Reimbursement can broadly be defined as money paid to an employee, customer, or any other party as repayment for a business expense, taxes, insurance, or other costs. Business expense reimbursements include out-of-pocket expenses such as travel, accommodation, food, and office supplies. Therefore,

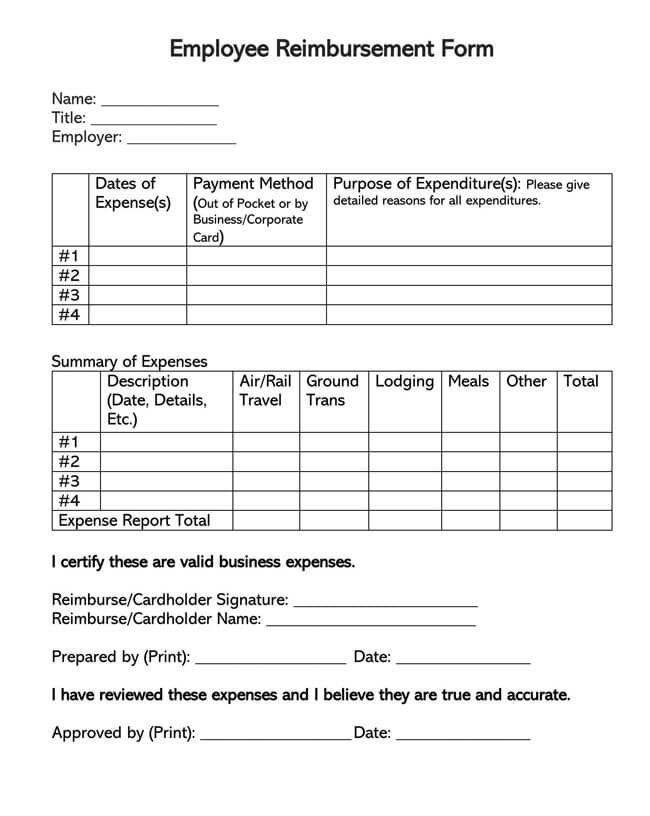

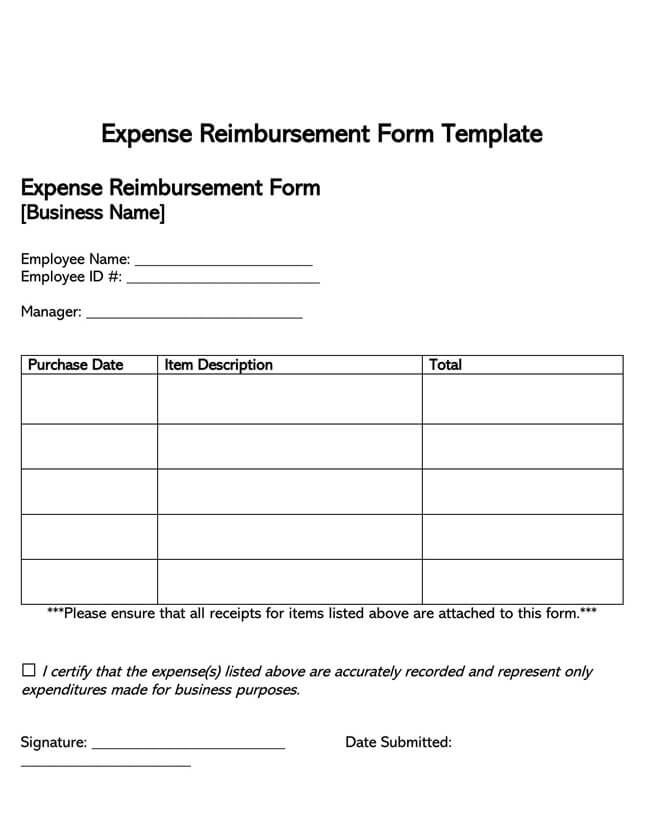

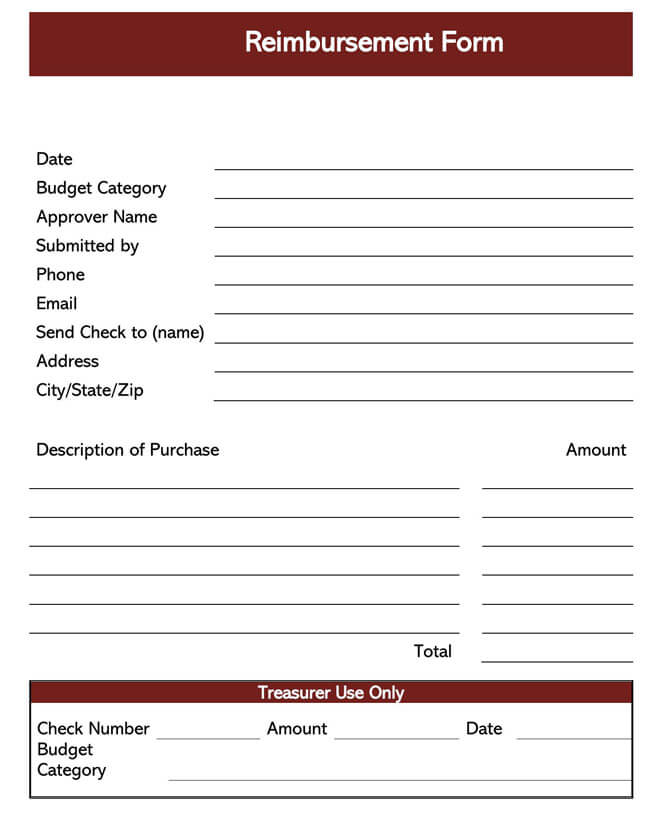

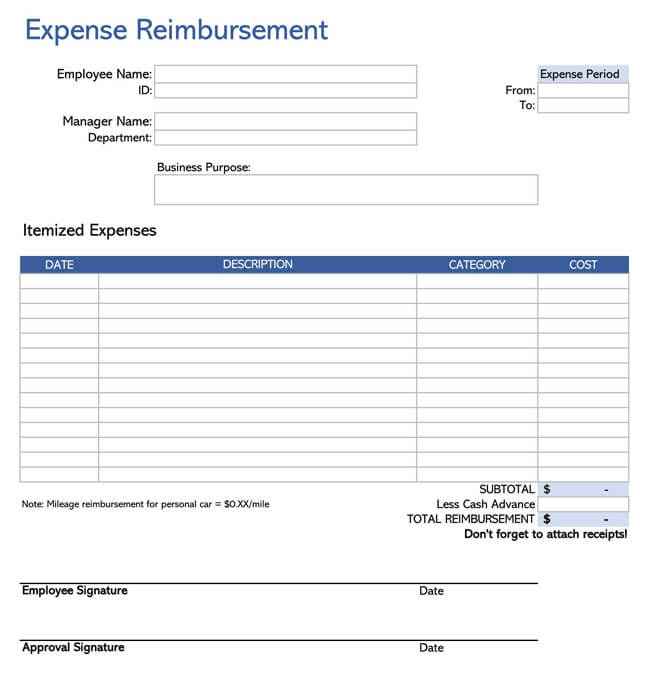

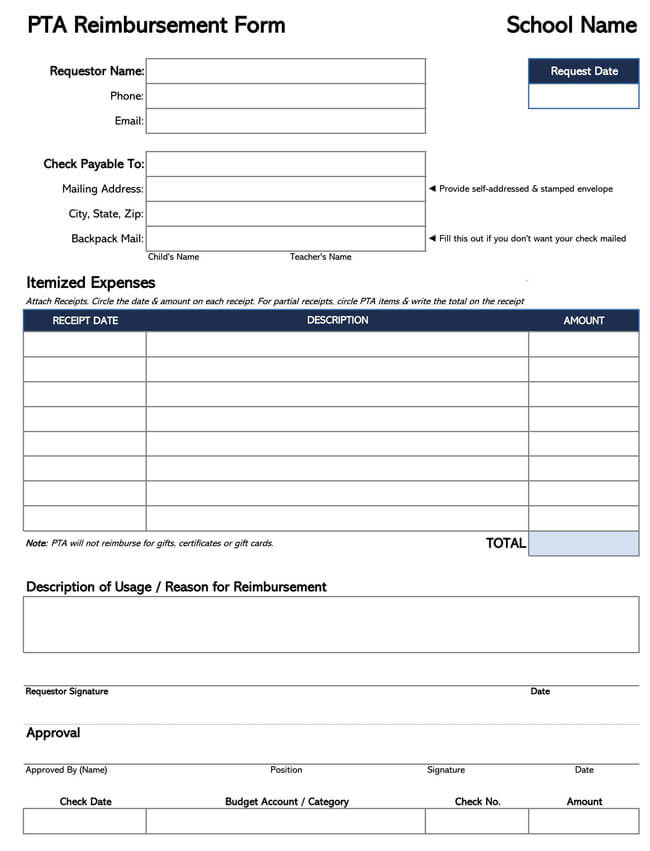

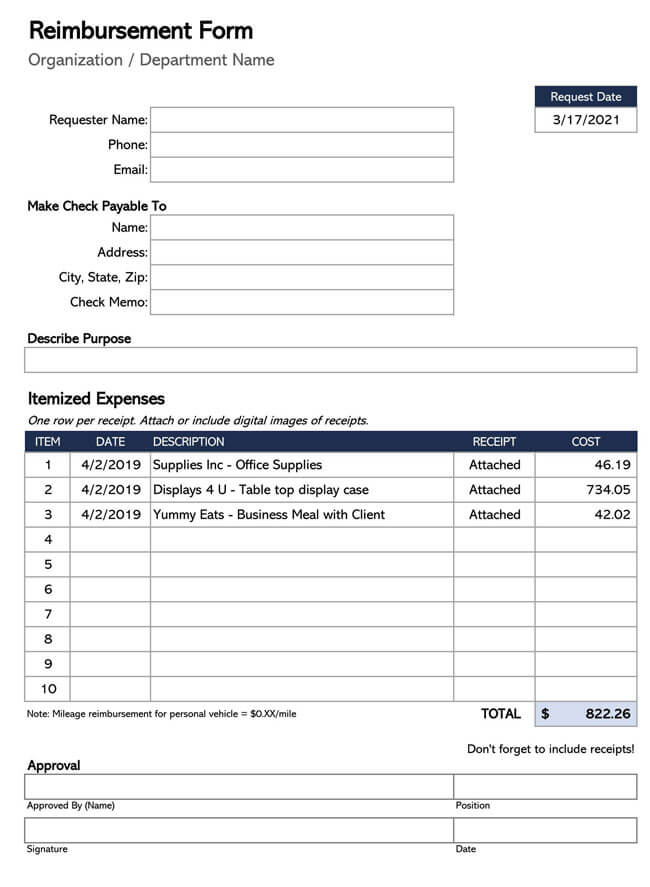

The reimbursement form is a standardized template that an employee can use to report expenses paid on behalf of the company while seeking repayment.

The specific reimbursable items depend on the agreement between the employer and the employee. These forms are common among employees who travel to conferences, meetings, and off-site work locations.

Free Employee Reimbursement Forms

Purpose of Employee Reimbursement Forms

For employees who travel to business conferences, meetings, and off-site work locations, having an expense reimbursement form can be a very valuable tool. This form helps to ensure that such employees are not left covering the business expenses for themselves.

It is beneficial for the following reasons:

