

- Creative

- Diligent

- Disciplined

- Experienced

- Flexible

- Organized

- Proactive

- Trustworthy

Step 6: Include your education

In addition to work experience, education also plays an integral part in a financial advisor’s resume. Namely, working as a financial advisor requires a bachelor’s degree, so make sure to mention the name of your program. Many people in this sector choose to get a master’s degree. You can omit your high school diploma from your resume if you have that degree.

It’s also helpful to mention some of the most significant courses you attended during your higher education. Doing so can help the recruiters understand which fields in finance you’re educated for to determine if you’re an ideal fit for the company.

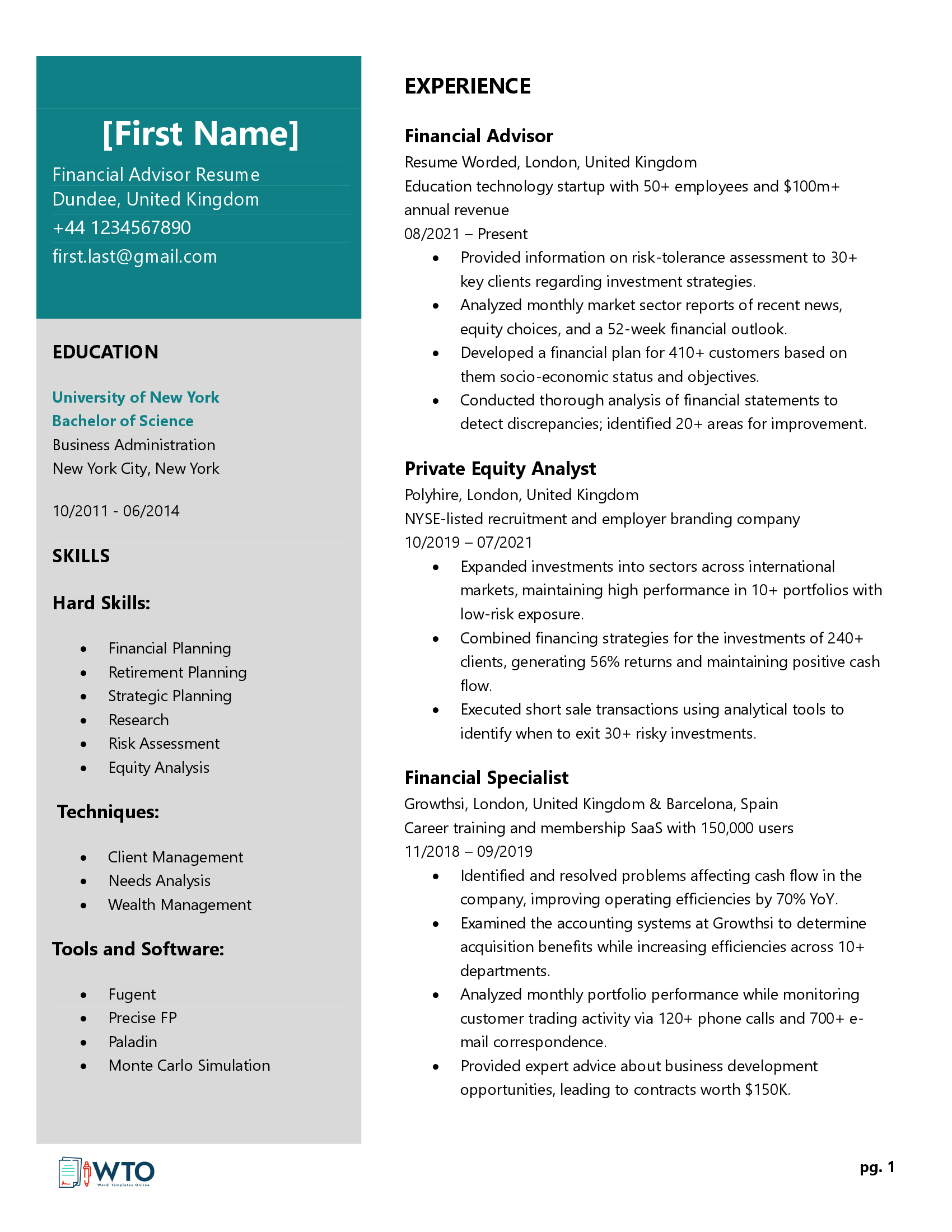

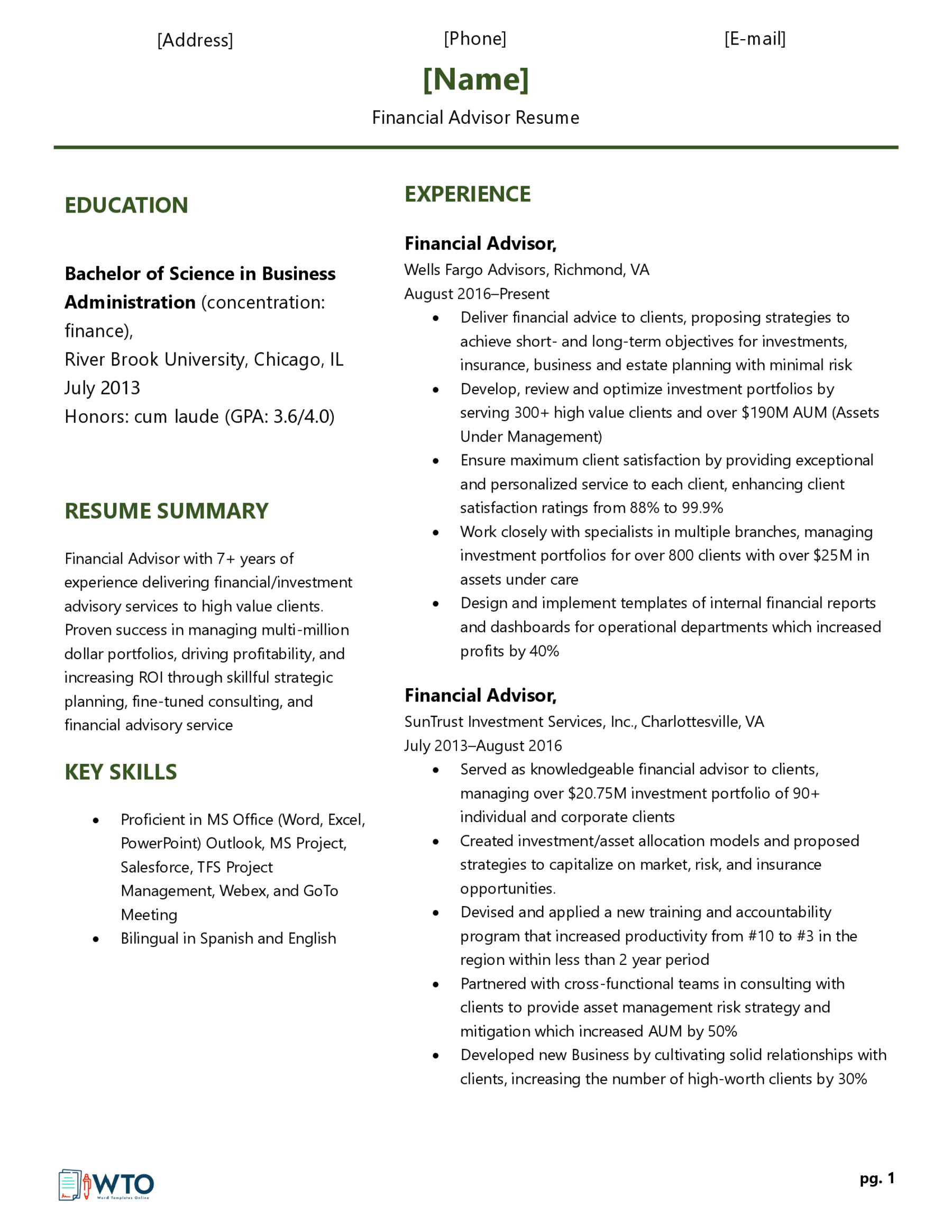

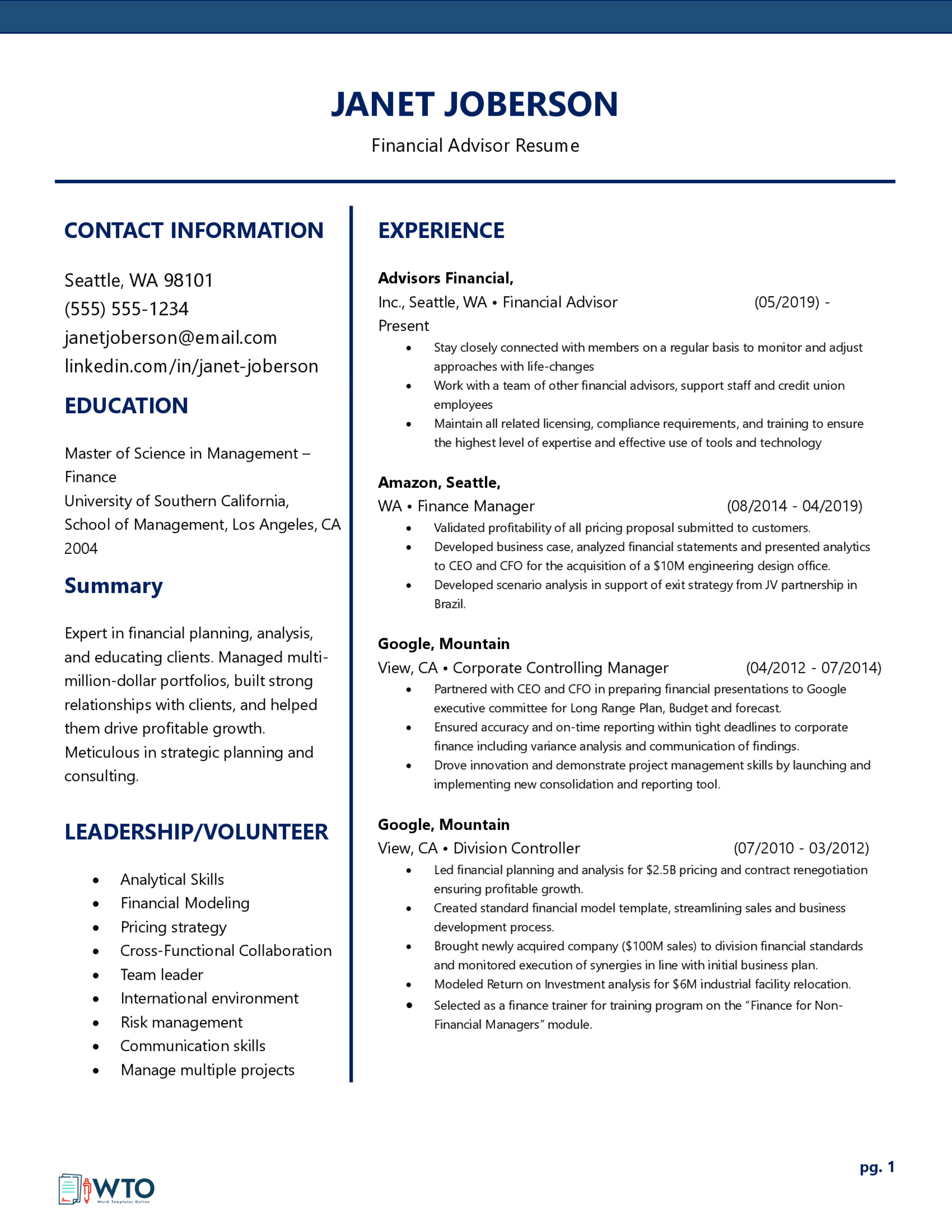

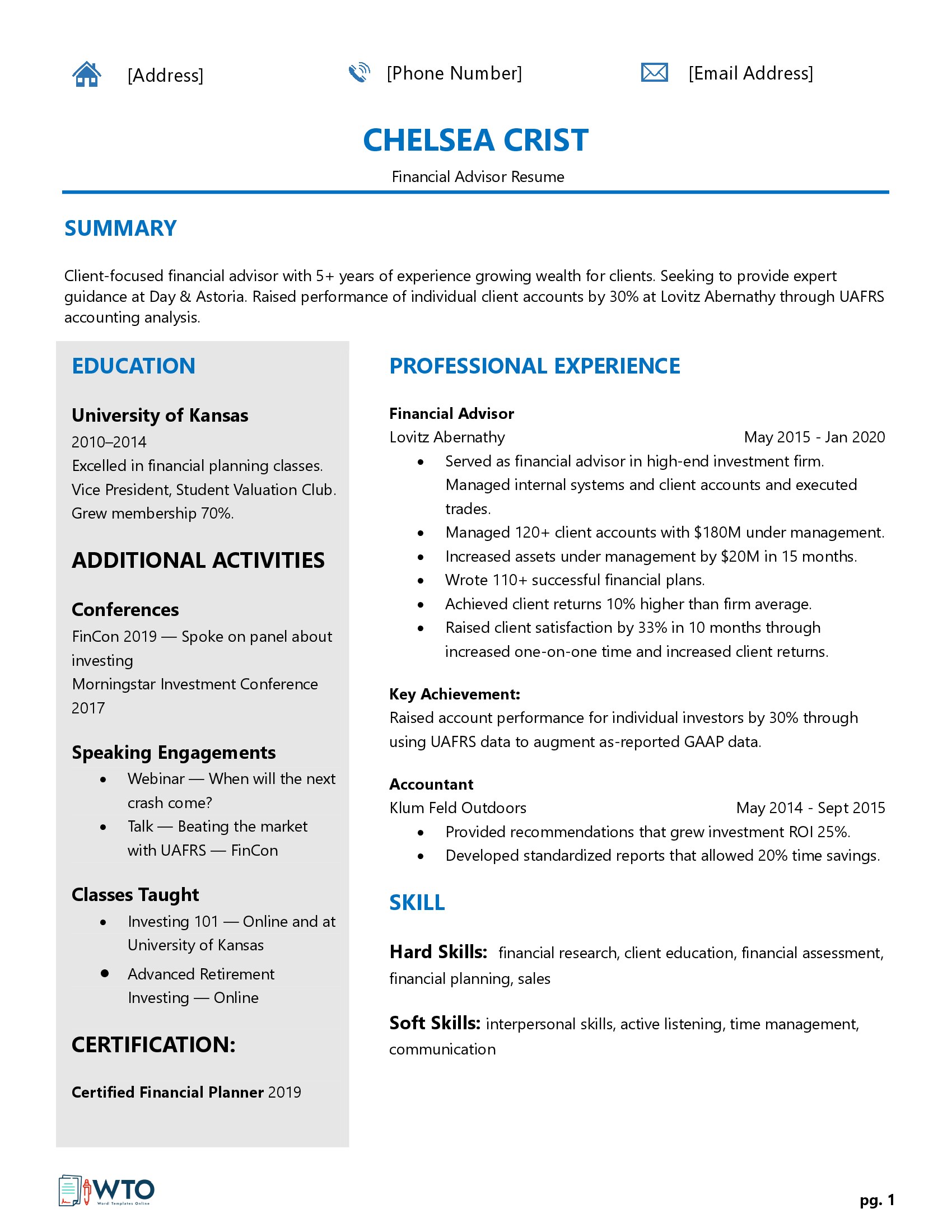

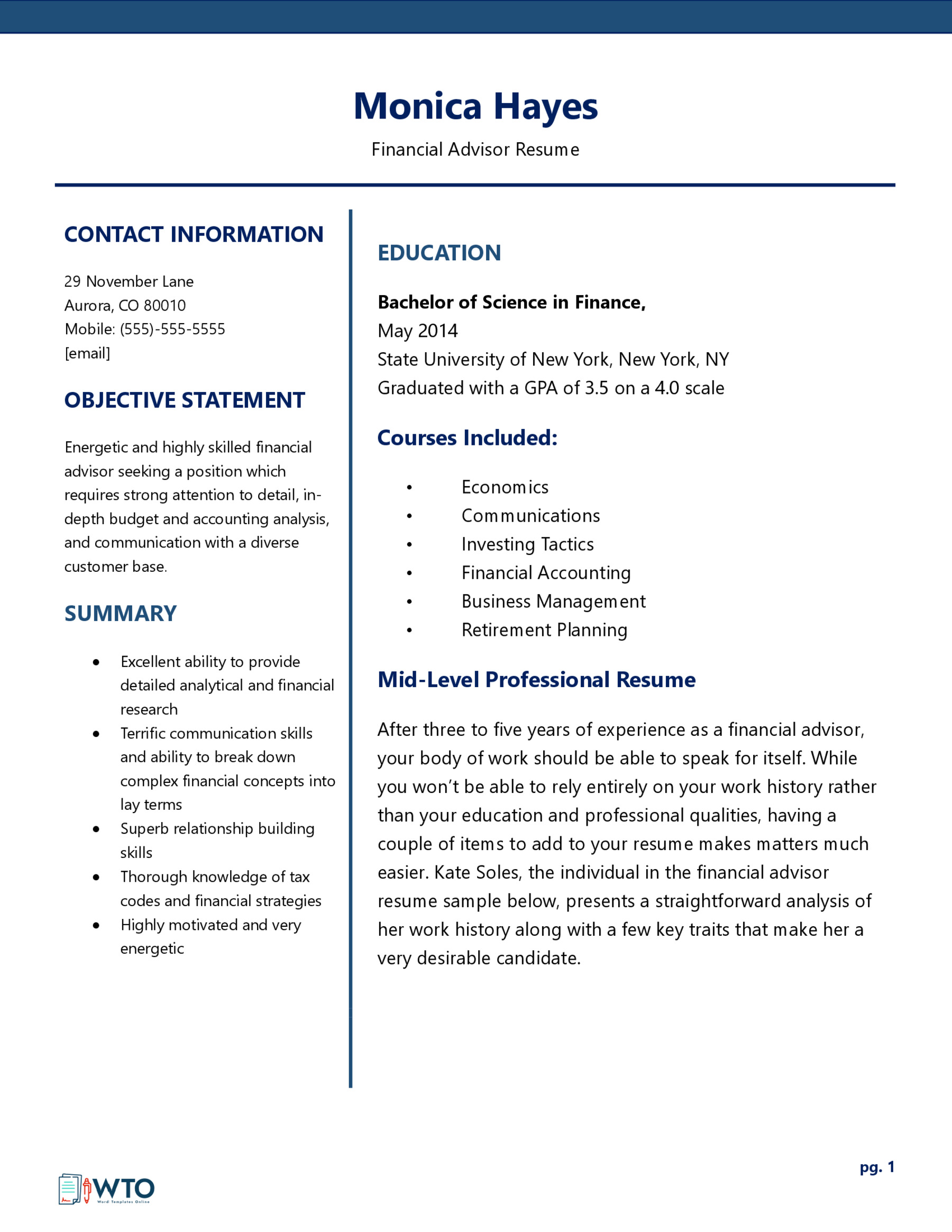

