A land/ farm lease agreement is a contract used by landowners (known as the lessor) to rent out or lease their piece of land to another party (tenant or lessee) for specific purposes such as property development, agriculture, or any other commercial or profitable reasons such as mounting a signal tower.

It is a contract that addresses the rights and responsibilities of the lessee and lessor. The landlord will usually require periodic payment and, in some cases, royalties in addition to rent payments. This and other terms of the transaction are laid out in the land (farm) lease agreement.

Renting land to another person or company is typically associated with certain terms and conditions of use or utilization. A land lease agreement allows the capturing of the expectations from each party (lessor and lessee) regarding the arrangement/transaction. This way, the agreement acts as the “constitution” of the arrangement. These agreements are thus used by landowners who intend to rent out their farm to another person or company.

The agreement communicates the obligations and permissions accorded to the lessee and other terms, such as the applicable compensation/rent for occupying and using the land. Therefore, a landowner can use the agreement to lease their property for hunting, grazing, building hotels, constructing a residential house, building a telecommunication tower, etc.

A farm lease agreement is legally binding and will typically be executed in accordance with the laws of the specific state where the land is located. It is advisable to have the document in writing as it is more enforceable than a verbal agreement.

A land (farm) lease agreement is alternatively referred to as;

- Billboard land lease agreement

- Farmland lease agreement

- Ground lease agreement

- Land contract

- Hunting lease contract

- Land lease agreement

- Pasture rental agreement

This article will comprehensively discuss how a farm lease agreement can benefit you as a landowner, what it contains and how it can be created. It will also provide free templates that you can use as your agreement, especially when you have never created one yourself.