First and most importantly, an expense reimbursement form creates documentation that strengthens your accounting records and protects against fraud. If any discrepancies are found between the amount reimbursed and the actual amount spent, then the form can be used as a point of reference to see what was claimed and what was reimbursed.

Secondly, using it is a standard form of gathering information related to reimbursement. Through the form, there is consistency in having the same pieces of information in the same areas of a document, regardless of the employee submitting it. Such a level of organization makes it easy for the accounting department to process the information presented. Departments dispensing the expense form will enjoy the basic structure established. It will allow them to edit the categories based on your company’s policies, with the appropriate program quickly and easily.

Lastly, these forms are a standard part of any expense reimbursement policy, and they help avoid overpaying or underpaying employees for business-related expenses.

Reimbursing Yourself for Expenses

As an employee, seeking reimbursement for your company expenditures is a process that involves collecting receipts either in soft copy or hard copy, and presenting these receipts to your employer, hoping to get a repayment. Ideally, these expenses are incurred during any business-related activity, and the employer is bound to reimburse them as legitimate business expenses, whether planned or unplanned.

The following steps will help guide you on how to reimburse for any work-related expenses that you might have incurred:

Educate yourself first

When an employer reimburses an employee under an accountable plan, usually regulated by the Internal Revenue Service (IRS), it does not count as wages or income. Often, the employer will deduct them, but the deductible amount may be limited. For this reason, you should read your company’s policy about expenses that are considered deductible to ensure that your employer pays for them.

According to IRS Publication 535, Business Expenses, to be deductible, a business expense must be both ordinary and necessary. An ordinary expense is one that is commonly accepted in your given industry. Conversely, a necessary expense is one that is useful and appropriate for your trade or business. A business expense does not have to be indispensable to be considered valuable and appropriate.

The most common types of expenses that employers pay to employees pursuant to reimbursements include:

- Business advertising costs- Costs associated with advertising the business or employee’s activities count as expenses that the employer should reimburse.

