Industry analysis is an assessment carried out by a business on multiple aspects of an industry to determine its position in the industry compared to competitors and make planning decisions.

The analysis assesses aspects such as demand-supply, trajectory in terms of development/growth, internal and external forces, and threats and opportunities. Data or information is the foundation of business decisions in any industry. Acquiring this information requires extensive assessments and the implementation of multiple market assessment techniques such as an analysis.

The analysis can be undertaken before starting up a business or periodically for the same reasons – strategic planning. Therefore, the analysis can be conducted by an entrepreneur, market analyst, or business manager in charge of planning in a business. The analysis looks into the internal factors such as demand, supply, direct competition, pricing, and external factors such as economic, political, social, and technological to establish the development of the industry and the sustainability of the business/company in question, based on opportunities and threats in the industry.

The objective of the analysis can fluctuate depending on what the business wants to achieve with the analysis and at what stage in the business cycle the analysis is applied. Regardless of the objective, the business is able to position itself in a way that it can keep up with competition and changes in the industry using information from the analysis. This article is a guide on how this analysis works, its importance, and its components.

Why Do You Need Industry Analysis?

It is beneficial to a business in many ways. Primarily it helps the company understand the overall structure of the industry or market. This means, if it is a start-up, it can position itself in the industry, knowing which untapped opportunities to invest in and what risks or threats to anticipate, more so from competitors and external forces such as political influence, social norms, and economic dynamics.

It also helps a business determine the market conditions such as demand and supply that greatly influence the business’s profitability. It can assess historical, current, and future market conditions and identify trends in practices and other factors to determine the sustainability of a business in a specific industry.

It can also be used in management. It helps determine the stage of growth – an industry can be in the growth stage, saturation, or decline stage. This way, management can plan the proper entry and exit points in the market for start-ups and declining businesses, respectively. By looking into the trajectory of the industry, the business can formulate an industry-specific strategy that establishes how it can utilize limited resources, identify opportunities and mitigate risks as a method of predicting success. Lastly, it can be used as an adaptation mechanism to help the business cope with changes in the industry throughout its life cycle.

How it Works

A comprehensive analysis should cover all the aspects of the industry to ensure that a company can make informed decisions and rank itself among competitors appropriately.

The step-by-step guide below can be employed when writing the analysis report to ensure the analysis captures all the necessary information:

Step 1: Review the available information

Firstly, a review of all available information should be done to make sure that enough information is collected to write an exhaustive report.

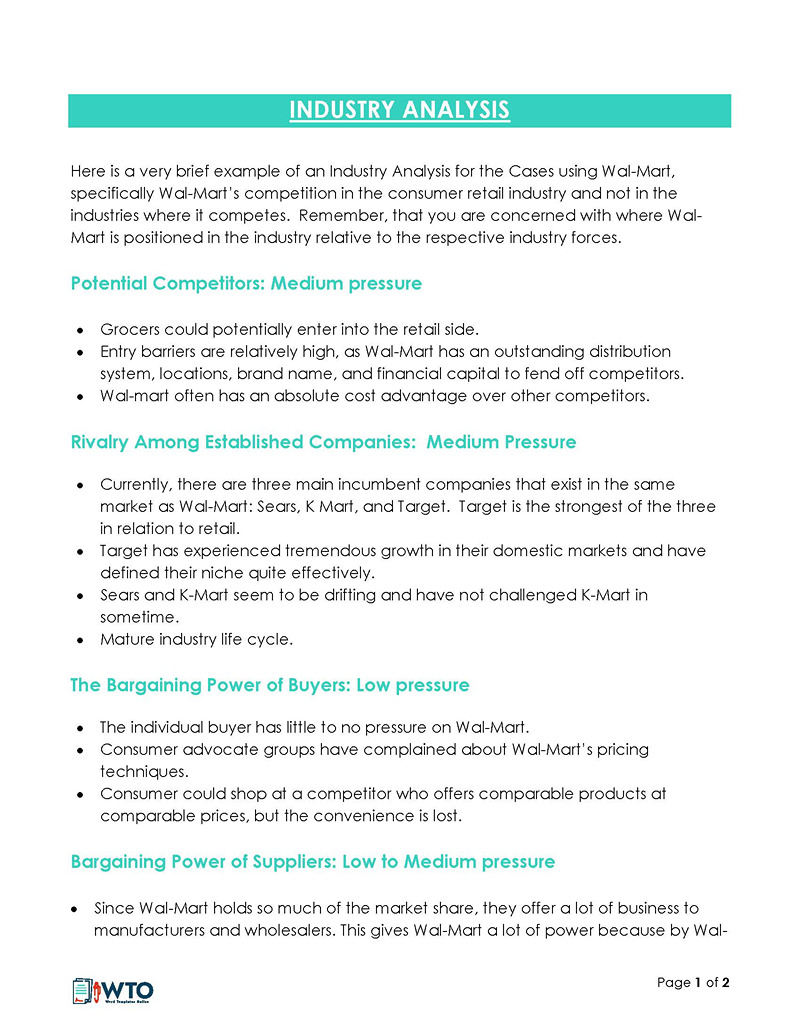

EXAMPLE

Examples of materials that should be reviewed for the analysis include research reports, previous analysis, industry-specific case studies, presentations, and white papers.

This information can be used as a guide of which aspects of the industry to prioritize and assess.

Step 2: Write an overview of the whole industry analysis

Secondly, write an overview of the industry being assessed. Specificity is key in this section. This is because industries will often be broad, but a business only focuses on one or several sub-markets in that industry.

EXAMPLE

Sub-markets for the technology industry analysis will include telecommunication, travel, artificial intelligence, management systems, etc. The information obtained from the previous step can be used to write an informative overview.

Step 3: Analytical presentation

The next step in writing the analysis report is creating an analytical presentation of the current market conditions based on historical and current data obtained from the analysis. Any patterns in demand, supply, returns, technology, customer behaviors, etc., can be identified and presented in the form of graphs, pie charts, histograms, etc.

Step 4: Forecast

Then, after presenting what is known about the industry, predictions about the growth and development of the industry can be made. Forecasting can be made on demand, supply, and competition. The trajectory of these factors from, say last five years, can be used to make educated predictions. Since this analysis is not a guarantee of success, assumptions may have to be made. Predictions can be made for the next five, ten, or thirty years. However, short-term predictions are advisable for fast-evolving industries.

