A lease agreement in Minnesota is a contract prepared to define the terms and conditions of the agreement between a landlord and a tenant.

With this document, the landlord can officially rent out their rental property for commercial or residential purposes in exchange for rent from the tenant. Some of the negotiations that must be agreed upon by both parties and then included in it for signing include utilities, fees, and deposits. Therefore, Minnesota landlords should screen their tenants accordingly, since it becomes legally binding once the document is signed.

Types of Lease Agreements

There are different types of lease agreements you can prepare in Minnesota. These are as follows:

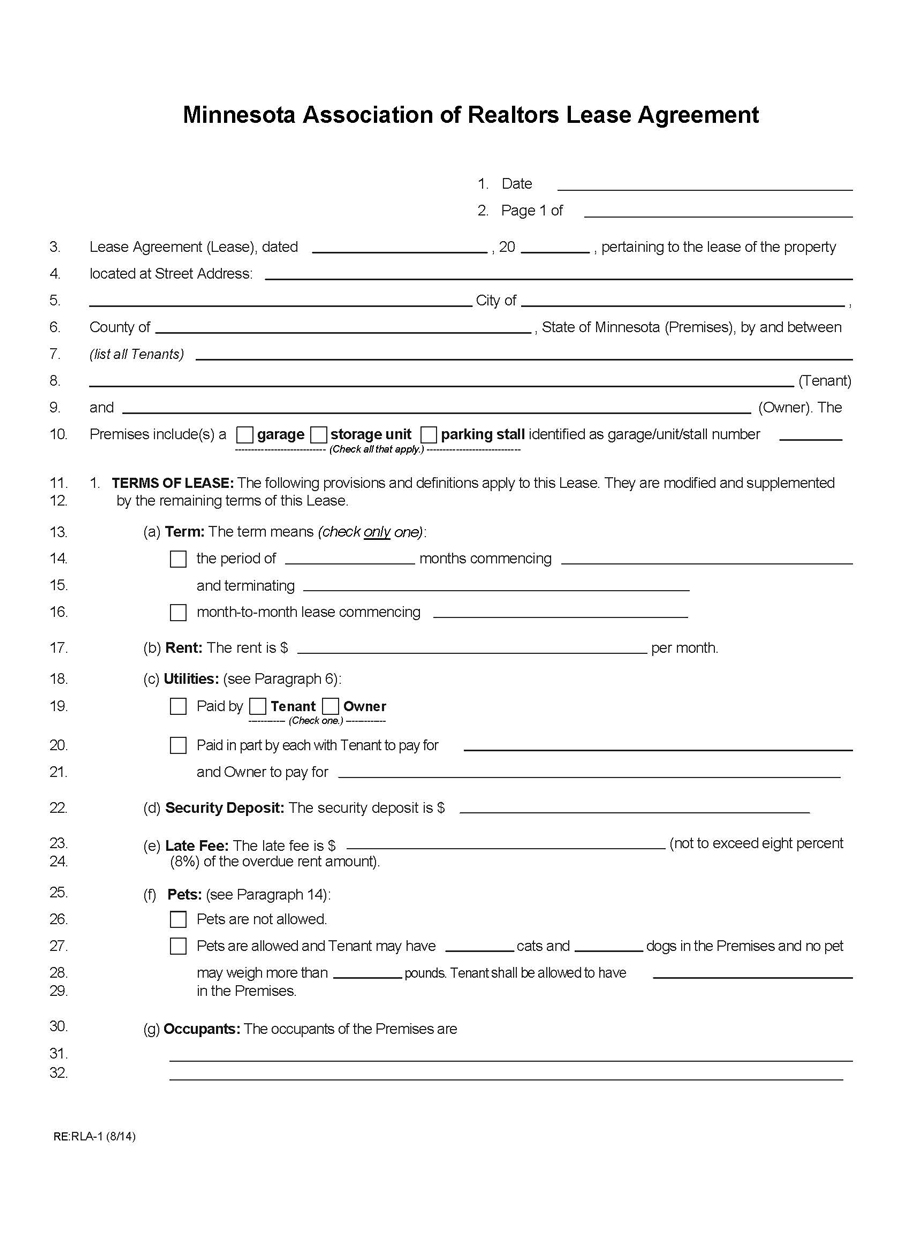

Association of realtors

An association of realtors lease agreement in Minnesota is a contract prepared by a certified realtor who deals with transactions, such as communications and negotiations, between a landlord and prospective tenant. The realtor will assist the tenant in viewing the rental property and inform them about all the landlord’s terms and conditions. Once an agreement has been reached, the realtor will provide a contract for both parties to sign and receive a commission.

