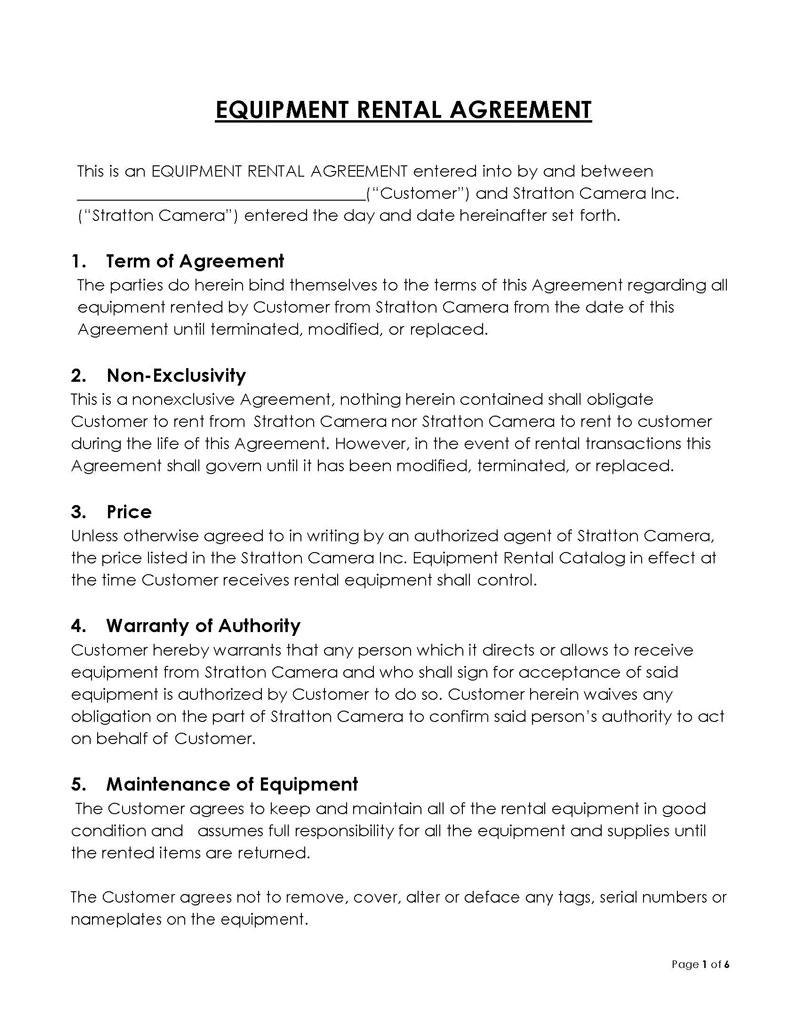

The Equipment Rental Agreement serves as a legally binding (contractual) document that specifies the terms and conditions of renting equipment and the legal responsibilities of every involved party.

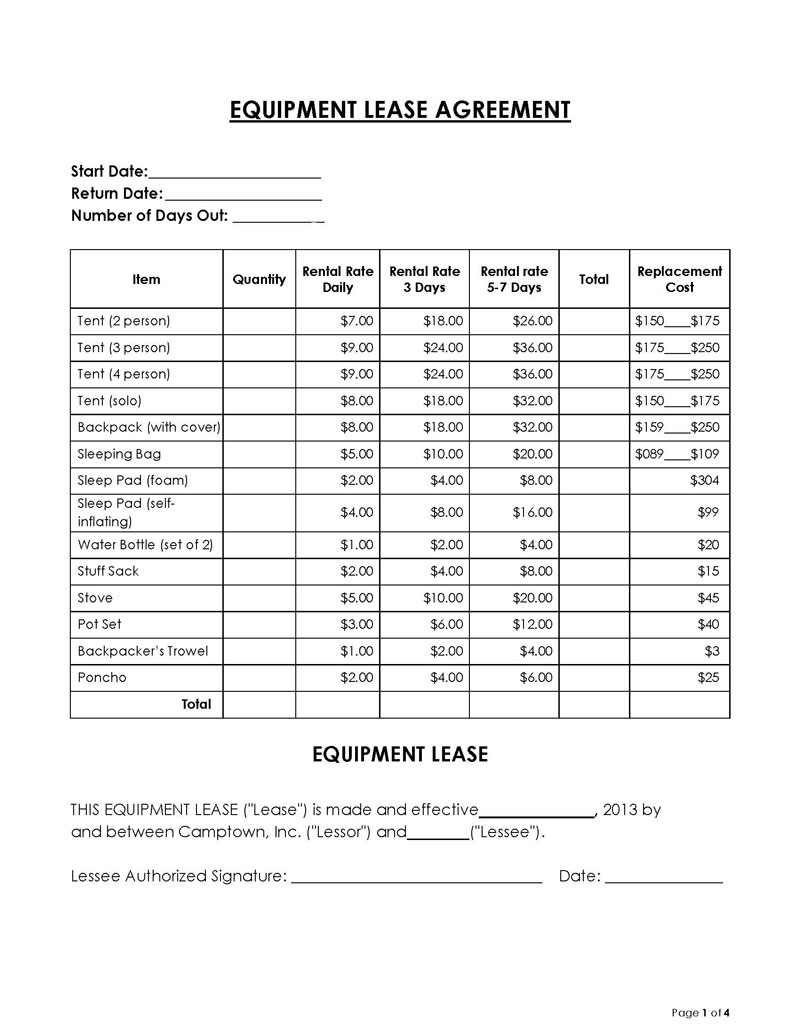

This type of rental agreement is used by businesses and individuals to define and regulate all necessary terms of renting equipment, such as the cost of renting and the rental period. The period specified by this agreement is usually defined with a start and end date. Alternatively, the lessor and the lessee can agree on a month-to-month rental structure. When the rental period expires, the lessee might be allowed to choose between terminating and renewing the agreement or offering to buy the equipment, all depending on the original terms.

As per the agreement, the lessee might also be allowed to modify or make adjustments to the equipment. However, the usual condition is that the value of the equipment must not be affected by these changes.

The equipment rental agreement can regulate the renting conditions of any given type of equipment. As a result, some equipment appears in rental agreements more frequently than others because they are too expensive or needed only on a one-off basis.

The following types of equipment are most frequent:

- Heavy machinery

- Vehicles

- Audio and visual devices

- Event/Party/DJ equipment

- Medical equipment

- Power tools

- IT and electronic devices

- Catering equipment

- Storage and disposal units

- Construction materials

- Furniture

- Gym equipment

- Electronics and appliances

- Any other personal property

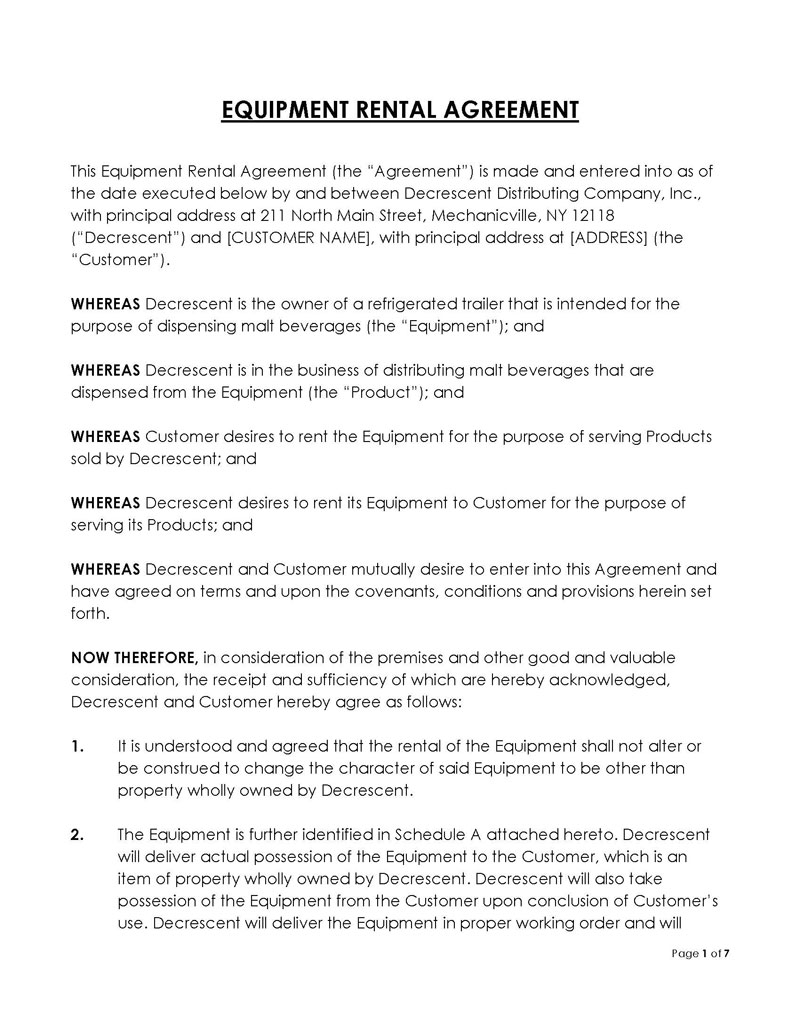

About Equipment Rental Agreement

In legal circles, this agreement is known under these alternate names as well:

- Equipment rental contract

- Equipment rental form

- Equipment lease form

- Equipment lease agreement

- Equipment loan agreement

Involved parties

There are two parties involved in every equipment rental agreement – the lessor and the lessee.

- The lessor is the legal term of the owner of the equipment and the party the equipment is being rented from.

- The lessee is the party that rents the equipment from the lessor and agrees to pay rent for a specified period.

Both the lessor and the lessee can be business entities or individuals.

Here are two examples. As a business entity, you might need heavy machinery for a construction project and decide to rent it from a professional vendor. As an individual, you might choose to rent an expensive camera from a professional (or a friend).

You might want or need to sign this rental agreement in both cases.

