Oftentimes, when payment is made or salary is paid, you are excited and you want to get a lot of things done. And after a few days, you realize you have spent so much, but can only account for very little. While some people spend money on mindless things once they get paid or have more than enough in their account, the story is different for others.

Some people actually spend on essential needs, but at the end of the day, you might still lose track of how much has been spent until you get debit alerts or see the amount you have left in the bank. As an individual with lots of expenses, you can only improve your financial situation if you understand it. And to do this, you must track all of your expenses, weekly and monthly, for a better financial analysis using an expense tracker.

What is Expense Tracking?

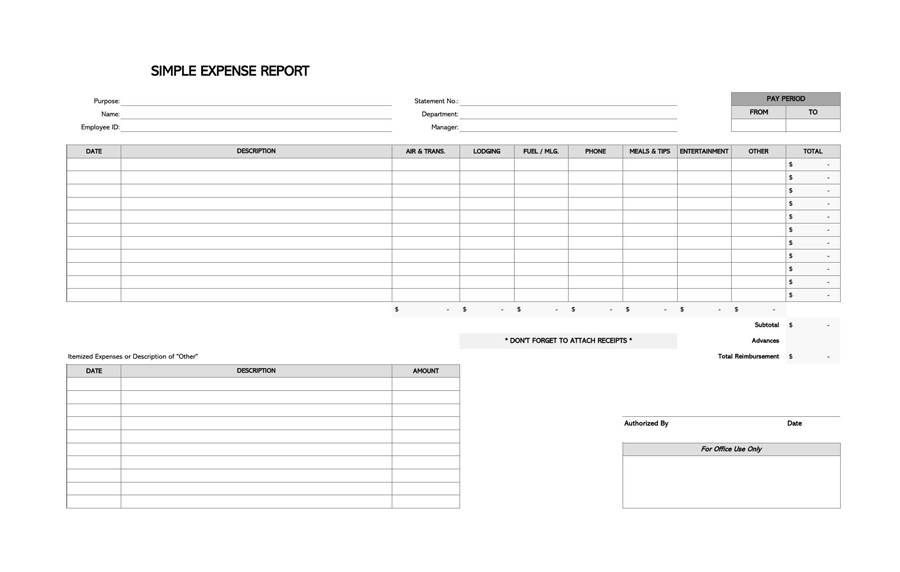

Expense tracking is the art of creating a spending budget and keeping a daily, weekly, and monthly record of one’s expenses in the form of receipts, invoices, and bills, and recording them on an expense tracker. An expense tracker helps improve your financial health and prevents unnecessary spending. With an expense tracker, you’ll understand where your money goes and be ready for taxes.

In the past, maybe you had to put all receipts and invoices together and do a manual calculation of all your cash outflow. This kind of system is not only rigorous, but it also is prone to errors, and you may even lose or misplace some receipts.

Also, some expenses do not come with receipts.

EXAMPLE

If you take a trip to the vending machine, you may not bother about a receipt or recording that expense because it seems insignificant. But today, there are various tracking tools– including expense tracker software and expense tracker templates.