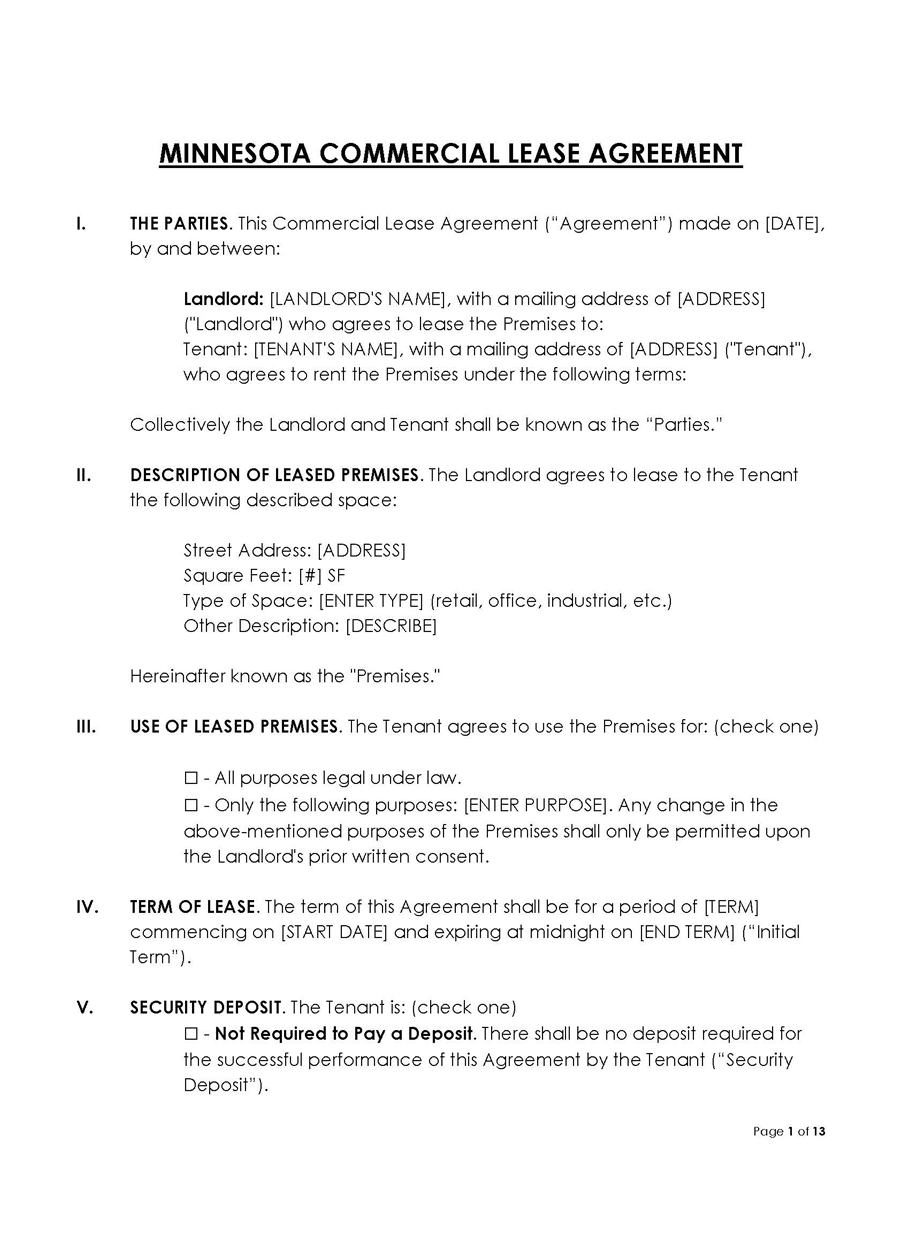

Commercial

In addition, for the commercial lease agreement, details such as the duration, rent amount, security deposit, subleasing, exclusivity, and lease renewal must be included according to Chapter 336, Article 1, and Part 2: Minnesota Uniform Commercial Code laws in Minnesota. It is advisable to ask for professional advice in Minnesota before entering into this contract.