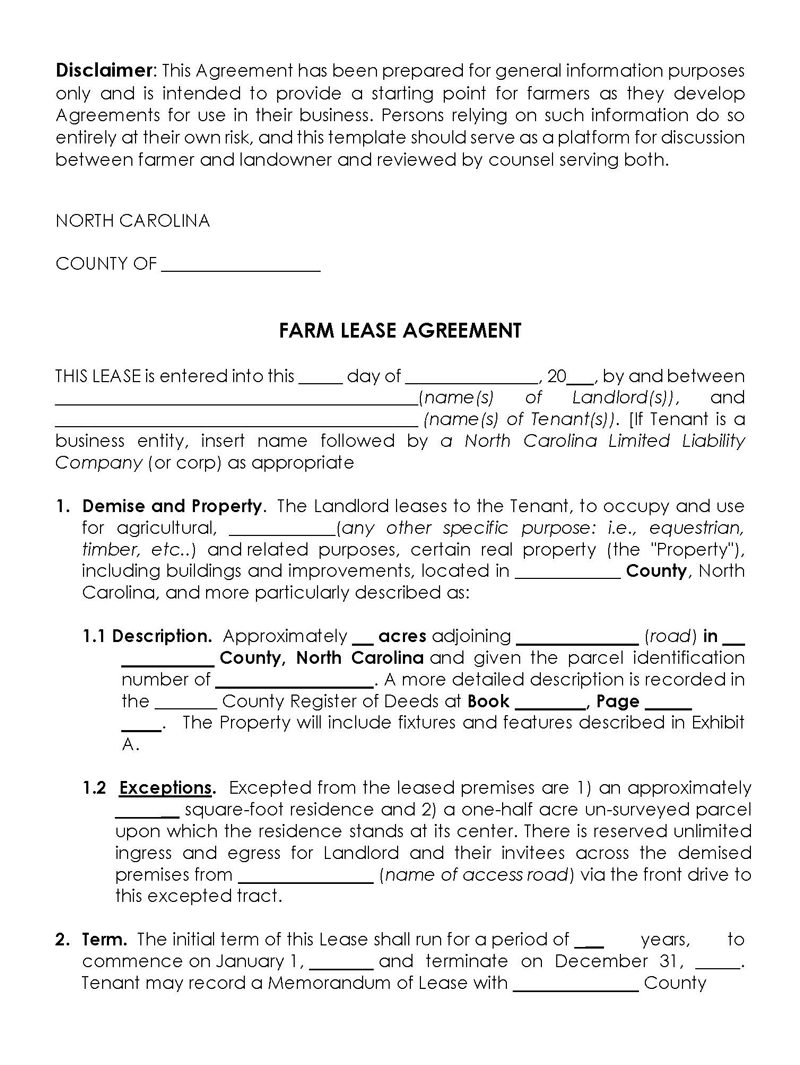

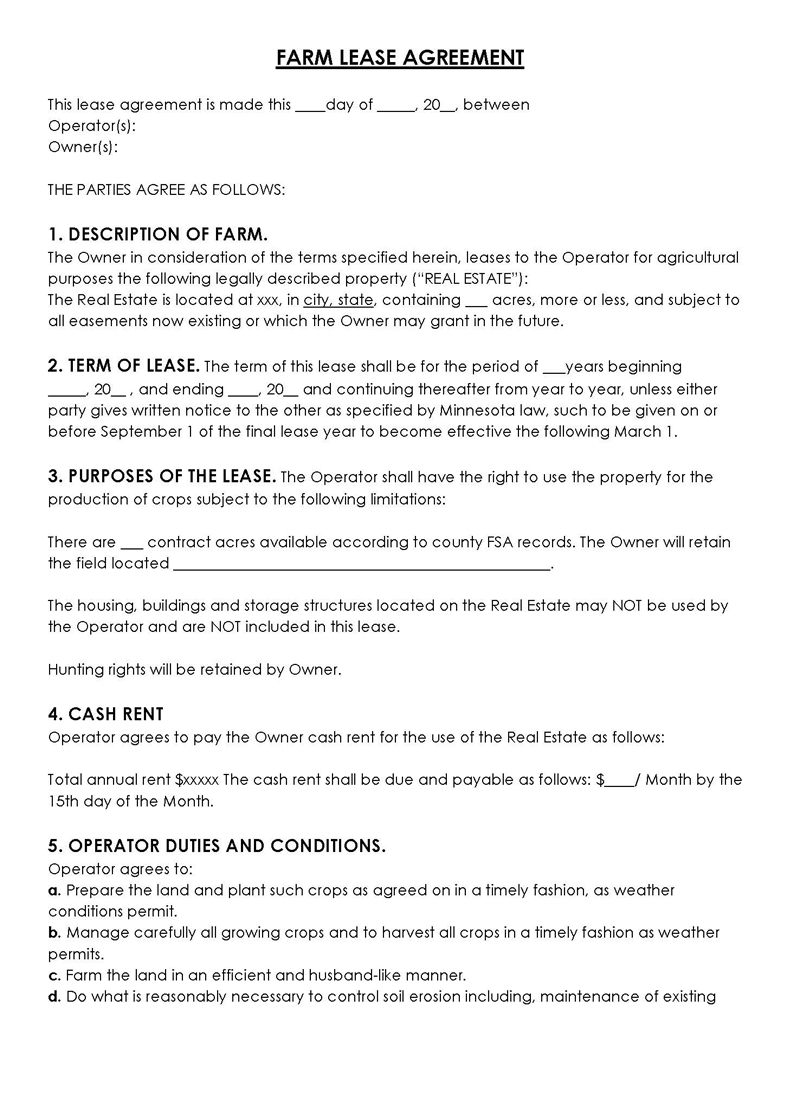

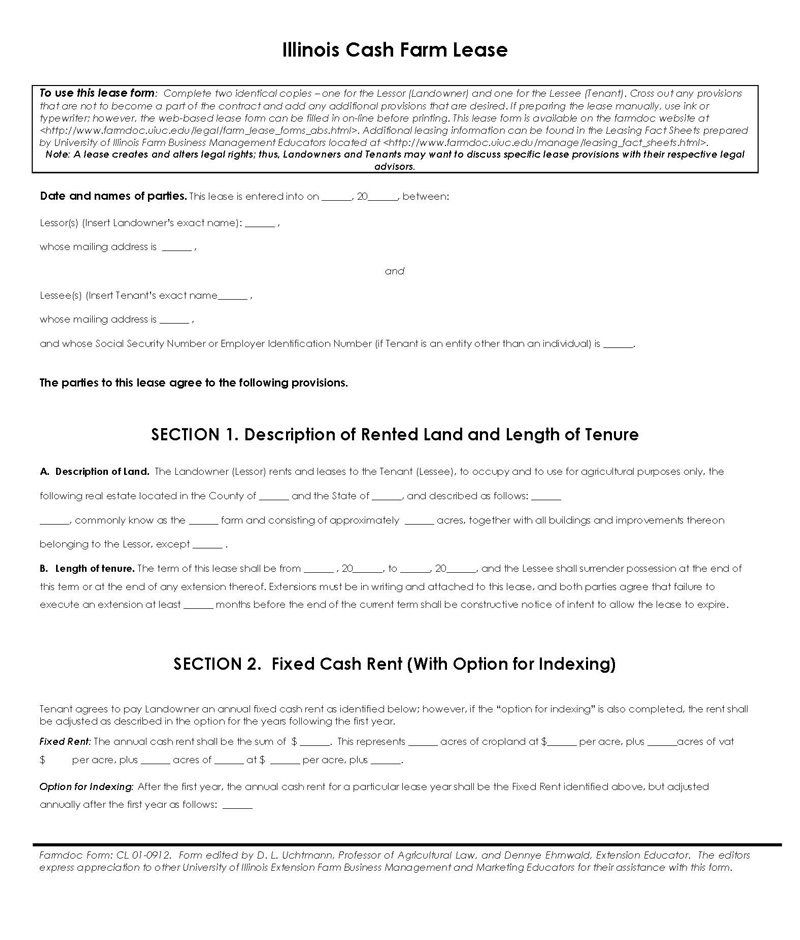

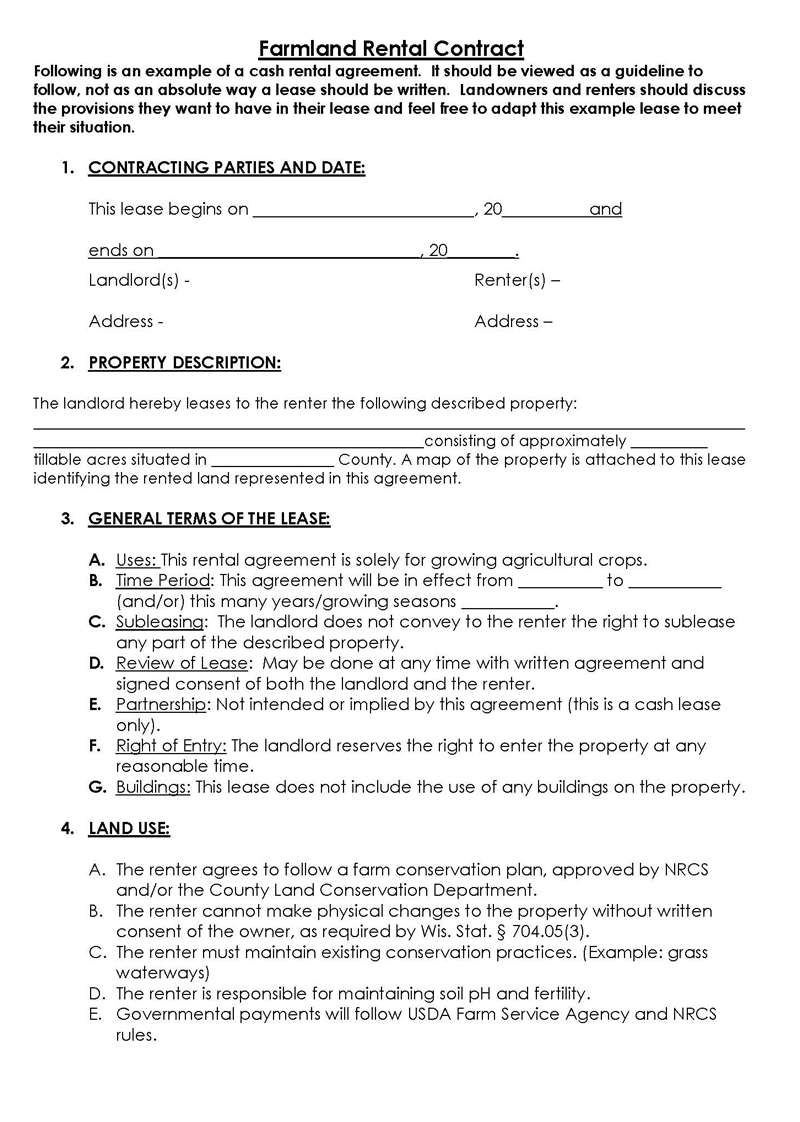

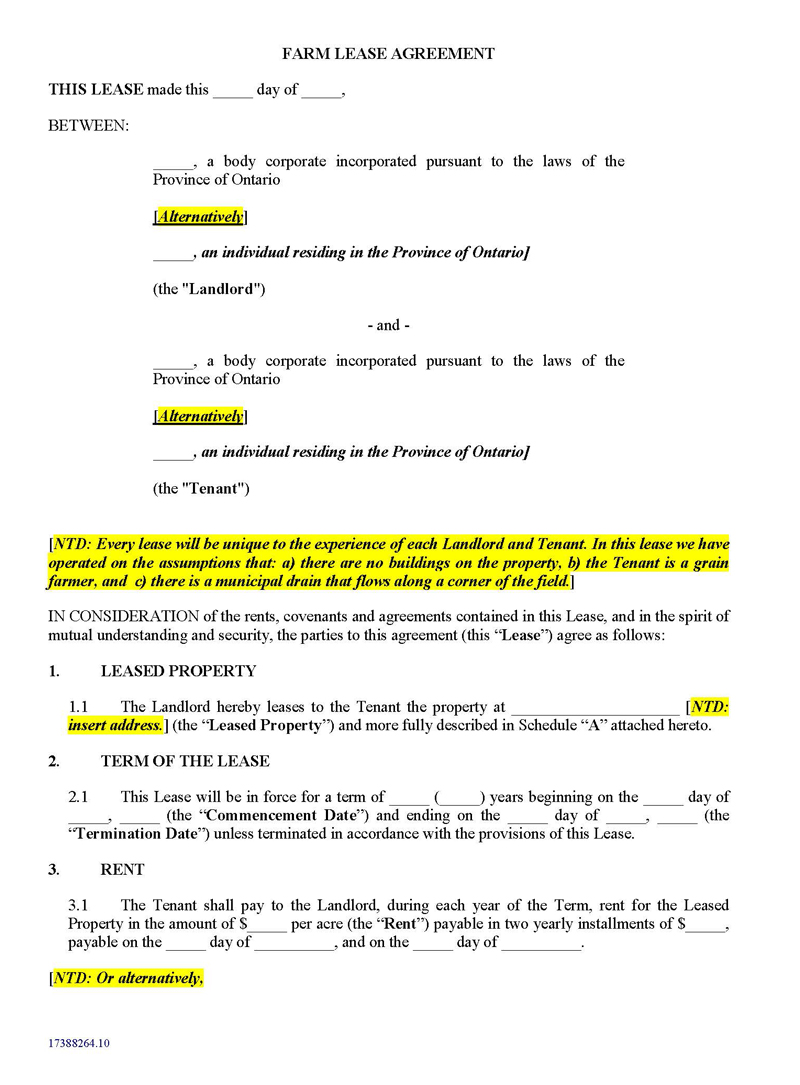