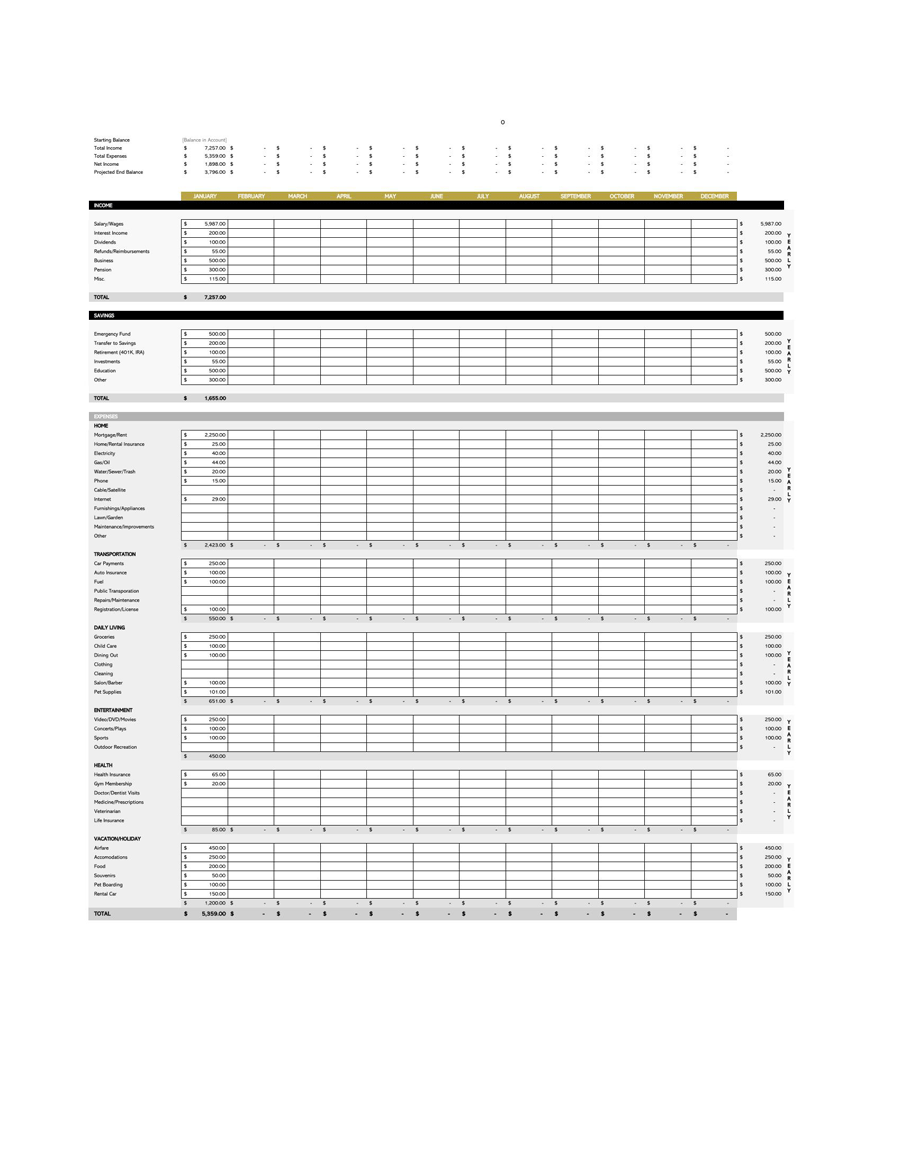

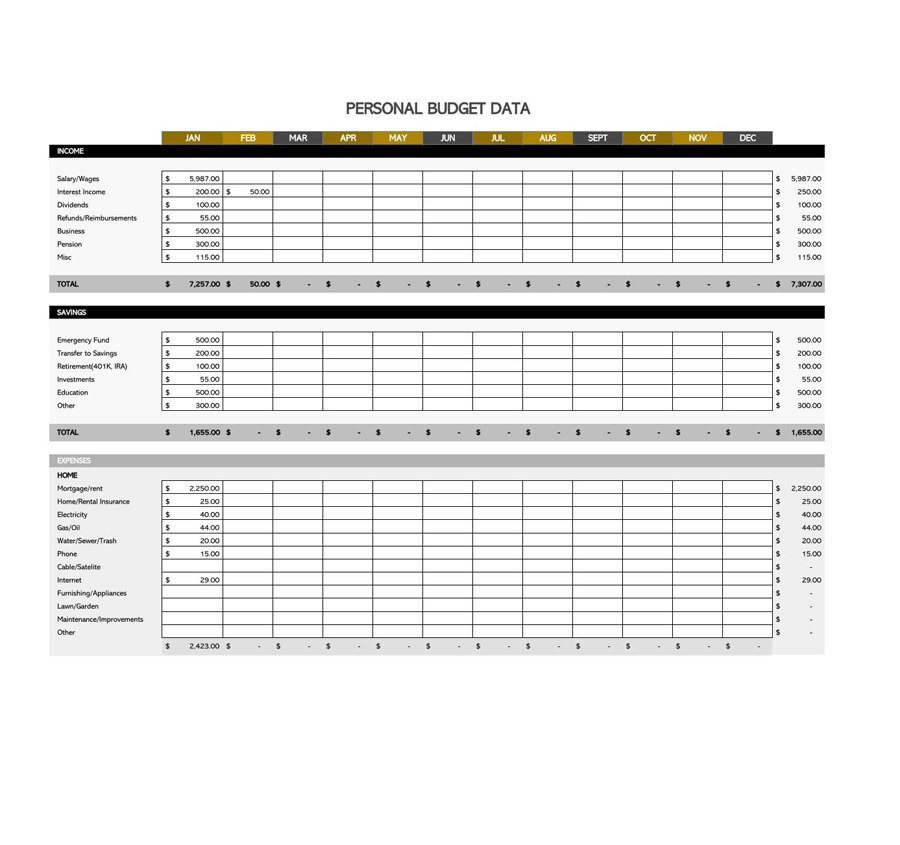

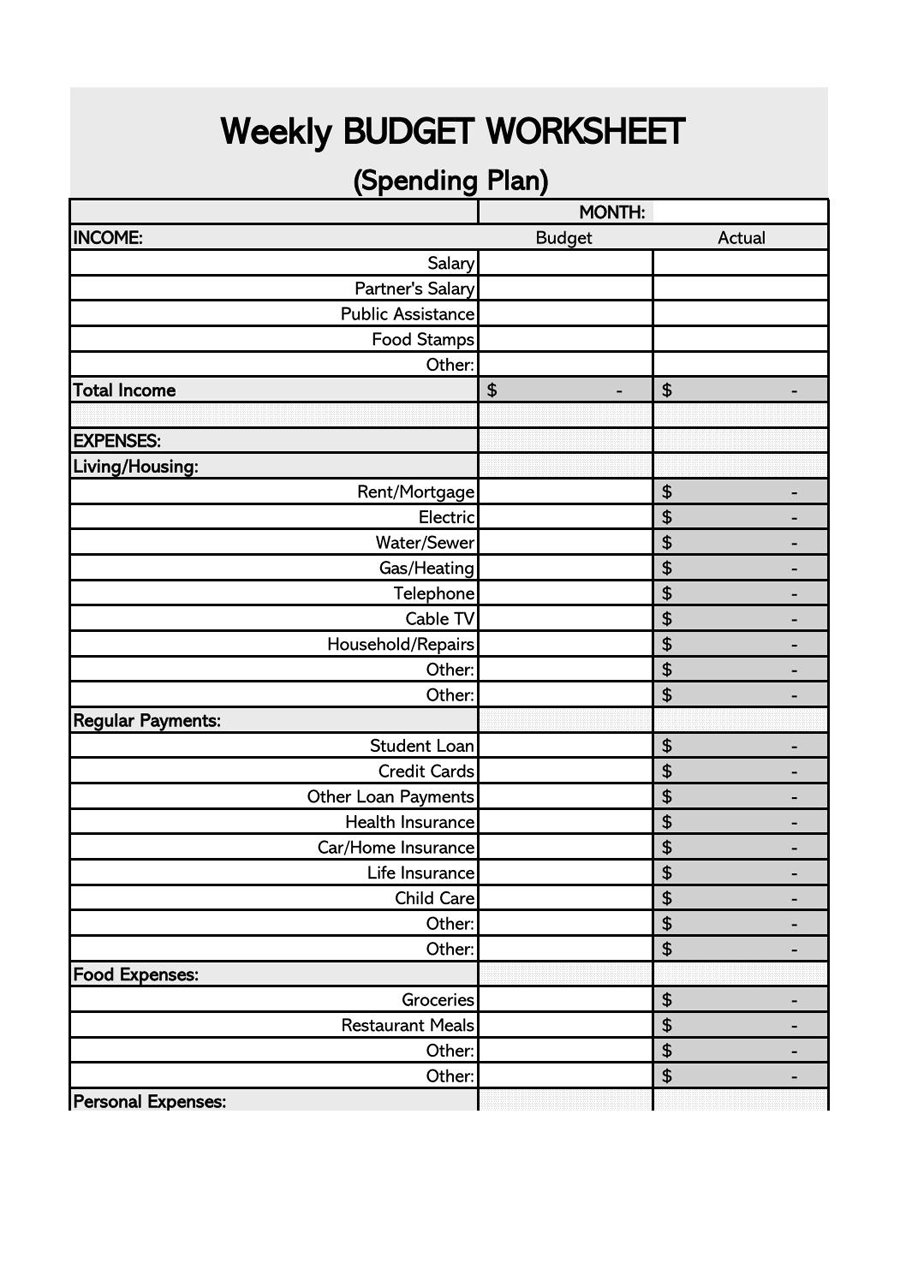

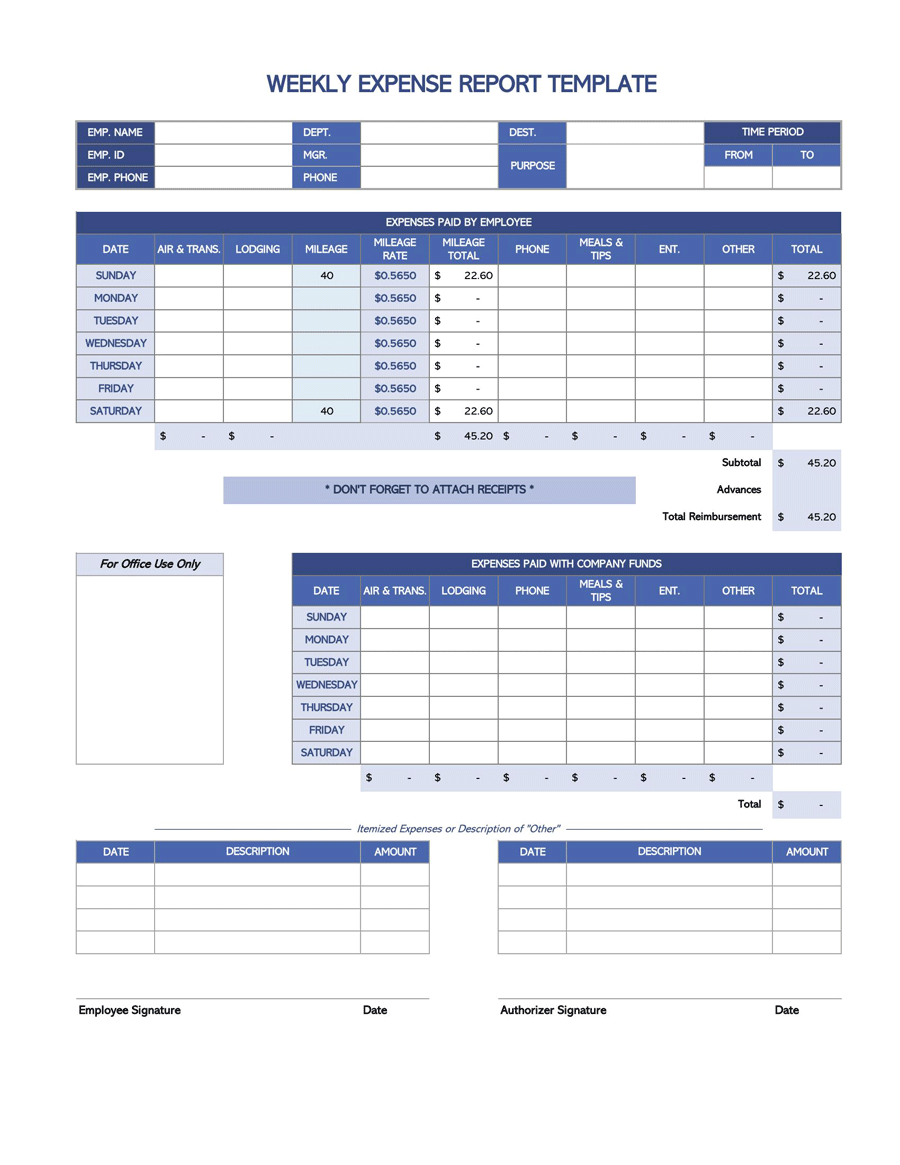

An expense tracker contains relevant information like your income, and expenses – starting with food and other utilities, including rent, mortgage, clothing, transportation, etc. Altogether, the information provided will be useful in determining your financial health.