Step 5: Summary of the report

Lastly, a summary of all the findings and recommendations of the analysis can be written in the report. Findings and recommendations comprise of opportunities, threats/risks, and proposed interventions.

What to Include

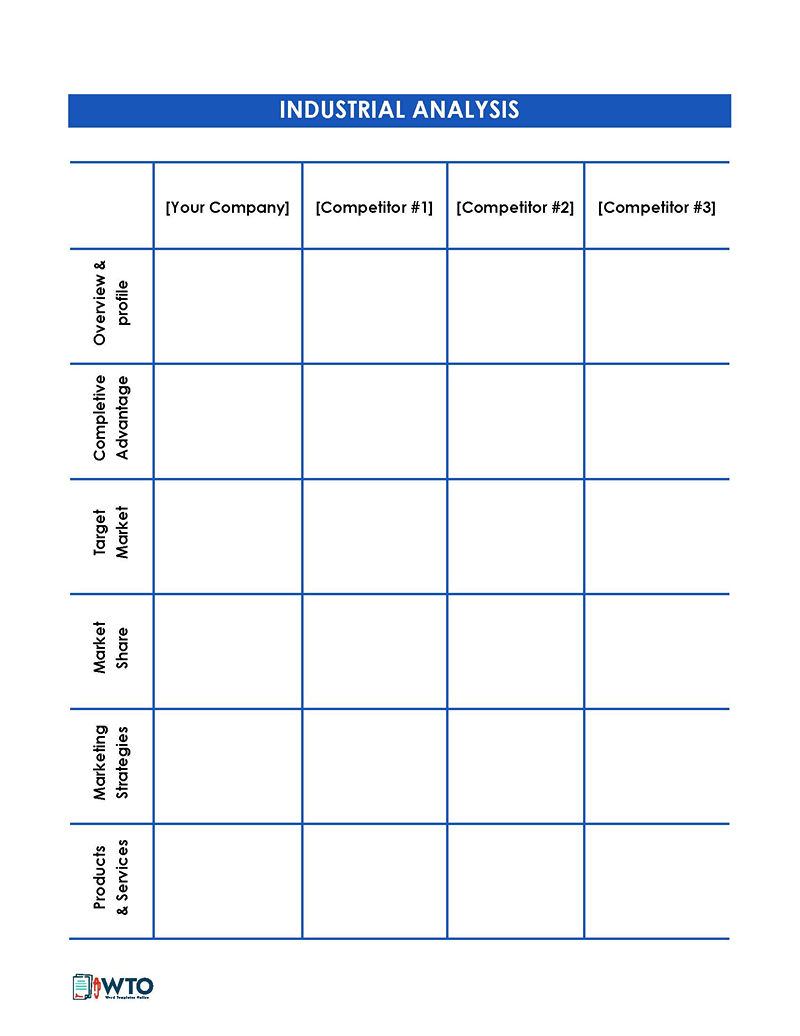

The specifics of the analysis report will vary from one industry and company to another. However, certain aspects will be consistent in different industries. These aspects make up the components of a standard analysis report.

They include:

Historical data

The report must document important historical data of the industry. This includes major discoveries, advancements, founding principles, changes in demand and supply over the years, customer habits, etc. This information lays a foundation for what goes on within the specific industry.

The current state of the industry

The analysis report must also indicate the current conditions of the industry (where the industry is in terms of demand, supply, technology, market share, etc.) and its potential based on similar aspects (where it can be ideally). The difference between the current and potential conditions signifies the potential for growth which is associated with opportunities. Probable risks associated with the ideal market conditions should also be indicated.

Economic factors influencing the industry

The analysis also assesses the economic factors that affect an industry. Such factors include inflation, availability of raw materials, cost of living, salary rates, taxes, etc. Therefore, the report must outline how these factors have and are likely to influence the order of business in the respective industry.

Reason for your analysis

The objective of the analysis should be provided in the report.

EXAMPLE

Examples of reasons the analysis can be performed include research for a start-up, a strategy for franchising/consolidating, a strategic planning tool, etc.

Information about the industry’s competitors

The analysis report should also discuss the nature of competition in the industry (both existing and potential). Competitors can include businesses that are offering similar services/products or substitute products/services. The analysis should look into the direct and indirect competitors.

Similar services or products

Similar services or products will always be offered in or outside the industry. These products or services can be identified. Analyzing the customer pain points is an effective way of identifying similar products and services. Also, aspects such as pricing and quality can be discussed in this section.

Income projections/price fluctuations

A comprehensive analysis should assess any patterns in price fluctuations based on historical data and current market conditions to make income projections for the company. Income determines the profitability of a business, and hence income projections are vital in establishing the sustainability of the business.

Consumer base/geographical growth

Understanding the target audience is a huge determinant of the success of a business. The analysis should therefore research the core customers of the business. Aspects to be considered under this section include demographics, customer needs (pain points), customer experience, journey, and satisfaction. In addition, the geographical growth of where the business is located should also be discussed in the report. Geographical growth will look into aspects such as political stability, legislation, taxes, infrastructure, cultural aspects, etc.