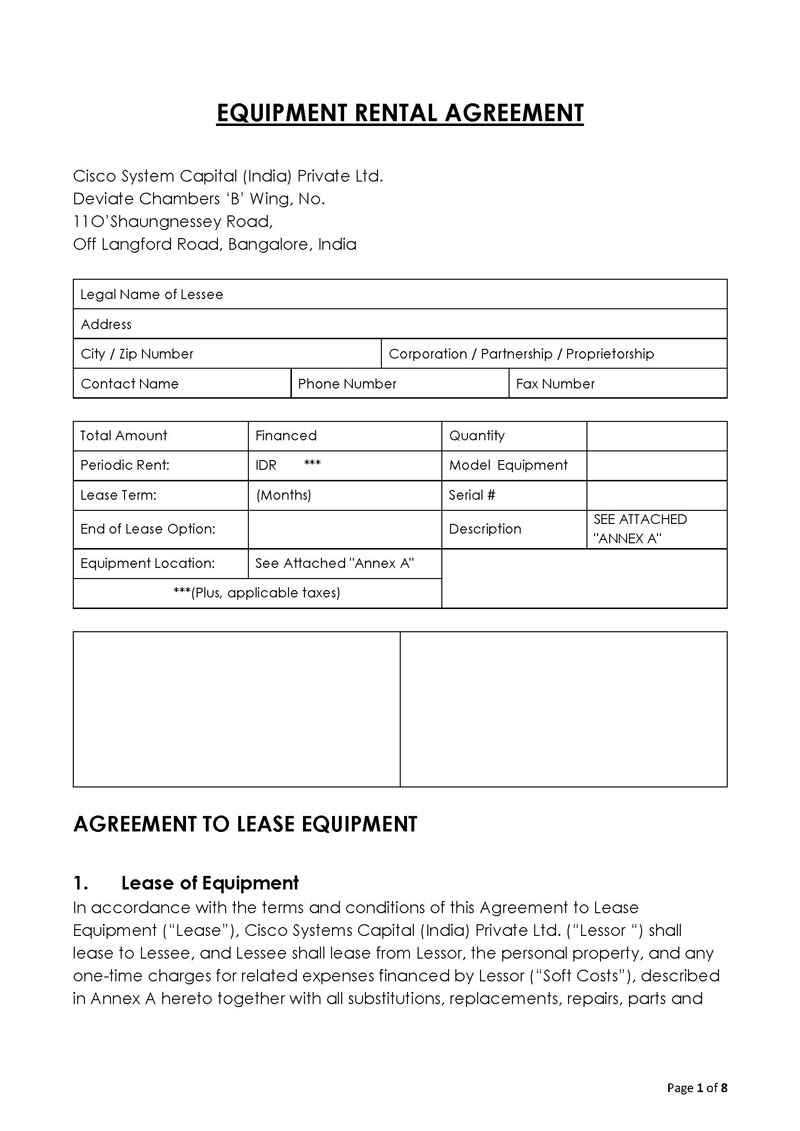

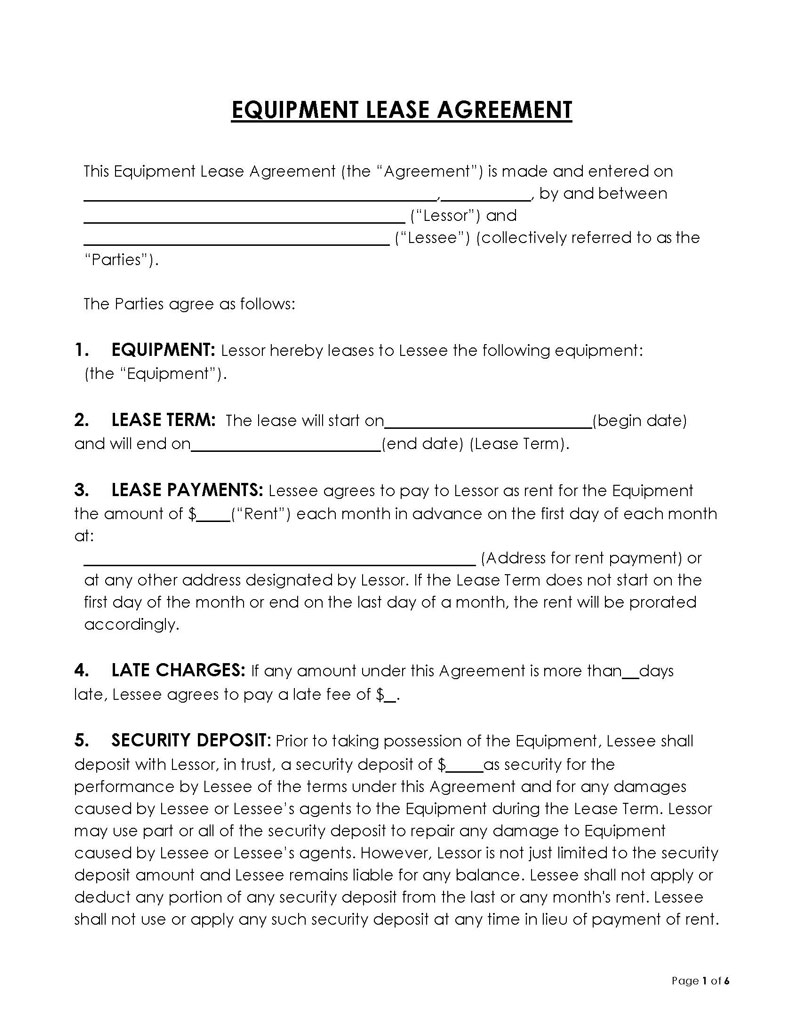

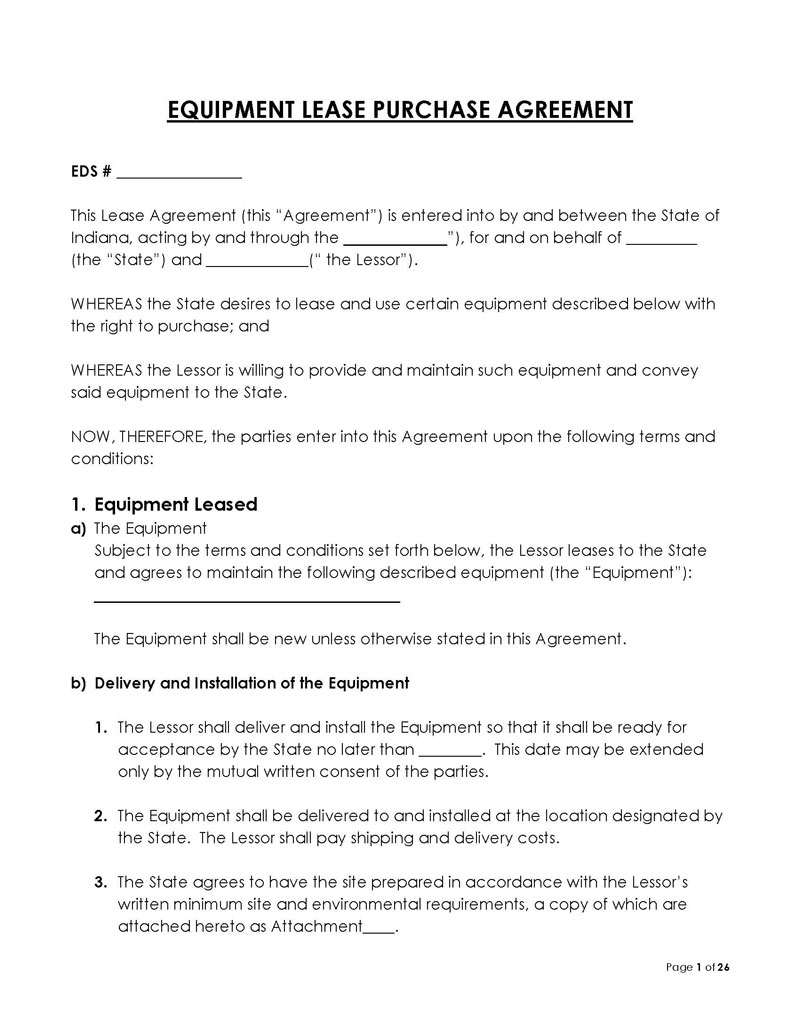

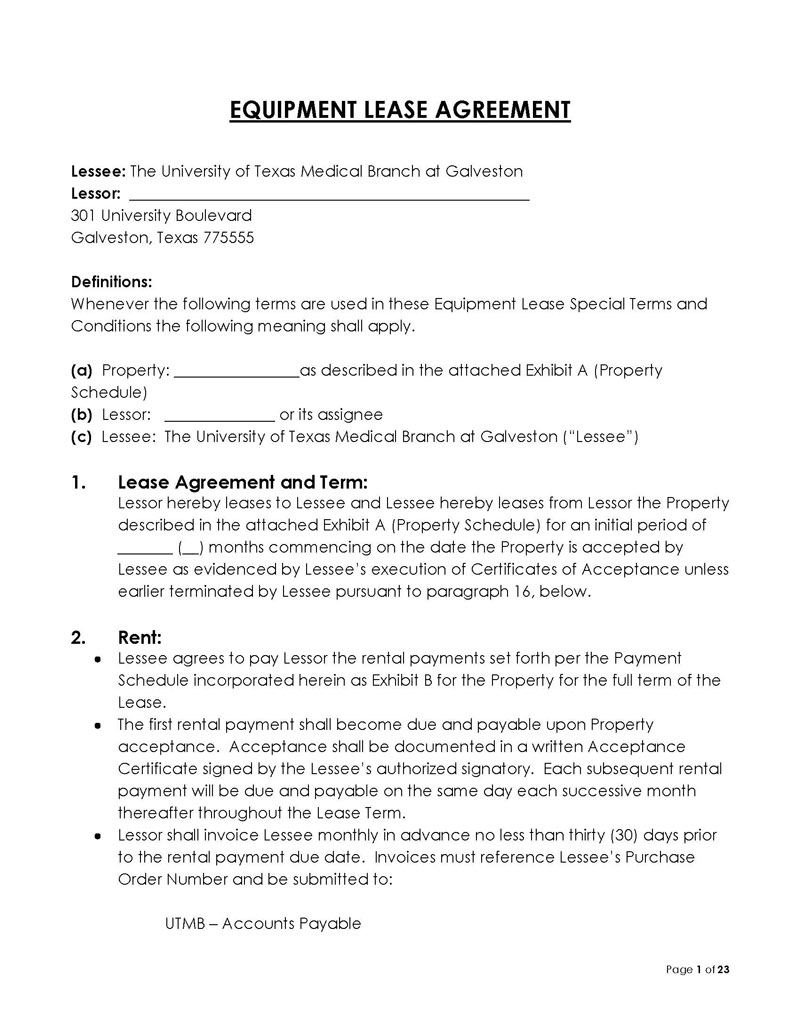

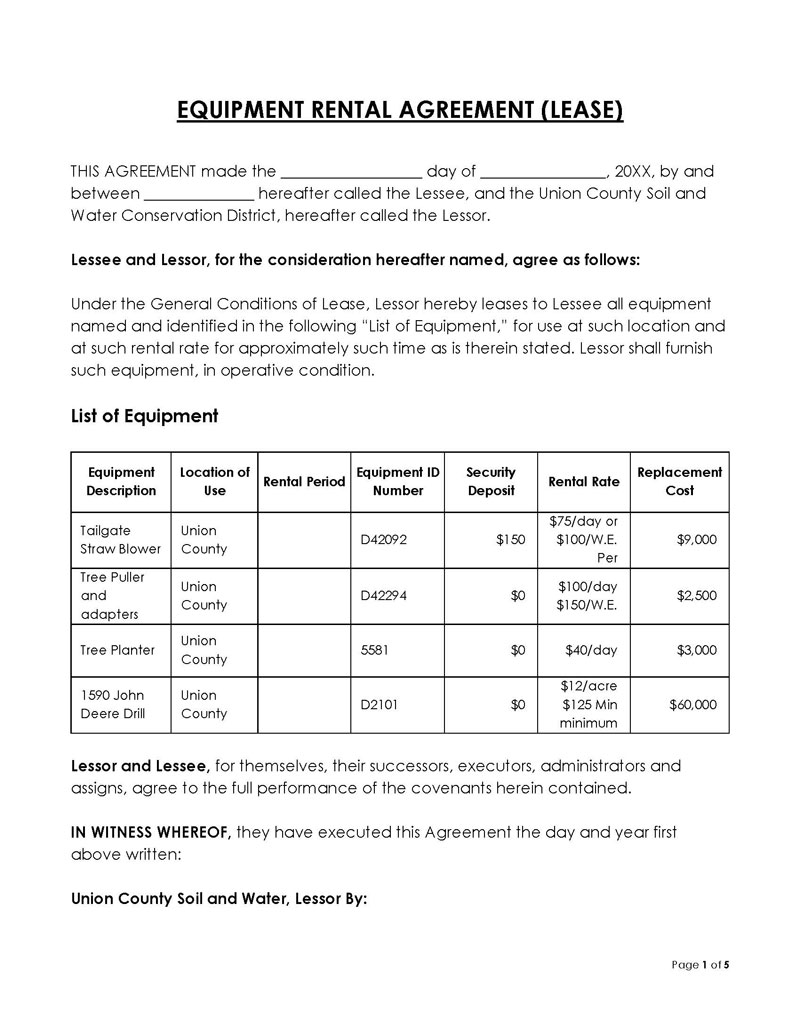

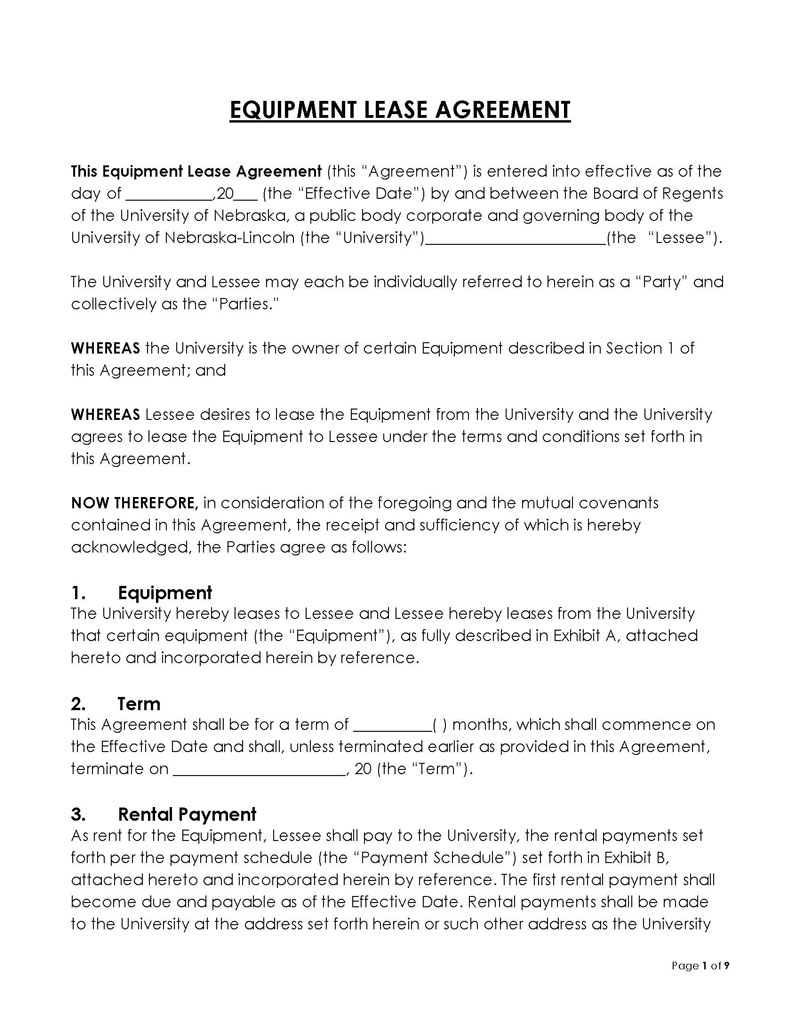

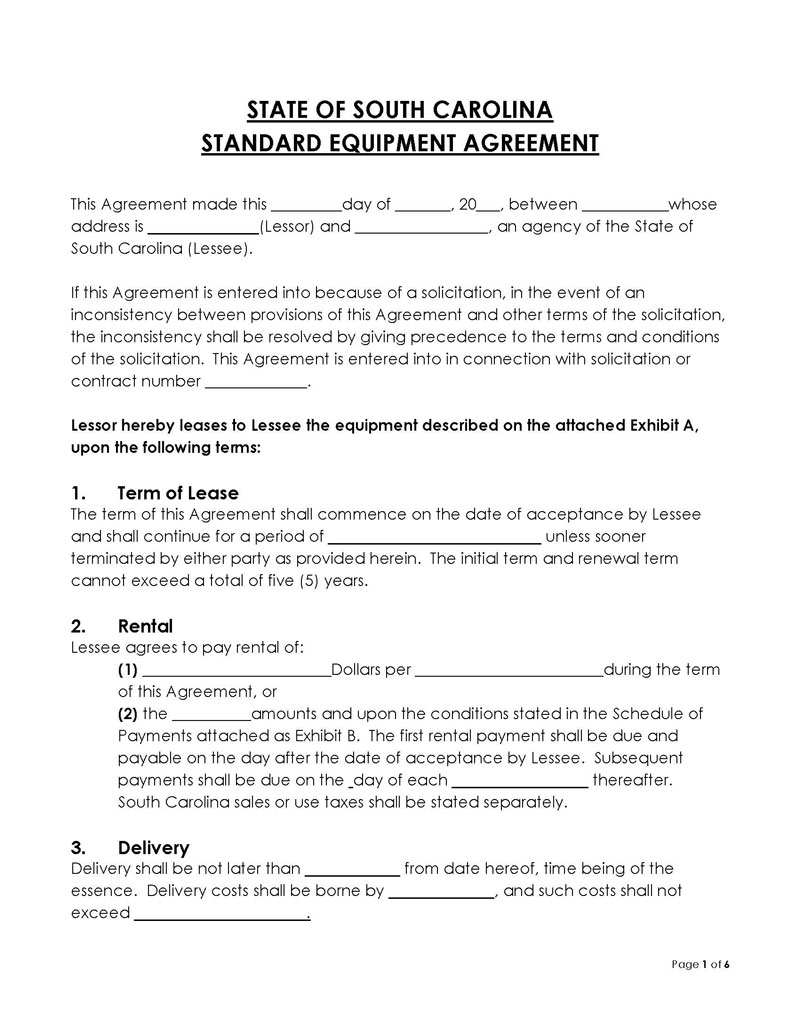

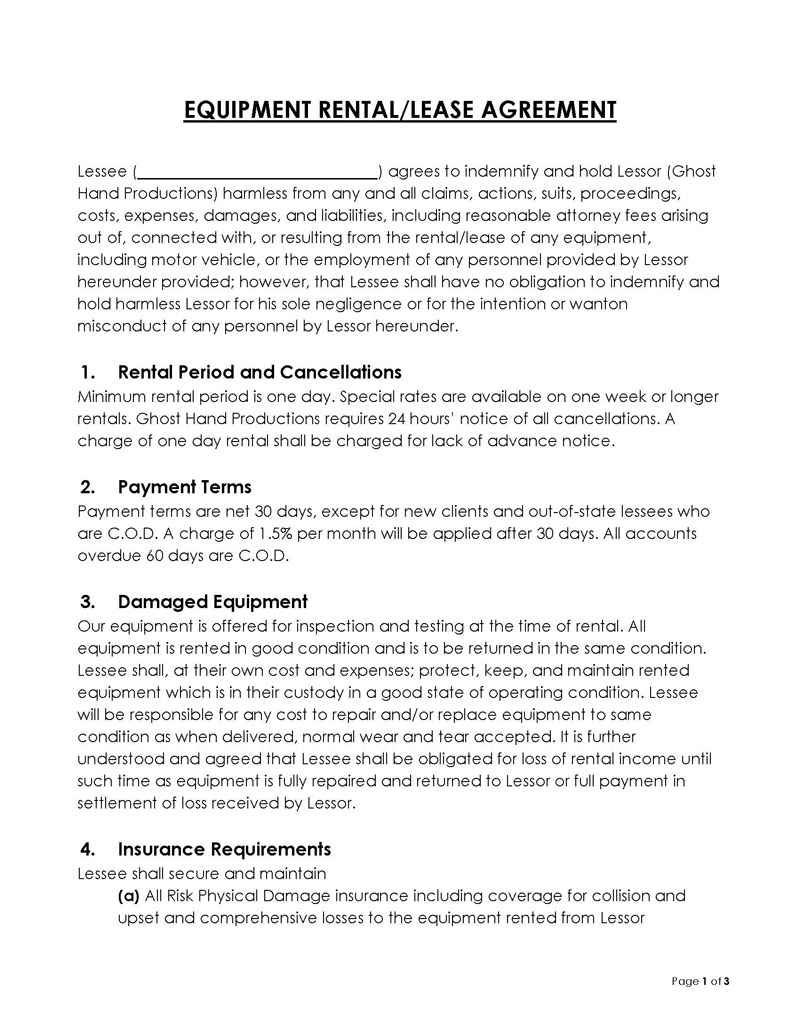

Free Templates

Why do companies use it?

Companies use these rental agreements for different reasons. When additional equipment is needed, renting provides a cost-effective alternative to purchasing. It is a usual course of action for businesses operating on scarce resources and companies that need equipment for one-off projects.

Instead of spending capital or taking out a loan from the bank, companies can rent the equipment at significantly lower prices and split the cost into monthly payments. Renting is an excellent way for aspiring businesses to procure cutting-edge technology without burning too much of their budget and simultaneously improve their working capital flow. Additionally, rental agreements often ensure tax benefits.