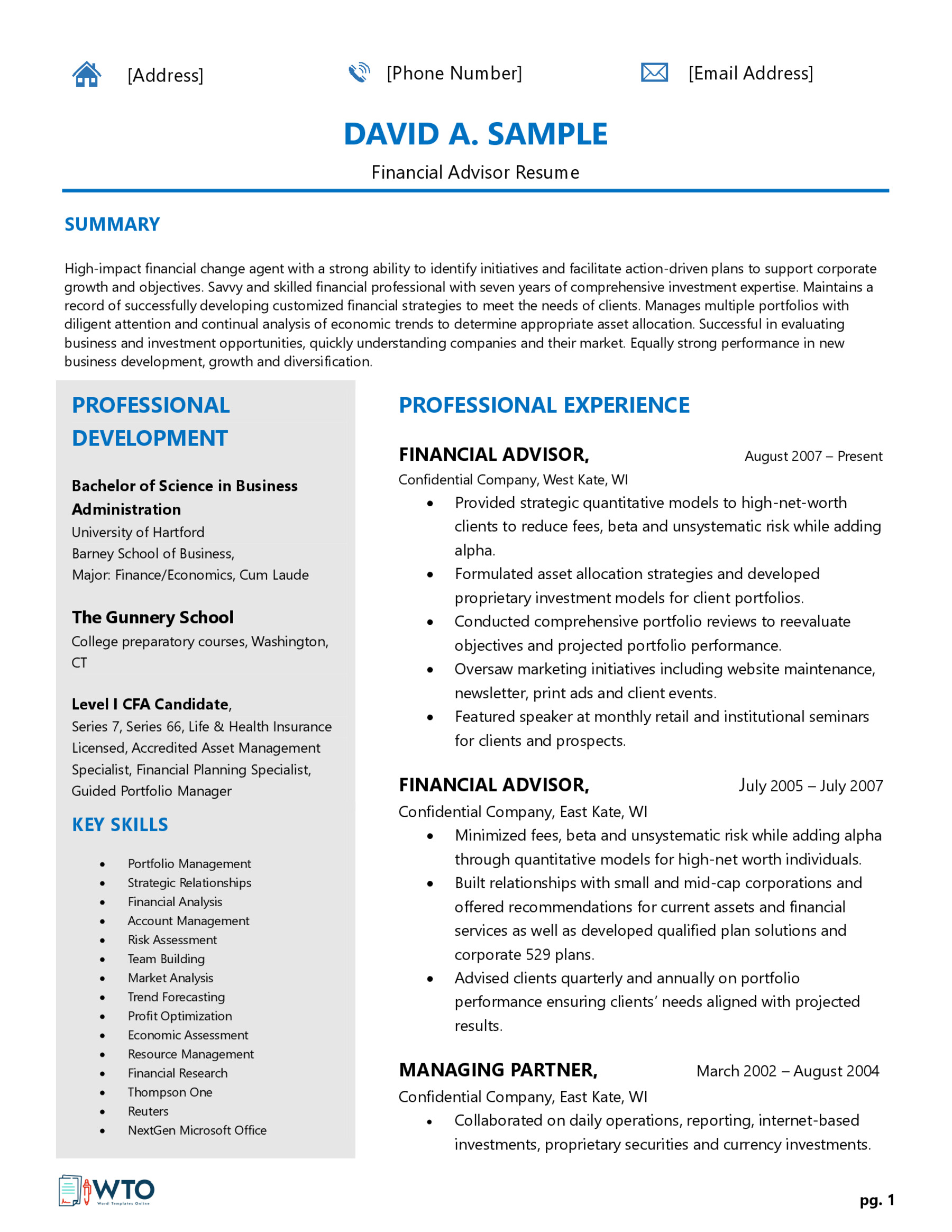

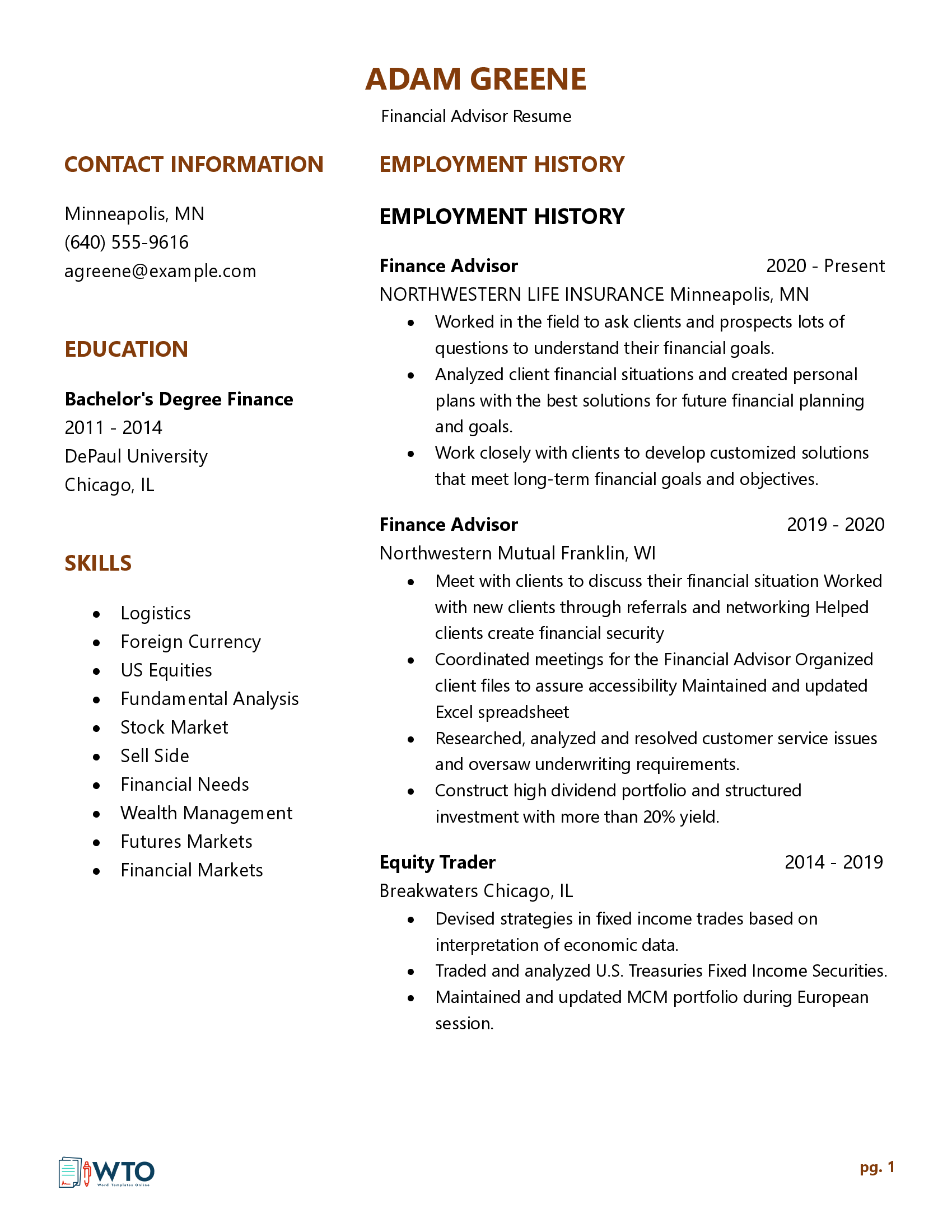

Free Templates

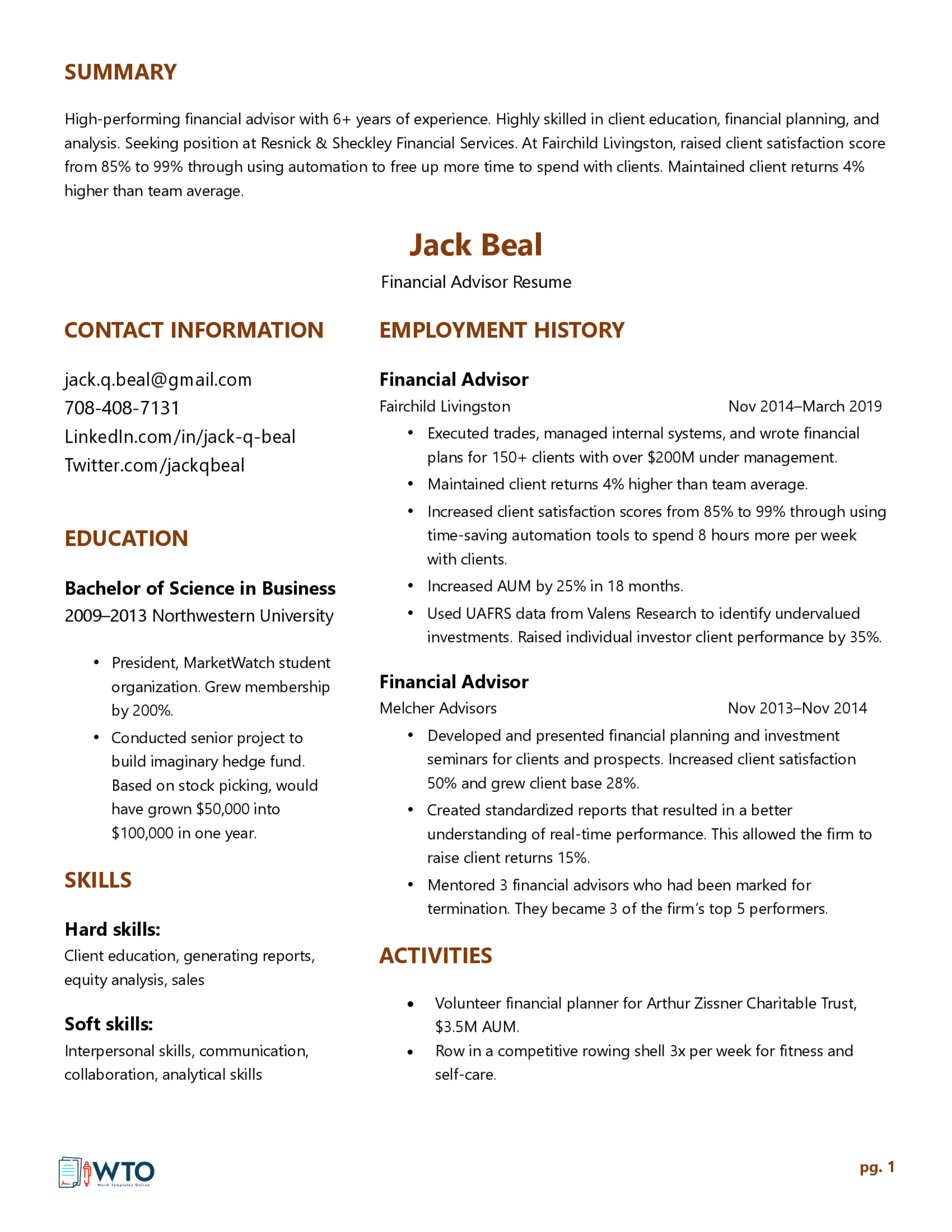

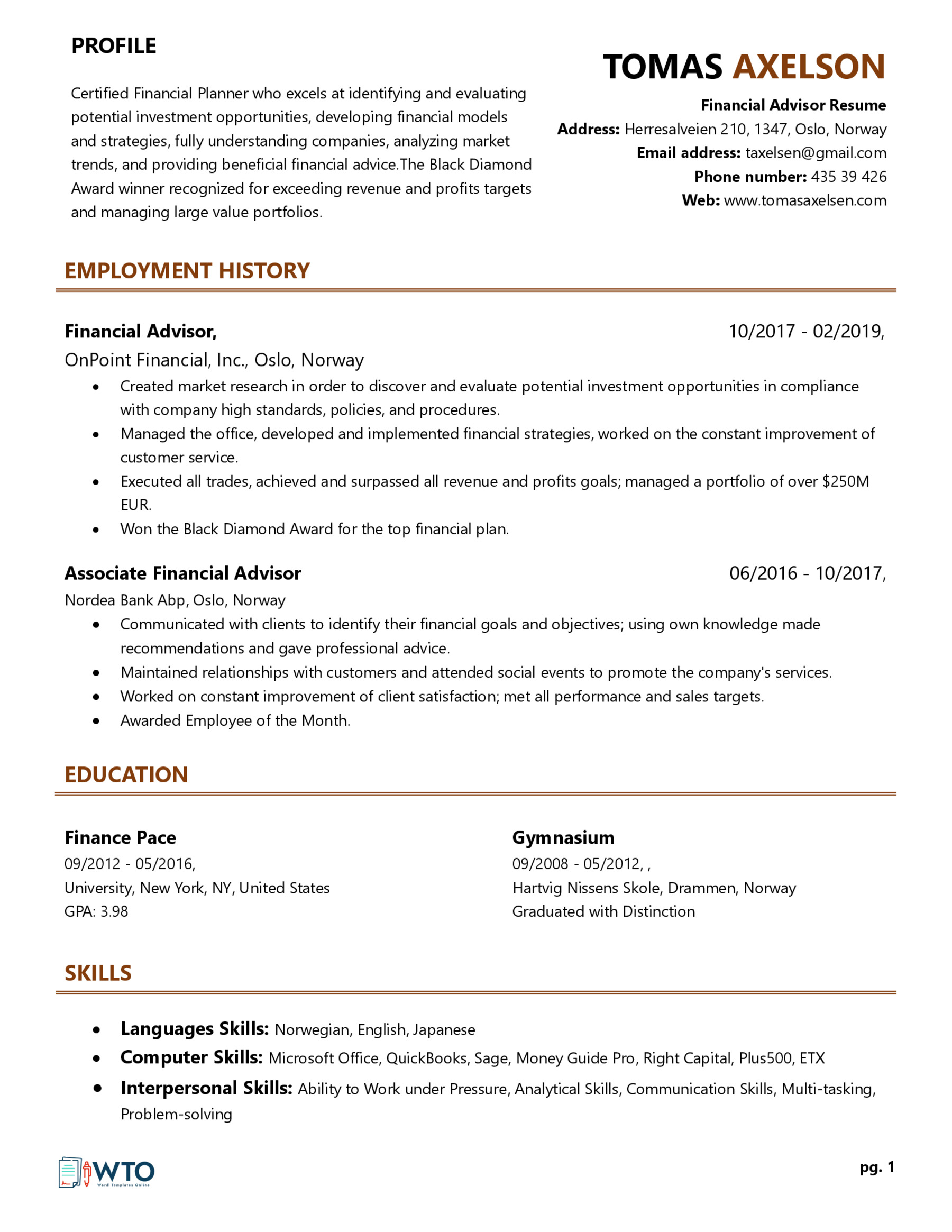

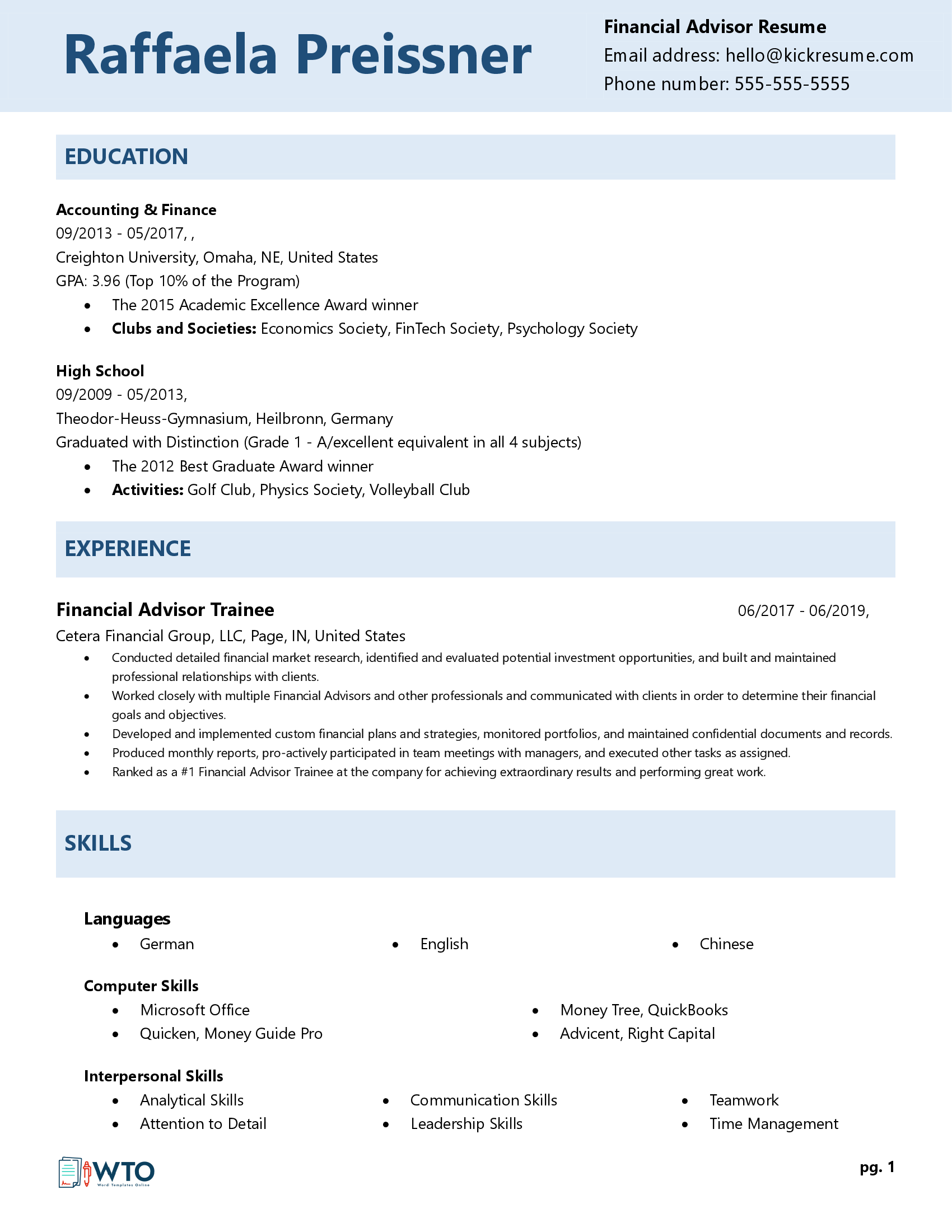

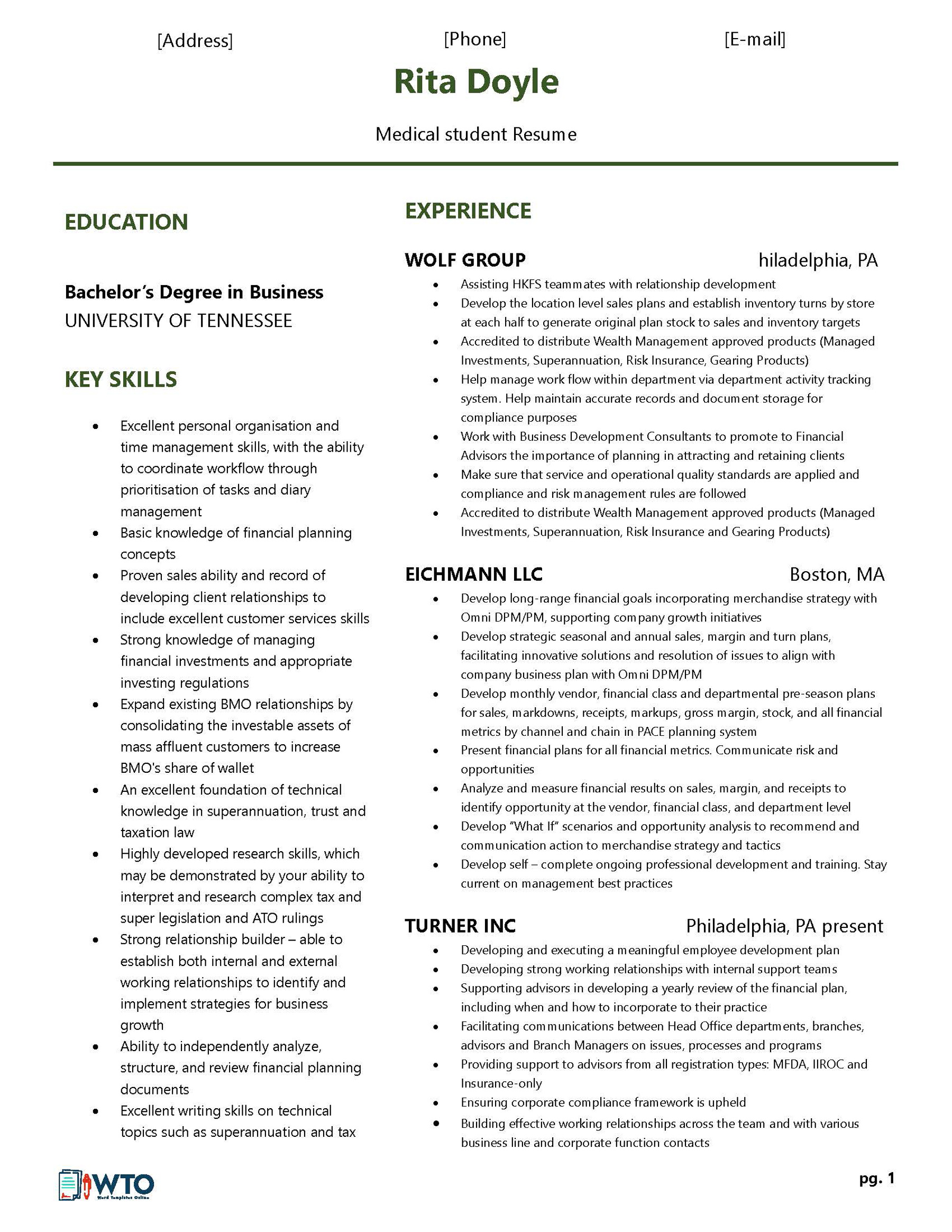

Preparing a financial advisor resume from scratch takes plenty of time and effort. Finding the relevant information can take several hours, let alone inserting all that data into a document and making it look presentable. However, resume templates can save you a lot of time and effort. We’ve created ours specifically for this job position to help financial advisors craft perfect resumes in just a few minutes.

10 Best Tips for an Effective Financial Advisor Resume

If you’re still unsure how to craft an effective financial advisor resume, these ten tips will surely help you:

Use relevant action verbs

