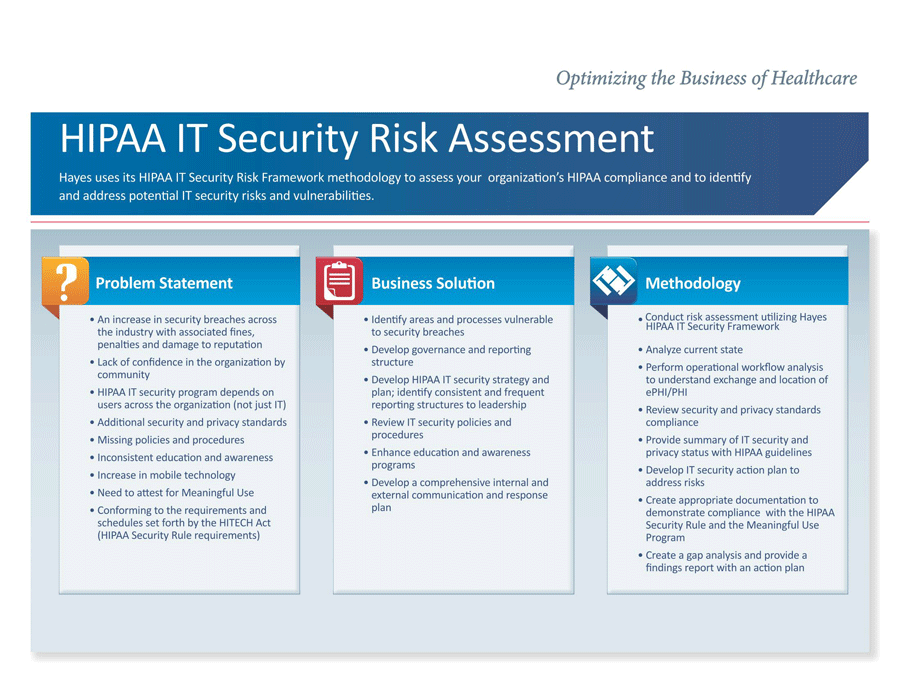

Risk assessment is a continuous process that is used to identify potential risks while establishing ways to handle and manage those risks.

In an organization or company, it is best to have this framework in place as you will be able to identify the risks in your company, analyze them, prioritize and find solutions. It is also important to have a proper risk management process to ensure that you can monitor the situation to avoid any further risks at your company.

In any organization, it is important to have a proper risk assessment process in place. This process is usually implemented gradually and maintained by company employees. That is why; companies need a risk management process that has a formal structure, enough resources for implementation, and is easily understood by the company.

As a company or organization, the chances are that every new project you embark on comes with its own new risks. Since it is impossible to completely avoid them, you need to have a well-established risk assessment process to have a better response strategy when the risks arise. With a risk management process in place, the company is bound to run its operations smoothly.

At times, risks may positively affect the company’s goals and its projects. This will only be possible if the risk assessment process is in place. This way, the company can view risk as a new opportunity or a challenge to do better. With the assessment process, your organization can always find a way to handle any situation.

