It is pretty normal for employers to pay employees using a bi-weekly approach, after every two weeks. In such a situation, budgeting two paychecks in a month can be confusing and require thorough planning to cover your monthly expenses. A template is an effective tool for ensuring you allocate and manage your checks.

A well-crafted template is the first step in ensuring you remain in control of your finances. This article will highlight what to include when creating your bi-weekly budget template. It summarizes an individual’s income and expenses by collecting paychecks every two weeks or twice a month. The budget covers your expenses for the entire month while considering your income from the two paychecks.

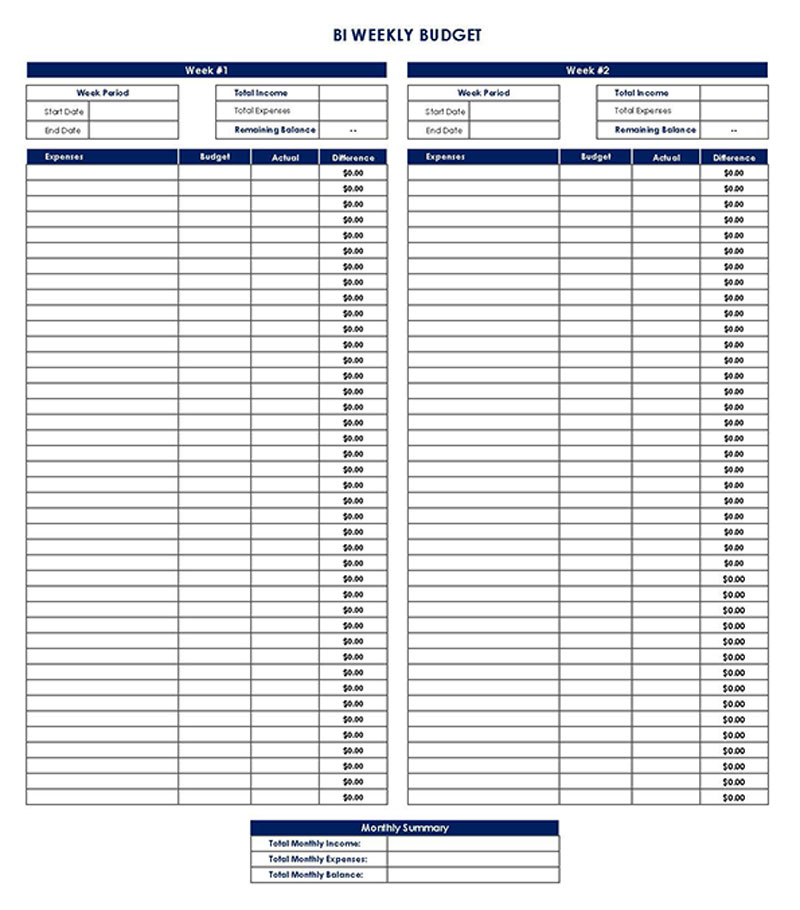

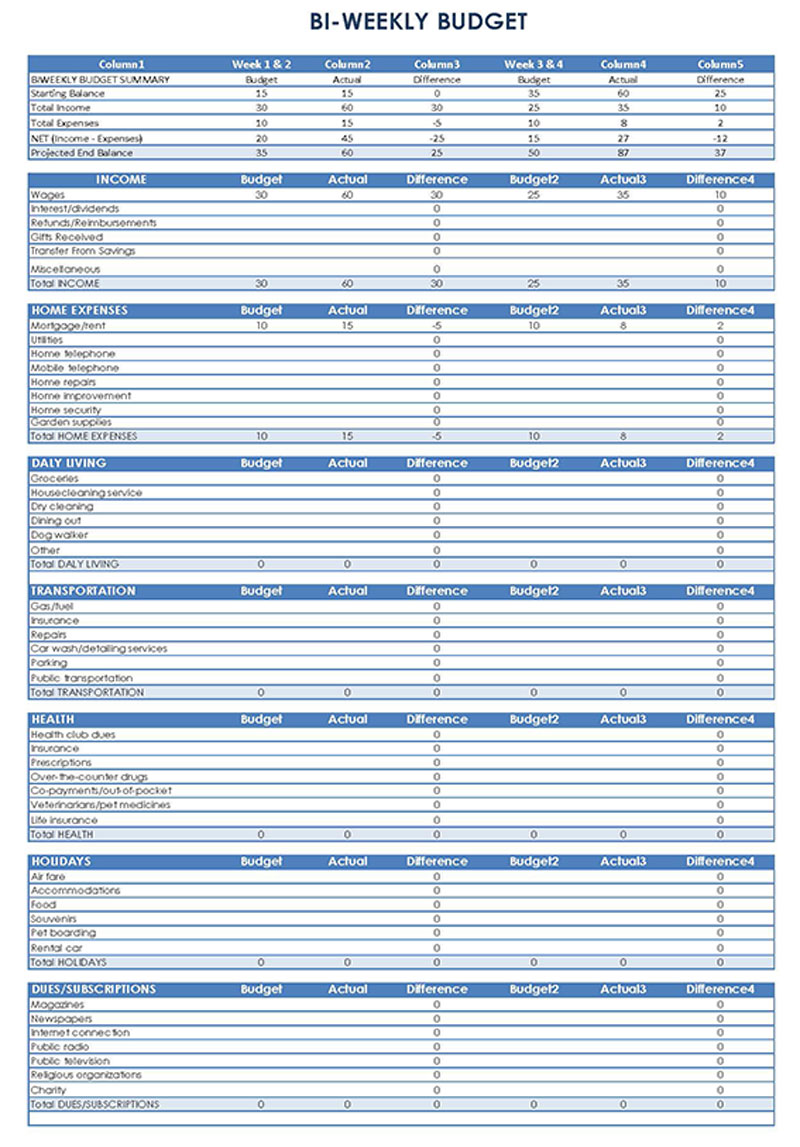

Free Templates

How does It Work?

While creating a bi-weekly budget, you have to consider the number of paychecks you will receive depending on the remuneration approach used by your employer. If you collect your paycheck twice a month, you have 24 paychecks to budget for in a year. However, if you’re paid after every 14 days, you have 26 paychecks to consider when budgeting. Semi-monthly paychecks give you two extra paychecks that must be considered in your income and expenses. A template can work to your advantage but can sometimes have its downfalls.

Below are the pros and cons of a bi-weekly budget template:

Pros

They include:

- It helps you manage your income while considering the timing of your paychecks.

- With a bi-weekly budget template in place, you can plan for extra income from extra paychecks, which can be directed to secondary needs such as savings, investments, and loan repayments.

- Bill payments and due dates are easier to track using a budget.

- With short notice, it can help you save up for special events such as birthdays, holidays, school field trips, etc.

Cons

They include:

- Laying down the framework for a bi-weekly budget template is frustrating at first.

- There is always a possibility of misappropriating income generated from the two extra paychecks in a 26-paycheck situation.

- You may be required to reschedule bill payment dates and times when implementing it.

Essential Components of a Bi-Weekly Budget Template

It is always advisable to create a personalized budget that addresses your expenses based on your income. However, using a template is considered more effective for having a more consistent plan. The template ought to itemize all your expenses to meet your basic needs first, then other auxiliary expenses.