It’s no secret that financial advisors handle all kinds of tasks. Although demonstrating your skills in completing these tasks is pretty challenging over a document, it’s still possible with the correct word usage.

Using relevant action verbs can do a lot for financial advisors when listing their skills and accomplishments. Using action verbs in combination with bulleted lists can also help hiring managers see candidates fully understand the work they require from a financial advisor.

Try to add these action verbs at the beginning of your bullet points for the best effect:

- Appraised

- Audited

- Created

- Generated

- Implemented

- Maintained

- Managed

- Organized

- Presented

- Projected

- Restructured

- Streamlined

Include your promotions in the financial industry

Nothing says more about your work ethic and determination than the time you spent working for a company before getting a promotion. Rapid promotions are some of the most impressive accomplishments, especially when it comes to financial advising positions.

If you believe you’ve been promoted within an impressive time limit, don’t be afraid to include details about your promotions in the financial industry. For instance, “Promoted within 16 months” is powerful yet straightforward.

Use numerical values with your accomplishments

As a financial advisor, you surely understand the power of numbers. Since the field of financial advertising heavily relies on numerical data, it only makes sense to mention the relevant data with your accomplishments. Not only do numerical values say more about your competencies, but they also signal your understanding of the field.

Any numerical value will add quality to your resume, whether you quantify your achievements in percentages, dollars, or time saved.

Consider mentioning details about:

- A specific value you increased or reduced.

- The percentage of your error-free reports.

Include relevant extracurriculars