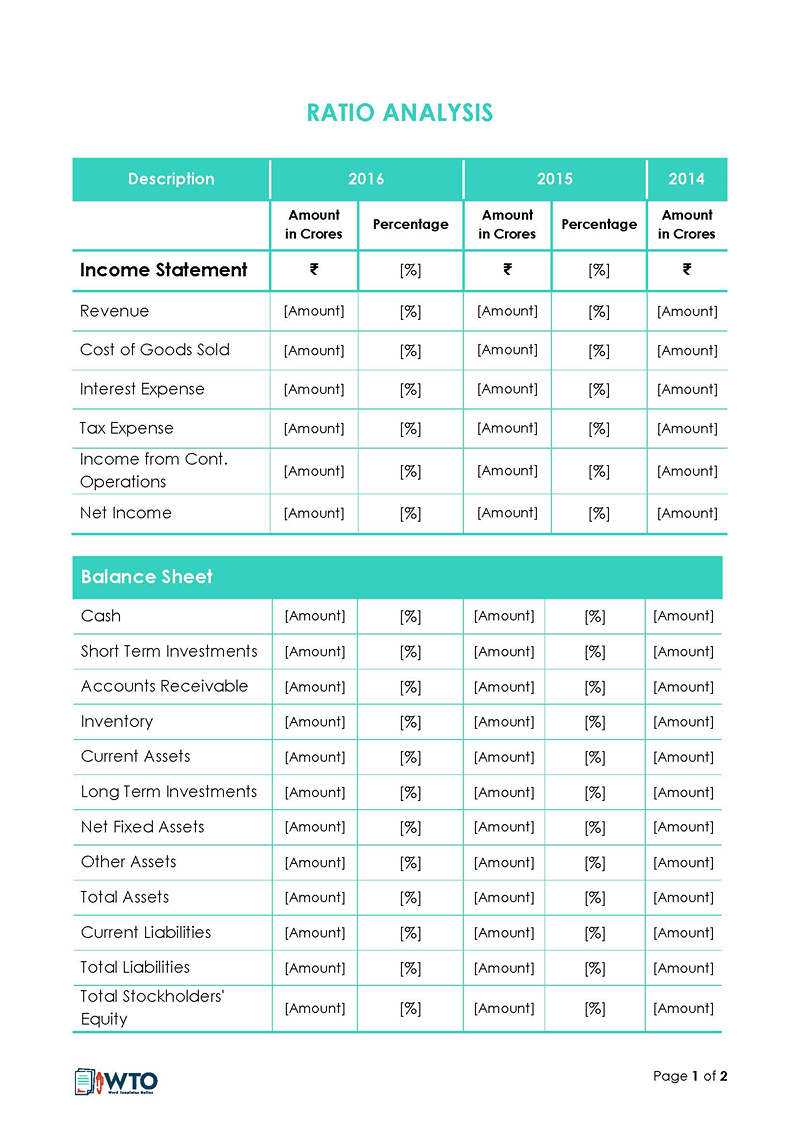

Existing financial data

The existing financial data must be considered when conducting the analysis for an operating business. This includes notable financial patterns in profits, losses, budgets, salaries, assets, etc. By understanding the financial health of a business, a company can determine how prepared it is against threats such as price fluctuations, strikes, pandemics, inflation, etc. Projected changes in the financial position or health of the company should also be provided in this section.

Industry understanding using a graph

The report should also include a general overview of the industry using visual aids such as a graph or chart to illustrate key components/facts.

EXAMPLE

The financial trajectory can be illustrated using a graph, while the customer base can be presented in a pie chart.

Long and short term assessments

Next, the analysis report should include both long-term and short-term assessments on the identified aspects of the industry. The assessments should be aligned with the objective(s) of the analysis and the company’s general success.

Foreseeable issues or opportunities

Any foreseeable issues or opportunities should be highlighted in the report. Opportunities imply any customer pain points, new procedures, innovations that the business can tap into to make/save money, improve efficiency or increase the customer base. Issues include any risks or uncertainties associated with existing, proposed, or projected market conditions or projects.

Three or four-line summary

A brief but precise summary should finalize the report on the analysis. The summary can be three or four lines.

Free Templates

Types

Businesses use different types of industry analysis to increase their chances of success. Each type of analysis will focus on specific key areas.

The differences between these types of analyses are discussed below:

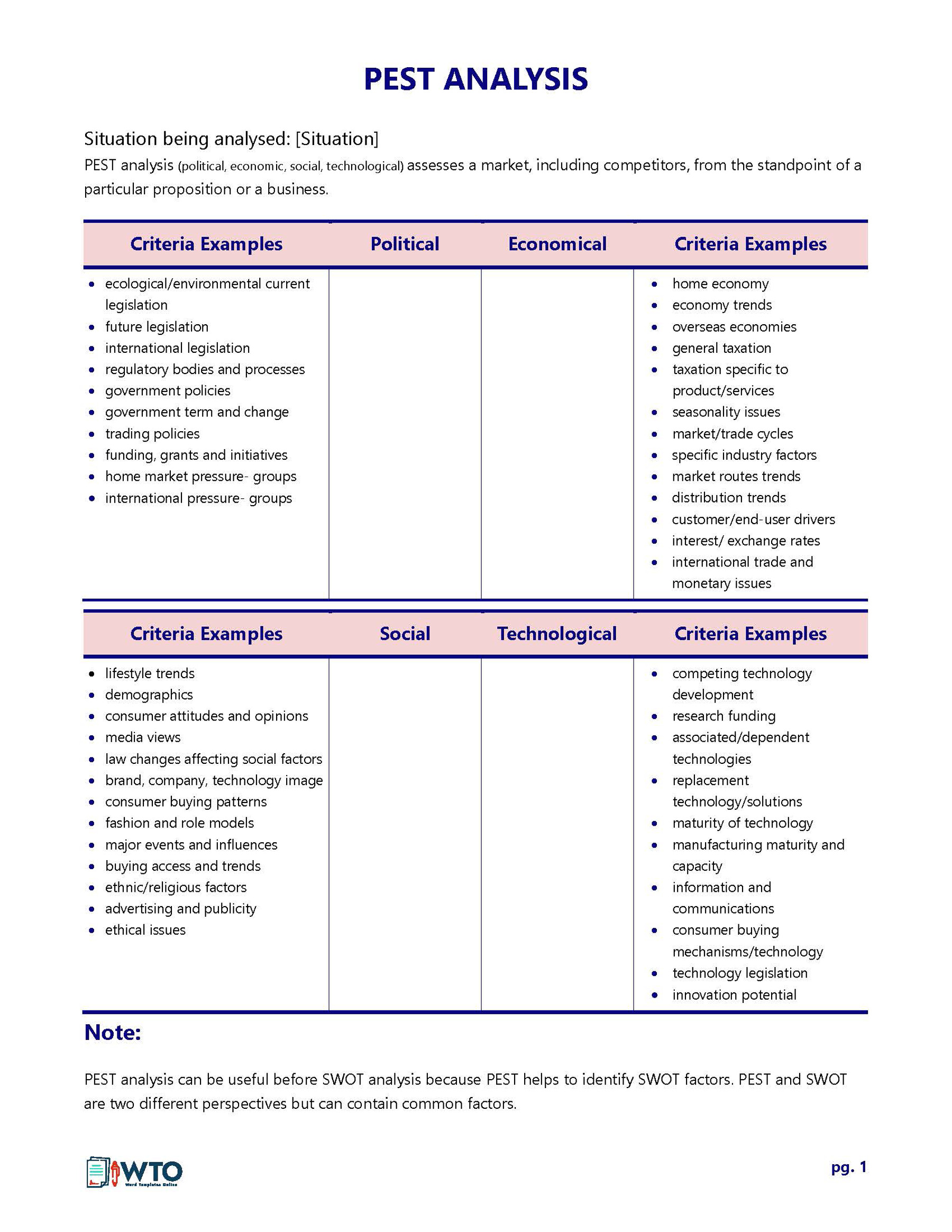

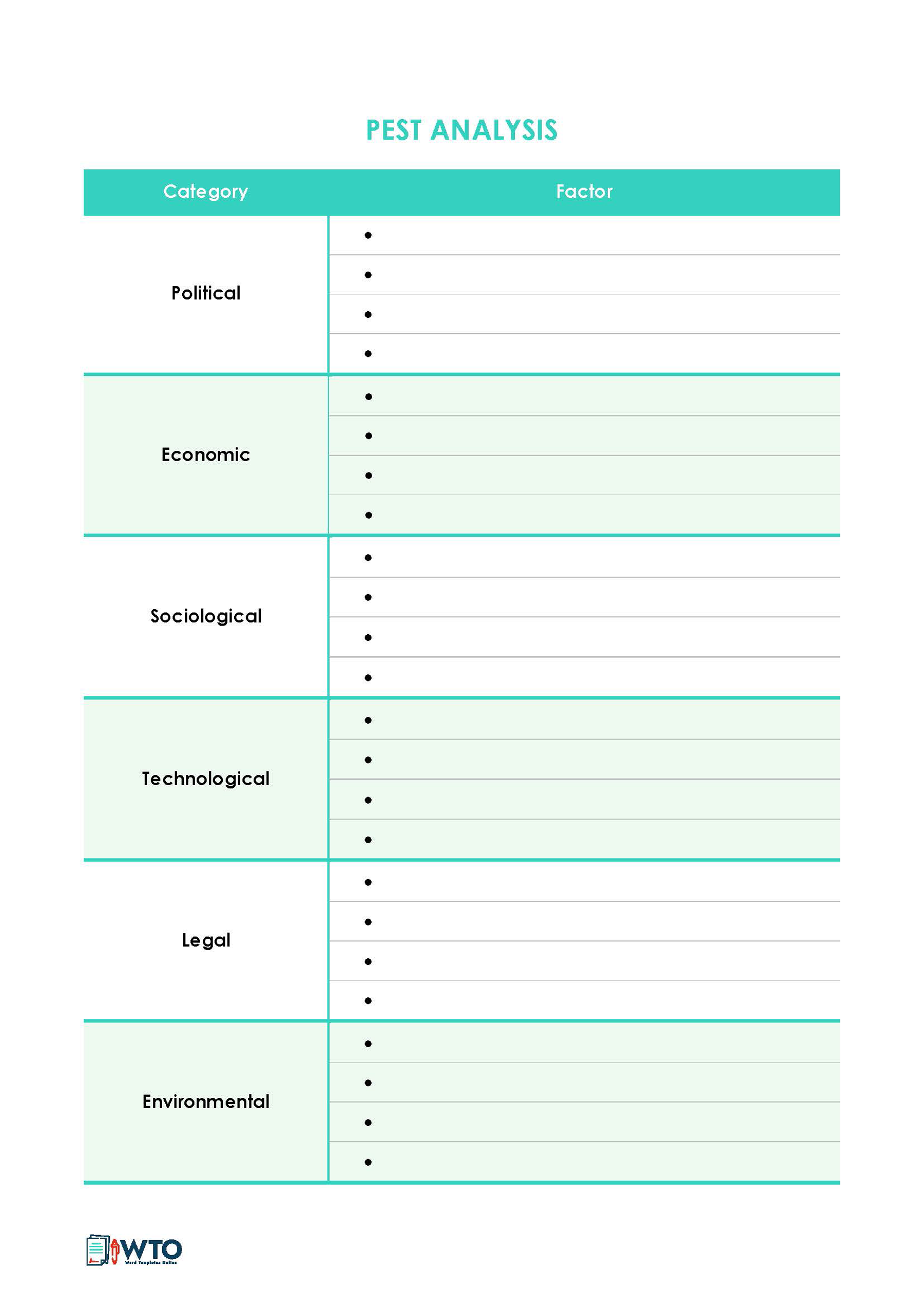

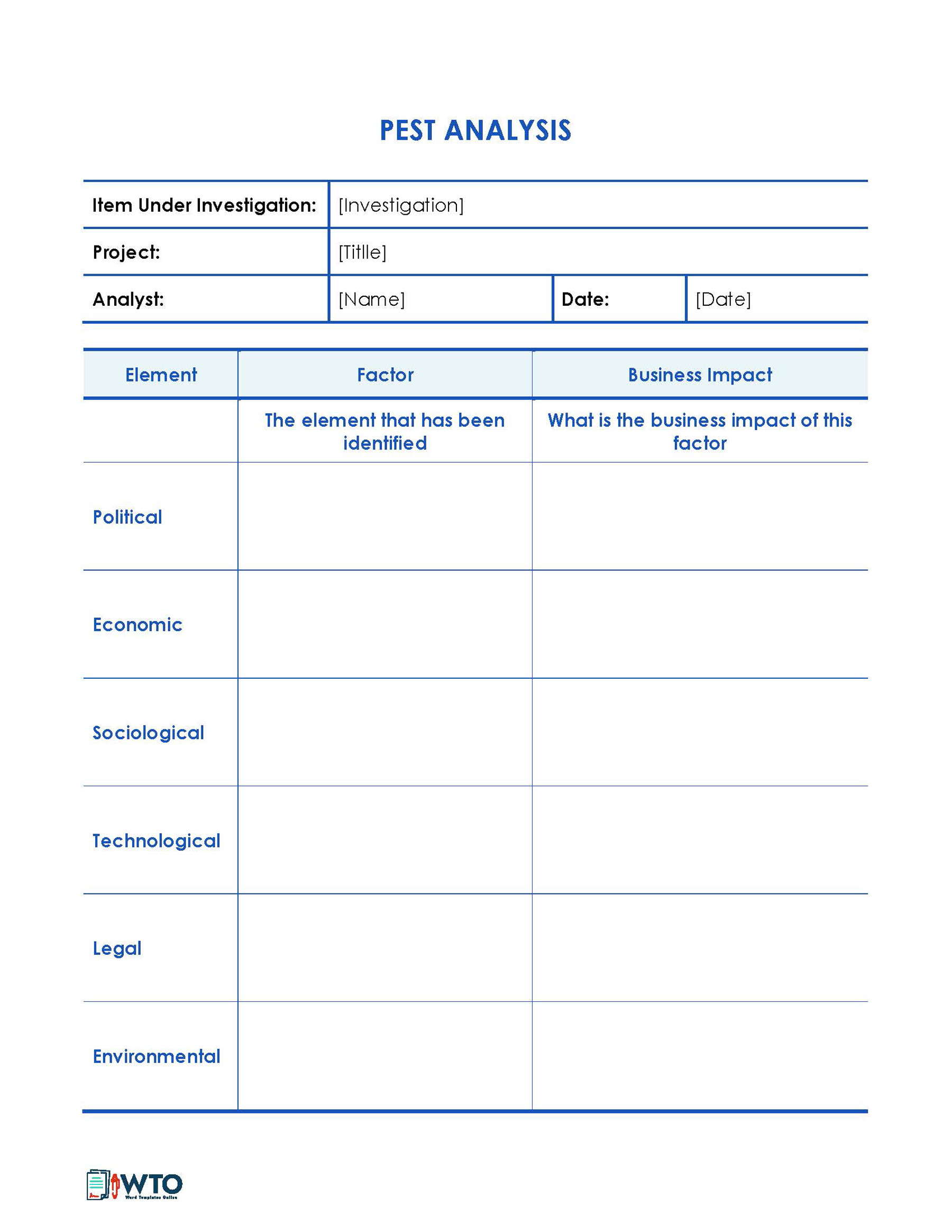

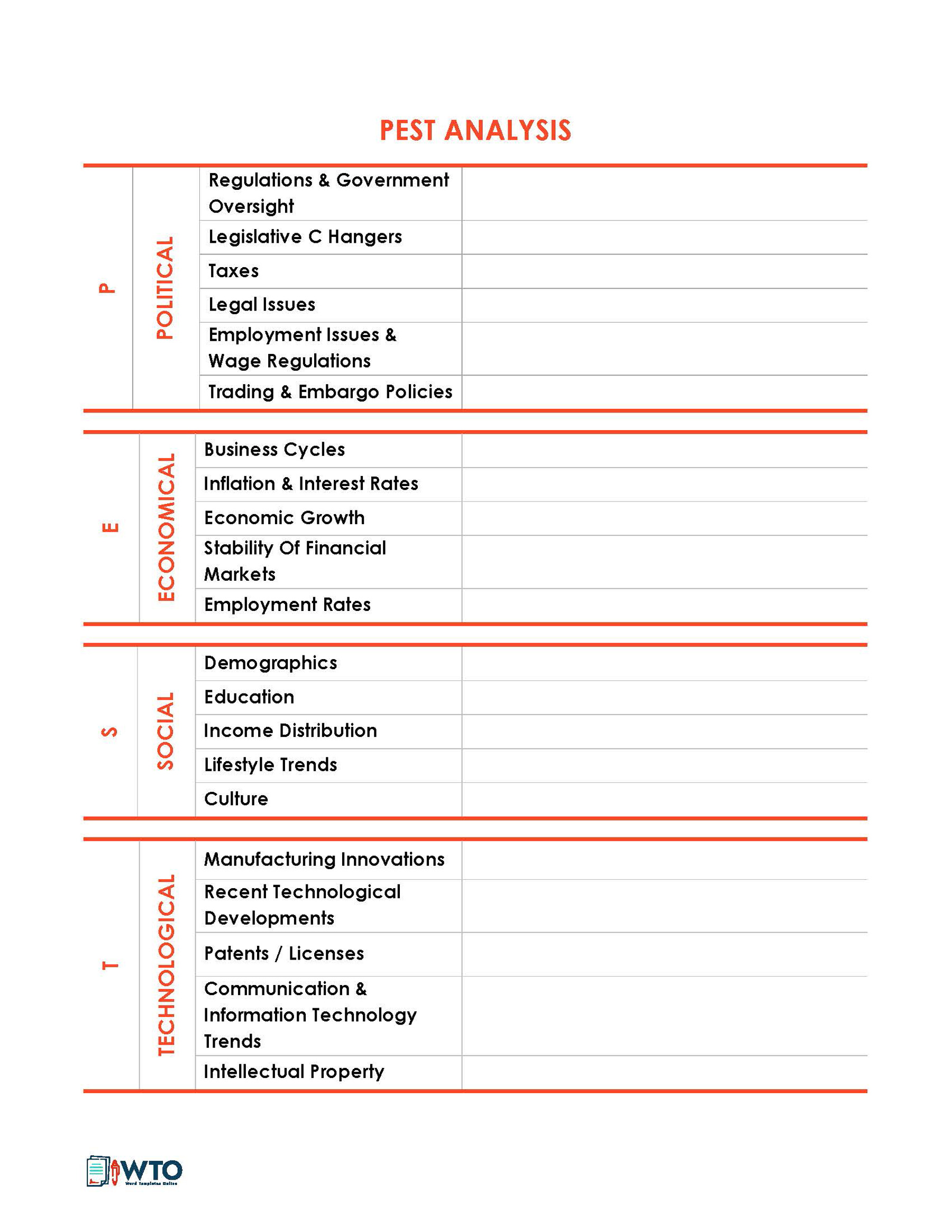

Broad factors analysis (PEST analysis)

This analysis assesses the political, social, economic and technological factors of an industry. This type of analysis is, therefore, more inclined towards external factors. Political factors include; regulations, taxes, industry-specific policies, trade policies, political stability, environmental regulations, etc.

Social factors include demographics, occupation, population growth, culture, etc. Economic factors include industry GDP growth rates, exchange rates, inflation, income gaps, infrastructure, etc. Technological factors include any technology advancements (inventions) applicable in the industry and affects how business is done.