Rent-to-own

A rent-to-own lease agreement is a contract that gives the tenant a purchase option in Minnesota. That means a tenant renting out your rental property has the option of buying it from you. These details must be discussed and agreed upon before the agreement is signed. Also, it is crucial to screen the tenant to establish their financial ability to purchase the property. The purchase option is only viable within the lease period as a tenant.

Month-to-month

A month-to-month lease agreement is a contract referred to as a tenancy at will. It has no end date, which means that if both parties uphold the contract, it can continue for an unspecified amount of time. However, it can be terminated by either the landlord or the tenant, provided a 30-day notice. Therefore, it is essential to properly screen the tenant before renting out the space, since this agreement can last a long time. While preparing this, the laws you need to observe are § 504B.135.

Room rental (roommate)

A room rental or roommate lease agreement is a contract that specifies the living arrangement of roommates in a shared living apartment in Minnesota. All tenants sharing the apartment have to discuss and agree on the terms and conditions of their co-existence. They must all sign it to make it final and legal. For this lease agreement, the landlord is not involved.

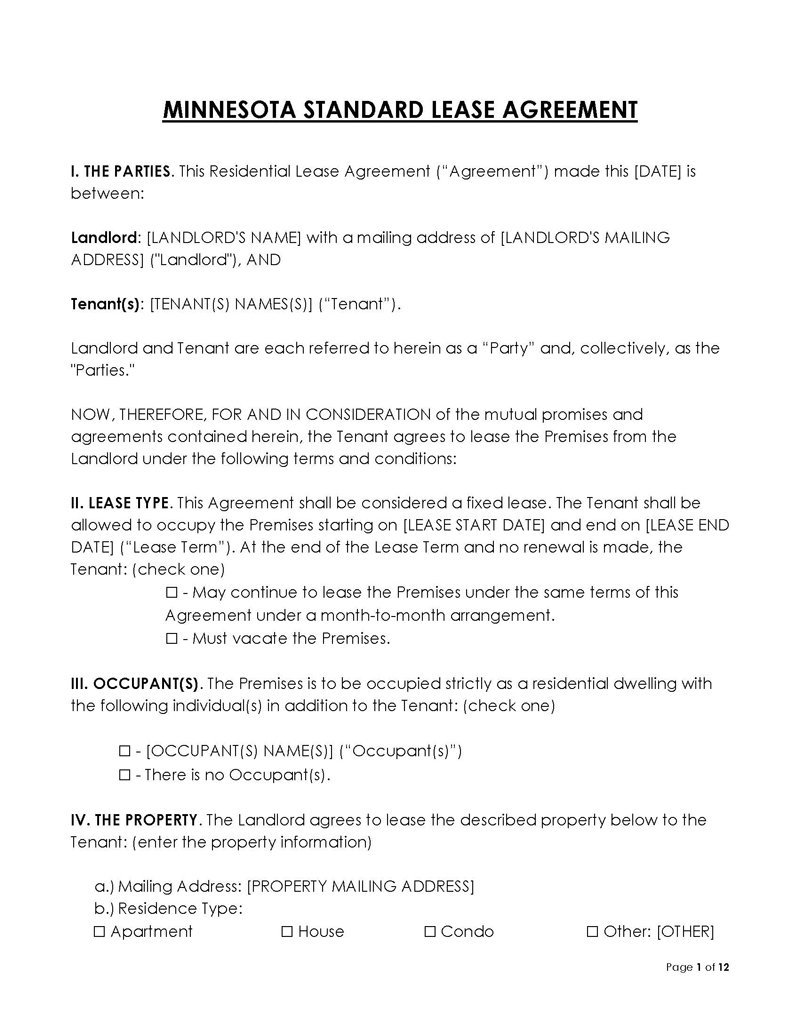

Standard

In Minnesota, a standard lease agreement is a legally binding contract that specifies the tenancy agreement between a landlord and the tenant. The tenant will first review the rental property, complete a rental application, negotiate terms and conditions with the landlord, and finally sign it. Chapter 504B (Landlord and Tenant) must be observed when preparing it, indicating that the first month’s rent and the security deposit should be requested before the tenant moves in.