Even if you’re an experienced financial advisor with high salary expectations, including relevant extracurriculars can say a lot about your passion for financial advising.

Volunteering and pro bono activities are excellent to include as they can help demonstrate how you extend your knowledge in financial advising beyond your workday. Clarify how long you’ve been volunteering within the organization and how much time you spend each week or month on extracurricular activities.

Use bullet points for your achievements

Bullet points are the best way to list and briefly describe your achievements as a financial advisor. Remember that action verbs work great when talking about achievements, so ensure to include them at the beginning of every bullet point.

Ensure your sections are easy to read

Recruiters have many obligations and don’t have the time to analyze every resume in great detail. That’s why applicants must ensure their resume sections are quickly scannable and easy to read. A simple way to do that is to include bullet points, use reverse chronological order, and stick to simple, concise sentences.

Tailor your resume to the job description

Today, it’s not enough to create a universal resume and send it out to all potential employers. As the job market becomes more competitive, financial advisors must step up their game when writing resumes.

As a result, candidates should craft resumes tailored to every job they consider. Financial advisors should customize their resumes to match the job descriptions as closely as possible. To do that, candidates should incorporate skill keywords or other resume requests their potential employer defined.

Pay attention to every detail

A resume is a perfect way for financial advisors to showcase their professionalism, attention to detail, and ability to follow instructions. Before crafting a financial advisor