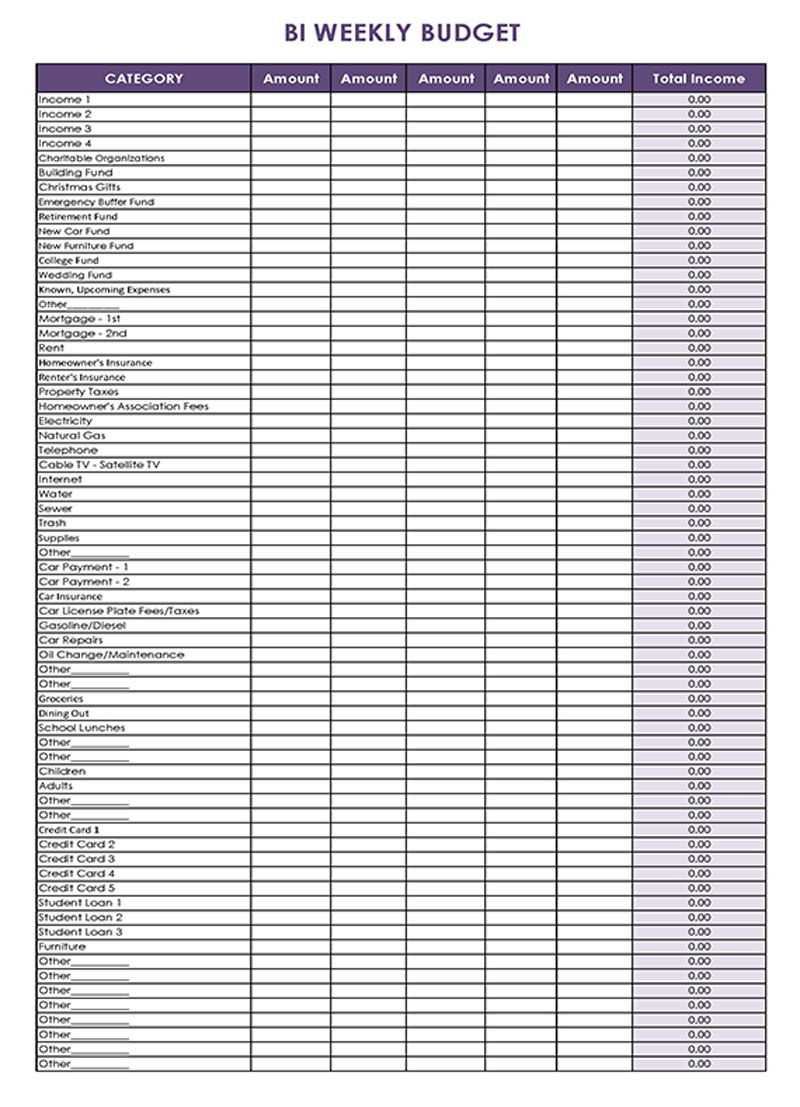

You don’t need to prepare it from scratch, but all you need to do is fill out each blank space with the appropriate information based on your needs for that specific budgeting period. Now, what do you include in your bi-weekly budget template?

Below are the components that ought to appear in a standard template:

Your rent/mortgage

Your budget needs to be aligned with your priorities at the top of the list. Housing or shelter, is one of the primary basic needs. In addition, your template should have a section to cover your rent or mortgage.

Utilities

It ought to cover utility expenses. Utilities are commodities or services that improve the quality of life. Examples of utilities to consider are water, electricity, gas, security, phone services, internet, recycling, cable TV, and AC. The template should have a section to input how much money will be directed to each utility category.

Health, life, and car insurance

Insurance is a vital factor to consider when creating a personal budget. The template should therefore outline your monthly installments on insurance. You can fill this section by breaking it into categories such as appropriate health, life, car, and house insurance.

Money put aside for car repairs and home repairs

Another expense that should be included is repair expenses. It may often seem unnecessary, especially if you don’t have urgent repairs needed for your car or house. However, it is important to set money aside for car and house repairs, as they often cost you a lot of money whenever they occur.

Retirement savings

Saving is a good financial habit. Your template can have a section to record how much you intend to set aside in your retirement savings account. A popular way of saving for retirement is using automatic deductions from your checks to your savings account.

Savings for your kids’ college education

Parents with kids at education levels can also plan for their kids’ college education through one. Adding a section that covers how much will go into the kids’ college fund can be a massive step in coping with the expensive cost of education.

Savings for medical bills and co-payments

Another expense you can save for is medical bills. Your template can include the amount you intend to save towards any current or expected medical bills. If you are subscribed to a medical insurance policy and have to make co-payments, you can add a section to record the amount you allocate weekly to the co-payment.

Savings for replacing your laptop and other devices

A bi-weekly budget template should also allow you to save up for costly purchases of items such as phones, laptops, mobile devices, and other digital devices. Since you will have to replace such devices routinely after a significant amount of time, saving up for them can help prevent using up a big chunk of your budget when you finally decide to buy the item.

Your high-interest debts

It is good financial planning to include debt repayments in it. The more you can effectively pay your debts, the more money you can save for your future. Note that it is essential to strategize how you repay your debts. You can organize your debts by annual percentage rate (APR) and balance, ranking them in descending order. Once listed, it is advisable to pay off high-interest debts, such as credit card debts. Alternatively, you can choose to pay off low-balance debts or a few low-APR debts first. Other factors to consider are repayment deadlines and urgency; you should prioritize debts whose deadlines are closest to avoid incurring late payment fees.