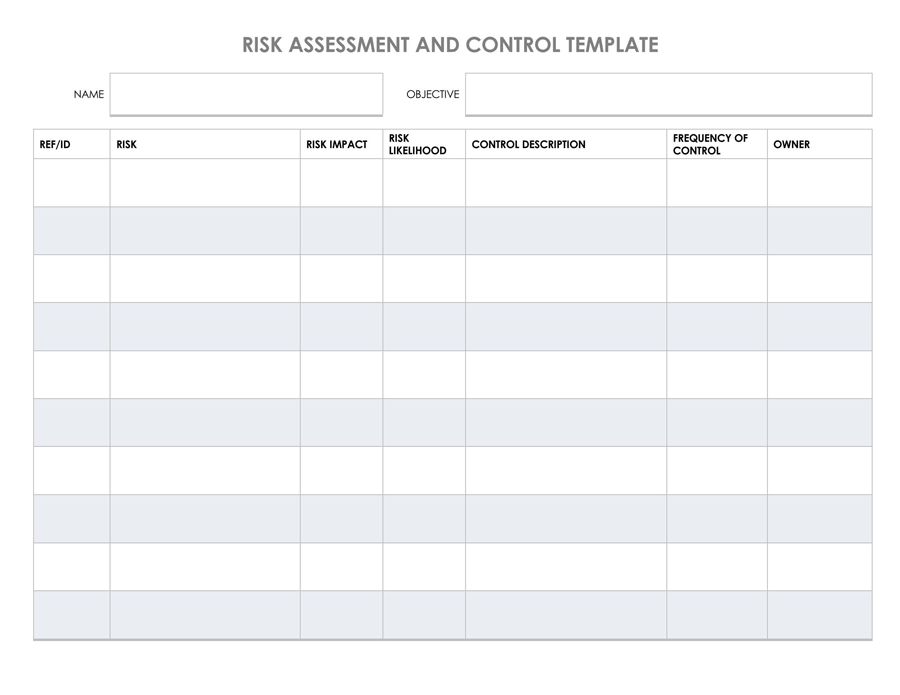

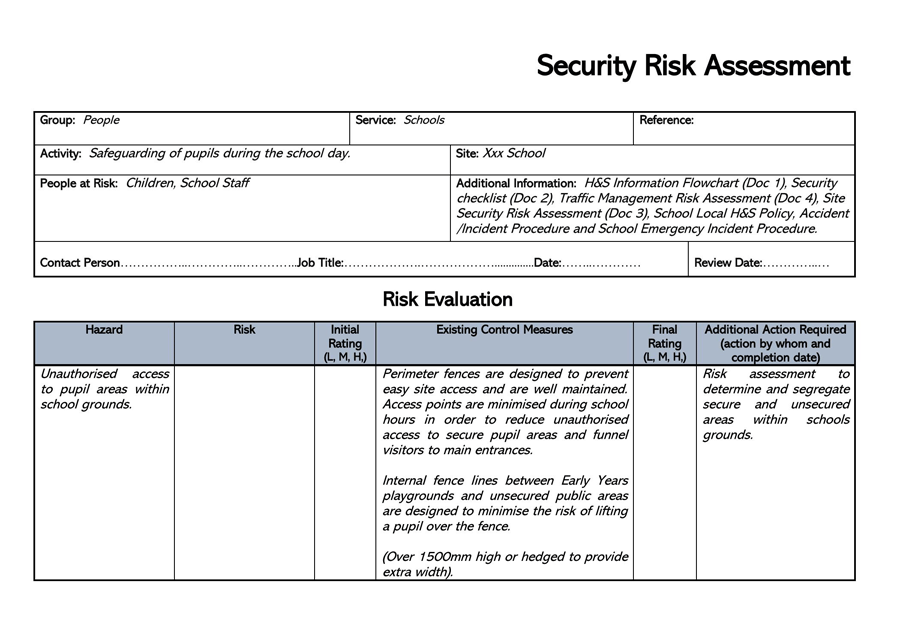

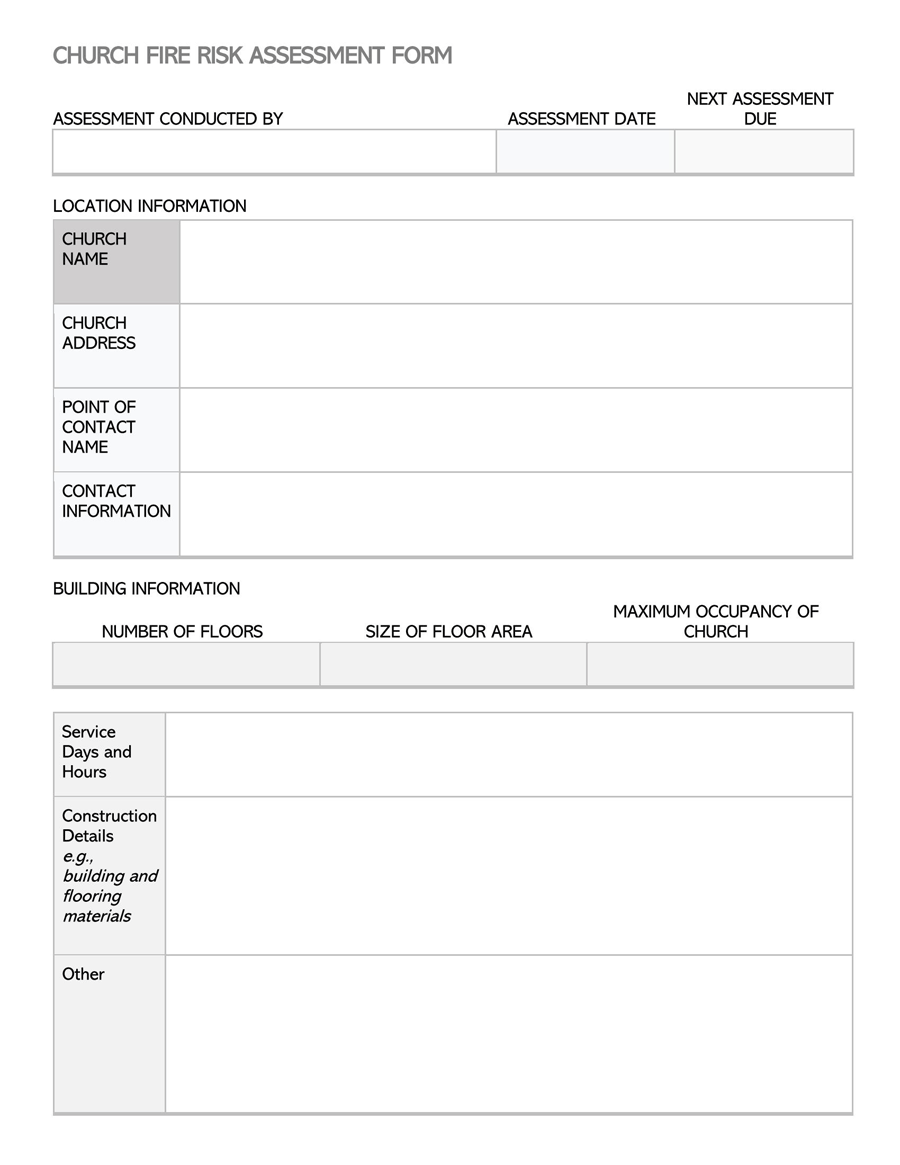

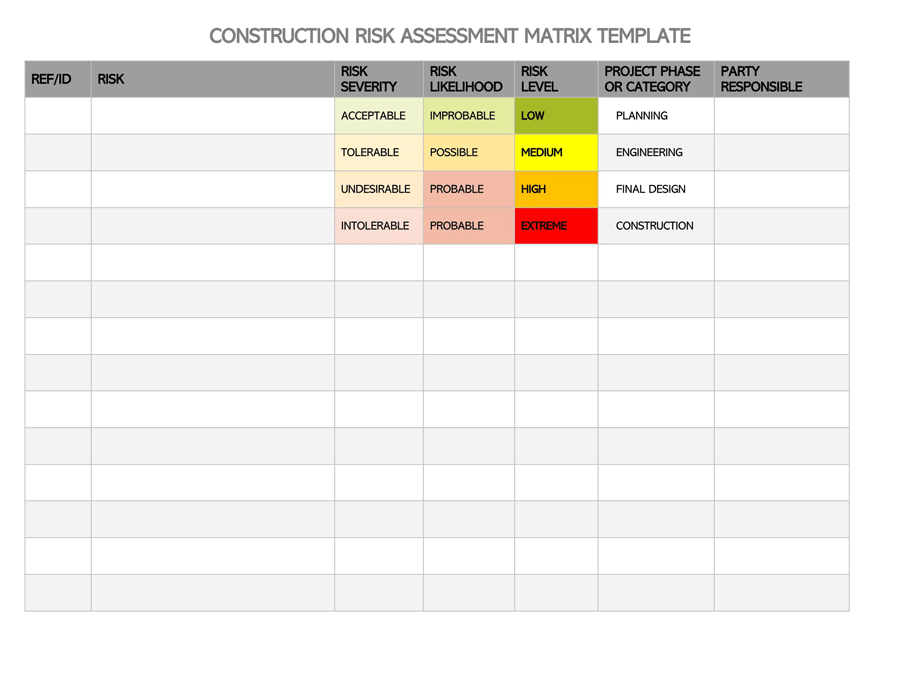

Customized Templates and Examples

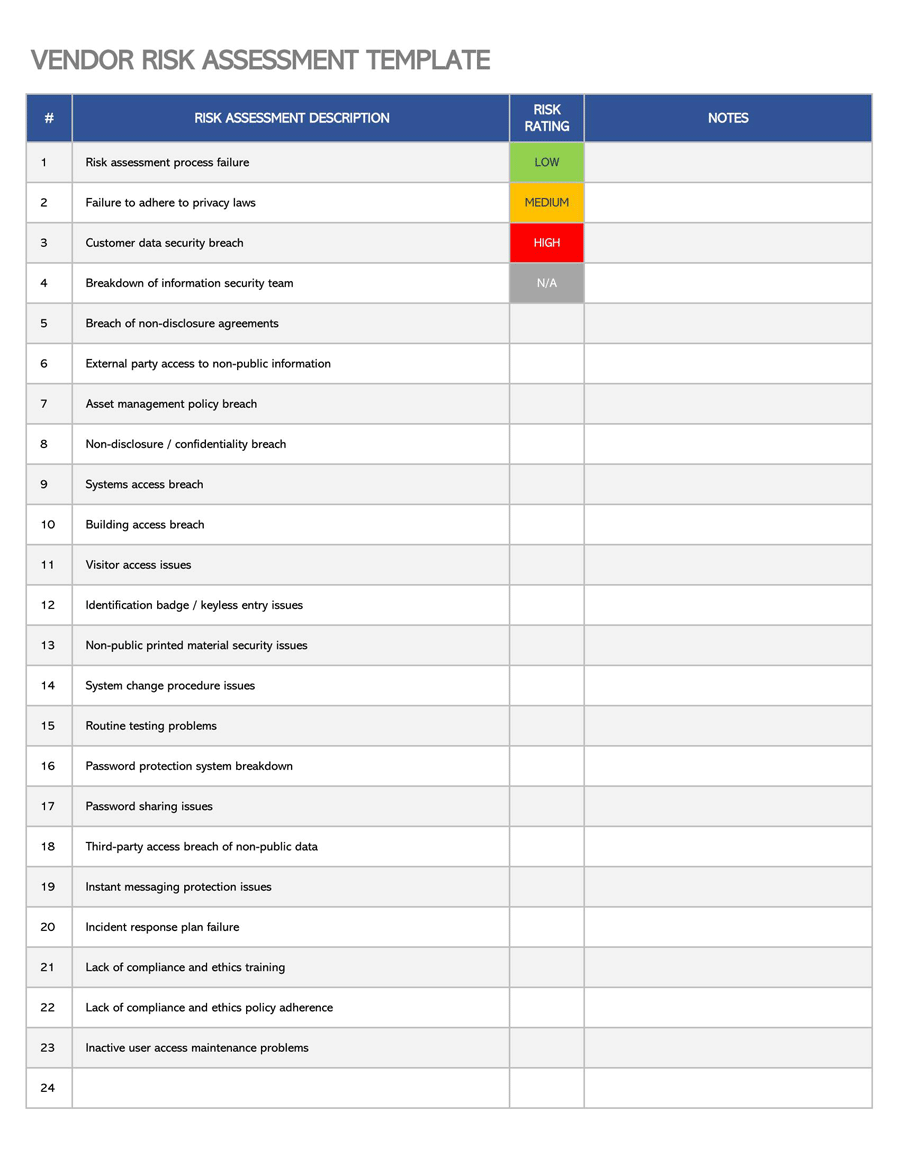

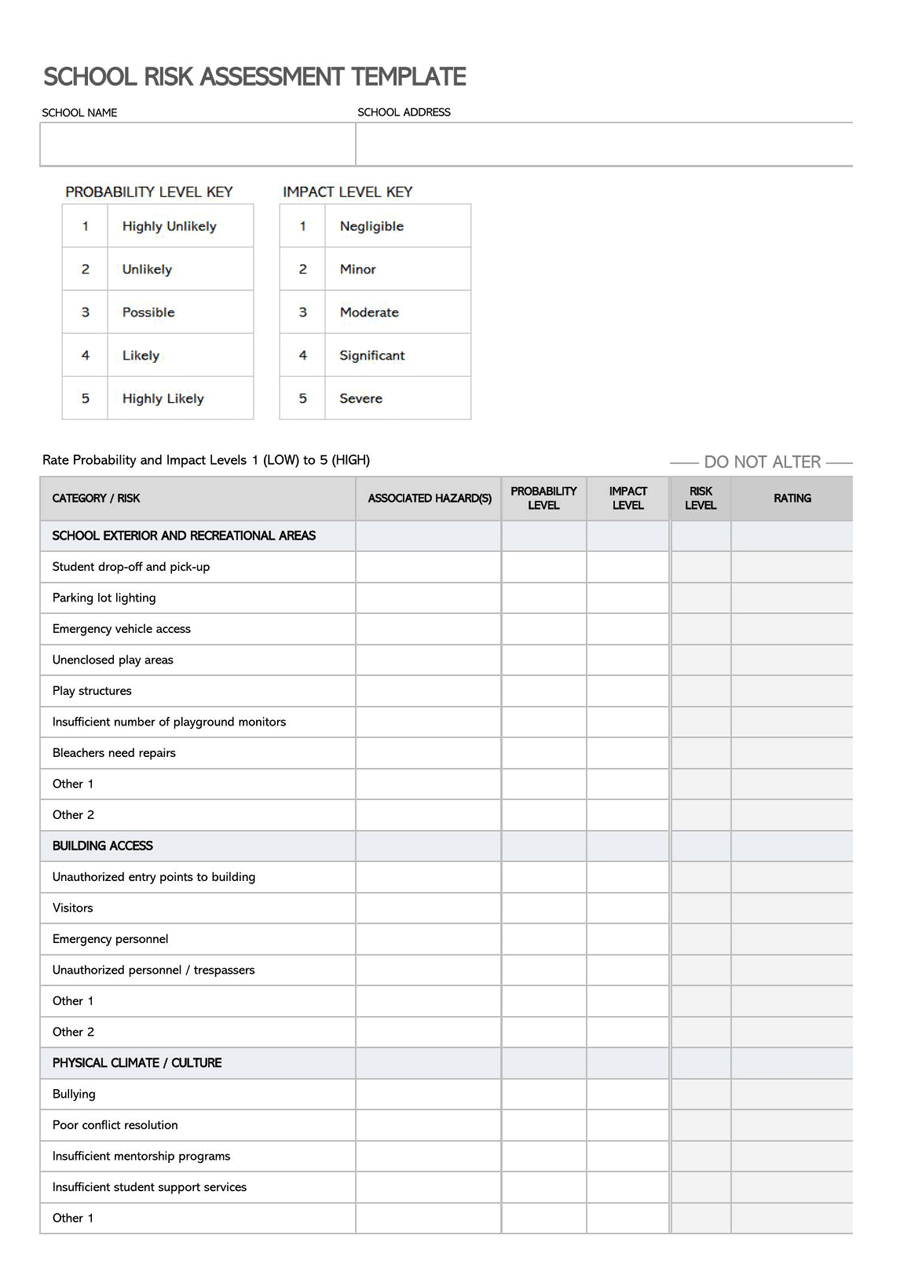

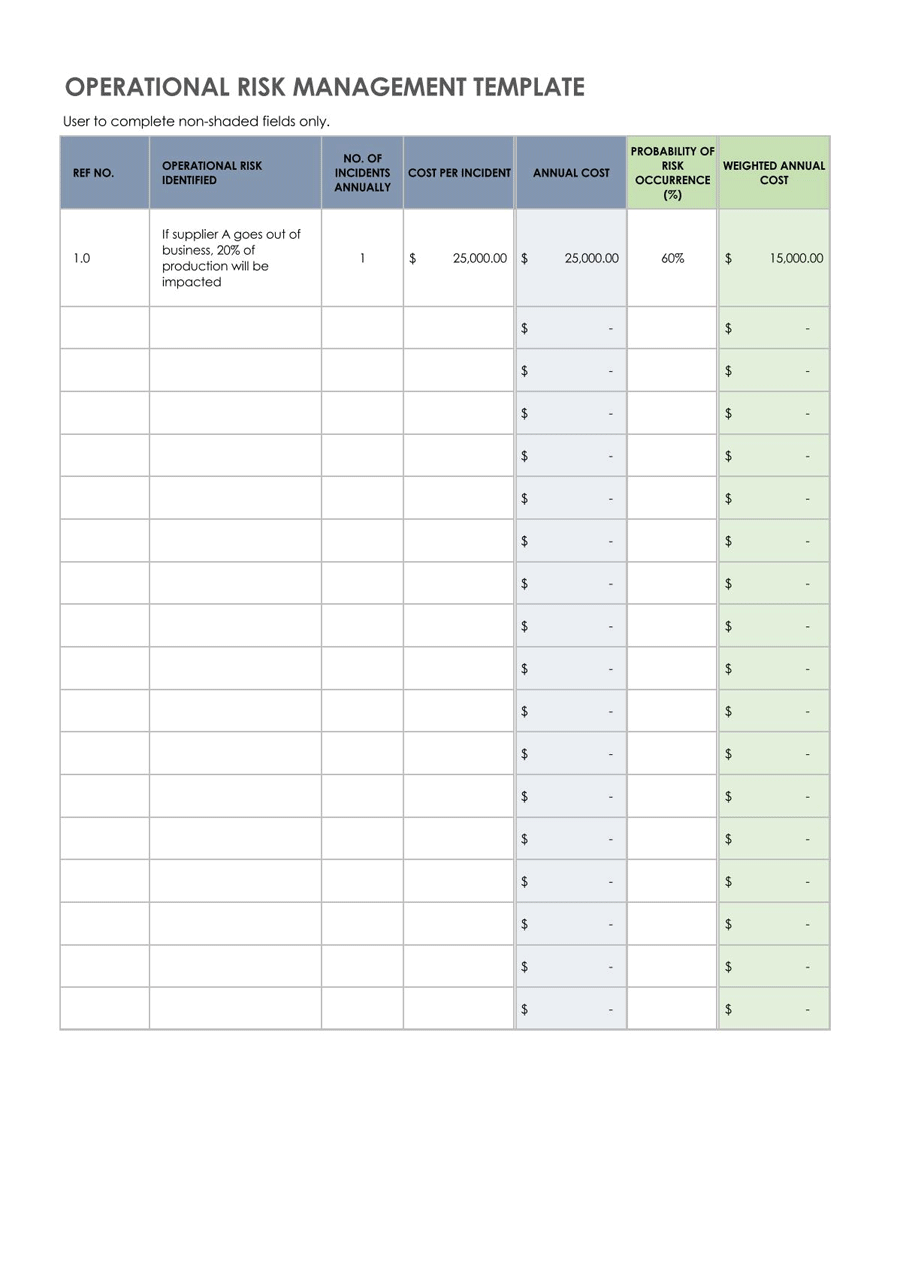

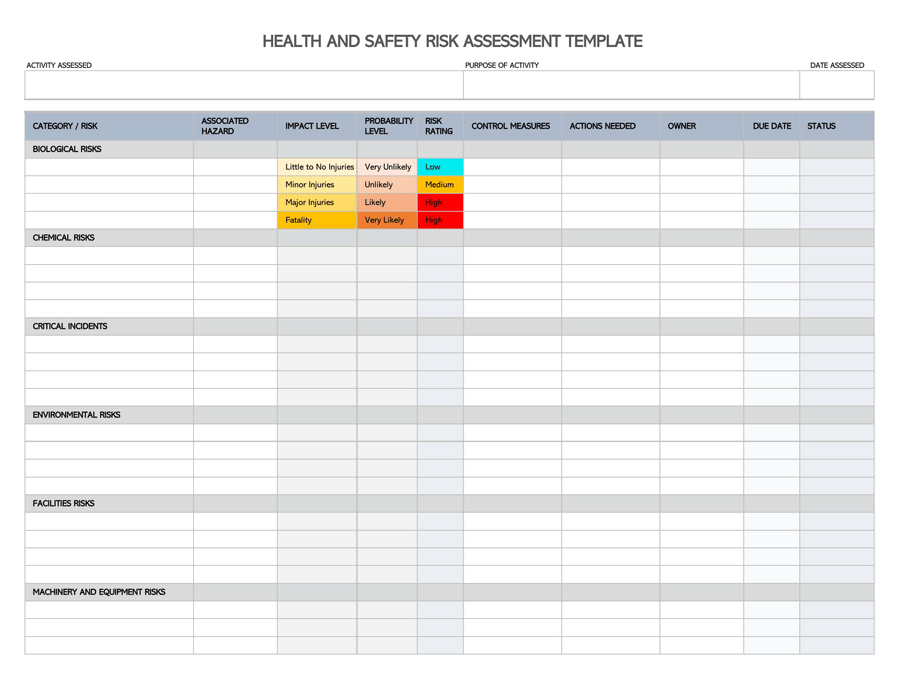