Sublease

In Minnesota, a sublease agreement is a contract between a sub-lessor and sub-lessee regarding a rental property where the sub-lessor is the original tenant. The landlord must be involved in this arrangement for security purposes. The original agreement between the landlord and the sub-lessor still stands even with this one in place. The sub-lessor cannot extend any benefits or entitlements to the sub-lessee that exceed the original lease. In addition, the sub-lessee will be required to handle rental costs, utilities, groceries, and any other finances related to the rental unit.

Minnesota Lease Agreement Disclosures

To avoid legal disputes and tenant conflicts, there are essential disclosures that, as a landlord, you must include in the lease agreement in Minnesota when preparing it.

The disclosures include the following:

Landlord/manager information

For all rental units, a lease agreement must include the landlord’s or manager’s information. The landlord’s full name and address are required in the contract to make it easier for tenants to send notices and communicate with the property owner.

Late fee disclosure

In Minnesota, late fee disclosure is required in any lease agreement prepared for rental units that charge late fees when tenants delay paying rent. The details to include when writing this disclosure are the amount of the fee, the rent due date, and the grace period allowed. In Minnesota, the late fee is usually 8% of the rent, and if the rent is paid within the mentioned grace period, then the late fee is not owed.

Inspection and condemnation

For any property in Minnesota with an inspection order citation issue regarding health and safety, the lease agreement must include the inspection and condemnation disclosure. The inspection orders must be attached to the rental agreement. This information must be made available to the tenant before the security deposit and rent have been paid. If the issued order is still pending and is not considered a health risk, the landlord can include it as a notice.

Financial distress

For any rental property with a foreclosure notice in Minnesota, the lease agreement must include the financial distress disclosure. As a landlord, you must also include the date of the foreclosure. Depending on the foreclosure date, you can only have periodic residential agreements with your tenants with a foreclosure notice, usually for less than two months. If the foreclosure issue has been resolved, you can have more extended or fixed-term rental agreements with your tenants.

Shared utility agreement

The shared utility agreement disclosure applies to rental units with multiple tenants and single meters. Landlords of such rental buildings are considered the bill payers and must inform the tenants of the utility bills they will be sharing.

Some of the details that should be provided under this disclosure include:

- The distribution of utility charges among the tenants

- The total utility costs from the shared utility meter

- The breakdown of the shared utility bill charges (in case a tenant requests these details up to two years ago, the landlord must provide this information)

Covenant of landlord/tenant

The covenant of the landlord/tenant not to allow unlawful activities is a necessary disclosure that must be included for all rental units in Minnesota. The exact clause for this section of the contract should state that both parties have agreed to not indulge in any illegal or unlawful activities within the rental premises.

Some of these criminal activities include prostitution, robbery, domestic violence, stolen property or property obtained by robbery, and the use of controlled substances. The clause should also define the areas where such habits have been prohibited from happening.

This disclosure outlines all the legal duties and responsibilities that the landlord and the tenant will each uphold during the rental period. The aim is to prevent any illegal activities or unlawful use of the property.

Lead-based paint

The lead-based paint disclosure applies to all rental units built before 1978. Landlords will need to fill out and attach a lead-based paint disclosure form to inform their tenants and highlight the risks posed by these paints. They are also required to provide Environmental Protection Agency (EPA) approved pamphlets containing information about lead-based paints’ hazardous nature.

Marijuana use

It is important to specify if your rental unit allows marijuana use or not. As a Minnesota landlord, you can restrict marijuana use completely, control where the marijuana users smoke, or even limit marijuana use to non-smoking techniques. This way, all tenants can co-exist peacefully with each other.

Move-in checklist

For the move-in checklist, you can either include this disclosure in your lease agreement or prepare a separate document that must be signed. This involves providing a list of property damages before the tenant moves in. This ensures that the tenant will be held liable for any other damages they might cause to the property.

Bed bug disclosure

If your rental unit has a history of bed bug infestations, you must disclose this information. With this disclosure, you will need to provide guidelines for handling an infestation, including how to prevent one and where to report any sign of it.

