Business activities such as travel to clients and routine office operations will usually involve expenses that employees must account for, for future reimbursement. Expenses, in this scenario, imply any payment or monetary loss that a person incurs on behalf of their employer. This includes transportation, lodging, food, mileage, office supplies, etc. These costs are tracked through an expense report.

The report records all the business costs within a particular reporting period for planning and tax reporting purposes. At the end of the specific reporting period, employees must submit this report for the company to reimburse them for incurred expenses. This article will explain the purpose of the reports and provide guidelines for creating one.

What is an Expense Report?

An expense report is a financial tool most companies use for accounting purposes.

It is a compilation of expenses incurred by employees for different purposes throughout their workdays or in their work duties. The costs vary from fuel expenses to travel to the client’s site, decreased value of assets owned by the company, and food, among others.

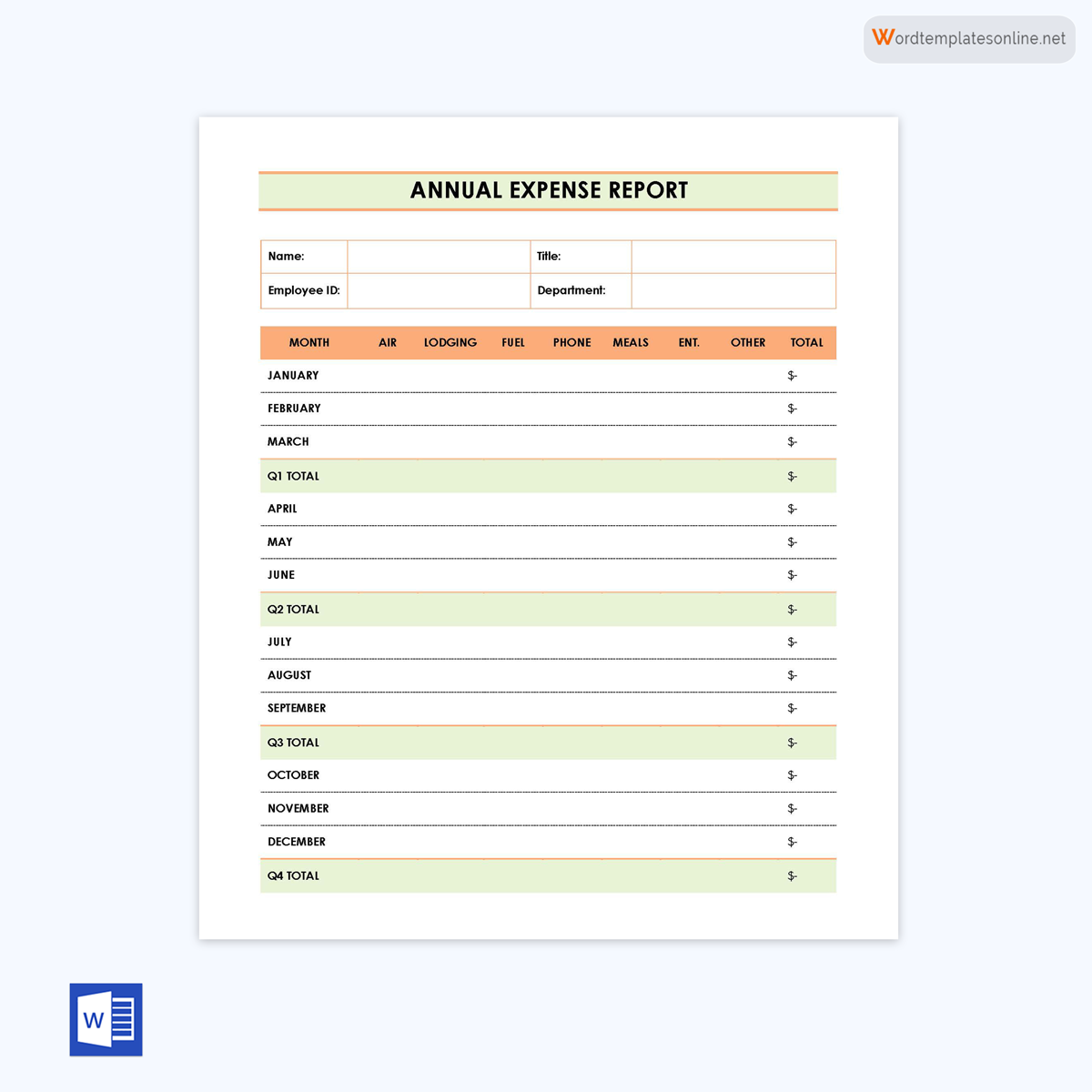

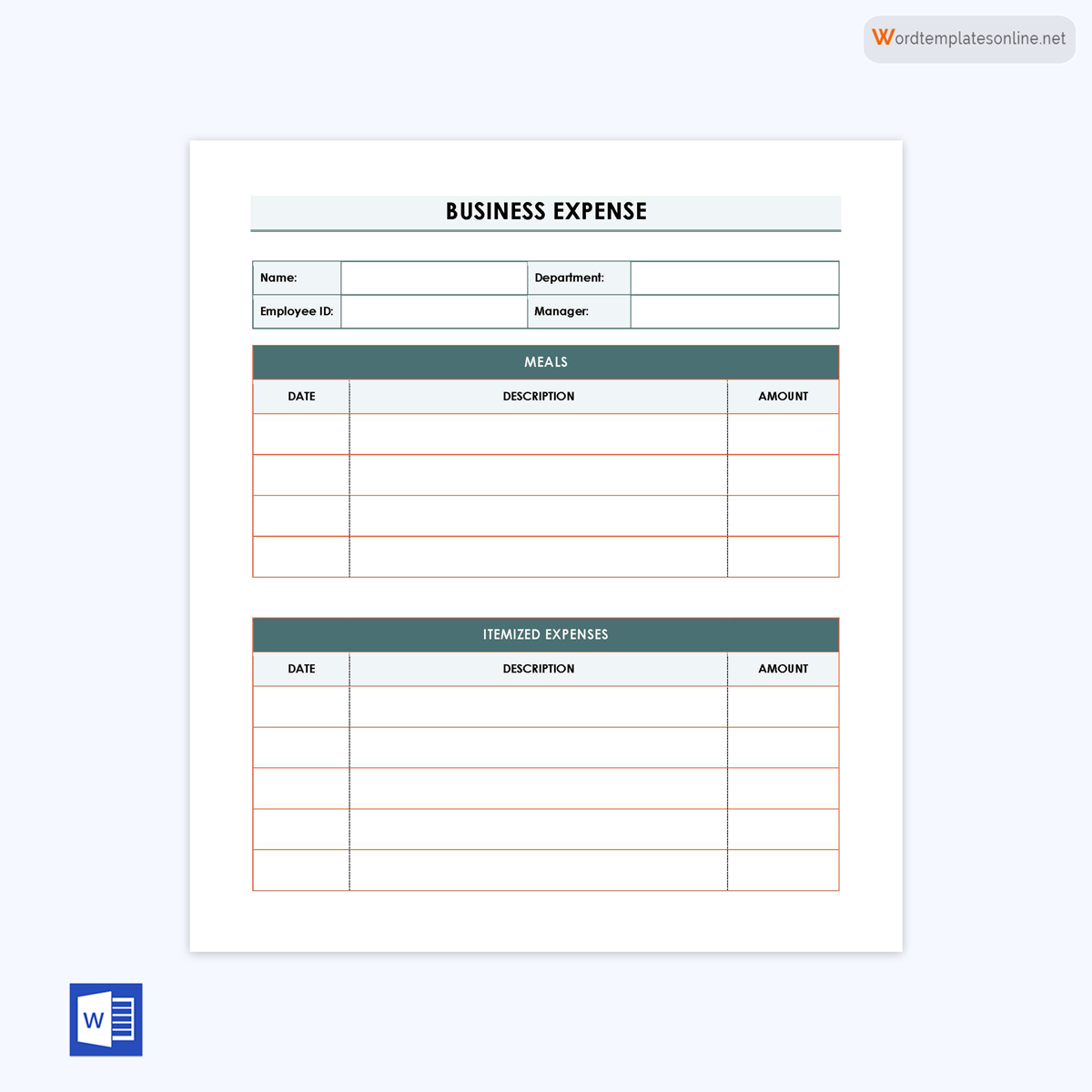

The expenses are categorized into mileage, meals, accommodation, etc. An itemized report simplifies auditing. The report can be submitted weekly or monthly; the corresponding receipts of the enlisted costs must also be provided. It can be electronic or paper-based, and it can track business costs through accounting software or a template.