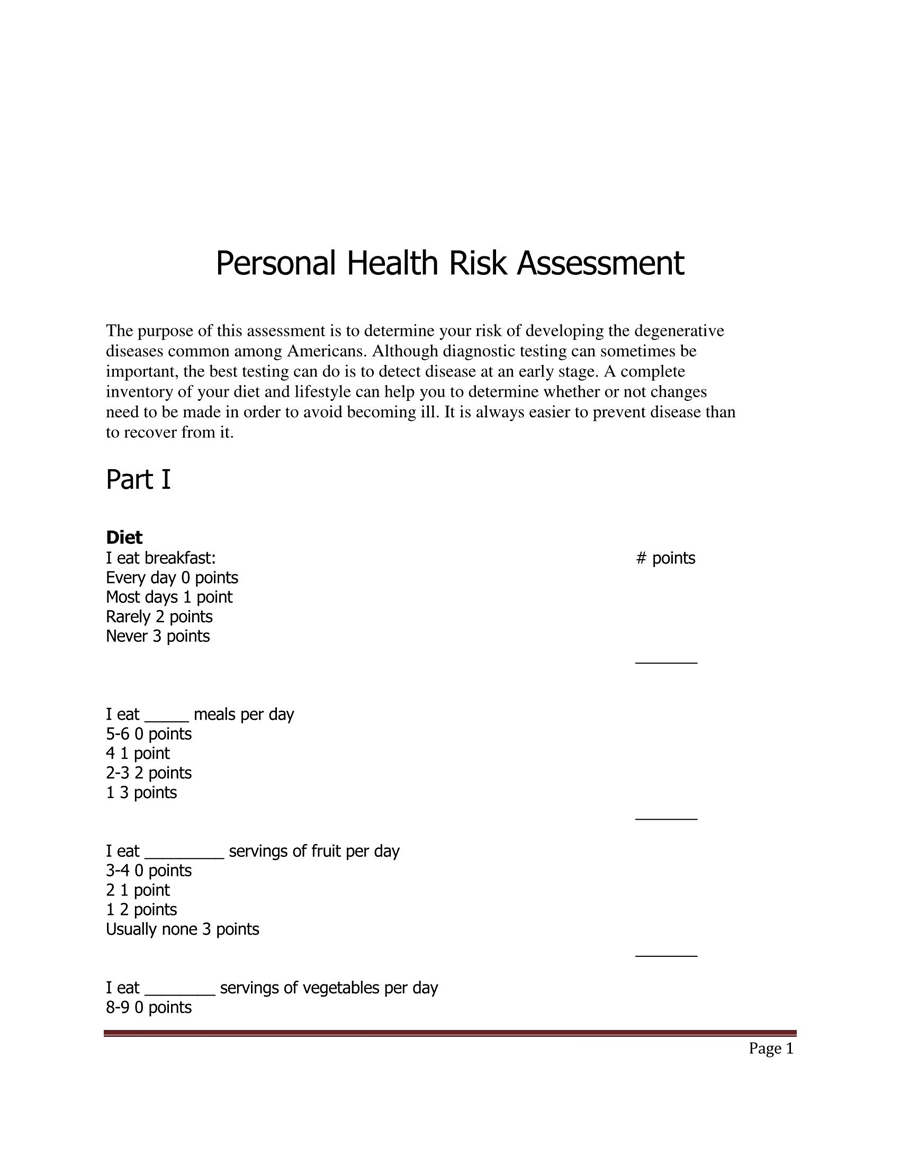

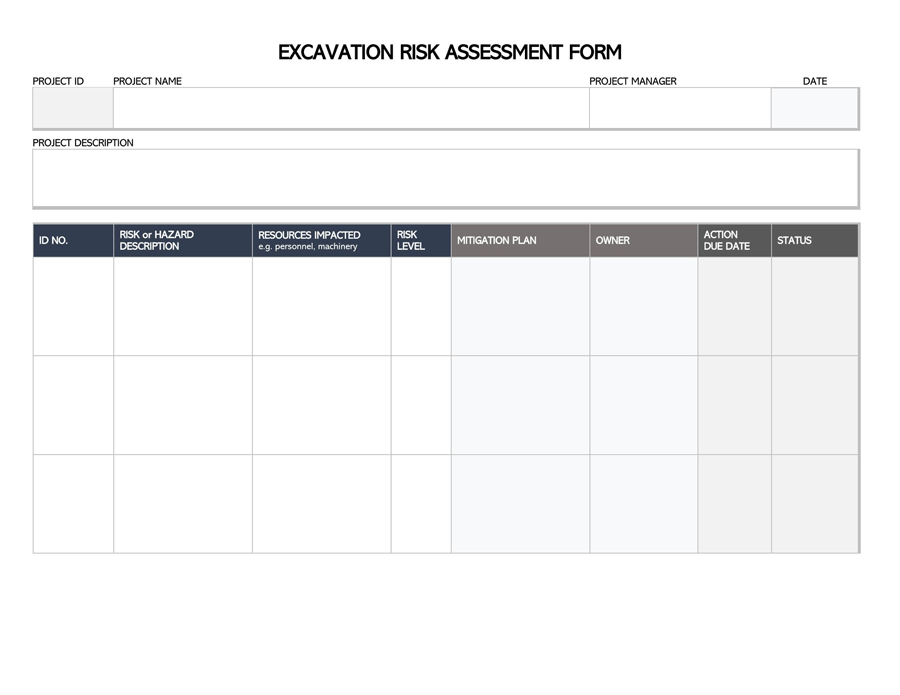

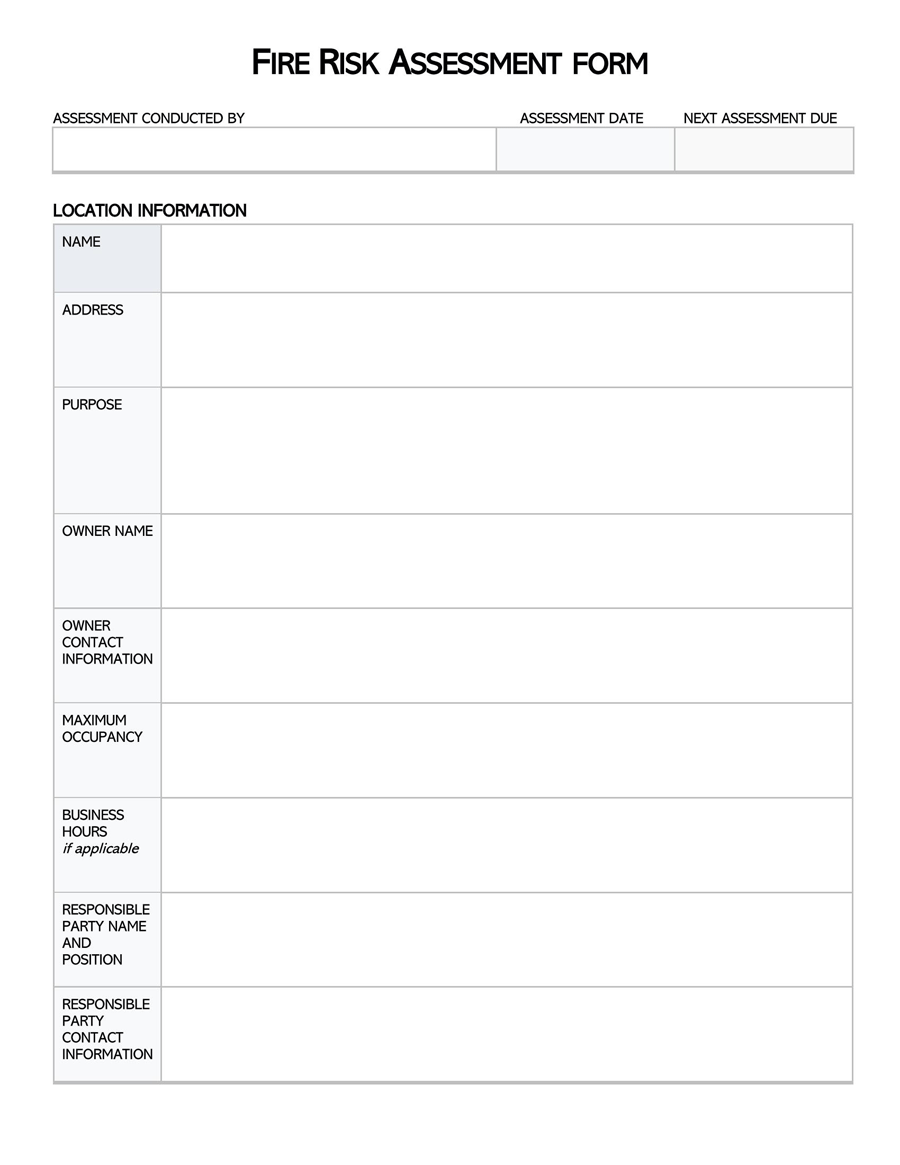

It is a tool used in companies or organizations to help identify and manage risks. With this template, an organization is able to conduct a systematic and effective risk evaluation. As a company, you need to have these templates of risk assesment since they are the most effective tools when it comes to dealing with risks.

You can access various risk assessment templates provided here. They are free and easy to download, making them easy to customize and format in a unique manner. Download these templates and examples of risk assessment today and secure the most effective tool for handling risks for your company.