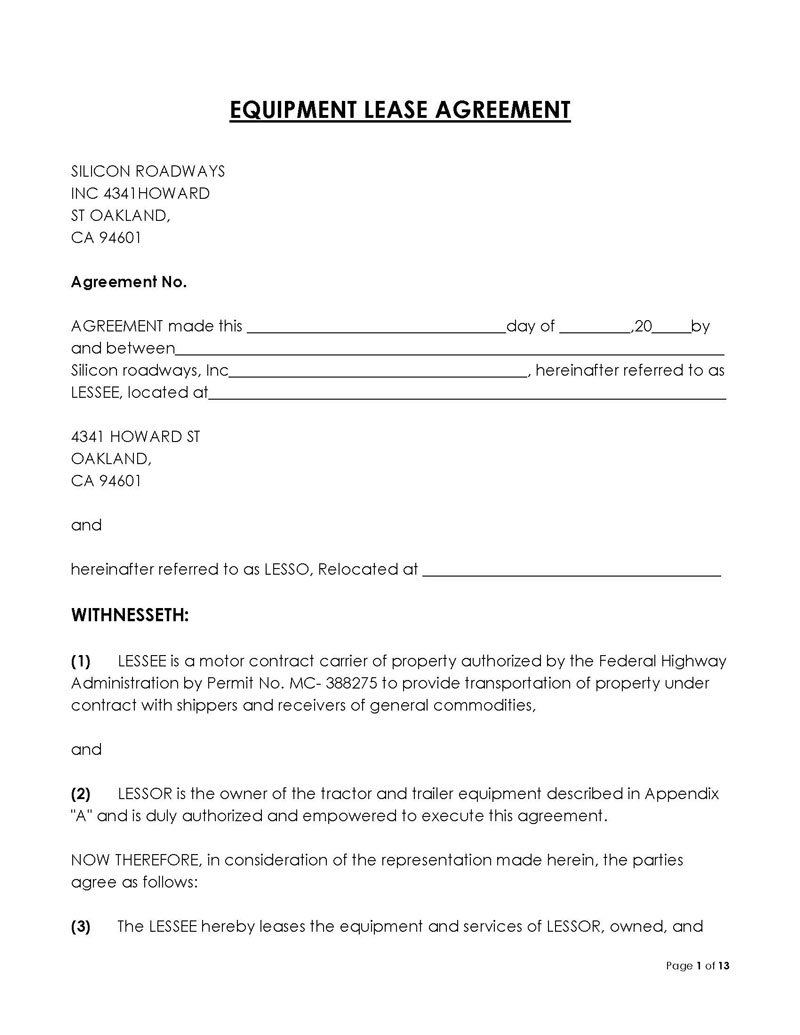

Types of the Equipment Lease Agreement

Equipment lease agreements can be customised to fit specific situations and cater to various needs. When a custom template is required, the agreement can be drafted using features from the two main types of the equipment rental agreement, which are:

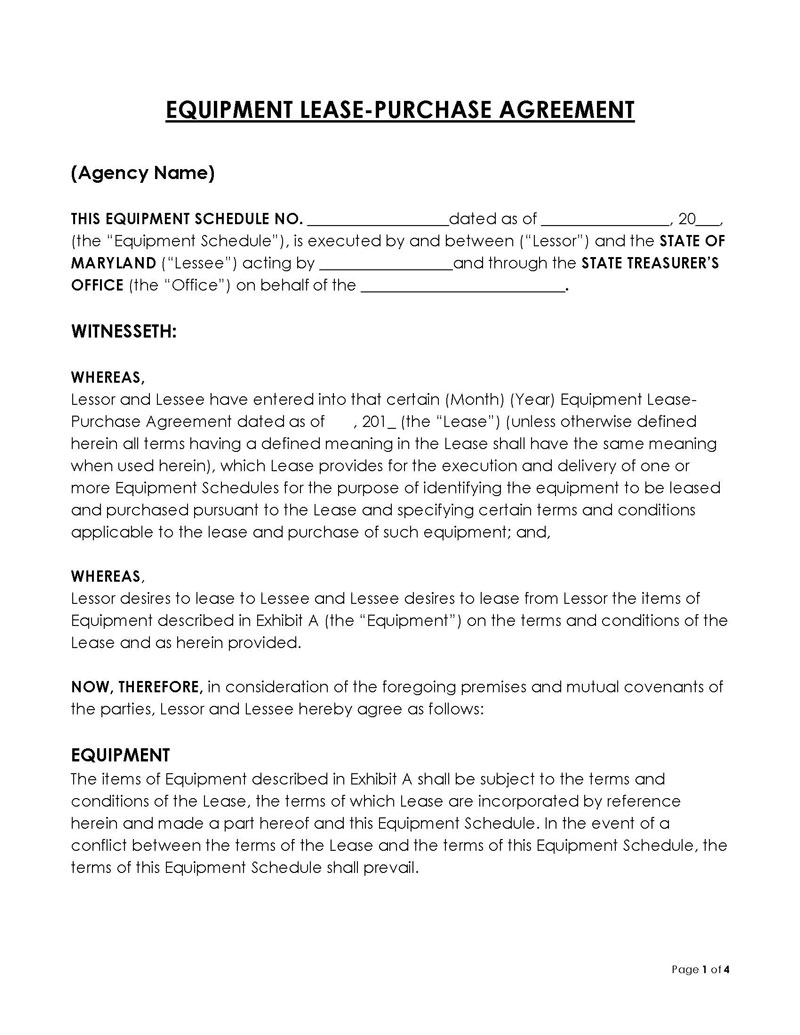

Capital lease

The capital lease benefits companies and individuals who want to rent equipment for a more extended period. Usually, the party who rents the equipment intends to purchase the equipment at the end of the rental period. In this case, the agreement typically holds the lessee responsible for keeping track and recording all assets and potential liabilities of the equipment during the said period.

A capital lease is particularly convenient for companies that need to procure specific equipment right away but don’t have the capital to pay for it. This rental agreement allows them to postpone the purchase and periodically pay for the lease in lower amounts.

Operating lease

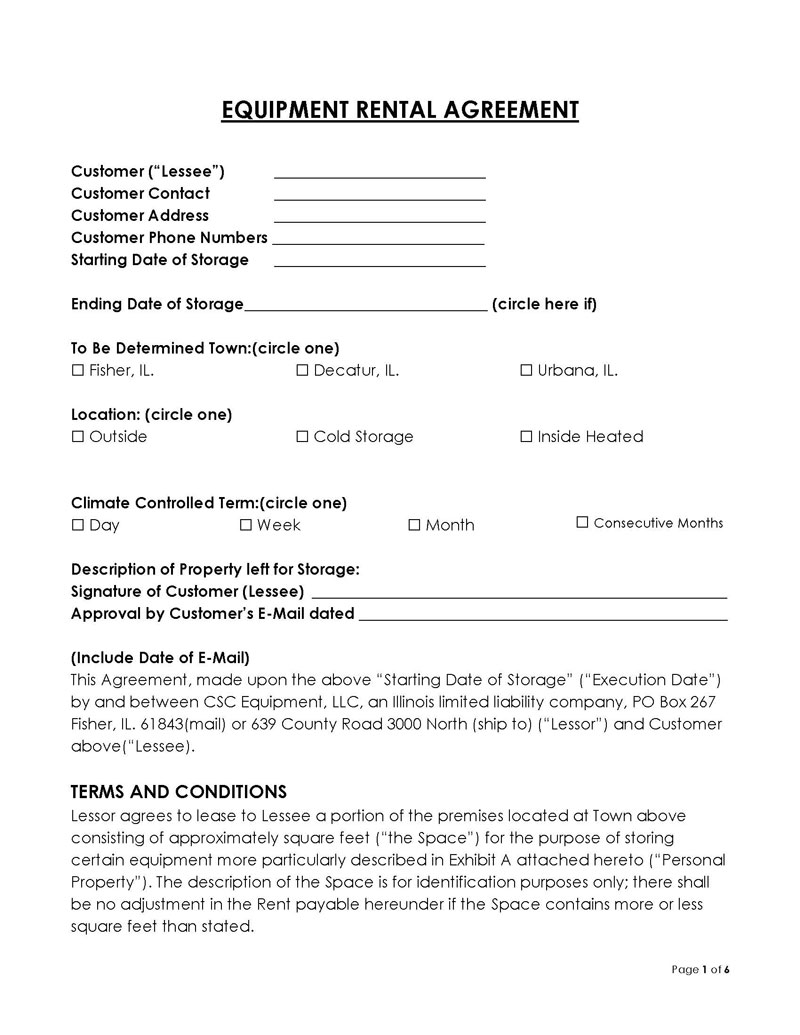

An operating lease is more suitable when individuals or companies need specific equipment for a defined period. This is a short-term type of equipment rental agreement – the rental period is typically much shorter than with capital lease agreements.

Another difference between a capital lease and an operating lease is that the latter allows the lessee to end the agreement even before the agreed-upon period expires.

This type of rental agreement is typically used by companies that require a specific piece of equipment for a specific period. If the company chooses to cancel the lease before the end of the rental period specified by the agreement, it is obligated to pay the penalty.

Equipment Rental Tax Laws

The lessee is obligated to pay tax for renting the equipment, and all gross receipts are subject to the state rental tax.

These are the only two scenarios where rental tax is non-applicable:

The first scenario is when the lessee is obligated to purchase the equipment at the end of the rental period without the option to return it to the lessor. The other scenario is when the lessee is an employee of the lessor, in which case the lease is considered a service.

Such rental tax laws vary from state to state, as shown in the following table:

| State | Personal Property | Vehicles |

| Alabama | Linens/Garments 2%; all other property is levied 4% | 1.5%* |

| Alaska | None | Passenger vehicles are 10%, and recreational vehicles are 3%. |

| Arizona | Transaction privilege tax (TPT) | 6.6% plus county fees* |

| Arkansas | 1% levied in addition to gross receipts tax* | 10%* |

| California | 7.25% (excluding motion picture films and tapes, linen supplies, and mobile transportation equipment) | None* |

| Colorado | None for rental durations lasting three years or less | $2.00/per day plus local surcharges* |

| Connecticut | 6.35% | 9.35% for rentals of 30 consecutive days or less, plus a $1.00/ per day surcharge* |

| Delaware | 1.9914% (excluding household furnishings and medical equipment) | 1.9914% |

| Florida | 6% on taxable personal property | 6% when rented for 12 months or less plus $2.00/ per day surcharges* |

| Hawaii (Personal property + Vehicles ) | 4% plus applicable county surcharges | $5.00/ per day* |

| Idaho | 6% (excluding fully operated equipment rentals) | None* |

| Illinois (Personal property + Vehicle ) | 6.25% | 5% |

| Indiana (Personal property + Vehicle ) | 7% (excluding certain motion picture rentals) | 4%* |

| Iowa | 6% | 5% plus local surcharges* |

| Kansas | 6.5% plus any local taxes (see chart for all exempt property) | 3.5%* |

| Kentucky (Personal property + Vehicle ) | 6% | 6% ‘You drive it’ tax |

| Louisiana | 4.45% | 3%* |

| Maine | 5.5% unless exempt under ME Rev. Stat, §1760 | 10% |

| Maryland (Personal property + Vehicle ) | 6% plus taxes levied on service charges (if any) | 11.5% |

| Massachusetts (Personal property + Vehicle ) | 6.25% | None, but separate surcharges may apply* |

| Michigan | 6% (payable through one of two methods) | 6%* |

| Minnesota (Personal property + Vehicle ) | 6.875% plus applicable local taxes | 9.2% tax and a 5% fee |

| Mississippi | 7% with certain exemptions | 6%* |

| Missouri | 4.225% (unless taxes were paid upfront in the original purchase of the rented property) | 4%* |

| Montana | None | 4% |

| Nebraska | 5.5% plus applicable local taxes | None |

| Nevada (Personal property + Vehicle ) | 4.6% plus applicable municipal taxes (payable through one of two methods) | 10%* |