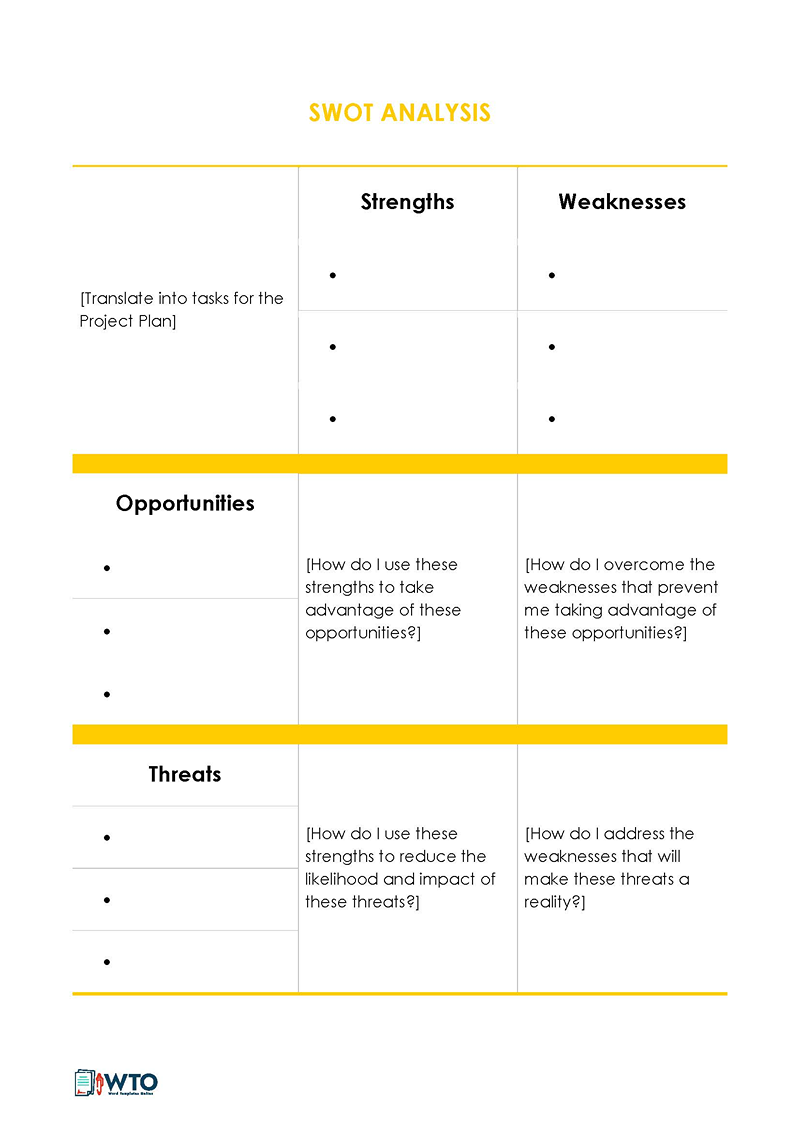

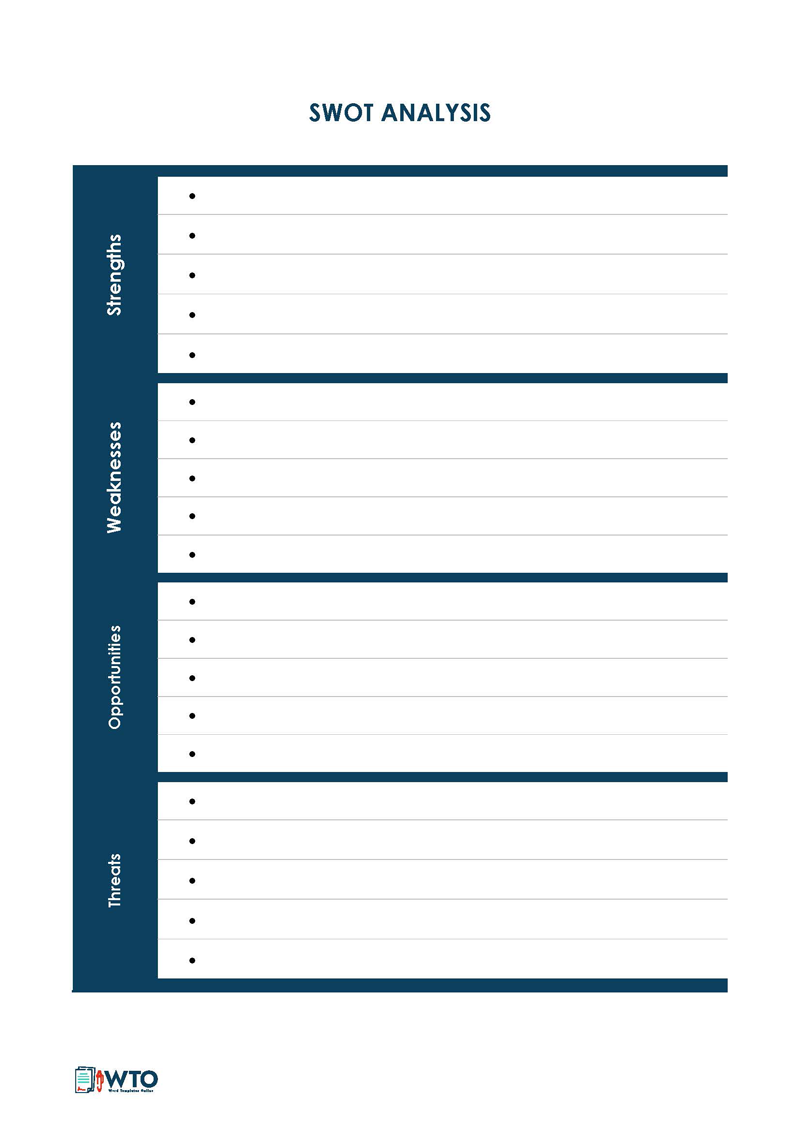

SWOT analysis

Unlike a PEST analysis, a SWOT analysis focuses more on the internal factors of a business and industry at large. This type of analysis looks into the business’s strengths and weaknesses by assessing customers, employees, equipment, technology, management system, financial aspects, and other factors that contribute to the current position of the business and industry. It also identifies the opportunities and threats associated with the current and future position of the business and industry. These can be caused by changes in government regulations, new competitors, consumer behavior, etc.