Asbestos disclosure

The asbestos disclosure is required for a rental property built before 1981 in Minnesota. With this information, the tenant is aware of the asbestos, can take precautions against disturbing the asbestos fibers, and can quickly inform you of any wall or ceiling deterioration. The tenant will also be prohibited from sanding, pounding, modifications, and repairs without your consent.

Mold disclosure

The lease agreement can include a mold disclosure to establish your rental property’s mold status in Minnesota. This protects you as the landlord against future liability from mold damages while guiding the tenant on how to stay away from the mold.

Security deposits

For security deposits in Minnesota, there is no maximum limit. However, as the landlord, you will be expected to return the security deposit to your tenant once the lease has ended, according to § 504B.178. Also, there is no set due date for rent by law since that is an agreement made between a landlord and a tenant, with the possibility of a grace period.

Maximum fees

For late rent fees, the maximum fee payable is 8% of the monthly rent, according to § 504B.177. This information must be included along with a reasonable fee for Not-Sufficient Funds (NSF Check) for rent payments. In addition, based on the guidelines in § 504B.211, the landlord has a right to enter the rental property if they provide reasonable notice.

How do I Write a Minnesota Lease Agreement?

Ensure that all the details mentioned below are included when writing a lease agreement in Minnesota.

The aim is to ensure that your contract is legal and viable according to applicable laws:

Names of the parties

The full and legal names of the landlord and the tenant(s) must be included. However, if an agent or a property management company is available, you can include their legal business name instead of the landlord’s name.

Property address

The premises’ location, which is the physical address for the rental property, should be included in the contract. This will include details such as the city, zip code, and the lot or unit number.

Term information

The term information determines the types of leases, which can be fixed-term or flexible. Whatever the case, you need to specify the term information to establish the length of the rental agreement and even the lease’s end date.

Rental amount

You must inform the landlord about when the lease begins, the monthly rent, the due date, and where the rent should be paid for the rental amount.

Late fee

The late fee for delaying paying rent must also be included and should be reasonable. Ensure that you also specify the due date of the rent payment in this section.

Security deposit

Landlords in Minnesota should specify their security deposit, the amount to be paid before the tenant can occupy the rental unit. Apart from establishing that the tenant is serious about renting the space, the security deposit is also used for repairs and future damages.

Initial payment

The initial payment is the total amount of the first month’s rent and the security deposit that a tenant must pay to be allowed to move into the rental property.

Occupants

The occupant’s section should include the full names of all tenants staying in the rental unit, and this will include the tenant signing the lease, the tenant not signing the lease, and even tenants who are minors. This information is vital for identifying who lives on the residential property. For commercial property, listing the occupants will help determine the rent price and establish who is allowed to use the leased space.

Utilities

This explains which utilities or services a tenant does not pay when renting out the unit.

Parking

The parking information includes notifying the tenant whether they have a parking space beside the rental property. As the landlord, you must specify if there is a parking space and if it is reserved and designated for the tenant.

Furnishings

The landlord must inform the tenant about the installations and appliances they are allowed to have and those prohibited for furnishings. In addition, the lease agreement must be specific to the machines and appliances, such as dishwashers and washing machines.

Notices

The document must have a section where the names of the landlord and tenant, together with their mailing address and other communication details, are included. This way, both parties can easily communicate and send notices.

Eviction

For the eviction details, the lease agreement must specify the eviction process for the tenant in case there is a breach of contract or they fail to make payments.

Additional terms

Your lease agreement should have an additional terms section where extra terms and conditions agreed upon by the landlord and tenant can be included if they are not present in the other sections.

Signature and date

The lease agreement must be signed and dated by both the landlord and the tenant.

Minnesota Lease Agreement

Key Takeaways

- A lease agreement in Minnesota is prepared according to federal and state laws to bind a landlord and their tenant in a legal contract. The landlord is paid, and the tenant gets a commercial or residential rental space in return.

- It must include the required disclosures, such as lead-based paint, mold, asbestos, bed bugs, etc.

- As a landlord or tenant, ensure that your rental situation aligns with the type of Minnesota lease agreement that you have prepared for signing.

- While preparing your lease agreement, you can use our samples to write a proper contract that will be viable and acceptable before the Minnesota courts.