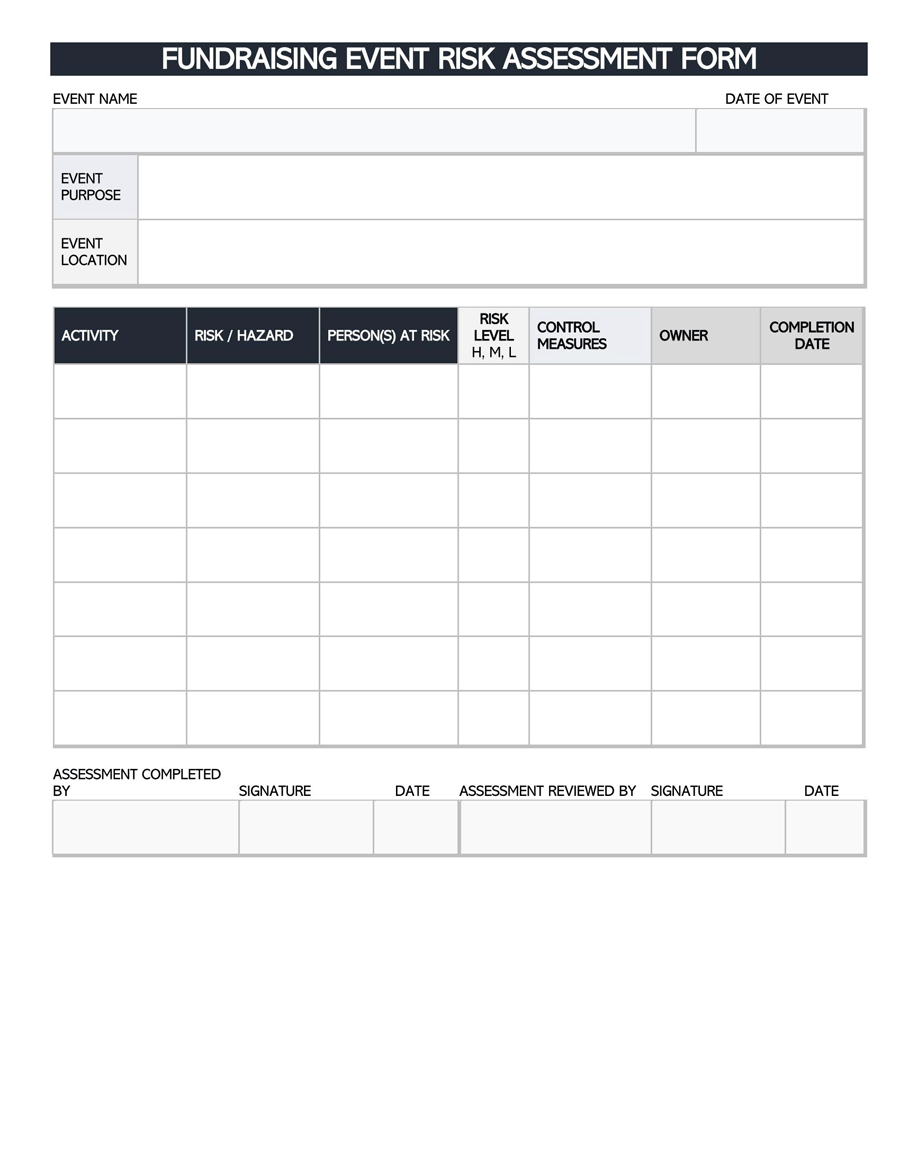

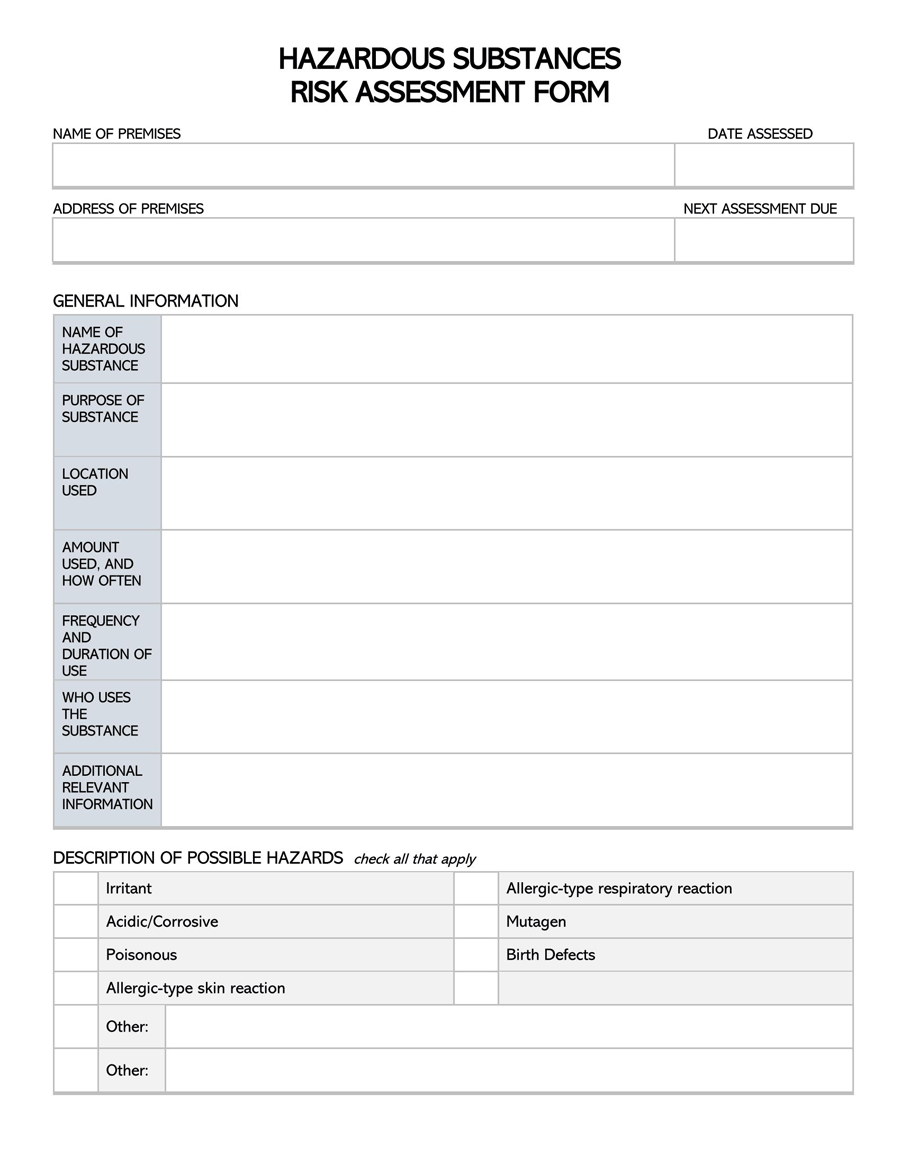

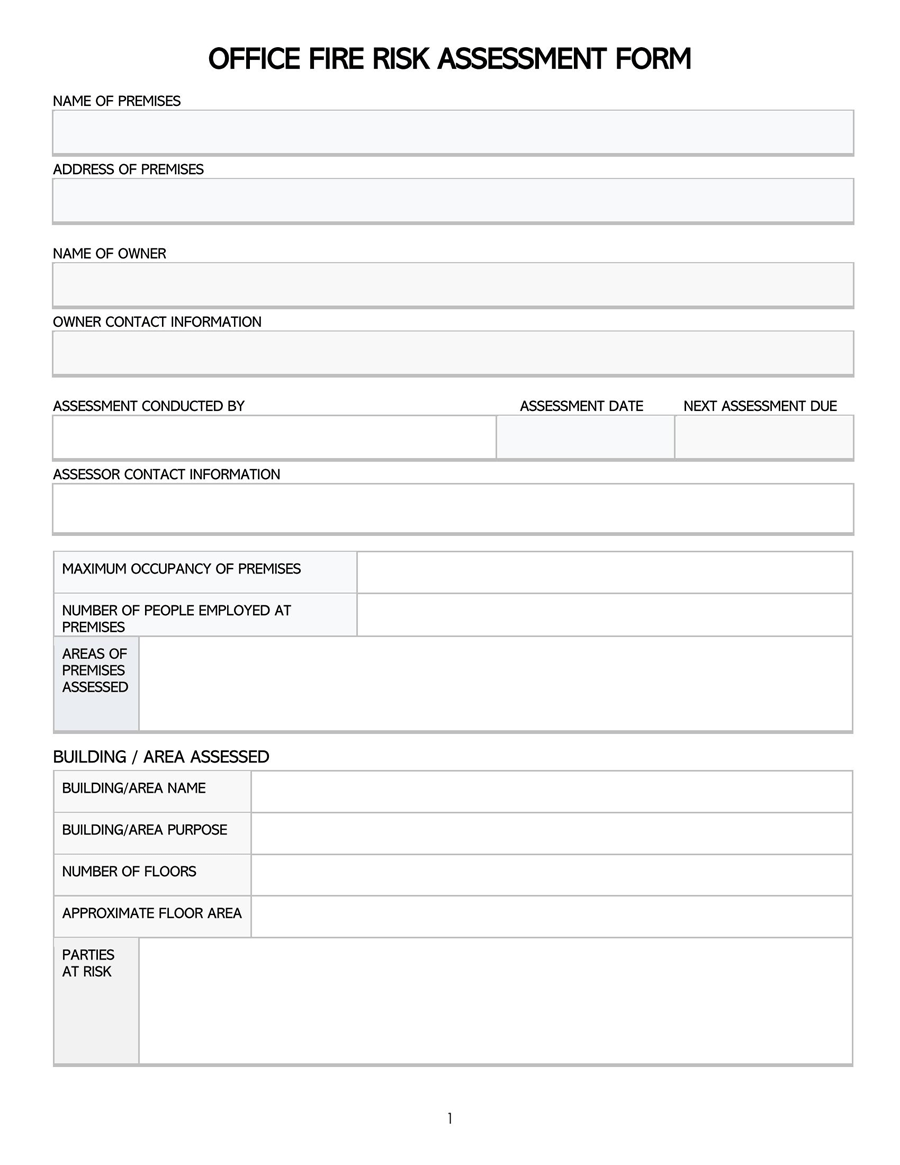

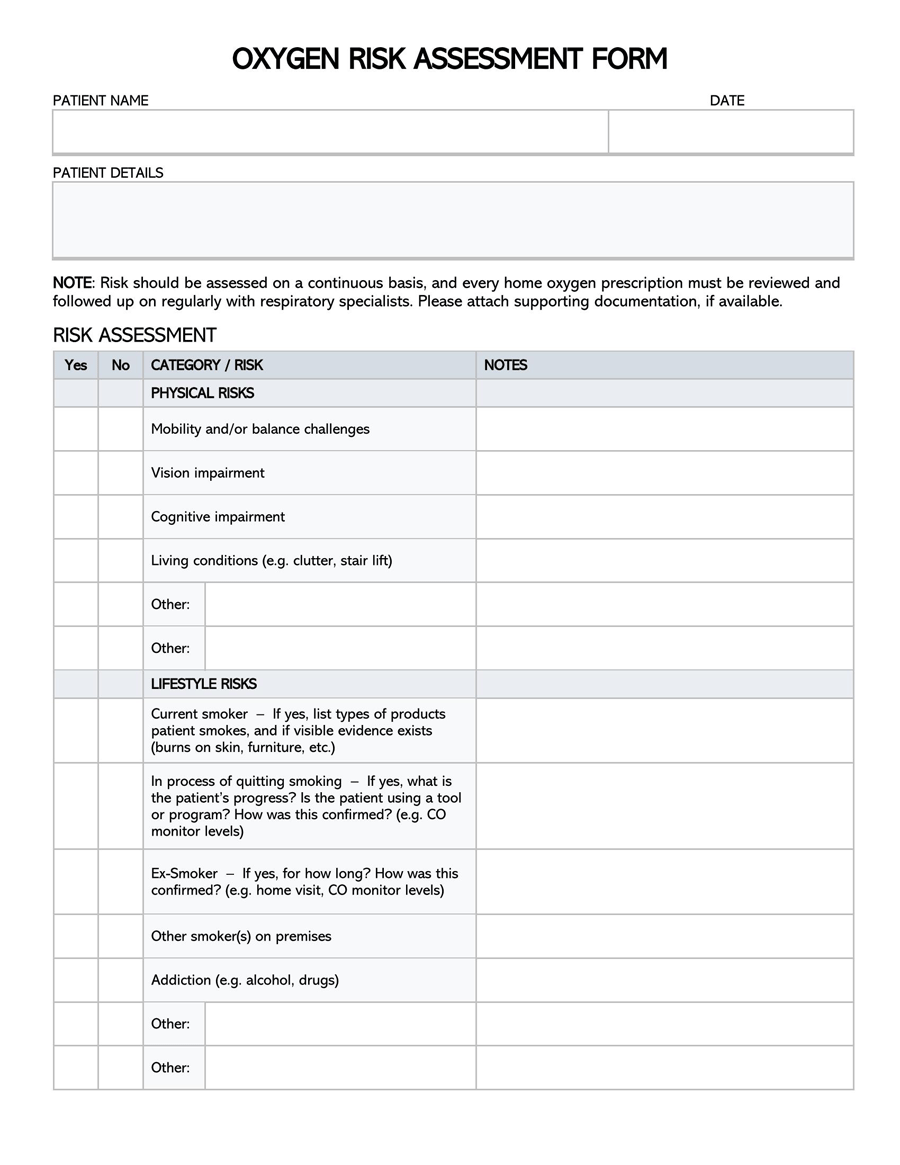

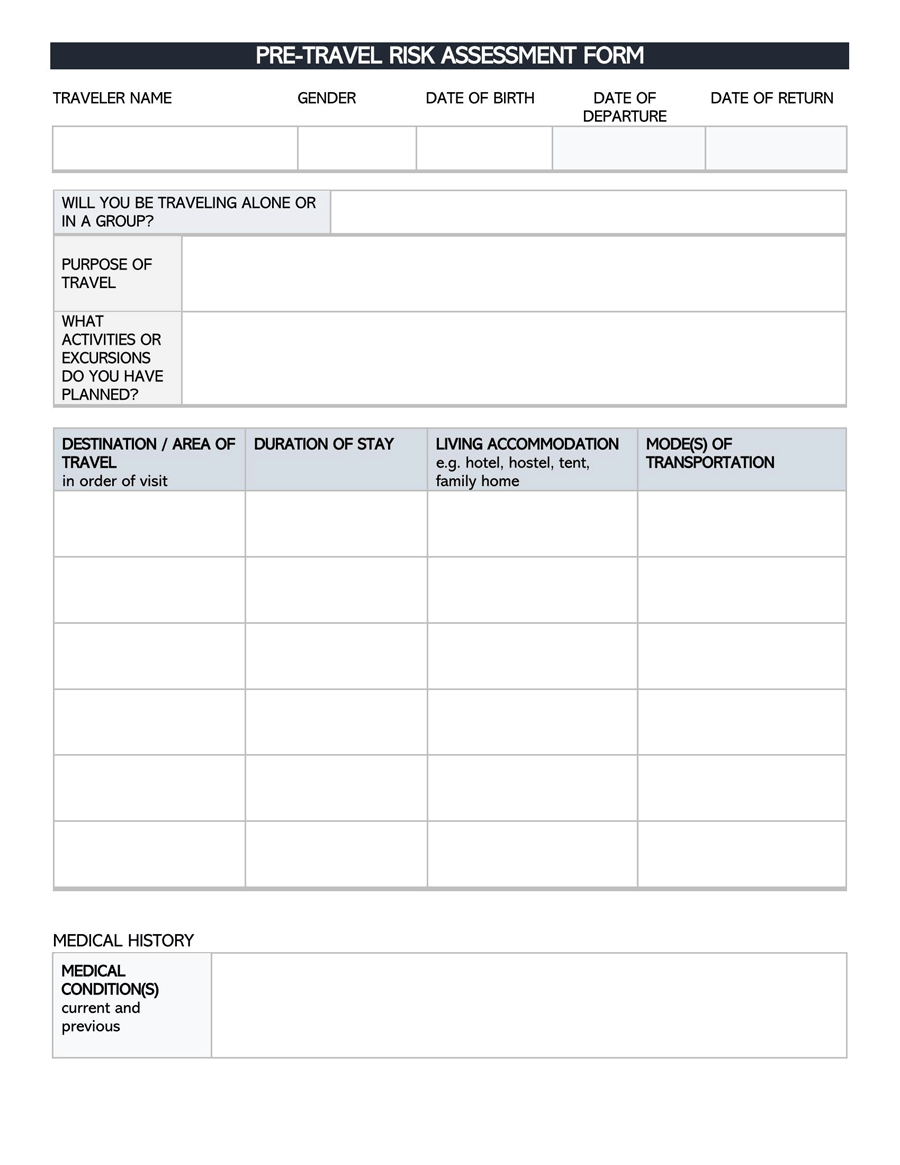

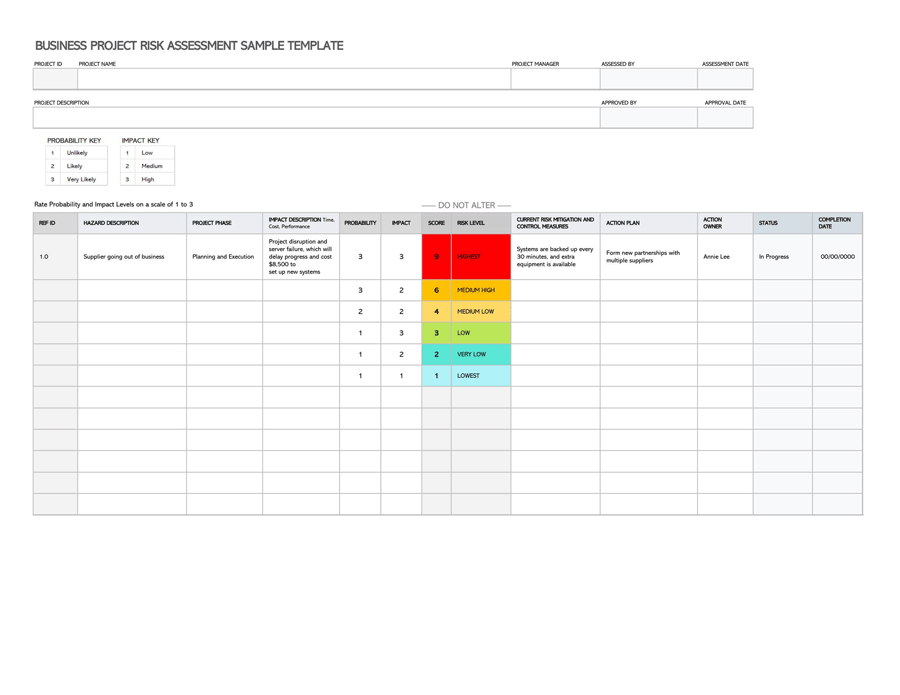

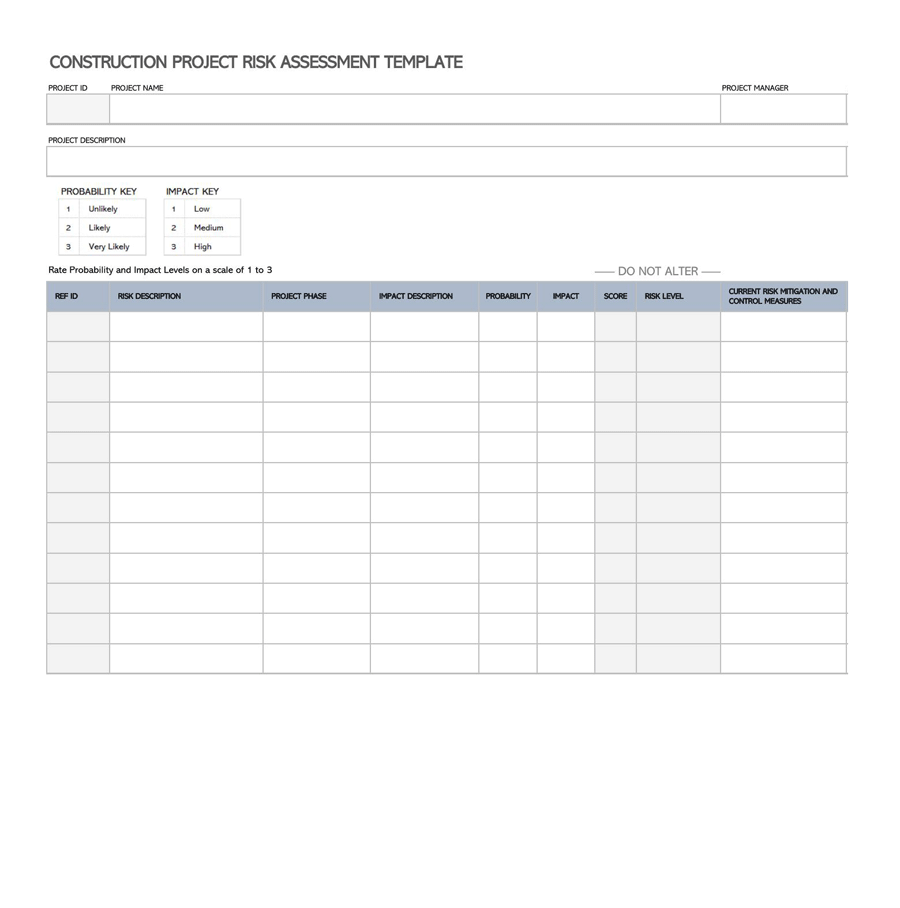