| New Hampshire | None | 9% |

| New Jersey (Personal property + Vehicle ) | 6.625%, but may vary depending on the duration of rental | $4.00/per day* |

| New Mexico (Personal property + Vehicle ) | 5.125%- 8.6875% depending on jurisdiction (see rates map ) | 5% plus $2.00. per day* |

| New York | 4% plus applicable local taxes | 6%* (New York City levies an additional 5%) |

| North Carolina | 4.75% plus local rates | 8%* |

| North Dakota | 5% | 3%* |

| Ohio | 5.75% unless an exemption applies | None* |

| Oklahoma | 4.5% plus any local taxes | 6%* |

| Pennsylvania (Personal property + Vehicle ) | 6% (excluding unprepared food, textbooks, computer services, and more) | 2% plus $2.00/per day* |

| Rhode Island (Personal property + Vehicle ) | 7% | 8%* |

| South Carolina | 6% | 5%* |

| South Dakota (Personal property + Vehicle ) | 4.5% unless an exemption applies | 4.5% plus a 1.5% tourism tax (if applicable) |

| Tennessee | 7% (unless the property is leased as a service with an operator or crew) | 3%* |

| Texas | 6.25% | 10% |

| Utah | 4.85% plus local and county taxes | 2.5%* |

| Vermont (Personal property + Vehicle ) | 6%( agricultural equipment is exempt if used predominantly for agricultural purposes) | 9% |

| Virginia (Personal property + Vehicle ) | 5.3% plus taxes levied on service charges | 10% (comprised of 4% rental tax, 4% local tax, 2% rental fee) |

| Washington (Personal property + Vehicle ) | 6.5% (an additional B&O tax may apply at the rate of 0.484%) | 5.9%* |