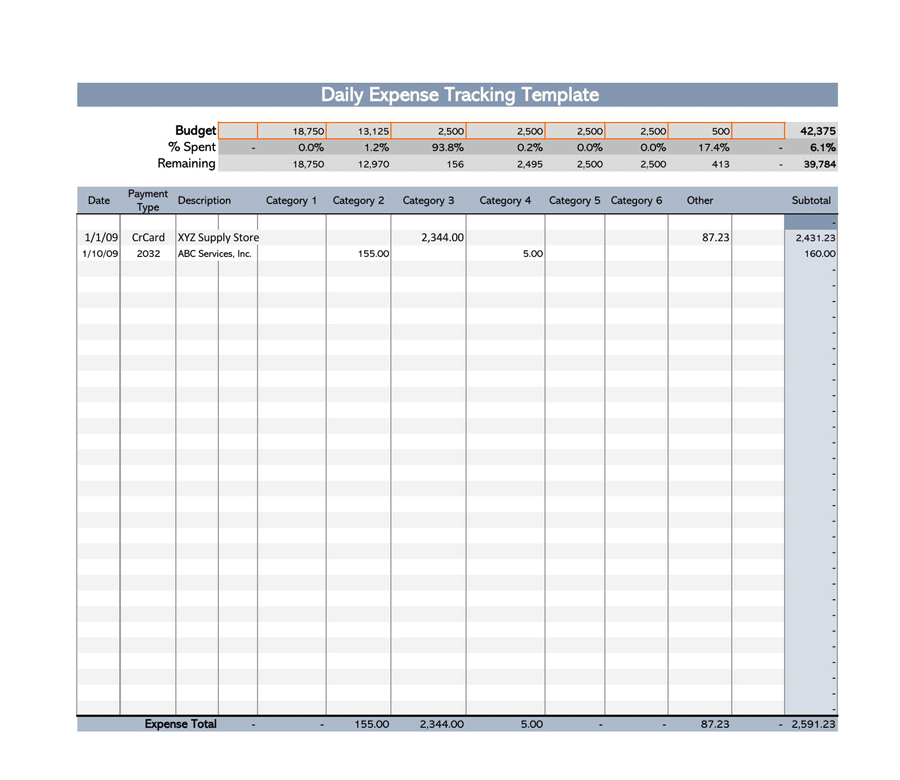

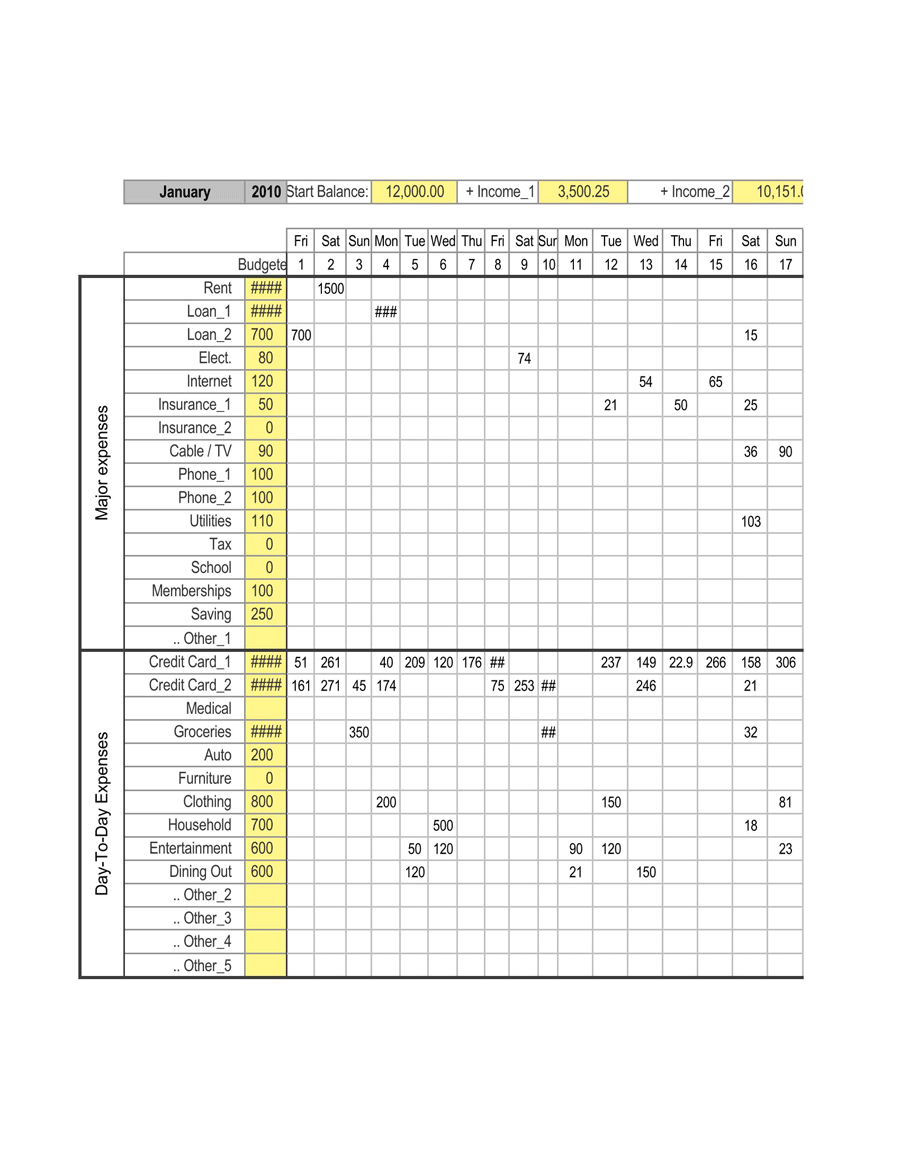

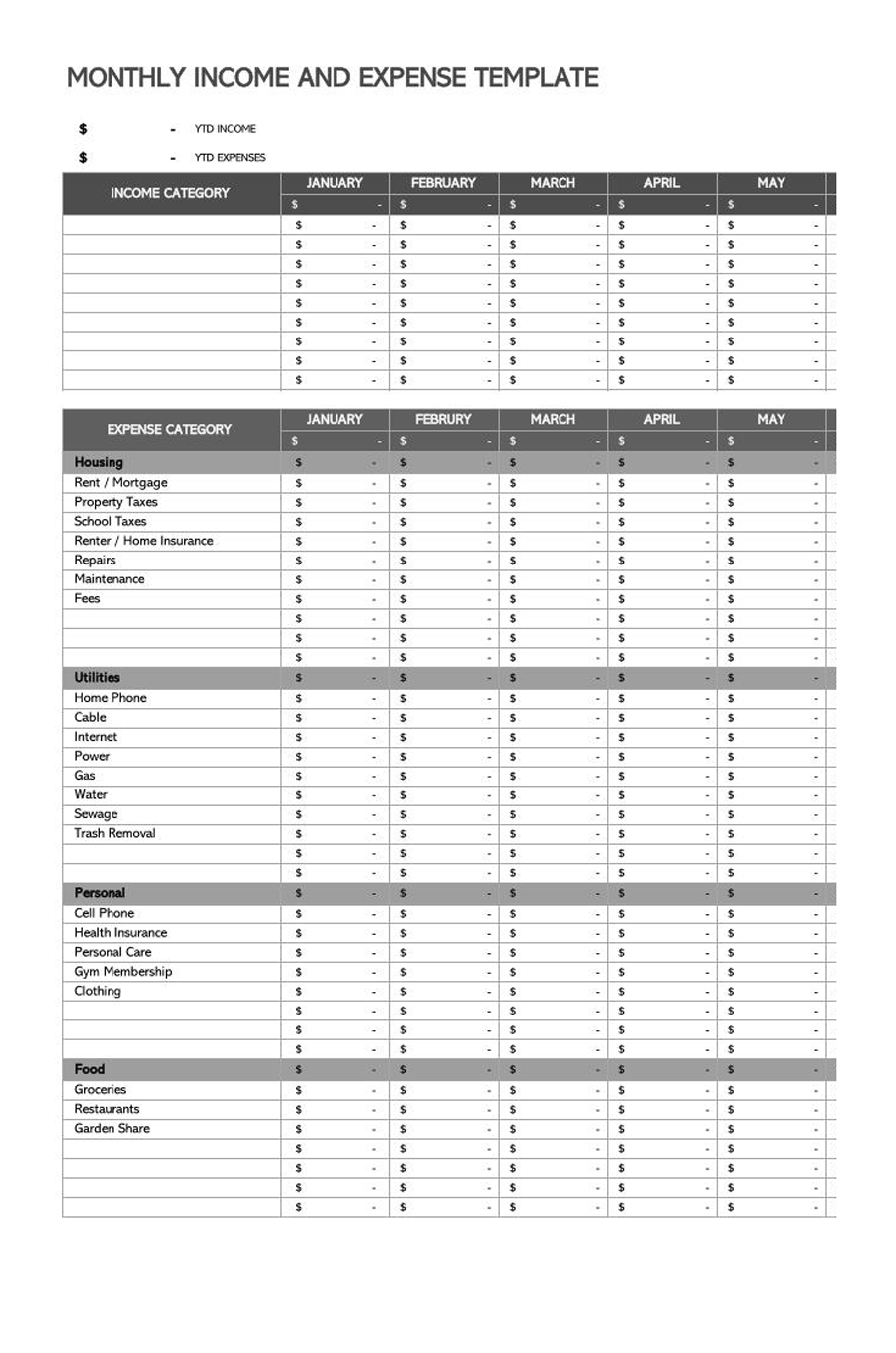

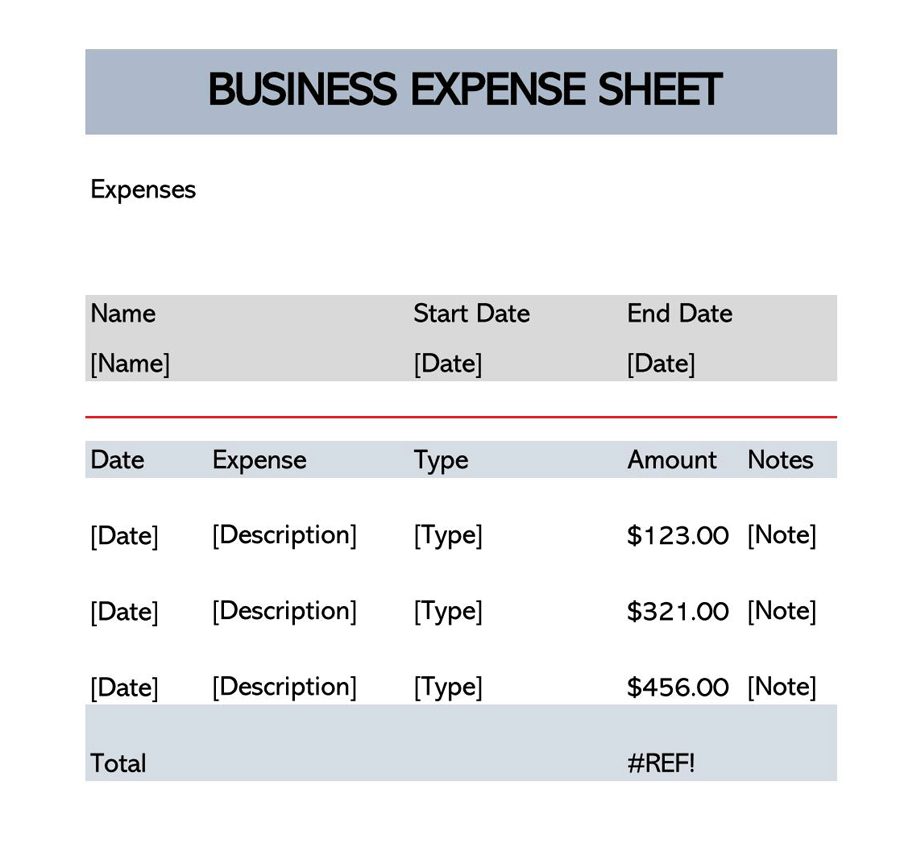

Expense Tracking Sheets

Importance of Expense Tracking

While you go about your daily activities, having your expenses monitored will help you stay on course and not fall off the financial discipline journey you have begun. This way, you don’t look for money in places because you know exactly where it went.

Since you do not want to overlook or forget any expense you incur during the course of the month, you can determine how money is being spent, on what, and also know when to cut down costs and maximize profits, all with the help of an expense tracker. The major reason you want to keep track of your expenditures is to be financially responsible and accountable. Since it is very easy to get carried away and overspend, you know a better financial discipline will do you more good.

There are so many other benefits that come with tracking your outflow with an expense tracker or using an expense tracking template.

Some of these are discussed below:

You maintain your budget

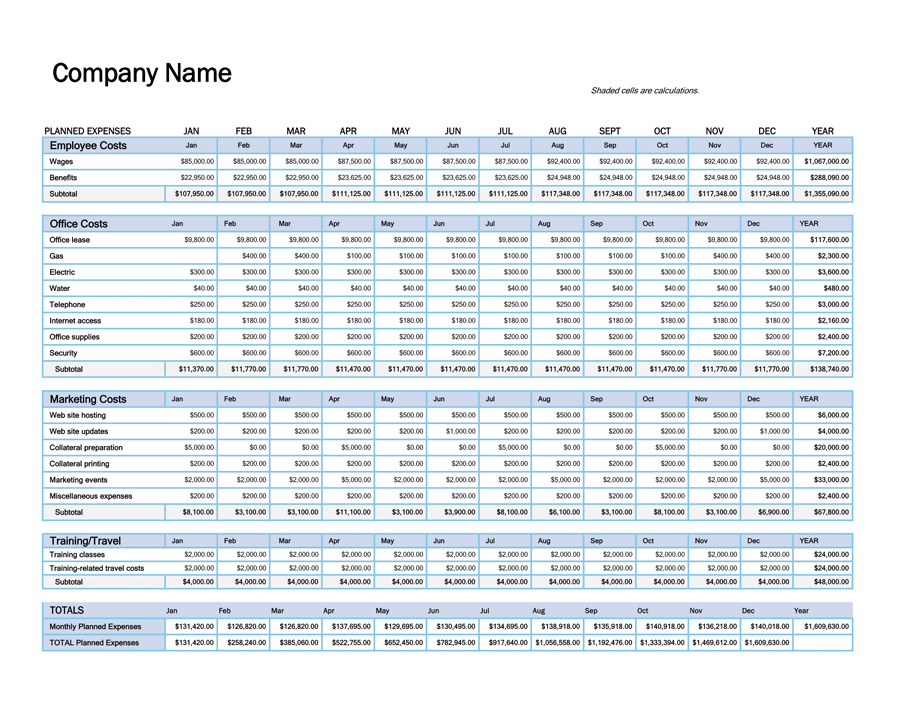

Usually, there is a budget set aside for different expenses, whether weekly, monthly or annually. After you have set the budget, it is imperative that you stick to the plan and not overshoot. And tracking your expenses will help you achieve this. If you don’t monitor how money is spent, you will be caught in a financial mess where you have spent more than the allocated resources – and this does not speak well about you, nor is it good for your business.

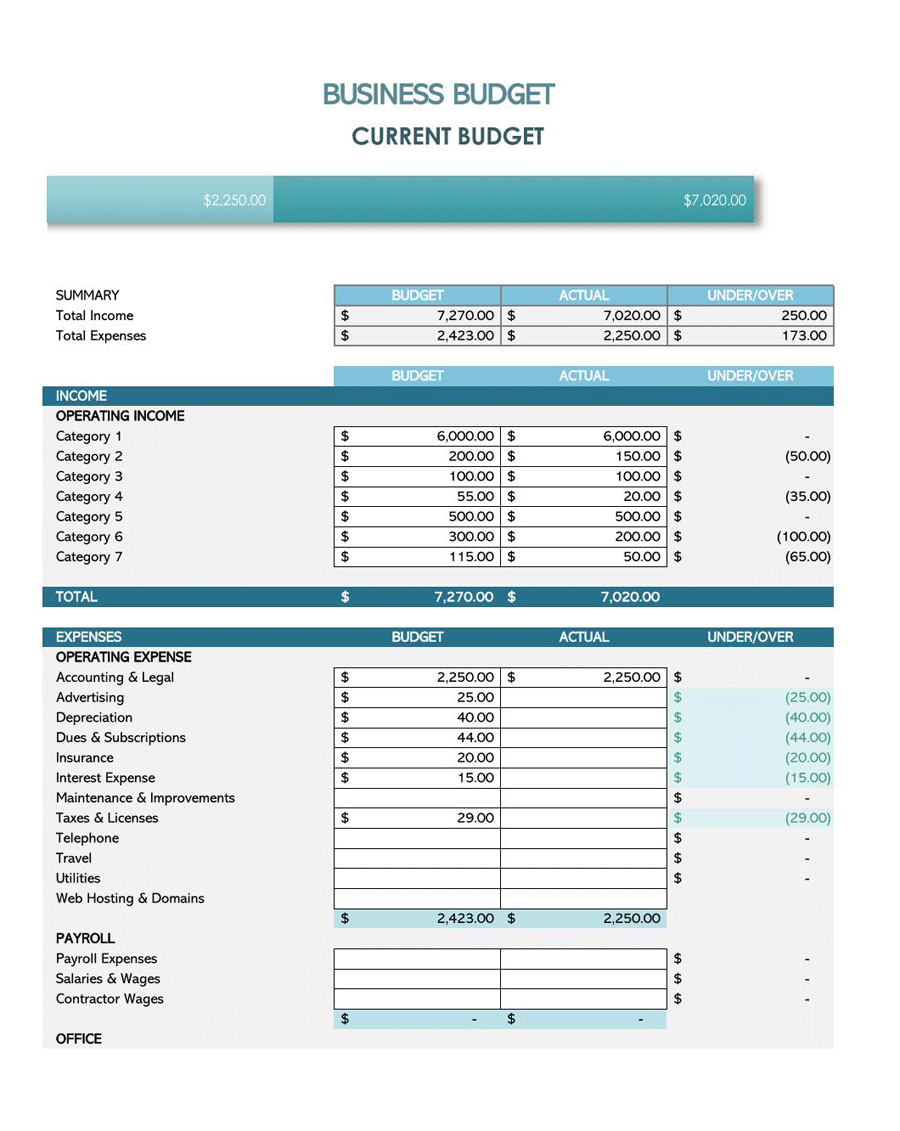

Keeping track of your expenses isn’t where it ends, however. At a stipulated time, whether weekly or monthly, you need to review the tracked expenditures and do a comparison between your budget and total expenses. This is how to determine whether you have overspent or stayed on course.

In a case where you have exceeded your budget and even spent more, the information provided will help you determine what took the chunk of your money and how you can cut costs. Similarly, if you spend below your budget (which is not a bad thing), you can allocate more funds to your savings or debt repayment, if any.

Whichever it is, the comprehensive analysis of your expenses provided by the expense tracker will give you an insight into your financial life and inform further decisions.

Prepare for tax season

Doing taxes can be complicated and tiring for an individual. And you do not want to cause yourself more headaches due to poor financial management decisions. So, when you keep a detailed record of your expenses daily using an expense tracker, you won’t start opening shoe boxes and searching holes in your car for receipts at the end of the month.