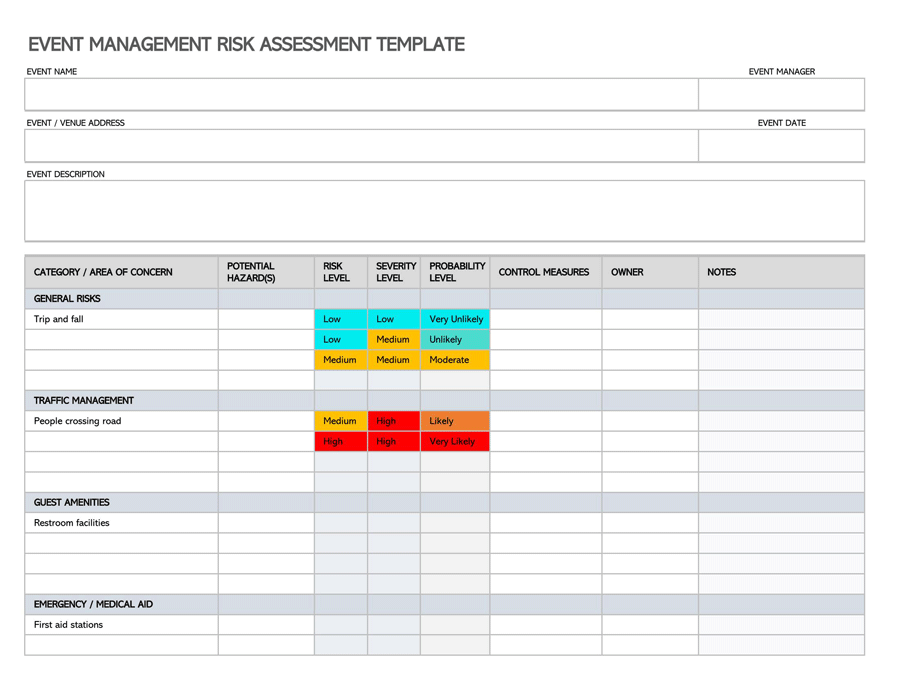

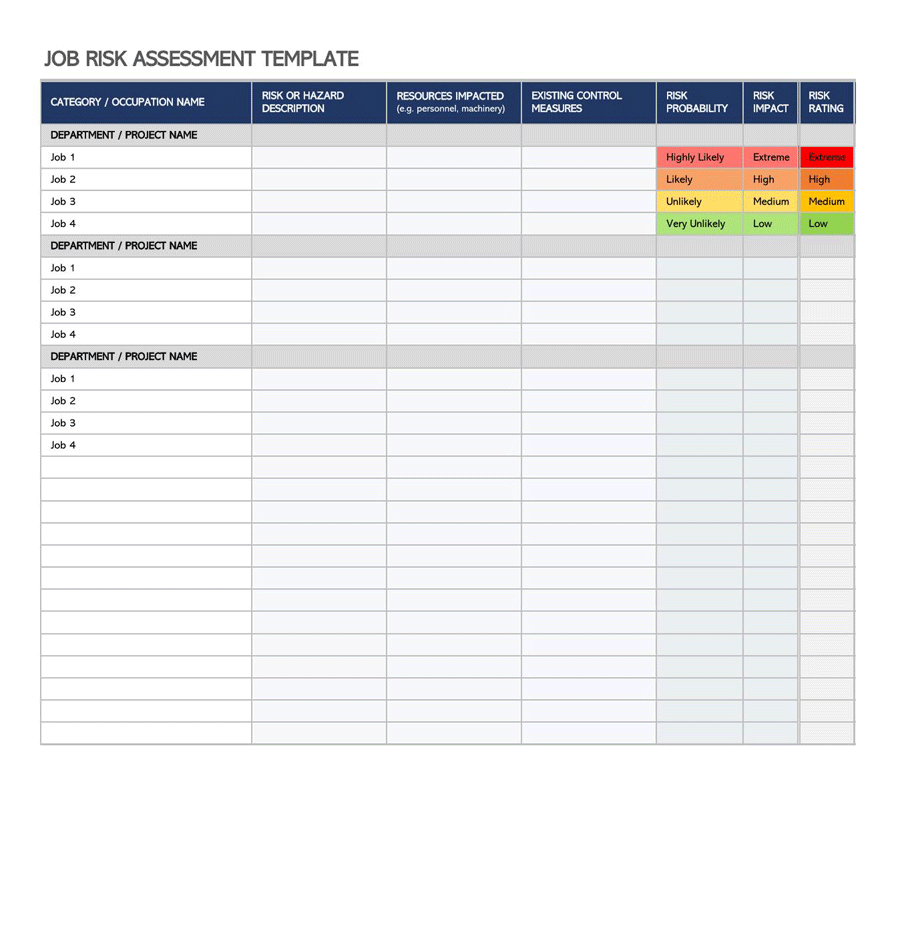

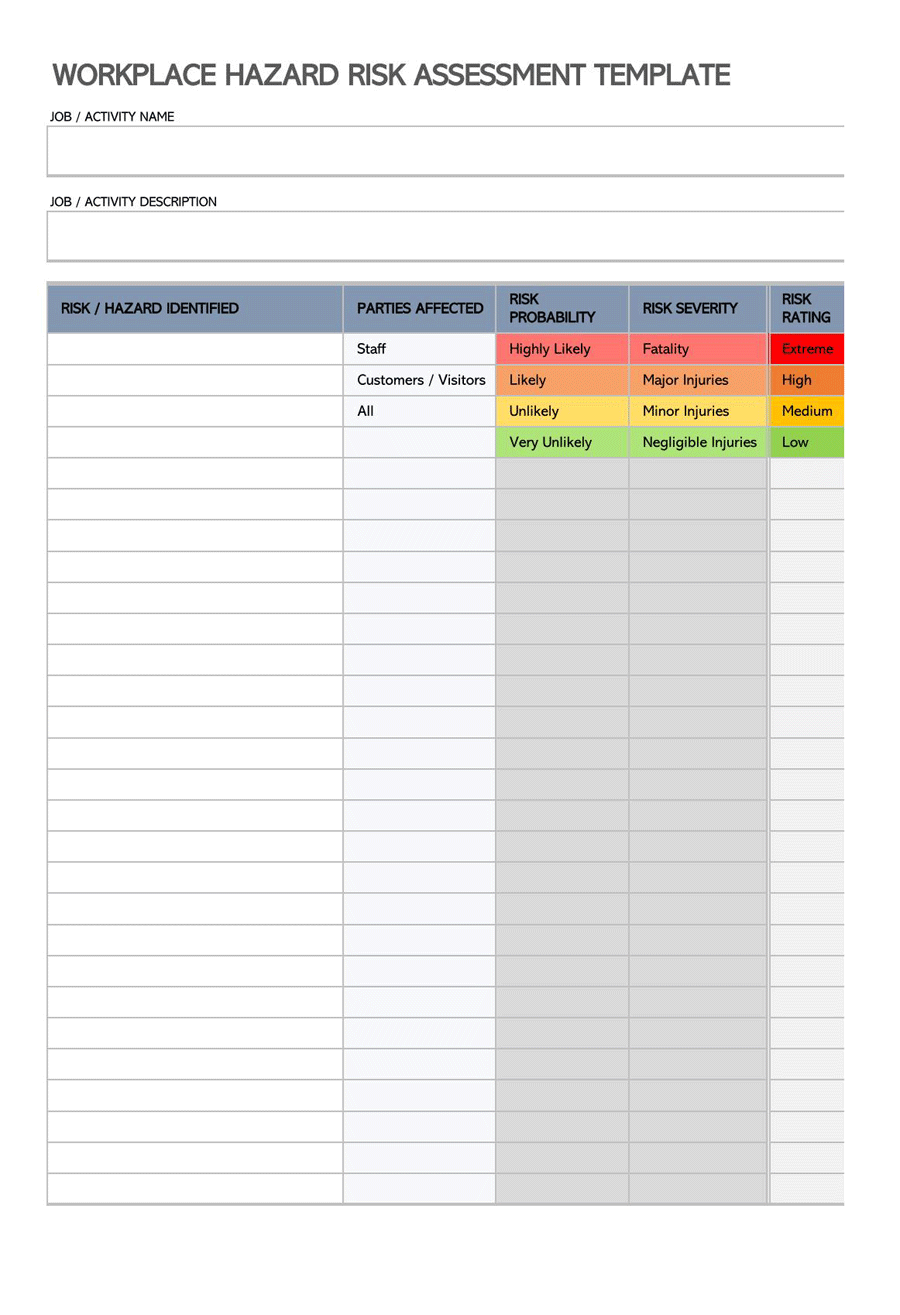

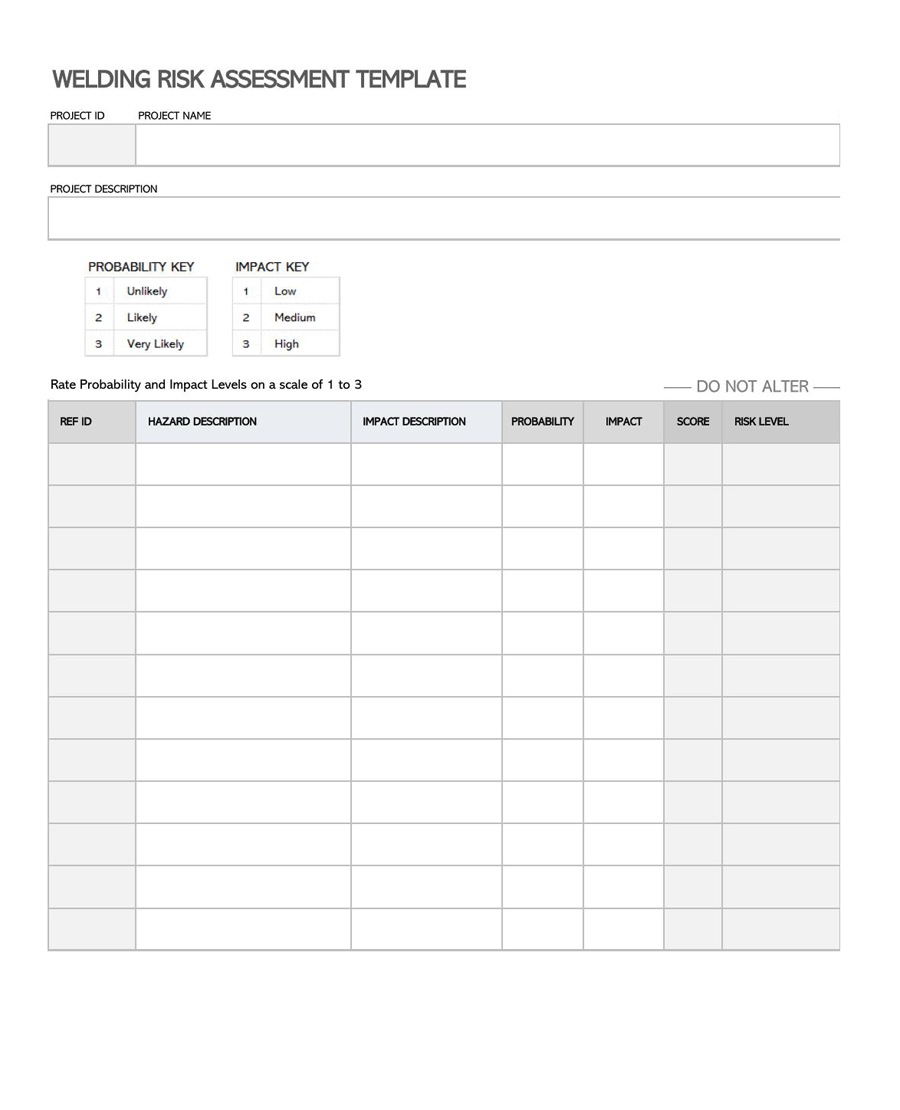

A few templates of risk assessment are:

5 Steps to Risk Assessment

When it comes to risk assessment, the steps that are followed are still the same, even in the current digital world. It is all about finding an efficient and effective way of implementing these steps to successfully manage any company risks. Companies also need to have appropriate risk assessment processes for the new and modern risks.