A template is a predesigned expense tracking tool that outlines the fundamental categories needed to document each expense incurred by an employee accurately. These categories include employee name and ID, dates, type of expense, amount, description, method of payment, etc. The template is flexible and can be customized to suit different business organizations or companies. In addition, you can use these templates to create your reports. Since the templates are readily accessible and cost-effective, they effectively save time and money when creating reports.

What is an expense report used for?

The primary purpose of this report is to keep track of business-related expenses incurred by employees during an accounting period. This report is audited so that the employees can be reimbursed. It also determines if the expenses are within the company’s expenditure limits.

tip

The reports can be prepared monthly, quarterly, and annually. Monthly and quarterly reports are used to ascertain that expenses are within the company’s budget and if certain costs can be lowered to increase profitability. In addition, yearly reports claim tax deductions from the company’s tax returns.

Free Templates

Given below are expense report templates:

Why are Expense Reports Needed?

Regardless of the type of industry and size of the company, the report is needed. These are prepared with different purposes in mind, some of which are as follows:

Helps in expense tracking and cost control

The company can monitor individual or departmental budgets by compiling employees’ expenses. Therefore, the report is a centralized point where the accountant and finance department can find information on the total amount spent by an employee and what it was spent on.

This information is needed for auditing purposes. This way, the auditors can identify areas where costs are high and devise cost-cutting solutions that either lower or eliminate unnecessary costs. This, in turn, helps a company control how much money is spent in every financial period. Through the report, the company can also identify expense policies that raise expenses and help modify the policies to be more favorable.

Helps with budgeting

A significant advantage of the report is the ability to predict future spending. If accurately completed, the report provides information on expenses incurred due to the company’s operations. It can be used to get information on purchasing patterns, employee travel trends, and billable hours among others, thus allowing the company to evaluate its business expenses within specified periods, for example, a month, and at different levels, such as departments or individual employees.

With this information from the report, a company can plan how much to spend on the different levels each year based on business needs. This is imperative for accurate budgeting and planning in an organization. The report also helps to verify if employees and departments are sticking to the budget limits.

Makes for accurate reimbursement

The information contained in the report is vital for accurate reimbursement. The template must be comprehensive and inclusive of all the essential categories the employees need to complete for a refund to be authorized. It should provide information on the purpose of the expense, a description, and the amount incurred.

A compiled and detailed report is critical in identifying legitimate claims and determining whether an employee is entitled to be reimbursed by the company. This ensures the employee receives their fair share and the company does not pay more than they owe. In addition, the expense reimbursement process is standardized with the report, and employees know which expenses they can claim. This ensures that everyone remains compliant when reporting their expenses.

Simplifies tax deduction

Most business-related expenses are tax deductible. However, to be claimed when filing returns, they must be properly documented. The report is an effective way of documenting these expenses and verifying their authenticity. In addition, since the report records all expenses, it simplifies tracking those that can be written. Therefore, this exercise considers reports more accurate than a bank account or corporate card statements.

How are Expense Report Processes?

Companies will adopt the reporting process that suits their needs and preferences. Typically, an employee will submit the report to their departmental head documenting all expenses incurred during their official duties in a particular period. Once the employee report is submitted, it must be reviewed by a manager or supervisor whose responsibility is to ensure that all expenses incurred by the employee have been entered appropriately and are following the company’s protocol. Only after this verification process can the report be forwarded for further auditing.

The finance department then reviews approved claims. Once the claims have been approved, a company may make payments to reimburse the employee. Proof of the expenses, such as receipts, is then stored for future audits and reference.

Alternatively, some companies give their employees an advance amount to cover business expenses. Employees are expected to account for how that money is used at the end of the reporting period. However, they are not reimbursed in this case. The finance department still records the advance amount as a business expense.

note

Tax deductions are one primary reason freelancers, sole proprietors, self-employed, and contractors use expense reports. Some ordinary deductible expenses include insurance, travel, and interest on business loans. Each expense should be recorded in the appropriate category in the suitable tax return form. The IRS tax forms will have standard categories of expenses depending on the type of filer. For example, sole proprietors must use Schedule C and federal income tax return forms.

What is Included in an Expense Report?

The reports may vary depending on the type of expenditure incurred and the company’s needs (company’s expense policy). Thus, each report will usually vary in content and structure.