| Washington D.C. | 6% | 10.25* |

| West Virginia | 6% plus local taxes | $ 1.00- $1.50/ per day* |

| Wisconsin (Personal property + Vehicle ) | 5% | 5%* |

| Wyoming (Personal property + Vehicle ) | 6% plus municipal taxes | 4%* |

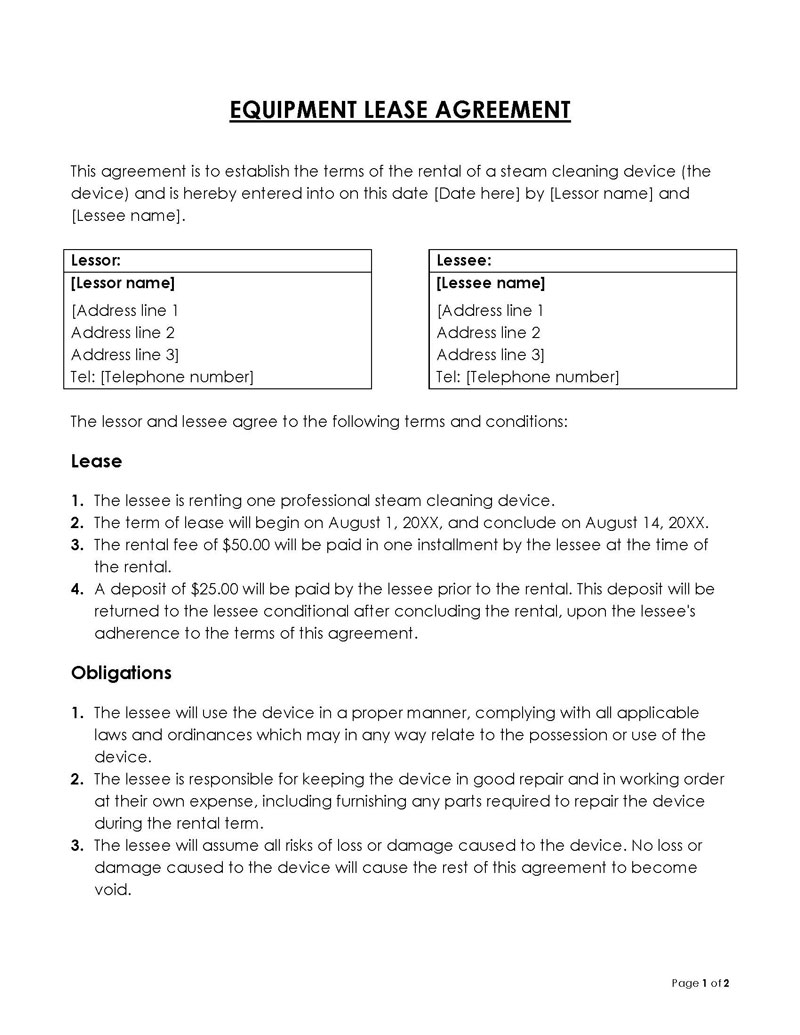

Essential Components to Include

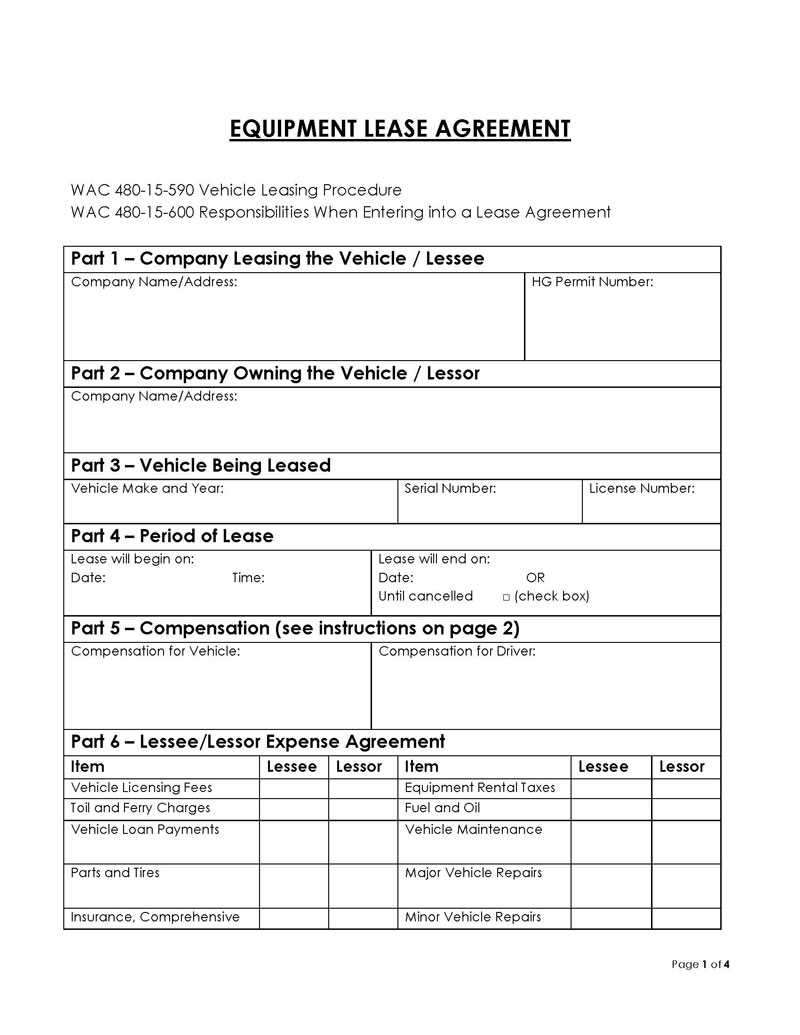

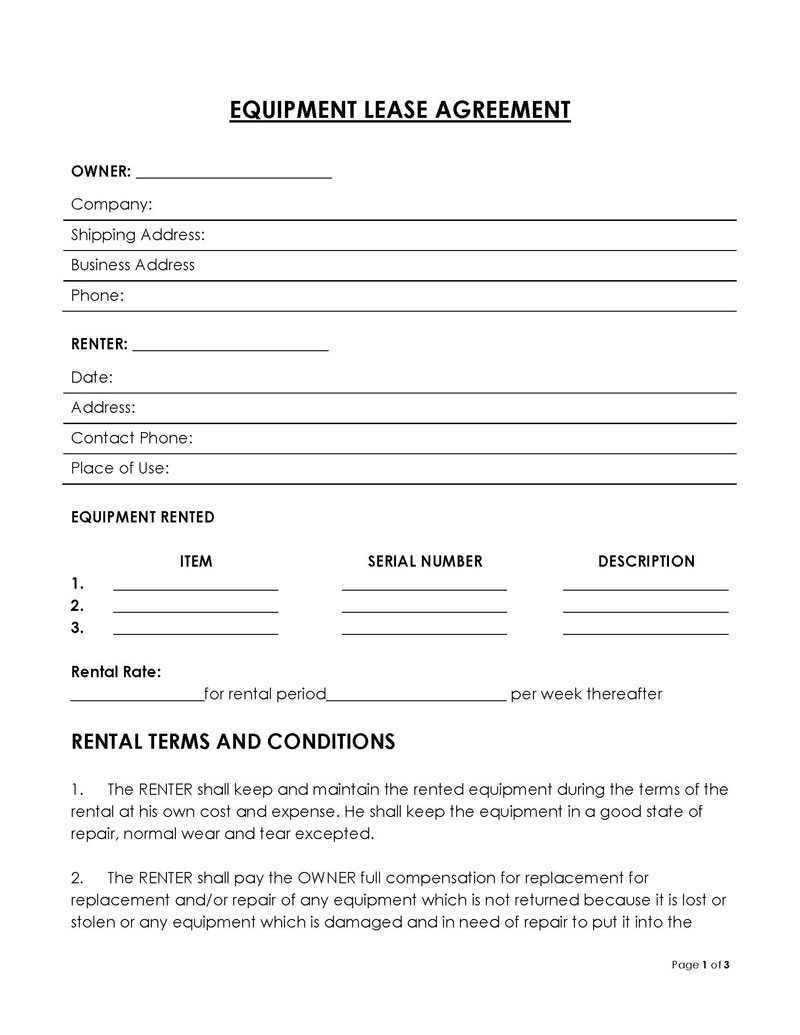

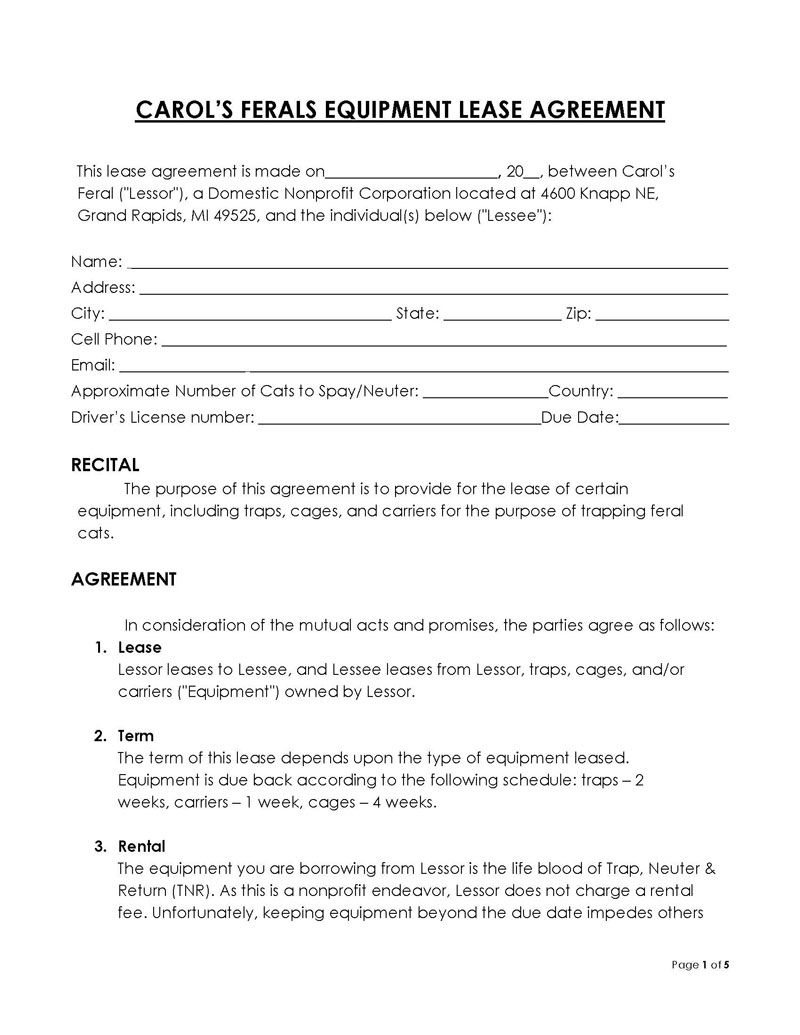

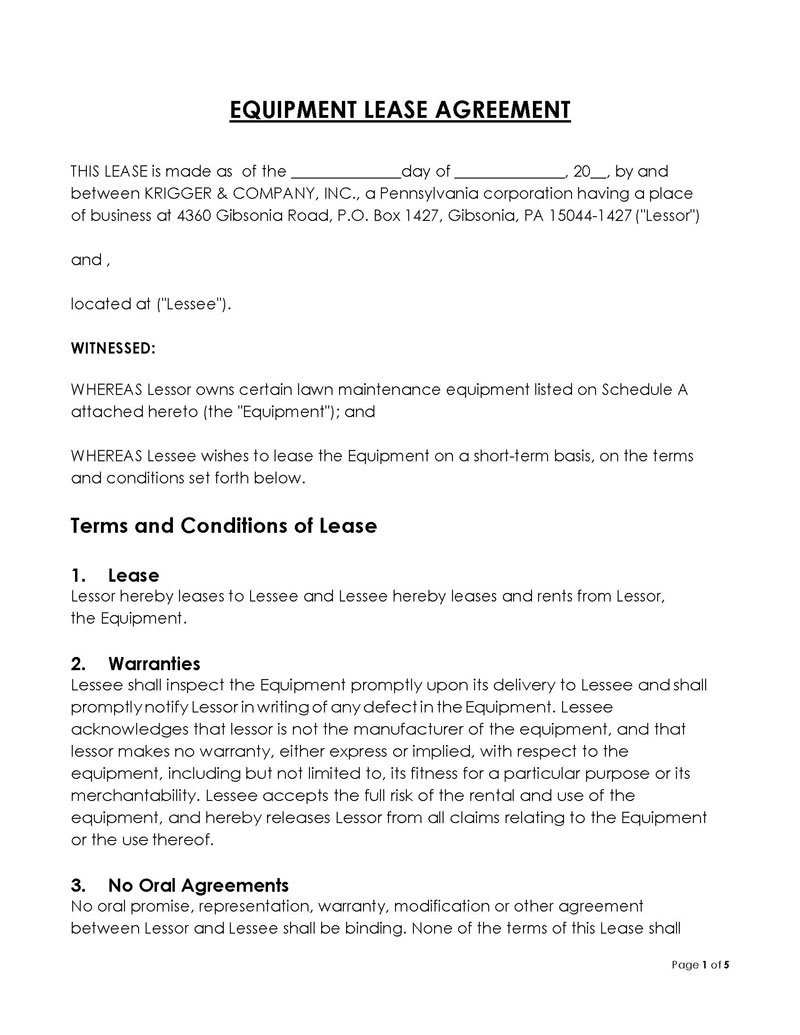

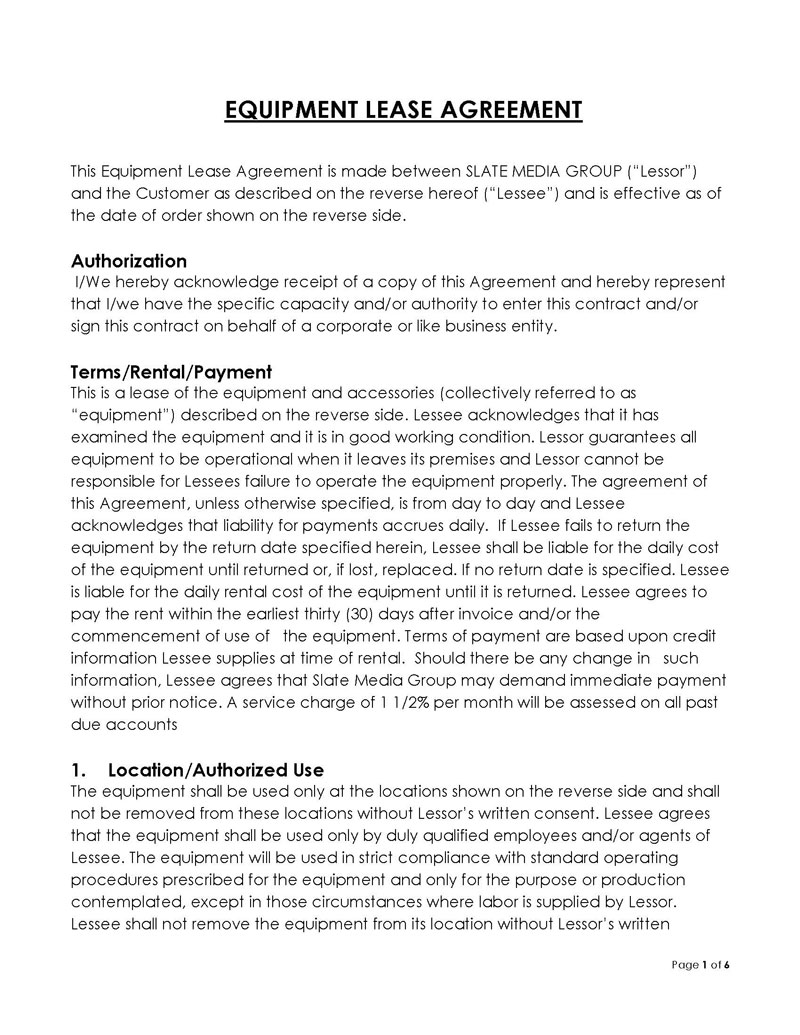

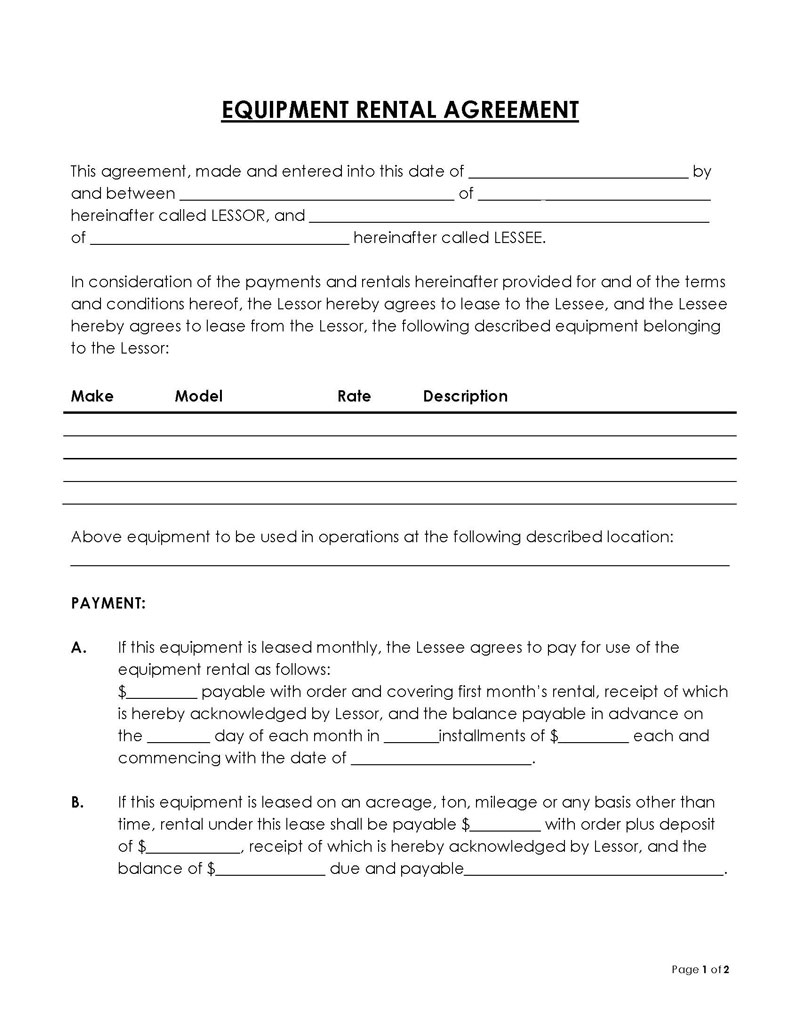

Even though an equipment rental agreement form can be customised depending on the nature of the lease and the specific needs of both the lessor and the lessee, a specific template must be followed.