resume, you must carefully examine the job ad and pay attention to specific formatting requests, essential keywords, unusual instructions, or any other directions.

Failing to do so can disqualify you from the recruiting process immediately, even if you match the candidate profile perfectly.

Take the ATS into account

More and more recruiters use ATS (Applicant Tracking System) to rank and filter candidate resumes. The same goes for financial advising, so whether you pass the first round or not depends on the software algorithms.

To get past the ATS, you must add critical skills and attributes present in the job ad. Don’t forget to tweak your language to match the one the recruiters used while keeping it natural.

Make your resume stand out

Finally, the best way to leave an excellent impression is to hand in a resume that stands out from the rest. Think of unique features worth mentioning that make you different.

Whether you’ll add impressive achievements or an interesting fact about yourself that’s not work-related, feel free to use any information you think could help you secure the job. Remember that hiring managers are also humans, so reading something interesting will catch their attention.

Final Thoughts

Writing a resume for the financial advisor position requires inserting many details and ensuring the entire document is flawless. Crafting such a resume with no experience can take you hours or even days. However, with the practices and recommendations discussed above, you can ensure to cover all the relevant data. This article contains everything you need to know to craft a quality resume for your new job position from defining what a financial advisor’s resume is to providing you with plenty of helpful information for formatting it. Furthermore, customizable and easy-to-use templates will help you write a professional and detailed resume in no time.