A Single-Member LLC (SMLLC) Operating Agreement is written for a limited liability company having only one owner. It is used as proof of the limited liability awarded to an owner by the LLC business structure, where the company is taken as a separate entity from the sole owner’s personal property/assets. It outlines the owner, manager, registered agent, and other officers’ role in the company.

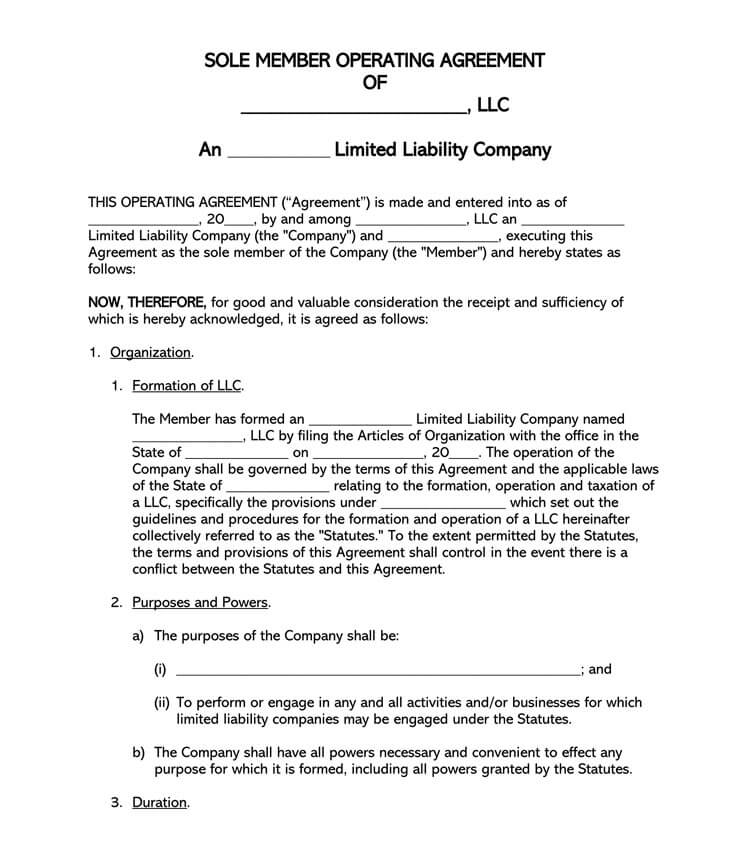

The IRS-adopted definition of a single member is as illustrated:

EXAMPLE

“An LLC is an entity created by state statute. An LLC with only one member is treated as an entity disregarded as separate from its owner for income tax purposes (but as a separate entity for purposes of employment tax and certain excise taxes) unless it files Form 8832 and affirmatively elects to be treated as a corporation.”

A SMLLC operating agreement is basically a guide on how a given single-member LLC is expected to be run. Single-member LLC companies are usually set up as a means of tax planning and for the owner to enjoy the benefits of limited liability that stem from an LLC business structure.

An LLC owner does not pay tax as an entity, as the single-member LLC is exempted from state tax or levy, but rather as individual taxpayers after revenue has been collected and expenses deducted. As a result, setting up an LLC for small businesses, real estate ventures, or any other tangible or intangible income-generating assets is highly recommended. It is important to note that a single-member LLC enjoys the same tax exemptions as a multi-member LLC.

You should have this agreement if:

- You’re an SMLLC that will be seeking future funding

- The state you operate in requires it

- There is a need to separate yourself from the business

- You wish to have an outline of your business operation for investors.

note

To validate this agreement, it is very much recommended that the sole owner sign the document in the presence of a notary of the public.

SM LLC Agreement Templates By State

Single-Member LLC vs. Sole Proprietorship

A single-member LLC, just like a sole proprietorship, ownership belongs to one person. However, unlike with a single-member LLC, in a sole proprietorship, the owner is legally liable to the financial and legal obligations of the business. An LLC shelters the owner from the financial and legal obligations of the company. To expound on this, here are several differences prevalent between a Single-member LLC and a sole proprietorship.

Characteristics of the two entities include:

| Single Member LLC | Sole Proprietorship |

| One can hire employees. | It is not allowed to hire employees unless the proprietor gets an Employer Identification Number (EIN). |

| The LLC acts as a separate entity. | The company does not act as a separate entity from the owner. |

| An LLC can create bank accounts. | Can only open bank accounts under a DBA or using a personal name, say that of the proprietor. |

note

To note is that LLC businesses are required to pay an annual fee across all the states in the US. However, they may vary in amount.

Advantages of Having a Single Member LLC

As a single owner/member of an LLC, a SM LLC Operating Agreement can be very important to you and your business. Even in situations where you are not officially required by the state to have one.

Some of the merits of having one include:

Prove separation

This agreement is an official proof that, indeed, the single-member LLC is a separate entity from the owner’s property/assets. This will always come in handy should the company have to deal with debt or litigation. The owner’s assets cannot be confiscated to settle the company’s financial or legal matters.

Define dissolution/succession

Through this agreement, the owner can outline how they wish the company’s assets and liabilities should be distributed should a time come when dissolution must be implemented. It also declares how ownership and management should be transferred in the event of the owner’s death, thereby reducing disputes.

Increase credibility

It increases your LLC’s credibility. When evaluating your company’s potential for investment, investors will often review the agreement, and its availability can go a long way in influencing their decision. Additionally, banks often request for this agreement before single-member LLC owners open a bank account or acquire investment loans.

Determine the rules

In the absence of this agreement, a single-member LLC business is governed by the state laws governing LLCs where the company’s articles of organization were filed.