The following elements are vital for drafting a coherent, viable, and legally binding agreement:

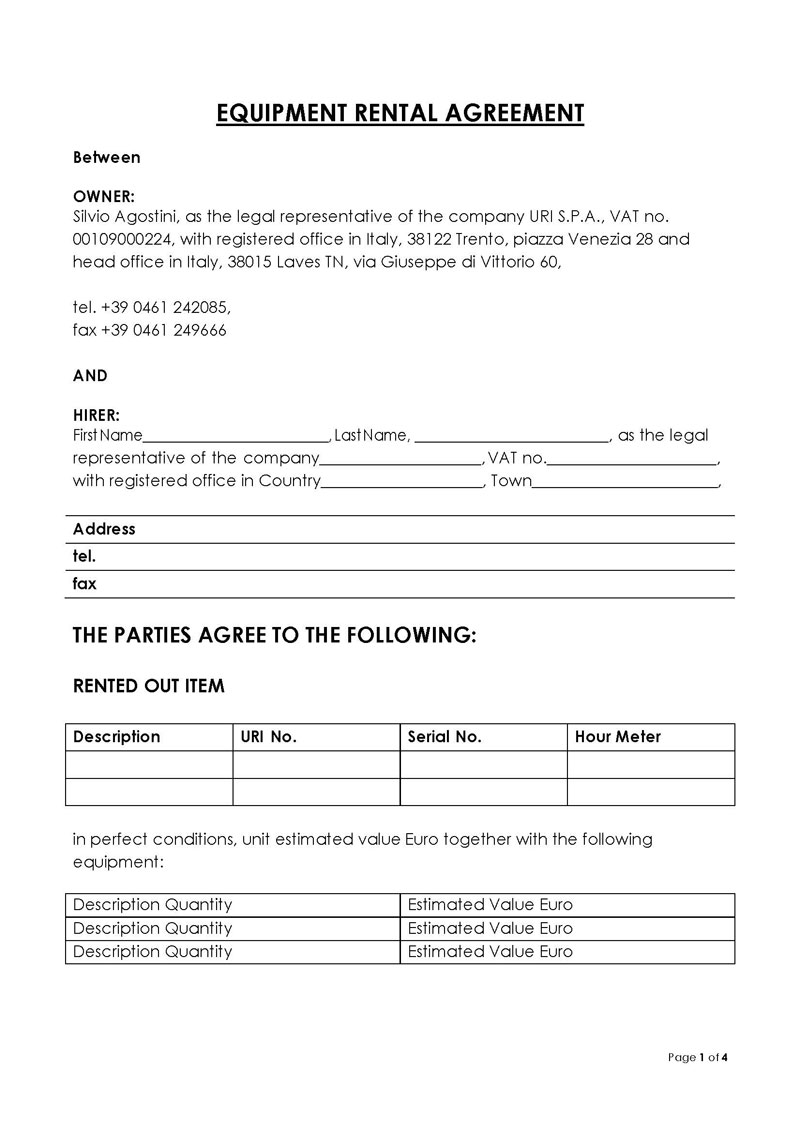

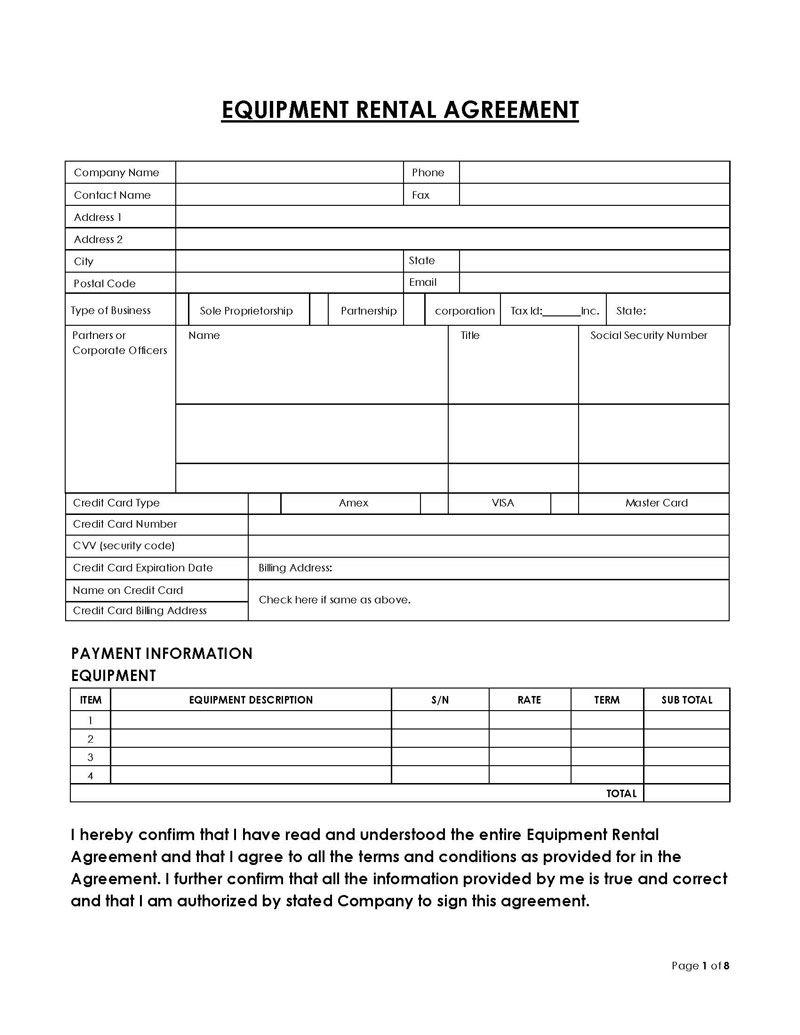

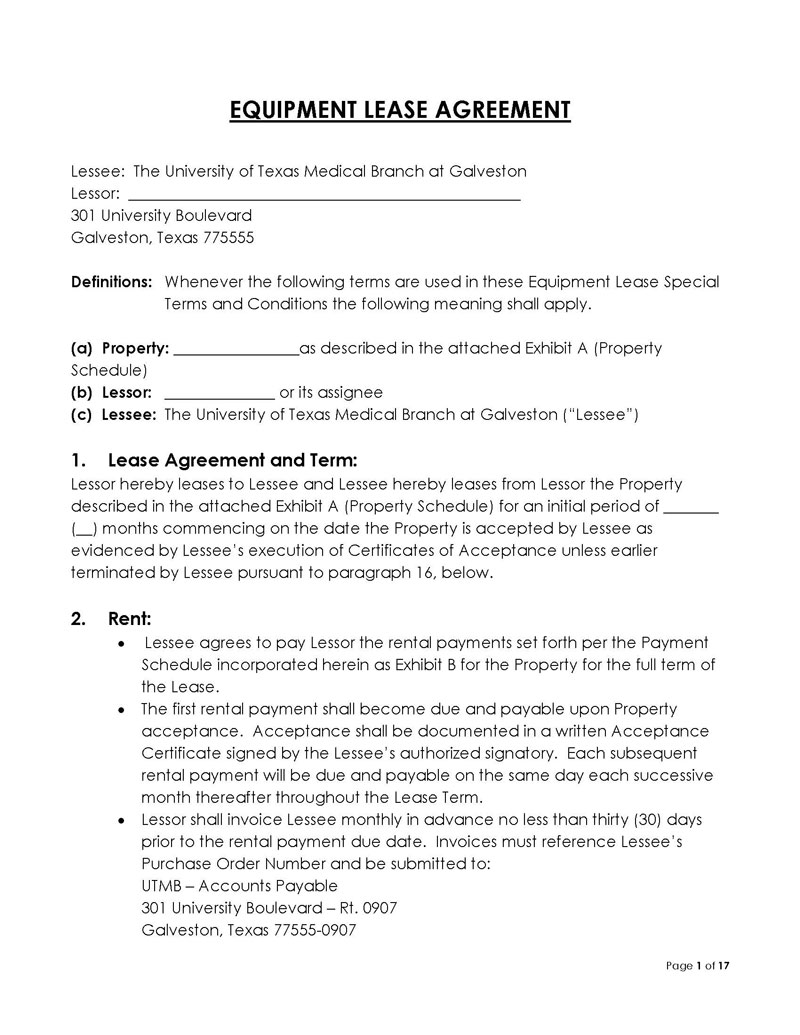

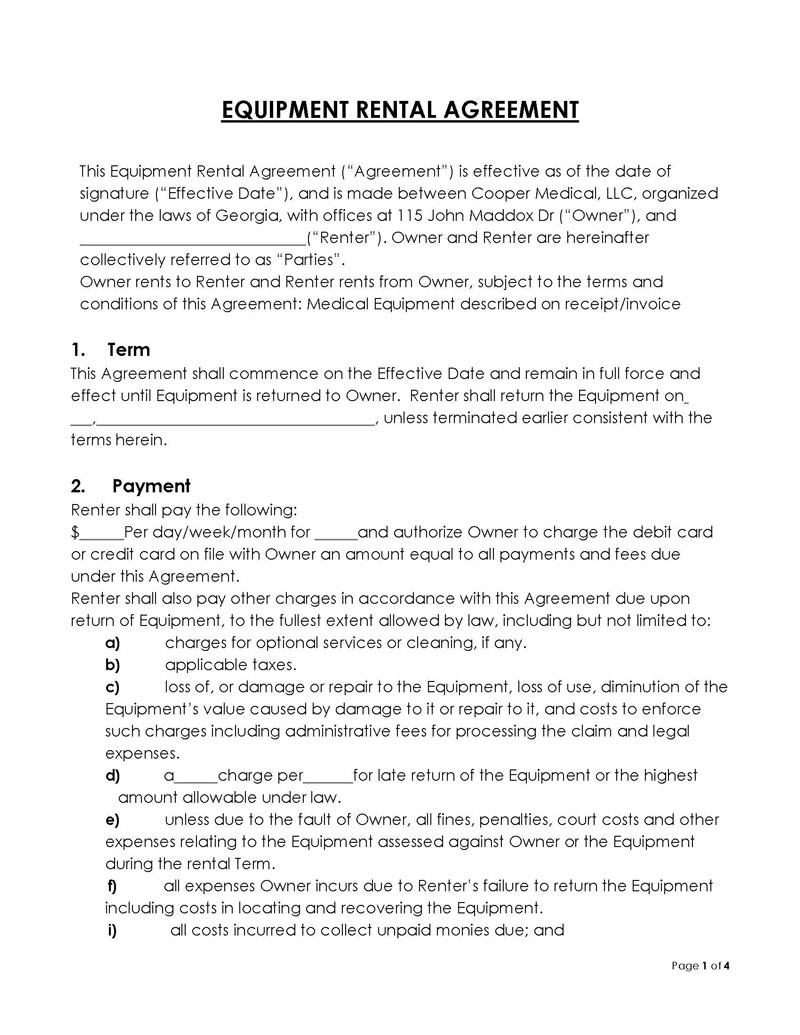

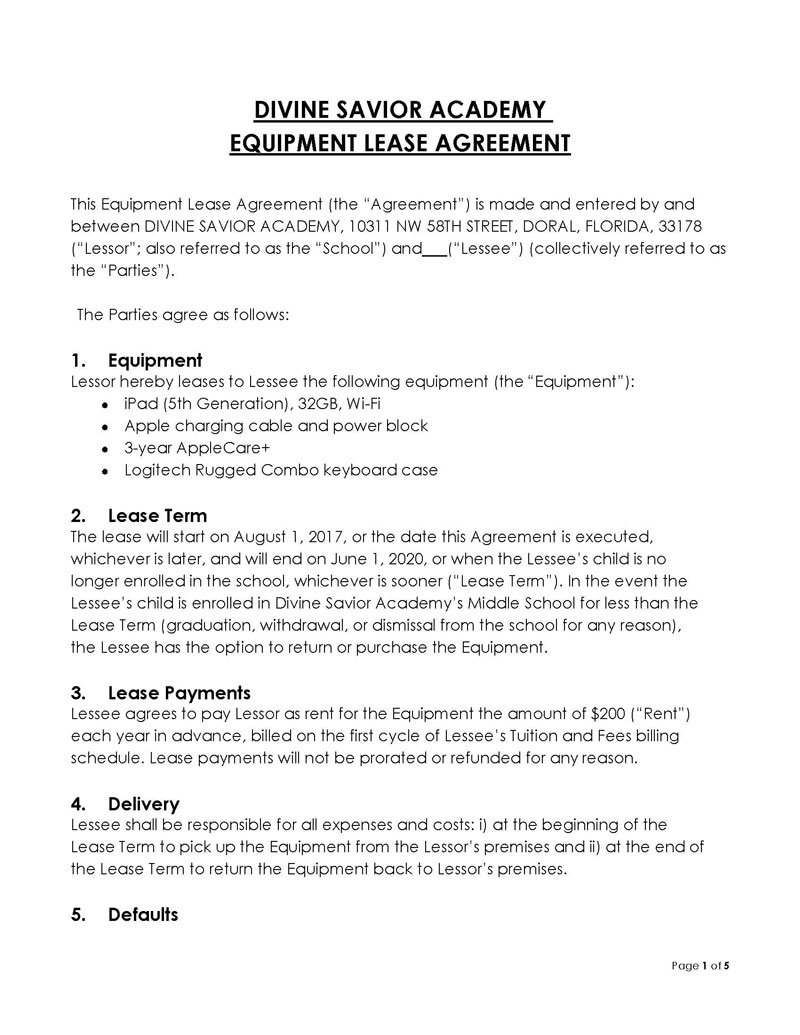

Information about involved parties

The required information about the parties involved in the agreement includes the lessor’s and the lessee’s names, which can be the names of either business entities or individuals involved. In addition, the lessor’s mailing address and the lessee’s billing address are also required to be part of the template.