However, some of the common categories of a standard template include the following:

Date of purchase/expense

The expense date should be accurately captured. This can be the date on the associated receipt.

Amount of expenditure

The exact amount incurred by the employee should be indicated in the report. It must correspond with the respective receipt.

Type and description of the expense

Each expense must be categorized appropriately. Examples of categories include accommodation, meals, mileage, etc. A short description can also be supplied. The name of the vendor or merchant from which the item was purchased should be included.

Purpose of the expense

It must be clear why the expense was incurred. The purpose can be given by indicating the project or client on which the expense was spent.

Employee details

The employee submitting the report must provide their details. These details include the employee’s name, ID, designation, department, contact information, etc.

Associated account

The report must indicate the account from which each expense should be reimbursed.

The subtotal and total

Each category of expenses should have a subtotal. Then, all the expenses incurred by the specific employee must be provided.

Difference

The difference between the total expenses and any advance payments made to the employee should be indicated. This ensures authenticity.

How to Create It?

There are two methods of creating reports – manual and automatic. The selected method will depend on the company’s preference and suitability to its needs.

Below is a discussion on how to use both methods to create the report:

Manual expense reporting with custom templates

Printed templates are a manual way of creating a report. The templates are available online. They are user-friendly and can be customized to suit the needs of a company. They can also be personalized to suit the various departments in a company. Our readers can download such templates from our site for free. These templates include essential components of a standard report.

The process involves having the company’s template available online and following the proper steps to create the blank form. Once the expenses have been compiled, you can enter the details into the fields provided for each category. The template used must align with the current business needs of an organization. In addition, the template must be functional and easy to use. Thus, it can be customized depending on the situation.

The template can be edited as follows:

- Fill in the employee details, including name, contact details, job title, the reporting period, and business purpose of the report.

- Create rows and columns to cover the expenses and expense categories, respectively. Some companies have specific mandatory columns that must be present to correspond with columns in IRS tax forms; if so, ensure they are completed.

- Complete the spaces appropriately based on the expenses incurred. The expenses should be filled in chronological order – earliest to recent expenses.

- Calculate the subtotal of each expense category and note it down. Then, calculate the total and record it.

- Attach corresponding receipts for all expenses. The receipts can be scanned or photocopied. Scans are for digital submissions, and photocopies are for physical submissions.

- Submit the report to the department or line manager for validation. Once validated, approval should be issued.

- Once approved, the report is submitted to the finance department. Then, after careful auditing, payments will be issued for reimbursement.

Automated expense reporting

Expense reporting can be automated to make it easier for employees. Automation of the reporting process is widespread among large corporations where templates would be time-consuming. In addition, automation makes the process faster and more effective, where multiple reports can be submitted, validated, and processed daily.

So how does automate expense reporting work?

- An expense management system is adopted. There are various apps/software that can be downloaded to create such reports.

- Employees log into the system and fill in their details and mandatory fields. Alternatively, they can record their receipts digitally and submit them. This way, the expenses are retrieved from the receipts, and a reimbursement claim is generated for each employee.

- Multiple claims are compiled into a group and submitted. Some software can gather claims that have not been submitted.

- Alternatively, some companies integrate employees’ credit/debit cards, bank accounts, and corporate cards with expense management software. The card provider can then generate statements after every expense has been incurred. Employees then collect the statements and forward them to the system as claims.

- The submitted claims are then reviewed and validated by the authorized officer, typically the department or line manager. The reports are reviewed against policy violations, fraud, duplicate expenses, etc. Hence, the review process can be automated, too, where issue-free reports are approved and unsatisfactory reports are rejected automatically.

- Once the respective authority has approved a claim, it is forwarded to the finance department for disbursement of reimbursements. A seamless reporting and reimbursement process is then concluded.

Expense Report in a Nutshell

Expense reports assist a company’s finance department in conducting an audit and ensure that the internal expenses of a company are controlled robustly and effectively. In addition, the reports are used to determine reimbursements for employees, especially those who travel frequently or have made purchases on behalf of their companies. The reports are also reliable proof of business expenses that can be claimed when filing taxes.

The reporting can be manual through templates or automatic through expense management applications. Companies typically choose the reporting method that best meets their needs. Using a template is more beneficial than creating the report from scratch as it provides a simple layout for tracking costs related to the business. Not all expenses are reimbursable, so employees need to heed which expenses their employer can reimburse by understanding the company’s expense policies.