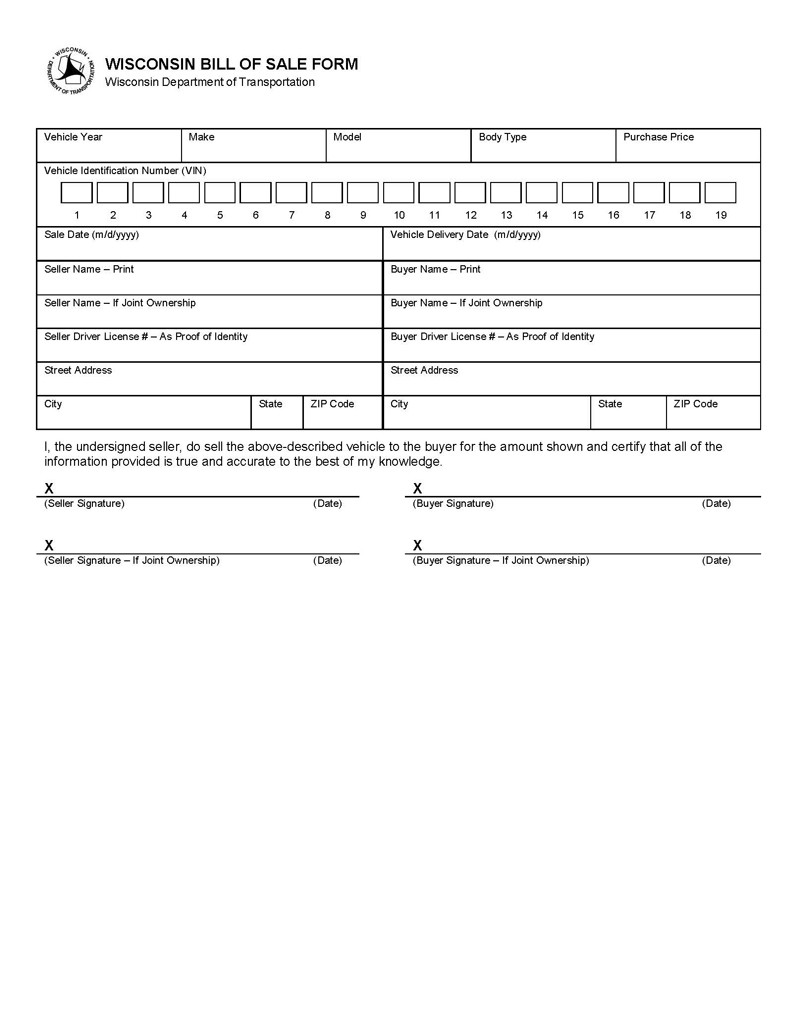

When selling, buying, or registering a vehicle in the state of Wisconsin, you will need to have a Wisconsin Bill of Sale (Form-MV2928). A vehicle bill of sale in Wisconsin acts as a legal document giving proof that a transfer of ownership has taken place and done so legally.

A bill of sale for a car in Wisconsin also acts as protection from liability should there be any issues with the vehicle, such as a fine against the vehicle. It proves who was in ownership of the vehicle at the time of the fine. A vehicle bill of sale in Wisconsin must have details about the vehicle, the transaction, and both parties who are entering into the sales agreement.

For the Wisconsin bill of sale to be legitimate, it must be signed by both the buyer and the seller.

Other Required Documentation

With the bill of sale, you will also need an Odometer Disclosure Statement. There is a space on the Title of the vehicle to fill in this information. The odometer details are only required if the vehicle being sold is from 2011 (model year) or newer. Wisconsin does not have an official form, so the odometer reading must be filled in on the Title.

If there is a lien against the vehicle, the seller must acquire a lien release document from the line holder. This must then be given to the buyer.

Brand Disclosure

In some circumstances, the seller will be required to complete the brand disclosure section of the title. This is to make sure the buyer is given a complete vehicle history. Failing to disclose these details can result in penalties as high as $5,000.

A brand disclosure is required in any of the following situations:

- The vehicle was used as a police vehicle

- The vehicle was previously used as public transportation or as a taxi

- The vehicle was salvaged

- The vehicle had flood damage

Creating a Vehicle Bill of Sale for Wisconsin

The state of Wisconsin provides its own bill of sale (Form-MV2928). However, you can create your own bill of sale for a car in Wisconsin.

It must have the following details:

- Vehicle identity: this must include the manufacturer’s year and make, the vehicle model, body type, VIN, and the purchase price.

- The date that the vehicle sale took place: If the vehicle is being delivered to the buyer at a time after the sale date, you will need to include the delivery/pick-up date as well.

