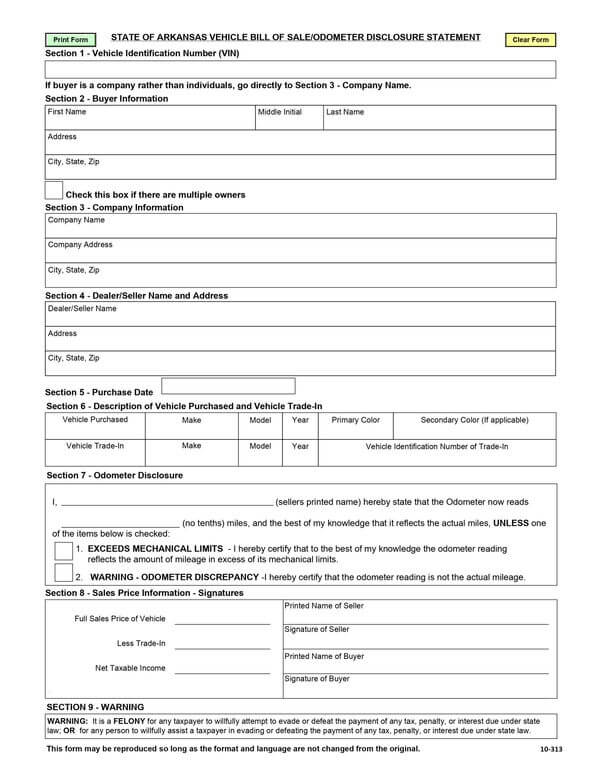

When registering a vehicle in Arkansas, the state requires you to submit a Bill of Sale (Form 10-313) for Vehicle. It serves as legal proof of transference to a new owner and shows the amount that was paid for the vehicle, as well as gives details of the parties that were involved in the selling and purchase.

The document needs to be signed by both the buyer and the seller of the vehicle.

Upon completion of the transaction, it is the responsibility of the buyer to submit this form, within 30 days of the date of sale or title transference, to the Arkansas Department of Finance and Administration. Sellers that intend to buy another vehicle within 45 days of the date of sale can use their copy of the bill of sale and submit this to a local Revenue Office, where they will receive a sales tax credit.

If a third party will be registering the vehicle on behalf of the buyer, they will need to submit an Arkansas Motor Vehicle Power of Attorney.

Arkansas Vehicle Bill of Sale Form

Registering a Vehicle in Arkansas

Arkansas requires individuals that are new vehicle owners or who have recently moved to the state to register their vehicle with the help of the vehicle bill of sale within 30 days of moving or making the purchase. This can be done by phone, online, or in person. However, if you are registering the vehicle online, you will need to submit the documentation including the Arkansas bill of sale by mail, and will not receive the new title until these have been received.

Sending via mail:

Office of Motor Vehicle

P O Box 3153,

Little Rock, AR 72203-3153

Registering by phone:

Toll-free: 1-800-941-2580

Arkansas is one of the few states that will allow new registrants to register online. If you are renewing a title, you can do this at the DMV website, Arkansas, the link to which has been provided earlier in this article. Registration periods will differ depending on the vehicle.

note

If you are required to register your vehicle in person, you can do so at the Office of Motor Vehicles, Arkansas. Be sure to bring the required documentation when registering in person.

Documents Required for Vehicle Registration

Following are the documents necessary for vehicle registration in the State of Arkansas:

- Arkansas Bill of Sale for car

- Odometer Disclosure Document

- Certificate of Title

- A current and valid drivers license

- The appropriate Registration Fees

- Proof of the vehicles insurance, which must have the following minimum requirements:

- $25,000 to cover bodily injury per person

- $50,000 that covers per accident

- $25,000 to cover property damage

There are other documents that you also may be required to submit, if applicable:

- PPAN (Personal Property Tax Number) that has been assigned by your county assessor

- Any Security Agreement/Lien Contract

- A current County Tax Assessment

- A paid tax receipt

- Out of state title

- Statement of origin from the manufacturer

note

If registering a vehicle online, the title will be sent to you via mail. If registering in person, you will receive your title document while you are at the office of motor vehicles.