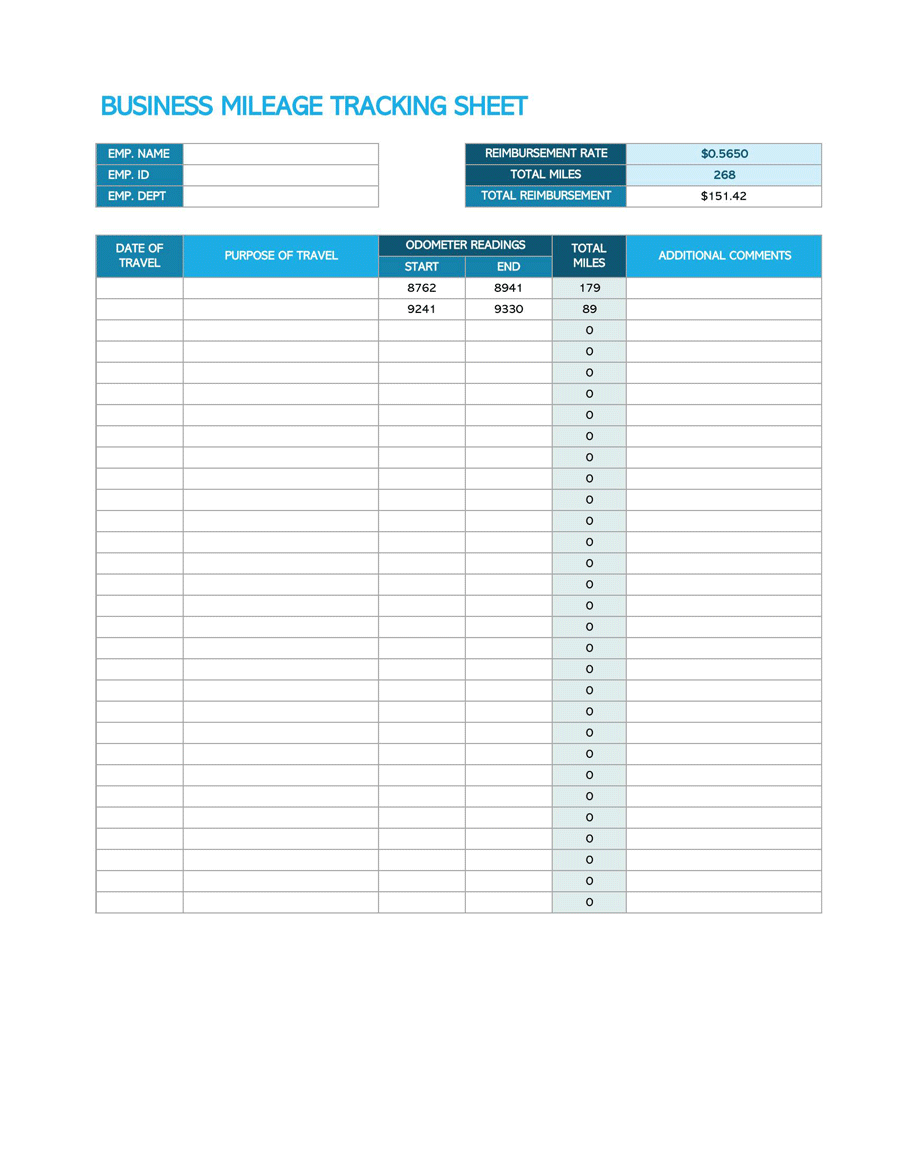

At the same time, you will be able to save some money by understanding what kinds of expenses are deductible by the tax. These expenses include business meals, education, office expenses, office supplies, bank fees and interests, telephone and internet bills, travel expenses, and so much more.

When you know how these expenses operate in relation to taxes, you will be able to do a quick and smart job during tax season.

Figure out spending problems

Another reason to keep track of your spending all through the month is that the financial breakdown will help you become more aware of your spending habits and identify if you have any spending problems.

Without the help of an expense tracker, you won’t be able to explain some counterproductive activities or resources you spend.

EXAMPLE

You can be paying for a cable subscription monthly, and you probably don’t even get to watch the TV since you get home tired most of the time. In this case, you now determine what to do.

Either you want to completely opt-out of the service or downgrade your package. Perhaps you are also the type that spends so much on designer brands. Then, you will be able to determine if that act is financially wise for you or otherwise.

While an expense tracker will help you identify your spending problems, you also need to make a conscious decision to change the situation. It may not be easy if you are used to that kind of lifestyle, but it is important not to go broke. So, this step will be worthwhile in the long run.

Meet financial goals

We always aim to start a new year with new goals. However, setting new goals for your new year won’t be enough if you don’t stick to your financial budget and implement realistic saving goals.

Whatever your financial goal might be – whether you want to save for college tuition, a vacation, retirement, business expansion, or build an emergency fund – you will be on your way to achieving these goals if you keep a record of these expenses on an expense tracker.

Having your expenses tracked will help you analyze your finances so that you can separate your earnings or funds accordingly.

EXAMPLE

If your plan is to save for college, include college tuition as a fixed expense in your budget and set a budgeted amount that goes into that every month.

Continually track your expenses monthly using an expense tracker to ensure the amount gets deducted as planned. Once you start and stick to it, you’ll have your college fee ready when you need it.

How to Track Your Expenses

Follow the steps given below to track your expenses in an effective way.

Step 1. Create a ledger

Once you have determined your budget for the week or month, the first thing to do is to have a ledger. This can be done manually using a notebook with different columns for each budget category. The categories can include food, rent, utilities, fun money, etc. Similarly, you can use budgeting software or a system to make your tracking process more seamless. The software will track your expenses automatically and save you time.

Also, for spending categories that require only cash transactions, get an envelope for each category and put dedicated funds in them at the beginning of every month. This way, you go shopping for a particular category with its dedicated cash. You can also use the envelope to keep receipts from the shops visited.

Step 2. Work with your partner

If you have a partner, you want to also add their expenses to your financial breakdown – especially if you operate a joint account. Both of you can record your individual expenses on paper and combine them later or opt for software that allows for multiple users.

You will find many budgeting systems online, but it is important to find the most suitable one for you and your family. We recommend you use cross-platform budgeting software that can also connect to your bank to make the process easier for you.

