A cash flow budget is a way of tracking the flow of cash in an organization over a given duration of time. It sets its eyes on the cash at hand, receivables, outstanding payables, loans, and other monies that may be owed for the purchase of capital and other forms of investments.

Below are some of the reasons for cash flow budgeting:

- To be able to know the status of the cash position at any given time

- Showcase the budget versus the cash flow

- Drafts a list of the cash inflows and cash outflows

- To know the adjustments to make for every expense

- Cater to the losses or any impending loopholes in budgeting.

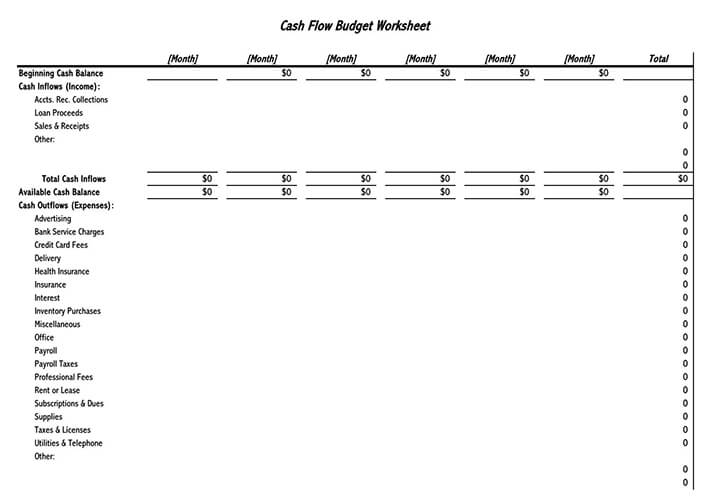

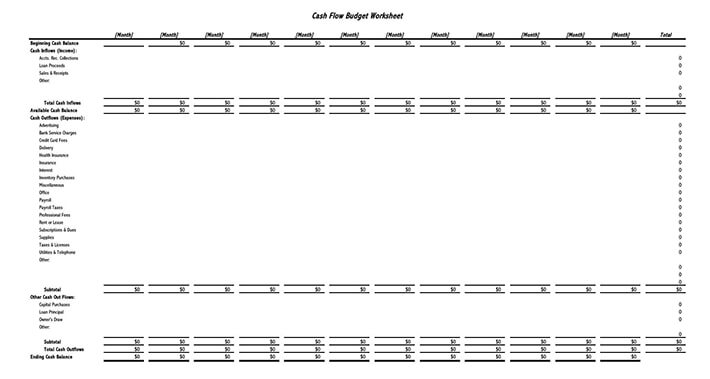

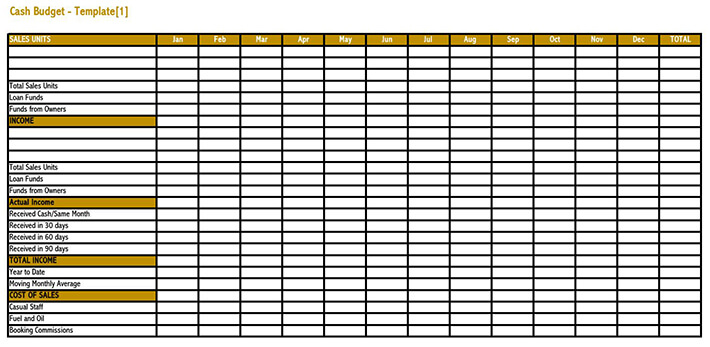

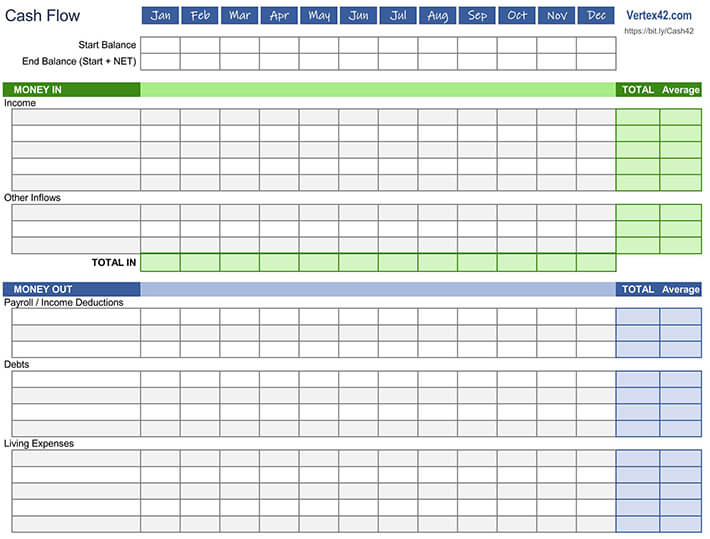

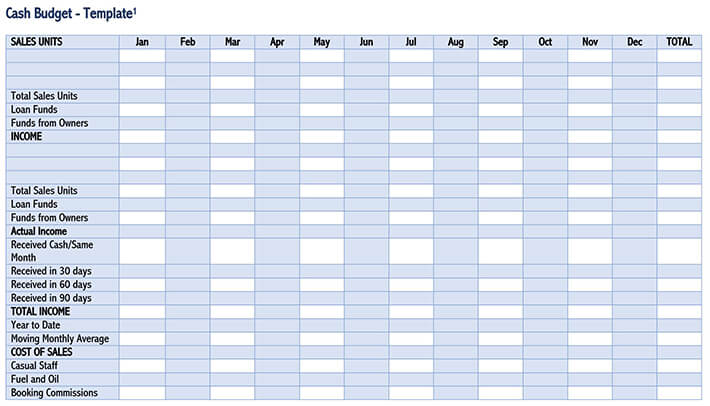

Using Free Worksheets

How to do Cash Flow Budgeting

To do the cash flow budgeting, there are steps you ought to take and tips you have to adhere to. Below are these steps, tips, and procedures explained in finer details:

Set a desirable timeframe

Start off by setting a desirable timeframe for your cash budgeting. This can be monthly, annually, bi-monthly, or weekly, as you so desire. Maintain this timeline for the sake of consistency in future budgeting procedures and techniques.

Project the cash inflows

After having set your desirable timeframe, you should move ahead now to project the cash inflows. This ought to be in line with past trends and revenue inflows. In the absence of the past data, leave the column blank and fill it later when the cash inflows commence.

Project the cash outflows