Requirements of Arkansas Vehicle Bill of Sale

This bill of sale is considered a requirement in 2 specific situations, but apart from them too, it is considered essential to be involved in a vehicle transaction in order for it to be legally secure.

Those two specific situations are:

- The title does not have room for the seller of the vehicle to sign it over

- The seller is applying for a sales tax credit

The general requirements of this bill of sale that are necessary in any circumstance are as follows;

Other requirements

These forms available at the Office of Motor Vehicles are only available in English and translation service is not provided by the state. This means you will need to supply your own interpreter if needed.

If this bill of sale is not required for the transaction, you may fill it out in any language, as long as both the buyer and the seller understand it. Any copies of an Arkansas bill of sale for a car, that has been written in another language, will need to be translated into English before submitting it to the OMV.

You will need to be sure that you have a copy of this bill of sale for both the buyer and seller, as well as for the OMV if it is required.

Dealership sales

A buyer who is purchasing a vehicle from a dealership will need to make sure that they have gotten the certificate of origin of the manufacturer. This must be signed over to the buyer before it can be registered. Vehicles that are being leased require that the buyer has a copy of the line agreement that has been signed.

Private sales

Sellers are responsible for providing a correctly signed title or Arkansas bill of sale for vehicle, to the buyer at the time of sale. If the vehicle is less than 10 years old, they must also provide the buyer with Form 10-313, (Odometer Disclosure Document)

The buyer is responsible for registering the vehicle within 30 days of the purchase. If you are a new Arkansas resident, the vehicle must be registered and titled within 30 days of you establishing your residency. Registration and titling of a vehicle can be done at the same time. You will need a completed Vehicle Registration Application (Form 10-381). This acts as both your registration and title application.

If you are planning to transfer your vehicle plates from one vehicle to another, you will need to provide the registration details of the former vehicle.

Sales tax

Vehicles that have a purchase amount of over $4,000 will be taxed 6.5%. Residents of Texarkana will be taxed 7%. Local tax rates will depend upon where you live. Vehicles that have been registered after the required 30 day period will be taxed at 10% of the amount that is owed.

If your vehicle has been registered within the 30-day time frame but has not been, you can file an Affidavit of Non-Use (Form 10-300), which allows you to claim a late fee exemption.

Other fees during registration

- $10 title fee

- $25 fees for specialized license plates

- $1 fee to transfer a license plate

Registration fees will be determined based on the weight and type of vehicle that you have:

- $17 for vehicles that are 3,000 lbs and under

- $25 for vehicles that are from 3,001 to 4,500 lbs.

- $30 for vehicles that are 4,501 lbs. and over

- $21 for vans and trucks

- $3 for motorcycles that are under 250 cubic centimeters

- $7 for motorcycles that are 250 cubic centimeters and over

Active military

For individuals who are active military personnel and are stationed in the state of Arkansas, you are allowed to keep your vehicle registration from your home state, as well as any insurance. You can also register the vehicle in the state and will be exempt from all property and assessment taxes, which can be done at a local revenue office. You will need to provide a current leave and earnings statement at the time of registration.

Insurance

By law in Arkansas, if you are found to not have vehicle insurance, you will be fined. First-time offenders can be fined up to $250, second offenders up to $500, and third offenders up to $1,000 with the potential of being jailed for a year. You may also have your Arkansas license plate revoked. If you are involved in a vehicle crash while uninsured, you risk having your vehicle impounded. Losing your registration will also open you up to further fees upon re-registering.

Final Words

Getting a bill of sale for vehicle in Arkansas in order to legalise your vehicle sale or purchase transaction is not a challenging task as this website contains a proper legal and perfectly crafted template of it that you can download with a single click. The rest of the procedure of registration of a motor vehicle in the State of Arkansas is mostly practical, therefore we lay more emphasis on of the most essential parts of the procedure i.e the bill of sale for a vehicle.