Emergency fund

You should also have a section to record the money you would like to direct to your emergency fund. An emergency fund is money set aside as a cushion for unprecedented financial setbacks, such as loss of employment. You can target saving up to three to six months of your monthly expenses in an emergency fund. You can keep the emergency fund in a high-yield savings account, a money market account, or a certificate of deposit.

A big goal

Another item is any huge financial goal you aim to undertake. This can include buying a home or car, starting a business, or setting up a trust for your heirs. Again, you can allocate available income or extra paychecks towards your financial goal.

Fund much-needed rewards

A bi-weekly budget template can incorporate personal rewards such as vacations and outings as incentives for good habits. You can plan for the rewards from the beginning of the year by devising a plan to raise the money needed for these rewards, which prevents impromptu expenditures.

It should reflect your expenses, and as a result, there isn’t a one-size-fits-all budget template. Therefore, this offers you the flexibility to choose any template that suits your requirements. We have provided the readers with different free, downloadable templates they can use as guides for it. The templates are easily fillable and contain all the fundamental items.

How to Plan a Bi-Weekly Budget

Being a semi-monthly employee means you receive two paychecks every month. The first thing that should come to mind after receiving your first paycheck is the basic needs that will sustain you. With this first paycheck, consider your rent or mortgage and utilities such as food, clothing, and medical bills, among other basic needs. If your first paycheck did not satisfy your basic needs, move to the second paycheck.

The main idea of a fortnightly budget is to fulfill your basic needs. After that, you should consider covering your loans. Start with loans that have a high interest rate. If you still have cash left, put it in emergency funds. Emergency funds can be used to tackle inflation, for example, in the food budget. And planning a vacation should be the last option.

First bi-weekly Paycheck

With the first paycheck, consider the following points:

Design a plan that assumes you are paid fortnightly

The first step is to make a framework that is based on a biweekly payment schedule. This is crucial since you will need to cater to the essential bills first

Get ahead on bills

This is your main idea; go ahead with bills. If you are capable of paying some bills, it is good since it will reduce anxiety in the coming months. Your bills include your rent, your mobile phone, and others. Consider prepaying for all the utilities, such as food, clothing, and other basic needs, to reduce the load. Since managing a budget is hard, it will relieve your anxiety since you know your first priority needs have been handled.

Pay your high-interest bills

Most people are not comfortable knowing that they owe someone or an organization. Get rid of your high-rate debt, which is mostly your credit card debt. You should make a list of your debts in an organized way by considering the annual percentage rate. Paying off the bills at the one with the highest rate will save you a fortune since you will be paying bills that carry a larger balance. Also, paying the low annual percentage rates and the low balance debt will ensure you gain momentum and other financial benefits.

Second Paycheck

If you’re content with how you managed your first paycheck, now is the time to plan for your second paycheck. With this money, your first priority will be setting aside an emergency fund. A vacation will be the last option, but it is still important to break your routine and have time to strengthen family bonds.

Below are things to consider with your second paycheck:

Create an emergency fund

An emergency fund is created for three to six months of your regular expenses to tackle financial setbacks, including a medical emergency or a lost job, without necessarily needing to take on new debt. You should keep these funds apart from your regular savings account, and this will help you reduce the temptation of dipping into the emergency savings account.

Save for a big goal

Goals are what keep us moving. If you want to save for a goal, for example, a home or a car, adding to your retirement account is good. If you are free of debt, you will be able to focus on the goal. The best way is to transfer your extra paycheck from your checking account to your savings.

Fund much-needed rewards

When you are paid semi-monthly, you should keep in mind that managing your money is not only about your dollars. Emotions play a part in your finances, and they are the cause of decision-making. You may need a vacation from your daily routine; for example, you may need a date night at your favorite restaurant. You should set aside a token for this purpose.

Making a Bi-Weekly Budget Template

Now that you’ve become familiar with the different components of a fortnightly budget template, let’s discuss how to tie all these components into a comprehensive budget that you can use in your financial planning.