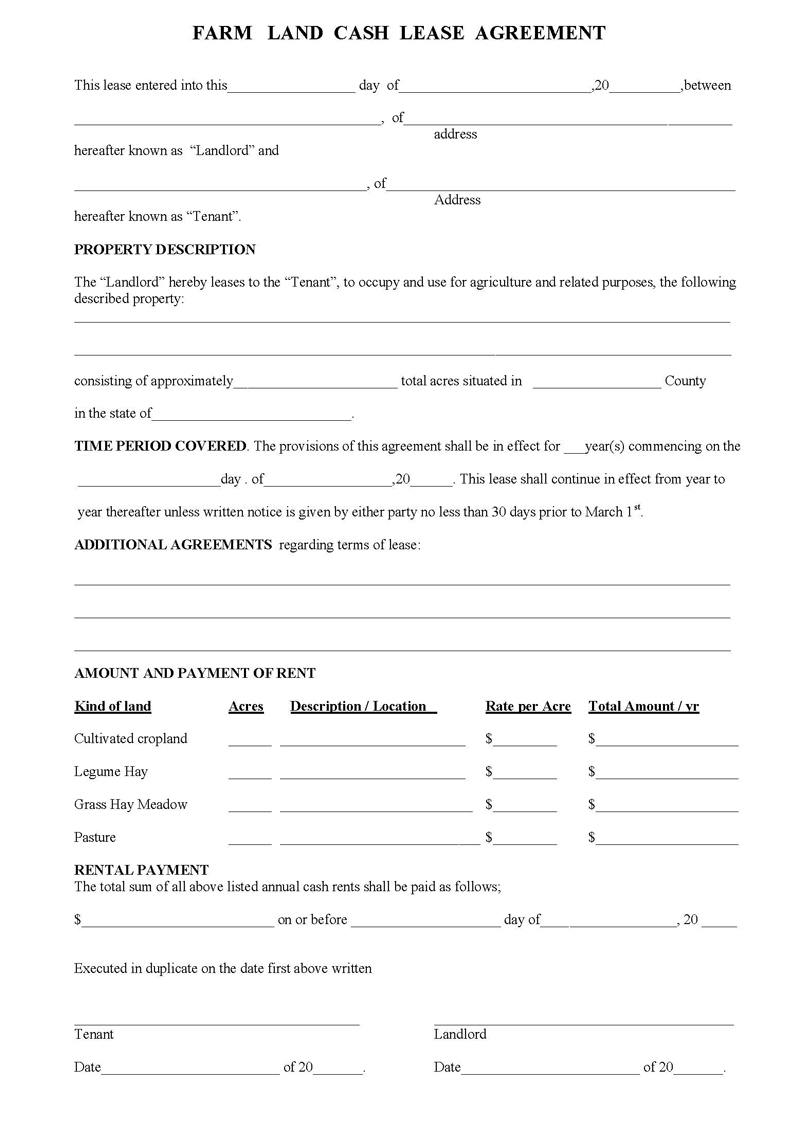

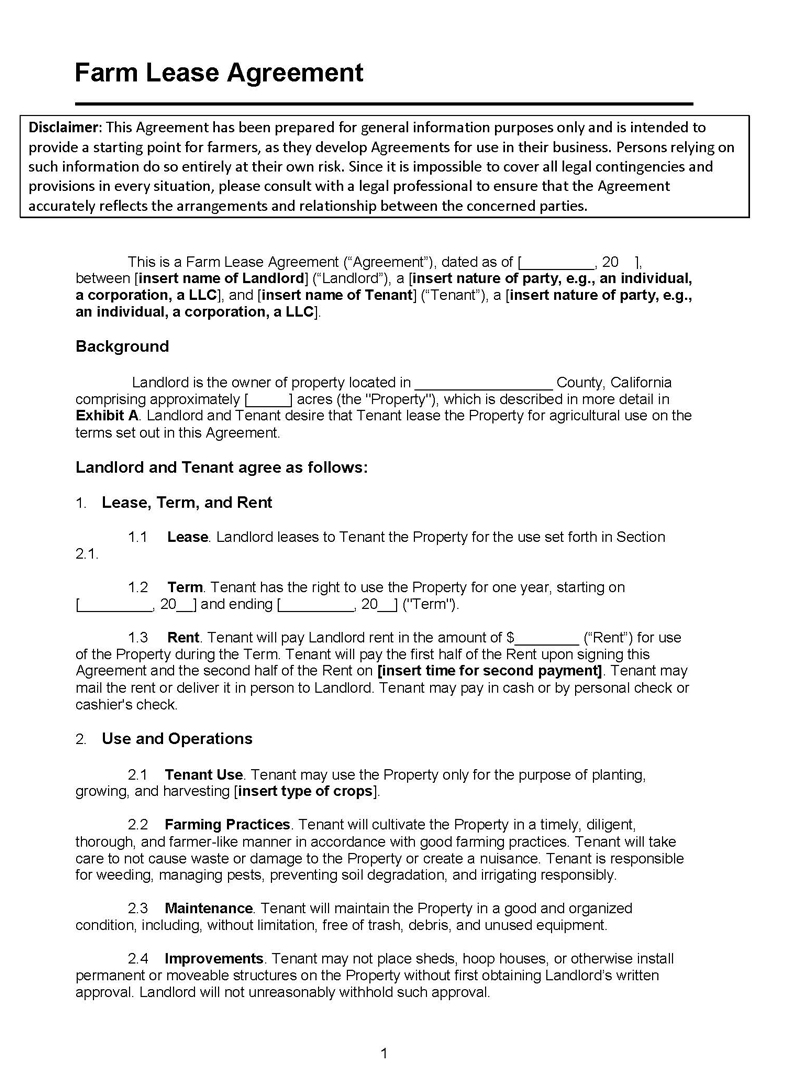

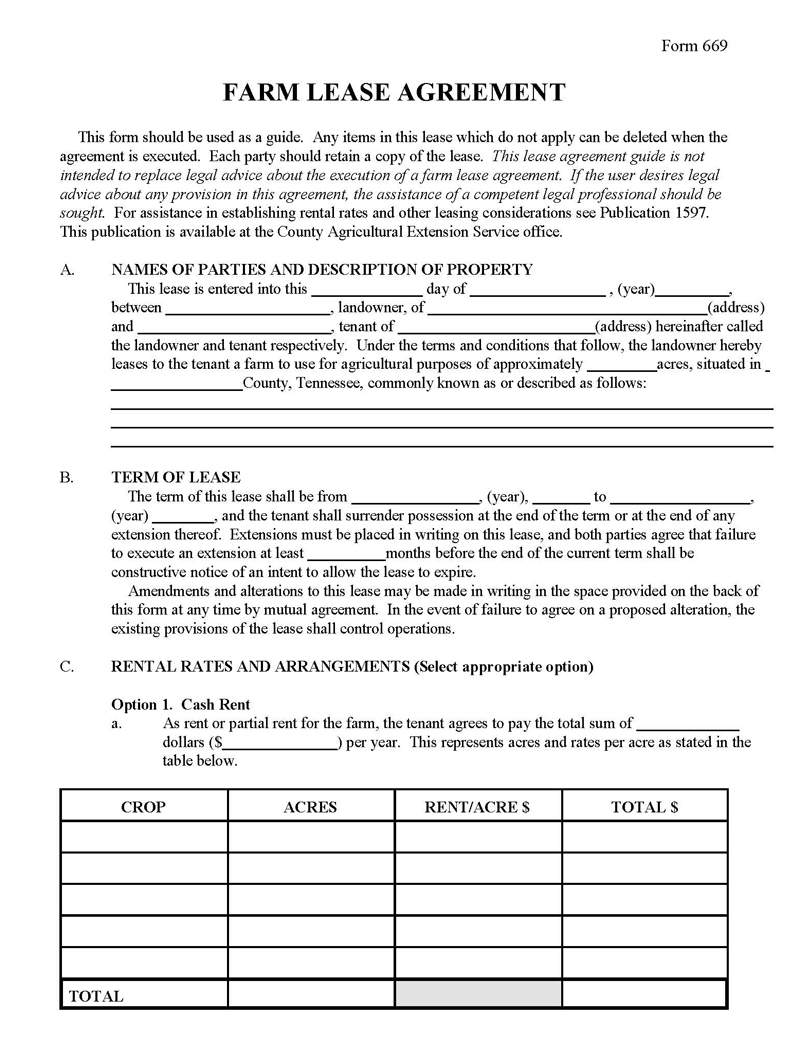

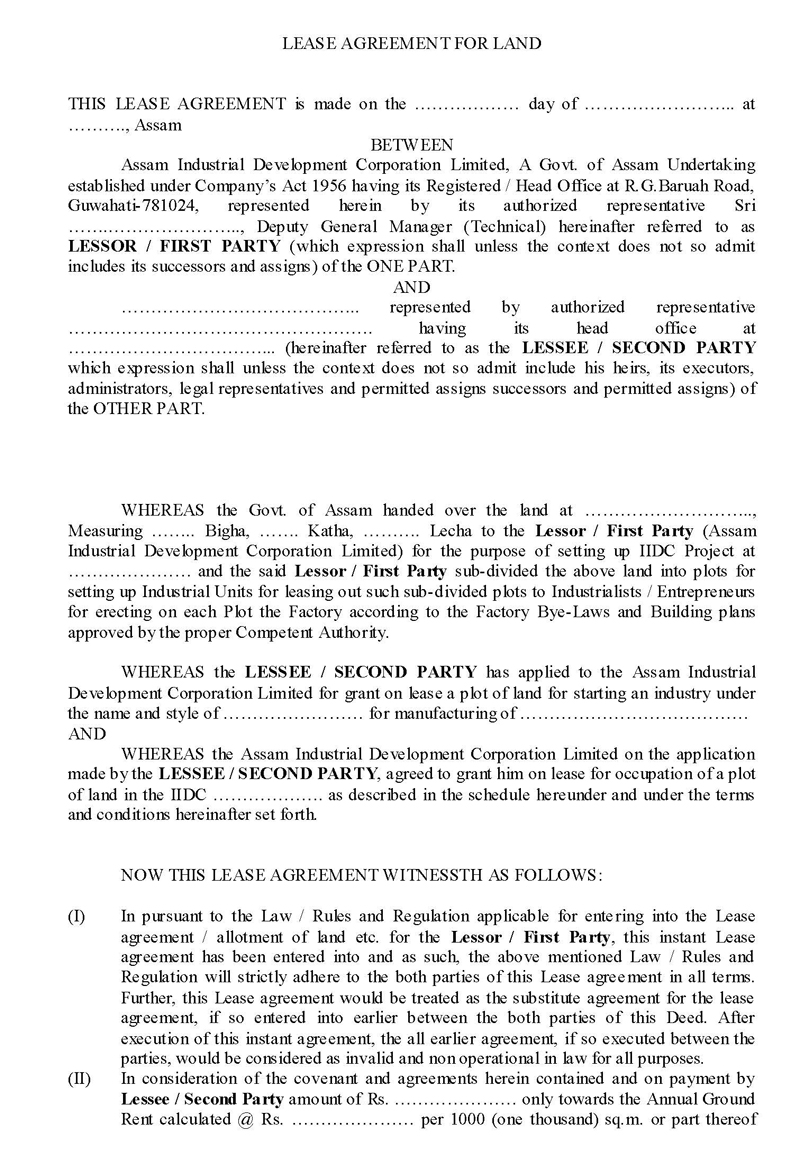

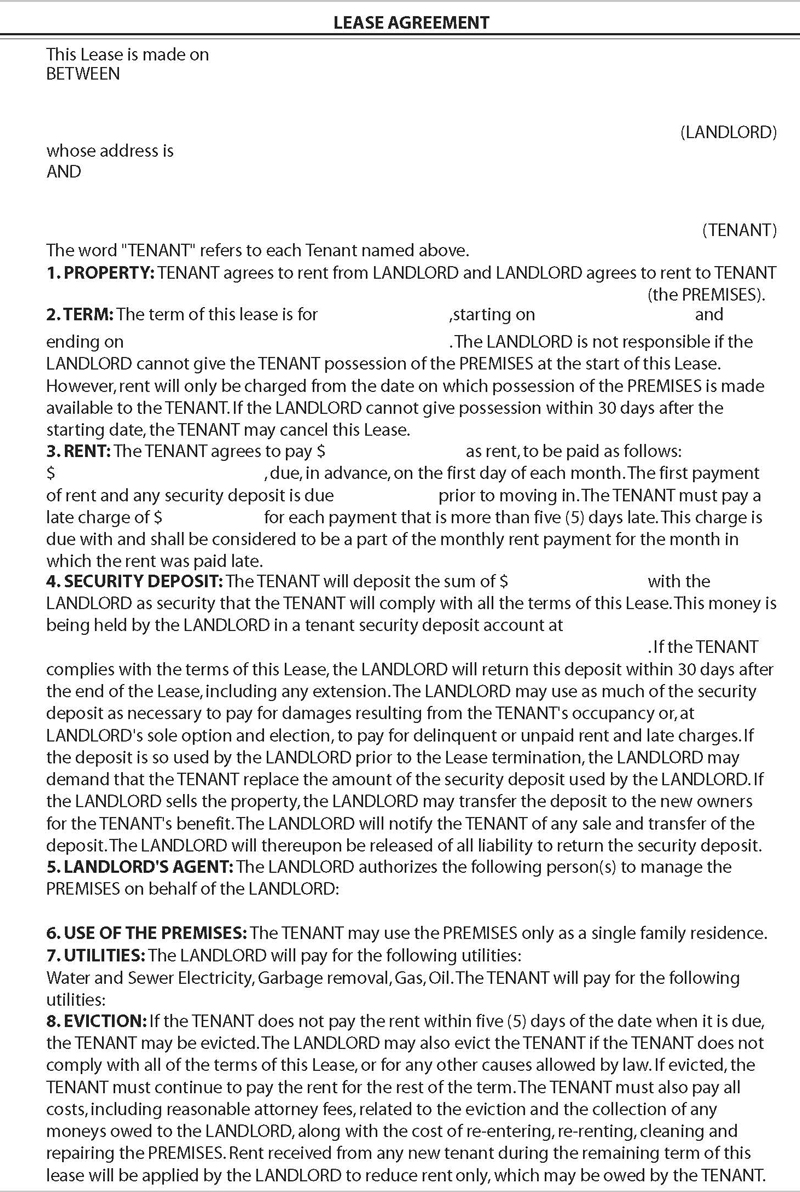

Free Templates

Templates for a land or farm lease agreement can be useful, especially for those unfamiliar with drafting and completing legal documents. They are meant to save on time and effort and streamline the process of creating an agreement.

When and Why Do You Need It

Land lease agreements are common in both rural and urban settings. A land (farm) lease agreement provides many advantages to both parties involved in leasing a piece of land. It acts as the “constitution” of the arrangement. You, as the landowner, can obtain significant financial benefits from leasing your land to another person or company.

