An operating agreement is the rules of your company. It’s an internal document that outlines how the company is managed on both an operational and a financial level. It describes what your business is, how financial decisions are made, how you and your members are paid, and how taxes are handled.

A Multi-Member Operating Agreement is designed for companies (LLCs) with more than one owner.

The use of the multi-member LLC operating agreement is highly recommended, as it is the only written document that entitles the owners of a company and what percentage of the company they own. Unlike corporations, Limited Liability companies are not owned by shares nor described as a percentage. Individuals (members) own them. An LLC can be owned by a single person, multiple people, a corporation, or even another LLC.

The multiple-member LLC operating agreement should be signed in front of a notary citizen with copies of the document presented to all the individual owners of the limited liability company. At least one original copy of the document should be retained at the company’s principal office address, mainly with the Secretary of State or any Government agency.

Agreement Templates By State

What an MMLLC Covers

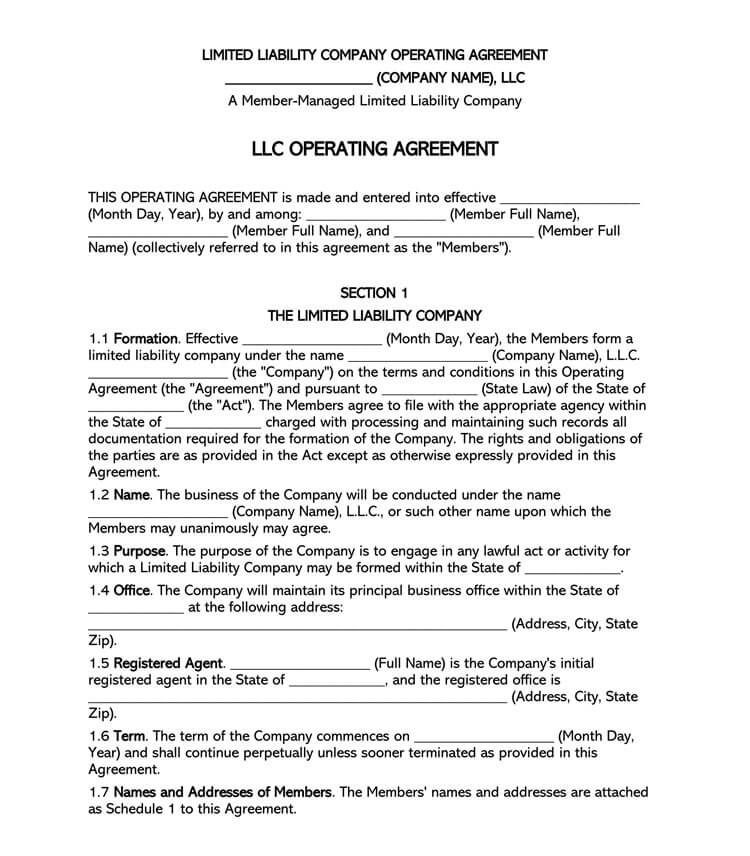

A multi-member LLC operating agreement is a legally binding company guide that contains the agreed-upon member structure, ownership, and regulations that all members are bound by. While the document is rarely required by state laws and does not necessarily need to be filled alongside the rest of the documentation, it is still a critical step in creating a limited liability company. The document serves the vital purpose of keeping the company operating smoothly and efficiently, with lesser misunderstandings and disputes among members.

The structure of an LLC operating agreement varies depending on the company. As such, there is no single approach to drafting the operating agreement. However, typical operating agreements include the following basic provisions:

- How the LLC will be managed

- Buy and sell provisions: What happens if a member wants to sell their part or if they die or become disabled

- The interest in percentage that each member holds in the business

- The voting power of each member

- The rights and responsibilities of each member

- The allocation of profits and losses

Importance of the MMLLC operating agreement

Some states necessitate business owners to file an operating agreement as part of the LLC formation process. However, in some other cases, only LLCs with more than a single member are required to have an operating agreement. Whether or not it is a state requirement to file an operating agreement, the form can be beneficial to an LLC as listed below:

- Allows owners control of the business- Several aspects of an LLC may be subject to State Laws or Default Rules without an operating agreement. State Laws/ Default rules act as a standard operating agreement for a limited liability company with no operating agreement of its own.

- Precise details of the business arrangements- An operating agreement provides members with clear details of the business structure. Given that all members have a clear understanding of the limited liability company’s procedures and rules, there is no likelihood of misunderstandings and disputes between members.

- Personal liability protection for owners- Without an LLC operating agreement, members can be vulnerable to personal liability if they seemingly operate the company like a sole proprietorship or simple partnership. This gives the owners more legitimacy in the eyes of customers, lenders, or even competitors.

Multi-Member LLC vs. Single-Member LLC

Although the main difference between a single-member LLC and a multi-member LLC may be obvious- a single-member LLC is owned by one member, and two or more members own the multi-member LLC, these variations of the LLC business structure have other nuances that should be considered. A single business owner may decide to form a multi-member LLC, while several people might choose to form a single-member company.