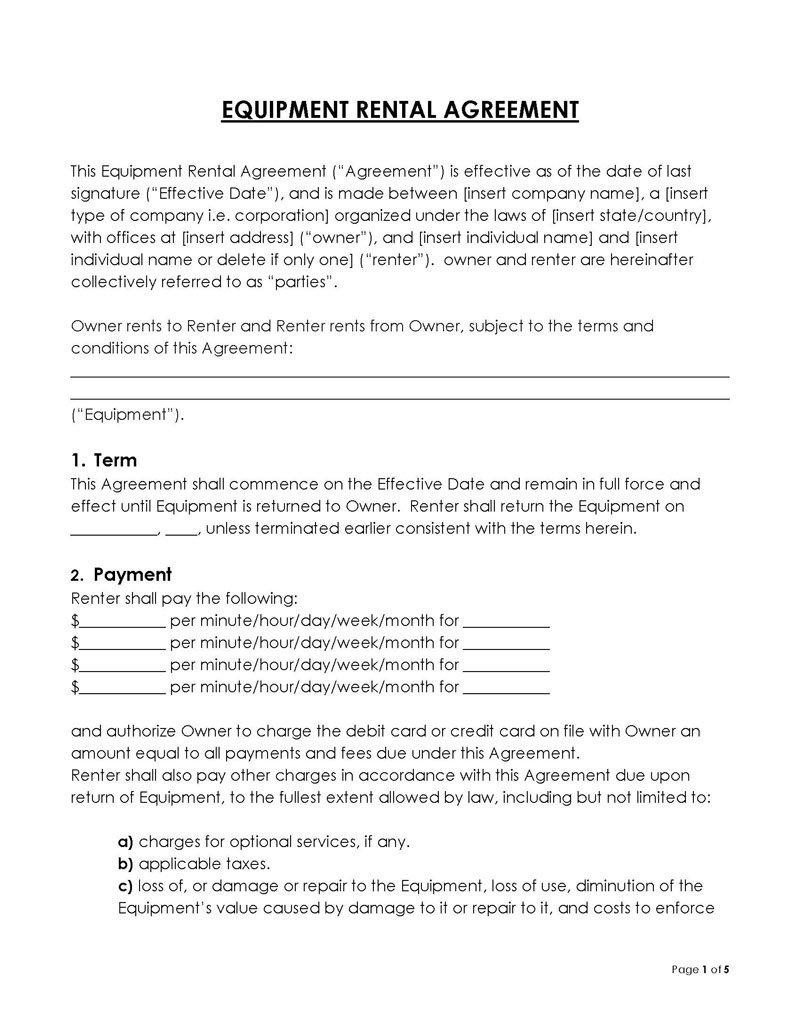

The duration of the lease

The duration of the lease or the rental period must also be included in the agreement form. Depending on their needs, the lessee can agree on a short-term rental period or a longer duration of the lease. Short-term is more convenient when the individual or the business needs equipment only once and for a determined period. On the other hand, long-term is more suitable for individuals and companies that need the equipment for a more extended period or indefinitely but can’t pay the total price.

Description of the equipment

Every agreement for equipment renting must include identifiers such as product name and serial number. Sometimes, additional information is required, so the equipment must be described in detail. Most agreement templates specify the model and make it as well.

Any visible damages, marks, or improvements must also be described if the equipment had already been leased and used before the agreement.

The financial terms

Thesel agreement forms may include various financial terms. A general timeline of the payments must be outlined, and payment methods and due dates for every billing period. In addition, additional financial obligations such as security deposits, taxes, fees, and penalties must also be specified.

The compensation due to the lessor

This part of the agreement template specifies the timeline of the payments with greater precision. The lessor and the lessee should agree upon a paying structure that the lessee can meet, considering their projected cash flow. This ensures that the lessee can honour their part of the agreement.

The equipment’s market value

Every rental agreement template must include an estimate of the equipment’s market value at drafting and signing. This estimate is essential for a few reasons.

First, the equipment for rent and lease is usually costly. Therefore, the lessee should understand the equipment’s market value to evaluate potential insurance costs.

Also, this estimate will help lessees better understand the terms of the agreement and decide whether the compensation due to the lessor makes financial sense. Additionally, it is crucial if the intention is to buy the equipment at the end of the lease.

Tax responsibilities

In certain situations, the lessee must pay tax on the leased equipment. Specifying these tax responsibilities beforehand is crucial for agreement templates that both parties will be able to honor without any ambiguity or confusion.

Conditions for cancellations

There are a couple of reasons for cancelling the lease before the end of the rental period. Sometimes, the lessee finds a more affordable option. Malfunctions, damages, and other problems that render the equipment unusable are not a rare occurrence either.

Because of this, terms of cancellation must be outlined in the agreement form as well. That includes the general conditions – situations when the lessee is allowed to cancel the lease – and the penalty that must be paid to the lessor as compensation for early termination.

Renewal options of the lessee

Once the lease expires, the lessee might be allowed to renew the agreement. If this is the case, the agreement form must define whether the compensation to the lessor will remain the same. In addition, the terms and conditions for the eventual purchase of the equipment at the end of the lease period should also be specified.

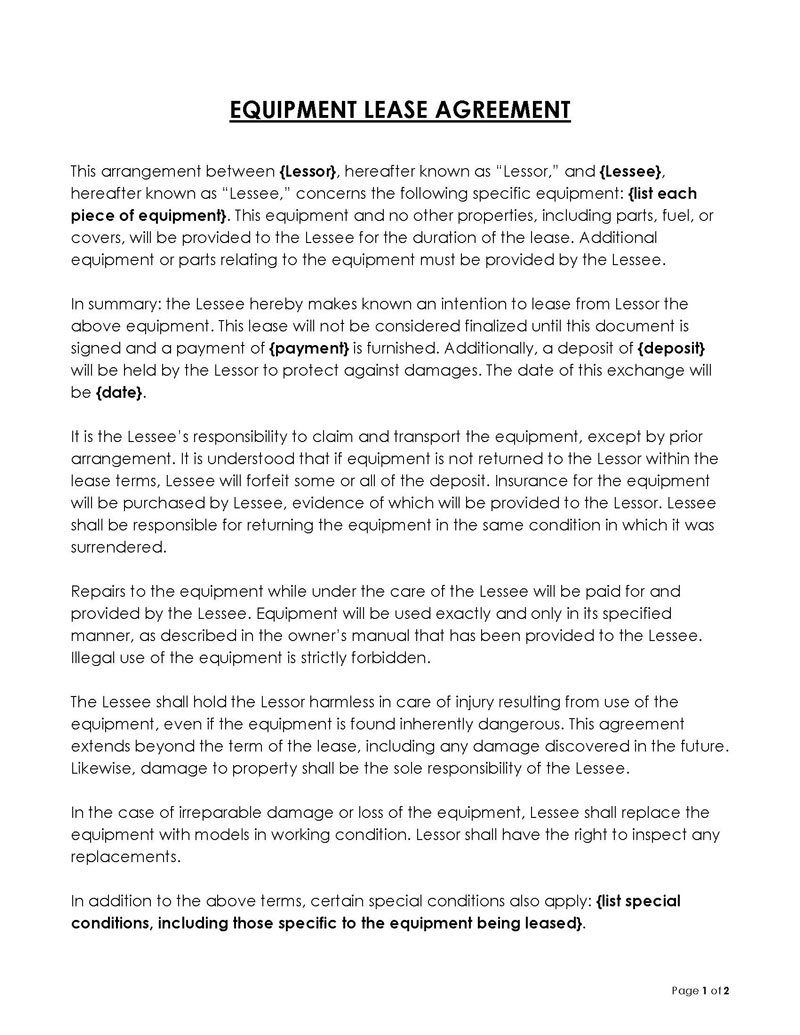

Frequently Asked Questions

Whether because you’ve discovered a better leasing opportunity or because the agreement you’ve signed turns out to be a trap, there are situations where you would want to cancel the lease before it expires. There are a couple of ways out, depending on the situation.

You can consult public legal sources or hire a lawyer to help you understand the equipment rental laws in your state and find loopholes or escape clauses in the agreement. Alternatively, you can draft a statement explaining your reasons for opting out of the lease. Including evidence, such as expert evaluation or maintenance and service receipts, will help you build a case for cancellation. If you have viable ground for cancellation, the lessor might agree to settle without legal officials.

You can draft and sign a legally binding rental agreement for any purpose or equipment you need to rent. For example, a rental agreement can serve as a contractual document between two businesspeople when one of them has to rent equipment from the other.

Rental agreements are created to help companies acquire valuable equipment and pay for it periodically instead of purchasing the item for the total price. In these situations, the agreement is there to protect both parties by specifying their rights and obligations.

The agreement ends after an agreed-upon period, which can be fixed or indefinite, depending on the type of the agreement. When a fixed end date comes, the lessee is obligated to return the equipment to the lessor or renew the agreement.

When the agreement is indefinite, it automatically and periodically renews itself weekly, monthly, or yearly. If one of the parties wants to cancel the lease, it must notify the other party in due time and explain why opting out of the rental contract.

The insurance for equipment rental may be necessary for some situations, but it’s not obligated unless the agreement specifies that. Typically, a lessor would be required to obtain insurance when the lease is indefinite, and the equipment is expensive and risky to use.

That way, both the lessor and the lessee would be protected in the event of accidental damage to the equipment or the property where the equipment is used. The equipment may be lost in any unforeseen circumstance, and the people using it may be injured.