Do the same to the cash outflows. Use the past data to make some projections on the future, likely cash outflows. In the absence of any past data, leave the space blank for the sake of filling it out at a later date if and when cash begins to flow out.

Compute the ending cash balance

With the projections, you will have already made, you may now go ahead to compute the ending ash balance. This is basically the difference between the cash inflow and the cash outflow. It basically gives you a peek into the cash at hand or the outstanding balance.

Set the minimum cash flow balance

Using the metric above, it is now possible for you to set the minimum cash flow balance. This is a rough guide on just how much money you should have at your fingertips at any given time. It acts as a rough guide on your future expenses and cash handling too!

Worksheet Example

| MONTH | CASH INFLOW ($) | CAH OUTFLOW ($) | |

| 1. | January | 1,299.00 | 1,100.00 |

| 2. | February | 678.95 | 534.00 |

| 3. | March | 2,099.11 | 1,509.00 |

| 4. | April | 1,876.22 | 1,367.98 |

| 5. | May | 1,309.44 | 1,0935 |

| 6. | June | 348,09 | 229.22 |

| 7. | July | 652.00 | 763,00 |

| 8. | August | 908.34 | 889.23 |

| 9. | September | 1,085.00 | 987.00 |

| 10. | October | 876.55 | 1,200.00 |

| 11. | November | 987.00 | 1,100.00 |

| 12. | December | 1,100.00 | 1,298.00 |

| TOTAL |

With the insight we have furnished, we now believe you have what it takes to draft a nice cash flow budget for your business. Just follow the steps we have delineated diligently to attain that very end. Most importantly, download and make use of the free worksheet templates we have prepared and made available for you.