How to Form a Single Member LLC

An operating agreement should delve into the business purpose, operations/management, and the business’ finances. It should be detailed and comprehensive. Remember, it is reflective of your company’s structure and mode of operation. To make it as effective as possible, including the information below can ensure that this is possible.

Search for duplicate names

Before registering a company, the initial step should be to search for a suitable name and one that is not already taken.

- Search the name of the LLC- To ascertain this, one searches their company’s name in the official State business database. Normally, at your Secretary of State’s office, you can do this as entities have to register with them. It is often done online at the office’s portal.

- Name reservation- Once you settle on a name and establish it does not match that of another company, corporation, or partnership, you ought to reserve it for use. This is usually at a small fee. Name reservation is made for 30 to 120 days, depending on the State.

- Trademark Office (USPTO)- Additionally, a person should check if their adopted business name has been trademarked. This is done by conducting a search in the USPTO Trademark Database. If a name is trademarked, a person cannot use it for the specific use it is trademarked for.

Complete articles of organization

Filing for the Articles of Organization is the formal application for registering a company.

This service is offered online in most States and addresses the following information:

- The effective date, that is, the 1st day of business.

- A request for the “Certificate of Status,” which could be an official document or seal.

- An LLC Name – the selected company name must end in either “Limited Liability Company” “or “LLC.”

- Name of manager(s)

- Name of officer(s)

- Purpose of Business

- Registered Agent – who is a representative of the Company/LLC. This can be the owner, but one is recommended to use legal counsel as their representative.

This information can be categorized into the following sections:

- Company details- Details such as the official name, the Principal Place of Business (main office), mailing address- Could be the address of the principal office (head office) and the purpose of the business.

- Business purpose- Outlining the purpose of the business is another critical factor to have in the agreement. One may have already written this up for a business plan.

- Registered agent and office- Most U.S states will require a registered agent, which is someone one has designated to be the recipient of official documents on your businesses’ behalf. It’s essential to check if the state requires a registered agent. Otherwise, one may incur penalties or, even worse, be prohibited from doing any business.

- Ownership- As this is a Single-Member LLC, you are expected to be the sole owner. This is declared and the fact that the sole owner has 100% voting rights within the LLC.

- Management- Being the sole owner, you decide if you plan on managing the company yourself or delegate the responsibilities to other managers. You should state the management structure expected in the LLC; this should be accompanied by the responsibilities assigned to each manager. Also, a successor has declared if the sole owner passes on.

- Contributions and distributions- These are in terms of capital, which includes cash, property, and any other assets. As the sole owner, one should outline how much capital they have contributed towards the LLC. One should also include how they plan to distribute the profits and losses made by the company.

- Governing rules- The owner should outline the basic rules they would like to run their business on, for example, company policy, decision-making, meetings, and voting. Also, one should declare the State whose laws are applicable to govern the LLC.

- Adding new members- One may be the sole owner of your business, but could find the need to appoint other people, such as a manager, to help run things. Make sure to list their responsibilities and duties.

- Financial aspects- Two key financial aspects to include in the agreement are how much financially one will put into your business and how one is going to be paying oneself. The first is essential if someone is going to be looking for people to invest in the company, as well as when it comes time to file taxes.

Getting paid will also be necessary for personal tax purposes to separate your business taxes from your taxes. Defining how one will be paying oneself is essential. - Dissolution- One should also have a plan in place that should be chosen to close, or dissolve the business. For this part, lay out what should be done with the business if the owner passes away or is not able to run it any longer.

- Signature- This process is officiated by having the sole owner sign the document (s). It being a Single-Member LLC, signing should be done in the presence of a notary public.

Filing Fee

Every state charges a fee to register an LLC; it ranges between $50 to $800. Payment can be made online or simply by sending a check to the applicable office. This will mark the end of the registration process. It takes between five to thirty days for the whole process to finalize.

Write a SMLLC operating agreement

The agreement will highlight how ownership of the LLC is held. It also directs on how succession would be distributed in the event of the death of the owner. This way, disputes are avoided as no one other than the declared party has a claim to the company. Verbal promises would not hold if the agreement were available in writing.

Get an EIN

Once all the highlighted steps have been completed, one should then obtain an Employment Identification Number. EIN is important for processes like the opening of bank accounts and filing for taxes. Acquiring an EIN is free and is normally fast, taking around 15 minutes to complete if done online, a bit longer if the application was via mail. The two processes are as follows.

- Online Application – www4.irs.gov/modiein/individual/index.jsp

- Mail-in – IRS Form SS-4 (instructions)

Standard SM LLC Agreement Template

Frequently Asked Questions

Yes. An operating agreement is used to show the business structure and outline how the owner is protected by having limited liability to the financial and legal obligations of the company. It is not a legal requisite document but either way a very important document in running an LLC.

You may need to provide your agreement if you are applying for business financing from a lender, purchasing real estate for the business, a lawyer, potential partners or investors of the company, or for financial assistance services.

Some states will require you to have this agreement, and in other countries, it won’t be a legal requirement. Either way, it’s beneficial for you to have one in place. Are available in all 50 states.

The consequences of not bearing this agreement when running an LLC are evident should unprecedented events like litigation, dissolution, or death occur. Without an operating agreement, proving that you and your personal assets are separated from the company would be hard to prove if there is no written evidence. It also outlines how processes such as dissolution and succession should be handled..

Key Takeaways

A Single-Member LLC is an LLC business with a single owner and usually with a hundred percent voting rights. An LLC protects the owner from any financial and legal obligations of the company. The owner is taxed based on the income generated from the business after expenses have been deducted. A Single-Member LLC (SMLLC) should have an operating agreement that outlines sole ownership of the company plus responsibilities of people involved in running the company, such as managers and officers. A Single-Member LLC Operating Agreement contains the owner’s name, company details, governing rules, principal place of business, and official information relevant to the LLC.