The rent is relatively high compared to what you would normally get if you decided to sell your property. This way, the agreement allows you to start earning some passive income without necessarily injecting resources into your farm or selling the property. Common uses of the land lease through farm lease agreements are agricultural, commercial, and residential uses.

Additionally, royalties are often paid instead of or in addition to rent as compensation from the lessee to the lessor. Royalties are a percentage of any revenue resulting from a contract with an independent third party (e.g., a client consultant, consultant, business entity, or any other business with which the lessee is associated) developed on the leased land. You, as the landlord, benefit because you no longer have to waste time and money worrying about upkeep, maintenance, and the property’s decreasing value.

This reduces costs associated with the property and mortgage payments. The document also ensures the responsibilities of each party are well defined – for example, property tax duties, maintenance, land use permits application, rental rates, etc. Disputes can also be prevented through the farm lease agreement, should they occur. The agreement can be consulted to provide the solution. The document is likely to reduce potential disputes more on the grounds of interpretation if the document is clearly worded and detailed enough.

Additionally, you can sometimes benefit from the arrangement by inheriting structures built by the lessee on the land after the lease expires.

What Should be Included?

These agreements will vary from one leasing arrangement to another. However, there are some essential components that should be included in a lease agreement for land or farm.

These include:

Contracting parties and date

The details of the contracting parties (i.e., lessor and lessee) of the agreement should be clearly stated in the document so that it becomes easier to identify both parties. In this case, you may consider including the contact details of both parties. However, if one party is a business, include the names and information about that business in this section as well. Also, the farm lease agreement should be dated.

Property description

It is important to include property descriptions in the agreement. The description should be accurate enough to enable both parties to identify the land or farm being used for the stated purpose. Details such as the size of the plot, plot number, location, etc., can be provided in the description.

The landowner or lessor should take a clear picture or shoot a video of the property from different angles so as to be able to depict it accurately in the document. Also, the USDA Farm Service Agency (FSA) maps can be attached to the agreement if you are participating in USDA form programs. This way, disagreements over whether the property described is actually what was leased by both parties can be avoided.

Rent amount

The rent amount is the major determining factor in the lease agreement. The rent amount should reflect the actual market value of the property. Therefore, a professional valuation of the property can be conducted to determine an accurate rent amount. The agreed-on figure should be indicated in the farm lease agreement.

Duration of lease

The duration of the lease (lease term) is the period of time during which the lessee will be able to use and occupy the property. It usually ranges from one year to several decades, depending on the arrangement between the landowner and the lessee. Therefore, the agreement should be worded clearly in accordance with this period so as not to cause any legal disputes after the expiration date.

General terms of the lease

It is important to state the general terms of the lease agreement in order to serve as a reference in the event of a dispute relating to any of the terms and conditions stipulated. The terms cover a wide range of aspects ranging from the term of the lease, permitted land uses, rights retained by the landowner, implied exclusive possession of the property of the tenant, contractual procedures for inspection, repairs to issuing notice, etc.

Some of the lease terms included in agreement are:

- Access: The agreement should include the terms and conditions that govern the lessor’s access to the property. For example, when can the lessor enters the property, and which access areas should they use?

- Amendment: The document should indicate the appropriate procedure for amending it. The reasons that justify the amendment should be limited to certain situations in order to avoid misuse. Most land-lease agreements warrant the amendment to be in writing.

- Choice of law: The documents should stipulate under which law the agreement will be enforced. The law in question should be the same jurisdiction as the land.

- Disputes: It is important to include the process of dispute resolution in the agreement. The affected party can initiate grievances and arbitration processes before resorting to legal action.

- Facilities: The agreement should include the details of the facilities provided by the lessor to the lessee at no additional cost. The facilities may be parking space, playfield, etc.

- Gate requirements: The lessor can issue any gate instructions necessary. For example, when they should be fully closed, which gates not to leave open, and reasons for such requirements.

- Government regulations: The lessor should state the government regulations governing the property and what measures must be implemented to comply with these regulations. The farm lease agreement must also indicate the party responsible for observing such regulations.

- Improvements: The agreement should state any improvements and alterations on the land that the lessee can make on the property. The document must also state if the lessee has to seek permission from the lessor.

- Insurance: The lessor should indicate which party is responsible for insuring the property, what insurance policies must be in place, and who covers any claims resulting from accidents, injuries, or maintenance work on the land.

- Liability: The agreement should clarify whether the lessee requires liability insurance. It must also state if the lessor will be exempt from certain liabilities and which liabilities those will be.

- Maintenance: The agreement should state the responsibilities of both parties in case of any maintenance work on the property. In addition, the lessee’s duties and responsibilities toward maintaining the value of the land must also be clarified.

- Mineral or subsurface rights: The lease agreement should include any mineral or subsurface rights of the property the lessee is awarded. The parties should also state the appropriate method for addressing such disputes in instances where such rights are at play.

- Mortgages: The agreement must state whether the mortgage is permitted on the leased property. The mortgage details include the purpose and duration of borrowing.

- Permits: The lessee and lessor must agree on who is responsible for acquiring any permits/approvals and what happens in the event of failure to acquire them.

- Subletting: The agreement should indicate whether the lessee will be able to sublease or lease out the property. In addition, the appropriate procedure for subletting should be provided.