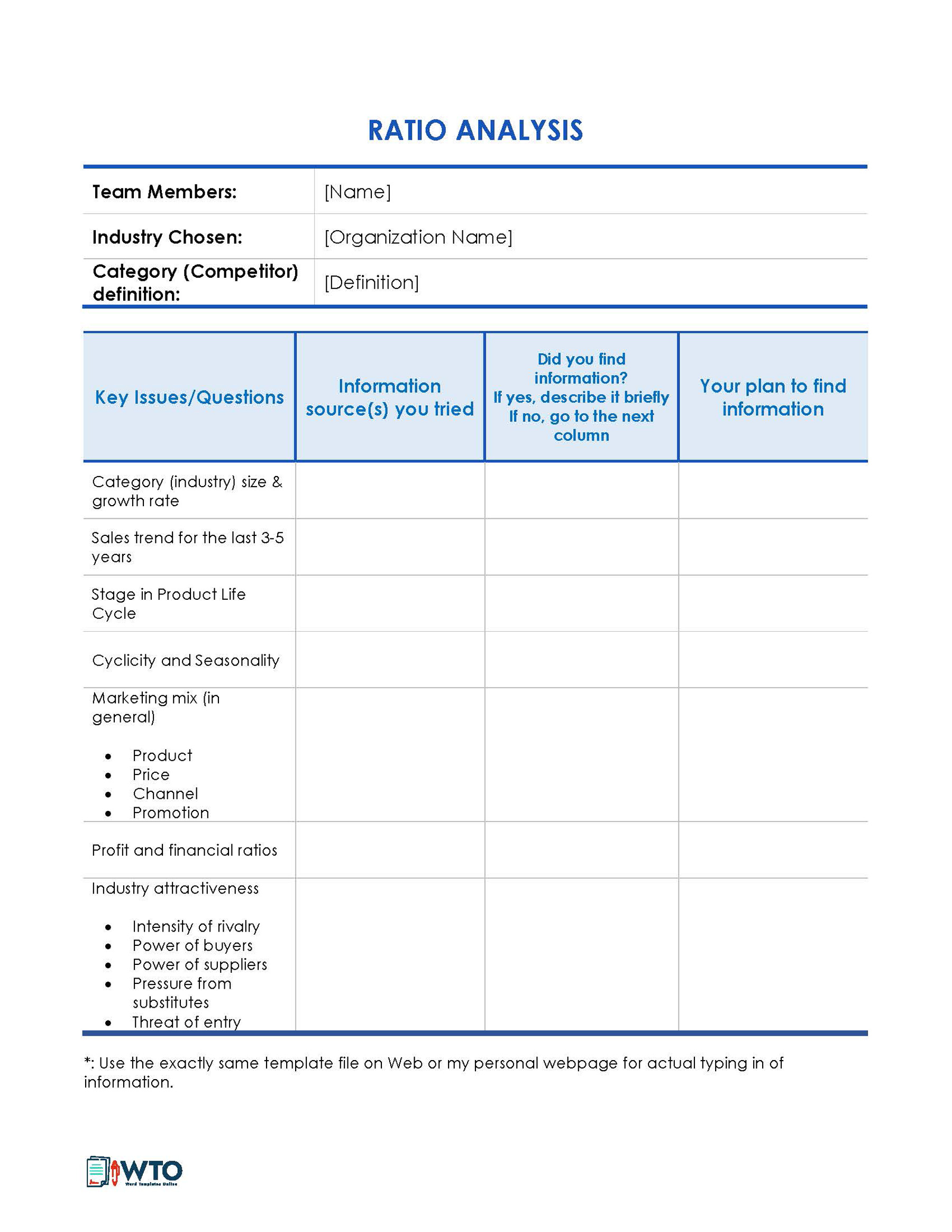

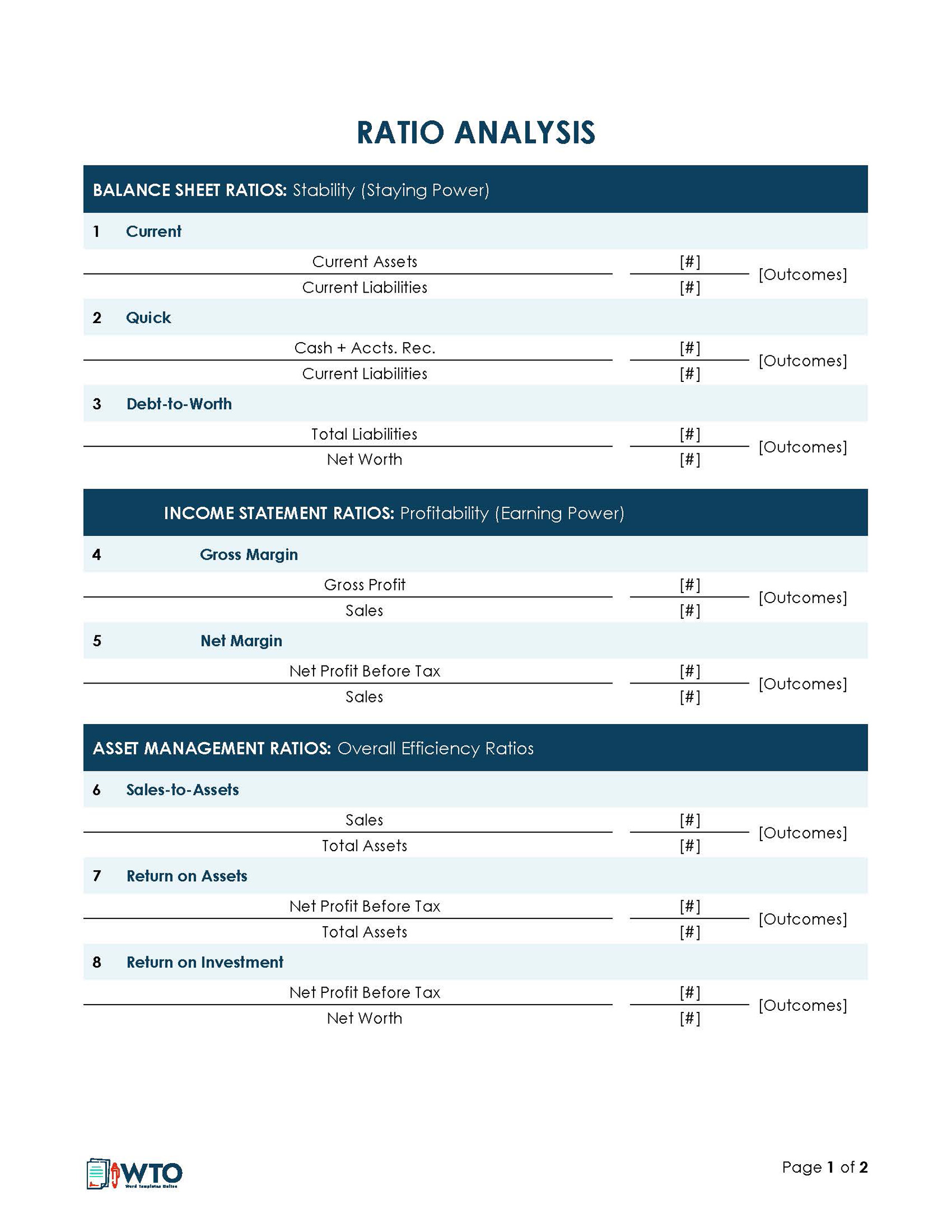

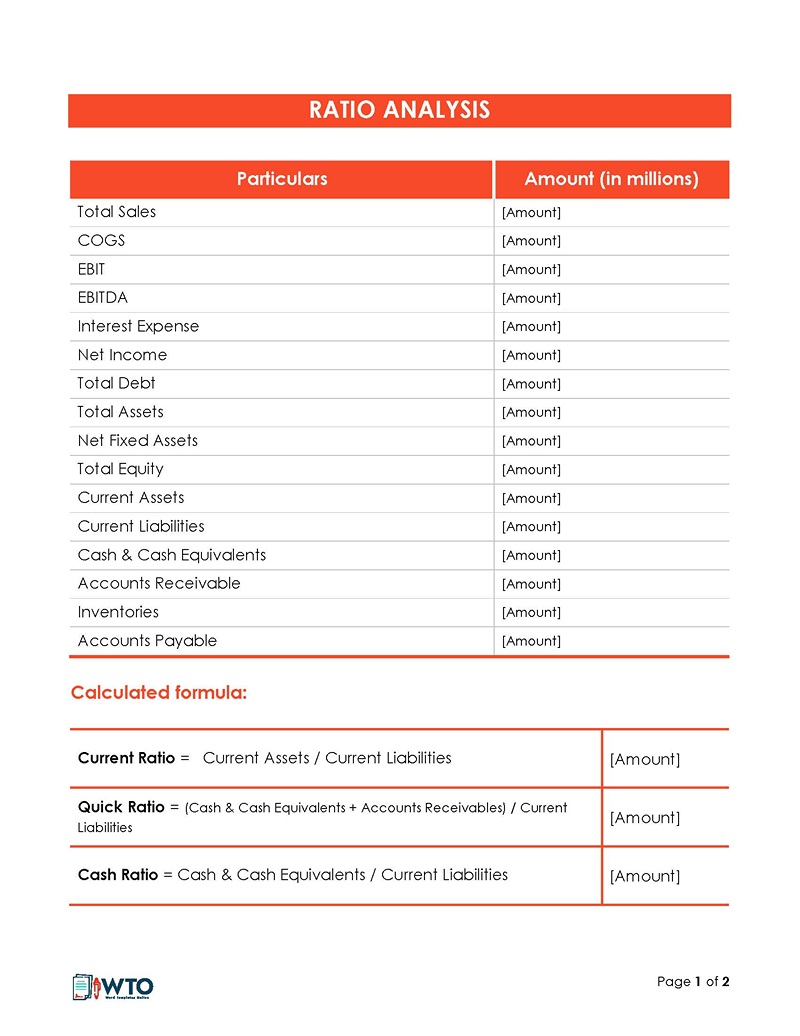

RATIO analysis

A ratio analysis compares two metrics that determine or influence success in the industry. A business determines the ratio metrics and compares them to the industry’s metrics.

EXAMPLE

A profit per employee ratio can be established with the help of this type of analysis.

Competitive Forces Model (Porter’s 5 Forces)

The Porter’s 5 Forces type, birthed by Michael Porter (1980), is one of the well-known types of analysis technique. It focuses on five competitive forces, namely:

- The intensity of industry rivalry: Industry rivalry looks into the number of participants/competitors, respective market shares, and industry growth to determine the intensity of competition. The intensity of competition is increased by slow growth, a high number of established companies, no product differentiation, low customer loyalty, labor unions, government restrictions, and high exit costs.

- Bargaining power of buyers: The bargaining power of buyers greatly influences the success and sustainability of a business within a particular industry. The higher the buyer’s bargaining power, the higher risks of investing since the buyer are positioned well enough to negotiate lower prices, additional services, better quality, etc. This can eat into the business’s profits. Such bargaining powers can be found in an industry with many competitors.

- Bargaining power of suppliers: The bargaining power of suppliers is another factor that affects competition in an industry. This power is often seen in an industry where there are limited supplies/raw materials or suppliers. In such a case, the suppliers can set high prices for their products, which ultimately affects the cost of production and pricing.

- The threat of substitutes: Substitutes are competitors in another industry offering products or services an industry’s target audience can use as substitutes – to satisfy the same pain points. Substitutes can challenge an industry or business in terms of prices and quality, affecting profitability. As a result, customers tend to go for the same product offered at a cheaper price or better quality.

- The threat of potential entrants/competitors: Emerging businesses/companies are significant competitors that should be considered in the analysis. If entry into the specific industry is easy, the more competition a business is likely to face from new entrants and vice versa. Barriers to entry into an industry include huge capital start-up amount, government policies, brand loyalty of the consumers, economies of scale, etc.

Final Thoughts

Business decisions are heavily reliant on information. Therefore, conducting an industry analysis is vital for start-ups as well as established businesses. This way, they can collect information about the industry they operate in, assess it, and make educated planning and management strategies. The analysis is also a crucial determinant of the trajectory or direction a business should take when faced with adversity such as economic and political unrest. The components of the analysis vary depending on the objective of the analysis, and therefore a business can conduct several analyses to address different aspects of its operations.