Below are the different steps involved in preparing it:

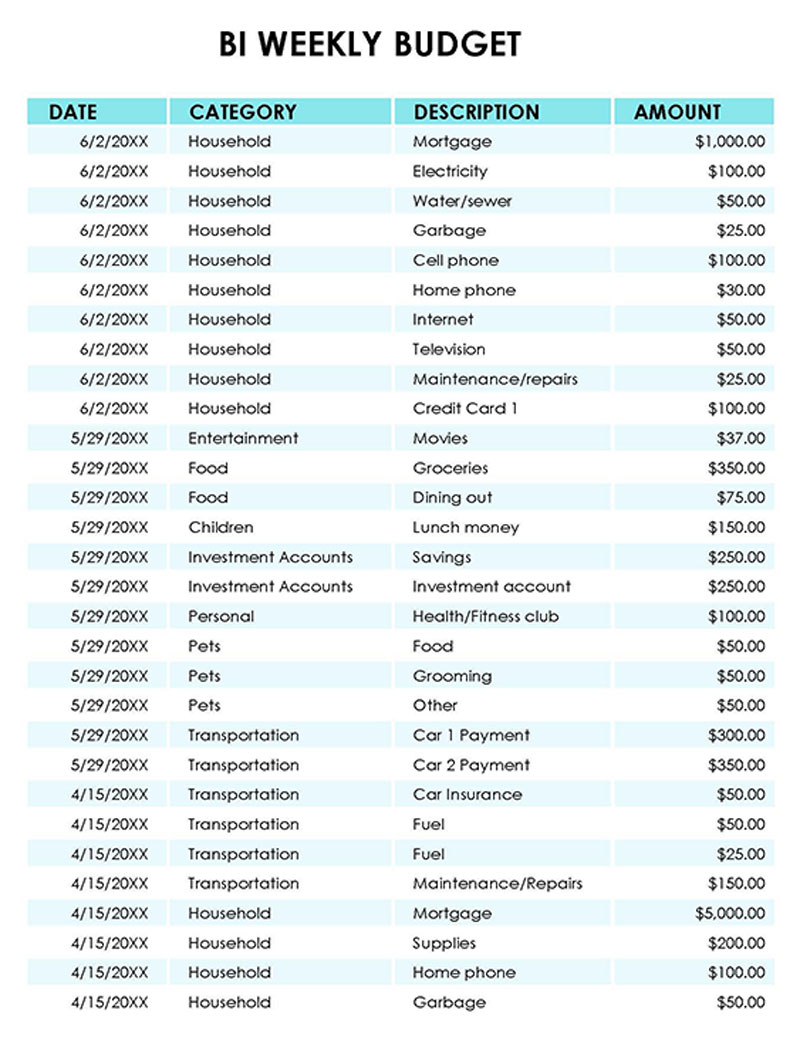

Fill out a monthly calendar

The first step is filling out a monthly budget calendar. It highlights the payment date, bill due date, and special event dates. Therefore, you have to first outline all the bills you have to pay within the respective month and their due dates. If you cover any expense using contributions from your two checks, consider using different color markers for each paycheck. It is a visual tool and should therefore be easy to interpret by simply viewing it.

Create monthly spending categories

After filling out your calendar, you can now complete your template. All the expenses should be listed in the appropriate categories. For example, savings can be a broad category, with retirement, college funds, and medical bills as sub-categories. Also, utility is a broad category that can be broken down into water, electricity, internet, etc. These are typically fixed expenses, as you can estimate how much you spend on these categories per month, and consequently, you can distribute the cost between the two paychecks.

Incorporate varying expenses

Next, you can incorporate varying expenses. These are expenses that can change from one month to the next. Examples of varying expenses include groceries, household items such as beauty and hair care products, personal expenses such as clothing and transportation, special events such as birthdays, etc. Remember to prioritize with varying expenses, too; for example, groceries should be prioritized over birthdays.