- Utilities: The agreement should mention whether the lessee will be responsible for buying and maintaining any required utilities, including power, water, sewage, etc.

- Severability: The lease agreement should clarify that in the event of any conflict between individual provisions of the farm lease agreement, the entire agreement will not be affected but only the mentioned conflicting provision.

- Surrender: The document should have a section stating under what conditions the lessee will be required to surrender the land at the end of the lease term.

- Taxes: The agreement should state whether taxes must be paid and who is responsible for paying them. Taxes can be local, state, or federal taxes. The agreement should also contain provisions on when payment of any additional taxes is due and what happens in case of late payment.

- Use of motorized vehicles: The farm lease agreement can also stipulate the terms under which the lessor can use motorized vehicles on the property. Examples of motor vehicles that can be regulated are all-terrain vehicles, four-wheelers, etc.

Land use

The lease agreement should stipulate that the land will be used for certain activities, including farming, stock rearing, and timber cutting, among other uses, in consideration of no rent or a lower amount. The document must also show any applicable conservation plans such as soil conservation practices, pesticide and fertilizer application limitations and limitations in terms of changes to the property and its resources such as trees.

Security deposit

A section that addresses matters regarding the security deposit should be provided. A security deposit is any money paid by the lessee to the lessor at an initial stage to guarantee that the lease agreement will be upheld. The lessor can determine the security deposit amount which should be returned to the lessee if all lease contract terms are met. However, in instances where there is a breach of any term of the agreement, both parties must agree on how to use these funds.

Payment and due dates

The agreement must state the amount and procedures of any rent, including payment dates, procedures, and any penalties for late payments. Rental rates can be determined based on acreage, land size, land use, the productivity of parcels, or any other arrangement.

Termination

The document must clearly state how termination will work, whether it is automatic by a certain period, will involve any notice periods, or require any reason to initiate termination proceedings. Therefore, the agreement should clearly state any notice requirements applicable to both parties and the process to be followed in case of termination and what would lead to this action.

Signatures

Lastly, a section that stipulates all the signatures that are required for the document to be authenticated and legally enforceable must be provided. Typically the lessor and the lessee should sign the lease agreement.

Types of Land Lease Agreements

Leases are contractual documents that serve as proof of the parties involved in an agreement to transfer the rights and responsibilities over a piece of land. Such agreements do not transfer ownership rights but instead only involve certain rights over the property, including building houses or using the land for farming. Therefore, two types of these lease agreements are commonly used by landowners.

They include:

Subordinated land lease agreement

This type of agreement is used to grant the lessee the right to use the property title to secure a leasehold mortgage or funds to make land improvements. With this provision, the landowner can ask for higher rental rates due to the risk involved since should the lessee default on the mortgage or loan, the landowner stands to lose their property through foreclosure.

Unsubordinated land lease agreement

This agreement prohibits the use of the title to the property for leasehold mortgage. As a result, this type of agreement is less risky for landowners and beneficial in that should the lessee default on their construction loan, land improvements are typically transferred to the landowner, and the land’s market value goes up. Consequently, the landowner is expected to charge a lower rental fee as he or she bears little to no risk.

Consequences of Not Using a Lease Agreement

Not having this agreement in place can result in misunderstandings between the lessor and the lessee since there is no reference tool to determine what was agreed on between the parties. More so for third parties who were not present when the parties agreed on leasing the land. This can result in the landowner assuming unwarranted liabilities resulting from the tenant’s actions or agreements with third parties.

Without a farm lease agreement, there won’t be a defined framework for resolving disputes in the future or in a court of law. Courts are known to value written agreements over verbal or handshake agreements. In addition, a lease agreement avoids interpretation issues hence helping judges make decisions.

Additionally, without an agreement in place, it becomes difficult for the landowner to have a reliable income source, with rental rates for farms being lower than that for houses. This will lead to greater chances of experiencing financial setbacks and bankruptcy in the absence of a steady income source.

Without a land lease agreement, there is no structure or system on what rights and responsibilities are to be shared, amount of rent to be paid, due dates, consequences of breach of contract, etc. As a result, it becomes significantly difficult to hold parties accountable for such obligations should they not be done at all or in a timely manner.

Frequently Asked Questions

The value of a land lease is the price a willing buyer would pay to acquire the lease on the property. To ascertain this value, professional evaluators are hired to determine the projected lease rate, escalation schedule, and terminal value before discount. The discount rate will typically depend on the risk profile of the projected cash stream (the project of the lessee). Based on these factors, the tenant thus pays equivalent rent or other compensation to use that property for some period of time.

Land lease agreements help the lessor and lessee avoid real estate taxes that would be incurred should the parcel have been sold. Land leasing also helps the lessor earn income from their land without giving up their ownership.

A tenant benefits from the agreement because it is more affordable as they do not have to raise high start-up capital, as would have been the case if they were to purchase the land. Additionally, the lessee can gain access to prime lands that would nearly be impossible to purchase upfront through land leasing.

Several factors will influence the rental rate of a land lease. These factors include area demand (competition), potential returns on investment, land quality or yield potential, slope and erosion potential of the parcel, available facilities and utilities, and previous history between the lessor and lessee.