- Business meals and entertainment- Business lunches and entertainment costs incurred within the employee’s tax home count as reimbursable expenses only if the meal or entertainment can be proved to have a clear business purpose.

- Transportation- Expenses associated with work-related travel, including transportation, and accommodation, are considered reimbursable expenses. Most employers reimburse an employee who uses his personal vehicle for a business at a standard mileage rate. However, it is important to note that this doesn’t include commuting expenses between your home and the workplace.

- Office supplies- Office supplies that employees purchase for business purposes are reimbursed at cost. This includes costs incurred while purchasing office pens, papers, printer cartridges, among others.

- Utilities- Cell phone bills and software subscription expenses that the employee might pay from their pockets also count as reimbursable expenses. They should be reimbursed at 100% pursuant to an organization’s accountable plan.

According to IRS publications, taxes such as tolls, sales taxes, and repairs and maintenance expenses for machinery or utilities used by the business are also allowed to be expensed from the company. However, this doesn’t necessarily guarantee that the company will reimburse the employee for all these expenses.

Keep your purchase receipts

Most companies require that an employee present documentation for any reimbursement claims. This implies that you have to save and keep receipts for all allowable purchases and submit them along with your form anytime you submit such claims. Although it is challenging to prove mileage and gas, toll receipts are good enough. If you drive for a long distance, you can print and submit online directions from online mapping sites such as Google Maps to verify the total kilometers covered. This way, the employer can reimburse you using the Standard Mileage Reimbursement rates in your current state.

If you have lost or already discarded your receipts, simply log into your online banking site and check the “account activity” section. This provides all electronic records of purchases, and you can use this information instead of the receipts.

Categorize your expenses

You can properly categorize your expenses using the form. While writing this section, provide as many details as you can regarding the payment. This includes the actual date you incurred the expense; the method used to make the payment (credit card, cash, check); and describe the expense and its purpose.

Once you have categorized your expense and keyed in all the relevant information relating to the expense, calculate the total amount you are asking as a reimbursable expense and submit your form to the respective department or directly to your employer.

Get reimbursed

For some companies, reimbursement requests are processed and issued immediately. However, other companies have a 30-day policy program. After submitting your form along with your relevant documentation and receipts, the employer might require you to submit additional paperwork. This entirely depends on your employer and the company’s policies. Afterward, you should receive an untaxed check in the amount of the total expensed amount.

Filling the Employee Reimbursement Form

To make sure that you receive full expense reimbursement from your employer, ensure that you include the following key information in the form:

Add your personal information

After downloading the form, write your full legal name, employee identification number, department, job title, and any other relevant information that may be required in the form so that the receiver of the form knows to whom to remit the reimbursement.

Write the expense details

Most forms require you to provide the purchase or expense details, including the date the expense was incurred, a brief and precise description of what was paid for, the total amount spent, and sometimes the mode of payment used- be it a credit card, check, or using cash. If you have more than one expense, itemize each individually.

Sign the expense form

At the bottom-most part of the form, include your signature and write the current date. Providing your signature shows that you are certifying that the information provided is accurate and reflects the actual business expenses incurred on behalf of the company using your personal funds.

Enclose receipts

Enclosed are purchase receipts for each item listed on the expense claim form. Attaching your receipts with the form is proof that you actually paid for the expense as claimed in the reimbursement form. Most employers will not reimburse full if you do not present them with the appropriate physical receipts. This is to prevent potentially fraudulent activities from some employees.

Submit the form

Once you have completed all the details in the form and attached the required receipts, submit the document to your manager or the appropriate department right away. Typically, most companies only accept reimbursement requests within 30 days of the original expense. Therefore, don’t stay with the document for too long. Instead, submit it immediately.

Frequently Asked Questions

According to IRS publications, all expense records and reports should be kept for a period of 3-7 years, although some records should be kept longer than just seven years. For this reason, a physical receipt should be presented for all business expenses that are paid in cash. This is important for tax filing purposes, and it may be required for potential audits by the IRS.

An expense claim form is the same as an employee reimbursement form. Both documents are used to record business expenses that an employer must reimburse.

Final Words

An employee expense reimbursement form or an expense claim form is submitted by employees whenever they need to be reimbursed for expenses paid out of their own pockets on behalf of a business or company. When writing this request, it is important to fill in the form appropriately using a fair and courteous tone so that your employer doesn’t doubt your honesty. Remember to provide a detailed description of the expense and state a reason for requesting the refund. While submitting the form, attach all the relevant physical receipts and submit them to the management or accounting department as soon as you can.