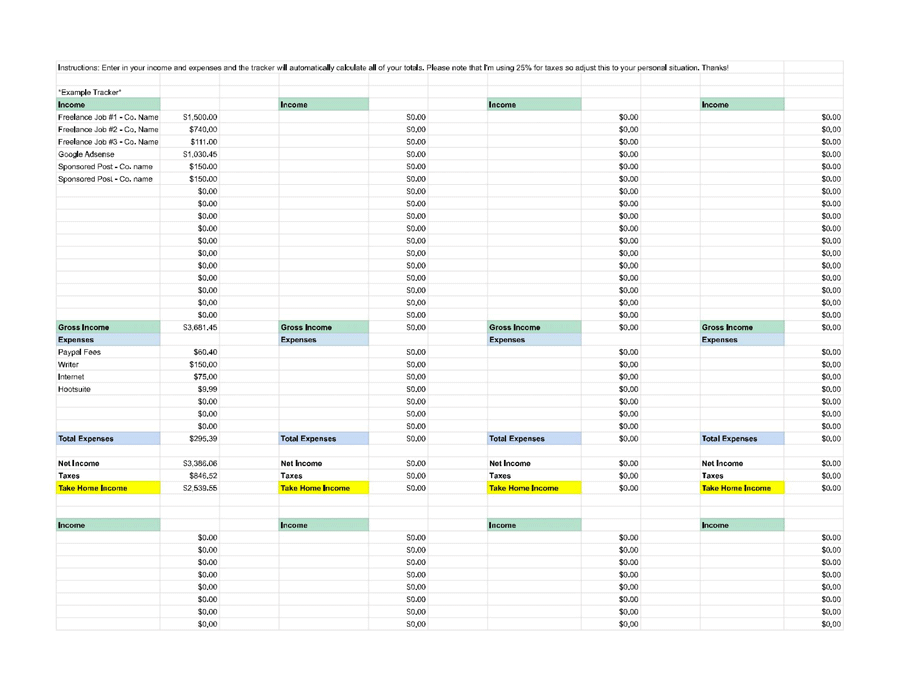

Step 3. Write down your monthly income

For a better understanding of your finances, you need to document all of your income on an expense tracker. Highlight all of your income revenue sources like your salary, side gigs, bonuses, etc. Similarly, you can add that of your partner if necessary. Documenting these sources will help you understand how much you make in comparison with your income expenditure.

Step 4. Divide your expenses into different categories

To make your tracking and sorting easier, you should categorize all of your expenses. Each category created will have its peculiarity in terms of budget, and you can add more categories as you go.

Step 5. Record your expenses

Recording your income goes hand-in-hand with proper documentation of your expenditure. As you record each of your expenses on an expense tracker software or a template, you will be able to arrive at the total amount left for each category being managed. This is arrived at once the total expenses have been deducted from the budget set aside.

Step 6. Watch those amounts

As stated earlier, keeping records of your expenses using an expenses tracker is just the first step of your financial journey. You must ensure you continuously pay attention and don’t overspend. Take note of what is left to be spent for all the different categories, and don’t compromise.

If you have a partner, ensure you both document your expenses and inform each other before making financial decisions. This will help you stay within your budget.

Finally, you should view your expense breakdown at an agreed time, preferably monthly, analyze whether you have overspent or underspent, then make subsequent informed financial decisions.

Benefits of Using an Expense Management Software

It is no surprise that spreadsheets have become the ubiquitous tool for expense management today. They are convenient to use, and many people find them familiar. However, spreadsheets can only do so much if you handle a lot of expenses.

A spreadsheet might not be the best approach when you manage a huge financial project or have a big purse with lots of expenses. Instead of using this manual method, you can opt for an automated system using expense management software. The software will help maximize efficiency and save time and money. Don’t forget that financial automation is the future of expense tracking.

Are you wondering what the perks are to using expense management software? There are lots of benefits.

An expense management software:

Reduces the chance of errors

According to a report, 19% of expense tracker reports contain errors. While this report is for businesses, we cannot entirely rule out the fact that as individuals, we are also susceptible to errors when doing the books.

In other words, since the expense tracking system is automated, manual data entry by you and/or your partner will be eliminated. At the same time, there will not be any need for direct supervision or compilation of expense figures because of features like receipt scanning and direct integration with card payment systems that come with expense management software.

At the end of the day, you will arrive at an accurate expense analysis if you use such software.

Saves time and money

Since expense management software has no limitations, you can easily prepare financial reports in a very timely manner. Similarly, the system is automated and no human delays will influence its speed. As long as there are expenses and the software is synchronized to detect such expenses, you do not have to go back to pick or calculate anything manually.

At the same time, you will save costs by working with this expense tracker software because these applications are cost-effective and can be used on your mobile device. They can also be custom-built to suit your needs and budget.

Allows for transparency and visibility

With an expense management software, literally everything is documented. So, apart from helping you improve efficiency, you can identify your spending habits, and see areas where you need to adjust.

Doing this manually is prone to errors, but with the precise analytics software that comes with the automated system, you are certain of your financial analysis.

If you have a partner, you also want to be accountable to them and vice-versa. So, both of you using an expense management software will help improve your financial habits as a couple and build trust.

Integrates with other software

Unlike spreadsheets, an expense tracker software seamlessly connects with a wide variety of applications for cash flow analysis. This makes automatic reporting achievable.

EXAMPLE

If you have a banking app connected to your management software, once you document an expense on the app, it automatically reports and gets saved.

This will also save you a lot of time that would have been spent on sifting through financial information or receipts and re-entering them into a spreadsheet. Similarly, with this system, you are rest assured there will be no data loss or errors during compilation.

Provides enhanced security and backup

You may think you have your spreadsheets protected with a password or have some sheets and formulas locked. However, this kind of security is not foolproof, as you may lose data if something happens to your storage device or if the document is tampered with.

In other words, spreadsheets are susceptible to security breaches and you may lose valuable data if something happens to your spreadsheet. But, with expense management software, your data is saved in the cloud and you can access it anytime. Similarly, there is a strong security network and technology that protect your data.

Allows for easy expense fraud detection

Once your expense tracker is accessible to more than one user, it becomes prone to fraud or expense theft. Expense tracker spreadsheets come with low security and it is very easy for another person with access to overwrite or alter the information available on such a document after your approval has been granted. If the person is smart, you may not detect such alterations on time.

In order to mitigate such a situation during expense reporting, you can deploy an expense management software. The software is built with some algorithms to detect fraudulent expenses and activities by highlighting duplicate receipts, transactions, or expense claims and alerting the users (including the approver) to correct such errors or violations.

Eventually, other users are aware they cannot get away with fraudulent acts, and you would have been able to prevent any fraudulent activities. Ultimately, you can be rest assured nothing will go wrong during the final expense breakdown.

Final Thoughts

No one has hacked the perfect way to financial management, so if you are on your way, you do not need to worry. However, you should look at your expenses closely and record them on an expense tracker to determine the good ways to channel your resources.

Using expense trackers or expense tracker templates will help you make informed financial decisions, and over time you’ll be able to make adjustments, anticipate your expenses, and plan accordingly.