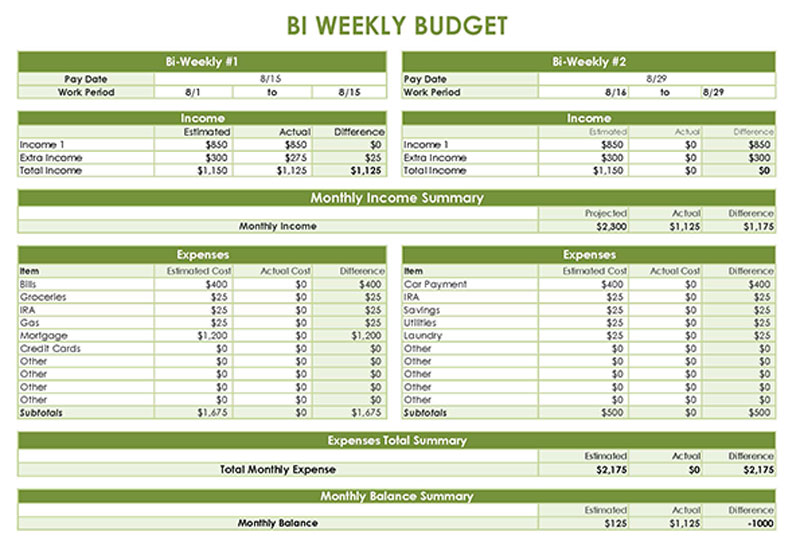

First bi-weekly budget

Now that you have all your monthly expenses outlined, you can create your first budget to distribute income from the first paycheck. The first paycheck does not cover the entire monthly expenses, so you need to distribute this money to cover the most urgent expenses until the next paycheck.

In this one, you should prioritize expenses due before the next paycheck of the month—typically rent, credit card installments, savings contributions, and groceries. Then, distribute your money rationally among the different categories. Finally, any amount left over can be transferred to the savings account or used as extra debt payments.

Second bi-weekly budget

Next, you should prepare the second one. This one is meant to cover the remaining expenses and supplement the variable expenses. This will often be less than the prioritized fixed expenses covered in the first one. Therefore, if you need to buy more groceries, clothes, or eat out, you can include these expenses in the second one. However, if you use a half-payment method, the budget covers the balance of the expenses.

Put in a buffer

After finalizing the second budget, you should then add a buffer or cushion in a sinking fund or emergency fund. This money gives you an extra layer of financial protection should the unexpected happen. A buffer gives you room to afford bills that overshoot the expected amount and protects you from frustration if you make mistakes in your estimations.

Start tracking

Lastly, once your bi-weekly budget is complete, you can begin tracking your expenses. Check bills as soon as they are settled. Sticking to a it can often be frustrating, but a reasonable budget is as helpful as how well it is followed. Always expect deviations; record them, whether they are positive or negative, and consider them when creating one.

Bi-Weekly Budgeting Tips

To further assist you in budgeting, there are several things you can implement. First, always make sure you have written everything down. Avoid committing figures or notes to memory. Instead, record them to ensure no information is forgotten. Also, consider using phone applications to track your expenditures.

In addition, it would be best to consider having a month’s expenses available at all times to give you a month’s cushion if anything happens. Lastly, if the timing of your paychecks is not working to your objectives, consider requesting companies to change your due dates to ensure payments are made on time.

Frequently Asked Questions

You should avoid having your entire bill due on the exact date you collect your paycheck. This will require you to pay all the bills, leaving you with no money to sustain yourself until the next payment. To solve this, you can call companies to compensate you and ask them to move your dates to a more convenient date. Ideally, having specific bills at the beginning of the month and others at the end of the month would be more appropriate. This way, you can divide your paychecks among the different due dates and have enough money left for use in between paychecks.

The third paycheck presents you with an option to take positive steps towards your financial goals. For example, you can use the paycheck to make extra payments on your debts, direct it to an emergency fund, carry it forward to an expected significant expense such as a home purchase, vacation, or annual fee of a utility bill, etc. Additionally, it can be used to contribute to your buffer. For example, two extra paychecks equate to an entire month’s expenses.

As a general rule, it is an ideal situation. However, in reality, this may be difficult or impossible. Therefore, you should save whichever amount you can, no matter how little. This amount can be increased as time goes on.

Monthly and weekly budgets can be equally effective in managing your income. None is superior to the other, even though monthly ones are more popular than bi-weekly ones. Whatever you use usually boils down to preference and convenience. Weekly or the-by-pay check method are more convenient for people who get paid weekly or live paychecks.

The 50/30/20 rule is a technique used to manage personal finances. It dictates that 50% of a personal budget should be allocated to needs (essentials) such as rent and food, 30% to wants (non-essentials) such as holidays, night outs, etc., and 20% should be delegated to savings. These figures are estimates and can be more or less.