- Details of the seller: must include the full legal name of the seller, their legal address, and their driver’s license number. Any joint seller should also be included.

- Details of the buyer: must include the full legal name of the buyer, legal address, and driver’s license number. If there is a joint buyer, their details must be included as well.

- Signatures: Both the seller and the buyer must sign the bill of sale.

Selling a Vehicle in Wisconsin: What the Law Requires

The requirements are given below:

Before you sell

- Make sure that you have the Title of the vehicle in your name. If the title has been lost, you can apply for a replacement title online with the Department of Transportation. You may also download Form MV2119 and mail the completed form and payment to the Wisconsin Department of Transportation, P.O. Box 7949, Madison, WI 53707-7949

- Any money that is owed on the vehicle must be paid before you can sell it. A lien release is required from the lien holder/lender (if applicable)

After you sell: private seller’s requirements

Once the vehicle has been sold, the seller is required to:

- As per Wisconsin Statute 342.41, any privately sold vehicle requires the seller to complete a Seller Notification. This must be done within 30 days from the date of the sale.

- If the vehicle had a lien on the title, the seller must provide the buyer with a lien release from the lender.

- Remember to remove the vehicle’s license plates, unless the vehicle is:

- A truck that has been listed as 10,000 pounds or over

- Farm vehicles that are listed as 16,000 or over

- Moped

- Recreational vehicle trailer or trailer

Registering a Vehicle in Wisconsin

By law, in order to operate a vehicle on public roads in Wisconsin, the vehicle must be registered with the DOT. If the vehicle was purchased from a dealership, the dealer will generally take care of the registration on the buyer’s behalf.

For private sales, it is the responsibility of the buyer to register the vehicle. While there is no set time frame for having a vehicle registered, the DOT does say that it should be done right away. You may be issued a temporary registration tag if there are documents that you are waiting for that are needed for the registration process.

Normally, vehicles must renew their registration annually, but some may have 2 years between renewals. You can renew your vehicle registration using the DOT Online Renewal process.

Where to Register a Vehicle in Wisconsin

If the vehicle ownership is being transferred and the title is being exchanged, you can register online at the eMV Public online service. Other types of vehicle registration will need to be done in person at your nearest Wisconsin DOT Office or by mail at: Wisconsin Department of Transportation, P.O. Box 7949, Madison, WI 53707-7949.

Documents required to register a vehicle in Wisconsin:

- A current and valid Driver’s License

- Bill of Sale (Form MV2928)

- Vehicle’s original Certificate of Title. You may also need to complete Form MV2489 if there are mistakes on the title or if the title needs to be altered.

- Form MV1 (Title and License Plate Application) if you are not registering online.

- If the vehicle had a lien you will need to bring the Lien Release, which should be given to you by the seller at the time of sale.

- A Vehicle Power of Attorney, if someone other than the buyer will be registering the vehicle on their behalf.

- Proof of vehicle insurance, which must have the minimum requirements:

- Cover of $25,000 for death or injury of one person

- Cover of $50,000 for death or injury of more than one individual

- Cover of $10,000 for property damage, per incident

- Proof that all fees and taxes have been paid, which includes:

- Title fees

- Registration fees for your vehicle’s type

- Local/county sales tax

- Wheel tax (for eligible vehicles)

- Surcharge for electric and hybrid vehicles

Wisconsin Vehicle Tax

The structure for vehicle tax in the state of Wisconsin is very specific. As a new vehicle owner, you should check beforehand to see which taxes and fees will apply to your vehicle and situation, with the links given above. State sales tax is 5% of the vehicle’s actual price. Your vehicle may also be exempt from this, for example, vehicles purchased from a close relative, or purchased by an individual who is not a Wisconsin resident.

Emissions Testing in Wisconsin

If your vehicle is registered in one of the following counties, you may be required to have an emissions test when registering:

- Kenosha

- Milwaukee

- Ozaukee

- Racine

- Sheboygan

- Washington

- Waukesha.

Emissions testing can be done at one of the licensed Test Facilities in your area. You may also check online to see if your vehicle is required to have an emissions test. Normally, if an emissions test is required, you will be notified by Wisconsin’s Department of Transportation. The following vehicles will require a test in the above-mentioned counties:

- A vehicle that has a light truck or auto plates

- Vehicles that are between model years 1996 – 2006, and that have a GVWR of fewer than 8,501 pounds.

- Vehicles that are from model year 2007 and newer that have a GVWR of up to 14,000 pounds

You may also be required to have your vehicle tested, within a 45-day time frame, if:

- The vehicle was purchased

- The owner has been added or removed on the title of the vehicle

- Every 2 years before the license plates can be renewed

- If you are a new resident that is transferring your vehicle to Wisconsin