A bookkeeping services agreement defines the terms between a client and the Bookkeeper providing accounting services for a one-time or even monthly basis.

The Bookkeeper will have access to the banking records, revenue details, receipts, and other financial details regarding the Client and their business. This, therefore, means that the selected Bookkeeper has to be trustworthy.

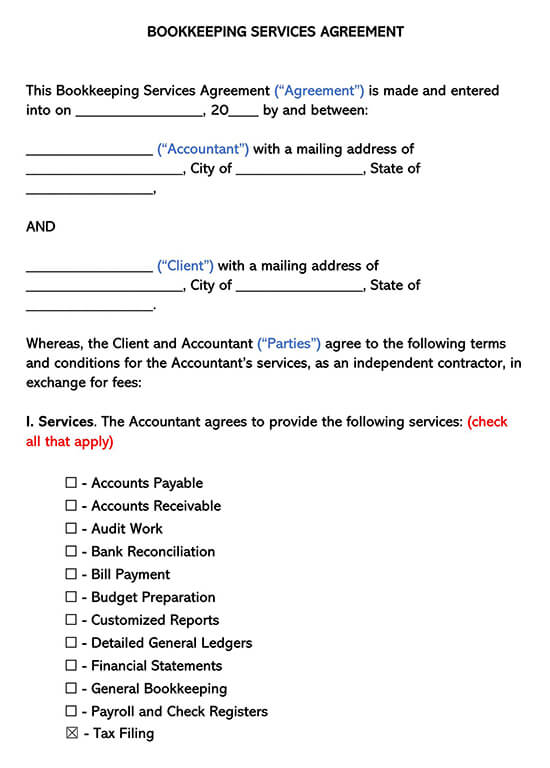

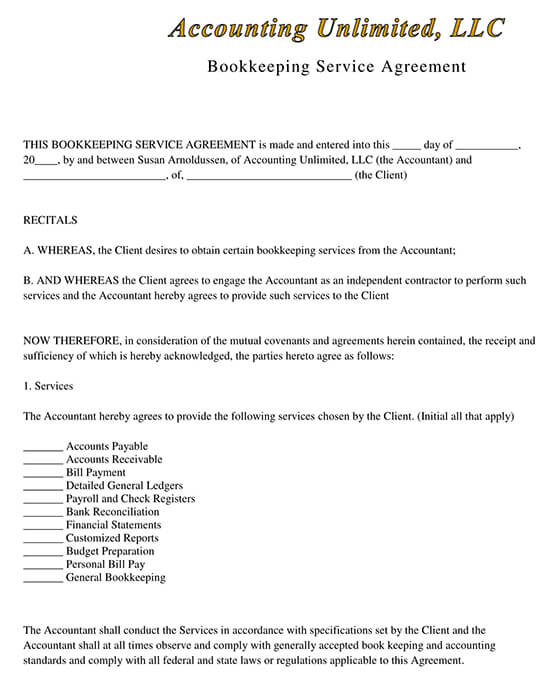

Free Templates

What Are the Roles of a Bookkeeper?

A bookkeeper, an accountant, is entrusted in creating a process of managing all the records of an individual or business for tax returns and internal financial reports. The management tasks of the professional Bookkeeper may vary depending on the client.

However, the expert may be asked to oversee the following:

- Accounts Payable

- Bank Reconciliation

- Budget Preparation

- Detailed General Books or ledgers

- Financial Statements

- General Bookkeeping

- Check Registers and Payrolls

- Customized Reports

How to Write a Bookkeeping Services Agreement

Following are the steps to write a bookkeeping services agreement:

1. Access the bookkeeping services agreement

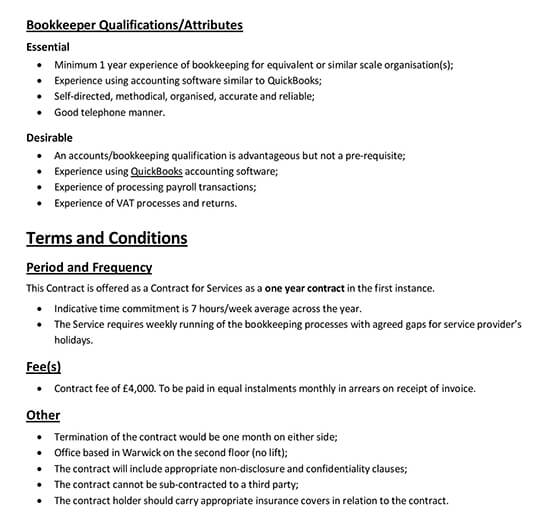

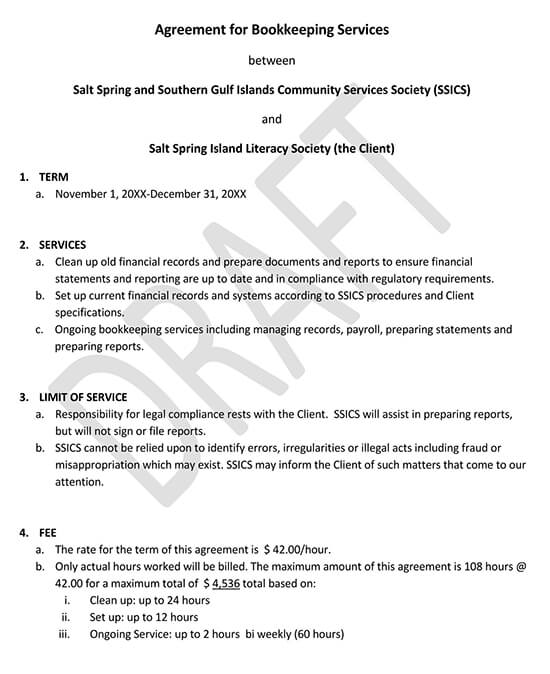

The first process is to ensure you locate and access the services agreement template on the right page. After this, the paperwork highlighted in the image will offer a structure and the language for a Bookkeeper/ Accountant to solidify the client’s job. This can be downloaded by clicking any of the preview image buttons within the preview image’s caption area or by following the links provided. If you don’t have the right word processing software or PDF editor, you have the option of using your browser to save and print a copy if you wish to fill the form manually.

2. The client and accountant has to be identified

The first statement must be documenting the appropriate date when both parties agreed. This means you have to record the calendar month and day on the first blank while the year should be recorded on the second blank line.

The accountant has to be named in the statement. Therefore locate the space labeled Accountant and provide the legal name of the commissioned accountant. Ensure you solidify the entity’s identity by providing their mailing address within the next three empty lines.

The Client intending to hire the accountant mentioned earlier through this Agreement must also provide his or her full name on the blank space labeled Client. The mailing address must also be included, with the three empty spaces being where you need to provide your street address, city, and the state of the Client’s mailing address.

3. Define the services to be provided

Now that all the concerned entities have been identified, you have to give an accurate description of the accounting job at hand. A checklist will be supplied to the first article, allowing you to clearly define the accountant’s services to fulfill his or her Agreement.

You have to name services such as Accounts Payable, Bank Reconciliation, Budget Preparation, Bill Payment, customized Reports, Accounts Receivable, and other services by marking the corresponding checkboxes. If none of the items defines what the professional is being hired to do, you should mark the last part, which states others and describes the required services.

4. Record all the agreed compensation for the services

The next segment deals with the payment terms of the Bookkeeper. Here you have to mark one of the boxes describing the accountant’s pay rate. If you are paying hourly, you should mark the first checkbox and fill in the amount in dollars to be paid.

If you settle for large sums for the services rendered, then mark the second box and record the full amount of cash the accountant should be paid after the fixed amount.

However, suppose the options mentioned above are not describing the accountant’s pay rate for the Agreement. In that case, you need to mark the third checkbox and precisely calculate how the pay should be calculated.

The second part under this segment will also require you to outline how frequent the payment has to be. This can either be recurring upon completion or define a different schedule altogether by marking the last checkbox and providing the details within the blank line provided. You must also state if you will be reimbursing any amount used to form the accountant’s pocket, including travel, audit, and tax fees.

5. State when and where the agreement will be effective

A report on where and when the agreement terms should be active is a must. Here you will have to choose among the three checkbox statements when defining when the accountant is expected to start work. If the professional will be expected to work within a predetermined period, you need to mark the fixed time and enter the first calendar date to start to work.

For specific dates, the second checkbox should be marked. Here two blank lines are provided to record the first calendar date of working. However, for the termination checkbox, it will be reported on how the Agreement and the accountant and client relationship’s employment and client relationship will come to an end here. If the Agreement continues until both parties terminate it, then the first checkbox should be marked and record the notice days that the party terminating the agreement has to give the other party.

6. Finally, the agreement has to be entered through a binding signature

The signature segment contains enough space for both the Client and the accountant to formally enter into a binding agreement. Each party has to ensure they sign under their titles and provide a signature date.