For instance, an individual with a single-owner business might form a multi-member LLC and choose their spouse or child as a member. If business partners or spouses own several properties as two separate LLCs, they may as well decide to form a multiple-member LLC that owns the two separate LLCs, therefore allowing them to evade filing separate tax returns.

Remember: Taxes are similar for single and multi-member LLCs.

In both cases, members report all profits and losses and pay taxes on their personal income tax returns. With a multiple-member LLC, each owner will pay a portion of the LLC’s taxes based on their interest in the business.

There are several situations where you would need to present your MMLLC Operating Agreement:

- To a lender when seeking financing

- To title companies, if you are purchasing real estate for the business

- To tax and accounting professionals when seeking their advice

- To a lawyer when seeking legal advice

- To a potential investor when you are seeking funding

- To a court, if you are in a legal battle

Standard Template

- MS Word

Forming a Multi-Member LLC

Forming and managing a multi-member LLC is not as difficult as setting up a corporation. There are not many formalities required. You only have to fill out the proper documents, pay your fees, get approved by your state and your business is ready to become an official Limited Liability Company. The following steps will see you form your multi-member LLC:

Choose a business name

Before registering your company’s business name, find out if the desired name is still available. You can do this online using trademark search tools. If the preferred business name is still available in your state, then you can proceed. But if it is already taken, then you must rethink a new business name. LLCs do not let more than one business have similar names within the same state.

Visit state’s business division department

Once you have verified your desired business name, you can visit your department of state’s business division and get all the information you need to start the paperwork process. This process varies depending on the state. Therefore, even if you had applied for an LLC, it might be a different process if you have moved to another state.

File your article of organization

The next step involves filing your article of organization, sometimes referred to as a Certificate of Organization. When submitting these documents, you will have to pay a filing fee of a couple of hundred dollars. Information requested and fee amounts payable vary by state. Once you have paid the required amount of money, your state will process the application, and you will obtain your Certificate of Formation via email. This is official proof that you have formed a multi-member LLC.

The article of organization that you file with your business’s state contains the following information:

- The basic details of the entity including the company name, state of incorporation, and the founding date

- A Statement of Intent for confirming the operating Agreement conforms with state laws and indicating that the LLC will be formally established once the required documents are submitted to the state.

- The nature and purpose of the business and a statement to cover possible changes in the future, e.g., “and for any other lawful purposes.”

- The duration of the LLCs’ existence, which can be until the completion of a project or dissolution of the LLC.

- It will include how the business pays its taxes, how profits and losses are handled and distributed to the company’s members, and how much the owners will be contributing to financing the business.

- The procedure for accepting new members into the LLC.

- The name and address of the registered agent and address registered to the business

Entity Classification Election Form (IRS form 8832)

To determine the LLC’S tax status, one must fill in the entity classification election form. If electing S Corporation Tax Treatment, members must complete the IRS Form 2553.

Create an operating agreement

While this is not a requirement for most states, the LLC operating agreement is an essential document that outlines the rules for how the LLC will be run, who has what authority and responsibility, how profits and losses will be distributed among members, and how members’ disputes and disagreements will be settled.

Open a business bank account

Before you start earning money from the LLC or spending money out of business, you will first need to open a dedicated bank account for the LLC. This is crucial because it ensures that the business maintains the “corporate veil” that helps shield members’ personal assets from the company’s liabilities.

Obtain business permits and licenses

Based on the type of business that the LLC will be conducting and its location, various business licenses and permits may be required to operate the business legally. Identify these requirements and complete all the necessary applications. Alternatively, you could consult the Secretary of the State office, county, etc., to substantiate these requirements.

Know the laws

If your LLC has employees, ensure that you follow all the employment-related rules and submit mandatory reports at the state, federal, and local levels. Stay updated with all the required business compliance formalities and make this an ongoing process.

It’s essential to have an operating agreement to protect yourself legally. For example, if a court found you were running an LLC business but had no operating agreement in place, they could legally go after your assets. With an operating agreement, your assets would be protected.

By law, each state requires an LLC to have a registered agent who will be the recipient of all correspondence and communication for the company.

Frequently Asked Questions

As mentioned above, an LLC, whether single-member or multi-member, needs to have a registered agent. The role of a registered agent also referred to as an “Agent for Service of Process, is to handle the communication aspects of the LLC. They need to have an address registered in the state the business operates from.

It may depend on the state you are running your business in. While getting an operating agreement, notarized isn’t a requirement in some countries, and it is a smart practice to do som when you have more than two members.

Multi-Member LLCs are usually taxed as partnerships and do not file taxes or pay them as the LLC. The profits and losses are equally distributed among members, meaning that each member will pay taxes on their share by filling out Form 1040 and attaching it to their personal tax return.

Two or more members can own a multi-member LLC. There is no limit to the number of members in the Entity unless it elects for S Corporation tax treatment, in which case membership is limited to a maximum of a hundred members or fewer.

Final Words

A multi-member LLC operating agreement is an essential document that outlines the ownership and operational structures and procedures of an LLC with two or more members. While it may not be a requirement for forming an LLC in most states, it is still essential as it serves the vital purpose of keeping the multi-member LLC running smoothly and efficiently, with fewer misunderstandings and disputes.