Here are the steps and examples to follow for the risk assessment process to manage the different types of risks that may emerge in a company:

Identify potential risks

The first step in the risk assessment process is being able to identify any potential risks. For example, you can use the project risk log or project risk register to conduct the risk assessment process. It provides a current analysis of every risk that might arise in a project. It also offers storage for past projects and acts as a reference point for future projects. There is a need to fill in the correct data in this log or register. That way, you can properly and quickly identify and assess possible risks when handling a project.

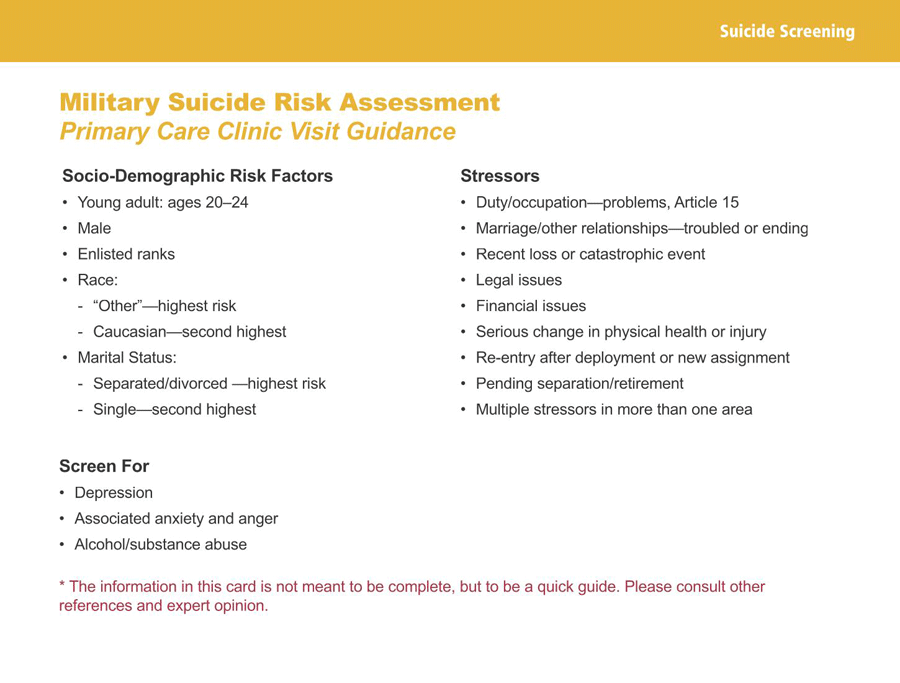

Whether it is a financial risk, hazard risk, operational risk, strategic risk, or legal risk; identifying the risks in a company is important. The company’s management can identify these risks either through experience or by consulting external professionals. These risks are written down manually or recorded digitally, depending on the company.

The most effective way of identifying potential risks in a company is by using the risk management system. This way, everyone has access to the risks identified. This is positive for the company since people can either learn from it or find ways of alleviating its potential negative outcomes.

Also, a company will be able to improve communication among its employees as everyone will be involved in finding solutions to the potential risks. As a company, you can also use a risk breakdown structure to identify different risks towards the company’s projects and goals. The most urgent and high-level risks should always be indicated on top of the structure.

Measure the scale of the risk

After identifying all the potential risks, the next step is to measure the scale of the risk. This is done by determining whether the risk is likely to happen and its negative impact across the company. The company will be able to understand the potential of the risk to affect its goals and projects.

A company can use a risk map to visualize the level of frequency of any risk and determine its scale; that is, how intense the risk is and the number of resources it will require. With this knowledge, you can now spend your time channeling the right resources towards all the potential risks so as to mitigate the problem. Also, the company may choose to redefine its risk assessment process to suit the possible potential risks.

Measuring the scale of the risk is also meant to determine if the business will stand or collapse in case the risks are actualized. You will be able to identify risk factors like financial losses, time wastage, and even the severity level of the risks as they will help in measuring each of the identified risks.

Therefore, when mapping and analyzing risks, you will need to fit them against different company policies, documents, processes, and procedures. This will help you determine how much the company can withstand using its established framework of dealing with risks.

Evaluate and prioritize the risk

The next step is to analyze and rank the risks into different categories based on their level of severity and how possible it is for them to happen. For example, an inconvenient risk is ranked as low, while a catastrophic risk is ranked as a high-level risk. Ranking risks allows the company to view the whole organization and identify any vulnerability they might have in their system.

Also, companies can identify all the risks that need immediate intervention to avoid catastrophic outcomes. The company is able to come up with prevention methods and solutions to all potential risks via risk assessment. By prioritizing risks, the company can avoid disrupting projects and still achieve its goals.

When you evaluate and prioritize risks as a company, there are four options you have to choose from:

- First, you can accept the risk in the business and focus on the fact that the benefits realized from this course of action are greater than the risks involved.

- Second, you can avoid the risk by entirely evading the course of action.

- Third, you can choose to control the risk by preventing and mitigating its likelihood to happen and the foreseen impact it may have on the company.

- Finally, you can transfer the risk by giving another party the negative outcomes related to the risks involved. For example, the company can take insurance.

Treat the risk

This step is also known as risk response planning. This is done by assessing the risks ranked the highest and establishing a plan of treating them so as to reduce the risk levels. It is all about minimizing the potential effects of a particular risk and improving the chances of a positive outcome.

The best solution to the identified, evaluated and ranked risks is the one that guarantees the most beneficial outcome for the company. You will have to put together all the resources and personnel that will contribute to the realization of a positive outcome. It is also important to have a systematic and logical way of implementing the solution and keeping the employees motivated.

The company should also focus on keeping their projects running as they try to reduce or treat the identified risks. This means that resources should be well distributed to avoid any stagnation in realizing the company’s goals. The resources may include personnel and funding. Also, there should be records of previous projects and their risks so that the company can easily identify how to distribute the resources.

Involving external experts can help treat the risks effectively. A company should have a well-established channel for communication so that every party can receive the appropriate information and updates regarding treating or mitigating the risk. This way, a proper solution can be found within a short period of time without more issues being realized. Also, it will provide a way to set up more contingency plans for the company as the senior company members will quickly approve the treatment plans and there will be a communication channel to inform the team members of the changes.

In the case that the risks are actualized, it is best to utilize your treatment plan. It is all about either treating or mitigating the highest priority risk first as you go towards the least priority ones. This way, you will be to reduce the level of consequences and in some cases even prevent the whole threat from affecting the project. With a proper treatment and mitigation plan, it is likely that the company will handle these risks using a proactive rather than a reactive response.

Monitor the risk

Since not all risks can be resolved, there is a need to have a system in place to monitor these risks. Such risks include the market, environmental risks, and even the organization itself. You can either use digital means or manually task employees to diligently monitor these risks at the company. These employees will be focused on identifying any risk factors that might contribute to the realization of these risks.

Companies should strive on having and using digital ways of monitoring risks. This is because every employee will be able to access the system and help in identifying any potential risks to the company. Also, with clear communication among your teams and employees, monitoring risks becomes effective and beneficial to the company.

With proper monitoring, the company is able to come up with a new framework or improve the current one to prevent any catastrophic outcomes. Since the whole risk assessment business is not a one-time event but a process, having a well-established monitoring system will go a long way in benefitting the business. As you monitor these ever-changing risks to the company, you will be able to have a well-equipped business that is ready to handle any risks.

Following are a few risk assessment examples for you:

Benefits of Risk Assessment

With the risk assessment examples given above, you will be able to deal with any risks that your company may face. You need to establish a proper risk assessment process to effectively manage all forms of risks.

Here are some of the benefits companies are bound to enjoy if they have a risk assessment process in place:

- A company is able to prepare enough resources to handle risks by being prepared for any unplanned costs.

- Organizations can keep track of their projects and monitor their investments and returns.

- Companies are more aware of the legal requirements concerning handling risks.

- Organizations can have properly set plans to prevent physical risks like injuries and illnesses, especially among their employees.

- Enterprises will have better and more flexible plans instead of panicking when dealing with any crisis.

- Companies can identify, analyze and track risks, which in turn helps to alleviate the risk impact.

- Risk assessment also helps to guarantee company stability since the company is already aware of the losses it might face and has set plans to mitigate them.

- Businesses can identify their vulnerabilities and focus their time and resources on resolving the issue instead of risking further time, labor, and money.

Here are free templates and samples of risk assessments for you:

Frequently Asked Questions

Risk assessment evaluations are tools used to optimize the effectiveness of the risk assessment or management process in a company. With more evaluations, a company is able to highlight its abilities, strengths, and weaknesses. Also, evaluations help companies identify areas that need improvement in relation to handling risks. Organizations should use technology to perform risk assessment evaluations before changing the framework.

Enterprise risk management (ERM) is a tool used by large companies to simplify and restructure the risk management process. It is a field of governance that is meant to deal with different risks that might affect the position and organization of large companies. Some of the risks that are handled using the ERM include operational, market, environmental, regulatory, and financial risks.